TIDMTHRU

RNS Number : 7234G

Thruvision Group PLC

21 July 2023

21 July 2023

Thruvision Group plc

Results for the year ended 31 March 2023

Thruvision Group plc (AIM:THRU, "Thruvision" or the "Group"),

the leading provider of walk-through security technology, today

publishes its results for the financial year ended 31 March

2023.

Key Highlights

-- Revenue was up 49% to GBP12.4 million (2022: GBP8.4 million).

-- Multi-year framework contract awarded by US Customs and

Border Protection ('CBP') and related orders from the same

customer delivered revenue of GBP8.3 million (2022: GBP3.7

million).

-- Adjusted gross margin (2) up 4.8pp to 51.5% resulting from

positive product mix and higher margin software revenue,

with statutory gross margin(3) growing 6.2pp to 47.0% reflecting

production efficiencies.

-- Adjusted EBITDA(2) loss was GBP0.2 million (2022: loss GBP1.7

million).

-- Operating loss was GBP1.0 million (2022: loss GBP1.9 million)

-- Cash balance as at 31 March 2023 was GBP2.8 million (31

March 2022: GBP5.4 million), with cash at 20 July 2023 of

GBP2.4 million.

2023 2022

Continuing operations GBPm GBPm Change

--------------------------------- ------- ------- ---------

Statutory measures:

Revenue(1) 12.4 8.4 +49%

Gross profit(3) 5.8 3.4 +71%

Gross margin(3) 47.0% 40.8% +6.2pp

Operating loss (1.0) (1.9) +48%

Loss before tax (1.0) (1.9) +48%

Loss per share (pence) (0.55) (1.14) +52%

Alternative measures (2) :

Adjusted gross profit 6.4 3.9 +64%

Adjusted gross margin 51.5% 46.7% +4.8pp

Adjusted EBITDA loss (0.2) (1.7) +87%

Adjusted loss before tax (0.8) (2.3) +62%

Adjusted loss per share (pence) (0.46) (1.39) +67%

--------------------------------- ------- ------- ---------

(1) Re-translation of 2023 US$ entity revenues at prior year

exchange rates results in a constant currency increase in Group

revenue of 37%.

(2) Alternative performance measures ('APMs') are used

consistently throughout this announcement and are referred to as

'adjusted'. These are defined in full and reconciled to the

reported statutory measures in the Appendix.

(3) As restated see note 5.

Commenting on the results, Colin Evans, Chief Executive, said: "

In this breakthrough year, which saw revenues jump by 49%, we have

now taken a significant step forward towards meeting our key

strategic objectives of becoming the leading provider of

walk-through security technology to the international market and

delivering sustainable profitability as a Group.

We are delighted to be first to market with our unique, new

WalkTHRU solution. Walk-through security - the ability to screen

100% of people for all types of concealed items at walking pace -

is seen by many customers as their ultimate requirement, and we are

seeing strong interest in our new capability.

With the award of a multi-year US CBP contract and the addition

of further flagship retailers as customers, we have secured our

market-leading position in the International Customs Agency and

Retail Distribution markets. We believe that our existing revenue

base in these markets, combined with their significant potential,

provides a robust base from which we can profitably grow the Group.

"

For further information please contact:

Thruvision Group plc

Colin Evans, Chief Executive

Victoria Balchin, Chief Financial

Officer +44 (0)1235 425400

Investec Investment Banking (NOMAD

& Broker)

James Rudd / Patrick Robb / Sebastian

Lawrence +44 (0)20 7597 5970

Meare Consulting

Adrian Duffield +44 (0) 7990 858548

About Thruvision ( www.thruvision.com)

Thruvision is the leading developer, manufacturer and supplier

of walk-through security technology. Its technology is deployed in

more than 20 countries around the world by government and

commercial organisations in a wide range of security situations,

where large numbers of people need to be screened quickly, safely

and efficiently. Thruvision's patented technology is uniquely

capable of detecting concealed objects in real time using an

advanced AI-based detection algorithm. The Group has offices and

manufacturing capability in the UK and US.

Important information

This announcement may include statements that are, or may be

deemed to be, "forward-looking statements" (including words such as

"believe", "expect", "estimate", "intend", "anticipate" and words

of similar meaning). By their nature, forward-looking statements

involve risk and uncertainty since they relate to future events and

circumstances, and actual results may, and often do, differ

materially from any forward-looking statements. Any forward-looking

statements in this announcement reflect management's view with

respect to future events as at the date of this announcement. Save

as required by applicable law, the Company undertakes no obligation

to publicly revise any forward-looking statements in this

announcement, whether following any change in its expectations or

to reflect events or circumstances after the date of this

announcement.

Chairman's statement

This was a breakthrough year for the Group where we delivered

very strong revenue growth and took a significant step towards

sustainable profitability. I am delighted with the excellent

progress we made towards our strategic objective of becoming the

leading provider of walk-through security technology to the

international market.

It was very pleasing to see such strong revenue growth during

the year to 31 March 2023. This was based on a combination of

adding new customers, often as a result of recommendations from

existing users and, equally encouragingly, from those existing

customers extending and upgrading their use of our solutions. This

supports our long-held view that Thruvision technology adds

significant value for our customers which underpins our long-term

confidence in the business.

We are now a leader in the development, manufacture and supply

of walk-through security technology to the international market.

Our systems are used by a growing number of both government and

commercial organisations in a variety of security situations,

where, typically, large numbers of people need to be screened

quickly, safely and cost-effectively for items hidden in their

clothing.

Although we have an established product range now in place, we

continued to invest in R&D. This paid off with the highly

successful launch of our "WalkTHRU" solution, based on our latest

AI-driven detection software and developed in close cooperation

with NEXT plc, a long-term user and one of our most highly-valued

customers. This new offering enables very high numbers of people

per hour to be checked for all types of concealed item, allowing

NEXT to security screen 100% of staff leaving its Distribution

Centre at the end of their shifts, thereby maximising deterrence

and reducing theft rates. Such capability meets a very clear market

need and we are delighted to be unique in the market with such a

solution.

