TIDMTRU TIDMTRU

RNS Number : 0830O

TruFin PLC

29 September 2023

29 September 2023

TruFin plc

("TruFin" or the "Company" or together with its subsidiaries

"TruFin Group" or the "Group")

Interim Financial Report for the six months ended 30 June 2023

(Unaudited)

-- Combined gross revenue for the Group increased 35% to GBP8.5m (H1 2022: GBP6.3m)

-- Gross revenue at Oxygen Finance Group Limited (together with

its subsidiaries) ("Oxygen") increased by 8% to GBP2.7m (H1 2022:

GBP2.5m), driven by growth in its core UK Early Payments market.

EBITDA was flat at GBP0.3m as Oxygen executed a targeted investment

program focused on maximising the revenue potential embedded in its

client base

-- Gross revenue at Satago Financial Solutions Limited

("Satago") increased 180% to GBP1.7m (H1 2022: GBP0.6m) with strong

growth in subscription services and invoice financing

facilities

-- Playstack Ltd ("Playstack") recorded 7% revenue growth to

GBP2.5m (H1 2022: GBP2.3m), with the highly anticipated launch of

The Last Faith on track for a Q4 release

-- Gross revenue at Vertus Capital Limited ("Vertus") increased

67% to GBP1.5m (H1 2022: GBP0.9m), driven by new facilities,

interest rate rises and early settlements

-- TruFin Group's EBITDA loss improved 12% to GBP3.8m (H1 2022: GBP4.3m)

-- TruFin Group's loss before tax was GBP6.2m (H1 2022: GBP4.8m)

as a result of a one-off net impairment loss of GBP1.3m on goodwill

(due to the anticipated sale of TruFin's stake in Vertus) plus a

depreciation and amortisation charge of GBP1.2m (H1 2022:

GBP0.5m)

6 months to 6 months to 12 months to

30 June 30 June 31 December

2023 2022 2022*

Financials and KPI's (Unaudited) GBP'000 GBP'000 GBP'000

Gross Revenue 8,497 6,281 16,119

EBITDA (3,786) (4,320) (6,425)

Loss before tax (6,220) (4,795) (8,020)

Net Assets 34,228 42,419 40,104

*Audited figures

Key milestones during the period:

-- Approximately 30% of Oxygen's EP clients purchased two or

more products during the period (H1 2022: c15%)

-- Migration of existing Lloyds Banking Group's factoring

clients onto the platform has started with the remainder of the

factoring book expected to be materially progressed during 2024

-- Following the success of its Mortal Shell game, which has

sold more than one million units, Playstack signed an agreement to

develop and licence Mortal Shell 2 and Mortal Shell 3

-- Successful Placing and Open Offer raising GBP7.6m before

expenses, enabling Playstack to secure the Mortal Shell franchise

and provide the Group with additional working capital

Key milestones post period end:

-- Satago has today signed a Letter of Intent with a UK

challenger bank - covering the adoption of Satago's LaaS solution.

This will enable the Challenger Bank to offer invoice financing to

its customers and to simplify and automate internal processes

-- To build on Satago's platform launch with Lloyds Banking Group and execute on the significant opportunities ahead, Satago has today agreed a GBP4m Convertible Loan Note ("CLN") with existing shareholders

-- Playstack signed a new, multi-year partnership with a major

technology platform for more than $2m to develop a series of sequel

games based on existing published IP. In addition, Playstack's

proprietary discovery technology has sourced four new titles for

release throughout 2024

-- TruFin received and conditionally accepted a non-binding cash

offer for its shares in Vertus. Due diligence and contract

negotiations are ongoing and, if successful, the deal is expected

to complete before year end. If completed, TruFin expects to

receive cash proceeds of approximately GBP3.2m

James van den Bergh, Chief Executive Officer commented:

"We have made positive progress during 2023, with growth across

the Group. It was pleasing to successfully conclude TruFin's

fundraise in June 2023, and I would like to personally thank

shareholders for their ongoing support. The fundraise has enabled

targeted additional investment in Playstack, Oxygen and Satago

which the Board believes will maximise the equity value of these

businesses for shareholders.

The proceeds allowed Playstack to enter into an agreement to

develop and licence further games in the Mortal Shell franchise -

an exceptional series that the whole team is excited to work on.

Playstack's signing of a further multi-million-dollar, multi-year

partnership to develop a series of sequel games based on existing

published IP is further testament to the momentum within the

business.

The fundraise has also allowed us to participate in Satago's

CLN. Already delivering on its next generation lending platform for

Lloyds Banking Group, today's announcement of the signing of a

Letter of Intent with a UK Challenger Bank marks a big moment in

Satago's development. Having shifted focus from a lending business

to a software business, Satago will soon be a tech player with

multiple enterprise customers, forward-thinking and united in a

desire to offer SMEs a fully digitised end-to-end proposition. In

so doing they are helping SMEs unlock their potential in the face

of economic uncertainty.

As we look to reveal the full value embedded within Oxygen, we

have made various tactical investments to make the company as

attractive as possible to the largest number of potential

acquirers. The value Oxygen adds to its customer base cannot be

underestimated, and its cross-selling opportunities remain

significant.

TruFin is very well positioned, and the Board looks to the

future with excitement."

For further information, please contact:

TruFin plc

James van den Bergh, Chief Executive Officer 0203 743 1340

Kam Bansil, Investor Relations 07779 229508

Liberum Capital Limited (Nominated Adviser and

Corporate broker)

Chris Clarke

Edward Thomas 0203 100 2000

TruFin plc is the holding company of an operating group

comprising four growth-focused technology businesses operating in

niche markets: early payment provision, invoice finance, IFA

finance and mobile games publishing. The Company was admitted to

AIM in February 2018 and trades under the ticker symbol: TRU. More

information is available on the Company website: www.TruFin.com

Chief Executive's Statement

Oxygen

Oxygen's position as a financial technology company delivering

social value strengthened significantly during H1 2023.

Gross revenue at Oxygen increased by 8% to GBP2.7m (H1 2022:

GBP2.5m). Oxygen's core Early Payments ("EP") revenue grew 20% to

GBP1.8m (H1 2022: GBP1.5m) whilst other revenue predominantly

comprising of Software as a Service ("SaaS") and partnership

revenues was flat at GBP0.9m.

