UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16

OF

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of May 2024

Commission

File Number: 001-40472

A2Z

SMART TECHNOLOGIES CORP.

(Registrant)

1600-609

Granville Street

Vancouver,

British Columbia V7Y 1C3 Canada

(Address

of Principal Executive Offices)

Indicate

by check mark whether the Registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Exhibit

99.1 and Exhibit 99.2 are hereby incorporated by reference into the registrant’s Registration Statement on Form F-3

(File No. 333-271226), to be a part thereof from the date on which this report is submitted, to the extent not superseded by documents

or reports subsequently filed or furnished.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

A2Z

SMART TECHNOLOGIES CORP. |

| |

(Registrant) |

| |

|

|

| Date

May 15, 2024 |

By |

/s/

Gadi Graus |

| |

|

Gadi

Graus |

| |

|

Chief

Executive Officer |

EXHIBIT

INDEX

Exhibit

99.1

A2Z

Smart Technologies Corp.

CONDENSED

CONSOLIDATED INTERIM

FINANCIAL

STATEMENTS

FOR

THE THREE MONTHS ENDED

MARCH

31, 2024

(Unaudited)

(Expressed

in US Dollars)

A2Z

SMART TECHNOLOGIES CORP.

CONDENSED

CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR

THE THREE MONTHS ENDED MARCH 31, 2024

(Unaudited)

(Expressed

in US Dollars)

INDEX

A2Z

SMART TECHNOLOGIES CORP.

CONDENSED

CONSOLIDATED INTERIM STATEMENTS OF FINANCIAL POSITION

(Unaudited)

(Expressed

in Thousands of US Dollars, except per share data)

| | |

As

at March

31, 2024 | | |

As

at December

31, 2023 | |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash

equivalents | |

$ | 480 | | |

$ | 2,267 | |

| Restricted cash | |

| 76 | | |

| 77 | |

| Inventories | |

| 246 | | |

| 250 | |

| Trade receivables, net | |

| 1,772 | | |

| 1,477 | |

| Other

accounts receivable | |

| 582 | | |

| 660 | |

| Total

current assets | |

| 3,156 | | |

| 4,731 | |

| Non-current assets | |

| | | |

| | |

| Intangible asset - patent,

net | |

| 1,819 | | |

| 1,850 | |

| Investment in associate | |

| 75 | | |

| 77 | |

| Property,

plant and equipment, net | |

| 1,728 | | |

| 1,861 | |

| Total

non-current assets | |

| 3,622 | | |

| 3,788 | |

| | |

| | | |

| | |

| Total

Assets | |

$ | 6,778 | | |

$ | 8,519 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’

DEFICIT | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Short term loan and current

portion of long-term loans | |

$ | 1,194 | | |

$ | 1,166 | |

| Lease liability | |

| 168 | | |

| 190 | |

| Trade payables | |

| 1,696 | | |

| 1,742 | |

| Other

accounts payable | |

| 3,256 | | |

| 2,534 | |

| Total

current liabilities | |

| 6,314 | | |

| 5,632 | |

| Non-current liabilities | |

| | | |

| | |

| Lease liability | |

| 357 | | |

| 410 | |

| Long term loans | |

| 198 | | |

| 228 | |

| Provision | |

| - | | |

| 1,362 | |

| Warrant

Liability (note 3) | |

| 673 | | |

| 3,075 | |

| Severance

payment, net | |

| 120 | | |

| 121 | |

| Total

non-current liabilities | |

| 1,348 | | |

| 5,196 | |

| Total

liabilities | |

| 7,662 | | |

| 10,828 | |

| Shareholders’

deficit (note 4) | |

| | | |

| | |

| Share capital and additional paid in capital | |

| 57,998 | | |

| 55,485 | |

| Warrant Reserve | |

| 30,863 | | |

| 30,863 | |

| Accumulated other comprehensive loss | |

| (2,022 | ) | |

| (1,330 | ) |

| Transaction with non-controlling interests | |

| 927 | | |

| 927 | |

| Accumulated deficit | |

| (83,289 | ) | |

| (83,456 | ) |

| | |

| 4,477 | | |

| 2,489 | |

| Non-controlling interest | |

| (5,361 | ) | |

| (4,798 | ) |

| Total shareholders’ deficit | |

| (884 | ) | |

| (2,309 | ) |

| Total

liabilities and shareholders’ deficit | |

$ | 6,778 | | |

$ | 8,519 | |

| May

15, 2024 |

|

“Yonathan

De Yonge” |

|

“Gadi

Graus” |

| Date

of approval of the financial statements |

|

Yonathan

De Yonge - Director |

|

Gadi

Graus

Chief

Executive Officer |

The

accompanying notes are an integral part of these condensed consolidated interim financial statements.

A2Z

SMART TECHNOLOGIES CORP.

CONDENSED

CONSOLIDATED INTERIM STATEMENTS OF LOSS AND COMPREHENSIVE LOSS

(Unaudited)

(Expressed

in Thousands of US Dollars, except per share data)

| | |

For

the period of three Months Ended March

31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Revenues

(note 6) | |

$ | 1,697 | | |

$ | 4,608 | |

| Cost of revenues | |

| 1,370 | | |

| 3,587 | |

| Gross profit | |

| 327 | | |

| 1,021 | |

| | |

| | | |

| | |

| Expenses: | |

| | | |

| | |

| Research and development

costs | |

| 1,235 | | |

| 1,023 | |

| Sales and marketing costs | |

| 311 | | |

| 123 | |

| General

and administration expenses | |

| 2,503 | | |

| 3,905 | |

| Operating loss | |

| (3,722 | ) | |

| (4,030 | ) |

| | |

| | | |

| | |

| Gain on

revaluation of warrant liability (note 4) | |

| 3,354 | | |

| 405 | |

| Financial income | |

| 23 | | |

| 22 | |

| Financial

expenses | |

| (51) | | |

| (240 | ) |

| Loss

before taxes on income | |

| (396 | ) | |

| (3,843 | ) |

| Income

tax expense | |

| - | | |

| - | |

| Net

loss for the period | |

| (396 | ) | |

| (3,843 | ) |

| | |

| | | |

| | |

| Less:

Net loss attributable to non-controlling interests | |

| (563 | ) | |

| (270 | ) |

| Net

profit (loss) attributable to controlling shareholders | |

| 167 | | |

| (3,573 | ) |

| | |

| (396 | ) | |

| (3,843 | ) |

| Other

comprehensive loss | |

| | | |

| | |

| Item

that will not be reclassified to profit or loss: | |

| | | |

| | |

| Adjustments

arising from translating financial statements of foreign operations | |

| (692 | ) | |

| (349 | ) |

| Other

comprehensive loss | |

| (692 | ) | |

| (349 | ) |

| | |

| | | |

| | |

| Total

comprehensive loss for the period | |

$ | (1,088 | ) | |

$ | (4,192 | ) |

| | |

| | | |

| | |

| Net

profit (loss) attributable to controlling shareholders | |

$ | 167 | | |

$ | (3,573 | ) |

| Basic

and diluted profit (loss) per share | |

$ | 0.004 | | |

$ | *(0.12 | ) |

| Weighted

average number of shares outstanding | |

| 40,852,782 | | |

| 31,302,034 | |

(*)

The company restated its presentation of basic and diluted loss per share for the three months ended March 31, 2023 due to an immaterial

error from (0.11) basic and diluted loss per share to (0.12) basic and diluted loss per share.

The

accompanying notes are an integral part of these condensed consolidated interim financial statements.

A2Z

SMART TECHNOLOGIES CORP.

