TIDMBEH

RNS Number : 3948N

Bayfield Energy Holdings PLC

28 September 2012

28 September 2012

BAYFIELD ENERGY HOLDINGS PLC

Results for the 6 months ended 30 June 2012

Bayfield Energy Holdings plc ("Bayfield", the "Company" or the

"Group"), (Ticker Symbol: BEH), an upstream oil and gas exploration

and production company with interests in Trinidad and South Africa,

today announces its results for the six month period ended 30 June

2012.

Highlights

Financial

-- Revenue US$12.2million (30 June 2011 - US$11.2 million).

-- Net cash from operating activities US$13.2 million inflow (30

June 2011 - US$5.5 million outflow).

-- Exploration expenditure US$ 46.2 million (30 June 2011 - nil).

-- Field development expenditure US$13.3 million (30 June 2011 - US$ 6.5 million).

-- Dry hole costs written off US$ 21.9 million (30 June 2011 - nil).

-- Loss after tax US$15.1 million (30 June 2011 - US$1.6 million).

Operational

-- Exit gross production at the end of June 2012 - 1,808 barrels of oil per day ("bopd").

-- Average net production 851 bopd (30 June 2011 - 768 bopd).

-- Average realised oil price US$78.93/bbl (2011 US$ 79.15/bbl).

-- Two exploration wells (EG7 and EG8) completed. EG8

encountered hydrocarbons with additional assessed net development

potential of 5.2 million barrels (mmbbls) and 44.9 billion standard

cubic feet ( bcf) (gross 32 mmbbls and 69 bcf). EG7 did not

encounter hydrocarbons in commercial quantities and was abandoned

as a dry hole.

Subsequent events

-- Average net production for the third quarter is approximately

1,300 bopd (gross 2,000 bopd).

-- Bayfield has secured substantially improved terms for the

sale of its oil effective 1 August 2012 which will increase the

current realised price by approximately US$27/bbl, based on current

market prices.

-- The Rowan Gorilla III rig is not scheduled to be available

before November 2012 and following its release by Niko it is

expected that the rig will be assigned by Bayfield and Niko to a

third party operator in Trinidad for a period of at least six

months. As a consequence, Bayfield will have no further liability

under the rig contract except in relation to any future wells to be

drilled at its option.

Prospects and outlook

-- Five development wells are expected to be completed in the

Trintes field during the fourth quarter targeting net production in

excess of 1,950 bopd (gross 3,000 bopd) by the end of the year.

-- The Company is evaluating a range of financing and strategic

alternatives. Cost control and working capital optimization remain

priorities.

Executive Chairman, Finian O'Sullivan, commented:

"Stabilised gross production in excess of 2,000 bopd and

substantially better pricing for our oil provides improved cash

flow and a solid foundation from which to fund growth potential and

follow through on previously announced strategic initiatives. "

For further information contact:

Bayfield Energy Holdings plc +44 (0) 20 7747 9200

Finian O'Sullivan, Chairman

Hywel John, Chief Executive

M:Communications

Patrick d'Ancona +44 (0) 20 7920 2347

Andrew Benbow +44 (0) 20 7920 2344

Seymour Pierce +44 (0) 20 7107 8000

Jonathan Wright/Stewart Dickson (Corporate Finance)

Richard Redmayne/Jeremy Stephenson (Corporate Broking)

First Energy +44 (0) 20 7 448 0200

Hugh Sanderson/David van Erp (Corporate Finance)

Operations review

Trinidad

Trintes field

During the first half of the year Bayfield drilled seven

sidetracks and completed five workovers in the Trintes field.

Average net production increased from 564 bopd (gross 868 bopd) in

January to 720 bopd (gross 1,108 bopd) in June and in the third

quarter has stabilised at approximately 1,300 bopd (gross 2,000

bopd). Current net production is 1,430 bopd (gross 2,200 bopd) with

plans to exit 2012 at rates in excess of 1,950 bopd (gross 3,000

bopd). This will be achieved substantially through the drilling of

four long sidetracks. The most recently completed development well

(B3), the first of the planned long sidetracks, is presently

producing at a stabilised net rate of 293 bopd (gross 450

bopd).