Our decision to focus our efforts primarily on International

Customs Agencies and on the Retail Distribution (previously called

Profit Protection) markets has paid off. Significant progress with

US Customs and Border Protection ('CBP') led to very strong demand

from the Customs market which offset a weaker performance in Retail

Distribution which was not surprising given the strong headwinds

faced by the retail sector. We remain confident that both markets

represent significant growth opportunities and that their

complementary nature provides us with a high degree of resilience

to economic cycles.

We continued to strengthen our leadership team during the year.

The most significant arrival was Victoria Balchin, our new Chief

Financial Officer ('CFO'), who joined last Autumn. More recently,

we promoted Nick Graham-Rack to Chief Technology Officer ('CTO') to

accelerate the development of our new software capabilities. John

Woollhead, our Company Secretary, retired in December after 12

years of service with the Group and was replaced by Hannah Platt.

John was a first-class and trusted colleague for almost 20 years,

and we will greatly miss his wise counsel and good humour.

On behalf of the Board, I would like to express our thanks to

all our staff who have worked so hard to grow the business during

the year. Many are long-term employees, and some have been with

Thruvision since its inception, and I am delighted that they are

now seeing the Group starting to fulfil its undoubted

potential.

Outlook

Having proved the value of our solutions beyond doubt, the focus

of the business is now moving towards scaling as rapidly as our

markets and resources will allow. We believe that our target

markets are significant and should impose no foreseeable limits on

our growth. Our growing sales team will focus equally on acquiring

new customers, particularly in the US, and on increasing the

Thruvision presence with existing customers. Meanwhile, our

technology investment will ensure that we build an even greater

lead over our competition.

The past year, combined with current activity levels, have

reinforced our confidence that Thruvision will continue to grow

well and become the solution of choice for walk-through

security.

Chief Executive's statement

Strategic update

Our strategy is to build on our market-leading position as a

developer, manufacturer and supplier of walk-through security

technology. We aim to become a mainstream provider and increase our

market-share in a number of growing and established international

markets. We expect that our continued investment in improving our

patented, AI-enhanced Terahertz (THz) imaging technology will

maintain our significant advantage over our competition.

Business performance

We took a significant step forward towards meeting a key

strategic goal of sustainable profitability in the reporting

period. Revenue grew strongly by 49% to GBP12.4 million (2022:

GBP8.4 million) and, driven by the uptake of our new, higher

performance products and AI software licences, Adjusted gross

margin increased by 4.8 percentage points to 51.5% (2022: 46.7%).

For the first time software license revenues made a modest but

meaningful, contribution at GBP0.5 million (2022: nil). We see

software licences as an important new and margin-enhancing revenue

stream and expect to add further licensable software functionality

in FY24. Statutory gross margin grew by 6.2 percentage points to

47.0% reflecting increasing economies of scale in our manufacturing

operations.

Given this performance, the Board decided to award bonuses

across the business for the first time. These totalled GBP0.5

million (2022: GBP0.1 million) and rewarded all employees for

achieving such strong growth. While leading to a small Adjusted

EBITDA loss, the Board believes this award is in the best long-term

interests of the Group.

Technology strategy

Walk-through security - the ability to screen 100% of people for

all types of concealed items at walking pace - is seen by many

customers as their ultimate requirement. Derived from our R&D

work in the Aviation sector, we were therefore delighted to be able

to be the first company to offer this capability to the market in

the form of our new "WalkTHRU" security system in October 2022.

NEXT, Selfridges and Saks Fifth Avenue all bought walk-through

lanes in the second half of the financial year and we see growing

interest for this solution from a broader range of existing and new

customers.

During the year we also established that, in many cases,

existing customers purchase upgrades for their existing systems if

available rather than wait to replace old systems at end-of-life.

This point was well illustrated by US Customs and Border

Protection's ('CBP') decision to upgrade its systems to the latest

high-performance version during the year and purchase our

AI-software algorithm to run on them.

In the light of this strong interest in walk-through security

and a willingness by customers to upgrade, we have refined our

technology strategy and will be launching a series of new products

and product upgrades in FY24. These will extend our walk-through

product range and offer the opportunity to further extend system

functionality in the form of software upgrades which we will be

able to license separately.

Strategic market focus

We have now firmly established ourselves in two strategic

markets: International Customs Agencies and Retail Distribution,

and these are described in more detail in the Business Review. With

differing economic drivers, together these markets are sizeable

enough to offer us a very significant growth opportunity,

particularly given the increasing reliance our existing customers

have on our technology. Furthermore, the two markets offer us

revenue diversity and, over time, will help ensure our growth

prospects are resilient to economic cycles.

A key strategic achievement in the year was the award of a

multi-year CBP contract in September 2022, and CBP is already

delivering operational success from these new systems. The adoption

by CBP of our technology assists our broader sales efforts with

other international Customs agencies.

Retail Distribution, we believe, is ultimately our largest

target market and, as such, offers us the greatest growth

potential. Given economic challenges, employee theft is

increasingly problematic for the retail industry and, despite

challenging trading conditions for our customers, our performance

in Retail Distribution remained resilient. We made progress in

opening up Europe and the US, and we continued to add new customers

as well as receiving further orders from existing customers. We

remain confident that the very rapid return on investment reported

by our Retail Distribution customers (with many citing a payback

period of less than one year) means that our performance in this

market will return to growth as economic conditions recover.

Leadership team strengthening

As reported in the Chairman's statement, we continued the

process of strengthening the leadership within the business and

appointed a new CFO and a CTO in the period. To complete our

investment in senior leadership, we have recently recruited a very

senior sales leader with 20 years' experience working for one of

the global security equipment vendors. With this strengthened

leadership, we now have an established infrastructure, encompassing

technology, operations, finance, sales and commercial, that is

capable of supporting our continued international growth.

