TIDMUKR

RNS Number : 2526B

Ukrproduct Group Ltd

30 September 2022

30 September 2022

UKRPRODUCT GROUP LIMITED

("Ukrproduct", the "Company" or, together with its subsidiaries,

the "Group")

UNAUDITED INTERIM FINANCIAL RESULTS FOR THE SIX MONTHSED 30 JUNE

2022

Ukrproduct Group Limited (AIM: UKR), one of the leading

Ukrainian producers and distributors of branded dairy foods and

beverages (kvass), today announces its unaudited interim financial

results for the six months ended 30 June 2022.

The full unaudited interim financial results for the six months

ended 30 June 2022 are available on the Company's website at

www.ukrproduct.com .

For further information contact:

Ukrproduct Group Ltd

Jack Rowell, Non-Executive Chairman Tel: +44 1534 814814

Alexander Slipchuk, Chief Executive www.ukrproduct.com

Officer

Strand Hanson Limited

Nominated Adviser and Broker Tel: +44 20 7409 3494

Rory Murphy , Richard Johnson www.strandhanson.co.uk

Chairman and Chief Executive Statement

Ukrproduct, one of the leading Ukrainian producers and

distributors of branded dairy foods and beverages (kvass), is

pleased to announce its interim results for the half year ended 30

June 2022 ("1H 2022") and outlook for the remainder of 2022.

2022 Half-Year Trading Update

Trading in 2022 was severely affected by the Russian invasion of

Ukraine and the ongoing war. Ukrainian regions experienced a loss

of production capacity in the occupied territory and in the war

zone. Moreover, damaged infrastructure and increases in fuel prices

together with fuel shortages, have impacted transportation and

adversely affected logistics costs, both on the supply and

distribution side. As the Ukrainian sea ports have been blockaded

by the Russian Navy, there is increased pressure on the remaining

routes for export.

In 2022, dairy processing enterprises throughout Ukraine did not

have the opportunity to fully utilize production capacities as a

result of difficulties in sourcing raw material. In the first half

of 2022 the total milk production in Ukraine declined by 13.2% down

to 3.7 million tons compared to the same period last year.

Decreases in milk production, increases in fuel price and the

effect of the occupation of part of the territories of Ukraine has,

of course, led to an increase in the purchase price of milk.

As a result, management took steps to secure the supply chain

vital for operational continuity. The Group concluded contracts

with new alternative suppliers, where necessary, and developed new

logistics routes. The central warehouse was moved to the one of

Group's main plants at Zhytomyr, away from the line of active

hostilities.

2022 Half-Year Highlights

Consolidated revenue of the Group for the 1H 2022 decreased by

28.4% to GBP18.3 million while Gross profit increased by 63.6% to

GBP3.3 million. The Group raised prices for products several times

and decreased trade marketing activities, which made it possible to

compensate for the increase in prices for raw materials, fuel and

energy and to increase gross profit margins.

Selling, general and administrative expenses, as well as CAPEX,

have been reduced to the minimum required to meet the primary needs

of the Group's core business.

Major customers have not been affected by the hostilities and

continue to cooperate and fulfil their contractual obligations with

the Group. Nevertheless, the Group recognized additional provision

for trade receivables of GBP1.2 million, which is a part of Other

operating expenses.

Trading headwinds were significant and meant the Group's EBITDA

in 1H 2022 reduced by 7.7% to GBP0.4 million compared with 1H 2021,

with the EBITDA margin increasing from 1.9% in 1H 2021 to 2.4% in

1H 2022. The Group's EBITDA in 1H 2022, if adjusted and stated

before expenses relating to the war (including additional bad debt

provision for receivables from customers which have been affected

by the hostilities ) would amount to GBP1.6 million.

The consolidated net loss of Ukrproduct for 1H 2022 amounted to

GBP0.2 million compared with a net profit of GBP0.2 million in 1H

2021.

