TIDMVLG

RNS Number : 4378N

Venture Life Group PLC

25 September 2023

25 September 2023

VENTURE LIFE GROUP PLC

("Venture Life", "VLG" or the "Group")

Unaudited interim results for the six months ended 30 June

2023

Venture Life (AIM: VLG), a leader in developing, manufacturing

and commercialising products for the international self-care

market, is pleased to announce its interim results for the six

months ended 30 June 2023 (the "Period"). The Group has delivered

another half year of growth and development across the whole

business, along with the integration of the HL Healthcare business

acquired in late 2022. Strong cash generation has been a theme of

the first half, reducing Group net leverage(1) to 1.47x, from 1.65x

at 31 December 2022, with the contingent consideration of GBP3.0m

for the acquisition of HL Healthcare ("HLH") paid in full during

the period.

Financial Highlights

-- Group revenue increased 24.5% to GBP23.5m (H1 22: GBP18.9m)

-- Adjusted EBITDA(3) * up 33.4% to GBP4.4m (H1 22: GBP3.3m) and

adjusted EBITDA(3) * margin up 1.3% to 18.9% (H1 22: 17.6%)

-- Operating profit before amortisation and exceptional items*

up 40.9% to GBP3.3m (H1 22: 2.4m)

-- Loss before tax increased to GBP1.3m (H1 22: GBP0.2m) as

anticipated, reflecting higher amortisation and finance costs

versus the comparative period

-- Cash from operations up 131% to GBP4.1m (H1 22: GBP1.8m) and

free cashflow of GBP2.6m (H1 22: GBP0.5m)

-- Underlying cash from operations* up 159% to GBP4.8m (H1 22:

GBP1.8m) and improved cash conversion* of 108% (H1 22: 56%)

-- Net debt reduced to GBP15.3m with Group net leverage(1)

commensurately reduced to 1.47x (31 Dec 2022: 1.65x)

Operating Highlights

-- H1 revenues comprised growth from both the VLG Brands and

Customer Brands with revenue growth in customer brands being

particularly strong. On a proforma(2) basis revenue was 10.4% ahead

of the previous year

-- Continued strong performance of Balance Activ and Lift

Brands, achieving revenue growth of 24% and 16% respectively

-- 17 new listings secured with major retailers for Balance

Activ, Lift and Earol, plus progress on digital transformation;

online sales were 69% ahead of the previous year at GBP1.6m (H1 22:

GBP0.9m)

Jerry Randall, CEO of Venture Life Group plc commented: "I am

delighted with performance of the business over this first half,

with strong growth contributions, in particular from our Customer

Brands, as well as from Balance Activ and Lift, in the VLG Brands

portfolio. The acquisitions we made in 2021 and 2022 are now fully

integrated and delivering good organic growth, and as expected, we

will be launching newly developed products in the second half of

the year and increasing our distribution points in the UK, which

will both contribute to the expected stronger revenues in H2. We

have delivered good cash conversion and seen a meaningful reduction

in our debt position, having now paid the full contingent

consideration for the acquisition of HLH in the first half. We

expect strong cash generation to continue through the second half

and will maintain our focus on cost savings to further reduce our

net leverage(1) . I send out a big thanks again to all our hard

working, dedicated and innovative team across the Group for

continuing to grow our business in challenging times."

* The performance of the Group is assessed using Alternative

Performance Measures ("APMs"), which are measures that are not

defined under IFRS but are used by management to monitor ongoing

business performance against both shorter term budgets and

forecasts and against the Group's longer term strategic plans. APMs

are defined in note 16.

(1) Group net leverage calculated as net debt (excl. finance

leases) and using proforma (1) Adjusted EBITDA(3) on a trailing

12-month basis.

(2) Proforma basis i.e. if the acquisition had been in place for

the whole of the prior period.

(3) Adjusted EBITDA for Group net leverage is EBITDA after

deduction of finance lease costs and before deduction of

exceptional items (see note 6) and share based payments (see note

16 for reconciliation)

Investor Meets Presentation

A live presentation relating to the 2023 Interim Results via

Investor Meet Company will be provided on 27 September 2023 at

11:00am BST. The presentation is open to all existing and potential

shareholders. Investors can sign up to Investor Meet Company for

free and add to meet Venture Life Group plc via:

https://www.investormeetcompany.com/venture-life-group-plc/register-investor

Investors who already follow Venture Life Group plc on the Investor

Meet Company platform will automatically be invited.

Change of Name of Nominated Adviser and Broker and Appointment

as Sole Broker

The Company also announces that its Nominated Adviser and Broker

has changed its name to Cavendish Securities plc ("Cavendish")

following completion of its own merger.

The Company also announces that Cavendish will act as Nominated

Adviser and sole corporate broker with immediate effect.

For further information, please contact:

Venture Life Group PLC +44 (0) 1344 578004

Jerry Randall, Chief Executive Officer

Daniel Wells, Chief Financial Officer

+44 (0) 20 7397

Cavendish Securities plc (Nomad and Broker) 8900

Michael Johnson (Sales)

Stephen Keys / Camilla Hume (Corporate Finance)

About Venture Life ( www.venture-life.com )

Venture Life is an international consumer self-care company

focused on developing, manufacturing and commercialising products

for the global self-care market. With operations in the UK, Italy,

The Netherlands and Sweden, the Group's product portfolio includes

some key products such as the UltraDEX and Dentyl oral care product

ranges, the Balance Activ range in the area of women's intimate

healthcare, the Lift and Glucogel product ranges for hypoglycaemia,

Gelclair and Pomi-T for oncology support, Earol for ear wax

removal, products for fungal infections and proctology, and

dermo-cosmetics for addressing the signs of ageing. Its products

are sold in over 90 countries worldwide.

The products, which are typically recommended by pharmacists or

healthcare practitioners, are available primarily through

pharmacies and grocery multiples. In the UK and The Netherlands

these are supplied direct by the Company to retailers, elsewhere

they are supplied by the Group's international distribution

partners.

Through its two Development & Manufacturing operations in

Italy and Sweden, the Group also provides development and

manufacturing services to companies in the medical devices and

cosmetic sectors.

Trading Performance

Overview

Group revenues for the period grew by 24.4% to GBP23.5m and on a

proforma(1) basis revenue was 10.4% ahead of H1 2022, comprising

growth from both the VLG brands and Customer brands. Excluding the

newly acquired HLH, revenue performance elsewhere in the Group was

11.4% ahead of the same period last year. Traditionally the VLG

Brand revenues are weighted more towards the second half (2022: H1

44%, H2 56%), and we expect this to be the case in the second half

of 2023 which is also expected to benefit from the impact of new

distribution gains and the launch of several newly developed

products.

Revenue GBP'm 30-Jun-23 Actual 30-Jun-22 Actual 30-Jun-22 Proforma Growth Vs 2022 Growth Vs Proforma

Unaudited six months

ended

Balance Activ 2.9 2.3 2.3 24% 24%

Lift 2.3 2.0 2.0 16% 16%

Earol 2.3 - 2.2 100% 6%

Ultradex 1.1 0.9 0.9 16% 16%

Gelclair 1.0 0.3 0.3 201% 201%

Glucogel 1.0 1.1 1.1 (9%) (9%)

Dentyl 0.9 1.2 1.2 (29%) (29%)

Footcare 0.8 0.9 0.9 (9%) (9%)

Pomi-T 0.1 0.4 0.4 (77%) (77%)

Other 0.5 0.8 1.0 (32%) (45%)

Sub-Total VLG Brands 12.9 10.1 12.5 27% 3%

Customer Brands 10.6 8.8 8.8 20% 20%

Total 23.5 18.9 18.9 25% 10%

Venture Life Brands

VLG Brands delivered revenues of GBP12.9m (H1 22: GBP10.1m), a

growth of 27% over the previous period and accounted for 55% of

first half revenues (H1 22: 53%). VLG Brands include the

acquisition of HLH on 30 November 2022 which delivered revenues of

GBP2.4m during the period (H1 22: GBP2.4m). HLH's main product is

Earol which contributes c.95% of the sales and achieved revenues of

GBP2.3m in the period (H1 22: GBP2.2m), a growth of 6.1% over the

previous period on a proforma(2) basis.

