false

0001621832

0001621832

2024-08-05

2024-08-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 5, 2024

AQUA METALS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

001-37515

|

47-1169572

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification Number)

|

|

5370 Kietzke Lane, Suite 201

|

|

Reno, Nevada 89511

|

|

(Address of principal executive offices)

|

|

(775) 446-4418

|

|

(Registrant’s telephone number, including area code)

|

|

(Former name or former address, if changed since last report)

|

Securities registered pursuant to Section 12(b)of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock: Par value $.001

|

AQMS

|

Nasdaq Capital Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions.

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14d-2(b)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On August 5, 2024 Aqua Metals, Inc. issued a press release announcing its operational and financial results for the Second quarter of 2024. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. The press release shall be deemed furnished, not filed, for purposes of this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

The following exhibits are being filed herewith:

|

Exhibits

|

Description

|

|

99.1

|

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

AQUA METALS, INC.

|

|

| |

|

|

|

Dated: August 5, 2024

|

/s/ Judd Merrill

|

|

| |

Judd Merrill

|

|

| |

Chief Financial Officer

|

|

Exhibit 99.1

Aqua Metals Announces Continued Progress on Sierra ARC Buildout and Ongoing Efforts to Finance Remainder of Construction and Commissioning

Company continues to pursue financing for Sierra ARC through commissioning, impacted by further dips in battery minerals pricing;

Deploys cash preservation initiatives, and extends pilot operations to support continued strategic partner development

RENO, Nev., August 5, 2024 – Aqua Metals, Inc. (NASDAQ: AQMS), a pioneer in sustainable lithium battery recycling, today provided an update on its progress and strategic initiatives.

Development of its first commercial scale black mass recycling facility, the Sierra ARC, has progressed throughout Q2, including completion of a five megawatt upgrade of utility power, installation of switchgear, steel superstructures, equipment platform with two overhead cranes, as well as equipment deliveries, including tanks, evaporation systems, controls systems, and other key equipment.

To complete the Sierra ARC, the Company will need additional financing. In May 2024, Aqua Metals announced the signing of a non-binding term sheet with one of the world’s largest privately held companies for a secured credit facility of up to $33 million. However, the Company was recently advised by the lender that it was suspending further activity with regard to the secured credit facility due to continued high interest rates and recent declines in the market price for lithium-ion minerals, including an over 25% drop in lithium carbonate pricing, since signing the term sheet. These factors raised concerns on the part of the lender regarding the ability of Aqua Metals to meet the lender’s proposed debt service covenants. This follows two months of rigorous due diligence by the lender, which management believes satisfied the lender’s inquiries into the Company’s technology, processes, supply and offtake chain and overall effectiveness of the ability to recycle black mass. Management intends to maintain communications with the lender in the hopes of resuming negotiations in the event of declining interest rates and/or rising mineral prices. Simultaneously, management continues to actively pursue the required funding through various other engagements with funding counterparties, including debt, project finance, joint venture and strategic investment options.

The Company also announced that due to the delay in funding, it has completed a reduction in force of personnel hired largely in expectation of securing the required funding for the completion of the Sierra ARC and commencement of operations. The Company however does not expect the reduction in force to materially impact its current pilot operations or continuing research and development. Although the Sierra ARC continues to be at or under budget to date, attributable to both the benefits of piloting Li AquaRefining™ technology in 2022 and 2023 and the disciplined approach to procurement and build, the timeline is now shifting into 2025 compared to the previously planned late 2024 commissioning. Management believes that the reduction in force, coupled with non-essential asset disposition, deferral of certain expenses and more standard equipment leasing, will provide approximately one year of cash runway with no other sources of cash.

Second Quarter Highlights:

| |

1.

|

Advancements at the Sierra ARC

|

The Sierra ARC facility has surpassed numerous milestones, including the completion of floor reinforcement, equipment foundations, electric utility and switchgear upgrades, and mezzanine installation with overhead cranes. We have begun receiving and installing the initial equipment including, tanks, chillers, evaporators, and controls with testing underway.

| |

2.

|

Pilot Facility Operations

|

The pilot facility has been consistently operating 24x5, showcasing the scalability and efficiency of Aqua Metals' AquaRefining™ technology. We believe these operations provide critical process validation data as a part of due diligence conducted by financing counterparties.

| |

3.

|

Successful Capital Raise

|

Aqua Metals completed an $7.3 million net funding round, reflecting continued investor confidence in the company’s technology and business plan.