Momentum within Oxygen's EP market continues to build, with

combined supplier spend totalling GBP24bn at the end of June 2023,

up 9.4% from 30 June 2022.

An unprecedented number of clients' suppliers participated in EP

programmes in H1 2023, with on-boarded annual supplier spend

exceeding GBP1.2bn across 4,600 suppliers, growth of 20% over H1

2022. A record amount of new supplier spend, GBP201m, was also

added during H1 2023, an increase of 22% over H1 2022.

Transacted spend attracting an early payment discount reached

GBP468m in H1 2023, up 12% versus H1 2022. Total rebates generated

were GBP5.1m in H1 2023, up 20% on H1 2022.

Oxygen's entrenchment into client procurement activity is

illustrated by the continuing growth of its "Freepay" initiative.

This sees Oxygen help clients deliver social value to their local

communities by enabling them to pay local micro and small suppliers

early, at no cost. By the end of June 2023 more than 11,000

suppliers were participating in this programme (up from 6,000 as at

end June 2022). These local micro and small suppliers enjoyed early

invoice payments totalling GBP275m, without charge, during the

first six months of the year.

SaaS H1 revenues were flat at GBP0.7m, despite some irrational

competitor pricing potentially prompted by financial strain.

Oxygen's management believes this may lead to consolidation in the

marketplace. Oxygen remains the market leader, unrivalled in its

knowledge of local authority procurement and trusted partner

status. Approximately 30% of Oxygen's Early Payments clients

purchased two or more products during the period (H1 2022: circa

15%).

Partnership revenues which relate to third party products sold

into Oxygen's client base grew strongly to GBP134,000 (H1 2022:

GBP7,000). This highlights the strength of Oxygen's client

relationships and distribution capabilities and has significant

growth potential.

To fully exploit its dominant market position and client

pipeline, Oxygen invested in its technology and people and

continued to opt for higher revenue gain share over up-front fees,

benefitting outer-year revenue. These targeted initiatives have

supressed the 2023 year-on-year revenue growth rate, and added

GBP0.2m of cost, temporarily supressing EBITDA growth. However,

they are anticipated to benefit both revenue and profit in 2024 and

beyond.

Satago

Satago offers its customers technically advanced invoice finance

and cashflow management systems via its online software

platform.

Satago is continuing its transition from predominantly

self-funding its balance sheet to a hybrid model incorporating

"partner balance sheet financing" which utilises Satago's

lending-as-a-service ("LaaS") solutions and embedded finance model.

This strategy remains anchored by the company's five-year

commercial agreement and partnership with Lloyds Banking Group, and

its strategic partnership with Sage to offer embedded finance in a

number of Sage products.

During the period, Satago migrated a small set of Lloyds Banking

Group's factoring clients onto the platform. Large scale migration

is now due to begin in 2024; with migration anticipated to be

materially progressed during 2024. Platform functionality for

onboarding new clients and supporting the Sage50 embedded finance

customers remains the primary focus in Q4 2023.

Satago more than doubled revenues in the first half of the year

to GBP1.7m (H1 2022: GBP0.6m), driven by LaaS income and increases

in interest and fee income (GBP605,000 versus GBP252,000 in H1

2022) as it builds on its existing partnerships while growing its

invoice financing capabilities.

Subscription numbers with one of Satago's existing strategic

technology partners continue to grow strongly, with active

subscriptions increasing 134% to 640 over the same period in 2022

(H1 2022: 273). Based on the success of this year's UK and Irish

roll out, Satago and its strategic partner have agreed, subject to

contract, to roll out the same offering in the US and Canada in H1

2024.

Satago has recently extended its GBP5m facility with a

specialist niche funder to GBP7m, in order to continue its

expansion plans. The facility is currently GBP5.7m drawn.

Playstack

Playstack is a gaming technology business providing publishing

and related services to the mobile game and console sector.

Playstack is the Group's entry point into the highly attractive

growth market of video game publishing.

Playstack continues to target positive EBITDA and operating cash

generation in 2023.

Playstack has continued to track to its three-year commercial

plan and expects to deliver significant growth from 2022 through to

2024 and beyond. During the period, the Group signed an agreement

to develop Mortal Shell 2 and 3 following the success of Mortal

Shell which has sold over one million copies. The securing of the

Mortal Shell franchise has generated real excitement across the

gaming landscape and provided Playstack a multi-year release

programme.

Additionally, through valuable platform and technology

partnerships, Playstack has been able to deliver valuable revenue

visibility ahead of games launches, de-risking development

spend.

Playstack continues to develop its own innovative technology

suite that sets it apart from market rivals.

Vertus

Vertus provides succession finance to Independent Financial

Advisers ("IFAs"). The business originates deals through its

collaboration with IntegraFin Holdings plc ("IntegraFin") and

various business brokers focused on the IFA market.

Given the increase in cost of debt and equity capital, the deal

market has softened during 2023. However significant consolidation

persists as Financial Planners continue to retire from the

industry, pressured by age and regulation (consumer duty being the

most recent regulatory driver).

Private Equity-backed consolidators proliferate and continue to

drive high valuations and significant deal activity with aggressive

integration strategies. In contrast, Vertus funds a succession

process that ensures planning firms can remain independent and meet

client demand for quality and bespoke advice.

The loan book continues to perform well, with the value of the

underlying security increasing as Vertus' borrowers retain and grow

their client bases. The combination of higher interest rates and

suppressed equity and bond markets has put downward pressure on ad

valorem recurring revenue for firms, which has introduced early

signs of stress on the profitability of firms. Furthermore,

competition with yields on cash and the impact of inflation on

household budgets has reduced new inflows. Despite this, borrowers

are managing the environment well and Vertus remains without credit

losses since inception.

The increasing interest rate environment has precipitated some

early settlements for Vertus, which has helped early settlement

charge profitability, whilst hampering growth in the loan book.

Despite the increase in these settlements, Vertus is aiming to end

2023 with a loan book of GBP24m (31 December 2022: GBP21.9m).

Vertus is developing further capital products to enable

independent succession in the UK IFA market and has good prospects

for the future.