Financial position

As at 30 June 2022, Ukrproduct had net assets of GBP 6. 3

million compared to GBP5.7 million as at 30 June 2021.

For the six months ended 30 June 2022, the Group continued to be

in breach of several provisions of the loan agreement with the

European Bank for Reconstruction and Development ("EBRD"), missed

some interest payments and repayments and the EBRD has not issued a

waiver for the breaches. The Company has been holding negotiations

with the EBRD to potentially restructure the loan repayment

schedule since June 2021. At this current stage the active phase of

negotiations with EBRD has been slowed owing to the ongoing war in

Ukraine. At present, the EBRD has taken no action to accelerate

repayment of the loan.

Outlook for 2022

The development of the business in the second half of 2022

remains highly uncertain due to the ongoing war and further local

currency devaluation and inflation in Ukraine. Ukrproduct continues

to implement further efficiencies in procurement, processing,

distribution and sales of its products, with a major focus on

diversifying risks, maintaining profitability and Group assets.

Jack Rowell Alexander Slipchuk

Non-Executive Chairman Chief Executive Officer

Ukrproduct Group

CONDENSED CONSOLIDATED INTERIM STATEMENT OF COMPREHENSIVE

INCOME

FOR THE SIX MONTHSED 30 JUNE 202 2

(in thousand GBP, unless otherwise stated)

Note Six months Six months

ended ended

3 0 June 2022 30 June 2021

-------------- -------------

GBP '000 GBP '000

-------------- -------------

Revenue 9 18 278 25 532

Cost of sales (15 009) (23 534)

-------------- -------------

GROSS PROFIT 3 269 1 998

Administrative expenses (554) (631)

Selling and distribution expenses (1 113) (1 250)

Other operating expenses (1 543 ) (170)

-------------- -------------

PROFIT/(LOSS) FROM OPERATIONS 59 (53)

Net finance expenses (231) (232)

Net foreign exchange gain 20 366

-------------- -------------

(LOSS)/ PROFIT BEFORE TAXATION (152) 81

Income tax (expense) / credit (45) 70

-------------- -------------

(LOSS)/ PROFIT FOR THE SIX MONTHS (197) 151

============== =============

Attributable to:

Owners of the Parent (197) 151

Non-controlling interests - -

Earnings per share from continuing

and total operations:

Basic (in pence) 10 (0.50) 0.38

Diluted (in pence) 10 (0.50) 0.38

OTHER COMPREHENSIVE INCOME:

Items that may be subsequently

reclassified to profit or loss

Currency translation differences 506 269

OTHER COMPREHENSIVE INCOME, NET

OF TAX 506 269

-------------- -------------

TOTAL COMPREHENSIVE INCOME FOR

THE SIX MONTHS 309 420

============== =============

Attributable to:

Owners of the Parent 309 420

Non-controlling interests - -

Ukrproduct Group

CONDENSED CONSOLIDATED INTERIM STATEMENT OF FINANCIAL

POSITION

AS AT 30 JUNE 202 2

(in thousand GBP, unless otherwise stated)

Note As at As at As at

-----

30 June 31 December 30 June

202 2 20 21 20 21

----- --------- ------------ ---------

GBP '000 GBP '000 GBP '000

--------- ------------ ---------

ASSETS

Non-current assets

Property, plant and equipment 9 926 9 795 9 909

Intangible assets 842 809 765

10 768 10 604 10 674

Current assets

Inventories 6 4 556 4 655 5 919

Trade and other receivables 5 528 6 763 6 976

Current taxes 120 920 305

Other financial assets 43 40 41

Cash and cash equivalents 293 312 147

--------- ------------ ---------

1 0 540 12 690 13 388

--------- ------------ ---------

TOTAL ASSETS 21 308 23 294 24 062

========= ============ =========

EQUITY AND LIABILITIES

Equity attributable to owners

of the parent

Share capital 4 282 4 282 4 282

Treasury shares (315) (315) (315)