East Galeota

In April, exploration well EG8 demonstrated gross development

potential of 32 mmbbl of oil and 69 bcf of gas in the EG2/EG5/EG8

Central and East fault blocks. Initial interpretation suggested

that substantially all of the gas potential lies within the Galeota

Licence though the oil potential extends into an adjacent licence

in which the Group has no participating interest. The Group is

continuing discussions with the operator of the adjacent block,

Repsol E&P T&T Limited ("Repsol"), regarding the potential

for accelerated joint development of the accumulations of oil and

gas identified by EG8 which may ultimately lead to a

reclassification of prospective and contingent resources.

In June, exploration well EG7 reached a target depth of 7,029

feet. All the shallow reservoir objectives were encountered and, in

the interval between 1,000ft and 3,000ft, the reservoirs identified

as the F, G and H Sands were predominantly water-bearing. The well

was abandoned as a dry hole and the associated costs have been

written off in the income statement.

The Rowan Gorilla III rig is not scheduled to be available to

Bayfield before November 2012 and following its release by Niko it

is expected that the rig will be assigned by Bayfield and Niko to a

third party operator in Trinidad for a period of at least six

months. As a consequence, Bayfield will have no further liability

under the rig contract except in relation to any future wells to be

drilled at its option.

South Africa

The formal execution of an exploration right over the Pletmos

licence area was completed with an effective date of 17 April 2012.

Bayfield has commenced the work programme for the initial

three-year term and has contracted for the reprocessing of legacy

2D seismic data from this area. The reprocessing should be

completed in the first quarter of 2013.

Russia

Bayfield terminated its operations in Russia in 2011 and the

administrative processes to effect the orderly dissolution of the

Group's operating subsidiary and the surrender of its licence

interest are continuing. It is expected that the processes will be

completed before the end of the year.

Financial Review

Selected financial data

H1 2012 H1 2011 Year 2011

------------------------------- ------------- -------- -------- ----------

Revenue US$ million 12.2 11.2 22

------------------------------- ------------- -------- -------- ----------

Cash on hand at end of period US$ million 19.2 10.4 59.4

------------------------------- ------------- -------- -------- ----------

Net loss before tax US$ million (26.4) (2.7) (17.2)

------------------------------- ------------- -------- -------- ----------

Statement of financial position

At 30 June 2012, Bayfield held US$19.2 million cash and cash

equivalents (December 2011: US$59.4 million, June 2011: US$10.4

million). Group net assets at 30 June 2012 were US$104.2 million

compared to US$118.7 million at 31 December 2011 and US$41.1

million at 30 June 2011.

Net additions to oil and gas assets in the first half of 2012

totalled US$37.6 million (December 2011: US$37.1 million, June

2011: US$12.7 million) and comprised of US$13.3 million in Trinidad

on producing assets, US$24.3 million on exploration assets.

Going concern statement

In making their going concern assessment, the directors have

considered Group budgets and cash flow forecasts.

The Group's cash flow forecast reflects the reasonable

assumptions of management regarding the outcome of a number of

matters including the assignment of the Rowan Gorilla III rig

contract to a third party and the rescheduling of payments to a

principal creditor. Whilst these matters have been agreed in

principle, they remain subject to execution of transaction

documentation. This indicates the existence of a material

uncertainty which may cast doubt on the Group's ability to continue

as a going concern and therefore the Group may be unable to realise

their assets and discharge their liabilities in the normal course

of business.

However, the board of directors has carefully considered and

formed a reasonable judgement that, at the time of approving the

financial statements, there is a reasonable expectation the Company

will be able to continue operations for the foreseeable future. For

this reason the board of directors continues to adopt the going

concern basis in preparing the financial statements.

Principal risks and uncertainties

The directors do not consider that the principal risks and

uncertainties for the remaining 6 months of the year have not

significantly changed since the year ended 31 December 2011. The

principal risks and uncertainties at that time were stated as:

-- operational risk;

-- reservoir and reserves risk;

-- oil price risk;

-- competitive environment;

-- changes to (and challenges by environmental and other

interest groups to) the regulatory environment;

-- changes to the taxation system;

-- failure by contractors to carry out their duties;

-- retention of key business relationships;

-- ability to exploit successful discoveries;

-- cost overruns or significant delays in the commercialisation of fields; and

-- ongoing access to sources of funding.

A detailed explanation of these risks can be found in the

directors report of the Annual Report for the year ended 31

December 2011, a copy of which can be found on the company's

website.