Post period end developments and outlook

Oxygen

Oxygen's core EP revenue maintained strong organic growth, with

EP revenues to the end of August up by 22% year-on-year.

Seven of the eight EP client contracts due to expire in FY23

have already been re-signed or had renewal confirmed, for

multi-year periods.

Additionally, three new EP client contracts were signed by the

end of August 2023, with an exceptionally strong pipeline expected

to deliver a record number of new clients in 2023. The Board is

confident of continued and significant financial progress in 2024

and beyond.

Partnerships continue to develop. Oxygen anticipates these will

contribute more than GBP0.25m to full year revenues, from reselling

services and referral fees. Seventeen EP clients now purchase one

or more additional service from Oxygen.

The turmoil of the Covid pandemic has now passed with record

numbers of attendees at the various local government conferences

that Oxygen attends and hosts annually, enabling Oxygen to build

its client prospect pipeline.

The normalisation of remote working post-Covid continues to

benefit Oxygen, with ongoing efficiencies achieved particularly

with new client implementation. Moreover, councils in England alone

are expected to increase procurement expenditure to GBP74bn in

2023, up 4% over 2022. These favourable tailwinds, coupled with

rising interest rates and inflation, make Oxygen's supply side

offer even more compelling.

Satago

Full client migration of Lloyds Banking Group's factoring

clients is set to be materially progressed during 2024.

In addition, platform functionality for onboarding clients and

supporting the Bank's embedded finance customers within Sage50 is

anticipated to be delivered in November 2023.

Building on this success, today Satago is pleased to announce

that it has signed a Letter of Intent with a UK Challenger Bank

("Challenger Bank"), covering the adoption of Satago's LaaS

solution. This will enable the Challenger Bank to offer invoice

financing to its customers and to simplify and automate internal

processes.

This Letter of Intent demonstrates the ongoing demand for the

compelling product which Satago has built and further solidifies

Satago's place as a Critical Integration Platform for incumbent

Banks globally. Conversations are ongoing with multiple strategic

partners in other territories.

To build on Satago's successful Platform launch with Lloyds

Banking Group and execute on the significant opportunities ahead,

Satago has today agreed GBP4m CLN from existing shareholders.

TruFin is investing GBP3m via the CLN which will earn interest of

15% per annum and convert to common equity at a material discount

to the price of a future equity fund raise completed by Satago.

Playstack

Playstack's two new PC and console releases - AK-Xolotl and The

Last Faith - combined with the securing of further platform deals

are key to delivery of revenues for the current year.

AK-Xolotl launched on 14 September to strong critical acclaim,

performing in-line with expectations. AK-Xolotl has been released

across PC, Xbox 1, Xbox Series S/X, PlayStation 4, PlayStation 5

and Nintendo Switch. This was Playstack's first simultaneous

release across six platforms and is testament to the business's

strong operational capability.

The Last Faith is slated for release in November 2023 and is

enjoying strong wish-list momentum following the release of a new

playable demo.

During September Playstack secured a new multi-million-dollar,

multi-year partnership with a major technology platform to develop

a series of sequel games based on existing published IP. This

contract underpins Playstack's ambition to sequel high quality

existing IP via a fully funded model.

Playstack's proprietary discovery technology has sourced several

high potential games, including four new titles for release

throughout 2024 with more in the pipeline.

Vertus

In August 2023 the TruFin board received and conditionally

accepted a non-binding cash offer for its shares in Vertus. Due

diligence and contract negotiations are ongoing and, if successful,

the deal is expected to complete before year end.

Vertus has originated new facilities of GBP4m and the pipeline

is experiencing increased volumes. The company's loan book is

forecast to grow to GBP24m (from GBP21.9m as at 31 December 2022).

Loan book growth has been largely offset by an increase in early

settlements as borrowers seek to pay down debt subject to higher

interest rates.

The subsidiaries within the TruFin Group have been resilient in

the first six months of 2023 and the board remains confident

regarding prospects for the remainder of 2023.

As at 31 August 2023, the following assets were not less

than:

-- GBP7.8m of cash or cash equivalents

-- GBP6.9m of assets within the Satago Group's loan book

The TruFin Group has no more than GBP2.4m in net near-term

liabilities.

UNAUDITED CONDENSED INTERIM STATEMENT OF COMPREHENSIVE

INCOME

6 months 6 months Year ended

ended ended 31 December

2022

Notes 30 June 2023 30 June (Audited)

2022

(Unaudited) (Unaudited) GBP'000

GBP'000 GBP'000

======================================= ======= ============== ============= ============

Interest income 3 2,093 1,003 2,619

Fee income 3 3,930 2,955 7,183

Publishing income 3 2,474 2,323 6,317

Gross revenue 3 8,497 6,281 16,119

-------------- ------------- ------------

Interest, fee and publishing expenses (2,564) (1,947) (5,075)

-------------- ------------- ------------

Net revenue 5,933 4,334 11,044

============== ============= ============

Staff costs 5 (6,737) (6,433) (12,609)

Other operating expenses (2,922) (2,215) (4,810)

Depreciation & amortisation (1,171) (479) (1,596)

Net impairment loss on financial

assets (69) (6) (50)

Impairment of goodwill 9 (1,250) - -

Share of (loss)/profit from associates (4) 4 1

-------------- ------------- ------------

Loss before tax (6,220) (4,795) (8,020)

============== ============= ============

Taxation 8 241 230 1,214

-------------- ------------- ------------

Loss for the period/year (5,979) (4,565) (6,806)

============== ============= ============

Other comprehensive income

Items that may be reclassified subsequently

to profit and loss

Exchange differences on translating

foreign operations 103 9 (65)

Other comprehensive income for

the period/year, net of tax 103 9 (65)

============== ============= ============

Total comprehensive loss for the

period/year (5,876) (4,556) (6,871)

============== ============= ============

Loss after tax attributable to:

Owners of TruFin plc (5,995) (3,716) (6,637)

Non-controlling interests 16 (849) (169)

-------------- ------------- ------------

(5,979) (4,565) (6,806)

============== ============= ============

Total comprehensive loss for the

period/year attributable to:

Owners of TruFin plc (5,894) (3,706) (6,704)

Non-controlling interests 18 (850) (167)

(5,876) (4,556) (6,871)

