TIDMTHX

RNS Number : 6765U

Thor Explorations Ltd

27 November 2023

NEWS RELEASE

NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR

DISTRIBUTION TO U.S. WIRE SERVICES

27 November 2023 TSXV & AIM: THX

THOR EXPLORATIONS

FINANCIAL AND OPERATING RESULTS FOR THE THREE AND NINE MONTHSING

SEPTEMBER 30, 2023

Focus on drilling regional Segilola gold targets, continuation

of lithium prospects

Thor Explorations Ltd. (TSXV / AIM: THX) ("Thor Explorations",

"Thor" or the "Company") is pleased to provide an operational and

financial review for its Segilola Gold mine, located in Nigeria

("Segilola"), and for the Company's mineral exploration properties

located in Nigeria, Senegal, and Burkina Faso for three ("Q3 2023"

or the "Period") and nine months to September 30, 2023.

Financial Highlights of Q3 2023 and nine months to Sept 2023

US$ Q3 2023 Q3 2022 Nine months Nine months

to Sept to Sept 2022

2023

Revenue $36.6m $55.7m $118.2m $121.9m

--------- --------- ------------ --------------

AISC* $1392/oz $1378/oz $1321/oz $1273/oz

--------- --------- ------------ --------------

Cash operating cost $1193/oz $1137/oz $1005/oz $991/oz

--------- --------- ------------ --------------

EBITDA $11.8m $17.8m $47.0m $49.0m

--------- --------- ------------ --------------

Net Profit $2.3m $7.6m $14.5m $17.8m

--------- --------- ------------ --------------

Cash at end of period $8.3m $2.5m - -

--------- --------- ------------ --------------

Net Debt $19.4m $40.7m - -

--------- --------- ------------ --------------

* all-in sustaining cost

Operational Highlights for Q3 2023

Gold production targets on track for FY23 guidance

-- Gold production for the Period totalled 19,021 ounces ("oz")

-- Nine months to Sept '23 production of 63,328 oz - in line with expectations

-- All main operating units of the process plant continue to

perform well, with the main west wall push back completed

-- Ongoing improvements at process plant being undertaken and to be commissioned in Q4 2023

Focused exploration at Segilola

-- Focus of gold exploration activities within a 25km radius from the Segilola operations

-- Continuation of reverse circulation ("RC") drilling, stream

sediment sampling and grid auger sampling at the Kola Prospect,

23km south of Segilola,

-- Continuation of diamond drilling on identified high-grade

quartz-vein style mineralisation at Aye-Ile prospect which is

located 15km west of Segilola with several narrow high-grade

intersections drilled

Ongoing impact Assessment of Douta Project

-- Further progress made with Pre-Feasibility Study ("PFS")

workstreams with an expected completion for Q1 2024

-- Environmental and Social Impact Assessment is ongoing

-- Metallurgical test work is continuing at IMO Laboratory in Perth, Western Australia

-- Compilation and reporting of geotechnical data

-- Resource drilling, which targeted the higher-grade parts of

the existing inferred resource has been completed

Thor Lithium Exploration at Oyo Project

-- At Oyo Project Location 6 a total of 77 RC drillholes

totalling 4,585 metres ("m") were drilled

-- Significant intersections previously reported include 11m

grading 1.53% lithium oxide ("Li2O"), 9m grading 2.42% Li2O and 11m

grading 2.61% Li2O

-- Regional soil geochemical surveys commenced

-- Additional tenure obtained at both the Oyo and Ekiti Project Areas

-- Reconnaissance mapping and sampling at the Ekiti Project

returned positive results including a rock chip sample grading

2.92% Li2O with drilling now commence at this Project

ESG

-- Two weather stations installed at Segilola to assist with

accurate climate database and mine planning

-- Continuous progression of livelihood restoration programmes

to individuals affected locally within the Segilola mine

footprint

-- Community projects undertaken by Africa Star Resources team

in Senegal, including improvements of local school toilet

facilities, clearing wasteland at local cemetery and providing a

generator for the local police station

Outlook

-- FY 2023 production guidance of 85,000 oz of gold maintained

-- AISC guidance for the year maintained at US$1,150 - US$1,350 per ounce

-- H2 2023 drilling programs:

o Continuation of drilling at Segilola gold regional targets and

underground project

o Continuation of drilling at Oyo lithium prospect and

commencement of drilling at the Ekiti lithium prospects in

Nigeria

-- Completion of the Douta resource update in Q4 2023

-- Continued assessment of prospective exploration properties in Nigeria

-- Continued exploration programs across our exploration portfolio in Nigeria

Segun Lawson, CEO, commented:

"Our Q3 2023 gold production of 19,104oz is in-line with our

August guidance update of 85,000oz for the full year 2023.We are

pleased to have achieved this and to have completed the pushback of

the west wall which means that the pit conditions have

significantly improved. We are now well positioned to mine more

flexibly and efficiently going forwards.

"Our process plant continues to perform above design capacity.

Upgrades to the process plant leaching and electrowinning circuits

are being phased-in over Q4 2023 and Q1 2024, which are expected to

result in a release of gold-in-circuit and increased plant

recoveries from December 2023, continuing throughout 2024.

"In terms of financial performance, whilst the lower grades have

led to lower revenue and profits in the quarter, we have maintained

good levels of positive cash flow. We anticipate a stronger

financial performance in the final quarter as the mine grade

increases.

"The resource drilling at our Douta gold project in Senegal,

which was targeting the higher-grade zones of the inferred

resource, has been completed and final assays are pending. The

Environmental and Social Impact Assessment is ongoing and

metallurgical test work is continuing at IMO Laboratory in Perth,

Western Australia. To maximise the full potential of the 1.78 Moz

of gold resource at Douta, we are extending the metallurgical

testwork program with IMO and will also be conducting further

testwork with our engineering design partner JinPeng engineering in

China to confirm equipment selection. It is important that we

confirm a robust process design that maximises the overall

economics of the project and that provides us with the confidence

to progress directly to project implementation. We are therefore

postponing the preparation of an updated resource for Douta until

confirmation of the process design and thereafter release of the

PFS, targeting Q1 2024.

"We have made good early progress at our West Oyo Lithium

Project in Nigeria, with an encouraging initial set of drilling

results. We have been able to confirm and delineate lithium-bearing

mineralisation, with spodumene confirmed as the primary

lithium-bearing mineral. Our plan is to expand our drilling program

to the other pegmatites across our permits and expect to receive

further results in Q4 2023."

The Group's Consolidated Condensed Interim Financial Statements

together with the notes related thereto, as well as the

Management's Discussion and Analysis for the three and nine months

ended September 30, 2023, are available on Thor Explorations'

website at https://thorexpl.com/investors/financials/ .

About Thor Explorations

Thor Explorations Ltd . is a mineral exploration company engaged

in the acquisition, exploration, development and production of

mineral properties located in Nigeria, Senegal and Burkina Faso.

Thor Explorations holds a 100% interest in the Segilola Gold

Project located in Osun State, Nigeria and has a 70% economic

interest in the Douta Gold Project located in south-eastern

Senegal. Thor Explorations trades on AIM and the TSX Venture

Exchange under the symbol "THX".

For further information please contact:

Thor Explorations Ltd

Email: info@thorexpl.com

Canaccord Genuity (Nominated Adviser & Broker)

Henry Fitzgerald-O'Connor / James Asensio / Harry Rees

Tel: +44 (0) 20 7523 8000

Hannam & Partners (Broker)

Andrew Chubb / Matt Hasson / Jay Ashfield / Franck Nganou

Tel: +44 (0) 20 7907 8500

Fig House Communications (Investor Relations)

Tel: +1 416 822 6483

Email: investor.relations@thorexpl.com

Yellow Jersey PR (Financial PR)

Charles Goodwin / Shivantha Thambirajah / Soraya Jackson

Tel: +44 (0) 20 3004 9512

BlytheRay (Financial PR)

Tim Blythe / Megan Ray / Said Izagaren

Tel: +44 207 138 3203

Qualified Person

The technical information included in this report has been

prepared under the supervision of Alfred Gillman (Fellow, AusIMM,

CP Geology), who is designated as a "qualified person" under

National Instrument 43-101 and AIM and has reviewed and approves

the content of this news release. He has also reviewed QA/QC,

sampling, analytical and test data underlying the information.