CONDENSED

CONSOLIDATED INTERIM STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (DEFICIT)

(Unaudited)

(Expressed

in Thousands of US Dollars, except per share data)

| | |

Ordinary

share capital | | |

| | |

Accumulated | | |

Transactions | | |

| | |

| | |

| |

| | |

Number

of shares | | |

Additional

paid in capital | | |

Warrant

reserve | | |

Other Comprehensive

Loss | | |

with non-controlling

interests | | |

Accumulated

deficit | | |

Non-controlling

interest | | |

Total

shareholders’

deficit | |

| Balance - January 1, 2024 | |

| 38,399,440 | | |

$ | 55,485 | | |

$ | 30,863 | | |

$ | (1,330 | ) | |

$ | 927 | | |

$ | (83,456 | ) | |

$ | (4,798 | ) | |

$ | (2,309 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net profit (loss) for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 167 | | |

| (563 | ) | |

| (396 | ) |

| Remeasurement loss from defined benefit plans | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Adjustments arising

from translating financial statements of foreign operations | |

| - | | |

| - | | |

| - | | |

| (692 | ) | |

| - | | |

| - | | |

| - | | |

| (692 | ) |

Net comprehensive

profit (loss) for the period | |

| - | | |

| - | | |

| - | | |

| (692 | ) | |

| - | | |

| 167 | | |

| (563 | ) | |

| (1,088 | ) |

| Issuance of share in January

2024 private placement (note 4(b)) | |

| 2,806,302 | | |

| 2,022 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,022 | |

| Share based compensation | |

| | | |

| 491 | | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 491 | |

| Balance - March 31,

2024 | |

| 41,205,742 | | |

$ | 57,998 | | |

$ | 30,863 | | |

$ | (2,022 | ) | |

$ | 927 | | |

$ | (83,289 | ) | |

$ | (5,361 | ) | |

$ | (884 | ) |

The

accompanying notes are an integral part of these condensed consolidated interim financial statements.

A2Z

SMART TECHNOLOGIES CORP.

CONDENSED

CONSOLIDATED INTERIM STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (DEFICIT)

(Unaudited)

(Expressed

in Thousands of US Dollars, except per share data)

| | |

Ordinary

share capital | | |

| | |

Accumulated | | |

| | |

| | |

| |

| | |

Number

of shares | | |

Additional

paid in capital | | |

Warrant

reserve | | |

Other

Comprehensive Loss | | |

Accumulated

deficit | | |

Non-controlling

interest | | |

Total

shareholders’ equity | |

| Balance - January 1, 2023 | |

| 30,945,322 | | |

$ | 43,452 | | |

$ | 30,863 | | |

$ | (1,634 | ) | |

$ | (67,395 | ) | |

$ | (2,397 | ) | |

$ | 2,889 | |

| Net loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| (3,573 | ) | |

| (270 | ) | |

| (3,843 | ) |

| Adjustments arising

from translating financial statements of foreign operations | |

| - | | |

| - | | |

| - | | |

| (349 | ) | |

| - | | |

| - | | |

| (349 | ) |

| Net comprehensive loss

for the period | |

| - | | |

| - | | |

| - | | |

| (349 | ) | |

| (3,573 | ) | |

| (270 | ) | |

| (4,192 | ) |

| Issuance of shares in private placement | |

| 1,783,561 | | |

| 2,233 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,233 | |

| Share based compensation | |

| - | | |

| 1,529 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,529 | |

| Balance

- March 31, 2023 | |

| 32,728,883 | | |

$ | 47,214 | | |

$ | 30,863 | | |

$ | (1,983 | ) | |

$ | (70,968 | ) | |

$ | (2,667 | ) | |

$ | 2,459 | |

The

accompanying notes are an integral part of these condensed consolidated interim financial statements.

A2Z

SMART TECHNOLOGIES CORP.

CONDENSED

CONSOLIDATED INTERIM STATEMENTS OF CASH FLOWS

(Unaudited)

(Expressed

in Thousands of US Dollars, except per share data)

| | |

For the period

of three months ended | |

| | |

March

31 | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Cash flows from operating

activities | |

| | | |

| | |

| Net loss for the period | |

$ | (396 | ) | |

$ | (3,843 | ) |

| Adjustments to reconcile net loss to net cash

provided by operating activities: | |

| | | |

| | |

| Amortization and depreciation | |

| 195 | | |

| 302 | |

| Share based compensation | |

| 491 | | |

| 1,529 | |

| Gain on revaluation

of warrant liability | |

| (3,354 | ) | |

| (405 | ) |

| Loss (gain) on revaluation

of provision | |

| - | | |

| 137 | |

| Change in severance

liability | |

| (1 | ) | |

| (1 | ) |

| Change in inventory | |

| 4 | | |

| (53 | ) |

| Change in trade receivables | |

| (295 | ) | |

| (199 | ) |

| Change in other account

receivables | |

| 78 | | |

| 304 | |

| Accrued interest on

loans and leases | |

| 7 | | |

| (24 | ) |

| Change in accounts payable | |

| (46 | ) | |

| 732 | |

| Change in deferred revenues | |

| - | | |

| (1,373 | ) |

| Change

in other accounts payable | |

| (584 | ) | |

| 413 | |

| | |

| (3,901 | ) | |

| (2,481 | ) |

| Cash flows from investing

activities | |

| | | |

| | |

| Restricted deposits | |

| - | | |

| 8 | |

| Purchase

of property, plant and equipment | |

| (31 | ) | |

| (14 | ) |

| | |

| (31 | ) | |

| (6 | ) |

| | |

| | | |

| | |

| Cash flows from financing

activities | |

| | | |

| | |

| Proceeds from issuance

of shares and warrants | |

| 2,189 | | |

| 2,696 | |

| Lease payments | |

| (84 | ) | |

| (71 | ) |

| Repayment of loans | |

| (46 | ) | |

| (166 | ) |

| Proceeds

from receipt of loans | |

| 46 | | |

| - | |

| | |

| 2,105 | | |

| 2,459 | |

| | |

| | | |

| | |

| Decrease in cash and

cash equivalents | |

| (1,827 | ) | |

| (28 | ) |

| Effect of changes in foreign exchange rates | |

| 40 | | |

| (316 | ) |

| Cash and cash equivalents

at beginning of period | |

| 2,267 | | |

| 2,616 | |

| | |

| | | |

| | |

| Cash and cash equivalents

at end of period | |

$ | 480 | | |

$ | 2,272 | |

| | |

| | | |

| | |

| Interest paid during the period | |

$ | 34 | | |

$ | 25 | |

The

accompanying notes are an integral part of these condensed consolidated interim financial statements.

A2Z

SMART TECHNOLOGIES CORP.

NOTES

TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(Unaudited)

(Expressed

in Thousands of US Dollars, except per share data)

NOTE

1 – NATURE AND CONTINUANCE OF OPERATIONS

A2Z

SMART TECHNOLOGIES CORP. (the “Company” or “A2ZST”) was incorporated on January 15, 2018 under the laws of British

Columbia. The head office is located at 1600 – 609 Granville Street, Vancouver, British Columbia V7Y 1C3, and the records and registered

office is located at 2200 HSBC Building 885 West Georgia Street, British Columbia, V6C 3E8.

The

Company was listed on the NASDAQ Stock Market LLC (“Nasdaq”) starting January 22, 2022, and trades under the symbol “AZ”.

The Company was listed on the TSX Venture Exchange (“TSX.V”) in Toronto until February 28, 2024. Following approval for a

voluntary delisting, the Company no longer trades on the TSX.V but remains a reporting issuer in Canada and its common shares remain

listed on Nasdaq.

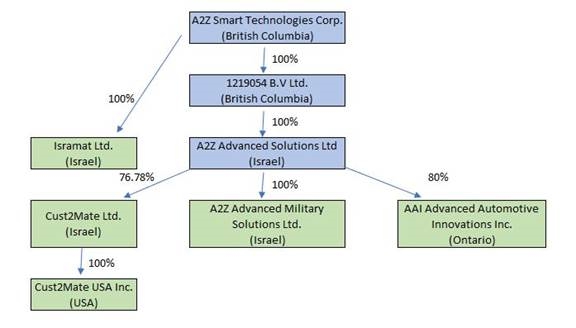

The

Company owns 76.78% of the common shares of Cust2Mate Ltd (“Cust2Mate”), a technology company focused on providing retail

automation solutions, in particular for large grocery stores and supermarkets. The Company’s primary product is the Cust2Mate system

which incorporates a “smart cart” which automatically calculates the value of the customers purchases in their smart cart,

without having to unload and reload their purchases at a customer checkout point.

The

Cust2Mate system offers various features for shoppers and retailers such as product information and location, an on-cart scale to weigh

items and automatically calculate costs, bar-code scanner and on-board payment system to bypass checkout lines. In addition, the product

includes big data smart algorithms and computer vision capabilities, allowing for customer specific targeted advertising. (“The

Cust2Mate Platform”).

The

Company’s other activities include the provision of services in the field of services to the military and security markets as well

as the development of related products for the civilian markets. Such services include providing maintenance services and container leasing.

