TIDMTMO

RNS Number : 7108S

Time Out Group plc

08 November 2023

8 November 2023

Time Out Group plc

("Time Out," the "Company" or the "Group")

Audited Full Year Results for the twelve months ended 30 June

2023

Continued progress in revenues and adjusted EBITDA with both

Media and Markets growing strongly -

Company well positioned for sustained growth

Time Out Group plc (AIM: TMO), the global media and hospitality

business, today announces its audited full year results for the

twelve months ended 30 June 2023.

Financial highlights

-- Gross revenue grew by 43% to GBP104.6m (2022: GBP72.9m) and

net revenue (1) by 37% to GBP76.0m (2022: GBP55.4m)

-- Gross profit increased 39% to GBP61.9m (2022: GBP44.6m) with gross margins +1% points

-- Group adjusted EBITDA (2) up 336% to GBP5.3m (2022: GBP1.2m)

with both Media and Markets delivering positive adjusted EBITDA

-- Group operating loss of GBP17.5m (2022: GBP14.1m loss), GBP3m

year-on-year movement comprising +GBP4.2m improvement in EBITDA

less GBP7.7m increase in exceptional costs to GBP10.0m, of which

GBP7.8m are non cash

-- Cash of GBP5.1m at 30 June 2023 (2022: GBP4.8m) and

borrowings of GBP29.9m (2022: GBP22.0m), resulted in adjusted net

debt (3) of GBP24.8m (2022: GBP17.1m). Reported net debt was

GBP49.7m (2022: GBP44.5m) including GBP24.9m (2022: GBP27.4m) of

IFRS 16 lease liabilities

-- Refinancing completed in November 2022; settled existing

Incus loan facility with new four-year EUR35m facility with

Crestline, repayable November 2026, of which EUR29.2m was drawn as

at 30 June 2023; in addition, the Company today announces the

extension of the Loan Note with Oakley Capital Investments,

GBP5.2m, now repayable June 2025

Operational highlights

-- Time Out Market: strong revenue growth and expanding global footprint

o Gross revenue growth of +54% YoY and net revenue growth of 48%

to GBP42.8m (2022: GBP28.9m)

o Adjusted EBITDA up significantly to GBP4.3m (2022: GBP2.2m)

and adjusted EBITDA margin increasing by 94 basis points as a

result of increasing footfall and ongoing operational

improvements

o Growing portfolio of 15 Markets includes six open and nine

contracted sites set to open 2023-2027 with Cape Town, Vancouver,

Riyadh, Barcelona and Bahrain signed in the year and a pipeline of

new Management Agreements in advanced negotiations on the back of

continued interest from real estate developers

o Exit from Miami Market in June 2023 (opened 2019) to focus on

profitable locations, Miami trading loss of (GBP2.7m) in FY23 with

exceptional costs of GBP7.1m comprising GBP6.7m of non-cash

impairments of assets, and GBP0.4m of provisions for future cash

costs of exit. Also withdrew from negotiations on potential Market

in Spitalfields resulting in impairment charges of GBP1.0m

o Cape Town Market opening on 17 November 2023 and construction

in Porto well advanced with expected opening date in FY24 - for

both sites the city's top chefs have been curated

-- Time Out Media: digital focus drives improved economics and growing audience

o Gross revenue growth of +25% YoY underpinned by digital

revenue growth of 44%

o Improved adjusted EBITDA of GBP3.1m (2022: GBP1.7m) with gross

margin up by 300 basis points to 80% (2022: 77%)

o Global monthly brand audience grew by 16% to 83m (2022: 72m)

as a result of a consistent strategy to bring Time Out content to

digital channels

o Winning big-ticket campaigns from an expanding client roster

via relationships with agency partners and brand owners, in both

existing and new sectors, with continued demand from blue-chip

brands for our unique campaign solutions

o Time Out Creative Solutions team delivered bespoke

multi-channel campaigns leveraging the entire Time Out platform,

combining digital channels with live events in Markets

Commenting on the results, Chris Ohlund, CEO of Time Out Group

plc, said:

"This year we achieved important milestones in delivering a

further improved adjusted EBITDA - despite the challenging

macroeconomic conditions - building on our recent progress and

momentum. While this is only the beginning and there is still much

to do, we are now positioned for sustained growth and have an

ambitious strategy to realise Time Out's potential.

"Our digital strategy for Time Out Media is working, driving

significant gross revenue and adjusted EBITDA growth that has

exceeded our expectations. Our expanding audience values our "best

of the city content" and we are winning high-value campaigns with

leading brands. Time Out Market is a much younger business which,

now that we have enjoyed a year of uninterrupted trading,

demonstrates the unique opportunity it presents: our open Markets

continue to grow, and we contracted five new sites in the year as

interest from real estate developers remains strong. The portfolio

includes six open and nine contracted sites, with more in the

pipeline - in a few years, it will more than double in size.

"Synonymous with going out and having a good time, Time Out

continues to be trusted and relevant as we inspire and enable

millions of people every month to experience the best of the city.

Consumers are increasingly spending time on digital channels but

still want to socialise in real life - capturing these trends

through the combination of Media and Market is powerful."

Outlook

The 2023 financial year provides us with the foundations for

continued growth which, combined with ongoing rigorous management

of the cost base, can significantly improve future cash flows and

profitability. In contrast to most media and hospitality

businesses, Time Out Group now has multiple avenues for sustained

growth and is building a valuable long term recurring earnings

stream.

We expect the step-change in Media performance to continue as

demand from blue-chip brands for our unique campaign solutions

grows. Over the next 18 months, we are set to open five new Markets

which will increase revenues and the signing of new locations

globally is expected to continue, supported by a strategy to focus

on the highest quality leads. In time, the nine Management

Agreements (two open and seven contracted), each with a term of at

least 10 years, will generate a contracted minimum aggregate

contribution to EBITDA of c.GBP14m per annum when all are

operational.

Despite macroeconomic headwinds, we have increased confidence in

future growth and further traction as we continue to deliver

against our ambitious plans, with Q1 FY24 performance in line with

management expectations.

(1) Net revenue is calculated as gross revenue less the

concessionaires' share of revenue. See appendix Alternative

Performance Measures for a reconciliation to the statutory

numbers.

(2) Adjusted EBITDA is operating loss stated before interest,

taxation, depreciation, amortisation, share-based payments,

exceptional items and profit/(loss) on the disposal of fixed

assets. This is a non-GAAP alternative performance measure ("APM")

that management uses to aid understanding of the underlying

business performance. See appendix Alternative Performance Measures

for a reconciliation to the statutory numbers.

(3) Adjusted net debt excludes lease-related liabilities under

IFRS 16. This is an APM. See appendix Alternative Performance

Measures for a reconciliation to the statutory numbers.

For further information, please contact:

Time Out Group plc Tel: +44 (0)207

813 3000

Chris Ohlund, CEO

Matt Pritchard, CFO

Steven Tredget, Investor Relations Director

Liberum (Nominated Adviser and Broker) Tel: +44 (0)203

100 2222

Andrew Godber / Edward Thomas / Miquela Bezuidenhoudt

FTI Consulting LLP Tel: +44 (0)203

727 1000

Edward Bridges / Stephanie Ellis / Fiona Walker

Notes to editors

About Time Out Group

Time Out Group is a global media and hospitality business that

inspires and enables people to experience the best of the city

through its two divisions - Time Out Media and Time Out Market.