Production Metrics

Units Q3 - Q2 -2023 Q1 - Q4 - Q3 - Q2 - Q1 -

2023 2023 2022 2022 2022 2022

Mining

Total Mined Tonnes 5,673,193 5,633,688 4,194,689 4,296,494 4,018,431 4,031,584 3,759,524

Waste Mined Tonnes 5,370,279 5,355,105 3,996,264 3,974,073 3,793,249 3,747,504 3,533,610

Ore Mined Tonnes 302,915 278,583 198,425 322,421 225,182 284,079 226,314

Grade g/t Au 2.44 2.43 2.85 3.51 4.43 3.63 2.68

Daily Total

Mining Rate Tonnes/Day 61,665 61,909 46,608 46,701 43,679 44,303 41,772

Daily Ore

Mining Rate Tonnes/Day 3,292 3,061 2,205 3,505 2,448 3,122 2,515

Stockpile

Ore Stockpiled Tonnes 338,558 297,060 270,215 300,531 229,909 249,281 179,758

Ore Stockpiled g/t Au 0.99 1.06 1.14 1.48 1.19 1.46 1.23

Ore Stockpiled Oz 10,756 10,124 9,904 14,300 8,796 11,701 7,109

Processing

Ore Processed Tonnes 261,671 255,231 231,001 254,824 241,434 211,582 221,900

Grade g/t Au 2.46 2.99 2.95 3.38 3.58 3.66 3.18

Recovery % 92.3 94 94.1 95 95.5 95.5 94.1

Gold Recovered Oz 19,104 23,078 20,629 26,331 26,523 23,785 21,343

Milling

Throughput Tonnes/Day 2,844 2,805 2,567 2,770 2,624 2,325 2,466

Key Exploration updates

Exploration Activity Summary Q3 2023

Segilola near mine exploration continued as a priority for the

Group in 2023. The Group also completed its field exploration

activities at the Douta Project in Senegal and is now completing

various workstreams for the Douta Preliminary Feasibility

Study.

The Group continued to expand its portfolio in Nigeria through

the acquisition of additional pegmatite bearing lithium licences in

various locations via entering into joint venture agreements with

existing licence holders.

The majority of the exploration activities carried out on all

the Group's licences, consisted of Reverse Circulation drilling,

Diamond Drilling, geochemical stream sediment sampling, auger

drilling and soil sampling. Work continued on the Kola target which

is located about 20km from the Segilola Mine following the

significant geochemical signature and follow up drill results that

included several anomalous zones.

In Senegal, the Group's Douta Project encompasses a mineral

resource of 1.78 million ounces ("Moz") of gold ("Au"). Workstreams

focussed on the proposed process flow sheet in support of a

Preliminary Feasibility Study (PFS) commenced during the quarter

following the completion of the resource drilling program.

As part of its strategy of identifying high-value mineral

resource opportunities, Thor, through its fully owned subsidiary

Newstar Minerals Ltd, continued to carry out drilling activities on

its West Oyo Lithium project however the drilling program was

interrupted due to heavy rains in Oyo, delaying the drill results

to Q4 2023.