The Company also provides maintenance services for complex electronic systems and products.

The

Company, through its 80% owned subsidiary, Advanced Automotive Innovations Inc., (“AAI”) continues the development of a product

for the automotive market - the FTICS or Fuel Tank Inertia Capsule System which activates automatically in the event of a vehicle collision.

This eliminates the danger of fuel tank combustion thereby saving lives and reducing damage.

As

of March 31, 2024, the Company had four key subsidiaries, all of which are companies incorporated under the laws of Israel: (1)

Cust2mate Ltd. (“Cust2mate”); (2) A2Z Advanced Military Solutions Ltd (“A2Z MS”); (3) A2Z Advanced Solutions

Ltd. (“A2Z AS”); and (4) Isramat Ltd., the “Subsidiaries”). On August 10, 2023, Cust2mate announced the launch

of Cust2mate USA Inc. (Cust2mate USA”), a subsidiary of Cust2mate, incorporated on July 12, 2023, under the laws of Delaware.

The

accompanying condensed consolidated financial statements have been prepared assuming that the Company will continue as a going concern.

The Company has incurred recurring losses and negative cash flows from operating activities since inception, such that as of March 31,

2024, the Company had accumulated losses of $83,289 and a net loss in the amount of $396 for the three months ended March 31, 2024. As

of the date of the issuance of these financial statements, the Company has not yet commenced generating sufficient revenues to fund its

operations, and therefore depends on fundraising from new and existing investors to finance its activities.

A2Z

SMART TECHNOLOGIES CORP.

NOTES

TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(Unaudited)

(Expressed

in Thousands of US Dollars, except per share data)

Considering

the above, the Company’s dependency on external funding for its operations raises a substantial doubt about the Company’s

ability to continue as a going concern. The condensed consolidated financial statements for the three months ended March 31, 2024, do

not include any adjustments that might result from the outcome of these uncertainties.

On

October 7, 2023, Hamas terrorists infiltrated Israel’s southern border from the Gaza Strip and conducted a series of attacks on

civilian and military targets. Hamas also launched extensive rocket attacks on Israeli population and industrial centers located along

Israel’s border with the Gaza Strip and in other areas within the State of Israel. These attacks resulted in extensive deaths,

injuries and kidnapping of civilians and soldiers. Following the attack, Israel’s security cabinet declared war against Hamas and

a military campaign against these terrorist organizations commenced in parallel to their continued rocket and terror attacks. The intensity

and duration of Israel’s current war is difficult to predict, as are such war’s implications on our business and operations.

While none of our supply chains have been impacted since the war broke out on October 7, 2023, the ongoing war may create supply and

demand irregularities in Israel’s economy in general or lead to macroeconomic indications of a deterioration of Israel’s

economic standing, which may have a material adverse effect on us and our ability to effectively conduct our operations. Moreover, we

cannot predict how this war will ultimately affect Israel’s economy in general, which may involve a downgrade in Israel’s

credit rating by rating agencies (such as the recent downgrade by Moody’s of its credit rating of Israel from A1 to A2, as well

as the downgrade of its outlook rating from “stable” to “negative”).

In

connection with the Israeli security cabinet’s declaration of war against Hamas and possible or currently occurring hostilities

with other organizations, several hundred thousand Israeli military reservists were drafted to perform immediate military service. A

few of our employees, none of whom are members of management, have been called to active military duty since October 7, 2023.

Some

of these employees have since returned, but there can be no assurance that they will not be called to military service again. In addition,

we rely on service providers located in Israel and our employees or employees of such service providers may be called for service in

the current or future wars or other armed conflicts with Hamas and such persons may be absent from their positions for a period of time.

As of May 15, 2024, any impact as a result of the number of absences of our personnel and personnel at our service providers or counterparties

located in Israel has been manageable. However, military service call ups that result in absences of personnel from our service providers

or contractual counterparties in Israel may disrupt our operations and absences for an extended period of time may materially and adversely

affect our business, prospects, financial condition and results of operations.

Following

the attack by Hamas on Israel’s southern border, Hezbollah in Lebanon has also launched missile, rocket, and shooting attacks against

Israeli military sites, troops, and Israeli towns in northern Israel. In response to these attacks, the Israeli army has carried out

a number of targeted strikes on sites belonging to Hezbollah in southern Lebanon. It is possible that other terrorist organizations,

including Palestinian military organizations in the West Bank or the Houthis in Yemen, as well as other hostile countries, such as Iran,

will join the hostilities. Such hostilities may include terror and missile attacks. Any hostilities involving Israel or the interruption

or curtailment of trade between Israel and its trading partners could adversely affect our operations and results of operations. Our

commercial insurance does not cover losses that may occur as a result of events associated with war and terrorism. Although the Israeli

government currently covers the reinstatement value of direct damages that are caused by terrorist attacks or acts of war, we cannot

assure you that this government coverage will be maintained or that it will sufficiently cover our potential damages. Any losses or damages

incurred by us could have a material adverse effect on our business. Any armed conflicts or political instability in the region would

likely negatively affect business conditions and could harm our results of operations.

These

Condensed Interim Consolidated financial statements were authorized for issue by the Board of Directors on May 15, 2024.

A2Z

SMART TECHNOLOGIES CORP.

NOTES

TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(Unaudited)

(Expressed

in Thousands of US Dollars, except per share data)

NOTE

2 – BASIS OF PREPARATION

| |

1. |

Significant

accounting policy |

Statement

of Compliance

These

unaudited Condensed Interim Consolidated financial statements of the Company are as of March 31, 2024, and presented in US dollars, which

is not the functional currency. The functional currency is the NIS. These unaudited interim condensed consolidated financial statements

have been prepared in accordance with the requirements of International Accounting Standard IAS 34 “Interim Financial Reporting”

as issued by the IASB. They do not include all the information required in annual financial statements in accordance with IFRS and should

be read in conjunction with the financial statements of the Company for the year ended December 31, 2023.

The

policies applied in these Condensed Interim Consolidated financial statements are based on IFRS effective as of March 31, 2024,

and are consistent with those included in the Company’s annual financial statements for the year ended December 31, 2023.

Basis

of Consolidation

The

financial results of subsidiaries are included in the consolidated financial statements from the date that control commences until the

date that control ceases. Intercompany balances and transactions and any unrealized income and expenses arising from such transactions

are eliminated upon consolidation.

Basis

of measurement

These

consolidated financial statements have been prepared on a going concern basis, under the historical cost basis, except for financial

instruments which have been measured at fair value.

| |

2. |

Critical

Estimates and Assumptions |

The

preparation of the Company’s financial statements requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities at the date of the financial statements and reported amounts of expenses during the reporting period.

Actual outcomes could differ from these estimates. The Company’s financial statements include estimates which, by their nature,

are uncertain. The impacts of such estimates are pervasive throughout the Company’s financial statements and may require accounting

adjustments based on future occurrences. Revisions to accounting estimates are recognized in the period in which the estimate is revised

and also in future periods when the revision affects both current and future periods.

The

functional currency for each of the Company’s subsidiaries is the currency of the primary economic environment in which the respective

entity operates; the Company has determined the functional currency of each entity to be the New Israeli Shekel. Such determination involves

certain judgements to identify the primary economic environment. The Company reconsiders the functional currency of its subsidiaries

if there is a change in events and/or conditions which determine the primary economic environment. During the three and nine months ended

March 31, 2024, there have been no such changes. The Company’s presentation currency is the U.S. dollar.

A2Z

SMART TECHNOLOGIES CORP.