On a proforma(1) basis, revenue from VLG Brands was 3.5% ahead

of the same period the previous year; within this portfolio the

Balance Activ and Lift brands have continued to perform strongly,

achieving revenue growth of 24% and 16% respectively during the

period. Revenues for the VLG Brands are expected to show stronger

growth in the second half consistent with previous years.

The Group's focus for 2023 is driving organic growth through the

dual approach of distribution gains and new product development.

The Group's extensive research and development capability, coupled

with significant capacity in its manufacturing operations, means it

is well positioned to rapidly innovative and develop efficacious

new products for its VLG Brand portfolio. The second half of 2023

will see the market entry for some of these new products and the

Group has a program to continue this innovation program over the

coming years.

VLG Brands Revenue 30-Jun-23 30-Jun-22 30-Jun-22 Growth Growth

GBP'm Actual Actual Proforma Vs Reported Vs Proforma

Unaudited six months % %

ended

Energy Management 3.3 3.2 3.2 4% 4%

Women's Health 2.9 2.3 2.3 24% 24%

Ear, Nose & Throat 2.4 - 2.4 100% 0%

Oral Care 2.0 2.4 2.4 (16%) (16%)

Oncology Support 1.2 0.9 0.9 42% 42%

Footcare 0.8 0.9 0.9 (9%) (9%)

Other 0.2 0.4 0.4 (44%) (44%)

Total 12.9 10.1 12.5 27% 3%

Energy Management

Energy management (LIFT & Glucogel) grew by 4% to GBP3.3m

(H1 22: GBP3.2m). These products are predominantly sold in the UK

& Eire and the main component of this first half growth has

been the impact of the increased listing of Lift in Eire through

our distributor there. As with most of our VLG Brands, we are

increasing our online revenues through Amazon at this time, and

although small, we saw growth in the Lift online revenues in both

the UK and USA driven by advertising investment and listing

optimisation.

Lift revenues for the first half were GBP2.3m (H1 22: GBP2.0m)

and Glucogel revenues GBP1.0m (H1 22: GBP1.0m). The second half of

the year is expected to deliver more growth for Lift as several

newly developed products will be launching in both the off-line and

on-line settings. Extension of the Lift brand with these new

products will allow us to broaden the offering and bring new users

into the brand, as well as extend our points of distribution.

Women's Health

Revenues for the Balance Activ brand grew 24% to GBP2.9m (H1 22:

GBP2.3m). Revenues from this brand were split GBP1.2m (H1 22:

GBP1.1m) in UK & EU direct to retail and online, and GBP1.7m

(H1 22: GBP1.2m) internationally with our distribution

partners.

Growth in the UK & EU retail and online has been driven by

several initiatives. The launch of a 14 tube multipack (compared to

the usual 7 tube pack) of the Balance Activ gel has allowed us to

attract value shoppers at a time when cost of living pressures have

been increasing. Performance in the grocery channel has also been

good, with both the BV gel and pessary in growth, and the launch of

our newly developed Thrush cream in the first outlets.

Internationally our partners have performed well, with increased

geographic distribution contributing to growth. Revenues with

partners rose 33% to GBP1.7m (H1 22: GBP1.2m). The launch of the

Balance Activ gel in Brazil with our partner contributed to revenue

growth in the first half.

Ear, Nose & Throat

Revenues for the brands in this area were GBP2.4m (H1 22:

GBPnil) and arose from the HL Healthcare Limited business, acquired

on 30 November 2022. Products in this portfolio are Earol, Earol

Swim and Sterinase.

Earol accounts for the vast majority of revenues (and includes

sales under the brand name Vaxol in certain European territories)

and was GBP2.2m in the first half of 2023. On a like for like basis

in 2022, revenues were GBP2.1m, so H1 2023 was 6% ahead of the H1

2022 revenues. This growth has been driven more on the

international side than in the UK. New points of distribution and

the launch of the product on Amazon is expected to contribute to

growth in the UK in H2, with new product development also being

launched in H2 2023.

Earol Swim revenues were GBP0.2m vs GBP0.2m on a like for like

basis in H1 2022.

Oncology Support

Revenues for the brands in this area were up 42% to GBP1.2m (H1

22: GBP0.9m), driven by growth of Gelclair, with revenues three

times higher than for the same period in 2022 at GBP1.0m (H1 22:

GBP0.3m). This brand is sold entirely through partners, and as

indicated when we acquired this brand, timing of revenues can be

variable and growth is dependent, to a large extent, on geographic

expansion. Integration into the Group from the previous owner,

coupled with the MDR process meant revenues in H1 2022 were lower

than historically seen for the products, and revenues in H1 2023

are more reflective of the normal level of business. New agreements

signed in 2022 are expected to continue to contribute to growth in

the second half.

Pomi T revenues were lower in the first half of 2023 at GBP0.1m

(H1 22: GBP0.5m) due to the timing of delivery of orders. H2

revenues are expected to be significantly higher based on the order

book in hand for this product. With only a small number of current

partners, activity is ongoing to increase the geographic

penetration of this brand, as well as areas of new product

development.

Oral care

Revenues for the oral care brands were down 16% at GBP2.0m

compared to the same period last year (H1 22: GBP2.4 m). Whilst

Ultradex revenues grew in the period there was an overall revenue

reduction in this sector driven by lower Dentyl revenues, emanating

from the combination of poor performance by our Chinese partner and

aggressive promotion of competitor brands during the Period.

Revenues for UltraDEX were 16% higher at GBP1.1m (H1 22:

GBP0.9m), as we see a continued return to usage of the product post

lockdowns with the growth being driven primarily by our online

sales through Amazon.

Dentyl revenue, by comparison, was down 9% in the UK, to GBP0.9m

(H1 22: GBP1.0m) as a result of aggressive promotion from the big

competitors, such as Listerine. Internationally we currently only

have one partner for Dentyl, Samarkand in China, and we have

recorded no sales to them in the first half of 2023 (H1 22:

GBP0.3m), as they have performed poorly with the product, and this

is under review. Elsewhere within the International business, other

oral care revenues from non-core products were GBP0.1m (H1 22:

GBP0.2m).

Digital

Direct online sales (through Amazon) increased 69% to GBP1.6m

(H1 22: GBP0.9m), as a result of strong growth by a number of our

brands, including Balance Activ and Lift, and included the launch

of Balance Activ through Amazon Germany, the largest Amazon market

in the EU. As a result of this growth, online sales represented

12.3% of the Venture Life Brands revenues in H1 2023, compared to

9.7% in H1 2022.

We expect to see further progress in online revenues in the

second half, as we extend our online presence, including the launch

of Earol on Amazon and further European roll out of Balance Activ

across the Amazon platform.

Customer Brands

The Customer Brands business had a strong first half with

revenue increasing 20% to GBP10.6m (H1 22: GBP8.8m). This growth

was delivered mainly from existing customers and included GBP1.2m

of revenues from newly developed products that completed

development in 2022. This shows the strength of the in-house

development expertise we have within our Italian facility, which

has also developed a number of new products for the Venture Life

Brands which will be launching in H2 2023 and beyond. The balance

of growth came from the existing customers growing their own sales

and showing that demand remains strong in the consumer health

space.