Business review

Markets

As discussed above, while we operate in four distinct markets,

our strategic focus is on two, Customs and Retail Distribution,

which represented 93% of our revenue in the year (2022: 90%). We

remain active in the other two markets, Aviation and Entrance

Security, but we are not expecting strong growth in either in the

short term and these are not therefore a current focus. We report

and review performance internally as one segment.

Customs

Thruvision is used by international customs agencies to screen

people who travel for drugs, cash and other contraband. We already

have systems deployed with agencies in nine countries.

Very much driven by CBP in the US, revenue here more than

doubled to GBP9.2 million (2022: GBP3.9 million). We successfully

delivered all the upgraded and new high-performance systems that

had been ordered in the two contracts we received in September

2022. Deployed at a range of land border crossings, international

airports and cruise liner terminals, CBP is already achieving

operational success with these systems where, at some locations,

100% of legal entrants to the US are being screened using our

technology.

With the multi-year CBP framework purchasing agreement secured

by our US distribution partner in September 2022 and running to

September 2026, we expect further orders, noting that CBP normally

places new orders during the latter part of the US Government

fiscal year, which ends on 30 September.

Elsewhere, we delivered an order for a sixth tranche of systems

to an existing Asian customer in March 2023 and have several

significant opportunities with other Customs Agencies, where we

expect to see progress in FY24.

Retail Distribution

Retailers and their logistics partners use our technology to

check employees as they leave Distribution Centres ('DCs') for a

wide range of items that they may be trying to steal. Our analysis

shows there are around 20,000 DCs in UK, US and Europe which could

use Thruvision systems.

Retail Distribution delivered revenue of GBP2.4 million (2022:

GBP3.8 million). However, FY22 performance was boosted by a single

major sale, and without this, revenue was broadly flat year to

year. Given the challenging trading environment currently faced by

the retail industry, we believe this represents a resilient

result.

We continue to focus on major retailers and their third-party

logistics ('3PL') partners and were particularly pleased that over

half of our revenues in Retail Distribution came from the

purchasing of further new systems, or upgrading of systems, by

existing customers. Such high levels of customer loyalty

demonstrates the value ourtechnology provides and further

reinforces the very rapid return on investment that Thruvision

offers.

Our investment in the US also started to deliver results, with

new customers including Saks Fifth Avenue and Clarins. We are

confident that a very large opportunity exists for the Group in the

US and we expect to continue to invest here to build the

business.

Although progress in Europe has been impacted by economic

challenges, we did receive orders from two new customers. With

conditions stabilising, we are seeing renewed interest levels and

expect to make further progress moving forwards.

Aviation

Thruvision is approved for airport employee screening in the US

and has equipment in use with three US airports. We are seeking

formal US Government accreditation to compete with airport body

scanners for the aviation passenger screening market.

As expected, there was minimal sales activity in this sector

through the year, with revenue of GBP0.2 million (2022: GBP0.2

million). This constituted a single sale to an existing US airport

employee screening customer which upgraded its Thruvision

technology to the latest high-performance camera. We have seen a

gradual uptick in interest from other US airports for staff

screening applications, driven by possible future changes in US

Government policy, and we will respond quickly as circumstances

change.

Although we are already used to security screen employees in

airports in the US, we require formal US Government Transportation

Security Administration accreditation to compete with airport body

scanners for the passenger screening market. We started this

process in 2020 and, after several COVID-related delays, it

restarted during the period. Some further progress has been made

through what we continue to expect to be a protracted process.

Entrance Security

Thruvision is used by a wide variety of venues ranging from

high-security government sites to public museums to check visitors

for concealed weapons.

We saw a modest improvement in revenue of GBP0.6 million (2022:

GBP0.5 million) as a number of delayed opportunities in the Middle

East re-engaged after the Pandemic. We expect to make some further

progress in this area with the launch of our WalkTHRU solution but

continue to see this as a fragmented, high cost of sale market.

Routes to market

For our core geographies, UK, US and Europe, we retain our own

sales force, and we tend to sell directly to end customers (noting

that, with CBP, we contract via a third-party). In Retail

Distribution, we have a small number of partnerships with

large-scale security system integrators that serve this market. We

saw good progress with new customer sales through this channel in

the period, with Saks Fifth Avenue and Clarins examples of new

customers that were added.

Outside our core geographies, we work with a range of smaller

Value-Added Resellers across a broader set of international

markets. Each of these tends to bring very specific domain

expertise and each is typically focused on specific foreign

government departments of interest to us.

Product R&D and Intellectual Property ('IP')

Our technology allows security guards to see items hidden in

clothing which means that intrusive physical searches, or

'pat-downs', are no longer necessary. Based on our patented THz

sensor and image processing software, our systems can detect,

quickly and reliably, all types of material (non-metallic as well

as metallic).

With the major innovations on our hardware sensor successfully

completed with US Government funding three years ago, our focus is

now on broadening the number of sensor types we can offer at

differing price / performance levels. This sensor range utilises

the same underlying modular hardware design meaning we get

economies of scale in sourcing components and manufacturing,

resulting in a lower cost per sensor as we grow volumes.

The focus of our more recent investment in R&D, led by our

newly appointed CTO, has been making significant improvements to

our image processing software. Encouraged by the commercial success

of our AI-based automated detection algorithm, we have made further

significant progress and expect to launch further new software

capability in FY24. Importantly, this will include software

licensing capability which will enable us to deliver on, in due

course, our ambition to increasingly monetise our software

functionality.

The Group's patent strategy is designed to cover the IP value in

the Group which is based on our modular, satellite-grade

engineering THz sensor platform, the unique combination of this

sensor with purpose-designed optics and scanning mirror, and

purpose-developed image processing software.

As we invest more in our R&D, we continue to manage our

patent portfolio carefully and ensure our IP and broader

information assets are well protected. We remain comfortable with

the position as it stands and will maintain a proactive stance

regarding patenting new innovations as they are developed.

Competition

We remain very confident that we are the clear market leader in

our two key markets, Customs and Retail Distribution. In these

markets, items being searched for are predominantly non-metallic,

so metal detectors are completely ineffective.

