AIM Sch 1 update - Bayfield Energy Holdings Plc (7850W)

31 Enero 2013 - 2:23AM

UK Regulatory

TIDMBEH

RNS Number : 7850W

AIM

31 January 2013

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION

IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES ("AIM

RULES")

---------------------------------------------------------------------------------

COMPANY NAME:

---------------------------------------------------------------------------------

Bayfield Energy Holdings plc (to be renamed Trinity Exploration

& Production plc prior to Admission) ("Bayfield" or the "Company")

---------------------------------------------------------------------------------

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY

TRADING ADDRESS (INCLUDING POSTCODES) :

---------------------------------------------------------------------------------

Fourth Floor

Burdett House

15-16 Buckingham Street

London

WC2N 6DU

United Kingdom

---------------------------------------------------------------------------------

COUNTRY OF INCORPORATION:

---------------------------------------------------------------------------------

England and Wales

---------------------------------------------------------------------------------

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED

BY AIM RULE 26:

---------------------------------------------------------------------------------

www.bayfieldenergy.com until Admission, www.trinityexploration.com

thereafter

---------------------------------------------------------------------------------

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

POLICY). IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE

TAKE-OVER UNDER RULE 14, THIS SHOULD BE STATED:

---------------------------------------------------------------------------------

Bayfield is the parent company of an independent oil and gas

exploration and production group, which was established in

order to develop a portfolio of interests providing current

production, near-term development, appraisal and exploration

opportunities. The group was established in 2008 by former

executives of Burren Energy who left that company following

its acquisition by Eni. Bayfield's ordinary share capital was

admitted to trading on AIM in July 2011.

On 15 October 2012, Bayfield Energy Holdings plc announced

that it had reached agreement on the terms of a conditional

merger (the "Merger") with Trinity Exploration & Production

Limited ("Trinity"). Bayfield has conditionally agreed to acquire

100 per cent. of Trinity's issued and to be issued share capital.

Bayfield, following the Merger (the "Enlarged Group"), will

be the leading Trinidad focused independent exploration & production

with a diversified portfolio with 11 operated fields including

assets onshore and offshore both the East and West coasts of

Trinidad. In addition, the Enlarged Group will hold an exploration

licence over the Pletmos Inshore Block in South Africa.

The Enlarged Group is currently producing approximately 3,965

barrels of oil per day and as at 30 June 2012 had proved and

probable reserves of 31 million barrels of oil (net) and contingent

resources of 38 million barrels of oil equivalent (net) based

on the directors of Bayfield's calculation of gas in terms

of barrels of oil equivalent.

The Enlarged Group will be led by Bruce Dingwall CBE as Executive

Chairman and Joel "Monty" Pemberton as Chief Executive Officer

(currently Executive Chairman and Chief Executive Officer of

Trinity respectively) and will be headquartered in San Fernando,

Trinidad.

The Company has conditionally raised gross proceeds, by way

of a private placing, of approximately US$90 million. The Enlarged

Group intends to use the proceeds to accelerate the Enlarged

Group's development programme, to fund a material and high

value infrastructure-led exploration programme and for general

corporate purposes and thereby accelerate delivery of what

the current and proposed directors of Bayfield believe to be

significant upside that exists in the combined portfolio.

The Merger constitutes a reverse takeover under the AIM Rules

and is therefore conditional, inter alia, on the approval of

Bayfield shareholders at a General Meeting to be held on 13

February 2013. At the General Meeting, approval will also be

sought, inter alia, for a one for ten share consolidation.

---------------------------------------------------------------------------------

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS

AS TO TRANSFER OF THE SECURITIES (i.e. where known, number

and type of shares, nominal value and issue price to which

it seeks admission and the number and type to be held as treasury

shares):

---------------------------------------------------------------------------------

94,799,986 ordinary shares of US$1.00 each, following a proposed

consolidation of the existing issued ordinary shares of US$0.10

each on a one for ten basis

Placing Price 120 pence per share (Placing Price reflects the

one for ten share consolidation)

No restrictions to the transfer of securities

No treasury shares

---------------------------------------------------------------------------------

CAPITAL TO BE RAISED ON ADMISSION (IF APPLICABLE) AND ANTICIPATED

MARKET CAPITALISATION ON ADMISSION:

---------------------------------------------------------------------------------

Gross placing proceeds of approximately US$90 million

Market capitalisation of the Company at the Placing Price on

Admission of approximately GBP114 million

---------------------------------------------------------------------------------

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION:

---------------------------------------------------------------------------------

30.97%

---------------------------------------------------------------------------------

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH

THE AIM COMPANY HAS APPLIED OR AGREED TO HAVE ANY OF ITS SECURITIES

(INCLUDING ITS AIM SECURITIES) ADMITTED OR TRADED:

---------------------------------------------------------------------------------

None

---------------------------------------------------------------------------------

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS

(underlining the first name by which each is known or including

any other name by which each is known):

---------------------------------------------------------------------------------

Current Directors:

Finian Rory O'Sullivan, (Executive Chairman)

Hywel Rhys Richard John, (Chief Executive Officer)

Andrey Pannikov, (Non-Executive Director)

Jonathan Gervaise Fitzpatrick Cooke, (Non-Executive Director)

David Archibald MacFarlane, (Non-Executive Director)

Directors upon Admission:

Bruce Alan Ian Dingwall (Executive Chairman)

Joel Montgomery ("Monty") Pemberton (Chief Executive Officer)

Jonathan David Murphy (Non-Executive Director)

Charles Anthony Brash Junior (Non-Executive Director)

Ronald Harford (Independent Non-Executive Director)

Finian Rory O'Sullivan, (Non-Executive Director)

David Archibald MacFarlane, (Non-Executive Director)

---------------------------------------------------------------------------------

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED

AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER

ADMISSION (underlining the first name by which each is known

or including any other name by which each is known):

---------------------------------------------------------------------------------

Pre admission:

Andrey Pannikov (1) 17.79%

Finian O'Sullivan (2) 16.75%

Brian Thurley 11.45%

BlackRock Investment Management 9.51%

Alta Limited 4.51%

(1) Includes 1.41% held by Latravia Limited and 16.15% held

by Lion Invest and Trade Limited

(2) Includes 13.53% held by Prelude Holdings Limited

Post admission:

Bruce Dingwall 6.10%

Charles Anthony Brash

Junior and family (1) 5.90%

Jonathan Murphy 5.14%

Finian O'Sullivan 3.83%

Regent Pacific Group Limited 3.73%

David Segal 3.46%

(1) of which 3.07% will be held by Well Services Petroleum

Company Limited

---------------------------------------------------------------------------------

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE

2, PARAGRAPH (H) OF THE AIM RULES:

---------------------------------------------------------------------------------

None

---------------------------------------------------------------------------------

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION

DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited

interim financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS

PURSUANT TO AIM RULES 18 AND 19:

---------------------------------------------------------------------------------

(i) 31 December

(ii) The financial information on Trinity has been prepared

to 30 June 2012.

(iii) 30 June 2013 (final results for the year ended 31 December

2012)

30 September 2013 (interim results for six months ending 30

June 2013)

30 June 2014 (final results for the year ended 31 December

2013)

---------------------------------------------------------------------------------

EXPECTED ADMISSION DATE:

---------------------------------------------------------------------------------

14 February 2013

---------------------------------------------------------------------------------

NAME AND ADDRESS OF NOMINATED ADVISER:

---------------------------------------------------------------------------------

Seymour Pierce

20 Old Bailey

London

EC4M 7EN

United Kingdom

Immediately following admission:

RBC Europe Limited, which trades as RBC Capital Markets

Riverbank House

2 Swan Lane, London EC4R 3BF

will be appointed as nominated adviser to the Company

---------------------------------------------------------------------------------

NAME AND ADDRESS OF BROKER:

---------------------------------------------------------------------------------

Seymour Pierce

20 Old Bailey

London

EC4M 7EN

United Kingdom

FirstEnergy Capital LLP

85 London Wall

London EC2M 7AD

United Kingdom

Immediately following admission:

RBC Europe Limited, which trades as RBC Capital Markets

Riverbank House

2 Swan Lane, London EC4R 3BF

and

Jefferies International Limited

Vintners Place

68 Upper Thames Street

London

EV4V 3BJ

will be become the joint brokers to the Company.

---------------------------------------------------------------------------------

OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE

(POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE

AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

---------------------------------------------------------------------------------

The Admission Document containing full details about the applicant

and the admission of its securities will be available during

normal business hours from the offices of Ashurst LLP, Broadwalk

House, 5 Appold Street, London EC2A 2HA from the date of the

document until at least 30 days after the date of Admission

and is available for viewing on the Company's website at www.bayfieldenergy.com

(up to Admission) or www.trinityexploration.com (following

Admission).

---------------------------------------------------------------------------------

DATE OF NOTIFICATION:

---------------------------------------------------------------------------------

31 January 2013

---------------------------------------------------------------------------------

NEW/ UPDATE:

---------------------------------------------------------------------------------

Update

---------------------------------------------------------------------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

AIMGIGDBDDXBGXB

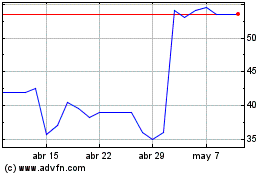

Trinity Exploration & Pr... (LSE:TRIN)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Trinity Exploration & Pr... (LSE:TRIN)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024