Operational developments

Operationally we have worked in the first half to bolster the

team to manage the growing business. This included the appointment

of Fabio Perego as Group Operations Director, and General Manager

of both the Biokosmes manufacturing facility in Italy and the Rolf

Kullgren manufacturing facility in Sweden. Fabio has extensive

experience in the Contract Development and Manufacturing

Organisation space, and in particular, in medical devices, and will

be responsible for the harmonisation of the two facilities and the

maximisation of efficiencies in production at the two sites.

Innovation and the Medical device Directive

At our Biokosmes development facility we have a deep technical

department covering research, innovation, development, regulatory

and quality assurance. With our own quality management systems in

place across the business (in Italy, Sweden, The Netherlands and

the UK) we are strongly positioned to develop and manufacture new

products for both the Venture Life and Customer Brands business

units. We have seen this already in the Customer Brands business in

the first half, and will see this impact also in the Venture Life

Brands in the second half, with the launch of a number of new

products in UK retailers including:

-- Baby Earol

-- Lift Energy Boost Range

-- Balance Activ cleansing range

-- Balance Activ Thrush cream

-- Women's Intimate Health probiotic range

During 2023 and into 2024 it is our intention to focus resource

on the expansion of our revenues through new product development

and organic growth, and further capitalising on the brands and

products we have acquired over recent years.

The transition from the Medical Device Directive (MDD) to the

Medical Device Regulations (MDR) continues. However, an extension

to the deadline to transfer products has been recently announced,

and now products can continue to be sold under their MDD

certificates until May 2028 (previously May 2024), which means that

the timing to complete new MDR registrations has become more

relaxed with 4 additional years to achieve this. As a result, we

have slowed down the registration process for the remaining

technical files that we have not yet registered under MDR, to

alleviate pressure in the approval system. This will also have an

added benefit that the costs to undertake these new registrations

(in excess of EUR1 million across all our files) can be spread over

the next 4 and a half years rather than the next 12 months. This

will free up more cash flow to further reduce our net leverage(1)

.

Sustainable Life

Our progress in the pursuit of our sustainability goals

continued to be strong in the first half. We were delighted to

bolster the ESG team in February 2023, with the appointment of Emma

Caprini, a dedicated executive in the ESG team in Italy. Objectives

for ESG in 2023 are:

-- Obtaining BCorp status for our Biokosmes manufacturing

facility - this will also be a test run of the process for

obtaining BCorp for the whole Group in 2024.

-- Assessing the carbon footprint of our Biokosmes manufacturing

facility and designing the net zero 2050 plan for the facility -

this will also be a test run of the process for obtaining carbon

footprint and net zero plan for the whole Group in 2024.

-- Undertaking the life cycle analysis for three of Venture Life

Brands - Dentyl, UltraDEX and Balance Activ.

We are on target to complete these objectives by the end of

2023.

Post period end, we have been awarded the Ecovadis Silver

Sustainability Rating at our Biokosmes facility. Ecovadis is

world's largest and most reliable provider of corporate

sustainability assessments and has more than 90,000 companies

assessed in 175 countries in over 200 industries. Many of our

customers look to this assessment to understand our commitment to

sustainability. This Silver Sustainability Rating places us in the

top 25% of companies assessed. Last year we were awarded the Bronze

Award and it is as a result of numerous improvements around the

facility and hard work by the whole team that we achieved this

improved rating.

Profit and loss account

The Group delivered Adjusted EBITDA(1) of GBP4.4m for the

six-month period, an increase of 33% over the GBP3.3m reported in

the previous year and at an improved margin of 18.9% (H1 22:

17.6%).

The inflationary environment has been challenging over the last

three years but we have continued to see this plateau gradually

over the course of 2023. Raw materials and packaging, which had

been procured at inflated prices during the height of the supply

chain issues in the prior year, have now unwound through cost of

goods sold.

Our teams have worked hard to mitigate the financial impact,

delivering production efficiencies and extending our supplier

network to increase the number of alternative supply options

available. Costs have been passed onto customers only where it has

been possible to do so. As there is a lag effect between these

costs being incurred and being passed onto customers, we expect to

see a positive impact on margins in the second half of 2023.

In addition, the first half of 2023 has absorbed the impact of

fair value adjustments on inventory acquired as part of the HLH

acquisition which inflated the cost of goods sold and this

inventory has been sold in full during the period.

The net impact of these factors resulted in an overall decline

in gross margin by 350 basis points (bp) to 37.1% (H1 22: 40.6%)

and a 14% increase in gross profit to GBP8.7m (H1 22: GBP7.7m),in

line management's expectations and is expected to improve in the

second half of the year.

Our vertically integrated business model enables newly acquired

brands to be integrated profitably within the existing

infrastructure. Operating costs (defined as operating expenses less

depreciation) were in line with the previous year at GBP4.5m (H1

22: GBP4.5m) and as a % of revenue reduced by 450bp to 19.1% (H1

22: 23.6%) which highlights the Group's ability to deliver

significant operational gearing benefit.

Operating profit before amortisation and exceptional items

increased by 40.9% to GBP3.3m (H1 22: GBP2.4m) reflecting the pull

through effect of the EBITDA improvement which was offset partially

by an GBP0.2m increase in depreciation charges to GBP1.0m (H1 22:

GBP0.9m).

As disclosed in the 2022 full year results, there was a material

uncertainty around the impairment assessment of Dentyl due to an

unknown speed of recovery from our partner in China. This position

has not changed since last year and coupled with a decline in the

UK performance, has resulted in an impairment of GBP0.4m being

recognised against the Dentyl brand during the period. The carrying

value of the attributable intangible assets is now GBP3.8m at 30

June 2023 (30-Jun-22: GBP4.3m). The Group is actively seeking new

opportunities for the brand internationally, however as a prudent

measure we have reduced the useful economic life (UEL) applied to

Dentyl for amortisation purposes to mitigate the risk of further

impairment.

Amortisation of GBP2.3m (H1 22: GBP1.6m) increased significantly

due to the acquisition of HLH as well as a reduction in the UEL of

the acquired brand pertaining to Dentyl. Exceptional costs incurred

to complete integration of previous acquisitions have reduced to

GBP0.2m (H1 22: GBP0.3m) and were significantly lower than the full

year prior year.

Net finance costs of GBP1.7m were significantly higher than the

prior period (H1 22: GBP0.7m) due to a significant increase in

interest payable on the Group's revolving credit facility by

GBP0.6m to GBP0.8m (H1 22: GBP0.2m) reflecting the additional debt

drawn to fund the acquisition of HLH which has been compounded by

the increase in the Bank of England base rate. The balance of the

overall increase comprised non-cash factors, including a GBP0.2m

increase in amortisation of the up-front fees of this facility

which are already paid for, the profile of amortisation is aligned

to the anticipated usage of the facility over the term, as such the

full year finance charge in the P&L is expected to increase.

Net exchange losses of GBP0.7m (H1 22: GBP0.4m) accounted for the

remainder of the increase.

Net of the increase in amortisation, impairment and finance

costs and reduction in exceptional costs, the loss before tax for

the period increased to GBP1.3m (H1 22: GBP0.2m).