Time Out launched in London in 1968 to help people discover the

exciting new urban cultures that had started up all over the city -

today it is the only global brand dedicated to city life. Expert

journalists curate and create content about the best things to Do,

See and Eat across 333 cities in 59 countries and across a unique

multi-platform model spanning both digital and physical channels.

Time Out Market is the world's first editorially curated food and

cultural market, bringing a city's best chefs, restaurateurs and

unique cultural experiences together under one roof. The portfolio

includes open Markets in six cities such as Lisbon, New York and

Dubai, several new locations with expected opening dates in 2023

and beyond, in addition to a pipeline of further locations in

advanced discussions. Time Out Group PLC, listed on AIM, is

headquartered in London (UK).

FORWARD-LOOKING STATEMENTS

This document contains "forward-looking statements", which

include all statements other than statements of historical facts,

including, without limitation, any statements preceded by, followed

by or that include the words "targets", "believes", "expects",

"aims", "intends", "will", "may", "anticipates", "would", "could"

or similar expressions or the negative thereof. Such

forward-looking statements involve known and unknown risks,

uncertainties and other important factors beyond the Group's

control that could cause the actual results, performance or

achievements of the Group to be materially different from future

results, performance or achievements expressed or implied by such

forward-looking, including, among others, the achievement of

anticipated levels of profitability, growth, the impact of

competitive pricing, volatility in stock markets or in the price of

the Group's shares, financial risk management and the impact of

general business and global economic conditions. Such

forward-looking statements are based on numerous assumptions

regarding the Group's present and future business strategies and

the environment in which the Group will operate in the future. By

their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future. These

forward-looking statements speak only as at the date as of which

they are made, and each of Time Out Group Plc and the Group

expressly disclaims any obligation or undertaking to disseminate

any updates or revisions to any forward-looking statements

contained herein to reflect any change in Time Out Group Plc's or

the Group's expectations with regard thereto or any change in

events, conditions or circumstances on which any such statements

are based. Neither the Group, nor any of its agents, employees or

advisors intends or has any duty or obligation to supplement,

amend, update or revise any of the forward-looking statements

contained in this document.

Chief Executive's Review

Group overview

Financial summary

Year ended Year ended

30 June 30 June

2023 2022 Change

GBP'000 GBP'000 %

Market 42,848 28,924 48%

Media 33,130 26,479 25%

------------------------------- ----------- ----------- -------

Group net revenue (1) 75,978 55,403 37%

Gross profit 61,889 44,583 39%

Gross margin % (2) 81% 80% 1%

Divisional Adjusted operating

expenses (3) (54,486) (40,654) 34%

Divisional Adjusted EBITDA(3) 7,403 3,929 88%

------------------------------- ----------- ----------- -------

Market 4,311 2,225 94%

Media 3,092 1,704 81%

------------------------------- ----------- ----------- -------

Corporate costs (2,088) (2,710) 23%

Group Adjusted EBITDA (3) 5,315 1,219 336%

------------------------------- ----------- ----------- -------

Loss before tax (24,991) (19,462) 28%

------------------------------- ----------- ----------- -------

(1) Net revenue is calculated as gross revenue less the

concessionaires' share of revenue. See appendix Alternative

Performance Measures for a reconciliation to statutory numbers.

(2) Gross margin calculated as gross profit as a percentage of net revenue.

(3) Adjusted measures are stated before interest, taxation,

depreciation, amortisation, share-based payments, exceptional items

and profit/(loss) on the disposal of fixed assets. These are APMs

that management uses to aid understanding of the underlying

business performance. See appendix Alternative Performance Measures

for a reconciliation to statutory numbers.

The financial year - the first full reporting period of

uninterrupted trading since 2019 - saw continued progress across

both the Markets and the Media divisions, positioning the Group for

a transition to sustained growth. With its curation of the best of

the city combined with ongoing operational improvements, Time Out

Market delivered strong revenue growth and increased profitability

in addition to a growing pipeline of contracted sites. Time Out

Media - following its completed print to digital transformation -

achieved significant digital revenue growth and higher EBITDA

margin as we attract an increasing audience as well as blue-chip

clients seeking our bespoke advertising solutions.

-- Group net revenue increased by 37% to GBP76.0m (2022:

GBP55.4m) and gross margin increased by 100 basis points to 81%

(2022: 80%)

-- Divisional operating expenses increased by 34%, 3% slower

than net revenue as a result of reductions in fixed costs and focus

on operational efficiency, partly offset by additional variable

costs as sales grew; continued growth offers the scope to further

dilute fixed costs as a % of sales

-- Improvement in Divisional adjusted EBITDA of GBP7.4m (2022:

GBP3.9m) with corporate costs decreased by 23% to GBP2.1m (2022:

GBP2.7m) following a focus on cost reduction and efficiency,

delivering benefits now and in future years; this resulted in a

positive Group adjusted EBITDA of GBP5.3m (2022: GBP1.2m)

Matt Pritchard has been newly appointed Chief Financial Officer,

replacing Patrick Foley who had been CFO since September 2022 and

decided to leave the business to pursue new opportunities. It is

expected that Matt will be appointed to the Board in due course.

Matt has over 25 years of experience of value creation in Retail

and FMCG, in both private equity and listed environments, including

strategic review and funding of growth strategies. From 2014 to

2023, Matt was CFO of Hotel Chocolat PLC. In this role he

formulated long term growth strategies including a pivot to digital

and prepared the business for IPO in 2016, growing revenues and

EBITDA. Prior to this, he worked in senior finance roles with

several blue-chip retail organisations including Asda, Somerfield

Stores and WHSmith. Matt qualified as a Certified Accountant in

1998.

Time Out Market trading overview

Year ended Year ended

30 June 30 June

2023 2022 Change

GBP'000 GBP'000 %

Gross revenue 71,511 46,454 54%

Owned operations 38,509 24,734 56%

Management fees 4,339 4,190 4%

-------------------------------- ----------- ----------- -------

Net revenue (1) 42,848 28,924 48%

-------------------------------- ----------- ----------- -------

Gross profit 35,535 24,081 48%

Gross margin % (2) 83% 83% -

Adjusted operating expenditure

(trading) (3) (22,968) (17,320) 33%

-------------------------------- ----------- ----------- -------

Trading EBITDA(3) 12,567 6,761 86%

Market central costs (8,256) (4,536) 82%

Adjusted EBITDA (3) 4,311 2,225 94%

-------------------------------- ----------- ----------- -------

(1) Net revenue is calculated as gross revenue less

concessionaires' share of revenue. See appendix Alternative

Performance Measures for a reconciliation to statutory numbers.

(2) Gross margin calculated as gross profit as a percentage of net revenue.

(3) Adjusted measures are stated before interest, taxation,

depreciation, amortisation, share-based payments, exceptional items

and profit/(loss) on the disposal of fixed assets. These are APMs

that management uses to aid understanding of the underlying

business performance. See appendix Alternative Performance Measures

for a reconciliation to statutory numbers.

