Aura Biosciences, Inc. (NASDAQ: AURA), a clinical-stage

biotechnology company developing precision immunotherapies to treat

solid tumors designed to preserve the function of the organ with

cancer, today reported financial results for the first quarter

ended March 31, 2024, and provided recent business highlights.

“Throughout the first quarter of 2024, the

Company made significant progress across our ocular and urologic

oncology therapeutic area programs,” said Elisabet de los Pinos,

Ph.D., Chief Executive Officer of Aura. “Enrollment continues in

our global Phase 3 CoMpass trial in early-stage choroidal melanoma,

and we expect early Phase 1 data from our bladder cancer trial

mid-2024. Aura is committed to changing the treatment paradigms in

ocular and urologic oncology, both areas where patients desperately

need novel therapies that can effectively treat the tumor and also

preserve the function of the organ with cancer.”

Recent Pipeline

Developments

Enrollment continues in global Phase 3

CoMpass trial for the treatment of small choroidal melanoma and

indeterminate lesions.

- The CoMpass trial continues to

progress in the United States with additional site activations and

a strong endorsement from the ocular oncology community. This trial

has a global enrollment target of approximately 100 patients.

- CoMpass is a global, Phase 3,

randomized, superiority trial evaluating bel-sar treatment against

a sham control arm. Adult participants will be randomized 2:1:2 to

undergo three cycles of treatment with either a high or low dose of

bel-sar or to receive a sham control. The primary endpoint is time

to tumor progression at 15 months of follow-up, as agreed upon with

the United States Food and Drug Administration (FDA) under a

Special Protocol Assessment (SPA).

Bel-sar is being explored for additional ocular oncology

indications.

In addition to early-stage choroidal melanoma,

bel-sar is also being explored for choroidal metastasis and cancers

of the ocular surface. These three ocular oncology indications have

a collective incidence greater than 60,000 patients annually in the

United States and Europe.

Choroidal Metastasis The Company’s plan is to

initiate clinical development in choroidal metastasis, an

indication with a high unmet medical need and no drugs approved.

Choroidal metastasis is the second potential ocular oncology

indication for bel-sar, affecting approximately 20,000 patients in

the United States and Europe annually. The Company is on track to

initiate a Phase 2 trial in 2024.

Cancers of the Ocular SurfaceCancers of the ocular surface is

the Company’s third potential ocular oncology indication affecting

approximately 35,000 patients in the United States and Europe

annually. Positive preclinical data evaluating bel-sar in this

indication were presented at the Association for Research in Vision

and Ophthalmology (ARVO) 2024 Annual Meeting.

These preclinical data demonstrate that binding

of bel-sar was consistent across all conjunctival melanoma cell

lines tested which included both primary and recurrent cell lines.

The mechanism of action was also consistent with prior preclinical

data presented by the Company demonstrating that bel-sar induced

immunogenic cell death, which was characterized by enhanced

exposure of damaged associated molecular patterns (DAMPs) and

engulfment by THP1-derived macrophages. We believe these recent

preclinical data further support clinical development of bel-sar in

cancers of the ocular surface.

A Phase 1 trial of bel-sar for the

treatment of non-muscle invasive bladder cancer (NMIBC) and muscle

invasive bladder cancer (MIBC) is currently ongoing, with early

data expected in mid-2024.

NMIBC and MIBC represent an area of high unmet

need with approximately 80,000 patients diagnosed in the United

States annually. We believe bel-sar has the potential to

selectively treat and induce a tissue and tumor specific immune

response to prevent disease progression and recurrence while

allowing the patients to be treated in the office by urologists and

potentially avoiding the need for surgery. The Company received

Fast Track designation from the Oncology Division of the FDA for

NMIBC in June 2022.

- The ongoing Phase 1 multi-center,

open-label clinical trial is expected to enroll approximately 21

adult patients. The trial is designed to assess the safety and

feasibility of bel-sar as a monotherapy. The trial includes

histopathological evaluation after local treatment to assess

bel-sar’s biological activity, including the evaluation of focal

necrosis and immune activation.

- Preliminary data from the first

patient in the light activated cohort of the trial demonstrated a

clinical complete response demonstrated by absence of cancer cells

on histopathology with evidence of extensive necrosis and immune

activation after a single administration of bel-sar followed by

light activation.

- Phase 1 trial continues to enroll,

with early data expected mid-2024.

Recent Corporate Events

Strengthened leadership team with appointment of Conor

Kilroy as General Counsel and Secretary.

- Mr. Kilroy previously served as

general counsel and secretary at Neurogastrx, Inc. and Ironwood

Pharmaceuticals, Inc., among other roles. He brings years of legal

experience in the biopharmaceutical industry across clinical and

commercial stage organizations.

First Quarter 2024 Financial

Results

- As of March 31, 2024, Aura had cash

and cash equivalents and marketable securities totaling $202.9

million. The Company believes its current cash and cash equivalents

and marketable securities are sufficient to fund its operations

into the second half of 2026.