Exploration drilling statistics summary for the Period

Prospect Target Diamond RC Total

Commodity

No. Metres No. Metres No. Metres

Holes Holes Holes

------------ ------- ------- ------- ------- ------- -------

Western Prospect

- Aye-ile gold 14 1,866 14 1,866

------------ ------- ------- ------- ------- ------- -------

Southern Prospect

-Kola gold 39 2,621 39 2,621

------------ ------- ------- ------- ------- ------- -------

Newstar Lithium

- Oyo lithium 77 4,585 77 4,585

------------ ------- ------- ------- ------- ------- -------

Total 14 1,866 116 7,206 130 9,072

------- ------- ------- ------- ------- -------

Nigeria Gold

Introduction

The high grade Segilola gold deposit is located on the major

regional shear zone that extends for several hundred kilometres

through the gold-bearing Ilesha schist belt (structural corridor)

of Nigeria.

The key objective of the exploration strategy is to extend the

life of mine ("LOM") at Segilola. Approximately 80% of the Group's

Nigerian exploration effort is concentrated within a 25km radius

from the Segilola operation such that potential gold-bearing

material can be easily trucked to the existing plant. In parallel

to this, the Group also continued to carry out generative

exploration activities in areas that are further from the mine.

Segilola Southern Prospects

The southern prospects cover an area that is located to the

south from the Segilola Gold Mine. Regional stream sediment

sampling located an area of interest at what is now referred to as

the Kola target. Kola is located about 20km from the Segilola Mine.

Further follow up drill testing of this greenfield target

intersected several high grade anomalous zones of interest

including 13m grading 11.57g/tAu.

Further drilling at the Kola Target has delineated high grade

mineralisation extensions to the north-west and the south-east as

illustrated in Figure 2.2 below. Drilling is ongoing throughout Q4

2023 to test these extensional targets.

Figure 2.2 Segilola Southern Prospects

Kola Prospect Significant Results

Hole x Y Z Depth Dip Azimuth From To Interval Grade

ID (m) (m) (m) (g/tAu)

SGRC202 699920 807870 259 31 -90 0 0 7 7 0.86

------- ------- ---- ------ ---- -------- ----- ----- --------- ---------

SGRC203 699913 807870 259 26 -90 0 0 13 13 11.57

------- ------- ---- ------ ---- -------- ----- ----- --------- ---------

SGRC203 21 24 3 0.97

------- ------- ---- ------ ---- -------- ----- ----- --------- ---------

SGRC204 699938 807889 259 70 -60 270 5 11 6 0.73

------- ------- ---- ------ ---- -------- ----- ----- --------- ---------

SGRC215 699921 807890 259 31 -60 90 17 22 5 2.54

------- ------- ---- ------ ---- -------- ----- ----- --------- ---------

SGRC236 699901 807898 259 60 -60 90 20 26 6 2.24

------- ------- ---- ------ ---- -------- ----- ----- --------- ---------

(0.5g/tAu lower cut off; maximum 1m internal dilution)

Segilola Western Prospects

The Western Prospects are located about 15km directly west from

the Segilola Gold Mine and cover mostly amphibolitic rocks that

contrast with the more gneissic terrain that is developed at

Segilola itself. The prospect comprises several exploration permits

that are held under exercised option agreements. The area is easily

accessed through a series of sealed roads and gravel tracks. The

Western Prospects are held under a joint venture agreement

("Thor-Esteedan JV") between Thor's wholly owned subsidiary

Segilola Gold Limited ("SGL") and a local mineral exploration

company, Esteedan Limited ("Esteedan").

Igila

Drilling continued at Igila following up on the series of narrow

high grade mineralised lodes. Exploration activities at the Western

Prospects was aimed at identifying additional strike length and

identifying additional lodes such as the Aye-Ile prospect.

Aye-Ile

The Aye-Ile prospect is located approximately 1.2km along strike

to the south-east from Igala. Drill testing of anomalous auger

geochemistry located a north-east dipping vein-system that is

developed on the same structural orientation as Igala. Additional

drilling is planned to expand the zone of mineralisation and to

infill the prospective strike between Igala and Aye-Ile. Further

drilling intersections were drilled in the period with results

highlighted in the table below.