Time Out Market net revenue increased by 48% to GBP42.8m (2022:

GBP28.9m) and adjusted EBITDA of GBP4.3m nearly doubled

year-on-year (2022: GBP2.2m adjusted EBITDA) in the first full

financial year of uninterrupted trading and with some restrictions

still in place in the comparative year. The year saw travel rebound

and across our open sites, footfall from tourists continued to

recover at a faster rate than footfall from office workers. We

continue to carefully manage operating expenses to drive greater

profitability, alongside implementing operational improvements and

optimisations of our commercial model. Central costs increased as a

strengthened team is working on growing the Markets business,

preparing for several upcoming openings and negotiating further new

sites.

Sandy Hayek - who joined in 2021 as Time Out Market Dubai

General Manager and then became Time Out Market Co-CEO Operations -

was promoted to Time Out Market CEO in July 2023 to oversee both

the operations of existing and the development of new Markets,

reporting into Group CEO Chris Ohlund.

As a food and cultural market bringing the best of the city

together under one roof, the ongoing curation of top culinary

talents is key to keeping the offering fresh and reflective of the

cities we are in. Examples of concessions added in the year include

in Lisbon MICHELIN Bib Gourmand awarded O Frade and in New York

Bark Barbecue which has a cult following. Furthermore, each Market

has an ongoing cultural programme to drive additional high-value

footfall, differentiation and engaging content for social media and

Time Out channels. Throughout the year, many events took place from

live bands and artist performances to DJs and comedy nights.

Across our open Markets, the teams worked on operational

efficiencies to improve revenue per sq ft and thereby

profitability. As part of our focus to build a profitable

portfolio, it was decided that the Miami site would close on 30

June 2023. Following the launch of the first Market in Lisbon in

2014, the Miami site was the first to open as part of the global

expansion in 2019 and underperformed post-pandemic, contributing a

reported operating loss of GBP2.7m to the Group result in FY23. The

decision to exit resulted in exceptional costs of GBP7.1m

comprising GBP6.7m of non cash asset impairments, and GBP0.4m of

provisions for future cash liabilities.

In addition to our six existing Markets (Lisbon, New York,

Boston, Chicago, Montreal and Dubai - the latter two being

Management Agreements), new sites are set to open in Cape Town on

17 November 2023 and in Porto in FY24 - in both sites top local

chefs have been curated.

In the year, we accelerated the signing of new Markets and

contracted five sites including in Cape Town, Vancouver, Riyadh,

Barcelona and Bahrain. This takes the pipeline of new sites in

development to nine and the expected opening schedule based on

calendar year is structured as follows:

-- November 2023: Cape Town (Management Agreement)

-- 2024: Porto (Owned & Operated)

-- 2024: Barcelona (Owned & Operated)

-- 2024: Bahrain (Management Agreement)

-- 2024: Vancouver (Management Agreement)

-- 2025: Abu Dhabi (Management Agreement)

-- 2025: Osaka (Management Agreement)

-- 2027: Prague (Management Agreement)

-- 2027: Riyadh (Management Agreement)

As growth engine for the continued expansion, we are focused on

Management Agreements under which we receive a share of revenues

and profits (subject to a minimum guaranteed fee) which increases

our recurring revenue stream without capital expenditure. We will

consider lease agreements for Owned & Operated sites, where we

receive 100% of site profits, when the majority of capex is

contributed by the landlord.

We have a pipeline of Management Agreements in advanced

negotiations and expect to sign more in the year ahead as we

continue to optimise our systematic approach to sourcing

high-quality leads. As we grow our portfolio of open Markets we

continue to refine selection criteria based on the critical success

factors, with the objective of improving return on investment and

reducing time to completion. Furthermore, we are developing wider

flexibility in formats to best match our Markets proposition to the

locality.

In February 2023, we confirmed that we will not proceed with the

development of the site at 106 Commercial Street in London -

although recommended for approval by planning officers, the Tower

Hamlets Development Committee chose to defer its decision on our

application in 2022 after a process which had already taken several

years. With an expectation of the process being drawn out by

further delays we decided to no longer proceed with our application

- which resulted in exceptional costs of GBP1.0m arising from the

write-off of sunk pre-development costs - in order to focus our

resources on other opportunities.

Time Out Media trading overview

Year ended Year ended

30 June 30 June

2023 2022 Change

GBP'000 GBP'000 %

Gross Revenue 33,130 26,479 25%

------------------------------------ ----------- ----------- -------

Gross profit 26,354 20,502 29%

Gross margin % (1) 80% 77% 3%

Adjusted operating expenditure (2) (23,262) (18,798) 24%

Adjusted EBITDA (2) 3,092 1,704 81%

------------------------------------ ----------- ----------- -------

(1) Gross margin calculated as gross profit as a percentage of gross revenue.

(2) Adjusted measures are stated before interest, taxation,

depreciation, amortisation, share-based payments, exceptional items

and profit/(loss) on the disposal of fixed assets. These are APMs

that management use to aid understanding of the underlying business

performance. See appendix Alternative Performance Measures for a

reconciliation to statutory numbers.

Time Out Media trading was encouraging with gross revenue growth

of 25% to GBP33.1m (2022: GBP26.5m) generating adjusted EBITDA of

GBP3.1m (20 22: GBP1.7m).

Having exited print media in FY22, in our first year as a fully

digital media division we successfully tapped into the growing

digital advertising space, replacing print with digital

revenue:

-- Digital gross revenue grew by 44% to GBP25.8m (2022: GBP17.9m)

-- As a result of the removal of print revenues (2022: GBP8m) total Media net revenue grew 25%

Gross margin increased by 300 basis points to 80% (2022: 77%).

We continue to tightly manage the operating expenditure which

increased slower than sales by 23% as we invested in talent with

digital expertise and expanded our sales team tasked with growing

our client base and winning high-value campaign deals.

The digital growth was driven primarily by the UK and US

business. Time Out Media CEO Stacy Bettman - reporting into Group

CEO Chris Ohlund - is now applying the same business model to the

European and APAC Media business.

A key growth driver and focus going forward are high-value

campaigns for an expanding roster of advertising clients including

in new sectors. Time Out appeals to advertisers as our Creative

Solutions team develops bespoke campaigns to connect them with our

brand, content and audience in a brand-safe and positive

environment across a 360-degree platform spanning website, mobile,

social media, videos, newsletter and live events. In the year we

saw increased demand for these multi-channels campaigns from

clients such as Diageo, Estrella Damm, TAP Portugal, FREENOW and

Uber Eats.

We saw success with campaigns which leverage the synergies

between Media (digital high-quality content) and Market (real-life

experiences). Examples include campaigns for Mastercard,

Maybelline, BATISTE(TM) and P&O Cruises which spanned custom

digital content as well as videos and expanded to live events in

our Markets. With an expanding global Market footprint, this

presents future growth opportunities.