NOTES

TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(Unaudited)

(Expressed

in Thousands of US Dollars, except per share data)

The

critical judgments and significant estimates in applying accounting policies that have the most significant effect on the amounts recognized

in the financial statements are the same as at December 31, 2023:

| |

a) |

The

useful life of property and equipment |

Property

and equipment are amortized or depreciated over their useful lives. Useful lives are based on management’s estimates of the period

that the assets will generate revenue, which are periodically reviewed for continued appropriateness. Changes to estimates can result

in significant variations in the amounts charged to the consolidated statement of comprehensive income in specific periods.

| |

b) |

Determining

the fair value of share-based payment transactions |

The

fair value of share-based payment transactions is determined upon initial recognition by the Binomial model. The Binomial model is based

on share price and exercise price and assumptions regarding expected volatility, term of share option, dividend yield and risk-free interest

rate.

| |

c) |

Intangible

assets and goodwill |

Intangible

assets and goodwill are tested for impairment annually or more frequently if three is an indication of impairment. The carrying value

of intangibles with definite lives is reviewed each reporting period to determine whether there is any indication of impairment. If there

are indications of impairment the impairment analysis is completed and if the carrying amount of an asset exceeds its recoverable amount,

the asset is impaired and impairment loss is recognized.

| |

d) |

Derivative

liability – Warrants |

The

Company uses the Black-Scholes option-pricing model to estimate fair value at each reporting date. The key assumptions used in the model

are the expected future volatility in the price of the Company’s common shares, no par value per share (the “Common Shares”)

and the expected life of the warrants.

| |

e) |

ECL

and their measurement |

ECL

are measured as the unbiased probability-weighted present value of all cash shortfalls over the expected life of each financial asset.

For receivables from financial services, ECL are mainly calculated with a statistical model using three major risk parameters: probability

of default, loss given default and exposure at default. The estimation of these risk parameters incorporates all available relevant information,

not only historical and current loss data, but also reasonable and supportable forward-looking information reflected by the future expectation

factors. This information includes macroeconomic factors (e.g., gross domestic product growth, unemployment rate, cost performance index)

and forecasts of future economic conditions. For receivables from financial services, these forecasts are performed using a scenario

analysis (base case, adverse and optimistic scenarios).

As

of March 31, 2024, and December 31, 2023, ECL for trade and other account receivables are not material, and as such are not disclosed,

in accordance IFRS 9.

| |

3. |

New

Accounting Standards |

A

number of amended standards became applicable for the current reporting period. The Company and its subsidiaries did not have to change

its accounting policies or make retrospective adjustments as a result of adopting these amended standards:

1.Disclosure

of Accounting Policies – Amendments to IAS 1 and IFRS Practice Statement 2

2.Definition

of Accounting Estimates – Amendments to IAS 8

3.Deferred

Tax related to Assets and Liabilities arising from a Single Transaction – Amendments to IAS 12

A2Z

SMART TECHNOLOGIES CORP.

NOTES

TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(Unaudited)

(Expressed

in Thousands of US Dollars, except per share data)

NOTE

3 – WARRANT LIABILITY

| |

a) |

January

2024 Warrants

On

January 4, 2024, the Company issued an aggregate of 1,403,151 January 2024 Registered Direct Offerings Warrants (as defined below)

as part of registered direct offerings (see also note 4(b)). The warrants were issued with an exercise price denominated in US

Dollars ($1.50) (approx. CAD2.05) rather than the functional currency of the Company – New Israeli Shekels

(NIS). The January 2024 Registered Direct Offerings Warrants are exercisable for a period of 2 years from the issue date. The Black-Scholes

option pricing model was used to measure the warrant liability with the following assumptions: volatility of 107% using the historical

prices of the Company, risk-free interest rate of 3.92%, expected life of 2.00 years and share price of CAD1.80. |

Level

3 for the period ended on March 31, 2024:

| Balance at January 1, 2024 | |

$ | - | |

| Issuance of January 2024 Registered

Direct Offerings Warrants | |

| 1,027 | |

| Revaluation at March 31, 2024 | |

| (756 | ) |

| Effect of changes in

foreign exchange rates | |

| (23 | ) |

| Balance at March 31, 2024 | |

$ | 248 | |

For

the three-month period ended March 31, 2024, the Company recorded a gain on the revaluation of the total warrant liability in the amount

of $756 (compared to the three-month period ended March 31, 2023 - $nil).

| |

b) |

December

2023 Warrants

On

December 13, 2023, the Company issued an aggregate of 647,891 December 2023 Registered Direct Offerings Warrants (as defined below)

as part of registered direct offerings. The warrants were issued with an exercise price denominated in US Dollars ($1.50) or

Canadian Dollars (CAD2.05) rather than the functional currency of the Company – New Israeli Shekels (NIS). The December 2023

Registered Direct Offerings Warrants are exercisable for a period of 2 years from the issue date. The Black-Scholes option pricing

model was used to measure the warrant liability with the following assumptions: volatility of 107% using the historical prices of

the Company, risk-free interest rate of 4.19%, expected life of 2.00 years and share price of CAD1.62. |

Level

3 for the period ended on March 31, 2024:

| Balance at January 1, 2023 | |

$ | - | |

| Issuance of December 2023 Registered

Direct Offerings Warrants | |

| 402 | |

| Revaluation at December 31, 2023 | |

| 110 | |

| Effect of changes in

foreign exchange rates | |

| 8 | |

| Balance at December 31, 2023 | |

$ | 520 | |

| | |

| | |

| Revaluation at March 31, 2024 | |

| (397 | ) |

| Effect of changes in

foreign exchange rates | |

$ | (13 | ) |

| | |

| | |

| Balance at March 31, 2024 | |

$ | 110 | |

A2Z

SMART TECHNOLOGIES CORP.

NOTES

TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(Unaudited)

(Expressed

in Thousands of US Dollars, except per share data)

For

the three-month period ended March 31, 2024, the Company recorded a gain on the revaluation of the total warrant liability in the amount

of $397 (for the three-month period ended March 31, 2023 - $nil).

| |

c) |

June

2023 Warrants

On

June 15 and on June 20, 2023, the Company issued an aggregate of 1,909,134 June 2023 Registered Direct Offerings Warrants (as defined

below) as part of registered direct offerings. The warrants were issued with an exercise price denominated in US Dollars ($2.20)

or Canadian Dollars (CAD2.93) rather than the functional currency of the Company – New Israeli Shekels (NIS). The June

2023 Registered Direct Offerings Warrants are exercisable for a period of 2 years from the issue date. The Black-Scholes option pricing

model was used to measure the warrant liability with the following assumptions: volatility of 99% using the historical prices of

the Company, risk-free interest rate of 4.45%, expected life of 2.00 years and share price of CAD2.99. |

Level

3 for the period ended on March 31, 2024:

| Balance at January 1, 2023 | |

$ | - | |

| Issuance

of June 2023 Registered Direct Offerings Warrants | |

| 2,333 | |

| | |

| | |

| Balance at June 30, 2023 | |

$ | 2,333 | |

| Revaluation at September 30, 2023 | |

| (671 | ) |

| Effect of changes in

foreign exchange rates | |

| (33 | ) |

| | |

| | |

| Balance at September 30, 2023 | |

$ | 1,629 | |

| | |

| | |

| Revaluation at December 31, 2023 | |

| (499 | ) |

| Effect of changes in

foreign exchange rates | |

| 27 | |

| | |

| | |

| Balance at December 31, 2023 | |

$ | 1,157 | |

| | |

| | |

| Revaluation at March 31, 2024 | |

| (972 | ) |

| Effect of changes in

foreign exchange rates | |

| (28 | ) |

| | |

| | |

| Balance at March 31, 2024 | |

$ | 157 | |

For

the three-month period ended March 31, 2024, the Company recorded a gain on the revaluation of the total warrant liability in the amount

of $972 (for the three-month period ended March 31, 2023 - $nil).

| |

d) |

March

2023 Warrants

On

March 20, 2023, the Company issued an aggregate of 891,778 March 2023 Warrants as part of a private placement (see also note 4(a)).

The warrants were issued with an exercise price denominated in Canadian Dollars (CAD2.35) or US Dollars ($1.75) rather than

the functional currency of the Company – New Israeli Shekels (NIS). The warrants are exercisable for a period of 2 years from

the issue date. The Black-Scholes option pricing model was used to measure the warrant liability with the following assumptions:

volatility of 93% using the historical prices of the Company, risk-free interest rate of 3.62%, expected life of 2.00 years and share

price of CAD1.74. |

A2Z

SMART TECHNOLOGIES CORP.