Airport body scanners use active millimetre-wave technology to

detect all types of material. However, they are too large and too

slow for use in Retail Distribution where we consistently win any

head-to-head competitions.

In the passive THz field, we have still not seen any evidence

that an advertised Chinese manufactured product has successfully

been operationally deployed. We believe we beat this nascent

competitor in a recently won Asian contract award. We continue to

believe that our technology delivers superior operational

performance.

Manufacturing and support

We remain confident about the effectiveness of our manufacturing

capability across the UK and US. We set a new record in our fourth

quarter when, in one month, we delivered 40 cameras as we worked

through the large order backlog we had in H2.

Despite some challenges with the availability of various

components, our manufacturing capability has remained effective

through the year. Component shortages were limited to various types

of commercial electronics where we can "design around" to maintain

production levels. While we remain vigilant, we do not currently

foresee any material problem in this area moving forward.

We continue to work very closely with suppliers of the highly

specialised THz components and will continue to buy specialist

components ahead of forecast demand to guarantee availability.

Our post-sales support has now matured and is now increasingly

being provided by local partners which offers us an effective means

of scaling up as the number of deployed systems increases. We

remain confident about the reliability of our equipment.

People

Average headcount increased from 40 to 43 staff during the year.

This was driven by an increase in software R&D capability and

manufacturing management.

Financial review

Revenue for the year to 31 March 2023 was up 49% to GBP12.4

million (2022: GBP8.4 million) benefiting particularly from a large

order for CBP. Adjusted gross margin improved by 4.8pp to 51.5%

(2022: 46.7%) mainly due to increased sales of higher

performance products and software. Statutory gross margin was up

6.2pp to 47.0% (as restated see note 5) additionally reflecting

production efficiencies as volumes increased. Operating loss in the

period was GBP1.0 million (2022: loss

GBP1.9 million), with an Adjusted EBITDA loss of GBP0.2 million

(2022: loss GBP1.7 million). Adjusted loss before tax of GBP0.8

million improved by 62% (2022: loss GBP2.3 million) with statutory

loss before tax of GBP1.0 million (2022: loss GBP1.9 million).

Cash as at 31 March 2023 was GBP2.8 million (31 March 2022:

GBP5.4 million). The majority of the reduction in year-end cash

relates to the net working capital outflow of GBP2.3 million caused

principally by higher trade receivables at the end of the year,

primarily related to CBP for which settlement occurs as equipment

is deployed in the field.

Revenue

Revenue is split between our two principal activities below:

2023 2022

GBP'000 GBP'000

------------------------- ------- -------

Product 11,782 7,667

Support and Development 638 694

------------------------- ------- -------

Total 12,420 8,361

------------------------- ------- -------

The principal growth driver for the business is product sales.

Support revenue includes extended warranty and other post-sale

support revenue, as well as customer-funded development contracts.

We expect warranty and other support revenue to grow in the future,

with customer-funded development contracts not a key driver for

future growth.

Revenue is split by market sector and geographical region

below:

2023 2022

Revenue by market sector GBP'000 GBP'000

--------------------------------- ------- -------

Retail Distribution 2,429 3,756

Customs 9,165 3,947

Aviation 246 179

Entrance Security 580 479

12,420 8,361

-------------------------------- ------- -------

2023 2022

Revenue by geographical region GBP'000 GBP'000

--------------------------------- ------- -------

UK and Europe 2,249 3,508

Americas 9,223 4,445

Rest of World 948 408

12,420 8,361

-------------------------------- ------- -------

Revenue benefited from translational exchange as the

depreciation in the US$ exchange rates improved revenue by

approximately GBP1.0 million, compared to the prior year average

exchange rate experienced. This resulted in constant currency

growth in revenue of 37%.

Gross Profit

Adjusted gross profit, defined as gross profit excluding

production overheads, is used to enable a like-for-like comparison

of underlying sales profitability. Production overheads are

excluded due to recent changes in product mix and investments in

the production team which have improved capacity and therefore

changed the labour and overhead absorption rates in the current

year. As a result, adjusted gross profit is the Alternative

Performance Measure ('APM') used to represent this metric, see

Appendix for calculation. Statutory gross profit for 2022 has been

re-stated to include production overheads within cost of sales

rather than administrative expenses in accordance with IAS 2

(see note 5).

Adjusted gross margin grew in the second half of the year

reflecting improved product mix caused by an increased proportion

of higher performance product sales and software revenue. This

contributed to the 4.8pp increase in adjusted gross margin for the

full year, with statutory gross margin up by 6.2pp including a

1.4pp benefit from manufacturing efficiencies as we increased

production throughput. Statutory gross margin benefitted from

translational exchange as the depreciation in the US$ exchange

rates improved revenue by approximately GBP0.2 million, compared to

the prior year average exchange rate experienced.

Adjusted gross profit and statutory gross profit are shown

below.

2023 2022

GBP'000 GBP'000

(as restated

see note 5)

---------------------------- -------- -------------

Revenue 12,420 8,361

----------------------------- -------- -------------

Adjusted gross profit 6,401 3,902

Adjusted gross margin 51.5% 46.7%

----------------------------- -------- -------------

Statutory gross profit 5,837 3,413

Statutory gross margin 47.0% 40.8%

----------------------------- -------- -------------

Administrative expenses

Administrative expenses increased as expected by 29% (GBP1.5

million) to GBP6.8 million with overheads up by 19% (GBP0.9

million) to GBP6.1 million. The ratio of overheads to revenue fell

to 49% from 62% last year demonstrating continued operational

leverage. The anticipated payment of a bonus to all employees for

the first time accounted for almost half of the increase in

overheads in the year. Administrative expenses include share-based

payment charges, depreciation and amortisation and impairment of

intangible assets, but these are excluded from overheads. Overheads

were impacted by translational exchange as the depreciation in the

US$ exchange rates increased overheads by approximately GBP0.2

million, compared to the prior year average exchange rate

experienced.