Time Out's global monthly brand audience (1) grew by 16% to 83m

(2022: 72m) and by 46% compared to 2019 when it stood at 57m. This

is the result of a consistent strategy to bring our content -

previously distributed via print - to digital channels to attract

and engage a valuable audience. The audience growth demonstrates

how the Time Out brand and its "best of the city" content remain

relevant. In particular short-form videos continue to be a medium

our audience engages with and in which we invest. The year saw an

ongoing push of video content on social media (Instagram and

TikTok) and our site to drive both direct and programmatic revenue

with sponsored video series now often key elements of client

campaigns.

Our "best of the city" content spanning 333 cities in 59

countries is curated and created by a global network of local

expert journalists. Successful content which drove record traffic

numbers in the year included annual global tent poles such as The

World's Best Cities and The Coolest Neighbourhoods as well as

Halloween coverage which contributed to October being Time Out

USA's biggest traffic month of the year. Time Out delivered the 3rd

biggest growth of UK news publishers in September 2022 and in March

2023 topped that ranking (2) .

Whilst we are using generative AI to support operational

efficiency and insights, all of our content creation and editorial

curation is performed by expert local writers and editors.

(1) Global brand audience is the estimated monthly average in

the year including all Owned & Operated cities and franchises.

It includes print circulation and unique website visitors (Owned

& Operated), unique social users (as reported by Facebook and

Instagram with social followers on other platforms used as a proxy

for unique users), social followers (for other social media

platforms), opted-in members and Market visitors.

(2) Source: Press Gazette using data from (c) Ipsos, Ipsos iris,

1-30 September 2022 and 1-31 March 2023

Financial Review

Year ended Year ended

30 June 30 June

2023 2022 Change

GBP'000 GBP'000 %

Gross revenue 104,640 72,933 43%

Concessionaire share (28,662) (17,530) 64%

------------------------------------- ----------- ----------- -------

Net revenue 75,978 55,403 37%

Gross profit 61,889 44,583 39%

81% 80% 1%

Administrative expenses (79,383) (58,724) 35%

------------------------------------- ----------- ----------- -------

Operating loss (17,494) (14,141) 24%

Operating loss (17,494) (14,141) 24%

Depreciation & amortisation

- Intangible assets 2,163 2,540 (15)%

- Property, plant and equipment 6,544 6,575 -

- Right-of-use assets 2,367 2,065 15%

Share-based payments 1,701 1,817 (6)%

Exceptional items 10,029 2,316 333%

Loss on disposal of property, plant

and equipment 5 47 (89)%

Adjusted EBITDA (1) 5,315 1,219 336%

----------- ----------- -------

Finance income 167 8 1988%

Finance costs (7,664) (5,329) 44%

Loss before tax (24,991) (19,462) 28%

------------------------------------- ----------- ----------- -------

(1) Adjusted EBITDA is operating loss stated before interest,

taxation, depreciation, amortisation, share-based payments,

exceptional items and profit/(loss) on the disposal of fixed

assets. This is an APM that management uses to aid understanding of

the underlying business performance. See appendix Alternative

Performance Measures for a reconciliation to statutory numbers.

Revenue and gross profit

Group gross revenue for the year increased by 43% to GBP104.6m

(2022: GBP72.9m) with both Markets and Media delivering gross

revenue growth.

Markets gross revenues increased with both growth in existing

sites and revenues associated with signing new Management

Agreements. Media revenue growth was driven by digital sales growth

which more than offset loss in revenues from the exit from print in

FY22.

Gross margins increased by 1 percentage point to 81%.

Operating expenses

Administrative expenses of GBP79.4m grew more slowly than sales,

increasing by 35% year-on-year.

Adjusted EBITDA

Group adjusted EBITDA is a non-GAAP Alternative Performance

Measure, which is used by the Board to manage business performance

and to allocate resources across the Group. Group adjusted EBITDA

of GBP5.3m (FY22 GBP1.2m) is stated before interest, taxation,

depreciation and amortisation, share-based payment charges,

exceptional items, and loss on disposal of fixed assets. The

material improvement is a result of increased revenues and improved

operational efficiency. The GBP5.3m figure is inclusive of GBP2.7m

of operating losses from the Miami Market, which will not

recur.

Operating loss

The reported operating loss was GBP17.5m (2022: GBP14.1m

loss).

The net exceptional costs of GBP10.0m (2022: GBP2.3m) includes

costs related to a closure and exit of the Miami Market which

ceased trading on 30 June 2023 (GBP7.1m), staff redundancy costs of

staff who left the Group following the restructuring (GBP1.9m). The

majority of the prior year exceptional costs of GBP2.3m related

mainly to redundancy and restructuring costs.

The depreciation charge of GBP8.9m (2022: GBP8.6m) had minimal

change with an increase of GBP0.3m. The amortisation of intangible

assets of GBP2.2m (2022: GBP2.52m) decreased by GBP0.3m. Overall,

on a combined basis there was no change to the charge for

depreciation and amortisation.

Net finance costs

Net finance costs of GBP7.5m (2022: GBP5.3m) primarily relates

to interest on debt of GBP3.8m (2022: GBP2.4m), amortisation of

deferred financing costs of GBP0.5m (2022: GBP0.2m) and interest

cost in respect of lease liabilities of GBP3.0m (2022:

GBP2.6m).

Foreign exchange

The revenue and costs of Group entities reporting in dollars and

euros have been consolidated in these financial statements at an

average exchange rate of $1.21 (2022 $1.34) and EUR1.15 (2022:

EUR1.18) respectively.

Cash and debt

30 June 30 June

2023 2022

GBP'000 GBP'000

Cash and cash equivalents 5,094 4,849

Borrowings (29,883) (21,978)

--------- ---------

Adjusted net debt (24,789) (17,129)

IFRS 16 Lease liabilities (24,863) (27,420)

--------- ---------

Net debt (49,652) (44,549)

--------- ---------

Cash and cash equivalents increased by GBP0.3m since 30 June

2022 to GBP5.1m (2022: GBP4.8m). This was driven primarily by the

Group Adjusted EBITDA of GBP5.3m (2022: GBP1.2m Group Adjusted

EBITDA), exceptional costs cash outflow of GBP1.9m (2022: GBP2.8m),

net working capital outflow of GBP1.3m (2022: GBP2.6m), capital

expenditure of GBP2.9m (2022: GBP1.8m), net proceeds of financing

of GBP5.0m (2022: GBP3.7m net financing outflow) and the repayment

of lease liabilities of GBP5.1m (2022: GBP4.0m).

On 24 November 2022, the Group entered into a new EUR35.0m

secured four-year term loan facility with Crestline Europe LLP

("Crestline facility"). The facility has a term of four years, with

the right to settle in full after two years. Interest may be

capitalised or paid in cash, at the election of the Company, during

the first year at a rate of 9.5% plus 3-month EURIBOR and from the

second year onwards interest will be paid in cash at a rate of 8.5%

plus 3-month EURIBOR. An exit premium payable upon full repayment,

is amortised over the duration of the facility with reference to

the principal amount drawn. The facility is subject to quarterly

financial covenants based on minimum liquidity levels (quarterly

testing commenced on 31 December 2022) and target leverage ratio

(quarterly testing commenced on 30 June 2023).