Statement of Directors' Responsibilities

The directors confirm that to the best of their knowledge:

a) the condensed set of financial statements has been prepared

in accordance with IAS34 'Interim Financial Reporting';

b) the Interim Management Report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year); and

c) the Interim Management Report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related parties'

transactions and changes therein).

The directors of Bayfield Energy Holdings plc are listed in the

group's 2011 Annual Report and Financial Statements. A list of the

current directors is maintained on the company's website:

www.bayfieldenergy.com.

By order of the Board

Hywel John

Chief Executive Officer

27 September 2012

INDEPENDENT REVIEW REPORT TO BAYFIELD ENERGY HOLDINGS PLC

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 June 2012 which comprises the condensed

consolidated statement of comprehensive income, the condensed

consolidated statement of financial position, the condensed

consolidated statement of changes in equity, condensed consolidated

statement of cash flows and related notes 1 to 9. We have read the

other information contained in the half-yearly financial report and

considered whether it contains any apparent misstatements or

material inconsistencies with the information in the condensed set

of financial statements.

This report is made solely to the company in accordance with

International Standard on Review Engagements (UK and Ireland) 2410

"Review of Interim Financial Information Performed by the

Independent Auditor of the Entity" issued by the Auditing Practices

Board. Our work has been undertaken so that we might state to the

company those matters we are required to state to it in an

independent review report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the company, for our review work, for this

report, or for the conclusions we have formed.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the AIM Rules of the London Stock Exchange.

As disclosed in note 2, the annual financial statements of the

group are prepared in accordance with IFRSs as adopted by the

European Union. The condensed set of financial statements included

in this half-yearly financial report has been prepared in

accordance with International Accounting Standard 34, "Interim

Financial Reporting," as adopted by the European Union.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making inquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Emphasis of matter - Going concern

In forming our conclusion on the financial statements, which is

not qualified, we have considered the adequacy of the disclosure

made in note 2 to the financial statements concerning the Company's

ability to continue as a going concern. The Group incurred a net

loss of $15.1 million during the period ended 30 June 2012. The

Group's ability to meet its forecast expenditure requirements is

dependent on a number of factors including rig scheduling

arrangements and on-going creditor support. These conditions, along

with the other matters explained in note 2 to the financial

statements indicate the existence of a material uncertainty which

may cast significant doubt about the Company's ability to continue

as a going concern. The financial statements do not include the

adjustments that would result if the Company was unable to continue

as a going concern.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2012 is not prepared, in all material respects, in accordance

with International Accounting Standard 34 as adopted by the

European Union and the AIM Rules of the London Stock Exchange.

Deloitte LLP

Chartered Accountants and Statutory Auditor

London, UK

27 September 2012

Bayfield Energy Holdings plc

Condensed consolidated statement of comprehensive income for the

six months to 30 June 2012

Notes Six months Six months Year ended

to 30 June to 30 June 31 December

2012 2011 2011

US$000 US$000 US$000

(unaudited) (unaudited) (audited)

------------ ------------ -------------

Revenue 12,225 11,165 22,007

Cost of sales (14,135) (10,147) (24,804)

------------ ------------ -------------

Gross (loss)/profit (1,910) 1,018 (2,797)

Exploration expense 5 (21,900) - (3,324)

Administrative expenses (2,531) (1,426) (5,719)

Listing expenses - (1,930) (3,467)

------------ ------------ -------------

Operating loss (26,341) (2,338) (15,307)

Finance income 40 6 32

Finance costs (105) (403) (1,951)

Loss before tax (26,406) (2,735) (17,226)

Tax 11,313 1,182 2,970

Loss after tax for the

period (15,093) (1,553) (14,256)

------------ ------------ -------------

Loss after tax for the

period (15,093) (1,553) (14,256)

Currency translation

adjustments 179 (1) 29

Total comprehensive expense

for the period (14,914) (1,554) (14,227)

Attributable to:

- equity holders of the parent (14,848) (1,509) (13,304)

- non-controlling interest (66) (45) (923)

(14,914) (1,554) (14,227)

------------ ------------ -------------

Basic and diluted loss

per share (US$) 9 (0.07) (0.02) (0.09)

------------ ------------ -------------

Bayfield Energy Holdings plc

Condensed consolidated statement of financial position as at 30

June 2012

Notes As at 30 As at 30 As at 31

June 2012 June 2011 December

2011

US$000 US$000 US$000

(unaudited) (unaudited) (audited)