Administrative expenses are analysed as follows:

2023 2022

GBP'000 GBP'000

---------------------------------------- ------- -------

Sales and marketing 2,215 1,945

Engineering 1,359 1,300

Management 1,046 685

PLC costs 829 663

Property and administration 417 494

Bonus 458 84

Foreign exchange gains (198) (6)

----------------------------------------- ------- -------

Overheads 6,126 5,165

Depreciation and amortisation 569 500

Share based payments charge / (credit) 96 (366)

Impairment of intangible assets 36 -

Administrative expenses 6,827 5,299

----------------------------------------- ------- -------

The increase in overheads is driven by higher staff costs

including investments in headcount and related costs. Sales and

marketing expenditure increased due to higher sales commissions

resulting from revenue growth and travel to support growth in our

European and US Retail Distribution markets. Engineering costs,

including R&D costs, were up as a result of increased headcount

in our software team as we continue to scale up to support new

product offerings going forward. Management and PLC costs were

higher, driven by one-off costs relating to the CFO replacement,

higher insurance costs and professional fees.

Loss after tax and loss per share

Statutory loss after tax improved by 51% to a loss of GBP0.8

million with the adjusted loss after tax of GBP0.7 million

improving by 67%. The tax credit of GBP0.2 million (2022: GBP0.2

million) reflects R&D tax credits receivable. Unrelieved tax

losses in the UK available to carry forward indefinitely are

GBP15.2 million (2022: GBP14.0 million).

The loss per share and adjusted loss per share were 0.55 pence

and 0.46 pence respectively

(2022: loss per share and adjusted loss per share of 1.14 pence

and 1.39 pence respectively) and reflected the movements in

adjusted and statutory loss after tax.

Cash flow

The decrease in cash and cash equivalents during the year of

GBP2.6 million to GBP2.8 million as at 31 March 2023, was

principally caused by a GBP2.3 million outflow in net working

capital, with an operating cash outflow before working capital

movements of GBP0.2 million and net outflows of GBP0.1 million each

from investing and financing activities.

The movements in net working capital were as follows:

-- Trade and other receivables caused a GBP2.4 million outflow

in the year, driven by higher sales in the final quarter of the

year. Included in trade and other receivables of GBP3.7 million

at

31 March 2023 was GBP2.7 million relating to CBP, GBP1.7 million

of which has been received to date.

-- Inventory reduced by GBP0.2 million with tighter inventory

management offset by selective forward purchasing of key electronic

components where potential global shortages became apparent.

-- An increase in trade and other payables resulted in an inflow

of GBP0.3 million. Trade payables increased principally due to the

volume of stock purchased in the final quarter compared to the

prior year.

Financing, Treasury and Going Concern

Cash and cash equivalents as at 31 March 2023 were GBP2.8

million (31 March 2022: GBP5.4 million).

In order to manage fluctuations in working capital, the Group

has recently agreed an overdraft facility with HSBC of GBP1.0

million which reduces to GBP0.25 million from 30 September 2023 and

currently expires on 31 May 2024. This remains undrawn to date.

The Group has prepared and reviewed cash flow forecasts for the

period to 31 July 2024, which reflect forecast changes in revenue

across its business and performed a reverse stress test of the

forecasts to determine the extent of any downturn which would

result in insufficient cash being available to the business.

Following this assessment, the Board are satisfied that the Group

has sufficient resources to continue in operation for a period of

not less than 12 months from the date of this report. Accordingly,

they continue to adopt the going concern basis in relation to this

conclusion and preparing the Consolidated Financial Statements.

Currency

The Group has both translational and transactional currency

exposures. Translational exposures arise on the consolidation of

the US overseas subsidiary results into GBP. The largest

translational exposures during the year were to the US Dollar.

Translational exposures are not hedged. During the year, currency

translation effects resulted in revenue being GBP1.0 million

higher, gross margin being GBP0.2m higher and Adjusted EBITDA

GBP34k higher than they would have been if calculated using prior

year exchange rates.

Transactional exposures arise where the currency of sale or

purchase invoices differs from the functional currency in which

each company prepares its local accounts. The transactional

exposures include situations where foreign currency denominated

trade receivables, trade payables and cash balances are held.

Transactional foreign exchange gains of GBP0.2m (2022: GBP6k gain)

were included in administrative expenses. The Group maintains

non-GBP cash balances to meet short-term operational

requirements.

The table below shows the average and closing key exchange rates

for the US Dollar compared to GBP.

2023 2022

----------------------------------- ------ -----

Average exchange rate for the year 1.206 1.367

----------------------------------- ------ -----

Exchange rate at the year end 1.236 1.312

----------------------------------- ------ -----

Other

A limited programme of share purchases by the Thruvision plc

Employee Benefit Trust is being undertaken over the 12 months from

April 2023 with the purpose of partly satisfying future employee

exercises of share options. The first share purchase under this

programme occurred in April 2023.

Dividends

The Board is not proposing to pay a dividend (2022: none).

Events after the balance sheet date

The Group has recently agreed an overdraft facility of GBP1.0

million which reduces to GBP0.25 million for the period from 30

September 2023 to 31 May 2024 and nil thereafter, in order to

support working capital requirements as the business expands. The

Group has entered into guarantees in respect of this facility. This

facility remained undrawn at the date of publication of these

results.

Consolidated income statement

for the year ended 31 March 2023

Year ended

Year ended 31 March 2022

31 March GBP'000

2023 (As restated

Notes GBP'000 see note 5)

-------- ----------- ---------------

Revenue 2 12,420 8,361

Cost of sales (6,583) (4,948)

----------- ---------------

Gross profit 5,837 3,413

Administrative expenses (6,827) (5,299)

----------- ---------------

Operating loss 3 (990) (1,886)

Finance income 26 17

Finance costs (15) (20)

----------- ---------------

Loss before tax (979) (1,889)

Taxation credit 174 231

----------- ---------------

Loss for the year (805) (1,658)

----------- ---------------

Loss per share

Loss per share - basic and diluted 4 (0.55p) (1.14p)

----------- ---------------

All operations are continuing.