The Company has also executed an equity warrant instrument and

agreed to issue 11,400,423 equity warrants on 30 November 2022 and

a further 2,264,468 at full drawdown of the Loan Note Facility (in

total representing approximately 3.6% of its fully diluted share

capital) to the Crestline subscribers. The five-year equity

warrants, which have customary anti-dilution protections, have an

exercise price of 39 pence per ordinary share.

At 30 June 2023 borrowings principally comprised the partially

drawn Crestline facility of EUR31.3m (EUR29.2m plus capitalised

interest), EUR5m of the original EUR35m commitment remains undrawn.

At 30 June 2022 the borrowings principally comprised the Incus

Capital Facility GBP20.9m, which was fully repaid on 30 November

2022.

On 7 November 2023 the Group agreed to an amendment of an

existing GBP5m unsecured Loan Note with Oakley Capital investments

("OCI") to extend the repayment date to 30 June 2025. This is a

related party transaction under AIM Rule 13. Please see further

disclosure in relation to this in note 11.

Going concern

The financial statements have been prepared under the going

concern basis of accounting as the Directors have a reasonable

expectation that the Group and Company will continue in operational

existence and be able to settle their liabilities as they fall due

for the foreseeable future, being a period of at least 12 months

from the date of approval of the financial statements ("forecast

period"). In making this determination, the Directors have

considered the financial position of the Group, projections of its

future performance and the financing facilities that are in

place.

In making this assessment the Directors have considered two

scenarios over the forecast period: The base case assumes a slow

but steady period of growth across both Market and Media. Owned and

Operated Market revenues are assumed to see steady growth over the

forecast period. Media revenue continues to grow as the Group

focuses on high-margin digital-first offerings complemented by the

return of Live Events, Affiliate and Offers revenue. This scenario

does assume an appropriate element of cost inflation.

The downside case sensitises the base case to assume that the

Market Owned & Operated and Media revenues underperform the

base case by 10% while maintaining the base case gross margin, with

actionable cost mitigation over the forecast period. Consistent

with the base case, the sensitised case also assumes an appropriate

element of cost inflation.

The Directors consider the downside case reduction in revenue

for each division to be unlikely given recent performance, however

with the uncertainty created by inflationary and recessionary

factors this scenario is considered severe but plausible.

The Board is satisfied that under both scenarios the Group will

be able to operate within the level of its current debt and

financial covenants and will have sufficient liquidity to meet its

financial obligations as they fall due for a period of at least 12

months from the date of signing these financial statements. For

this reason, the Group and Company continue to adopt the going

concern basis in preparing its financial statements.

Chris Ohlund

Group Chief Executive

8 November 2023

Consolidated Income statement

Year ended 30 June 2023

Year ended

30 June Year ended

Note 2023 30 June 2022

----------- --------------

GBP'000 GBP'000

1,

Gross revenue 4 104,641 72,933

Cost of sales 4 (42,752) (28,350)

----------- --------------

Gross profit 61,889 44,583

Administrative expenses (79,383) (58,724)

----------- --------------

Operating loss (17,494) (14,141)

Finance income 167 8

Finance costs (7,664) (5,329)

----------- --------------

Loss before income tax 4 (24,991) (19,462)

Income tax (charge)/credit (1,132) (97)

----------- --------------

Loss for the year (26,123) (19,559)

----------- --------------

Loss for the year attributable to:

Owners of the parent (26,116) (19,553)

Non-controlling interests (7) (6)

(26,123) (19,559)

----------- --------------

Loss per share:

Basic and diluted loss per share

(p) 6 (7.8) (5.9)

Consolidated Statement of Other Comprehensive Income

Year ended 30 June 2023

Year ended

30 June Year ended

2023 30 June 2022

----------- --------------

GBP'000 GBP'000

Loss for the year (26,123) (19,559)

Other comprehensive income:

Items that may be subsequently reclassified

to the profit or loss:

Currency translation differences (1,301) 4,803

Other comprehensive (expense)/income

for the year, net of tax (1,301) 4,803

Total comprehensive expense for the year (27,424) (14,756)

----------- --------------

Total comprehensive expense for the year

attributable to:

Owners of the parent (27,417) (14,748)

Non-controlling interests (7) (8)

(27,424) (14,756)

----------- --------------

Condensed Consolidated Statement of Financial Position

At 30 June 2023

30 June

Note 2023 30 June 2022

---------- -------------

GBP'000 GBP'000

Assets

Non-current assets

Intangible assets - Goodwill 29,472 29,893

Intangible assets - Other 6,786 8,219

Property, plant and equipment 26,189 37,851

Right-of-use assets 17,843 20,490

Other receivables 4,016 3,554

84,306 100,007

---------- -------------

Current assets

Inventories 774 986

Trade and other receivables 14,638 14,906

Cash and cash equivalents 7 5,094 4,849

20,506 20,741

---------- -------------

Total assets 104,812 120,748

---------- -------------

Liabilities

Current liabilities

Trade and other payables (17,967) (14,872)

Borrowings 7 (5,878) (21,131)

Lease liabilities 7 (4,581) (5,056)

(28,426) (41,059)

---------- -------------

Non-current liabilities

Trade and other payables - -

Deferred tax liability (957) (1,158)

Borrowings 7 (24,005) (847)

Lease liabilities 7 (20,282) (22,364)

(45,244) (24,369)

---------- -------------

Total liabilities (73,670) (65,428)

---------- -------------

Net assets 31,142 55,320

---------- -------------

Equity

Called up share capital 9 338 336

Share premium 185,563 185,563

Translation reserve 6,561 7,862

Capital redemption reserve 1,105 1,105

Retained earnings / (losses) (162,420) (139,522)

Total parent shareholders' equity 31,147 55,344

---------- -------------

Non-controlling interest (5) (24)

Total equity 31,142 55,320

---------- -------------

Condensed Consolidated Statement of Changes in Equity

At 30 June 2023

Called Total

up Capital Retained parent Non-

Share Share Translation Redemption earnings/ Shareholders' Controlling Total

capital premium reserve reserve (losses) equity interest equity

-------- -------- ------------ ----------- ---------- -------------- ------------ ---------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 July

2021 332 185,563 3,057 1,105 (121,182) 68,875 (48) 68,827

Changes in equity

Loss for the year - - - - (19,553) (19,553) (6) (19,559)

Other

comprehensive

income/(expense) 4,805 - - 4,805 (2) 4,803

-------- -------- ------------ ----------- ---------- -------------- ------------ ---------

Total

comprehensive

income - - 4,805 - (19,553) (14,748) (8) (14,756)

Share-based

payments - - - - 1,817 1,817 - 1,817

Adjustment

arising on

change

of

non-controlling

interest - - - - (604) (604) 32 (572)

Issue of shares 4 - - - - 4 - 4

-------- -------- ------------ ----------- ---------- -------------- ------------ ---------

Balance at 30

June 2022 336 185,563 7,862 1,105 (139,522) 55,344 (24) 55,320

-------- -------- ------------ ----------- ---------- -------------- ------------ ---------

Changes in equity

Loss for the year - - - - (26,116) (26,116) (7) (26,123)