Share premium 4 562 4 562 4 562

(14 4 81

Translation reserve ) (14 987) (14 962)

Revaluation reserve 6 182 6 348 6 715

Retained earnings 6 026 6 057 5 403

--------- ------------ ---------

6 256 5 947 5 685

TOTAL EQUITY 6 256 5 947 5 685

Non-current Liabilities

Deferred tax liabilities 748 796 937

--------- ------------ ---------

748 796 937

Current liabilities

Bank loans 6 394 6 039 6 812

Short-term payables 448 587 -

Trade and other payables 7 032 9 829 10 610

Current income tax liabilities 154 41 -

Other taxes payable 276 55 18

--------- ------------ ---------

14 304 16 551 17 440

--------- ------------ ---------

TOTAL LIABILITIES 15 052 17 347 18 377

--------- ------------ ---------

TOTAL EQUITY AND LIABILITIES 21 308 23 294 24 062

Ukrproduct Group

CONDENSED CONSOLIDATED INTERIM STATEMENT OF C HANGES IN

EQUITY

FOR THE SIX MONTHSED 30 JUNE 202 2

(in thousand GBP, unless otherwise stated)

Attributable to owners of the parent

Share Share Share Revaluation Retained Translation Total Total

capital trasury premium reserve earnings reserve Equity

--------- --------- --------- ------------ ---------- ------------ ------ --------

GBP GBP GBP GBP '000 GBP GBP '000 GBP GBP

'000 '000 '000 '000 '000 '000

--------- --------- --------- ------------ ---------- ------------ ------ --------

As At 31 4 (315

December 2020 282 ) 4 562 7 031 4 935 (15 231) 5 264 5 264

Loss for the

six months - - - 152 - - 152

Currency translation

differences - - - - 269 269 269

--------- --------- --------- ------------ ---------- ------------ ------ --------

Total comprehensive

income - - - 152 269 421 421

Depreciation

on revaluation

of property,

plant and

equipment - - (316 ) 316 - - -

--------- --------- --------- ------------ ---------- ------------ ------ --------

As At 30 4

June 2021 282 (315) 4 562 6 715 5 403 (14 962) 5 685 5 685

========= ========= ========= ============ ========== ============ ====== ========

Profit for

the six months - - - 287 - 287 287

Currency translation (25 (25

differences - - - - (25 ) ) )

--------- --------- --------- ------------ ---------- ------------ ------ --------

Total comprehensive

loss - - - 287 (25 ) 262 262

Depreciation

on revaluation

of property,

plant and

equipment - - (367 ) 367 - - -

--------- --------- --------- ------------ ---------- ------------ ------ --------

As At 31 4 (315 (14 987

December 2021 282 ) 4 562 6 348 6 057 ) 5 947 5 947

========= ========= ========= ============ ========== ============ ====== ========

Loss for the (197 (197 (197

six months - - - ) - ) )

Currency translation

differences - - - - 506 506 506

--------- --------- --------- ------------ ---------- ------------ ------ --------

Total comprehensive (197

income - - - ) 506 309 309

Depreciation

on revaluation

of property,

plant and

equipment - - (166 ) 166 - - -

--------- --------- --------- ------------ ---------- ------------ ------ --------

As At 30 4

June 2022 282 (315) 45 262 6 182 6 026 (14 481) 6 256 6 256

========= ========= ========= ============ ========== ============ ====== ========

Ukrproduct Group

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 20 22

(in thousand GBP, unless otherwise stated)

Six months Six months

ended ended

3 0 June 2022 30 June 2021

-------------- -------------

GBP '000 GBP '000

-------------- -------------

Cash flows from operating activities

Profit before taxation (152) 81

Adjustments for:

Exchange difference (20) (366)

Depreciation and amortization 387 537

Loss on disposal of non-current assets - 5

Provision for bad debt 1 435 166

Impairment of inventories 18 9

Interest expense on bank loans 232 232

-------------- -------------

Operating cash flow before working

capital changes 1 9 00 664

Increase in inventories 85 1 390

Increase/Decrease in trade and other

receivables 5 96 (1 128)