Consolidated statement of comprehensive income

for the year ended 31 March 2023

Year ended Year ended

31 March 2023 31 March 2022

GBP'000 GBP'000

--------------- ---------------

Loss for the year attributable to owners of the parent (805) (1,658)

Other comprehensive loss - items that may be subsequently reclassified to profit or

loss:

Exchange differences on retranslation of foreign operations (50) (6)

--------------- ---------------

Total other comprehensive loss (50) (6)

--------------- ---------------

Total comprehensive loss attributable to owners of the parent (855) (1,664)

--------------- ---------------

Consolidated statement of financial position

at 31 March 2023

31 March 2023 31 March 2022

GBP'000 GBP'000

-------------- --------------

Non-current assets

Property, plant and equipment 1,173 1,175

Intangible assets 109 79

-------------- --------------

1,282 1,254

Current assets

Inventories 3,639 3,868

Trade and other receivables 4,342 1,982

Current tax recoverable 375 210

Cash and cash equivalents 2,810 5,441

-------------- --------------

11,166 11,501

-------------- --------------

Total assets 12,448 12,755

-------------- --------------

Current liabilities

Trade and other payables (2,690) (2,344)

Lease liabilities (121) (150)

Provisions (107) (178)

-------------- --------------

(2,918) (2,672)

-------------- --------------

Net current assets 8,248 8,829

-------------- --------------

Non-current liabilities

Trade and other payables (72) (97)

Lease liabilities (604) (503)

Provisions (38) (38)

-------------- --------------

(714) (638)

Total liabilities (3,632) (3,310)

-------------- --------------

Net assets 8,816 9,445

-------------- --------------

Equity

Share capital 1,472 1,466

Share premium 325 201

Capital redemption reserve 163 163

Translation reserve 11 61

Retained earnings 6,845 7,554

-------------- --------------

Total equity 8,816 9,445

-------------- --------------

Consolidated statement of changes in equity

for the year ended 31 March 2023

Share Share Capital redemption Retained Total

capital premium reserve Translation reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- ------------------------ -------------------- ---------- ---------

At 1 April 2021 1,458 47 163 67 9,578 11,313

Shares issued 8 154 - - - 162

Share-based payment

credit - - - - (366) (366)

--------- --------- ------------------------ -------------------- ---------- ---------

Transactions with

Shareholders 8 154 - - (366) (204)

Loss for the year - - - - (1,658) (1,658)

Other comprehensive loss - - - (6) - (6)

--------- --------- ------------------------ -------------------- ---------- ---------

Total comprehensive loss - - - (6) (1,658) (1,664)

--------- --------- ------------------------ -------------------- ---------- ---------

At 31 March 2022 1,466 201 163 61 7,554 9,445

Shares issued 6 124 - - - 130

Share-based payment

charge - - - - 96 96

--------- --------- ------------------------ -------------------- ---------- ---------

Transactions with

Shareholders 6 124 - - 96 226

Loss for the year - - - - (805) (805)

Other comprehensive loss - - - (50) - (50)

--------- --------- ------------------------ -------------------- ---------- ---------

Total comprehensive loss - - - (50) (805) (855)

--------- --------- ------------------------ -------------------- ---------- ---------

At 31 March 2023 1,472 325 163 11 6,845 8,816

--------- --------- ------------------------ -------------------- ---------- ---------

Consolidated statement of cash flows

for the year ended 31 March 2023

Year ended

31 March

2022

Year ended GBP'000

31 March 2023 (As restated

GBP'000 see note 5)

--------------- -------------------

Operating activities

Loss after tax (805) (1,658)

Adjustments for:

Taxation credit (174) (231)

Finance income (26) (17)

Finance costs 15 20

Depreciation of property, plant and equipment 619 546

Profit on disposal of property, plant and equipment (10) -

Amortisation of intangible assets 20 15

Impairment of intangible assets 36 -

Share-based payment charge/(credit) 96 (366)

--------------- -------------------

Operating cash outflow before changes in working capital and provisions (229) (1,691)

Increase in trade and other receivables (2,360) (540)

(Increase)/decrease in inventories (183) 621

Increase/(decrease) in trade and other payables 321 (378)

(Decrease)/increase in provisions (71) 3

--------------- -------------------

Cash utilised in operations (2,522) (1,985)

Net income taxes received/(paid) - 399

--------------- -------------------

Net cash outflow from operating activities (2,522) (1,586)

Investing activities

Purchase of property, plant and equipment (37) (187)

Purchase of intangible assets (86) (46)

Proceeds from disposal of property, plant and equipment 11 -

Interest received 26 17

--------------- -------------------

Net cash outflow from investing activities (86) (216)

Financing activities

Proceeds from issue of shares 130 162

Payments on principal portion of lease liabilities (180) (168)

Interest paid on lease liabilities (15) (13)

--------------- -------------------

Net cash outflow from financing activities (65) (19)

Net decrease in cash and cash equivalents (2,673) (1,821)

Cash and cash equivalents at 1 April 5,441 7,268

Effect of foreign exchange rate changes 42 (6)

--------------- -------------------

Cash and cash equivalents at 31 March 2,810 5,441

--------------- -------------------

Notes to the financial information

1. Accounting policies

1.1 Basis of preparation

The nancial information of the Group set out above does not

constitute statutory accounts for the purposes of Section 435 of

the Companies Act 2006. The nancial information for the year ended

31 March 2023 has been extracted from the Group's audited nancial

statements which were approved by the Board of Directors on 20 July

2023.

The financial statements of Thruvision Group plc have been

prepared in accordance with UK-adopted International Accounting

Standards and with the requirements of the Companies Act 2006 as

applicable to companies reporting under those standards.

These financial statements are presented in Pounds Sterling

('GBP') and are rounded to the nearest thousand (GBP'000), except

where otherwise stated.