NOTES

TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(Unaudited)

(Expressed

in Thousands of US Dollars, except per share data)

Level

3 for the period ended on March 31, 2024:

| Balance at January 1, 2023 | |

$ | - | |

| Issuance of March 2023 Warrants | |

| 496 | |

| | |

| | |

| Balance at March 31, 2023 | |

$ | 496 | |

| Revaluation at June 30, 2023 | |

| 1,004 | |

| | |

| | |

| Balance at June 30, 2023 | |

$ | 1,500 | |

| Revaluation at September 30, 2023 | |

| (688 | ) |

| Effect of changes in

foreign exchange rates | |

| (21 | ) |

| | |

| | |

| Balance at September 30, 2023 | |

$ | 791 | |

| | |

| | |

| Revaluation at December 31, 2023 | |

| (242 | ) |

| Effect of changes in

foreign exchange rates | |

| 13 | |

| | |

| | |

| Balance at December 31, 2023 | |

$ | 562 | |

| | |

| | |

| Revaluation at March 31, 2024 | |

| (470 | ) |

| Effect of changes in

foreign exchange rates | |

| (13 | ) |

| | |

| | |

| Balance at March 31, 2024 | |

$ | 79 | |

For

the three-month period ended March 31, 2024, the Company recorded a gain on the revaluation of the total warrant liability in the amount

of $470 (for the three-month period ended March 31, 2023 - $nil).

| |

e) |

November

2022 Warrants

On

November 2, 2022, the Company issued an aggregate of 1,489,166 warrants (November 2022 Warrants) as part of a private placement.

The warrants were issued with an exercise price denominated in Canadian Dollars (CAD2.35) rather than the functional currency of

the Company – New Israeli Shekels (NIS). The warrants are exercisable for a period of 2 years from the issue date. The Black-Scholes

option pricing model was used to measure the warrant liability with the following assumptions: volatility of 110% using the historical

prices of the Company, risk-free interest rate of 3.94%, expected life of 2.00 years and share price of CAD1.56. |

Level

3 for the period ended on March 31, 2024:

| Balance at January 1, 2023 | |

$ | 1,142 | |

| Revaluation at March

31, 2023 | |

$ | (405 | ) |

| | |

| | |

| Balance at March 31, 2023 | |

$ | 737 | |

| Warrant exercises (note 19(l)) | |

$ | (66 | ) |

| Revaluation at June

30, 2023 | |

| 1,745 | |

| Balance at June 30, 2023 | |

$ | 2,416 | |

| | |

| | |

| Warrant exercises (note 19(l)) | |

| (39 | ) |

| Revaluation at September 30, 2023 | |

| (1,175 | ) |

| Effect of changes

in foreign exchange rates | |

| (25 | ) |

| Balance at September 30, 2023 | |

$ | 1,177 | |

| | |

| | |

| Revaluation at December 31, 2023 | |

| (359 | ) |

| Effect of changes

in foreign exchange rates | |

| 18 | |

| Balance at December

31, 2023 | |

$ | 836 | |

| | |

| | |

| Revaluation at March 31, 2024 | |

| (736 | ) |

| Effect of changes

in foreign exchange rates | |

| (21 | ) |

| Balance at March

31, 2024 | |

$ | 79 | |

A2Z

SMART TECHNOLOGIES CORP.

NOTES

TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(Unaudited)

(Expressed

in thousands of US Dollars, except per share data)

For

the three-month period ended March 31, 2024, the Company recorded a gain on the revaluation of the total warrant liability in the amount

of $736 (for the three-month period ended March 31, 2023 - $405).

NOTE

4 - SHAREHOLDERS DEFICIT

| |

a) |

On

March 20, 2023, the Company closed a private placement for gross proceeds of $2,604 through the issuance of 1,783,561 units (“Units”)

at a price per Unit of US$1.46 (CAD$1.95). Each Unit consists of one Common Share and one half of one Common share purchase warrant

(each whole such warrant a “Warrant”). An aggregate of 891,778 Warrants were issued with an exercise price of CAD$2.35

(US$1.75), will result in the issuance of an additional 891,778 common shares (“March 2023 Private Placement Warrants”).

A finder’s fee of $208 (CAD$290,000) and 142,685 March 2023 Private Placement Warrants were paid and issued in connection with

the private placement. |

| |

|

|

| |

b) |

On

January 4, 2024, the Company closed a registered direct offering for gross proceeds of $3,227 through the issuance of 2,806,302 units

(“January 2024 Units”) at a price per Unit of $1.15 (CAD$1.36). Each January 2024 Unit consists of one Common Share and

one half of one Common Share purchase warrant (each whole such warrant a “Warrant”). An aggregate of 1,403,151 Warrants

were issued with an exercise price of CAD$2.05 ($1.50) per share. The Warrants have a term of two years and if fully exercised,

will result in the issuance of an additional 1,403,151 Common Shares (“January 2024 Registered Direct Offerings Warrants”).

A finder’s fee of $258 (CAD$348 thousand) was paid and 224,504 January 2024 Registered Direct Offerings Warrants were issued

in connection with the registered direct Offering. |

NOTE

5 - WARRANTS AND OPTIONS

a)

Warrants

| |

(i) |

Warrant

transactions for the three months ended March 31, 2024, and for the year ended December 31, 2023, are as follows: |

| | |

Number | | |

Weighted

Average Exercise Price | |

| Balance,

January 1, 2023 | |

| 7,056,972 | | |

$ | 3.54 | |

| Warrants issued in the March 2023 Private

Placement | |

| 1,034,463 | | |

| | |

| Exercise of warrants | |

| (92,000 | ) | |

| | |

| Warrants issued in the June 2023 Registered

Direct Offering | |

| 2,214,596 | | |

| | |

| Warrants issued in

the December 2023 Registered Direct Offering | |

| 751,554 | | |

| | |

| Balance, December 31,

2023 | |

| 10,965,585 | | |

$ | 2.63 | |

| Warrants issued in

the January 2024 Registered Direct Offering | |

| 1,627,655 | | |

| | |

| Balance,

March 31, 2024 | |

| 12,593,240 | | |

$ | 2.46 | |

A2Z

SMART TECHNOLOGIES CORP.

NOTES

TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(Unaudited)

(Expressed

in thousands of US Dollars, except per share data)

As

at March 31, 2024, the Company had outstanding warrants, enabling the holders to acquire common shares as follows:

| March

31, 2024 | | |

Expiry date | |

Exercise

price | | |

Exercise

price (USD) | |

| | 2,658,313 | | |

November 10, 2025 | |

| ILS | | |

| 7.1418

(1) | | |

$ | 1.94 | |

| | 1,366,631 | | |

December 24, 2025 | |

| ILS | | |

| 7.1418

(1) | | |

$ | 1.94 | |

| | 221,100 | | |

April 18, 2026 | |

| ILS | | |

| 29.025

(2) | | |

$ | 7.89 | |

| | 1,084,562 | | |

May 28, 2026 | |

| ILS | | |

| 29.025

(2) | | |

$ | 7.89 | |

| | 1,634,366 | | |

November 8, 2024 | |

| CAD | | |

| 2.04 | | |

$ | 1.60 | |

| | 1,034,463 | | |

March 13, 2025 | |

| CAD | | |

| 2.35 | | |

$ | 1.75 | |

| | 2,214,596 | | |

June 12, 2025 | |

| CAD | | |

| 2.93 | | |

$ | 2.20 | |

| | 751,554 | | |

December 13, 2025 | |

| CAD | | |

| 2.05 | | |

$ | 1.50 | |

| | 1,627,655 | | |

January 4, 2026 | |

| CAD | | |

| 2.05 | | |

$ | 1.50 | |

| | 12,593,240 | | |

| |

| | | |

| | | |

| | |

| |

1. |

On

March 31, 2021, warrant holders and the Company, agreed that the exercise price of CAD$2.70 would be payable in New Israeli Shekels.

The exercise price is NIS 7.1418 per warrant. |

| |

|

|

| |

2.

|

On

June 30, 2021, warrant holders and the Company, agreed that the exercise price of CAD$11.04 would be payable in New Israeli Shekels.