Increase in trade and other payables (2 653) (366)

-------------- -------------

Changes in working capital ( 1 97 2 ) (104)

-------------- -------------

Cash generated from operations (7 2 ) 560

Interest received 1 -

Income tax paid 33 9

-------------- -------------

Net cash generated from operating activities ( 38 ) 569

Cash flows from investing activities

Purchases of property, plant and equipment

and intangible assets (194) (519)

Issuance of loans (2) (13)

-------------- -------------

Net cash used in investing activities (196) (532)

Cash flows from financing activities

Interest paid (149) (188)

Repayments of long term borrowing - (57)

-------------- -------------

Net cash used in from financing activities (149) (245)

Net decrease in cash and cash equivalents (383) (208)

Effect of exchange rate changes on cash

and cash equivalents 364 199

-------------- -------------

Cash and cash equivalents at the beginning

of the six months 312 156

Cash and cash equivalents at the end

of the six months 293 147

============== =============

Ukrproduct Group

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED 30 JUNE 20 22

(in thousand GBP, unless otherwise stated)

EXTRACTS FROM NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

1. Basis of preparation

The unaudited condensed consolidated financial statements are

prepared in accordance with International Financial Reporting

Standards (IFRS) as adopted by the European Union (EU). The

condensed consolidated financial information in this half yearly

report has been prepared in accordance with International

Accounting Standard 34 'Interim Financial Reporting' (IAS 34), as

adopted by the EU, and the Disclosure Guidance and Transparency

Rules of the Financial Conduct Authority.

2. Going concern

On 24 February 2022, the Russian Federation launched a

full-scale military invasion of Ukraine. Having examined the

existing and potential implications of the war for the Ukraine

located businesses, the management of the Group have identified

several points of specific concern that require careful analysis

and assessment. They include, but are not limited to, the

following:

- risks related to safety of personnel;

- risk of physical destruction of the production assets;

- risks of disruption of the supply and distribution chains;

- risk of liquidity and limited access to financing.

In preparing these financial statements, the Directors have

assessed the Group's ability to continue as a going concern. T he

Company performed an analysis of the future cash flows and budgets

for the next 12 months based on the known facts and events applying

to them, including multiple scenarios as a result of the ongoing

war with the Russian Federation . The analysis revealed that the

Group would continue to maintain sufficient cash resources as well

as a stable flow of revenues in due course. The Group fully

complies with all sanctions rules and regulations regarding Russia

and Belarus.

Management is taking steps to secure the supply chain which is

vital for operational continuity. The Group concluded contracts

with new alternative suppliers where necessary and developed new

logistics routes. The central warehouse was moved to the one of

Group 's main plant s at Zhytomyr , away from the line of active

hostilities. Major customers have not been affected by the

hostilities and continue to cooperate and fulfil their contractual

obligations with the Group. The military action has had no critical

impact on the local distribution. The share of sales in the most

affected regions does not exceed 15%.

Selling, general and administrative and other operating

expenses, as well as CAPEX, has been reduced to the minimum

required to meet the primary needs of the Group's core

business.

The Group's management is exploring various opportunities to

attract additional financing to support the Group's the liquidity

under different state aid programs.

Ukrproduct Group

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED 30 JUNE 2022

(in thousand GBP, unless otherwise stated)

2. Going concern (continued)

For the six months ended 30 June 2022, the Group continued to be

in breach of several provisions of the loan agreement with the

European Bank for Reconstruction and Development ("EBRD"), missed

some interest payments and repayments and the EBRD has not issued a

waiver for the breaches. The Company has been holding negotiations

with the EBRD to potentially restructure the loan repayment

schedule since June 2021. At this current stage the active phase of

negotiations with EBRD has been slowed owing to the ongoing war in

Ukraine. At present, the EBRD has taken no action to accelerate

repayment of the loan.

