ARCA biopharma, Inc. (NASDAQ: ABIO) (“ARCA”) today announced that

its Board of Directors has declared a special cash dividend (the

“Special Dividend”) in connection with the previously announced

merger (the “Merger”) with Oruka Therapeutics, Inc. (“Oruka”)

pursuant to the Agreement and Plan of Merger and Reorganization,

dated April 3, 2024 (the “Merger Agreement”).

The Special Dividend, which ARCA estimates will

be $1.59 per share of ARCA’s common stock, will be payable in cash

to the stockholders of record as of August 26, 2024. The exact

amount of the Special Dividend will be calculated pursuant to the

Merger Agreement and based on ARCA’s reasonable, good faith

approximation of the amount by which ARCA’s net cash, as determined

prior to the closing of the Merger, will exceed $5,000,000. Total

actual distribution of the amount of the Special Dividend could be

higher or lower than $1.59 per share and the estimate for amount to

be distributed to stockholders could change. The payment date in

respect of the Special Dividend is scheduled for August 28,

2024.

Payment of the Special Dividend is conditioned

upon approval by the ARCA stockholders of the Merger, which ARCA’s

stockholders will consider and vote upon at the special meeting of

ARCA stockholders scheduled for 9:00 a.m. MT on August 22, 2024.

Closing of the Merger is expected to occur on

August 29, 2024 assuming that the transaction is approved

by ARCA’s stockholders and the satisfaction or waiver of all

conditions under the Merger Agreement.

If you need assistance in voting your shares or

have questions regarding the special meeting of ARCA’s

stockholders, please contact ARCA’s proxy solicitor, Innisfree

M&A Incorporated at (877) 750-8310 (toll-free).

About ARCA biopharma

ARCA biopharma is dedicated to developing

genetically and other targeted therapies for cardiovascular

diseases through a precision medicine approach to drug development.

For more information, please visit www.arcabio.com or follow

the company on LinkedIn.

About Oruka Therapeutics

Oruka Therapeutics is developing novel biologics

designed to set a new standard for the treatment of chronic skin

diseases. Oruka’s mission is to offer patients suffering from

chronic skin diseases like plaque psoriasis the greatest possible

freedom from their condition by achieving high rates of complete

disease clearance with dosing as infrequently as one or twice a

year. Oruka is advancing a proprietary portfolio of

potentially best-in-class antibodies that were engineered

by Paragon Therapeutics and target the core mechanisms underlying

plaque psoriasis and other dermatologic and inflammatory diseases.

For more information, visit www.orukatx.com.

Forward-Looking Statements

This communication contains forward-looking

statements (including within the meaning of Section 21E of the

Exchange Act and Section 27A of the Securities Act) concerning

ARCA, Oruka, the proposed transactions and other matters. These

forward-looking statements include express or implied statements

relating to the structure, timing and completion of the proposed

Merger; the combined company’s listing on Nasdaq after closing of

the proposed Merger; expectations regarding the ownership structure

of the combined company; the expected executive officers and

directors of the combined company; each company’s and the combined

company’s expected cash position at the closing of the proposed

Merger (including completion of Oruka’s private placement) and cash

runway of the combined company; the expected contribution and

payment of dividends in connection with the Merger, including the

timing thereof; the future operations of the combined company; the

nature, strategy and focus of the combined company; the development

and commercial potential and potential benefits of any product

candidates of the combined company; anticipated preclinical and

clinical drug development activities and related timelines,

including the expected timing for data and other clinical results;

the combined company having sufficient resources to advance its

pipeline candidates; and other statements that are not historical

fact. The words “anticipate,” “believe,” “contemplate,” “continue,”

“could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,”

“possible,” “potential,” “predict,” “project,” “should,” “will,”

“would” and similar expressions (including the negatives of these

terms or variations of them) may identify forward-looking

statements, but the absence of these words does not mean that a

statement is not forward-looking. These forward-looking statements

are based on current expectations and beliefs concerning future

developments and their potential effects. There can be no assurance

that future developments affecting ARCA, Oruka, including the

pre-closing private financing, or the Merger will be those that

have been anticipated.

The forward-looking statements contained in this

communication are based on current expectations and beliefs

concerning future developments and their potential effects and

therefore subject to other risks and uncertainties. These risks and

uncertainties include, but are not limited to, risks associated

with the possible failure to satisfy the conditions to the closing

or consummation of the Merger, including ARCA’s failure to obtain

stockholder approval for the Merger, risks associated with the

potential failure to complete the financing transaction in a timely

manner or at all, risks associated with the uncertainty as to the

timing of the consummation of the Merger and the ability of each of

ARCA and Oruka to consummate the transactions contemplated by the

Merger, risks associated with ARCA’s continued listing on Nasdaq

until closing of the Merger, the failure or delay in obtaining

required approvals from any governmental or quasi-governmental

entity necessary to consummate the Merger; the occurrence of any

event, change or other circumstance or condition that could give

rise to the termination of the Merger prior to the closing or

consummation of the Merger, risks associated with the possible

failure to realize certain anticipated benefits of the Merger,

including with respect to future financial and operating results;