Cash generation

Free cash flow in the period was GBP2.6m (H1 22: GBP0.5m). Net

debt reduced to GBP15.3m as at 30 June 2023 (31-Dec-22: GBP16.6m)

and Group net leverage(1) reduced to 1.47x at the period end

(31-Dec-22: 1.65x). Cash generated from operations increased to

GBP4.1m (H1 22: GBP1.8m) and underlying cash from operations

increased to GBP4.8m (H1 22: GBP1.8m) aided by improved cashflow

conversion of 108% versus the 56% in the comparative period.

This cash generation has been used to reduce interest bearing

borrowings by GBP3.3m to GBP19.0m at 30 June 2023 (31-Dec-22:

GBP22.3m) including full payment of the contingent consideration of

GBP3.0m on the acquisition of HLH.

We expect cash generation to increase further in H2, reflecting

the growth in revenues and collection of cash from customer billing

following strong revenues at the end of H1, and for Group net

leverage(1) to reduce to approximately 1.0-1.1x by the end of the

year.

Current trading and outlook

Post period trading continues to perform well. We anticipate

strong sales growth in H2 across our VLG Brands, including the

impact of new distribution in the UK which is bolstered by new

product launches and the continued strong sales growth from our

Customer Brands. The order book remains strong and is c.35% up

since the end of the previous year.

The order book growth is driven by our higher margin VLG Brands

and, on a standalone basis, revenue visibility for this part of the

business has increased 2.5x compared to the same time last year

giving us confidence in the Group's ability to deliver an improved

gross margin in the second half. This together with a tight control

on operating costs underpins the Board's confidence in meeting

management's expectations for the full year notwithstanding the

continued strong performance of the lower margin customer brands

business.

Jerry Randall Daniel Wells

Chief Executive Officer Chief Financial Officer

25 September 2023 25 September 2023

(1) Group net leverage calculated as net debt (excl. finance

leases) and using proforma (2) Adjusted EBITDA(3) on a trailing

12-month basis.

(2) Proforma basis i.e. if the acquisition had been in place for

the whole of the prior period.

(3) Adjusted EBITDA for Group net leverage is EBITDA after

deduction of finance lease costs and before deduction of

exceptional items (see note 6) and share based payments (see note

16 for reconciliation)

Unaudited Interim Condensed Consolidated Statement of

Comprehensive Income

For the six months ended 30 June 2023

Note Six months Six months Year

ended ended ended

30-Jun-23 30-Jun-22 31-Dec-22

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Revenue 4.1 23,454 18,860 43,980

Cost of sales (14,733) (11,203) (26,315)

--------------------- --------------------- ----------

Gross profit 8,721 7,657 17,665

Operating expenses (5,496) (5,309) (10,927)

Impairment gain / (losses) of

financial assets 1 (75) 180

Amortisation of intangible assets 5 (2,321) (1,612) (3,564)

Impairment of intangible assets (389) - -

--------------------- --------------------- ----------

Total administrative expenses (8,205) (6,996) (14,311)

Other income 84 77 151

Operating profit before exceptional

items 600 738 3,505

--------------------- --------------------- ----------

Exceptional items 6 (217) (300) (1,278)

Operating profit 383 438 2,227

--------------------- --------------------- ----------

Finance income - - 1

Finance costs 7 (1,716) (679) (1,522)

(Loss)/Profit before tax (1,333) (241) 706

--------------------- --------------------- ----------

Tax 8 (175) 9 (186)

(Loss)/Profit for the period

attributable to the equity shareholders

of the parent (1,508) (232) 520

--------------------- --------------------- ----------

Other comprehensive (loss)/income

which may be subsequently reclassified

to the income statement 9 (345) 763 1,679

Total comprehensive (loss)/profit

for the period attributable to

equity shareholders of the parent (1,853) 531 2,199

--------------------- --------------------- ----------

Basic (loss)/profit per share

(pence) attributable to equity

shareholders of the parent 10 (1.19) (0.18) 0.41

Diluted basic (loss)/profit per

share (pence) attributable to

equity shareholders of the parent 10 (1.19) (0.18) 0.39

Unaudited Interim Condensed Consolidated Statement of Financial

Position

As at 30 June 2023

Note 30-Jun-23 30-Jun-22 31-Dec-22

(Unaudited) (Unaudited) (Audited)

ASSETS GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 12A 75,846 64,271 78,694

Property, plant and equipment 12B 9,006 9,715 10,090

Deferred tax 8 2,457 2,502 2,443

87,309 76,488 91,227

--------------------- --------------------- ------------------

Current assets

Inventories 12,666 11,491 11,998

Trade and other receivables 13,034 12,637 16,433

Cash and cash equivalents 3,658 5,393 5,631

--------------------- --------------------- ------------------

29,358 29,521 34,062

--------------------- --------------------- ------------------

TOTAL ASSETS 116,667 106,009 125,289

--------------------- --------------------- ------------------

EQUITY & LIABILITIES

Capital and reserves

Share capital 13 379 379 379

Share premium account 13 65,960 65,960 65,960

Merger reserve 13 7,656 7,656 7,656

Foreign currency translation reserve 1,220 649 1,565

Share-based payment reserve 932 976 812

Retained earnings (2,221) (1,581) (713)

--------------------- ---------------------

Total equity attributable to equity

holders of the parent 73,926 74,039 75,659

--------------------- --------------------- ------------------

LIABILITIES

Current liabilities

Trade and other payables 8,973 11,063 11,725

Taxation 1,055 349 891

Interest bearing borrowings - Deferred

contingent consideration - - 2,947

Interest bearing borrowings - Leasing

obligations 761 786 920

--------------------- --------------------- ------------------

10,789 12,198 16,483

--------------------- --------------------- ------------------

Non-current liabilities

Interest bearing borrowings - Bank

loans 16,898 8,528 17,314

Interest bearing borrowings - Leasing

obligations 3,257 3,684 3,651

Interest bearing borrowings -

Subordinated

loan (deferred consideration) 2,106 - 2,014

Statutory employment provision 1,413 1,240 1,461

Deferred tax liability 8 8,278 6,320 8,707

--------------------- --------------------- ------------------

31,952 19,772 33,147

--------------------- --------------------- ------------------

TOTAL LIABILITIES 42,741 31,970 49,630

--------------------- --------------------- ------------------

TOTAL EQUITY & LIABILITIES 116,667 106,009 125,289

--------------------- --------------------- ------------------

Unaudited Interim Condensed Consolidated Statement of Changes in

Equity

For the six months ended 30 June 2023

Share Share Merger Foreign Share-based Retained Total

capital premium reserve currency payment earnings equity

account translation reserve

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- --------- ------------- ------------ ---------- --------

Balance at

1 January 2022

(Audited) 377 65,738 7,656 (114) 856 (1,349) 73,164

--------- --------- --------- ------------- ------------ ---------- --------

Loss for the

period - - - - - (232) (232)

Foreign exchange

for period - - - 763 - - 763

--------- --------- --------- ------------- ------------ ---------- --------

Total comprehensive

income - - - 763 - (232) 531

--------- --------- --------- ------------- ------------ ---------- --------

Share options

charge - - - - 120 - 120

Shares issued 2 222 - - - - 224

--------- --------- --------- ------------- ------------ ---------- --------

Transactions

with Shareholders 2 222 - - 120 - 344

Balance at

30 June 2022

(Unaudited) 379 65,960 7,656 649 976 (1,581) 74,039

--------- --------- --------- ------------- ------------ ---------- --------

Profit for the

period - - - - - 752 752

Foreign exchange

for period - - - 916 - - 916

--------- --------- --------- ------------- ------------ ---------- --------

Total comprehensive

income - - - 916 - 752 1,668

--------- --------- --------- ------------- ------------ ---------- --------

Share options

charge - - - - (48) - (48)