These financial statements are prepared using the going concern

basis assumption.

3. Foreign currency translation

Functional and presentation currency

Items included in the financial statements of each of the

Group's companies are measured using the currency of the primary

economic environment in which the company operates ("the functional

currency"). For the companies operating in Cyprus and British

Virgin Islands, the functional currency is United States Dollars

("USD"). For the Parent company, which is located in Jersey, the

functional currency is Pound Sterling ("GBP"). For the companies

operating in Ukraine, the functional currency is Ukrainian Hryvnia

("UAH").

These condensed consolidated interim financial statements are

presented in the thousands of Pound Sterling ("GBP"), unless

otherwise indicated.

Foreign currency transactions and balances

Transactions in foreign currencies are initially recorded by the

Group entities at their respective functional currency rates

prevailing at the date of the transaction.

Monetary assets and liabilities denominated in foreign

currencies are retranslated at the functional currency spot rate of

exchange ruling at the reporting date.

Non-monetary items that are measured in terms of historical cost

in a foreign currency are translated using the exchange rates as at

the dates of the initial transactions. Non-monetary items measured

at fair value in a foreign currency are translated using the

exchange rates at the date when the fair value is determined.

Ukrproduct Group

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED 30 JUNE 2022

(in thousand GBP, unless otherwise stated)

The principal exchange rates used in the preparation of these

condensed consolidated interim financial statements are as

follows:

Currency 30 June Average 31 December 30 June Average

202 2 for the six 20 2 1 2021 for the six

months ended months ended

(spot rate) 30 June (spot (spot rate) 30 June

2022 rate) 2021

----------- -------------- -------------- ------------- -------------- --------------

UAH/GBP 35,55 37,72 36,84 37,58 38,55

UAH/USD 29,25 28,91 27,28 27,18 27,77

UAH/EUR 30,77 31,74 30,92 32,30 33,46

---------------- -------------- -------------- ------------- -------------- --------------

4. Subsequent events

As of the date of this report, the Group continues to operate.

The management of the Group controls all of its operations. Office

staff mostly work remotely, while production staff perform their

duties at their sites. As of the date of this report, the war in

Ukraine continues.

The duration and consequences of the war in Ukraine are

currently unclear. It is not possible to reliably estimate the

duration and severity of these consequences, as well as their

impact on the financial position and results of the Group in future

periods.

Subsequent to 31 December 2021 and up to the date of these

consolidated financial statements, the Group has not settled the

principal and interest payment with reference to the loan agreement

schedule with the EBRD. The Company have been holding negotiations

with the EBRD to potentially restructure the loan repayment

schedule since June 2021. At this current stage the active phase of

negotiations with EBRD has slowed owing to the ongoing war in

Ukraine. At present the EBRD has taken no action to accelerate

repayment of the loan.

On 22 July 2022 the National Bank of Ukraine increased the

official exchange rate of EUR to UAH up to 37.27 UAH from 29.81 as

at 21 July 2022. As a result, the Group expect significant foreign

exchange losses related to EBRD loan liabilities in the second half

of 2022.

There were no other events after the end of the reporting date,

which would have a material impact on the financial statements.

5. Approval of interim statements

The unaudited condensed consolidated financial statements were

approved by the board of directors on 29 September 2022

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DZGZLRLFGZZM

(END) Dow Jones Newswires

September 30, 2022 02:00 ET (06:00 GMT)

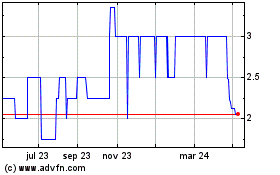

Ukrproduct (LSE:UKR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

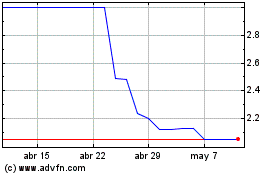

Ukrproduct (LSE:UKR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024