The exercise price is NIS 29.025 per warrant. On March 27, 2023, the expiry dates of a total of 221,100 share purchase warrants were

extended by three years to April 26, 2026, and the expiry dates of a total of 1,084,562 share purchase warrants were extended by

three years to May 6, 2026. |

b)

Stock Options

Stock

option transactions for the three months ended March 31, 2024, and for the year ending December 31, 2023, are as follows:

| | |

Number | | |

Weighted

Average Exercise Price (CAD) | | |

Weighted

Average Exercise Price (USD) | |

| Balance

January 1, 2023 | |

| 1,883,343 | | |

$ | 3.17 | | |

$ | 2.45 | |

| Options granted (i)(ii) | |

| 1,735,250 | | |

| 1.82 | | |

| | |

| Exercise of options | |

| - | | |

| - | | |

| | |

| Expiry of options | |

| (74,875 | ) | |

| 1.25 | | |

| | |

| Balance

December 31, 2023 | |

| 3,543,718 | | |

$ | 2.53 | | |

$ | 1.91 | |

| Options granted | |

| - | | |

| - | | |

| | |

| Balance

March 31, 2024 | |

| 3,543,718 | | |

$ | 2.53 | | |

$ | 1.87 | |

| |

(i) |

On

January 4, 2023, 816,500 stock options were issued to directors and consultants with an exercise

price of CAD$1.65. The options expire on January 4, 2033. The fair value of the options granted

was estimated at $1,017 using the Black-Scholes option pricing model, using the following

assumptions: Share Price: CAD$1.80; Expected option life 10 years; Volatility 112%; Risk-free

interest rate 3.28%; Dividend yield 0%.

|

| |

(ii) |

On

February 8, 2023, 100,000 stock options were issued to a consultant with an exercise price of CAD$1.50. The options expire on November

25, 2027. The fair value of the options granted was estimated at $135 using the Black-Scholes option pricing model, using the following

assumptions: Share Price: CAD$2.18; Expected option life 4.8 years; Volatility 112%; Risk-free interest rate 3.16%; Dividend yield

0%. |

A2Z

SMART TECHNOLOGIES CORP.

NOTES

TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(Unaudited)

(Expressed

in Thousands of US Dollars, except per share data)

NOTE

5 - WARRANTS AND OPTIONS (CONTINUED)

b)

Stock Options (continued)

As

at March 31, 2024, the Company had outstanding stock options, enabling the holders to acquire common shares as follows:

Outstanding

as

of March 31,

2024 | | |

Exercisable

as

of March 31,

2024 | | |

Expiry

date | |

Exercise

price (CAD) | | |

Exercise

price (USD) | |

| | 543,333 | | |

| 543,333 | | |

August 20, 2025 | |

| CAD | | |

| 1.50 | | |

$ | 1.11 | |

| | 33,333 | | |

| 33,333 | | |

January 28, 2025 | |

| CAD | | |

| 3.00 | | |

$ | 2.21 | |

| | 50,000 | | |

| 33,333 | | |

June 3, 2026 | |

| CAD | | |

| 8.40 | | |

$ | 6.19 | |

| | 16,677 | | |

| 16,677 | | |

October 28, 2026 | |

| CAD | | |

| 8.00 | | |

$ | 5.89 | |

| | 900,000 | | |

| 450,000 | | |

August 2, 2032 | |

| CAD | | |

| 3.56 | | |

$ | 2.62 | |

| | 300,000 | | |

| 300,000 | | |

August 21, 2032 | |

| CAD | | |

| 4.00 | | |

$ | 2.95 | |

| | 804,125 | | |

| 804,125 | | |

January 4, 2033 | |

| CAD | | |

| 1.65 | | |

$ | 1.22 | |

| | 100,000 | | |

| 100,000 | | |

November 25, 2027 | |

| CAD | | |

| 2.01 | | |

$ | 1.48 | |

| | 401,250 | | |

| - | | |

April 18, 2033 | |

| CAD | | |

| 1.60 | | |

$ | 1.18 | |

| | 245,000 | | |

| - | | |

June 28, 2028 | |

| CAD | | |

| 2.45 | | |

$ | 1.81 | |

| | 150,000 | | |

| 50,000 | | |

September 20, 2033 | |

| CAD | | |

| 2.20 | | |

$ | 1.62 | |

| | 3,543,718 | | |

| 2,330,801 | | |

| |

| | | |

| | | |

| | |

Share-based

compensation expense is recognized over the vesting period of options. During the three months ended March 31, 2024, share-based compensation

of $354 was recognized and charged to the Consolidated Statement of Comprehensive Loss (March 31, 2023 – $1,367).

c)

RSU’s

On

August 4, 2022, the Company granted 1,265,000 Restricted Share Units (“RSUs”) to directors, officers and advisers, of which

590,000 RSU’s are to executives and directors, pursuant to the Company’s RSU Plan and in acknowledgment of the Company’s

management recent success and increased future workload. The RSUs will vest at each recipient’s discretion and taking into account

personal tax implications and convert into 1,265,000 common shares of no-par value in the Company (“Common Shares”).

On

January 4, 2023, the Company granted 1,027,000 Restricted Share Units (“RSUs”) to directors, officers and advisers, of which

260,000 RSU’s are to executives and directors, pursuant to the Company’s RSU Plan and in acknowledgment of the Company’s

management recent success and increased future workload. The RSUs will vest at each recipient’s discretion and taking into account

personal tax implications and convert into 1,027,000 common shares of no-par value in the Company (“Common Shares”).

RSU’s

transactions for the three months ended March 31, 2023, and for the year ending December 31, 2022, are as follows:

| | |

Number | |

| Balance, January 1, 2023 | |

| 720,000 | |

| RSU’s granted | |

| 1,308,250 | |

| Expiry of RSU’s | |

| (91,667 | ) |

| Exercise of RSU’s | |

| (464,499 | ) |

| Balance, December 31, 2023 | |

| 1,472,084 | |

| RSU’s granted | |

| - | |

| Exercise of RSU’s | |

| - | |

| Balance, March 31,

2024 | |

| 1,472,084 | |

Total

exercisable RSU’s as at March 31, 2024, are 1,048,334 (December 31, 2023 – 274,166). During the three months ended March

31, 2024, share-based compensation of $137 was recognized and charged to the Consolidated Statement of Comprehensive Loss (March 31,

2023 – $162).

A2Z

SMART TECHNOLOGIES CORP.

NOTES

TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(Unaudited)

(Expressed

in Thousands of US Dollars, except per share data)

NOTE

6 - REVENUES:

Revenue

streams:

| | |

Three months

ended | |

| | |

March

31, | |

| | |

2024 | | |

2023 | |

| Revenues

from services | |

| | | |

| | |

| Revenues from services | |

$ | 367 | | |

$ | 532 | |

| Revenues from leasing | |

| 91 | | |

| 132 | |

| Precision

metal parts | |

| | | |

| | |

| Revenues from sales of precision metal parts | |

| 1,183 | | |

| 817 | |

| Smart

Carts | |

| | | |

| | |

| Revenues from smart

carts project | |

| 56 | | |

| 3,127 | |

| | |

$ | 1,697 | | |

$ | 4,608 | |

NOTE

7 – COMMITMENTS

The

Company’s Israeli subsidiary’s fixed assets (motor vehicles) are secured against bank borrowings.

NOTE

8 – OPERATING SEGMENTS:

The

Company and its subsidiaries are engaged in the following three segments:

| |

a. |

Maintenance

services to the military utilizing the application of advanced engineering capabilities as well as development of related products

for the civilian and retail markets. (“Advanced Engineering”) |

| |

|

|

| |

b. |

Retail

automation solutions – Smart Carts (“Smart Carts”) |

| |

|

|

| |

c. |

Manufacturing

and selling of precision metal parts – “Precision Metal Parts” |

| | |

Three

Months Ended March 31, 2024 | |

| | |

Precision Metal

Parts | | |

Services | | |

Smart

Carts | | |

Total | |

| Revenues | |

| | |

| | |

| | |

| |

| External | |

$ | 1,183 | | |

$ | 458 | | |

$ | 56 | | |

$ | 1,697 | |

| Inter-segment | |

| - | | |

| 34 | | |

| - | | |

| 34 | |

| Total | |

| 1,183 | | |

| 492 | | |

| 56 | | |

| 1,731 | |

| | |

| | | |

| | | |

| | | |

| | |

| Segment

loss (gain) | |

| 21 | | |

| 371 | | |

| 3,330 | | |

| 3,722 | |

| Gain on revaluation of warrant liability | |

| | | |

| | | |

| | | |

| (3,354 | ) |

| Financial expenses,

net | |

| | | |

| | | |

| | | |

| 28 | |

| Tax expenses | |

| | | |

| | | |

| | | |

| - | |

| Loss | |

| | | |

| | | |

| | | |

$ | 396 | |

A2Z

SMART TECHNOLOGIES CORP.