Share options

charge recycling - - - - (116) 116 -

--------- --------- --------- ------------- --------

Transactions

with Shareholders - - - - (164) 116 (48)

Balance at

31 December

2022 (Audited) 379 65,960 7,656 1,565 812 (713) 75,659

--------- --------- --------- ------------- ------------ ---------- --------

Profit for the

period - - - - - (1,508) (1,508)

Foreign exchange

for period - - - (345) - - (345)

--------- --------- --------- ------------- ------------ ---------- --------

Total comprehensive

income - - - (345) - (1,508) (1,853)

--------- --------- --------- ------------- ------------ ---------- --------

Share options

charge - - - - 120 - 120

Transactions

with Shareholders - - - - 120 - 120

Balance at

30 June 2023

(Unaudited) 379 65,960 7,656 1,220 932 (2,221) 73,926

--------- --------- --------- ------------- ------------ ---------- --------

Unaudited Interim Condensed Consolidated Statement of Cash

Flows

For the six months ended 30 June 2023

Six months Six months Year ended

30-Jun-23 30-Jun-22 31-Dec-22

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Cash flow from operating activities:

(Loss)/profit before tax (1,333) (241) 706

Finance cost 1,716 679 1,521

--------------------- --------------------- -----------

Operating profit 383 438 2,227

Adjustments for:

- Depreciation of property, plant

and equipment 1,006 855 1,821

- Impairment losses of financial

assets (1) 75 (180)

- Amortisation of intangible assets 2,321 1,612 3,564

- Impairment of intangible assets 389 - -

- Loss on disposal of non-current

assets - - 40

- Share-based payment expense 120 120 72

--------------------- --------------------- -----------

Operating cash flow before movements

in working capital 4,218 3,100 7,544

Increase in inventories (952) (2,282) (2,329)

Decrease/(increase) in trade and

other receivables 3,096 (288) (2,517)

(Decrease)/increase in trade and

other payables (2,296) 1,232 3,489

--------------------- --------------------- -----------

Cash generated by operating activities 4,066 1,762 6,187

Tax paid (370) (319) (674)

Tax receipt - - 53

--------------------- --------------------- -----------

Net cash from operating activities 3,696 1,443 5,566

Cash flow from investing activities:

Acquisition of subsidiaries, net

of cash acquired (2,933) - (7,482)

Purchases of property, plant and

equipment (242) (169) (860)

Expenditure in respect of intangible

assets (414) (377) (3,346)

--------------------- --------------------- -----------

Net cash used by investing activities (3,589) (546) (11,688)

--------------------- --------------------- -----------

Cash flow from financing activities:

Net proceeds from issuance of ordinary

shares - 224 224

Drawdown in interest-bearing borrowings 1,838 417 14,985

Repayment of interest-bearing borrowings (2,276) (500) (6,728)

Leasing obligation repayments (479) (433) (922)

Interest paid (755) (272) (637)

---------------------

Net cash from financing activities (1,672) (564) 6,922

--------------------- --------------------- -----------

Net (decrease)/increase in cash

and cash equivalents (1,565) 333 800

Net foreign exchange difference (408) (175) (404)

Cash and cash equivalents at beginning

of period 5,631 5,235 5,235

--------------------- --------------------- -----------

Cash and cash equivalents at end

of period 3,658 5,393 5,631

--------------------- --------------------- -----------

Notes to the Unaudited Interim Condensed Consolidated Financial

Statements for the six months ended 30 June 2023

1. Corporate information

The Interim Condensed Consolidated Financial Statements of

Venture Life Group plc and its subsidiaries (collectively, the

Group) for the six months ended 30 June 2023 ("the Interim

Financial Statements") were approved and authorised for issue in

accordance with a resolution of the directors on 25 September

2023.

Venture Life Group plc ("the Company") is domiciled and

incorporated in the United Kingdom, and is a public company whose

shares are publicly traded on AIM. The Group's principal activities

are the development, manufacture and distribution of healthcare and

dermatology products.

2. Basis of preparation

The Group Financial Statements are prepared in accordance with

the recognition and measurement principles of the United Kingdom

adopted International Financial Reporting Standards and does not

constitute statutory accounts within the meaning of section 343 of

the Companies Act 2006.

The interim financial information in this report has been

prepared using accounting policies consistent with International

Financial Reporting Standards ("IFRS") as adopted by the UK. IFRS

is subject to amendment and interpretation by the International

Accounting Standards Board (IASB) and the IFRS Interpretations

Committee (IFRIC) and there is an ongoing process of review and

endorsement by the UK Endorsement Board. The financial information

has been prepared based on IFRS that the Directors expect to be

adopted by the UK and applicable as at 31 December 2023. The Group

has chosen not to adopt IAS 34 "Interim Financial Statements" in

preparing the interim financial information.

The financial information contained in the Interim Financial

Statements, which are unaudited, does not constitute statutory

accounts in accordance with the Companies Act 2006. The financial

information for the year ended 31 December 2022 is extracted from

the statutory accounts for that year which have been delivered to

the Registrar of Companies and on which the auditor issued an

unqualified opinion that included an emphasis of matter reference

or statement made under section 498(2) or (3) of the Companies Act

2006.

3. Accounting policies

The accounting policies adopted in the preparation of the

Interim Financial Statements are consistent with those followed in

the preparation of the Consolidated Financial Statements for the

year ended 31 December 2022.

Foreign currencies

The assets and liabilities of foreign operations are translated

into sterling at exchange rates ruling at the balance sheet date.

Revenues generated and expenses incurred in currencies other than

sterling are translated into sterling at rates approximating to the

exchange rates ruling at the dates of the transactions. Foreign

exchange differences arising on retranslation of assets and

liabilities of foreign operations are recognised directly in the

foreign currency translation reserve.

The sterling/euro exchange and sterling/SEK rates used in the

Interim Financial Statements and prior reporting periods are as

follows:

Sterling/euro exchange rates Six months Six months Year ended

30-Jun-23 30-Jun-22 31-Dec-22

(Unaudited) (Unaudited) (Audited)

Average exchange rate for period 1.141 1.188 1.173

Exchange rate at the period end 1.163 1.162 1.129

Sterling/SEK exchange rates Six months Six months Year ended

30-Jun-23 30-Jun-22 31-Dec-22

(Unaudited) (Unaudited) (Audited)

Average exchange rate for period 12.926 12.439 12.461

Exchange rate at the period end 13.710 12.441 12.583

4. Segmental information

Management has determined the operating segments based on the

reports reviewed by the Group Board of Directors (Chief Operating

Decision Maker) that are used to make strategic decisions. The

Board considers the business from a line-of-service perspective and

uses operating profit/(loss) as its profit measure. The operating

profit/(loss) of operating segments is prepared on the same basis

as the Group's accounting operating profit/(loss) before

exceptional items (see note 6)

In line with the 2022 Consolidated Financial Statements, the

operations of the Group are segmented as VLG Brands, which includes

sales of healthcare and skin care products under distribution

agreements and direct to UK retailers, and Customer Brands, which

includes development and manufacturing.

The following is an analysis of the Group's revenue and results

by reportable segment.