Prospect Hole x Y Z Depth Dip Azimuth From To Interval Grade

ID (m) (m) (m) (g/tAu)

Aye-Ile SGD250 684182 836855 386 110 -60 320 40.7 41.8 1.1 0.64

-------- ------- ------- ---- ------ ---- -------- ----- ----- --------- ---------

Aye-Ile SGD266 684219 836824 376 84 -60 320 36.2 38.1 1.9 8.34

-------- ------- ------- ---- ------ ---- -------- ----- ----- --------- ---------

Aye-Ile SGD272 684246 836842 347 101 -60 320 70 73 3 6.84

-------- ------- ------- ---- ------ ---- -------- ----- ----- --------- ---------

(0.5g/tAu lower cut off; maximum 1m internal dilution)

Aye- Ile exploration map

Newstar Lithium

Thor has secured over 600km(2) of granted tenure in Nigeria that

form Oyo State, Kwara State and Ekiti State Lithium Project Areas.

The Oyo State Project Area encompasses what Thor considers to be

one of Nigeria's most significant lithium pegmatite occurrence

which is currently being exploited by small-scale lithium mining.

In the period, Thor has added further licences in Ekiti to its

portfolio.

The Oyo State Lithium Project comprises approximately 38km(2) of

exploration tenure that is located towards the westernmost border

of Nigeria and within 200km of the commercial capital of Lagos. The

project area is unique in the Nigerian context as it is mostly

located in a relatively sparsely populated region of the country

but within close proximity to large population centres and advanced

infrastructure such as road, rail and ports.

Target Area 1

Reconnaissance rock chip sampling carried out in 2022 in the

western parts of Oyo State returned Li(2) O analyses of between

1.34% and 9.31%. Thor has secured tenure over this area in a number

of joint venture agreements together with wholly owned exploration

permits.

A program of reverse circulation targeted an identified

pegmatite trend that is developed within northerly trending mafic

sequence that is surrounded by granitoid-gneiss terrain.

The significant results from this program are listed below.

Hole X y Depth Dip Azimuth From To Interval Grade True Width

ID (m) (m) (m) (%Li2O) (m)

NRC006 494432 899276 110 -60 110 14 25 11 1.53 10.5

includes 15 24 9 1.70 8.6

------- ------- ---------------------- ----- ----- --------- --------- -----------

NRC009 494530 899242 50 -60 110 14 15 1 0.42 1.0

------- ------- ------ ---- -------- ----- ----- --------- --------- -----------

NRC010 494515 899248 60 -60 290 15 26 11 2.61 10.5

------- ------- ------ ---- -------- ----- ----- --------- --------- -----------

NRC018 494450 899300 46 -90 0 26 29 3 1.66 2.9

------- ------- ------ ---- -------- ----- ----- --------- --------- -----------

includes 27 29 2 2.11 1.9

------- ------- ---------------------- ----- ----- --------- --------- -----------

35 44 9 2.42 8.6

------- ------- ------ ---- -------- ----- ----- --------- --------- -----------

NRC019 494445 899365 52 -90 0 33 35 2 1.27 1.9

------- ------- ------ ---- -------- ----- ----- --------- --------- -----------

includes 33 34 1 2.08 1.0

------- ------- ---------------------- ----- ----- --------- --------- -----------

NRC020 494396 899351 50 -90 0 6 10 4 0.43 3.8

------- ------- ------ ---- -------- ----- ----- --------- --------- -----------

NRC024 494500 899300 50 -90 0 35 39 4 1.03 3.8

------- ------- ------ ---- -------- ----- ----- --------- --------- -----------

includes 35 36 1 2.50 1.0

------- ------- ---------------------- ----- ----- --------- --------- -----------

(0.4%Li(2) O cut-off grade, minimum 1m thickness, up to 2m

internal dilution)

Sample analyses were carried by SGS Randfontein (GE_ICP90A50 and

GE_FUZ90A50). Cross check analyses were carried out by MSA

Laboratories, Vancouver (PER-700).

The drilled pegmatite averages 20m in thickness and dips at 5

degrees towards the north west. A continuous sheet of coarse

spodumene mineralisation of up to 11m thick is developed towards

the upper contact of the pegmatite and mafic country rocks.