============== ============= ============

Earnings per share 6 months 6 months Year ended

ended ended 31 December

2022

Notes 30 June 2023 30 June (Audited)

2022

(Unaudited) (Unaudited) Pence

pence pence

====================== ======= ============== ============= ============

Basic and Diluted EPS 14 (6.4) (4.3) (7.3)

UNAUDITED CONDENSED INTERIM STATEMENT OF FINANCIAL POSITION

As at As at 31

Notes 30 June 2023 December

2022

GBP'000 GBP'000

(Unaudited) (Audited)

================================= ======= ============== ===========

Assets

Non-current assets

Intangible assets 9 23,718 24,411

Property, plant and equipment 10 320 345

Deferred tax asset 8 165 250

Loans and advances 11 15,955 15,016

-------------- -----------

Total non-current assets 40,158 40,022

============== ===========

Current assets

Cash and cash equivalents 4,993 10,273

Loans and advances 11 10,615 9,145

Interest in associate - 4

Trade receivables 1,777 2,149

Other receivables 4,891 3,899

-------------- -----------

Total current assets 22,276 25,470

============== ===========

Total assets 62,434 65,492

============== ===========

Equity and liabilities

Equity

Issued share capital 12 85,706 85,706

Retained earnings (30,879) (24,884)

Foreign exchange reserve 38 (63)

Other reserves (26,531) (26,531)

-------------- -----------

Equity attributable to owners of

the company 28,334 34,228

-------------- -----------

Non-controlling interest 5,894 5,876

-------------- -----------

Total equity 34,228 40,104

============== ===========

Liabilities

Non-current liabilities

Borrowings 13 15,688 16,764

-------------- -----------

Total non-current liabilities 15,688 16,764

============== ===========

Current liabilities

Borrowings 13 5,449 1,783

Trade and other payables 7,069 6,841

Total current liabilities 12,518 8,624

-------------- ===========

Total liabilities 28,206 25,388

============== ===========

Total equity and liabilities 62,434 65,492

============== ===========

The financial statements were approved by the Board of Directors

on 28 September 2023 and were signed on its behalf by:

James van den Bergh

Chief Executive Officer

UNAUDITED CONDENSED INTERIM STATEMENT OF CHANGES IN EQUITY

Foreign Non-

Share Retained exchange Other controlling Total

capital earnings reserve reserves Total interest equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- -------- --------- --------- --------- -------- ------------ --------

Balance at 1

January 2023 85,706 (24,884) (63) (26,531) 34,228 5,876 40,104

Loss for the period - (5,995) - - (5,995) 16 (5,979)

Other comprehensive

income for the

period - - 101 - 101 2 103

Total comprehensive

loss for the period - (5,995) 101 - (5,894) 18 (5,876)

-------- --------- --------- --------- -------- ------------ --------

Balance at 30

June 2023 (Unaudited) 85,706 (30,879) 38 (26,531) 28,334 5,894 34,228

======== ========= ========= ========= ======== ============ ========

Balance at 1

January 2022 73,548 (17,731) 4 (24,393) 31,428 1,023 32,451

Loss for the period - (3,716) - - (3,716) (849) (4,565)

Other comprehensive

income for the

period - - 10 - 10 (1) 9

------

Total comprehensive

loss for the period - (3,716) 10 - (3,706) (850) (4,556)

------ -------- -------- ------- ----- -------

Issuance of shares 12,158 (496) - (2,138) 9,524 - 9,524

Issuance of shares

to subsidiary - - - - - 5,000 5,000

Balance at 30

June 2022 (Unaudited) 85,706 (21,943) 14 (26,531) 37,246 5,173 42,419

====== ======== ======== ======= ===== =======

UNAUDITED CONDENSED INTERIM STATEMENT OF CASH FLOWS

6 months 6 months Year ended

ended ended 31 December

2022

Notes 30 June 30 June (Audited)

2023 2022

(Unaudited) (Unaudited) GBP'000

GBP'000 GBP'000

========================================== ======= ============= ============= ============

Cash flows from operating activities

Loss before tax (6,220) (4,795) (8,020)

Adjustments for

Depreciation of property, plant

and equipment 55 55 108

Amortisation of intangible fixed

assets 1,637 822 2,377

Impairment of intangible assets 1,250 - -

Finance costs 820 384 974

Share of loss/(profit) from associates 4 (4) (1)

(2,454) (3,538) (4,562)

Working capital adjustments

Movements in loans and advances (2,408) (5,744) (8,029)

(Increase)/decrease in trade and

other receivables (415) 566 (34)

Increase/(decrease) in trade and

other payables 511 (1,511) 60

Net payables on acquisition of subsidiary - (76) (67)

(2,312) (6,765) (8,070)

Tax credit received/(paid) 88 (4) 668

Interest and finance costs paid (686) (308) (777)

------------- ------------- ------------

Net cash used in operating activities (5,364) (10,615) (12,741)

============= ============= ============

Cash flows from investing activities:

Additions to intangible assets (2,204) (1,054) (3,159)

Additions to property, plant and

equipment (28) (72) (113)

Acquisition of subsidiaries (157) (1,234) (1,217)

Cash on acquisition of subsidiary - 19 19

Net cash used in investing activities (2,389) (2,341) (4,470)

Cash flows from financing activities:

Issue of ordinary share capital - 9,524 9,524

Issue of ordinary share capital

of subsidiary - 5,000 5,000

Net borrowings 13 2,471 3,744 5,370

Lease payments (42) (27) (28)

Net cash generated from financing

activities 2,429 18,241 19,866

------------- ------------- ------------

Net (decrease)/increase in cash

and cash equivalents (5,324) 5,285 2,655

------------- ------------- ------------

Cash and cash equivalents at beginning

of the period/year 10,273 7,608 7,608

Effect of foreign exchange rate

changes 44 12 10

------------- ------------- ------------

Cash and cash equivalents at end

of the period/year 4,993 12,905 10,273

============= ============= ============

NOTES TO THE UNAUDITED CONDENSED INTERIM CONSOLIDATED FINANCIAL

STATEMENTS

1. Accounting policies

Basis of preparation

The annual financial statements of TruFin plc are prepared in

accordance with International Financial Reporting Standards as

adopted by the European Union ("IFRS").