VLG Customer Eliminations Consolidated

Brands Brands Group

GBP'000 GBP'000 GBP'000 GBP'000

Six months to 30 June 2023

Revenue

External Sales 12,875 10,579 - 23,454

Inter-segment sales 683 3,637 (4,320) -

Total revenue 13,558 14,216 (4,320) 23,454

-------- --------- --------------------- -----------------------

Results

Operating (loss)/profit before

exceptional items and excluding

central administrative costs (1,466) 4,315 - 2,849

-------- --------- --------------------- -----------------------

VLG Brands Customer Eliminations Consolidated

Brands Group

GBP'000 GBP'000 GBP'000 GBP'000

Six months to 30 June

2022

Revenue

External sales 10,077 8,783 - 18,860

Inter-segment sales 633 2,172 (2,805) -

Total revenue 10,710 10,955 (2,805) 18,860

----------- --------- ------------- -------------

Results

Operating profit before

exceptional items and excluding

central administrative

costs 1,270 1,163 - 2,433

----------- --------- ------------- -------------

VLG Brands Customer Eliminations Consolidated

Brands Group

GBP'000 GBP'000 GBP'000 GBP'000

Twelve months to 31 December

2022

Revenue

External sales 23,135 20,845 - 43,980

Inter-segment sales 1,444 4,776 (6,220) -

Total revenue 24,579 25,621 (6,220) 43,980

----------- --------- ---------------------- ----------------------

Results

Operating profit before

exceptional items and

excluding central administrative

costs 3,799 3,674 - 7,473

----------- --------- ---------------------- ----------------------

Six months Six months Year ended

30-Jun-23 30-Jun-22 31-Dec-22

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Operating profit before exceptional

items and excluding central administrative

costs 2,849 2,433 7,473

Central administrative costs (2,249) (1,695) (3,968)

Exceptional expenses (217) (300) (1,278)

Operating profit 383 438 2,227

Net finance cost (1,716) (679) (1,521)

(Loss)/profit before tax (1,333) (241) 706

------------ ------------ -----------

,

5. Amortisation of intangible assets

Six months Six months Year ended

30-Jun-23 30-Jun-22 31-Dec-22

(Unaudited) (Unaudited) (Audited)

Amortisation of: GBP'000 GBP'000 GBP'000

Acquired intangible assets (794) (611) (1,293)

Patents, trademarks and other intangible

assets (1,189) (786) (1,686)

Capitalised development costs (338) (215) (585)

(2,321) (1,612) (3,564)

------------ ------------ -----------

6. Exceptional items

Six months Six months Year ended

30-Jun-23 30-Jun-22 31-Dec-22

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Costs incurred in acquisitions - (75) (860)

Integration of acquisitions (160) (89) (202)

Restructuring costs (57) (136) (216)

(217) (300) (1,278)

------------ ------------ -----------

The Group treats costs as exceptional items where their

frequency and nature warrant being separately classified. In the

six month period to 30 June 2023, the Group incurred integration

costs of acquisitions of GBP160,000 which included the final unwind

of prepaid warranty insurance on the acquisition of BBIH and costs

incurred in completing the integration of HL Healthcare.

Restructuring costs of GBP57,000 were incurred in the period and

have been classified as an exceptional item in consistence with

prior periods.

7. Finance costs

Six months Six months Year ended

30-Jun-23 30-Jun-22 31-Dec-22

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

On loans and overdrafts 802 241 594

Amortised finance issue costs 183 (13) 212

Interest on lease liabilities 34 31 71

Net exchange difference 697 420 645

1,716 679 1,522

------------ ------------ -----------

8. Taxation

The Group calculates the income tax expense for the period using

the tax rate that would be applicable to the earnings in the six

months to 30 June 2023. The major components of income tax expense

in the Interim Condensed Statement of Comprehensive Income are as

follows:

Six months Six months Year

ended

30-Jun-23 30-Jun-22 31-Dec-22

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Current income tax (599) (438) (1,206)

Deferred income tax expense related

to origination and reversal of timing

differences 424 447 1,020

Income tax (expense)/credit recognised

in statement of comprehensive income (175) 9 (186)

------------ ------------ ----------

The current income tax expense is based on the profits of the

businesses based in Italy and Netherlands. The UK based businesses

have utilised tax losses and thus have no current income tax

expense.

At the period end, the estimated tax losses amounted to

GBP9,867,000 (30 June 2022: GBP10,163,000; 31 December 2022:

GBP9,867,000).

9. Other comprehensive income/(expense)

Other comprehensive income/(expense) represents the foreign

exchange difference on the translation of the assets, liabilities

and reserves of Biokosmes and PharmaSource which have functional

currencies of Euros and the Swedish entities which have functional

currencies in Swedish Krona (SEK). The movement is shown in the

foreign currency translation reserve between the date of

acquisition of Biokosmes, when the GBP/EUR rate was 1.193 and the

balance sheet date rate at 30 June 2023 of 1.163 (at 31 December

2022 of 1.129 and at 30 June 2022 of 1.162) together with the same

computation for PharmaSource BV between the date of acquisition

when the GBP/EUR rate was 1.185 and the balance sheet date rate at

30 June 2023 of 1.163. The movement for Sweden is shown in the

foreign currency translation reserve between the date of

acquisition of BBI Healthcare, when the GBP/SEK rate was 11.742 and

the balance sheet date rate at 30 June 2023 of 13.710 (at 31

December 2022 of 12.583 and at 30 June 2022 of 12.441). The result

is an amount that may subsequently be reclassified to profit and

loss.

10. Earnings per share

Six months Six months Year ended

30-Jun-23 30-Jun-22 31-Dec-22

(Unaudited) (Unaudited) (Audited)

Weighted average number of ordinary

shares in issue 126,498,197 126,012,009 126,257,101

(Loss)/profit attributable to equity

holders of

the Company (GBP'000) (1,508) (232) 520

Basic (loss)/profit per share (pence) (1.19) (0.18) 0.41

Diluted (loss)/profit per share

(pence) (1.19) (0.18) 0.39

Adjusted profit per share (pence)(4) 0.91 1.43 4.30

Diluted adjusted profit per share

(pence)(5) 0.86 1.37 4.07

(4) Adjusted earnings per share is profit after tax excluding

amortisation, exceptional items and share based payments.

(5) Diluted adjusted earnings per share is profit after tax

excluding amortisation, exceptional items and share based payments,

diluted by the inclusion of 6,454,515 stock options and 554,115

long-term incentive plan awards ("LTIP's"). Including this

dilution, the weighted average number of ordinary shares for the

diluted EPS calculation is 133,506,827 (30 June 2022: 131,622,290;

31 December 2022: 133,393,929) shares.

In circumstances where the Basic and Adjusted results per share

attributable to ordinary shareholders are a loss then the

respective diluted figures are identical to the undiluted figures.

This is because the exercise of share options would have the effect

of reducing the loss per ordinary share and is therefore not

dilutive under the terms of IAS 33.

11. Intangible assets

At the reporting date the Goodwill generated from the

acquisitions of Biokosmes Srl in March 2014, Periproducts Limited

in March 2016, Dentyl in August 2018, PharmaSource BV in 2020, BBI

Healthcare in June 2021, Helsinn in August 2021 and HL Healthcare

in November 2022 accounted for GBP38.8m of the intangible assets of

the Group (GBP35.8m at 31 December 2022). There was an impairment

of Goodwill of GBP389,000 (6 months to June 2022: GBPnil).