Looking Ahead

As Aqua Metals moves forward into the latter half of 2024, the company is focused on achieving several strategic objectives:

| |

●

|

Continued engagement with counterparties to finance the remainder of the Sierra ARC build in a way that does not require overburdened debt service. This includes project finance, strategic financial and/or industry investments.

|

| |

●

|

Continued Equipment Provisioning at the Sierra ARC:. Upon successful completion of the financing efforts, the company is in a position to move quickly to complete the remaining mechanical, electrical, plumbing, process equipment installs within 2 to 3 quarters and commence commissioning and scaling.

|

| |

●

|

Expanding Strategic Partnerships: Aqua Metals continues to explore and solidify partnerships that enhance its supply chain and expand its market presence. Collaborations with announced industry leaders like 6K Energy, Dragonfly Energy, and Yulho Materials as well as further developing unannounced partners are pivotal to the company’s strategy.

|

| |

●

|

Continued Pilot Operations: The Company intends to continue operations of its pilot facility at the Innovation Center and produce battery grade materials for existing and prospective industry partners. The Company believes that continued pilot operations will also serve as an ongoing operating showcase of low cost, decarbonized, sodium sulfate free, safe and clean working environment in contrast to smelting and other hydrometallurgical methods.

|

Conference Call and Webcast

The Company will hold a conference call to discuss results and corporate developments today at 4:30 p.m. ET. Investors can access the live conference call at https://event.webcasts.com/aqms or from the investor relations section of the Company’s website at https://ir.aquametals.com/. Alternatively, interested parties can access the audio call by dialing 877-407-9708 (toll-free) or 201-689-8259 (international).

Following the conclusion of the live event, a replay will be available by dialing 877-660-6853 or 201-612-7415 and using passcode 13748295. The webcast replay will also be available in the “News / Events” section of the Aqua Metals website.

About Aqua Metals

Aqua Metals, Inc. (NASDAQ: AQMS) is reinventing metals recycling with its patented AquaRefining™ technology. The Company is pioneering a sustainable recycling solution for materials strategic to energy storage and electric vehicle manufacturing supply chains. AquaRefining™ is a low-emissions, closed-loop recycling technology that replaces polluting furnaces and hazardous chemicals with electricity-powered electroplating to recover valuable metals and materials from spent batteries with higher purity, lower emissions, and minimal waste. Aqua Metals is based in Reno, NV and operates the first sustainable lithium battery recycling facility at the Company’s Innovation Center in the Tahoe-Reno Industrial Center. To learn more, please visit www.aquametals.com.

Aqua Metals Social Media

Aqua Metals has used, and intends to continue using, its investor relations website (https://ir.aquametals.com), in addition to its Twitter, Threads, LinkedIn and YouTube accounts at https://twitter.com/AquaMetalsInc (@AquaMetalsInc), https://www.threads.net/@aquametalsinc (@aquametalsinc), https://www.linkedin.com/company/aqua-metals-limited and https://www.youtube.com/@AquaMetals respectively, as means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

Safe Harbor

This press release contains forward-looking statements concerning Aqua Metals, Inc. Forward-looking statements include, but are not limited to, our plans, objectives, expectations and intentions and other statements that contain words such as "expects," "contemplates," "anticipates," "plans," "intends," "believes", "estimates", "potential" and variations of such words or similar expressions that convey the uncertainty of future events or outcomes, or that do not relate to historical matters. The forward-looking statements in this press release include our expectations for our pilot and commercial-scale recycling plants, our ability to recycle lithium-ion batteries and the expected benefits of recycling lithium-ion batteries. Those forward-looking statements involve known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially. Among those factors are: (1) the risk that we may not be able to successfully negotiate and conclude a definitive license agreement with Yulho or a definitive pilot facility agreement with 6K, (2) even if we are to conclude definitive agreements with Yulho and/or 6K, the risk that we may not achieve the expected benefits from such relationships; (3) the risk that we may not be able to acquire the funding necessary to develop our recently acquired five-acre campus; (4) the risk that we may not be able to develop the recycling facility on the five-acre campus within the expected time or at all; (5) even if we are able to develop the recycling facility, the risk that we may not realize the expected benefits; (6) the risk that potential licensees may refuse or be slow to adopt our AquaRefining process as an alternative in spite of the perceived benefits of AquaRefining; (7) the risk that we may not realize the expected economic benefits from any licenses we may enter into; and (8) those risks disclosed in the section "Risk Factors" are included in our Annual Report on Form 10-K filed on March 28, 2024. Aqua Metals cautions readers not to place undue reliance on any forward-looking statements. The Company does not undertake and specifically disclaims any obligation to update or revise such statements to reflect new circumstances or unanticipated events as they occur, except as required by law.

Contact Information

Investor Relations

Bob Meyers & Rob Fink

FNK IR

646-878-9204

aqms@fnkir.com

Media

David Regan

Aqua Metals

775-446-5398

david.regan@aquametals.com

Source: Aqua Metals

AQUA METALS, INC.