The condensed set of financial statements included in this

Interim Financial Report has been prepared in accordance with

International Accounting Standard 34 'Interim Financial Reporting'

('IAS 34'). This condensed set of Financial Statements has been

prepared by applying the accounting policies and presentation that

were applied in the preparation of the TruFin Group's published

Financial Statements for the year ended 31 December 2022.

The condensed set of financial statements included in this

Interim Financial Report for the six months ended 30 June 2023

should be read in conjunction with the annual audited financial

statements of TruFin plc for the year ended 31 December 2022, which

were delivered to the Jersey Financial Services Commission. The

audit report for these accounts was unqualified and did not draw

attention to any matters by way of emphasis.

Going concern

The Directors are satisfied that the TruFin Group has sufficient

resources to continue in operation for the foreseeable future, a

period of not less than 12 months from the date of the report.

Accordingly, they continue to adopt the going concern basis in

preparing the condensed financial statements.

Group information

The TruFin Group ("the Group") is the consolidation of;

-- TruFin plc,

-- TruFin Holdings Limited,

-- Oxygen Finance Group Limited, Oxygen Finance Limited and

Oxygen Finance Americas Inc., together the ("Oxygen Group"),

-- TruFin Software Limited,

-- Satago Financial Solutions Limited, Satago SPV 1 Limited,

Satago SPV 2 Limited, Satago Financial Solutions z.o.o, together

("Satago"),

-- AltLending (UK) Ltd,

-- Vertus Capital Limited and Vertus SPV 1 Limited, together ("Vertus"), and

-- Playstack Limited, Bandana Media Ltd, Playignite Ltd,

Playstack z.o.o, Playstack OY, Foxglove Studios AB, Magic Fuel

Games Inc, Playstack Inc and Playignite Inc, together the

("Playstack Group").

Additionally, the Playstack Group also includes two associate

companies incorporated in the UK which have been accounted for

using the equity method. These are;

-- A 49% interest in Snackbox Games Ltd, and

-- A 26% interest in Stormchaser Games Ltd.

On 13 March 2023, the Group disposed of its 49% interest in one

associate company, PlayFinder Games Ltd.

On 18 April 2023, Military Games International Limited, a

company in which the Group had a 42% interest was dissolved.

The principal activities of the Group are the provision of niche

lending, early payment services and mobile game publishing.

The financial statements are presented in Pounds Sterling, which

is the currency of the primary economic environment in which the

Group operates. Amounts are rounded to the nearest thousand.

Significant accounting policies and use of estimates and

judgements

The preparation of interim consolidated financial statements in

compliance with IAS 34 requires the use of certain critical

accounting judgements and key sources of estimation uncertainty. It

also requires the exercise of judgement in applying the TruFin

Group's accounting policies. There have been no material revisions

to the nature and the assumptions used in estimating amounts

reported in the annual audited financial statements of TruFin plc

for the year ended 31 December 2022.

The accounting policies, presentation and methods of computation

in the audited financial statements have been followed in the

condensed set of financial statements.

2. General information

TruFin plc is a public limited company incorporated in Jersey.

The shares of the Company are listed on the Alternative Investment

Market. The address of the registered office is 26 New Street, St

Helier, Jersey, JE2 3RA.

A copy of this Interim Financial Report including Condensed

Financial Statements for the period ended 30 June 2023 is available

at the Company's registered office and on the Company's investor

relations website (www.trufin.com).

3. Gross revenue

6 months 6 months Year ended

ended ended 31 December

2022

30 June 2023 30 June 2022 (Audited)

(Unaudited) (Unaudited) GBP'000

GBP'000 GBP'000

======================== ============== ============== ============

Interest income 2,093 1,003 2,619

-------------- -------------- ------------

Total interest income 2,093 1,003 2,619

-------------- -------------- ------------

EPPS* contracts 1,939 1,519 3,335

Consultancy fees 135 247 597

Implementation fees 1,015 412 1,644

Subscription fees 841 777 1,607

-------------- -------------- ------------

Total fee income 3,930 2,955 7,183

-------------- -------------- ------------

IAP revenue 80 207 342

Advertising revenue 78 299 453

Console revenue 2,316 1,816 5,521

Brand revenue - 1 1

-------------- -------------- ------------

Total publishing income 2,474 2,323 6,317

-------------- -------------- ------------

Gross revenue 8,497 6,281 16,119

============== ============== ============

*Early Payment Programme Services

4. Segmental reporting

The results of the Group are broken down into segments based on

the products and services from which it derives its revenue:

Short term finance:

Provision of invoice factoring and succession financing for the

IFA space. For results during the reporting period, this

corresponds to the results of Satago, Vertus and AltLending.

Payment services:

Provision of Early Payment Programme Services. For results

during the reporting period, this corresponds to the results of the

Oxygen Group.

Publishing:

Publishing of video games. For results during the reporting

period, this corresponds to the results of the Playstack Group.

Other:

Revenue and costs arising from investment activities. For

results during the reporting period, this corresponds to the

results of TruFin Software Limited, TruFin Holdings Limited and

TruFin plc.

The results of each segment, prepared using accounting policies

consistent with those of the Group as a whole, are as follows:

Short term Payment

finance services

6 months ended 30 June 2023 GBP'000 GBP'000 Publishing Other Total

(Unaudited) GBP'000 GBP'000 GBP'000

============================== =========== ========= ============ ========== ==========

Gross revenue 3,241 2,748 2,490 18 8,497

Cost of sales (908) (521) (1,135) - (2,564)

----------- --------- ------------ ---------- ----------

Net revenue 2,333 2,227 1,355 18 5,933

----------- --------- ------------ ---------- ----------

Loss before tax (3,256) (493) (1,378) (1,093) (6,220)

Taxation (85) 104 222 - 241

Loss for the period (3,341) (389) (1,156) (1,093) (5,979)

=========== ========= ============ ========== ==========

Total assets 33,279 7,892 20,781 482 62,434

Total liabilities (22,161) (1,816) (3,532) (697) (28,206)

----------- --------- ------------ ---------- ----------

Net assets 11,118 6,076 17,249 (215) 34,228

----------- --------- ------------ ---------- ----------

Short term Payment

finance services

6 months ended 30 June 2022 GBP'000 GBP'000 Publishing Other Total

(Unaudited) GBP'000 GBP'000 GBP'000

============================== =========== ========= ============ ========== ==========