NOTES

TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(Unaudited)

(Expressed

in Thousands of US Dollars, except per share data)

NOTE

8 - OPERATING SEGMENTS (CONTINUED)

| | |

Three

Months Ended March 31, 2023 | |

| | |

Precision

Metal Parts | | |

Services | | |

Smart

Carts | | |

Total | |

| Revenues | |

| | |

| | |

| | |

| |

| External | |

$ | 817 | | |

$ | 664 | | |

$ | 3,127 | | |

$ | 4,608 | |

| Inter-segment | |

| - | | |

| - | | |

| - | | |

| - | |

| Total | |

| 817 | | |

| 664 | | |

| 3,127 | | |

| 4,608 | |

| | |

| | | |

| | | |

| | | |

| | |

| Segment

loss | |

| 271 | | |

| (178 | ) | |

| 3,937 | | |

| 4,030 | |

| Loss on sale of fixed asset | |

| | | |

| | | |

| | | |

| (405 | ) |

| Financial expenses,

net | |

| | | |

| | | |

| | | |

| 218 | |

| Tax expenses | |

| | | |

| | | |

| | | |

| - | |

| Loss | |

| | | |

| | | |

| | | |

$ | 3,843 | |

| | |

As

at March 31, 2024 | |

| | |

Precision

Metal Parts | | |

Services | | |

Smart

Carts | | |

Adjustment

& Elimination | | |

Total | |

| Segment

assets | |

$ | 2,525 | | |

$ | 1,047 | | |

$ | 3,206 | | |

$ | - | | |

$ | 6,778 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Segment liabilities | |

$ | 1,983 | | |

$ | 2,252 | | |

$ | 3,427 | | |

$ | - | | |

$ | 7,662 | |

| | |

As

at March 31, 2023 | |

| | |

Precision

Metal Parts | | |

Services | | |

Smart

Carts | | |

Adjustment

& Elimination | | |

Total | |

| Segment

assets | |

$ | 2,611 | | |

$ | 1,121 | | |

$ | 8,270 | | |

$ | - | | |

$ | 12,002 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Segment liabilities | |

$ | 2,692 | | |

$ | 943 | | |

$ | 5,908 | | |

$ | - | | |

$ | 9,543 | |

A2Z

SMART TECHNOLOGIES CORP.

NOTES

TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(Expressed

in Thousands of US Dollars, except per share data)

NOTE

9 – SUBSEQUENT EVENTS

| |

a) |

On

April 2, 2024, the Company closed a registered direct offering for gross proceeds of approximately

$3,300 at a purchase price of $0.35 per share and issued an aggregate of 9,480,500 common

shares in the registered direct offering.

In

addition, on April 2, 2024 the Company entered into binding agreements with certain investors to issue 6,842,857 common shares

in a private placement at a purchase price of $0.35 per share, for gross proceeds of approximately $2,400. The private placement

is expected to close within 60 days of April 2, 2024, subject to satisfaction of closing conditions, including no material

adverse effect with respect to the Company between the dates of signing and closing.

In

connection with the registered direct offering, the Company has issued certain non-U.S. residents 734,440 common shares as finders

fees. These common shares and the common shares issued in the private placement have been issued pursuant to an exemption from registration

provided by Section 4(a)(2) of the Securities Act of 1933, as amended, for transactions not involving a public offering and Rule

506(b) promulgated thereunder, as applicable.

Additionally,

the Company advises that certain directors and officers of the Company participated in the registered direct offering and the private

placement in an amount of $525,000 (the “Insider Participation”). The Insider Participation transaction is considered

a “related party transaction” within the meaning of Canadian Securities Administrators Multilateral Instrument 61-101

- Protection of Minority Security Holders in Special Transactions (“MI 61- 101”). The Company expects to rely on exemptions

from the formal valuation and minority approval requirements in sections 5.5(a) and 5.7(1)(a) of MI 61-101 in respect of the Insider

Participation. |

| |

|

|

| |

b) |

On

April 18, 2024, Gadi Graus was appointed as Chief Executive Officer of the Company and Mr.

Reeves Ambrecht was appointed to the Board of Directors. |

| |

|

|

| |

c) |

The

Company received notices from the Nasdaq Stock Market LLC (“Nasdaq”) on April 24, 2024, notifying the Company that

it is not in compliance with Nasdaq’s minimum bid price requirement and minimum market value of listed securities (“MVLS”)

requirement.

Nasdaq

Listing Rule 5550(a)(2) requires listed securities to maintain a minimum bid price of $1.00 per share, and Listing Rule 5810(c)(3)(A)

provides that a failure to meet the minimum bid price requirement exists if the deficiency continues for a period of 30 consecutive

business days. Pursuant to Nasdaq Listing Rule 5810(c)(3)(A), the Company has a compliance period of 180 calendar days, or until

October 21, 2024 (the “Compliance Period”), to regain compliance with Nasdaq’s minimum bid price requirement. If

at any time during the Compliance Period, the closing bid price per share of the Company’s common shares is at least $1.00

for a minimum of ten consecutive business days, Nasdaq will provide the Company with a written confirmation of compliance and the

matter will be closed. In the event the Company does not regain compliance by October 21, 2024, the Company may be eligible for an

additional 180 calendar day grace period if it meets certain requirements.

Nasdaq

Listing Rule 5550(b)(2) requires listed securities to maintain a minimum MVLS of $35 million, calculated as total shares outstanding

multiplied by the closing bid price, and Listing Rule 5810(c)(3)(C) provides that a failure to meet this requirement exists if the

deficiency continues for a period of 30 consecutive business days. Pursuant to Nasdaq Listing Rule 5810(c)(3)(C), the Company has

180 calendar days, or until October 21, 2024, to regain compliance with Nasdaq’s minimum MVLS rule. If at any time prior to

the compliance period ending October 21, 2024, the Company’s MVLS closes at $35 million or more for a minimum of ten consecutive

business days, Nasdaq will provide the Company with a written confirmation of compliance and the matter will be closed. In the event

the Company does not regain compliance prior to October 21, 2024, Nasdaq will provide written notice to the Company that its securities

are subject to delisting. At that time, the Company may appeal the delisting determination to a Hearings Panel.

Receipt

of these notices does not impact the Company’s listing on Nasdaq at this time. The Company intends to monitor its bid price

and MVLS between now and October 21, 2024 and intends to cure the deficiencies within the prescribed grace period. During this time,

the Company expects that the common shares of the Company will continue to be listed and trade on Nasdaq. The Company’s management

is looking into various options available to regain compliance and maintain its continued listing.

The

Company’s business operations are not affected by the receipt of either notice letter.

|

Exhibit

99.2

A2Z

Smart Technologies Corp.

MANAGEMENT’S

DISCUSSION AND ANALYSIS

For

the Three Ended March 31, 2024

(Expressed

in U.S. Dollars)

March

15, 2024

The

following Management’s Discussion and Analysis (“MD&A”) for A2Z Smart Technologies Corp (“A2Z”

or the “Company”) is prepared as of May 15, 2024, and relates to the financial condition and results of operations

of the Company for the three months ended March 31, 2024. Past performance may not be indicative of future performance. This MD&A

should be read in conjunction with the Company’s audited consolidated annual financial statements for the year ended December 31,

2023, and with the Company’s condensed consolidated interim financial statements for the three months ended March 31, 2024, which

have been prepared using accounting policies consistent with International Financial Reporting Standards as issued by the International

Accounting Standards Board (“IFRS”).

All

amounts are presented in United States dollars (“USD” or “$”), the Company’s presentation

currency, unless otherwise stated.

Statements

are subject to the risks and uncertainties identified in the “Risks and Uncertainties”, and “Cautionary Note Regarding

Forward-Looking Statements” sections of this document. Readers are cautioned not to put undue reliance on forward-looking statements.

COMPANY

OVERVIEW

The

Company was incorporated on January 15, 2018, under the laws of British Columbia. The head office is located at 1600 – 609 Granville

Street, Vancouver, British Columbia V7Y 1C3, and the records and registered office is located at 2200 HSBC Building 885 West Georgia

Street, British Columbia, V6C 3E8.

Our

common shares (the “Common Shares”) are listed for trading on the TSX Venture Exchange (the “TSXV”) under the

trading symbol “AZ”, and in the United States, on the Nasdaq Capital Market (“Nasdaq”) under the trading symbol

“AZ”.