Other

comprehensive

expense - - (1,301) - - (1,301) - (1,301)

-------- -------- ------------ ----------- ---------- -------------- ------------ ---------

Total

comprehensive

income - - (1,301) - (26,116) (27,417) (7) (27,424)

-------- -------- ------------ ----------- ---------- -------------- ------------ ---------

Warrant

derivative - - - - 1,543 1,543 - 1,543

Share-based

payments - - - - 1,701 1,701 - 1,701

Adjustment

arising on

change

of

non-controlling

interest - - - - (26) (26) 26 -

Issue of new

shares 2 - - - - 2 - 2

-------- -------- ------------ ----------- ---------- -------------- ------------ ---------

Balance at 30

June 2023 338 185,563 6,561 1,105 (162,420) 31,147 (5) 31,142

-------- -------- ------------ ----------- ---------- -------------- ------------ ---------

Condensed Consolidated Statement of Cash Flows

Year ended 30 June 2023

Year ended

30 June Year ended

Note 2023 30 June 2022

----------- --------------

GBP'000 GBP'000

Cash flows from operating activities

Cash generated from/ ( used in) operations 8 4,735 (4,544)

Interest paid (1,033) (2,497)

Tax paid (431) -

Net cash generated from/ (used in)

operating activities 3,271 (7,041)

Cash flows from investing activities

Purchase of property, plant and equipment (1,950) (1,173)

Purchase of intangible assets (918) (740)

Interest received 72 2

Net cash used in investing activities (2,796) (1,911)

Cash flows from financing activities

Proceeds from borrowings 30,220 254

Costs related to borrowing (2,499) -

Repayment of borrowings (22,745) (1,505)

Repayment of lease liabilities (5,087) (4,035)

Proceeds from issue of shares 2 -

Acquisition of minority interest - (203)

Net cash from financing activities (109) (5,489)

Increase/(decrease) in cash and cash

equivalents 366 (14,441)

Cash and cash equivalents at beginning

of year 4,849 19,070

Effect of foreign exchange rate change (121) 220

Cash and cash equivalents at end

of year 5,094 4,849

----------- --------------

Notes to the condensed consolidated statements

1. Preliminary Information

The consolidated financial statements of Time Out Group PLC for

the year ended 30 June 2023 were authorised by the Board on 8

November 2023. Comparative information covers the year ended 30

June 2022.

While the financial information included in these summarised

financial statements has been prepared in accordance with the

recognition and measurement criteria of UK-adopted International

Accounting Standards ("IAS") and with the requirements of the

Companies Act 2006 as applicable to companies reporting under those

standards, this announcement does not itself contain sufficient

information to comply with lASs and IFRSs. The Company expects to

publish full financial statements that comply with lASs and IFRSs

in November 2023.

The financial information set out above does not constitute the

Company's statutory accounts for the year ended 30 June 2023 but is

derived from those accounts. The statutory accounts for this year

will be finalised on the basis of the financial information

presented by the directors in this preliminary announcement and

will be delivered to the Registrar of Companies following the

Company's Annual General Meeting. The external auditor has reported

on the accounts and their report did not contain any statements

under Section 498 of the Companies Act 2006.

The financial information is prepared under the historical cost

basis, unless stated otherwise in the accounting policies.

Going Concern

The financial statements have been prepared under the going

concern basis of accounting as the Directors have a reasonable

expectation that the Group and Company will continue in operational

existence and be able to settle their liabilities as they fall due

for the foreseeable future, being a period of at least 12 months

from the date of approval of the financial statements ("forecast

period").

In making this determination, the Directors have considered the

financial position of the Group, projections of its future

performance and the financing facilities that are in place. In

making this assessment the Directors have considered two scenarios

over the forecast period: The base case assumes a slow but steady

period of growth across both Market and Media. Owned and Operated

Market revenues are assumed to see steady growth over the forecast

period. Media revenue continues to grow as the Group focuses on

high-margin digital-first offerings complemented by the return of

Live Events, Affiliate and Offers revenue. This scenario does

assume an appropriate element of cost inflation.

The downside case sensitises the base case to assume that the

Market Owned & Operated and Media revenues underperform the

base case by 10% while maintaining the base case gross margin, with

actionable cost mitigation over the forecast period. Consistent

with the base case, the sensitised case also assumes an appropriate

element of cost inflation.

The Directors consider the downside case reduction in revenue

for each division to be unlikely given recent performance, however

with the uncertainty created by inflationary and recessionary

factors this scenario is considered severe but plausible.

The Board is satisfied that under both scenarios the Group will

be able to operate within the level of its current debt and

financial covenants and will have sufficient liquidity to meet its

financial obligations as they fall due for a period of at least 12

months from the date of signing these financial statements. For

this reason, the Group and Company continue to adopt the going

concern basis in preparing its financial statements.

2. Accounting policies

The same accounting policies and methods of computation are

followed in these condensed set of financial statements as applied

in the Group's latest annual audited financial statements.

3. Exchange rates

The significant exchange rates to UK Sterling for the Group are

as follows:

Year ended Year ended

30 June 2023 30 June 2022

Closing Average Closing Average

rate rate rate rate

-------- -------- -------- --------

US dollar 1.26 1.21 1.21 1.34

Euro 1.16 1.15 1.16 1.18

Australian dollar 1.91 1.79 1.76 1.84

Singaporean dollar 1.71 1.65 1.69 1.82

Hong Kong dollar 9.89 9.45 9.52 10.45

Canadian dollar 1.67 1.62 1.56 1.69

4. Segmental information

In accordance with IFRS 8, the Group's operating segments are

based on the figures reviewed by the Board, which represents the

chief operating decision maker. The Group comprises two operating

segments:

-- Time Out Market - this includes Time Out's share of

concessionaires' sales, revenues from Time Out operated bars and

other revenues include retail, events and sponsorship.

-- Time Out Media - this includes the sale of digital and print

advertising, local marketing solutions, live events tickets and

sponsorship, commissions generated from e-commerce transactions,

and fees from our franchise partners.

Year ended 30 June 2023

Time Out Time Out Corporate

Market Media costs Total

GBP'000 GBP'000 GBP'000 GBP'000

Gross revenue 71,511 33,130 - 104,641

Cost of sales (35,976) (6,776) - (42,752)

--------------------------- --------- --------- ---------- ---------

Gross profit 35,535 26,354 - 61,889

Administrative expenses (48,495) (26,084) (4,804) (79,383)

--------------------------- --------- ---------

Operating (loss) / profit (12,960) 270 (4,804) (17,494)

Finance income 167

Finance costs (7,664)

---------

Loss before income tax (24,991)

Income tax (1,132)

Loss for the year (26,123)

---------

Year ended 30 June 2022

Time Out Time Out Corporate

Market Media costs Total

GBP'000 GBP'000 GBP'000 GBP'000

Gross revenue 46,454 26,479 - 72,933

Cost of sales (22,373) (5,977) - (28,350)

------------------------- --------- --------- ---------- ---------

Gross profit 24,081 20,502 - 44,583

Administrative expenses (29,921) (22,728) (6,075) (58,724)

------------------------- --------- ---------

Operating loss (5,840) (2,226) (6,075) (14,141)

Finance income 8

Finance costs (5,329)

---------

Loss before income tax (19,462)

Income tax credit (97)

Loss for the period (19,559)

---------

Gross revenue represents the total value of all media sales

revenue, plus food, beverage and retail sales transactions in

relation to the North American markets, the Group's share of sales

transactions in relation to the Lisbon market and any management

agreement fees. Net revenue is calculated as gross revenue less the

concessionnaires' share of revenue.