Gross revenue 1,491 2,467 2,323 - 6,281

Cost of sales (441) (398) (1,108) - (1,947)

----------- --------- ------------ ---------- ----------

Net revenue 1,050 2,069 1,215 - 4,334

----------- --------- ------------ ---------- ----------

Loss before tax (2,298) (232) (1,085) (1,180) (4,795)

Taxation (1) - 231 - 230

Loss for the period (2,299) (232) (854) (1,180) (4,565)

=========== ========= ============ ========== ==========

Total assets 30,837 8,208 19,406 6,039 64,490

Total liabilities (16,907) (1,859) (2,572) (733) (22,071)

----------- --------- ------------ ---------- ----------

Net assets 13,930 6,349 16,834 5,306 42,419

----------- --------- ------------ ---------- ----------

*adjusted loss before tax excludes share-based payment

expense

Short term Payment

finance services

Year ended 31 December 2022 GBP'000 GBP'000 Publishing Other Total

(Audited) GBP'000 GBP'000 GBP'000

============================== =========== ========= ============ ========== ==========

Gross revenue 4,469 5,311 6,330 9 16,119

Cost of sales (1,153) (889) (3,033) - (5,075)

----------- --------- ------------ ---------- ----------

Net revenue 3,316 4,422 3,297 9 11,044

----------- --------- ------------ ---------- ----------

Loss before tax (3,879) (220) (1,569) (2,352) (8,020)

Taxation 218 395 601 - 1,214

Loss for the year (3,661) 175 (968) (2,352) (6,806)

=========== ========= ============ ========== ==========

Total assets 34,200 8,258 20,407 2,627 65,492

Total liabilities (19,747) (1,792) (2,911) (938) (25,388)

----------- --------- ------------ ---------- ----------

Net assets 14,453 6,466 17,496 1,689 40,104

----------- --------- ------------ ---------- ----------

*adjusted loss before tax excludes share-based payment

expense

5. Staff costs

Analysis of staff costs:

6 months 6 months Year ended

ended ended 31 December

2022

30 June 2023 30 June 2022 (Audited)

(Unaudited) (Unaudited) GBP'000

GBP'000 GBP'000

============================================== ============== ============== ============

Wages and salaries 5,392 5,269 10,365

Consulting costs 452 193 379

Social security costs 662 744 1,411

Pension costs arising on defined contribution

schemes 231 227 454

6,737 6,433 12,609

============== ============== ============

Consulting costs are recognised within staff costs where the

work performed would otherwise have been performed by employees.

Consulting costs arising from the performance of other services are

included within other operating expenses.

Average monthly number of persons (including Executive

Directors) employed:

6 months 6 months Year ended

ended ended 30 June 31 December

2022 2022

30 June 2023 (Unaudited) (Audited)

(Unaudited) Number Number

Number

================== ============== ============== ============

Management 16 18 17

Finance 8 11 10

Sales & marketing 43 34 30

Operations 57 50 78

Technology 60 54 43

-------------- -------------- ------------

184 167 178

============== ============== ============

Directors' emoluments

6 months 6 months Year ended

ended ended 31 December

2022

30 June 2023 30 June 2022 (Audited)

(Unaudited) (Unaudited) GBP'000

GBP'000 GBP'000

====================== ============== ============== ============

Combined remuneration 376 376 715

6. Employee share-based payment transactions

The employment share-based payment charge comprises:

6 months 6 months Year ended

ended ended 31 December

2022

30 June 2023 30 June 2022 (Audited)

(Unaudited) (Unaudited) GBP'000

GBP'000 GBP'000

====================================== ============== ============== ============

Performance Share Plan and Joint Share - - -

Ownership Plan Founder Award

Performance Share Plan Market Value - - -

Award

Performance Share Plan 2019 Award - - -

Performance Share Plan 2018 Award - - -

Total - - -

============== ============== ============

Performance Share Plan and Joint Share Ownership Plan Founder

Award ("PSP and JSOP")

The final 25% of Founder Awards held by James van den Bergh

vested on 22 February 2022 when the share price was GBP0.81. As a

result, 395,558 shares subject to the Joint Share Ownership Plan

became fully owned by the EBT and James' nil cost option under the

Performance Share Plan vested in respect of the same number of

shares.

Performance Share Plan Market Value Award ("PSP Market

Value")

On 21 February 2018, options to acquire 4,868,420 shares were

granted to the senior management team. The vesting of this award is

based on market--based performance conditions. The vesting of these

awards is subject to the holder remaining an employee of the

Company and the Company's share price achieving five distinct

milestones - vesting at 20% each milestone. The exercise price of

the awards at the time of grant was GBP1.90 per share. A Monte

Carlo simulation was used to determine the fair value of these

options. The model used an expected volatility of 10% and a risk

free rate of 1.3%.

In order to reflect the impact of the demerger, the PSP Market

Value Award was split into two:

-- Part of the award remained as an option in respect of TruFin

plc shares ("TruFin Market Value Award")

-- Part of the award became an award in respect of DFC shares ("DFC market Value Award")

The TruFin Market Value Award is on the same terms as the

original PSP Market Value Award except that:

-- The exercise price was adjusted to GBP0.85, and the share

price milestones were adjusted to reflect the demerger

-- The exercise price was further adjusted to GBP0.80, and the

share price milestones were further adjusted, to reflect the return

of value to shareholders in June 2019

-- The exercise price was further adjusted to GBP0.71, and the

share price milestones were further adjusted to reflect the return

of value to shareholders in December 2019

The modification has not resulted in a change in the valuation

of the award and this continues to be recognised over the remainder

of the original vesting period.

Performance Share Plan 2018 Award ("PSP 2018")

The unvested performance condition of this award had not been

met at the end of the vesting period.

Performance Share Plan 2019 Award ("PSP 2019")

The performance conditions had not been met at the end of the

vesting period.