------------ ------------ ----------

ASSETS

Non-current assets

Intangibles: exploration and

evaluation assets 5 35,695 12,661 11,358

Property, plant and

equipment 6 49,790 12,394 37,414

Deferred tax 18,906 5,805 7,593

104,391 30,860 56,365

------------ ------------ ----------

Current assets

Inventories 9,403 5,635 9,822

Trade and other receivables 12,369 7,543 10,647

Cash and cash equivalents 19,216 10,436 59,444

------------ ------------ ----------

40,988 23,614 79,913

Total assets 145,379 54,474 136,278

------------ ------------ ----------

LIABILITIES

Current liabilities

Trade and other payables (34,462) (5,504) (10,931)

Convertible loan notes - (4,192) -

------------ ------------ ----------

(34,462) (9,696) (10,931)

Net current assets 6,526 13,918 68,982

------------ ------------ ----------

Non-current liabilities

Decommissioning provision (6,676) (3,708) (6,693)

------------ ------------ ----------

(6,676) (3,708) (6,693)

Total liabilities (41,138) (13,404) (17,624)

------------ ------------ ----------

Net assets 104,241 41,070 118,654

------------ ------------ ----------

EQUITY

Share capital 21,648 11,938 21,498

Share premium 80,817 - 80,586

Merger reserve 35,046 35,034 35,046

Share based payment

reserve 2,367 1,480 2,247

Convertible loan stock - 161 -

Translation reserve 126 (83) (53)

Accumulated losses (34,774) (8,058) (19,747)

------------ ------------ ----------

Equity attributable to equity

holders of the parent 105,230 40,472 119,577

Non-controlling interest (989) 598 (923)

Total equity 104,241 41,070 118,654

------------ ------------ ----------

Bayfield Energy Holdings plc

Condensed consolidated statement of changes in equity for the

six months ended 30 June 2012 (unaudited)

Share Share Merger Share Convertible Translation Accumulated Sub-total Non-controlling Total

capital premium reserve based debt reserve losses interest equity

payment

reserve

US$000 US$000 US$000 US$000 US$000 US$000 US$000 US$000 US$000 US$000

-------- -------- -------- -------- ------------ ------------ ------------ ---------- ---------------- ---------

At 1 January

2011 9,294 - 27,196 650 149 (82) (6,632) 30,575 - 30,575

Loss for the

year - - - - - - (13,333) (13,333) (923) (14,256)

Currency

translation

differences - - - - - 29 - 29 - 29

-------- -------- -------- -------- ------------ ------------ ------------ ---------- ---------------- ---------

Total

comprehensive

expense - - - - - 29 (13,333) (13,304) (923) (14,227)

Share based

payments - - - 1,597 - - - 1,597 - 1,597

Issue of share

capital

prior to

scheme of

arrangement

(net of

share issue

costs) 2,263 - 6,350 - - - - 8,613 - 8,613

Issue of share

capital

post scheme

of

arrangement

(net of share

issue

costs) 9,641 80,586 - - - - - 90,227 - 90,227

Issue of

convertible

loan stock - - - - 69 - - 69 - 69

Issue of

redeemable

preference

shares 82 - - - - - - 82 - 82

Redemption of

redeemable

shares (82) - - - - - - (82) - (82)

Transfer from

retained

losses - - - - (218) - 218 - - -

Acquisition of

AGOC 300 - 1,500 - - - - 1,800 - 1,800

Balance at 31

December

2011 21,498 80,586 35,046 2,247 - (53) (19,747) 119,577 (923) 118,654

-------- -------- -------- -------- ------------ ------------ ------------ ---------- ---------------- ---------

Loss for the

period - - - - - - (15,027) (15,027) (66) (15,093)

Currency

translation

differences - - - - - 179 - 179 - 179

-------- -------- -------- -------- ------------ ------------ ------------ ---------- ---------------- ---------

Total

comprehensive

expense - - - - - 179 (15,027) (14,848) (66) (14,914)

Share based

payments - - - 120 - - - 120 - 120

Issue of share

capital 150 231 - - - - - 381 - 381

Balance at 30

June

2012 21,648 80,817 35,046 2,367 - 126 (34,774) 105,230 (989) 104,241

-------- -------- -------- -------- ------------ ------------ ------------ ---------- ---------------- ---------