On going exploration is underway to locate additional pegmatites

in the immediate vicinity of this target and further to the south

where extensive exposures of pegmatites have been mapped in Target

Area 2.

Exploration Target Map

Thor/Newstar has also secured additional tenure over this area

in a number of joint venture agreements together with wholly owned

exploration permits. Further to the west additional exploration

tenure has been obtained through the granting of a large

exploration permit (EL42245) to the north east together securing

additional ground under an agreement with SCT Mining &

Exploration Ltd.

The ongoing drilling program has been extended to test all the

mapped pegmatites with results expected to be announced by the

Group in Q4 2023.

Senegal

Introduction

The Douta Gold Project is a gold exploration permit E02038,

located within the Kéniéba inlier, eastern Senegal. The

northeast-trending license has an area of 58 km(2) . Thor, through

its wholly owned subsidiary African Star Resources Incorporated

("African Star"), has a 70% economic interest in partnership with

the permit holder International Mining Company SARL ("IMC"). IMC

has a 30% free carried interest in its development until the

announcement by Thor of a Probable Reserve.

The Douta licence Is strategically positioned 4km east of

Massawa North and Massawa Central deposits, which form part of the

world-class Sabadola-Massawa Project owned by Endeavour Mining. The

Makabingui deposit, belonging to Bassari Resources Ltd, is

immediately located east of the northern portion of E02038 (Figure

2.5).

Drilling Results

Drilling has been focussed in the following areas:

-- Resource Upgrade: Makosa and Makosa Tail, Makosa East

-- Metallurgical Sampling Makosa and Makosa Tail

-- Exploration: Sambara area

Potential Resource Upgrade

In April 2023 Thor commenced a program of infill RC drilling

with the objective of upgrading the inferred portions of the

resource that fall within the optimised pit shell, to indicated

classification. At Makosa, zones of gold mineralisation are

developed either within a sheared gabbro intrusive or within a

steep north-westerly dipping sequence of meta-sedimentary rocks

that are in close proximity to the gabbro. Higher grade zones or

shoots are suspected to occur along east-west oriented structures

that cut across the main north-east trend of the

mineralisation.

The significant intersections from this program are listed in

table below. Drill samples were analysed by ALS Laboratories in

Mali using the AA26 fire assay method (50 gram charge).

Douta Project Significant Results (>20 gram-metres:

grade*true width)

Prospect Hole ID Easting Northing Depth Dip From To Interval Grade True

(m) (m) (m) (g/tAu) Width

(m)

Makosa

Tail DTDD0017 174590 1434805 45.2 -50 32 41 9 2.38 2.4

---------- -------- --------- ------ ---- ----- ----- --------- --------- -------

Makosa DTDD0021 175377 1436071 90.2 -50 36 44 8 8.08 7.2

---------- -------- --------- ------ ---- ----- ----- --------- --------- -------

Makosa DTDD0021 175377 1436071 90.2 -50 55 61 6 4.03 11.7

---------- -------- --------- ------ ---- ----- ----- --------- --------- -------

Makosa DTDD0023 175219 1435902 70.4 -50 58 66 8 3.14 7.2

---------- -------- --------- ------ ---- ----- ----- --------- --------- -------

Makosa DTDD0024 175477 1436151 95.4 -50 64 71 7 3.77 14.4

---------- -------- --------- ------ ---- ----- ----- --------- --------- -------

Makosa DTDD0029 175949 1436665 20 -50 0 16 16 2.03 14.4

---------- -------- --------- ------ ---- ----- ----- --------- --------- -------

Makosa

East DTRC779 175885 1436181 54 -60 39 48 9 2.46 8.0

---------- -------- --------- ------ ---- ----- ----- --------- --------- -------

Makosa

Tail DTRC805 173959 1433743 50 -60 36 46 10 2.25 4.8

---------- -------- --------- ------ ---- ----- ----- --------- --------- -------