7. Loss before income tax

Loss before income tax is stated after charging:

6 months 6 months Year ended

ended ended 31 December

2022

30 June 2023 30 June 2022 (Audited)

(Unaudited) (Unaudited) GBP'000

GBP'000 GBP'000

==================================== ============== ============== ============

Depreciation of property, plant and

equipment 55 55 108

Amortisation of intangible assets 1,637 822 2,377

Staff costs including share-based

payments charge 6,737 6,433 12,609

8. Taxation

Analysis of tax credit/charge recognised in the period/year

6 months 6 months Year ended

ended ended 31 December

2022

30 June 2023 30 June 2022 (Audited)

(Unaudited) (Unaudited) GBP'000

GBP'000 GBP'000

==================== ============== ============== ============

Current tax credit (326) (230) (1,267)

Deferred tax charge 85 - 53

-------------- -------------- ------------

Total tax credit (241) (230) (1,214)

============== ============== ============

Deferred tax asset

6 months 6 months Year ended

ended ended 31 December

2022

30 June 2023 30 June 2022 (Audited)

(Unaudited) (Unaudited) GBP'000

GBP'000 GBP'000

======================================== ============== ============== ============

Balance at start of the period/year 250 303 303

Debit to the statement of comprehensive

income (85) - (53)

-------------- -------------- ------------

Balance at end of the period/year 165 303 250

============== ============== ============

Comprised of:

Losses 165 303 250

-------------- -------------- ------------

Total deferred tax asset 165 303 250

============== ============== ============

A deferred tax asset was recognised in 2021 in respect of Vertus

Capital SPV 1 Limited, as it became profitable.

9. Intangible assets

Software Separately

Client contracts licences identifiable

and similar intangible Goodwill Total

assets assets

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

============================ ================== ============ ============= ========== =======

Cost

At 1 January 2023 6,399 4,773 3,237 16,569 30,978

Additions 441 1,763 - - 2,204

Disposals (114) - - - (114)

Exchange differences (1) (24) - - (25)

-------------

At 30 June 2023 (unaudited) 6,725 6,512 3,237 16,569 33,043

================== ============ ============= ========== =======

Amortisation

At 1 January 2023 (2,496) (2,082) (1,581) - (6,159)

Charge for the period (521) (792) (324) - (1,637)

Disposals 114 - - - 114

Exchange differences - 15 - - 15

At 30 June 2023 (unaudited) (2,903) (2,859) (1,905) - (7,667)

================== ============ ============= ========== =======

Accumulated impairment

losses

At 1 January 2023 (408) - - - (408)

Charge - - - (1,250) (1,250)

------------------ ------------ ------------- ---------- -------

At 30 June 2023 (unaudited) (408) - - (1,250) (1,658)

================== ============ ============= ========== =======

Net book value

------------------ ------------ ------------- ---------- -------

At 30 June 2023 (unaudited) 3,414 3,653 1,332 15,319 23,718

------------------ ------------ ------------- ---------- -------

At 31 December 2022 3,495 2,691 1,656 16,569 24,411

================== ============ ============= ========== =======

Software Separately

Client contracts licences identifiable

and similar intangible Goodwill Total

assets assets

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

======================= ================== ============ ============= ========== =======

Cost

At 1 January 2022 5,490 2,579 1,642 15,746 25,457

Additions 905 2,254 - - 3,159

On Acquisition - 3 1,595 823 2,421

Disposals - (75) - - (75)

Exchange differences 4 12 - - 16

-------------

At 31 December 2022 6,399 4,773 3,237 16,569 30,978

================== ============ ============= ========== =======

Amortisation

At 1 January 2022 (1,607) (1,181) (1,070) - (3,858)

Charge (889) (977) (511) - (2,377)

Disposals - 75 - - 75

Exchange differences - 1 - - 1

At 31 December 2022 (2,496) (2,082) (1,581) - (6,159)

================== ============ ============= ========== =======

Accumulated impairment

losses

At 1 January 2022 (408) - - - (408)

At 31 December 2022 (408) - - - (408)

================== ============ ============= ========== =======

Net book value

------------------ ------------ ------------- ---------- -------

At 31 December 2022 3,495 2,691 1,656 16,569 24,411

------------------ ------------ ------------- ---------- -------

At 31 December 2021 3,475 1,398 572 15,746 21,191

================== ============ ============= ========== =======

Client contracts comprise the directly attributable costs

incurred at the beginning of an Early Payment Scheme Service

contract to revise a client's existing payment systems and provide

access to the Group's software and other intellectual property.

These implementation costs are comprised primarily of employee

costs.

The useful economic life for each individual asset is deemed to

be the term of the underlying Client contract (generally 5 years)

which has been deemed appropriate and for impairment review

purposes, projected cash flows have been discounted over this

period.

The amortisation charge is recognised in fee expenses within the

statement of comprehensive income, as these costs are incurred

directly through activities which generate fee income.

Software, licenses and similar assets comprises separately

acquired software, as well as costs directly attributable to

internally developed platforms across the Group. These directly

attributable costs are associated with the production of

identifiable and unique software products controlled by the Group

and are probable of producing future economic benefits. They

primarily include employee costs and directly attributable

overheads.

A useful economic life of 3 to 5 years has been deemed

appropriate and for impairment review purposes projected cash flows

have been discounted over this period.

The amortisation charge is recognised in depreciation and

amortisation on non-financial assets within the statement of

comprehensive income.

Goodwill and "Separately identifiable intangible assets" arise

from acquisitions made by the Group.

Vertus

In July 2019, the Group converted into ordinary shares its

existing convertible loan with Vertus Capital in full satisfaction

and discharge of the loan. This, together with a further cash

payment, gave the Group 51% ownership of Vertus Capital and Vertus

SPV 1.

Goodwill of GBP1,714,000 arose from this transaction and has

been included within the short term finance segment of the

business. In 2021, the Group increased its ownership of Vertus

Capital from 51% to 53.8%, resulting in a GBP50,000 adjustment to

Goodwill.

Separately identifiable intangible assets of GBP255,000

primarily related to the value of existing third party

relationships on acquisition have been identified.

These are being amortised over 5 years and the amortisation

charge for the year was GBP26,000 (2022: GBP51,000).

Net Book value of these assets at 30 June 2023 was GBP55,000

(2022: GBP81,000).

In August 2023, the Group accepted a non-binding offer for its

shares in Vertus Capital. Following this, Goodwill related to this

transaction has been impaired by GBP1,250,000.