At 1 January

2011 9,294 - 27,196 650 149 (82) (6,632) 30,575 - 30,575

Loss for the

period - - - - - - (1,508) (1,508) (45) (1,553)

Currency

translation

differences - - - - - (1) - (1) - (1)

-------- -------- -------- -------- ------------ ------------ ------------ ---------- ---------------- ---------

Total

comprehensive

expense - - - - - (1) (1,508) (1,509) (45) (1,554)

Share based

payments - - - 830 - - - 830 - 830

Issue of share

capital

prior to

scheme of

arrangement

(net of

share issue

costs) 2,262 - 6,338 - - - - 8,600 - 8,600

Conversion of

loan

stock - - - - (149) - - (149) - (149)

Issue of

convertible

loan stock - - - - 243 - - 243 - 243

Issue of

redeemable

preference

shares 82 - - - - - - 82 - 82

Transfer from

retained

losses - - - - (82) - 82 - - -

Acquisition of

AGOC 300 - 1,500 - - - - 1,800 643 2,443

-------- -------- -------- -------- ------------ ------------ ------------ ---------- ---------------- ---------

Balance at 30

June

2011 11,938 - 35,034 1,480 161 (83) (8,058) 40,472 598 41,070

-------- -------- -------- -------- ------------ ------------ ------------ ---------- ---------------- ---------

Bayfield Energy Holdings plc

Condensed consolidated statement of cash flows for the six

months ended 30 June 2012

Six months Six months Year ended

to 30 to 30 31 December

June 2012 June 2011 2011

US$000 US$000 US$000

(unaudited) (unaudited) (audited)

------------ ------------ -------------

Cash flow from operating activities

Operating loss (26,341) (2,338) (15,307)

Adjustments for:

Share based payments 127 829 1,633

Depreciation on property, plant

and equipment 1,200 797 2,190

Exploration write-off 21,900 - 3,324

------------ ------------ -------------

Operating cash flow before movement

in working capital (3,114) (712) (7,616)

Increase in inventory (52) (91) (7,185)

Increase in trade and other receivables (1,723) (3,635) (7,238)

Increase/(decrease) in trade

and other payables 8,291 (1,098) 2,142

------------ ------------ -------------

Net cash from / (used in) operating

activities 3,402 (5,536) (20,441)

------------ ------------ -------------

Cash flow from investing activities

Interest received 40 6 32

Additions to exploration and

evaluation assets (37,381) (3,029) (2,209)

Additions to property, plant

and equipment (6,481) (9,250) (30,432)

------------ ------------ -------------

Net cash generated used in investing

activities (43,822) (12,273) (32,609)

------------ ------------ -------------

Cash flow from financing activities

Interest paid (6) (11) (20)

Proceeds from issue of convertible

loan stock - 4,250 4,250

Share capital issued (net of

costs) 375 750 86,549

------------ ------------ -------------

Net cash generated from financing

activities 369 4,989 90,779

------------ ------------ -------------

Net (decrease)/increase in cash

and cash equivalents (40,051) (12,820) 37,729

Cash and cash equivalents at

beginning of period 59,444 23,255 23,255

Foreign exchange differences (177) 1 (1,540)

------------ ------------ -------------

Cash and cash equivalents at

end of period 19,216 10,436 59,444

------------ ------------ -------------

Bayfield Energy Holdings plc

Notes to the condensed financial statements for the six months

ended 30 June 2012

1. General Information

Bayfield Energy Holdings plc is registered in England and Wales

and listed on AIM. The address of the registered office is Burdett

House, 4(th) Floor, 15-16 Buckingham Street, London, WC2N 6DU.

The condensed financial statements for the six months ended 30

June 2012 were authorised for issue in accordance with a resolution

of the Board of Directors on 27 September 2012.

The information for the year ended 31 December 2011 contained

within the condensed financial statements does not constitute

statutory accounts within the meaning of section 434 of the

Companies Act 2006. Statutory accounts for the year ended 31

December 2011 were approved by the Board of Directors on 25 May

2012 and delivered to the Registrar of Companies. The auditor

reported on those accounts; the report was unqualified and

contained an emphasis of matter section on going concern.

The financial information contained in this report is unaudited.

The condensed consolidated income statement, condensed consolidated

statement of comprehensive income, condensed consolidated statement

of changes in equity and the condensed consolidated cash flow

statement for the six months to 30 June 2012, and the condensed

consolidated balance sheet as at 30 June 2012 and related notes,

have been reviewed by the auditor and their report to the Company

is attached.