We

are an innovative technology company operating the following four complementary business lines through our subsidiaries: (i) development

and commercialization of retail “smart cart” solutions designed primarily for use in large grocery stores and supermarkets

(“Cust2Mate Carts” or “Cust2Mate Products”); (ii) manufacture of precision metal parts; (iii) provision of maintenance

services in Israel (“Maintenance Services”); and (iv) development of our Fuel Tank Inertia Capsule System (“FTICS”)

technology and a vehicle device cover for the military and civilian automotive industry (collectively, “Automotive Products”).

In

2020, we began to rapidly develop smart carts for the retail industry, with the aim of becoming the leading mobile checkout system in

the international market by providing the optimal solution for shoppers and supermarket retailers. We have since focused the majority

of our strategic planning, investment, research, development and marketing efforts on our Cust2Mate Products, as management currently

believes our operational capabilities are most effectively leveraged by growing market share in the smart cart industry.

During

the first quarter of 2022, the Company completed the acquisition of 100% of the shares of Isramat, a privately held Israeli company.

This acquisition vertically integrates certain manufacturing capabilities for the production of the Cust2Mate Products, such as precision

metal fabrication of parts, while complementing existing contract manufacturing partnerships to support the Company’s growth.

The

raw materials required by the Company’s subsidiaries are readily available from multiple suppliers worldwide and their purchase

costs do not fluctuate more than standard raw materials.

Smart

Cart Products and Services

Cust2Mate

is a mobile self-checkout shopping cart solution that streamlines the retail shopping experience. With a user-friendly smart algorithm,

touch screen and computer vision technology, our Cust2Mate smart cart scans, recognizes and adds to a displayed shopping list, each item

placed in the cart, providing the shopper with real-time information regarding items in the cart and tabulating the total cost of purchase.

Our in-cart solution also enables shoppers to use the cart as the point of sale by use of mobile payment applications, e-wallets and

other financial services. Cust2Mate’s point of sale feature effectively increases overall efficiency of the shopping experience,

by expanding payment options for shoppers and retailers alike, reducing the need for cashiers, and reducing checkout wait times, which

ultimately leads to improved customer engagement and satisfaction.

We

combine scanning, computer vision, security scales and other anti-fraud/theft technologies, with a large screen tablet capable of relaying

real-time shopping information and value-added digital services. Our solution is stackable and lightweight, with a robust recognition

platform that provides a higher level of accuracy in product identification, leveraging in-store Wi-Fi and cutting-edge software.

For

retailers, Cust2Mate enables improved inventory management, increased efficiency, reduced labor costs, increased anti-fraud protection,

reduced theft and real-time data analytics and insights regarding consumer behavior. Our solutions are designed to easily integrate with

existing store systems.

The

Cust2Mate touch screen allows for the display of advertisements, promotions and other digital services which can bring added value to

shoppers and additional revenue sources to retailers.

We have launched a modular version of the Cust2Mate

smart cart, allowing local set-up with modular parts, making mass production and deployment of our smart carts faster and more efficient.

With a detachable control unit, our new generation cart will employ the same technologies as our previous offerings, presently deployed

in the Yochananof retail chain in Israel and in pilot programs throughout the world.

Our

largest smart carts are available in 212 liter and 275 liter sizes, , as customized at the discretion of retailers. These smart carts

are ideal for larger stores, our smart carts are

We

also offer smaller, lighter smart carts, available in 180 liter and 75 liter sizes, with the same touch screen and security features

of our larger carts. Our smaller carts are ideal for urban groceries and supermarkets, drugstores and duty-free shops, where aisles space

tends to be limited.

We

leverage third-party partners for the manufacture of our Cust2Mate Products in the locations we serve.

Our

Customers

M.

Yochananof and Sons (1988) Ltd., or Yochananof, a large Israeli retailer, has been our largest Cust2Mate customer to date. Yochananof

placed an initial order for an aggregate of 1,300 Cust2Mate smart carts which we are in the process of fulfilling. As of September 30,

2023, we have delivered all the smart carts in connection with Yochananof’s initial purchase order. On April 27, 2023, Yochananof

delivered a non-binding letter of intent to purchase up to an additional 1,700 smart carts on terms and conditions to be agreed by definitive

agreement. In addition, we have entered into a maintenance and support agreement with Yochananof. Our Maintenance Services division handles

the maintenance and support services required for Cust2Mate Products deployed in Israel.

HaStok

Concept Ltd., one of Israel’s leading home design and household essentials retail chain with approximately 40 stores across Israel,

delivered a purchase order on April 20, 2023. The agreement marked a significant expansion for our smart cart solution into a new vertical

outside of grocery retail. The Hastok purchase order was for up to 1,000 smart carts and is comprised of an upfront payment, a guaranteed

monthly payment, and a revenue share agreement on added value solutions, such as advertising. On October 31, 2023, Hastok increased its

order by an additional 1,000 smart carts, to a total of 2,000 smart carts.

On

May 29, 2023, the Company signed an agreement with Morton Williams Supermarkets, a U.S. supermarket with locations throughout the New

York City metropolitan area, for the order for up to 100 Cust2Mate smart carts. The Morton Williams order follows our successful pilot

of Cust2Mate smart carts at the grocer’s West End Avenue store in Manhattan.

On

June 13, 2023, the Company entered into a significant partnership with IR2S, which is intended to deploy 30,000 smart carts between 2023

and 2025 across renowned retail chains in France. With IR2S providing integration and other services, including Monoprix and the Casino

Group (who operate over 700 and over 10,500 stores respectively), the logistics and service support for the smart carts will be efficiently

carried out. IR2S, a leading integrator of advanced retail technologies (including integration and other services) to many prestigious

clients in France, will play a pivotal role in managing the installation, support, and maintenance of the smart carts. IR2S is well-positioned

to manage and integrate Cust2Mate’s smart cart solution, providing local hardware and software support to ensure a seamless customer

experience. The definitive agreement with IR2S was signed in September 2023. The first purchase order to deliver 250 smart carts to Monoprix

stores was received in October 2023, with anticipation for deployment at 20 select Monoprix locations. The first batch of smart carts

is scheduled to be delivered to the Monoprix Monop Malakoff store near the Champs Elysées, Paris in the fourth quarter of 2024.

On

September 14, 2023, the Company entered into a definitive agreement with HEX 1011, a leading integrator of technological solutions for

retail chains, intended to deploy 20,000 smart carts across Asia Pacific (APAC) from 2023 through 2025. The first delivery of Cust2Mate’s

smart carts is scheduled for this year. HEX 1011 will ensure the efficient rollout and maintenance of the carts for elite retail chains

in Thailand and Malaysia.

Since

March 2023, as part of the Carrefour’s Connected Cart Project, the Cust2mate smart carts have undergone rigorous testing at Carrefour’s

flagship Hypermarket store in Ste Genevieve Des Bois, near Paris, receiving overwhelmingly positive feedback and achieving excellent

customer satisfaction reviews. We have currently entered the rollout stage of Carrefour’s Connected Cart Project.

Our

objective is to generate orders of several thousand Cust2Mate smart carts in 2024.

Our

Markets

We

aspire to be the global leading provider of smart carts and associated technology solutions, providing a superior customer experience

and cutting-edge platform for digital value-added services, easing the pain points for all stakeholders in the retail industry.

The

market for smart carts is large and diverse, and includes grocery stores, hardware stores, household essentials, “do it yourself

(DIY)” retailers, discount stores, warehouse stores, convenience stores, drug stores, duty free shops and similar outlets.

We

have designed the range of our Cust2Mate smart carts to accommodate the needs of a varied customer base: large carts for hypermarkets

or large stores, medium carts for supermarkets or medium sized stores, and small carts for city stores, drug stores, duty free shops,

etc. We are also able to customize our carts with a “look and feel” unique to each retailer as requested.

Business

Model

We

envision deriving several distinct revenue streams from our Cust2Mate Products:

| |

● |

Outright

Purchase Model. The outright purchase of the smart carts by customers and payment of a monthly maintenance fee has been the

business model to date. For example, the first 1,300 carts ordered by Yochananof were sold to it outright with revenue recognized

upon delivery. We intend to move away from this model, however it will remain available as some retailers prefer this option. |

| |

|

|

| |

● |

Subscription

Based Model. We intend to retain title to our smart carts and make them available to customers on a multiyear subscription