Goodwill related to this transaction excluding Separately

identifiable intangible assets at 30 June 2023 was GBP158,000

(2022: GBP1,408,000).

10. Property, plant and equipment

Fixtures Computer Right-of-Use

& equipment Asset Total

fittings

Group GBP'000 GBP'000 GBP'000 GBP'000

===================== ========= ========== ============ =======

Cost

At 1 January 2023 139 96 276 511

Additions 14 14 - 28

Exchange differences 1 (1) - -

--------- ---------- ------------ -------

At 30 June 2023 154 109 276 539

--------- ---------- ------------ -------

Depreciation

At 1 January 2023 (60) (61) (44) (165)

Charge (15) (12) (28) (55)

Exchange differences - 1 - 1

--------- ---------- ------------ -------

At 30 June 2023 (75) (72) (72) (219)

--------- ---------- ------------ -------

Net book value

--------- ---------- ------------ -------

At 30 June 2023 79 37 204 320

========= ========== ============ =======

At 31 December 2022 79 34 232 345

========= ========== ============ =======

Fixtures Computer Right-of-Use

& equipment Asset Total

fittings

Group GBP'000 GBP'000 GBP'000 GBP'000

==================== ========= ========== ============ =======

Cost

At 1 January 2022 53 78 429 560

Additions 86 27 276 389

Disposals - (9) (429) (438)

At 31 December 2022 139 96 276 511

--------- ---------- ------------ -------

Depreciation

At 1 January 2022 (44) (44) (407) (495)

Charge (16) (26) (66) (108)

Disposals - 9 429 438

At 31 December 2022 (60) (62) (44) (166)

--------- ---------- ------------ -------

Net book value

--------- ---------- ------------ -------

At 31 December 2022 79 34 232 345

========= ========== ============ =======

At 31 December 2021 9 34 22 65

========= ========== ============ =======

11. Loans and advances

30 June 2023 31 December

2022

(Unaudited) (Audited)

GBP'000 GBP'000

========================= ============= ============

Total loans and advances 26,714 24,215

Less: loss allowance (144) (54)

26,570 24,161

============= ============

Past due receivables relating to loans and advances are analysed

as follows:

30 June 2023 31 December

2022

(Unaudited) (Audited)

GBP'000 GBP'000

============================== ============= ============

Neither past due nor impaired 26,142 23,875

Past due: 0-30 days 243 129

Past due: 31-60 days 49 77

Past due: 61-90 days 7 41

Past due: more than 91 days 48 39

Impaired 81 -

26,570 24,161

============= ============

The financial risk management procedures disclosed in the 31

December 2022 audited financial statements have been and remain in

place for the period to 30 June 2023.

12. Share capital

Share Capital Total

GBP'000 GBP'000

======================================= ============= ========

94,182,943 shares at GBP0.91 per share

at 30 June 2023 (unaudited) 85,706 85,706

All ordinary shares carry equal entitlements to any

distributions by the Company. No dividends were proposed by the

Directors for the period ended 30 June 2023.

13. Borrowings

30 June 2023 31 December

2022

(Unaudited) (Audited)

GBP'000 GBP'000

=========================== ============= ============

Loans due within one year 5,449 1,783

Loans due in over one year 15,688 16,764

21,137 18,547

============= ============

Movements in borrowings during the period/year

The below table identifies the movements in borrowings during

the period/year.

GBP'000

====================================== =======

Balance at 1 January 2023 18,547

Funding drawdown 5,789

Interest expense 758

Fee amortisation 55

Origination fees paid (41)

Repayments (3,278)

Interest paid (686)

Exchange differences (7)

Balance at 30 June 2023 (Unaudited) 21,137

=======

Balance at 1 January 2022 12,985

Funding drawdown 8,707

Interest expense 852

Fee amortisation 110

Repayments (3,337)

Interest paid (777)

Exchange differences 7

Balance at 31 December 2022 (Audited) 18,547

=======

14. Earnings per share

Earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares in issue during the period/year.

The calculation of the basis and adjusted earnings per share is

based on the following data:

6 months 6 months Year ended

ended ended 31 December

2022

30 June 2023 30 June 2022 (Audited)

(Unaudited) (Unaudited) GBP'000

GBP'000 GBP'000

=============================================== ============== ============== ============

Number of shares

At period/year end 94,182,943 94,182,943 94,182,943

Weighted average 94,182,943 86,727,509 90,485,862

Earnings attributable to ordinary shareholders GBP'000 GBP'000 GBP'000

Loss after tax attributable to the owners

of TruFin plc (5,995) (3,716) (6,637)

Earnings per share* Pence Pence Pence

Basic and Diluted (6.4) (4.3) (7.3)

* All Earnings per share figures are undiluted and diluted.

Management has been granted 5,451,578 share options in TruFin

plc (See note 6 for details). These could potentially dilute basic

EPS in the future, but were not included in the calculation of

diluted EPS as they are antidilutive for the periods presented, as

the Group is loss making.

15. Related party disclosures

Transactions with directors

Key management personnel disclosures are provided in notes 5 and

6.

During the period, the Group made loans to Storm Chaser UG, a

company based in Germany. Storm Chaser UG is 100% owned by Storm

Chaser Games - an associate company of Playstack (see note 1). The

balance of the loans including interest at the reporting date was

GBP756,000 (2022: GBP525,000)

16. Post balance sheet events

On 10 July 2023, the Company issued 11,653,744 ordinary shares

through a Placing and an Open Offer. These were issued at GBP0.65

per share, raising gross proceeds of GBP7,575,000.

On 27 July 2023, the Company awarded the first three tranches of

awards under a new Long Term Incentive Plan ("LTIP"). These are in

the form of options over a total of 3,116,667 Ordinary Shares (the

"Options") to the Chief Executive Officer and other senior

employees.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FZGZLGRDGFZZ

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

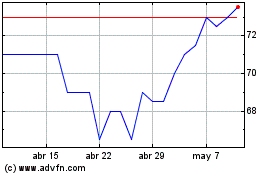

Trufin (LSE:TRU)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Trufin (LSE:TRU)

Gráfica de Acción Histórica

De May 2023 a May 2024