Makosa

Tail DTRC806 173939 1433758 74 -60 52 54 2 13.90 1.6

---------- -------- --------- ------ ---- ----- ----- --------- --------- -------

Makosa

Tail DTRC807 173920 1433773 100 -60 78 81 3 25.35 5.6

---------- -------- --------- ------ ---- ----- ----- --------- --------- -------

Makosa

Tail DTRC812 174161 1433787 90 -60 50 56 6 4.94 13.5

---------- -------- --------- ------ ---- ----- ----- --------- --------- -------

Makosa

Tail DTRC842 174556 1434762 69 -60 25 43 18 1.82 6.3

---------- -------- --------- ------ ---- ----- ----- --------- --------- -------

Makosa

Tail DTRC844 174476 1434806 69 -60 45 55 10 3.00 7.2

---------- -------- --------- ------ ---- ----- ----- --------- --------- -------

Makosa

Tail DTRC848 174583 1434868 114 -60 96 109 13 4.59 5.4

---------- -------- --------- ------ ---- ----- ----- --------- --------- -------

Makosa

Tail DTRC854 174545 1435016 107 -60 61 76 15 1.79 9.0

---------- -------- --------- ------ ---- ----- ----- --------- --------- -------

Makosa DTRC864 176149 1437011 90 -60 49 56 7 3.90 8.1

---------- -------- --------- ------ ---- ----- ----- --------- --------- -------

Makosa DTRC865 176203 1437037 72 -60 93 102 9 4.33 8.1

---------- -------- --------- ------ ---- ----- ----- --------- --------- -------

(0.5g/tAu lower cut off; minimum width 2m with 2m max internal

waste)

The drill results demonstrate the continuity of gold

mineralisation both along strike and down dip. Several higher-grade

intersections were obtained including 2m grading 13.90g/tAu g/tAu

in drillhole DTRC806, 3m grading 25.35g/tAu in DTRC807 and 6m

grading 4.94g/tAu in DTRC812.

In addition to upgrading the resource classification,

intersections such as these will likely have a positive effect in

locally elevating the average resource grade.

With the exploration fieldwork complete, the Group aims to

announce an updated resource in Q4 2023. The preliminary

feasibility study workstreams are ongoing with a preliminary

feasibility study expected to be completed in Q1 2024.

Douta Project Location Map

Metallurgical Sampling

A total of 22 diamond holes were completed to obtain

representative samples, from both Makosa and Makosa Tail to undergo

detailed metallurgical test work. Several of these holes twinned

existing historic RC holes and returned results that are consistent

with the earlier grades and thicknesses. Independent Metallurgical

Operations (IMO) are undertaking the test work program in Perth,

Western Australia.

Exploration

At the Sambara prospect several RC holes were drilled to test

both the extremities of the Sambara deposit and a soil geochemical

anomaly that was located in the northwestern part of the

exploration licence. Best results include 5m grading 1.35g/tAu in

drillhole DTRC726 and 4m grading 1.43g/tAu in DTRC729. Further

testing along the prospective strike length is planned for the

remainder of 2023

Drillhole location map showing Significant Results

(>20gram-metres)

Makosa Tail Cross-section Showing Grade Continuity on In-fill

Drill-section

http://www.rns-pdf.londonstockexchange.com/rns/6765U_2-2023-11-27.pdf

http://www.rns-pdf.londonstockexchange.com/rns/6765U_1-2023-11-27.pdf

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTPPGQUGUPWUGM

(END) Dow Jones Newswires

November 27, 2023 02:00 ET (07:00 GMT)

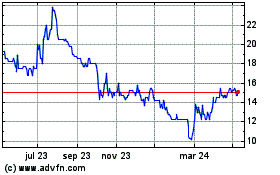

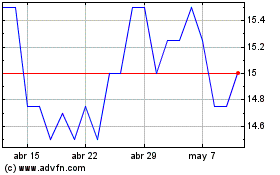

Thor Explorations (LSE:THX)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Thor Explorations (LSE:THX)

Gráfica de Acción Histórica

De May 2023 a May 2024