2. Basis of preparation

The condensed financial statements for the six months ended 30

June 2012 have been prepared in accordance with IAS 34 - 'Interim

Financial Reporting', as adopted by the European Union and with the

requirements of the Disclosure and Transparency Rules issued by the

Financial Services Authority. These condensed financial statements

should be read in conjunction with the annual financial statements

for the year ended 31 December 2011, which have been prepared in

accordance with International Financial Reporting Standards as

adopted by the European Union.

The condensed financial statements have been prepared on the

going concern basis.

Going Concern

In making their going concern assessment, the directors have

considered Group budgets and cash flow forecasts.

The Group's cash flow forecast reflects the reasonable

assumptions of management regarding the outcome of a number of

matters including the assignment of the Rowan Gorilla III rig

contract to a third party and the rescheduling of payments to a

principal creditor. Whilst these matters have been agreed in

principle, they remain subject to execution of transaction

documentation. This indicates the existence of a material

uncertainty which may cast doubt on the Group's ability to continue

as a going concern and therefore the Group may be unable to realise

their assets and discharge their liabilities in the normal course

of business.

However, the board of directors has carefully considered and

formed a reasonable judgement that, at the time of approving the

financial statements, there is a reasonable expectation the Company

will be able to continue operations for the foreseeable future. For

this reason the board of directors continues to adopt the going

concern basis in preparing the financial statements.

3. Accounting policies

The accounting policies applied in these condensed financial

statements are consistent with those of the annual financial

statements for the year ended 31 December 2011, as described in

those annual financial statements. A number of amendments to

existing standards and interpretations were applicable from 1

January 2012. The adoption of these amendments did not have a

material impact on the Group's condensed financial statements for

the half-year ended 30 June 2012.

4. Operating Segments

Management has determined the operating segments based on the

reports reviewed by the board of directors that are used to make

strategic business decisions.

Management considers the business from a geographical

perspective. Following the decision to relinquish licence interests

in Russia in 2011, management has reorganised its internal

reporting structure such that only one geographical location is

reported, being Trinidad. The following tables present revenue,

profit and certain asset and liability information in respect of

the Group's one segment for the period ended 30 June 2012, the year

ended 31 December 2011 and the period ended 30 June 2011. The

tables for the year ended 31 December 2011 and the period ended 30

June 2011 have been restated to reflect the new reportable segment

of the business.

Trinidad Unallocated Consolidated

US$000 US$000 US$000

(unaudited) (unaudited) (unaudited)

30 June 2012

Sales revenue by origin 12,225 - 12,225

------------ ------------ -------------

Segment result (22,696) (3,645) (26,341)

Investment revenue 40

Finance costs (105)

-------------

Loss before tax (26,406)

Tax 11,313

Loss after tax (15,093)

-------------

Segment assets - non current 104,377 14 104,391

Segment assets current 30,691 10,297 40,988

Segment liabilities (40,551) (587) (41,138)

Capital additions - oil & gas

assets 13,273 - 13,273

Capital additions - exploration

& evaluation 46,162 75 46,237

Capital additions - other 303 - 303

Depletion, depreciation and

amortisation (1,153) (47) (1,200)

------------ ------------ -------------

Trinidad Unallocated Consolidated

US$000 US$000 US$000

(audited) (audited) (audited)

31 December 2011

Sales revenue by origin 22,007 - 22,007

------------ ------------ -------------

Segment result (4,156) (11,151) (15,307)

Investment revenue 32

Finance costs (1,951)

-------------

Loss before tax (17,226)

Tax 2,970

Loss after tax (14,256)

-------------

Segment assets - non current 52,498 3,867 56,365

Segment assets current 22,714 57,199 79,913

Segment liabilities (16,961) (663) (17,624)

Capital additions - oil & gas

assets 32,971 - 32,971

Capital additions - exploration

& evaluation 4,169 3,324 7,493

Capital additions - other 678 205 883

Depletion, depreciation and

amortisation (2,146) (44) (2,190)

------------ ------------ -------------

Trinidad Unallocated Consolidated

US$000 US$000 US$000

(unaudited) (unaudited) (unaudited)

30 June

2011

Sales revenue by origin 11,165 - 11,165

------------ ------------ -------------

Segment result (523) (1,815) (2,338)