The financial statements were authorised for issue by the Board

of Directors on 20 July 2023 and the Statement of Financial

Position was signed on the Board's behalf by Colin Evans and

Victoria Balchin.

The Company is a public limited company incorporated and

domiciled in England and Wales and whose shares are quoted on AIM,

a market operated by the London Stock Exchange.

The consolidated financial statements have been prepared on a

historical cost basis.

1.2 Accounting policies

The key accounting policies which apply in preparing the

financial statements for the year are set out below. These policies

have been consistently applied to all periods presented in these

consolidated financial statements.

The USD/GBP exchange rates used in the consolidated financial

statements is as follows:

2023 2022

----------------------------------- ------ -----

Average exchange rate for the year 1.206 1.367

----------------------------------- ------ -----

Exchange rate at the year end 1.236 1.312

----------------------------------- ------ -----

1.3 Basis of measurement

Going concern

The Group's loss before tax from continuing operations for the

year was GBP1.0 million (2022: GBP1.9 million). As at 31 March 2023

the Group had net current assets of GBP8.2 million (31 March 2022:

GBP8.8 million) and cash and cash equivalents of GBP2.8 million (31

March 2022: GBP5.4 million).

The Board has taken the cash flow forecast for the period to 31

July 2024, reviewed the key assumptions unpinning the projection,

and considered a range of downside scenarios to assess whether the

business has adequate financial resources to continue operational

existence and to meet liabilities as they fall due for a period of

not less than 12 months from the approval of the financial

statements.

In completing the above analysis, the Board has reviewed the

following:

-- The current pipeline of potential sales opportunities,

differentiating between existing customers and new customers,

and smaller sales and large, multi-unit sales. Potential

scenarios included a general downgrading of smaller units

sales volumes and the removal of larger sales for which

confidence of securing an order was not already high based

on customer interaction to date

-- Market, political and recessionary economic trends that

may adversely impact the prospects of revenue realisation

from a broad range of customers in all geographical areas

of operation

-- The potential for supply chain issues to result in higher

purchasing costs and reduced margins, or an inability

to fulfil all orders received due to raw materials shortages

-- An expectation of retaining a materially higher overheads

cost base than the prior year, aligned to support a growing

business

-- General inflationary pressures that may have similar impacts

on revenues and costs to those described above

Stress testing has been performed to identify and analyse the

circumstances under which the Group's business would no longer be

viable without recourse to new funding throughout the period

reviewed, including steps taken to maximise liquidity, for example

a reduction in discretionary spend and inventory levels. The

testing undertaken applied various stresses simultaneously even

though it would not be considered reasonable to expect all

downsides to occur concurrently.

As a result, the above testing demonstrates that cash generation

is sufficient for the business to remain a going concern, without

recourse to alternative sources of finance, for the period to 31

July 2024.

Overall, the Group is well placed to manage business risk

effectively and the Board reviews the Group's performance against

budgets and forecasts on a regular basis to ensure action is taken

where needed. The Directors are satisfied that the Group has

adequate resources to continue operating for a period of at least

12 months from the approval of these accounts. For this reason,

they have adopted the going concern basis in preparing the

financial statements.

In addition, in order to manage fluctuations in working capital,

the Group has recently agreed an overdraft facility with HSBC of

GBP1.0 million reducing to GBP0.25 million from 30 September 2023

to 31 May 2024 and nil thereafter. This facility has remained

undrawn to date.

2. Segmental information

The business is run as one segment although we sell our products

into a number of sectors as disclosed in the Finance review. The

employees of the business work across both our geographical and

market sectors, with the assets of the business being utilised

across these sectors as well, and it is not possible to directly

apportion these costs between these sectors.

As such, the Directors do not split the business into segments

in order to internally analyse the business performance. The

Directors believe that allocating administrative expenses by

department provides a suitable level of business insight. The

overhead department cost centres comprise:

-- Engineering (including R&D);

-- Sales and marketing;

-- Property and administration;

-- Management; and

-- Plc costs.

with the split of costs as shown within the Financial

Review.

2. Segmental information (continued)

Revenue is split between our two principal activities below:

2023 2022

GBP'000 GBP'000

------- -------

Product 11,782 7,667

Support and Development 638 694

------- -------

12,420 8,361

------- -------

The principal growth driver for the business is product sales.

Support revenue includes extended warranty and other post-sale

support revenue, as well as customer-funded development contracts.

We expect warranty and other support revenue to grow in the future,

with customer-funded development contracts not a key driver for

future growth.

The Group's revenue by market sector and geographical region is

detailed below:

2023 2022

Revenue by market sector GBP'000 GBP'000

--------- ---------

Retail Distribution 2,429 3,756

Customs 9,165 3,947

Aviation 246 179

Entrance Security 580 479

--------- ---------

12,420 8,361

--------- ---------

2023 2022

Revenue by geographical region GBP'000 GBP'000

--------- ---------

UK and Europe 2,249 3,508

Americas 9,223 4,445

Rest of World 948 408

--------- ---------

12,420 8,361

--------- ---------

The Group's revenue by point of recognition is detailed

below:

2023 2022

GBP'000 GBP'000

--------- ---------

Revenue recognised at point in time 11,888 7,718

Revenue recognised over time - Extended warranty and support revenue 532 643

--------- ---------

12,420 8,361

--------- ---------

Analysis of revenue by customer

There has been one individually material customer (comprising

over 10% of total revenue) in the year (2022: two customers). This

customer represented GBP8,286k (or 66%) of revenue for the year

(2022: GBP3,740k (44%) and GBP1,059k (13%)).