Gross revenue is analysed geographically by origin as

follows:

Year ended

30 June Year ended

2023 30 June 2022

----------- --------------

GBP'000 GBP'000

Europe 29,850 25,826

Americas 66,743 41,703

Rest of World 8,048 5,404

104,641 72,933

----------- --------------

5. Exceptional items

Exceptional items are analysed as follows:

Year ended

30 June Year ended

2023 30 June 2022

----------- --------------

GBP'000 GBP'000

Restructuring costs 1,882 1,958

Exit costs in relation to Time Out Market

Miami 7,098 -

Exit costs in relation to Time Out Market

Spitalfields 1,049 -

Gain on recognition / derecognition of

right-of-use asset and related lease liability - (475)

Discontinued corporate transaction costs - 833

10,029 2,316

----------- --------------

The restructuring costs of GBP1.9m relates to the reorganisation

of the group, principally redundancies, following the Group's

decision to exit the Miami market. The prior year relates to

redundancy costs following the discontinuation of print in the UK

and the establishment of a new senior management team (2022:

GBP2.0m).

Write-off of capitalised costs (GBP5.3m) and irrecoverable

balances (GBP1.8m) relating to Time Out Market Miami have been

recognised following the decision to close the market.

Write-off of capitalised costs relating to Time Out Market

Spitalfields have been recognised following the decision to exit

the process.

In the prior year discontinued corporate transaction costs of

GBP0.8m related to an aborted corporate transaction. In the prior

year the gain on recognition of right-of-use asset and related

lease liability arose on the modification of the Time Out Lisbon

lease.

6. Loss per share

Basic loss per share is calculated by dividing the loss

attributable to shareholders by the weighted average number of

shares during the year.

For diluted loss per share, the weighted average number of

shares in issue is adjusted to assume conversion for all dilutive

potential shares. All potential ordinary shares including options

and deferred shares are antidilutive as they would decrease the

loss per share and are therefore not considered. Diluted loss per

share is equal to basic loss per share.

Year ended

30 June Year ended

2023 30 June 2022

------------ --------------

Number Number

Weighted average number of ordinary shares

for the purpose of basic and diluted loss

per share 336,648,648 334,198,517

GBP'000 GBP'000

Losses from continuing operations for

the purpose of loss per share (26,116) (19,553)

Pence Pence

Basic and diluted loss per share (7.8) (5.9)

7. Cash and debt

30 June

2023 30 June 2022

--------- -------------

GBP'000 GBP'000

Cash and cash equivalents 5,094 4,849

Borrowings (29,883) (21,978)

IFRS 16 Lease liabilities (24,863) (27,420)

Net debt (49,652) (44,549)

--------- -------------

Borrowings principally comprise the Crestline Europe LLP

facility, which was used to fully repay the Incus Capital Finance

loan facility, which was fully repaid on 30 November 2022.

Notes to the cash flow statement

Reconciliation of loss before income tax to cash used in

operations

Year ended

30 June Year ended

2023 30 June 2022

----------- --------------

GBP'000 GBP'000

Loss before income tax (24,991) (19,462)

Add back:

Net finance costs 7,497 5,321

Share-based payments 1,701 1,817

Depreciation charges 8,910 8,640

Amortisation charges 2,163 2,540

Loss on disposal of property, plant and

equipment 5 47

Exceptional cost - Time Out Market Miami 7,098 -

Exceptional cost - Time Out Market Spitalfields 1,049 -

Gain on recognition / derecognition of

right-of-use asset and related lease liability - (475)

Other non-cash movements 33 (67)

(Increase)/ decrease in inventories (37) 18

Increase in trade and other receivables (1,629) (3,961)

Increase/ in trade and other payables 2,936 1,038

----------- --------------

Cash used in operations 4,735 (4,544)

----------- --------------

8. Share capital

Nominal

value per 30 June

share 2023 30 June 2022

------------ -------------

Number Number

Ordinary shares 337,589,584 335,870,417

Aggregate amounts 337,589,584 335,870,417

------------ -------------

GBP'000 GBP'000

Ordinary shares GBP0.001 338 336

Aggregate amounts 338 336

------------ -------------

9. Post balance sheet events

On 7th November 2023 the Directors agreed to enter into an

extension of the GBP5.2m Oakley Capital loan facility to June

2025.

10. Principal risks and uncertainties

The 2023 Annual Report sets out on pages 35 and 36 the principal

risks and uncertainties that could impact the business.

11. Extension of unsecured Loan Note with related party

The Group has agreed to an amendment of the unsecured Loan Note

with Oakley Capital investments ("OCI") to extend the repayment

date to 30 June 2025. The loan note, listed on The International

Stock Exchange ("TISE") will increase from GBP5.1m to GBP5.2m

(representing interest accrued on the initial Loan Note). The terms

remain the same, with interest charged at a 90-day average SONIA

rate plus 10% per annum, with an exit premium.

OCI is interested in 67,436,385 ordinary shares of 0.001 pence

each in the Company ("Ordinary Shares"), representing approximately

19.97 per cent. of the Company's issued share capital. OCI and

Oakley Capital Private Equity L.P. together hold 147,897,400

Ordinary Shares, representing approximately 43.79 per cent. of the

Company's issued share capital. As a substantial shareholder in

Time Out, OCI is a related party of the Company and the extension

of the OCI Loan Note is, for the purposes of AIM Rule 13,

considered a related party transaction. The Directors of the

Company (excluding Peter Dubens, Non-Executive Chairman of the

Company, David Till, Non-Executive Director of the Company and

Alexander Collins, Non-Executive Director of the Company, who are

not considered independent for the purposes of this transaction as

a consequence of being partners of Oakley Capital Private Equity

L.P. and Oakley Capital Limited, and Peter Dubens being a

non-executive director of OCI) consider that, having consulted with

the Company's nominated adviser, Liberum Capital, the terms of the

extension of the OCI Loan Note are fair and reasonable insofar as

shareholders in the Company are concerned.

Appendix: Alternative Performance Measures

The Group has included various unaudited alternative performance

measures (APMs) in its Annual Report and Accounts. The Group

includes these non-GAAP measures as it considers these measures to

be both useful and necessary to the readers of the Annual Report

and Accounts to help them more fully understand the performance and

position of the Group. The Group's measures may not be calculated

in the same way as similarly titled measures reported by other

companies. The APMs should not be viewed in isolation and should be

considered as additional supplementary information to the statutory

measures. Full reconciliations have been provided between the APMs

and their closest statutory measures.

The Group has considered the European Securities and Markets

Authority (ESMA) 'Guidelines on Alternative Performance Measures'

in these annual results.