the effect of the completion of the Merger on the combined

company’s business relationships, operating results and business

generally; risks associated with the combined company’s ability to

manage expenses and unanticipated spending and costs that could

reduce the combined company’s cash resources; risks related to the

combined company’s ability to correctly estimate its operating

expenses and other events; changes in capital resource

requirements; risks related to the inability of the combined

company to obtain sufficient additional capital to continue to

advance its product candidates or its preclinical programs; the

outcome of any legal proceedings that may be instituted against the

combined company or any of its directors or officers related to the

Merger Agreement or the transactions contemplated thereby; the

ability of the combined company to obtain, maintain and protect its

intellectual property rights, in particular those related to its

product candidates; the combined company’s ability to advance the

development of its product candidates or preclinical activities

under the timelines it anticipates in planned and future clinical

trials; the combined company’s ability to replicate in later

clinical trials positive results found in preclinical studies and

early-stage clinical trials of its product candidates; the combined

company’s ability to realize the anticipated benefits of its

research and development programs, strategic partnerships,

licensing programs or other collaborations; regulatory requirements

or developments and the combined company’s ability to obtain

necessary approvals from the U.S. Food and Drug Administration or

other regulatory authorities; changes to clinical trial designs and

regulatory pathways; competitive responses to the Merger and

changes in expected or existing competition; unexpected costs,

charges or expenses resulting from the Merger; potential adverse

reactions or changes to business relationships resulting from the

completion of the Merger; legislative, regulatory, political and

economic developments; and those risks and uncertainties and other

factors more fully described in filings with the Securities and

Exchange Commission (“SEC”), including reports filed

on Form 10-K, 10-Q and 8-K, in other

filings that ARCA makes and will make with the SEC in

connection with the proposed Merger, including the Proxy

Statement/Prospectus described below under “Important Additional

Information About the Proposed Transaction Filed with the SEC,”

and in other filings made by ARCA with the SEC from time to

time and available at www.sec.gov. These forward-looking statements

are based on current expectations, and with regard to the proposed

transaction, are based on ARCA’s current expectations, estimates

and projections about the expected date of closing of the proposed

transaction and the potential benefits thereof, its business and

industry, management’s beliefs and certain assumptions made by

ARCA, all of which are subject to change. Such forward-looking

statements are made as of the date of this release, and the parties

undertake no obligation to update such statements to reflect

subsequent events or circumstances, except as otherwise required by

securities and other applicable law.

No Offer or Solicitation

This communication is not intended to and do not

constitute (i) a solicitation of a proxy, consent or approval

with respect to any securities or in respect of the proposed

transactions (the “Proposed Transactions”) between ARCA and Oruka

or (ii) an offer to sell or the solicitation of an offer to

subscribe for or buy or an invitation to purchase or subscribe for

any securities pursuant to the Proposed Transactions or otherwise,

nor shall there be any sale, issuance or transfer of securities in

any jurisdiction in contravention of applicable law. No offer of

securities shall be made except by means of a prospectus meeting

the requirements of the Securities Act of 1933, as amended, or an

exemption therefrom. Subject to certain exceptions to be approved

by the relevant regulators or certain facts to be ascertained, the

public offer will not be made directly or indirectly, in or into

any jurisdiction where to do so would constitute a violation of the

laws of such jurisdiction, or by use of the mails or by any means

or instrumentality (including without limitation, facsimile

transmission, telephone and the internet) of interstate or foreign

commerce, or any facility of a national securities exchange, of any

such jurisdiction.

NEITHER THE SEC NOR ANY STATE SECURITIES

COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR

DETERMINED IF THIS COMMUNICATION IS TRUTHFUL OR COMPLETE.

Important Additional Information About

the Proposed Transaction Filed with the SEC

This communication is not a substitute for the

registration statement on Form S-4 or for any other document that

ARCA has filed or may file with the SEC in connection with the

Proposed Transactions. In connection with the Proposed

Transactions, ARCA has filed with the SEC a registration statement

on Form S-4, which contains a proxy statement/prospectus

of ARCA. ARCA URGES INVESTORS AND STOCKHOLDERS TO READ THE

REGISTRATION STATEMENT ON FORM S-4, PROXY STATEMENT/PROSPECTUS AND

ANY OTHER RELEVANT DOCUMENTS THAT ARE OR MAY BE FILED WITH THE SEC,

AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS,

CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY DO AND WILL CONTAIN

IMPORTANT INFORMATION ABOUT ARCA, ORUKA, THE PROPOSED TRANSACTIONS

AND RELATED MATTERS. Investors and stockholders can obtain free

copies of the proxy statement/prospectus and other documents filed

by ARCA with the SEC through the website maintained by the SEC at

www.sec.gov. Stockholders are urged to read the proxy

statement/prospectus and the other relevant materials filed with

the SEC before making any voting or investment decision with

respect to the Proposed Transactions. In addition, investors and

stockholders should note that ARCA communicates with investors and

the public using its website (https://arcabio.com/investors/).

Participants in the

Solicitation

ARCA, Oruka and their respective directors and

executive officers may be deemed to be participants in the

solicitation of proxies from stockholders in connection with the

Proposed Transactions. Information about ARCA’s directors and

executive officers including a description of their interests in

ARCA is included in the proxy statement/prospectus relating to the

Proposed Transactions and ARCA’s most recent Annual Report on

Form 10-K, including any information incorporated therein

by reference, each as filed with the SEC. Information about ARCA’s

and Oruka’s respective directors and executive officers and their

interests in the Proposed Transactions is included in the proxy

statement/prospectus relating to the Proposed Transactions filed

with the SEC.

ARCA biopharma Investor & Media

Contact:

Jeff Dekker720.940.2122ir@arcabio.com

Oruka Therapeutics Investor Relations

Contact:

Alan Lada650.606.7911Alan.lada@orukatx.com

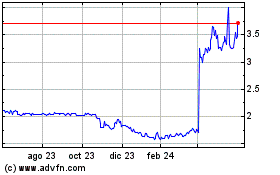

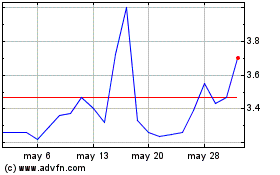

ARCA Biopharma (NASDAQ:ABIO)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

ARCA Biopharma (NASDAQ:ABIO)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024