Condensed Consolidated Balance Sheets - Unaudited

(in thousands, except share and per share amounts)

| |

|

June 30, 2024

|

|

|

December 31, 2023

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

7,833 |

|

|

$ |

16,522 |

|

|

Note receivable - LINICO

|

|

|

400 |

|

|

|

600 |

|

|

Accounts receivable

|

|

|

— |

|

|

|

67 |

|

|

Inventory

|

|

|

908 |

|

|

|

929 |

|

|

Prepaid expenses and other current assets

|

|

|

174 |

|

|

|

181 |

|

|

Total current assets

|

|

|

9,315 |

|

|

|

18,299 |

|

| |

|

|

|

|

|

|

|

|

|

Non-current assets

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net

|

|

|

17,009 |

|

|

|

10,347 |

|

|

Intellectual property, net

|

|

|

191 |

|

|

|

281 |

|

|

Other assets

|

|

|

7,706 |

|

|

|

4,673 |

|

|

Total non-current assets

|

|

|

24,906 |

|

|

|

15,301 |

|

| |

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

34,221 |

|

|

$ |

33,600 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

1,679 |

|

|

$ |

1,836 |

|

|

Accrued expenses

|

|

|

2,908 |

|

|

|

2,467 |

|

|

Lease liability, current portion

|

|

|

288 |

|

|

|

275 |

|

|

Note payable, current portion

|

|

|

2,979 |

|

|

|

35 |

|

|

Total current liabilities

|

|

|

7,854 |

|

|

|

4,613 |

|

| |

|

|

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

|

|

|

|

|

|

|

Lease liability, non-current portion

|

|

|

593 |

|

|

|

— |

|

|

Note payable, non-current portion

|

|

|

— |

|

|

|

2,923 |

|

|

Total liabilities

|

|

|

8,447 |

|

|

|

7,536 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies (see Note 12)

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity

|

|

|

|

|

|

|

|

|

|

Common stock; $0.001 par value; 300,000,000 shares authorized; 134,257,193 and 133,800,547, shares issued and outstanding as of June 30, 2024, respectively and 108,308,661 and 107,880,095, shares issued and outstanding as of December 31, 2023, respectively

|

|

|

134 |

|

|

|

108 |

|

|

Additional paid-in capital

|

|

|

260,554 |

|

|

|

249,687 |

|

|

Accumulated deficit

|

|

|

(234,554 |

) |

|

|

(223,215 |

) |

|

Treasury stock, at cost; common shares: 456,646 and 428,566 as of June 30, 2024 and December 31, 2023, respectively

|

|

|

(360 |

) |

|

|

(516 |

) |

|

Total stockholders’ equity

|

|

|

25,774 |

|

|

|

26,064 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity

|

|

$ |

34,221 |

|

|

$ |

33,600 |

|

AQUA METALS, INC.

Condensed Consolidated Statements of Operations - Unaudited

(in thousands, except share and per share amounts)

(Unaudited)

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating cost and expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Plant operations

|

|

$ |

2,373 |

|

|

$ |

1,481 |

|

|

$ |

4,582 |

|

|

$ |

2,546 |

|

|

Research and development cost

|

|

|

363 |

|

|

|

525 |

|

|

|

951 |

|

|

|

970 |

|

|

Gain on disposal of property, plant and equipment

|

|

|

— |

|

|

|

(3 |

) |

|

|

— |

|

|

|

(23 |

) |

|

General and administrative expense

|

|

|

2,863 |

|

|

|

2,849 |

|

|

|

5,858 |

|

|

|

5,855 |

|

|

Total operating expense

|

|

|

5,599 |

|

|

|

4,852 |

|

|

|

11,391 |

|

|

|

9,348 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

|

(5,599 |

) |

|

|

(4,852 |

) |

|

|

(11,391 |

) |

|

|

(9,348 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income and (expense)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(84 |

) |

|

|

(255 |

) |

|

|

(190 |

) |

|

|

(431 |

) |

|

Interest and other income

|

|

|

99 |

|

|

|

348 |

|

|

|

245 |

|

|

|

414 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total other income (expense), net

|

|

|

15 |

|

|

|

93 |

|

|

|

55 |

|

|

|

(17 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income tax expense

|

|

|

(5,584 |

) |

|

|

(4,759 |

) |

|

|

(11,336 |

) |

|

|

(9,365 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense

|

|

|

3 |

|

|

|

— |

|

|

|

3 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(5,587 |

) |

|

$ |

(4,759 |

) |

|

$ |

(11,339 |

) |

|

$ |

(9,365 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding, basic and diluted

|

|

|

123,793,140 |

|

|

|

84,184,884 |

|

|

|

116,923,889 |

|

|

|

82,743,345 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share

|

|

$ |

(0.05 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.11 |

) |

v3.24.2.u1

Document And Entity Information

|

Aug. 05, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

AQUA METALS, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 05, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-37515

|

| Entity, Tax Identification Number |

47-1169572

|

| Entity, Address, Address Line One |

5370 Kietzke Lane, Suite 201

|

| Entity, Address, City or Town |

Reno

|

| Entity, Address, State or Province |

NV

|

| Entity, Address, Postal Zip Code |

89511

|

| City Area Code |

775

|

| Local Phone Number |

446-4418

|

| Title of 12(b) Security |

Common stock

|

| Trading Symbol |

AQMS

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001621832

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

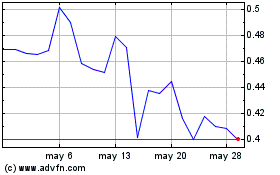

Aqua Metals (NASDAQ:AQMS)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Aqua Metals (NASDAQ:AQMS)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025