Other segment information

The Group's non-current assets by geography are detailed

below:

2023 2022

GBP'000 GBP'000

--------- ---------

United Kingdom 1,027 1,157

United States of America 255 97

--------- ---------

1,282 1,254

--------- ---------

3. Operating loss

The operating loss is stated after charging/(crediting):

2023 2022

GBP'000 GBP'000

--------- ---------

Cost of inventories recognised as an expense - restated 2022 see note 5 5,475 4,571

Research and development expense 598 631

Net impairment (credit)/charge on trade receivables and contract assets (57) 57

Share based payment charge/(credit) 96 (366)

Depreciation of property, plant and equipment 619 546

Profit on disposal of property, plant and equipment (10) -

Expenses relating to short-term and low-value leases 3 3

Amortisation of intangible assets 20 15

Impairment of intangible assets 36 -

Exchange gains (198) (6)

--------- ---------

4. Loss per share

2023 2022

------------ ------------

Loss after tax (GBP'000) (805) (1,658)

Weighted average number of shares (number) 147,138,774 145,853,091

Basic and diluted loss per share (pence) (0.55p) (1.14p)

------------ ------------

The inclusion of potential Ordinary Shares arising from LTIPs

and EMI Options would be anti-dilutive. Basic and diluted loss per

share has therefore been calculated using the same weighted number

of shares for each financial year.

5. Restatements

Income statement

In 2022, gross margin has been restated to correctly classify

certain fixed and variable production overheads including

production staff costs and related overheads to cost of sales from

administrative expenses. The total costs reclassified in 2022 from

administrative expenses to cost of sales was GBP0.5 million. There

is no impact on operating profit.

Cash flow statement

The cash flow statement has been re-stated to correct non-cash

movements relating to leases. A new lease entered into during 2022

had incorrectly been grossed up and presented as a lease property

addition outflow within investing activities and the respective

lease liability had been presented as a new lease cash inflow

within financing activities. The impact is a reduction in investing

activities of GBP0.5 million and a reduction in financing

activities of GBP0.5 million. There is no impact on cash and cash

equivalents.

For both restatements there was no impact on the basic and

diluted EPS figures as reported or on the statement of financial

position for the 2022 financial year.

6. Post-balance sheet events

The Group has recently agreed an overdraft facility of GBP1.0

million, reducing to GBP0.25 million on 30 September 2023, and

expiring on 31 May 2024, in order to further support working

capital requirements as the business expands. The Group has entered

into guarantees in respect of this facility. This facility remained

undrawn at the date of signing of these financial statements.

From 1 April 2023 to the date of this report, 309,619 of Shares

in the Company have been purchased by the EBT with a nominal value

of GBP3.1k for total consideration of GBP80k.

APPIX - ALTERNATIVE PERFORMANCE MEASURES (APMs)

Thruvision uses adjusted figures as key performance measures in

addition to those reported under IFRS, as management believe these

measures enable management and stakeholders to assess the

underlying trading performance of the businesses as they exclude

certain items that are considered to be significant in nature

and/or quantum.

The APMs are consistent with how the businesses' performance is

planned and reported within the internal management reporting to

the Board. Some of these measures are used for the purpose of

setting remuneration targets.

The key APMs that the Group uses include adjusted measures for

the income statement together with adjusted cash flow measures.

Explanations of how they are calculated and how they are reconciled

to an IFRS statutory measure are set out below.

Adjusted measures

The Group's policy is to exclude items that are considered to be

significant in nature and/or quantum and where treatment as an

adjusted item provides stakeholders with additional useful

information to better assess the period-on-period trading

performance of the Group. The Group excludes certain items, which

management have defined as:

- Share based payments charge or credit

- Impairment of intangible assets or property, plant and equipment

Gross profit, excluding production overheads, is used to enable

a like-for-like comparison of underlying sales profitability.

Production overheads are excluded due to recent changes in product

mix and investments in the production team which have improved

capacity and therefore changed the labour and overhead absorption

rates in the current year. As a result, adjusted gross profit is

the APM used to represent this metric.

Based on the above policy, the alternative performance measures

are derived from the statutory figures as follows:

a) Adjusted gross profit

2023 2022

GBP'000 GBP'000

----------------------- -------- --------

Gross profit 5,837 3,413

------------------------ -------- --------

Add back:

Production overheads 564 489

------------------------ -------- --------

Adjusted gross profit 6,401 3,902

------------------------ -------- --------

b) Adjusted EBITDA

2023 2022

GBP'000 GBP'000

------------------------------------- -------- --------

Statutory operating loss (990) (1,886)

-------------------------------------- -------- --------

Add back:

Depreciation and amortisation 639 561

Impairment of intangible assets 36 -

Share-based payment charge/(credit) 96 (366)

-------------------------------------- -------- --------

Adjusted EBITDA (219) (1,691)

-------------------------------------- -------- --------

c) Adjusted loss before tax

2023 2022

GBP'000 GBP'000

------------------------------------- -------- --------

Statutory loss before tax (979) (1,889)

-------------------------------------- -------- --------

Add back:

Impairment of intangible assets 36 -

Share-based payment charge/(credit) 96 (366)

-------------------------------------- -------- --------

Adjusted loss before tax (847) (2,255)

-------------------------------------- -------- --------

d) Adjusted loss per share

2023 2022

GBP'000 GBP'000

------------------------------------- ------------ ------------

Statutory loss after tax (805) (1,658)

-------------------------------------- ------------ ------------

Add back:

Impairment of intangible assets 36 -

Share-based payment charge/(credit) 96 (366)

-------------------------------------- ------------ ------------

Adjusted loss after tax (673) (2,024)

-------------------------------------- ------------ ------------

Weighted average number of shares 147,138,774 145,853,091

-------------------------------------- ------------ ------------

Statutory loss per share (pence) (0.55) (1.14)

-------------------------------------- ------------ ------------

Adjusted loss per share (pence) (0.46) (1.39)

-------------------------------------- ------------ ------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR URSRROSUBUUR

(END) Dow Jones Newswires

July 21, 2023 02:00 ET (06:00 GMT)

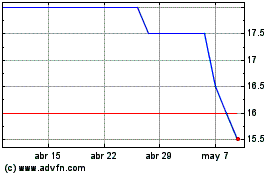

Thruvision (LSE:THRU)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Thruvision (LSE:THRU)

Gráfica de Acción Histórica

De May 2023 a May 2024