Investment revenue 6

Finance costs (403)

-------------

Loss before tax (2,735)

Tax 1,182

Loss after tax (1,553)

-------------

Segment assets - non current 28,083 2,777 30,860

Segment assets current 14,359 9,255 23,614

Segment liabilities (7,205) (6,199) (13,404)

Capital additions - oil & gas

assets 7,213 - 7,213

Capital additions - exploration

& evaluation 2,362 3,110 5,472

Capital additions - other 251 75 326

Depletion, depreciation and

amortisation (791) (6) (797)

------------ ------------ -------------

Business segments

The operations of the Group comprise one class of business,

being oil and gas exploration, development and production. All

sales are made to a single customer for all periods shown.

5. Intangible assets

Exploration

and evaluation

assets

US$000

At 30 June 2011 12,661

Additions 2,021

Exploration write-off (3,324)

At 31 December 2011 11,358

Additions 46,237

Exploration write-off (21,900)

At 30 June 2012 35,695

================

Exploration write-off

Well EG7 in the offshore Galeota Licence Area was sidetracked to

a total depth of 7,090ft. Some thin hydrocarbon bearing sandstones

were logged at 5,500ft but due to deterioration in hole conditions

it was not possible to run a sampling tool. The decision was made

to plug and abandon the well and the associated costs, totalling

US$21.9million have been written off.

Astrakhanskaya Gas and Oil Company ('AGOC'), a subsidiary

undertaking, holds a 100% interest in the Karalatsky licence which

is in its exploration phase. Interpretation of the reprocessed 2D

seismic data acquired over the Karalatsky license area in the first

quarter of 2011 did not identify any prospects that would justify

further investment in an exploration well. A decision was made to

abandon the licence and write off all associated capitalised costs

in 2011.

6. Property, plant and equipment

Oil and Land Other Total

gas property and buildings

US$000 US$000 US$000 US$000

Cost:

At 30 June 2011 14,333 214 708 15,255

Additions 25,757 - 556 26,313

At 31 December 2011 40,090 214 1,264 41,568

---------

Additions 13,273 - 303 13,576

-------------- ---------------- --------- ---------

At 30 June 2012 53,363 214 1,567 55,144

============== ================ ========= =========

Depreciation:

At 30 June 2011 2,558 11 292 2,861

Charge for the year 1,139 1 153 1,293

---------

At 31 December 2011 3,697 12 445 4,154

Charge for the period 1,009 3 188 1,200

At 30 June 2012 4,706 15 633 5,354

============== ================ ========= =========

Net Book Value:

At 30 June 2011 11,775 203 416 12,394

-------------- ---------------- --------- ---------

At 31 December 2011 36,393 202 819 37,414

-------------- ---------------- --------- ---------

At 30 June 2012 48,657 199 934 49,790

============== ================ ========= =========

7. Related party transactions

There have been no transactions with the Directors, officers,

significant shareholders or other related parties during the year

besides intercompany transactions which have been eliminated in the

consolidated financial information and normal remuneration of

Directors and officers.

8. Post balance sheet events

Bayfield has secured improved terms for the sale of its oil

effective 1 August 2012 which will improve the realised price by

approximately US$27/bbl. The Sales price is now linked to ICE Brent

rather than WTI at a discount of 9.5%.

9. Loss per share

Basic loss per share is calculated by dividing the loss

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period (less those

non-vested shares held by employee ownership trusts). For diluted

loss per share the weighted average number of shares in issue is

adjusted to assume conversion of all dilutive potential ordinary

shares arising from unvested share-based awards including share

options. As there is a loss for all periods, there is no difference

between the basic and diluted loss per share.

30 June 30 June 31 December

2012 2011 2011

Loss after tax for the period

attributable to owners of the

company (US$000s) (14,848) (1,509) (13,333)

Denominator:

Weighted average number of

shares used in basic and diluted

loss per share (thousands) 215,822 89,061 154,262

Loss per share - basic and

diluted (cents per share) (0.07) (0.02) (0.09)

--------- -------- ------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SESEEWFESELU

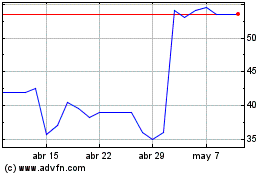

Trinity Exploration & Pr... (LSE:TRIN)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Trinity Exploration & Pr... (LSE:TRIN)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024