APM Closest statutory Adjustments to reconcile statutory

measure measure

Net revenue Gross revenue Net revenue is calculated as Gross

revenue less the concessionnaires'

share of revenue.

------------------- ----------------------------------------------

Adjusted EBITDA Operating profit Adjusted EBITDA is profit or loss

before interest, taxation, depreciation,

amortisation, share-based payments,

exceptional items and profit/(loss)

on the disposal of fixed assets.

It is used by management and analysts

to assess the business before one-off

and non-cash items.

------------------- ----------------------------------------------

EBITDA Operating profit EBITDA is profit or loss before

interest, taxation, depreciation,

amortisation, and profit/(loss)

on the disposal of fixed assets.

It is used by management and analysts

to assess the business before one-off

and non-cash items.

------------------- ----------------------------------------------

Divisional adjusted Administrative Divisional Adjusted operating expenses

operating expenses expenses of the are Operating costs stated before

Media and Market Corporate costs, depreciation, amortisation,

segments (see share-based payments, exceptional

note 4) items and profit/ (loss) on the

disposal of fixed assets.

------------------- ----------------------------------------------

Divisional adjusted Operating profit Divisional Adjusted EBITDA is Adjusted

EBITDA of the Media and EBITDA of the Media or Market segment

Market segments stated before corporate costs.

(see note 4)

------------------- ----------------------------------------------

Corporate costs Operating loss Corporate costs are Administrative

of the Corporate expenses of the Corporate Cost segment

costs segments stated before interest, taxation,

(see note 4) depreciation, amortisation, share-based

payments, exceptional items and

profit/(loss) on the disposal of

fixed assets.

------------------- ----------------------------------------------

Adjusted operating Administrative Administrative expenses of the Market

expenditure expenses of the segment before Market central costs.

(trading) Market segment

(see note 4)

------------------- ----------------------------------------------

Trading EBITDA Operating profit Trading EBITDA represents the Adjusted

of the Market EBITDA from owned and operated markets,

segment (see note Management Agreement fees, and the

4) development fees relating to Management

Agreements. It is presented before

central costs of the Market business.

------------------- ----------------------------------------------

Adjusted net Net debt Adjusted net debt is cash less borrowings

debt and excludes any finance lease liability

recognised under IFRS 16.

------------------- ----------------------------------------------

Global monthly brand audience is the estimated monthly average

in the period including all Owned & Operated cities and

franchises. It includes print circulation and unique website

visitors (Owned & Operated), unique social users (as reported

by Facebook and Instagram with social followers on other platforms

used as a proxy for unique users), social followers (for other

social media platforms), opted-in members and Market visitors.

The Group has concluded that these APMs are relevant as they

represent how the Board assesses the performance of the Group and

they are also closely aligned with how shareholders value the

business. They provide like-for-like, year-on-year comparisons and

are closely correlated with the cash inflows from operations and

working capital position of the Group. They are used by the Group

for internal performance analysis and the presentation of these

measures facilitates comparison with other industry peers as they

adjust for non-recurring factors which may materially affect IFRS

measures. The adjusted measures are also used in the calculation of

the Adjusted EBITDA and banking covenants as per our agreements

with our lenders. In the context of these results, an alternative

performance measure (APM) is a financial measure of historical or

future financial performance, position or cash flows of the Group

which is not a measure defined or specified in IFRS. The

reconciliation of adjusted EBITDA to operating loss is contained

within the note below.

Alternative Performance Measures

Adjusted EBITDA

Year ended 30 June 2023

Time Out Time Out Corporate

Market Media costs Total

GBP'000 GBP'000 GBP'000 GBP'000

Gross revenue 71,511 33,130 - 104,641

Concessionaire share (28,663) - - (28,663)

----------------------------------- --------- --------- ---------- ---------

Net revenue 42,848 33,130 - 75,978

----------------------------------- --------- --------- ---------- ---------

Gross profit 35,535 26,354 - 61,889

Administrative expenses (48,495) (26,084) (4,804) (79,383)

----------------------------------- --------- ---------

Operating loss (12,960) 270 (4,804) (17,494)

Operating loss (12,960) 270 (4,804) (17,494)

Amortisation of intangible assets 21 1,202 940 2,163

Depreciation of property, plant

and equipment 6,322 222 - 6,544

Depreciation of right-of-use

assets 2,077 290 - 2,367

Loss on disposal of fixed assets - 5 - 5

----------------------------------- --------- --------- ---------- ---------

EBITDA (loss)/ gain (4,540) 1,989 (3,864) (6,415)

Share-based payments - - 1,701 1,701

Exceptional items 8,851 1,103 75 10,029

Adjusted EBITDA profit/ (loss) 4,311 3,092 (2,088) 5,315

--------- --------- ----------

Finance income 167

Finance costs (7,664)

---------

Loss before income tax (24,991)

Income tax (1,132)

Loss for the year (26,123)

---------

Adjusted EBITDA

Year ended 30 June 2022

Time Out Time Out Corporate

Market Media costs Total

GBP'000 GBP'000 GBP'000 GBP'000

Gross revenue 46,454 26,479 - 72,933

Concessionaire share (17,530) - - (17,530)

----------------------------------- --------- --------- ---------- ---------

Net revenue 28,924 26,479 - 55,403

----------------------------------- --------- --------- ---------- ---------

Gross profit 24,081 20,502 - 44,583

Administrative expenses (29,921) (22,728) (6,075) (58,724)

----------------------------------- --------- ---------

Operating loss (5,840) (2,226) (6,075) (14,141)

Operating loss (5,840) (2,226) (6,075) (14,141)

Amortisation of intangible assets 14 2,526 - 2,540

Depreciation of property, plant

and equipment 6,425 150 - 6,575

Depreciation of right-of-use

assets 2,017 48 - 2,065

Loss on disposal of fixed assets - 47 - 47

----------------------------------- --------- --------- ---------- ---------

EBITDA (loss)/ gain 2,616 545 (6,075) (2,914)

Share-based payments - - 1,817 1,817

Exceptional items (391) 1,159 1,548 2,316

Adjusted EBITDA profit/(loss) 2,225 1,704 (2,710) 1,219

--------- --------- ----------

Finance income 8

Finance costs (5,329)

---------

Loss before income tax (19,462)

Income tax credit (97)

Loss for the period (19,559)

---------

Alternative Performance Measures

Adjusted net debt

30 June 30 June 2022

2023

--------- -------------

GBP'000 GBP'000

Cash and cash equivalents 5,094 4,849

Borrowings (29,883) (21,978)

--------- -------------

Adjusted net debt (24,789) (17,129)

IFRS 16 Lease liabilities (24,863) (27,420)

--------- -------------

Net debt (49,652) (44,549)

--------- -------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR XDLLBXFLXFBX

(END) Dow Jones Newswires

November 08, 2023 02:00 ET (07:00 GMT)

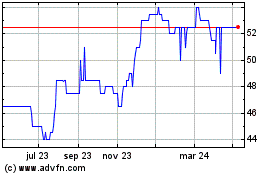

Time Out (LSE:TMO)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Time Out (LSE:TMO)

Gráfica de Acción Histórica

De May 2023 a May 2024