Development Brands Patents Goodwill Other Total

Costs and Trademarks Intangible

Assets

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------ -------- ---------------- --------- ------------ --------

Cost or valuation:

------------ -------- ---------------- --------- ------------ --------

At 1 January 2022 4,049 20,093 979 35,483 10,727 71,331

------------ -------- ---------------- --------- ------------ --------

Acquired through - - - - - -

business combinations

------------ -------- ---------------- --------- ------------ --------

Additions 340 - 37 - - 377

------------ -------- ---------------- --------- ------------ --------

Disposals - - - - - -

------------ -------- ---------------- --------- ------------ --------

Foreign exchange 103 - 16 346 76 541

------------ -------- ---------------- --------- ------------ --------

At 30 June 2022 4,492 20,093 1,032 35,829 10,803 72,249

------------ -------- ---------------- --------- ------------ --------

Acquired through

business combinations - 9,282 - 3,407 2,628 15,317

------------ -------- ---------------- --------- ------------ --------

Additions 583 - 8 - - 591

------------ -------- ---------------- --------- ------------ --------

Disposals (84) - - - - (84)

------------ -------- ---------------- --------- ------------ --------

Foreign exchange 128 - 19 416 92 655

------------ -------- ---------------- --------- ------------ --------

At 31 December

2022 5,119 29,375 1,059 39,652 13,523 88,728

------------ -------- ---------------- --------- ------------ --------

Additions 411 - 3 - - 414

------------ -------- ---------------- --------- ------------ --------

Disposals - - - - - -

------------ -------- ---------------- --------- ------------ --------

Foreign exchange (182) - (20) (428) (94) (724)

------------ -------- ---------------- --------- ------------ --------

At 30 June 2023 5,348 29,375 1,042 39,224 13,429 88,418

------------ -------- ---------------- --------- ------------ --------

Amortisation:

------------ -------- ---------------- --------- ------------ --------

At 1 January 2022 2,112 822 511 - 2,807 6,252

------------ -------- ---------------- --------- ------------ --------

Charge for the

period 215 704 82 611 1,612

------------ -------- ---------------- --------- ------------ --------

Disposals - - - - - -

------------ -------- ---------------- --------- ------------ --------

Foreign exchange 56 - 8 - 50 114

------------ -------- ---------------- --------- ------------ --------

At 30 June 2022 2,383 1,526 601 - 3,468 7,978

------------ -------- ---------------- --------- ------------ --------

Charge for the

period 370 818 82 - 682 1,952

------------ -------- ---------------- --------- ------------ --------

Disposals (46) - - - - (46)

------------ -------- ---------------- --------- ------------ --------

Foreign exchange 73 - 10 - 67 150

------------ -------- ---------------- --------- ------------ --------

At 31 December

2022 2,780 2,344 693 - 4,217 10,034

------------ -------- ---------------- --------- ------------ --------

Charge for the

period 338 1,115 74 - 794 2,321

------------ -------- ---------------- --------- ------------ --------

Impairment charge - - - 389 - 389

------------ -------- ---------------- --------- ------------ --------

Disposals - - - - - -

------------ -------- ---------------- --------- ------------ --------

Foreign exchange (89) - (12) - (71) (172)

------------ -------- ---------------- --------- ------------ --------

At 30 June 2023 3,029 3,459 755 389 4,940 12,572

------------ -------- ---------------- --------- ------------ --------

Carrying amount:

------------ -------- ---------------- --------- ------------ --------

At 31 December

2022 2,339 27,031 366 39,652 9,306 78,694

------------ -------- ---------------- --------- ------------ --------

At 30 June 2022 2,109 18,567 431 35,829 7,335 64,271

------------ -------- ---------------- --------- ------------ --------

At 30 June 2023 2,319 25,916 287 38,835 8,489 75,846

------------ -------- ---------------- --------- ------------ --------

12. Property, Plant & Equipment

The carrying value of property, plant & equipment at 30 June

2023 reduced to GBP9.0m compared to prior year (30 June 2022:

GBP9.7m).

Plant Other Right Land Total

& Equipment Equipment of Use & Buildings

Assets

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------- ----------- -------- ------------- --------

Cost or valuation:

------------- ----------- -------- ------------- --------

At 1 January 2022 5,739 228 6,766 1,465 14,198

------------- ----------- -------- ------------- --------

Acquired through business - - - - -

combinations

------------- ----------- -------- ------------- --------

Additions 154 15 558 - 727

------------- ----------- -------- ------------- --------

Disposals - - - - -

------------- ----------- -------- ------------- --------

Foreign exchange 27 5 163 (22) 173

------------- ----------- -------- ------------- --------

At 30 June 2022 5,920 248 7,487 1,443 15,098

------------- ----------- -------- ------------- --------

Acquired through business

combinations - 13 - - 13

------------- ----------- -------- ------------- --------

Additions 681 10 476 - 1,167

------------- ----------- -------- ------------- --------

Disposals (45) - (325) - (370)

------------- ----------- -------- ------------- --------

Foreign exchange 83 8 201 (13) 279

------------- ----------- -------- ------------- --------

At 31 December 2022 6,639 279 7,839 1,430 16,187

------------- ----------- -------- ------------- --------

Additions 215 12 34 15 276

------------- ----------- -------- ------------- --------

Disposals (202) (2) - - (204)

------------- ----------- -------- ------------- --------

Foreign exchange (456) (8) (207) (97) (768)

------------- ----------- -------- ------------- --------

At 30 June 2023 6,196 281 7,666 1,348 15,491

------------- ----------- -------- ------------- --------

Depreciation:

------------- ----------- -------- ------------- --------

At 1 January 2022 1,749 140 2,527 45 4,461

------------- ----------- -------- ------------- --------

Charge for the period 388 12 405 50 855

------------- ----------- -------- ------------- --------

Disposals - - - - -

------------- ----------- -------- ------------- --------

Foreign exchange 8 4 63 (8) 67

------------- ----------- -------- ------------- --------

At 30 June 2022 2,145 156 2,995 87 5,383

------------- ----------- -------- ------------- --------

Charge for the period 433 15 468 50 966

------------- ----------- -------- ------------- --------

Disposals (43) - (325) - (368)

------------- ----------- -------- ------------- --------

Foreign exchange 30 4 87 (5) 116

------------- ----------- -------- ------------- --------

At 31 December 2022 2,565 175 3,225 132 6,097

------------- ----------- -------- ------------- --------

Charge for the period 420 16 521 49 1,006

------------- ----------- -------- ------------- --------

Disposals (202) (2) - - (204)

------------- ----------- -------- ------------- --------

Foreign exchange (271) (4) (99) (40) (414)

------------- ----------- -------- ------------- --------

At 30 June 2023 2,512 185 3,647 141 6,485

------------- ----------- -------- ------------- --------

Carrying amount:

------------- ----------- -------- ------------- --------

At 31 December 2022 4,074 104 4,614 1,298 10,090

------------- ----------- -------- ------------- --------

At 30 June 2022 3,775 92 4,492 1,356 9,715

------------- ----------- -------- ------------- --------

At 30 June 2023 3,684 96 4,019 1,207 9,006

------------- ----------- -------- ------------- --------

13. Share capital, share premium and merger reserve

Ordinary Ordinary Share

shares of shares premium Merger

0.3p each reserve

No. GBP'000 GBP'000 GBP'000

Audited at 31 December 2022 126,498,197 379 65,960 7,656

Unaudited at 30 June 2023 126,498,197 379 65,960 7,656

During the period 31 December 2022 to 30 June 2023 there has not

been a change in the shares issued.

14. Related party transactions

The following transactions with related parties are considered

by the Directors to be significant for the interpretation of the

Interim Condensed Financial Statements for the six-month period to

30 June 2023 and the balances with related parties at 30 June 2023

and 31 December 2022:

Key transactions with other related parties:

Braguts' Real Estate Srl (formally known as Biokosmes

Immobiliare Srl), a company 100% owned by Gianluca Braguti (a

Director and shareholder of the Group) provided property lease

services to the Development and Manufacturing business totalling

GBP218,964 in the six months to 30 June 2023 (GBP195,944 in the six

months to 30 June 2022). At 30 June 2023, the Group owed Braguts'

Real Estate Srl GBP43,680 (GBP32,449 at 30 June 2022). Biokosmes

Srl provided technical services to Braguts'Real Estate in the six

months to 30 June 2023 in the amount of GBP243 (GBP2,136 in the six

months to 30 June 2022). At 30 June 2023 Bragut's Real Estate owed

to the Group GBPnil (GBPnil at 30 June 2022).