- Research and development expenses

increased to $17.1 million for the three months ended March 31,

2024 from $14.4 million for the three months ended March 31, 2023,

primarily due to ongoing clinical costs related to the progression

of our Phase 2 study of bel-sar in early-stage choroidal melanoma

and contract research organization costs associated with the

advancement of our Phase 3 trial of bel-sar in early-stage

choroidal melanoma and higher personnel expenses related to growth

of our Company.

- General and administrative expenses

increased to $5.3 million for the three months ended March 31, 2024

from $5.0 million for the three months ended March 31, 2023.

General and administrative expenses include $1.4 million and $1.1

million of stock-based compensation for the three months ended

March 31, 2024 and 2023, respectively. The increase was primarily

driven by personnel expenses, as well as increases in general

corporate expenses related to the growth of our Company.

- Net loss for the three months ended

March 31, 2024 was $19.7 million compared to $17.5 million for the

three months ended March 31, 2023.

About Aura Biosciences

Aura Biosciences is a clinical-stage

biotechnology company developing precision immunotherapies to treat

solid tumors designed to preserve the function of the organ with

cancer. Our lead candidate bel-sar is in late-stage clinical

development for the treatment of patients with primary choroidal

melanoma, and other ocular oncology indications as well as in

early-stage clinical development in bladder cancer. We are

evaluating the safety and efficacy of bel-sar as a potential

vision-sparing therapy in an ongoing global Phase 3 CoMpass trial

for the first-line treatment of adult patients with early-stage

choroidal melanoma. Bel-sar is also being evaluated in additional

solid cancers, including bladder cancer. Our mission is to develop

vision and organ-sparing therapies to improve patient outcomes in

cancer. Aura is headquartered in Boston, MA. For more information,

visit aurabiosciences.com. Visit us @AuraBiosciences and on

LinkedIn.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995, as amended, and other federal securities laws.

Any statements that are not statements of historical fact may be

deemed to be forward looking statements. Words such as “may,”

“will,” “could,” “should,” “expects,” “intends,” “plans,”

“anticipates,” “believes,” “estimates,” “predicts,” “projects,”

“seeks,” “endeavor,” “potential,” “continue” or the negative of

such words or other similar expressions that can be used to

identify forward-looking statements. These forward looking

statements include express or implied statements regarding Aura’s

future expectations, plans and prospects, including, without

limitation, statements regarding the therapeutic potential of

bel-sar for the treatment of cancers including choroidal melanoma,

bladder cancer, choroidal metastasis and cancers of the ocular

surface; statements regarding the Company’s expectations for the

Phase 2 and Phase 3 clinical trials of bel-sar for small choroidal

melanoma and indeterminate lesions, the Phase 1 trial of bel-sar

for NMIBC and MIBC and the clinical development of bel-sar in

choroidal metastasis and cancers of the ocular surface; statements

regarding the Company’s expectations for an improved quality of

life of patients after treatment with bel-sar; statements regarding

the Company’s expectations for a potential paradigm shift in the

approach to the treatment of choroidal melanoma; statements

regarding the Company’s beliefs and expectations for the urgent

need for a targeted therapy in ocular and urologic oncology to

preserve the function of the organ with cancer; and statements

regarding the Company’s expectations for the estimated patient

populations and related market opportunities for bel-sar.

The forward-looking statements in this press

release are neither promises nor guarantees, and investors should

not place undue reliance on these forward-looking statements

because they involve known and unknown risks, uncertainties and

other factors, many of which are beyond Aura’s control and which

could cause actual results to differ materially from those

expressed or implied by these forward-looking statements,

including, without limitation, uncertainties inherent in clinical

trials and in the availability and timing of data from ongoing

clinical trials; the expected timing for submissions for regulatory

approval or review by governmental authorities; the risk that the

results of Aura’s preclinical and clinical trials may not be

predictive of future results in connection with future clinical

trials; the risk that interim data from ongoing clinical trials may

not be predictive of final data from completed clinical trials; the

risk that governmental authorities may disagree with Aura’s

clinical trial designs, even where Aura has obtained agreement with

governmental authorities on the design of such trials, such as the

Phase 3 SPA agreement with the FDA; whether Aura will receive

regulatory approvals to conduct trials or to market products;

whether Aura’s cash resources will be sufficient to fund its

foreseeable and unforeseeable operating expenses and capital

expenditure requirements; Aura’s ongoing and planned preclinical

activities; and Aura’s ability to initiate, enroll, conduct or

complete ongoing and planned clinical trials. These risks,

uncertainties and other factors include those risks and

uncertainties described under the heading “Risk Factors” in Aura’s

most recent Annual Report on Form 10-K and Quarterly Report on Form

10-Q filed with the United States Securities and Exchange

Commission (SEC) and in subsequent filings made by Aura with the

SEC, which are available on the SEC’s website at www.sec.gov.

Except as required by law, Aura disclaims any intention or

responsibility for updating or revising any forward-looking

statements contained in this press release in the event of new

information, future developments or otherwise. These

forward-looking statements are based on Aura’s current expectations

and speak only as of the date hereof and no representations or

warranties (express or implied) are made about the accuracy of any

such forward-looking statements.