15. Financial instruments

Set out below is an overview of financial instruments held by

the Group as at:

30-Jun-23 30-Jun-22 31-Dec-22

Loans Total Loans Total Loans Total

and receivables financial and financial and financial

assets receivables assets receivables assets

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Financial assets:

Trade and other

receivables (a) 12,785 12,785 12,173 12,173 16,152 16,152

Cash and cash

equivalents 3,658 3,658 5,393 5,393 5,631 5,631

Total 16,443 16,443 17,566 17,566 21,783 21,783

------------------- ----------- --------------- ----------- --------------- -----------

30-Jun-23 30-Jun-22 31-Dec-22

Liabilities Total Liabilities Total Liabilities Total

(amortised financial (amortised financial (amortised financial

cost) liabilities cost) liabilities cost) liabilities

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Financial liabilities:

Trade and other payables

(b) 8,912 8,912 11,057 11,057 11,725 11,725

Lease obligations 4,018 4,018 4,470 4,470 4,571 4,571

Interest bearing 19,004 19,004 8,528 8,528 22,275 22,275

Total 31,934 31,934 24,055 24,055 38,571 38,571

------------ ------------- ------------ ------------- ------------ -------------

(a) Trade and other receivables excludes prepayments.

(b) Trade and other payables excludes deferred revenue.

16. Alternative performance measures

The Group uses certain financial measures that are not defined

or recognised under IFRS. The Directors believe that these non-GAAP

measures supplement GAAP measures to help in providing a further

understanding of the results of the Group and are used as key

performance indicators within the business to aid in evaluating its

current business performance. The measures can also aid in

comparability with other companies who use similar metrics.

However, as the measures are not defined by IFRS, other companies

may calculate them differently or may use such measures for

different purposes to the Group.

Measure Definition Reconciliation to GAAP measure

EBITDA and Adjusted EBITDA Earnings before interest, tax, Note a below

depreciation, amortisation and

impairment (EBITDA)

and Adjusted EBITDA which is defined as

EBITDA excluding share-based payment

charges and exceptional

items.

Operating profit before amortisation and Operating profit before amortisation and Note b below

exceptional items exceptional items.

Underlying cash from operations Cash from operations excluding payment Note c below

for exceptional costs.

Cash conversion Underlying cash from operations as a Note d below

percentage of Adjusted EBITDA.

Free cash flow Free cash flow is defined as net cash Note e below

generated from operations less cash

payments made for

leases and capital expenditure.

Net debt Net debt is defined as the Group's gross Note f below

bank debt position net of cash.

Net leverage Net leverage calculated as net debt Note g below

(excl. finance leases) and using

proforma (2) Adjusted

EBITDA on a trailing 12-month basis.

Proforma Proforma figures compare financial Not needed

results in one period with those for the

previous period,

excluding the impact of acquisitions and

disposals made in either period. For

2022, like-for-like

revenue includes HL Healthcare Ltd which

was acquired in December 2022

a) EBITDA and Adjusted EBITDA Six months Six months Year ended

30-Jun-23 30-Jun-22 31-Dec-22

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Operating profit 383 438 2,227

Add back:

Depreciation 1,006 855 1,821

Amortisation 2,321 1,612 3,564

Impairment charge 389 - -

EBITDA 4,099 2,905 7,612

Add back:

Share-based payment charge 120 120 72

Exceptional costs 217 300 1,278

Adjusted EBITDA 4,436 3,325 8,962

------------ ------------ -----------

b) Operating profit before amortisation Six months Six months Year ended

and exceptional items

30-Jun-23 30-Jun-22 31-Dec-22

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Operating profit 383 438 2,227

Add back:

Amortisation 2,321 1,612 3,564

Impairment charge 389 - -

Exceptional costs 217 300 1,278

Operating profit before amortisation

and exceptional items 3,310 2,350 7,069

------------ ------------ -----------

c) Underlying cash from operations Six months Six months Year ended

30-Jun-23 30-Jun-22 31-Dec-22

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Cash from operating activities 4,066 1,762 6,187

Exceptional costs paid in period 707 84 488

Underlying cash from operations 4,773 1,846 6,675

--------------- -------------- ---------------

d) Cash conversion Six months Six months Year ended

30-Jun-23 30-Jun-22 31-Dec-22

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Cash generated by operating activities 4,066 1,762 6,187

Add back:

Exceptional costs paid 707 84 488

------------ ------------ -----------

Adjusted cash generated by operating

activities 4,773 1,846 6,675

------------ ------------ -----------

Adjusted EBITDA 4,436 3,325 8,962

------------ ------------ -----------

Cash conversion 108% 56% 74%

e) Reconciliation of free cash Six months Six months Year ended

flow

30-Jun-23 30-Jun-22 31-Dec-22

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Net cash generated by operating

activities 3,696 1,443 5,566

Capital expenditure (656) (546) (1,706)

Lease payments (479) (433) (992)

Free cash flow 2,561 464 2,868

------------ ------------ -----------

f) Net debt / (cash) Six months Six months Year ended

30-Jun-23 30-Jun-22 31-Dec-22

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Cash and cash equivalents (3,658) (5,393) (5,631)

Interest bearing borrowings - Deferred

contingent consideration - current - - 2,947

Interest bearing borrowings - Bank

Loans - non-current 16,898 8,528 17,314

Interest bearing borrowings - Subordinated

Loan (deferred consideration) -

non-current 2,106 - 2,014

Net debt (excl finance leases) 15,346 3,135 16,644

Interest bearing borrowings - Leasing

obligations - current 761 786 920

Interest bearing borrowings - Leasing

obligations - non-current 3,257 3,684 3,651

Net debt (incl finance leases) 19,364 7,605 21,215

--------------------- --------------------- ----------------

g) Net leverage Six months Six months Year ended

30-Jun-23 30-Jun-22 31-Dec-22

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Net debt (excl finance leases) 15,346 3,135 16,644

------------ ------------ -----------

Proforma (2) adjusted EBITDA(3)

on a trailing 12-month basis

Adjusted EBITDA 4,436 3,325 8,962

Adjustment to increase adjusted

EBITDA to trailing 12 month basis

- as reported 5,637 4,660 -

Adjustment to include mid year acquisition

on trailing 12 month basis 1,391 - 2,110

12 month trailing adjusted EBITDA 11,464 7,985 11,072

deduct:

Lease payments for 12 month period (1,041) (840) (992)

Adjusted EBITDA for net leverage 10,423 7,145 10,080

------------ ------------ -----------

Net leverage 1.47x 0.44x 1.65x

17. Post Balance Sheet Event

There are no post balance sheet events .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FIFSTALISFIV

(END) Dow Jones Newswires

September 25, 2023 02:00 ET (06:00 GMT)

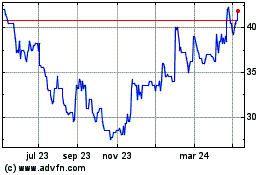

Venture Life (LSE:VLG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

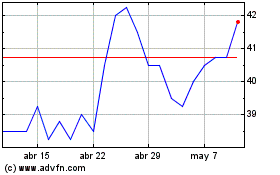

Venture Life (LSE:VLG)

Gráfica de Acción Histórica

De May 2023 a May 2024