Investor and Media Contact:

Alex DasallaHead of Investor Relations and

Corporate CommunicationsIR@aurabiosciences.com

|

Aura Biosciences, Inc.Condensed

Consolidated Statement of Operations and Comprehensive

Loss(Unaudited)(in thousands,

except share and per share amounts) |

|

|

|

|

|

|

|

|

Three Months

EndedMarch 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

Operating Expenses: |

|

|

|

|

|

|

|

Research and development |

|

$ |

17,052 |

|

|

$ |

14,405 |

|

|

General and administrative |

|

|

5,261 |

|

|

$ |

5,039 |

|

|

Total operating expenses |

|

|

22,313 |

|

|

|

19,444 |

|

| Total

operating loss |

|

|

(22,313 |

) |

|

|

(19,444 |

) |

| Other

income (expense): |

|

|

|

|

|

|

|

Interest income, including amortization and accretion income |

|

|

2,685 |

|

|

|

1,991 |

|

|

Other income (expense) |

|

|

(32 |

) |

|

|

(13 |

) |

| Total

other income |

|

|

2,653 |

|

|

|

1,978 |

|

| Loss

before income taxes |

|

|

(19,660 |

) |

|

|

(17,466 |

) |

|

Income tax benefit (provision), net |

|

|

(46 |

) |

|

|

— |

|

| Net

loss |

|

|

(19,706 |

) |

|

|

(17,466 |

) |

| Net loss

per common share—basic and diluted |

|

|

(0.40 |

) |

|

|

(0.46 |

) |

| Weighted

average common stock outstanding—basic and diluted |

|

|

49,451,943 |

|

|

|

37,784,282 |

|

|

Comprehensive loss: |

|

|

|

|

|

|

| Net

loss |

|

$ |

(19,706 |

) |

|

$ |

(17,466 |

) |

| Other

comprehensive items: |

|

|

|

|

|

|

|

Unrealized gain (loss) on marketable securities |

|

$ |

(521 |

) |

|

|

27 |

|

| Total

other comprehensive income (loss) |

|

|

(521 |

) |

|

|

27 |

|

| Total

comprehensive loss |

|

$ |

(20,227 |

) |

|

$ |

(17,439 |

) |

|

|

|

|

|

|

|

|

|

|

|

Aura Biosciences, Inc. Condensed

Consolidated Balance Sheets (Unaudited)

(in thousands, except share and per share

amounts) |

| |

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

Assets |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

26,279 |

|

|

$ |

41,063 |

|

|

Marketable securities |

|

|

176,595 |

|

|

|

185,087 |

|

|

Restricted cash and deposits |

|

|

— |

|

|

|

19 |

|

| Prepaid

expenses and other current assets |

|

|

9,375 |

|

|

|

5,625 |

|

| Total

current assets |

|

|

212,249 |

|

|

|

231,794 |

|

|

Restricted cash and deposits, net of current portion |

|

|

768 |

|

|

|

768 |

|

| Right of

use assets - operating lease |

|

|

18,501 |

|

|

|

18,854 |

|

| Other

long-term assets |

|

|

453 |

|

|

|

509 |

|

| Property

and equipment, net |

|

|

3,054 |

|

|

|

3,150 |

|

|

Total Assets |

|

$ |

235,025 |

|

|

$ |

255,075 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

| Accounts

payable |

|

|

1,933 |

|

|

|

1,787 |

|

|

Short-term operating lease liability |

|

|

2,741 |

|

|

|

2,687 |

|

| Accrued

expenses and other current liabilities |

|

|

4,989 |

|

|

|

7,883 |

|

| Total

current liabilities |

|

|

9,663 |

|

|

|

12,357 |

|

|

Long-term operating lease liability |

|

|

16,579 |

|

|

|

16,870 |

|

|

Total Liabilities |

|

|

26,242 |

|

|

|

29,227 |

|

|

Commitments and Contingencies |

|

|

|

|

|

|

|

Stockholders’ Equity: |

|

|

|

|

|

|

| Common

stock, $0.00001 par value, 150,000,000 authorized at March 31, 2024

and December 31, 2023, and 49,504,405 and 49,350,788 shares issued

and outstanding at March 31, 2024 and December 31, 2023,

respectively |

|

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

|

515,779 |

|

|

|

512,617 |

|

|

Accumulated deficit |

|

|

(307,014 |

) |

|

|

(287,308 |

) |

|

Accumulated other comprehensive loss |

|

|

18 |

|

|

|

539 |

|

|

Total Stockholders’ Equity |

|

|

208,783 |

|

|

|

225,848 |

|

|

Total Liabilities and Stockholders’ Equity |

|

$ |

235,025 |

|

|

$ |

255,075 |

|

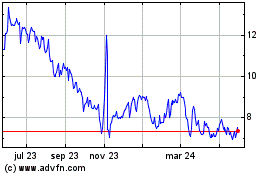

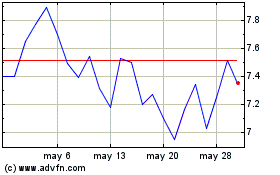

Aura Biosciences (NASDAQ:AURA)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Aura Biosciences (NASDAQ:AURA)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024