- Presented clinical data for multiple assets across modalities,

including bispecific antibody candidate BNT327/PM8002 and mRNA

cancer vaccine candidate BNT113 based on BioNTech’s FixVac

platform

- Initiated two Phase 2 dose optimization trials with

BNT327/PM8002 in small-cell lung cancer and in triple-negative

breast cancer to inform planned pivotal Phase 3 trials

- Phase 2 clinical trial on track to evaluate mRNA-based

individualized cancer vaccine candidate autogene cevumeran

(BNT122/RO7198457) as an adjuvant treatment in patients with

high-risk muscle-invasive urothelial cancer

- Successfully launched variant-adapted COVID-19 vaccines for the

2024/2025 vaccination season in multiple regions

- Reports third quarter 2024 revenues of €1.2 billion, net

profit of €198.1 million and diluted earnings per share of

€0.81 ($0.89)1

- Ended the third quarter of 2024 with €17.8 billion in cash

and cash equivalents plus security investments

- Expects to be at low end of full year 2024 revenue guidance

range (€2.5-3.1 billion)

- Re-confirms guidance of planned full year 2024 R&D expenses

of €2.4-2.6 billion and reduced guidance range for SG&A

expenses to €600-700 million and for capital expenditures for

operating activities to €300-400 million

Conference call and webcast scheduled for

November 4, 2024, at 8:00 a.m. EST (2:00 p.m.

CET)

MAINZ, Germany, November 4,

2024 (GLOBE NEWSWIRE) -- BioNTech SE (Nasdaq: BNTX,

“BioNTech” or “the Company”) today reported financial results for

the three and nine months ended September 30, 2024 and

provided an update on its corporate progress.

“BioNTech’s achievements during the period were

the successful launch of our variant-adapted COVID-19 vaccines and

the progress across our oncology pipeline. In particular, we

initiated later-stage trials and shared important updates for our

PD-L1 x VEGF-A bispecific antibody candidate BNT327/PM8002 and for

our mRNA cancer vaccine portfolio. These successes reinforce the

potential of our multi-platform technology approach and inform our

strategy to pursue novel proprietary combinations,” said

Prof. Ugur Sahin, M.D., CEO and Co-Founder of BioNTech.

“We remain focused on advancing our late-stage oncology product

candidates towards potential registration. We believe our pipeline

and capabilities uniquely position us to execute on our vision of

becoming a global multiproduct immunotherapy company.”

Financial Review for Third Quarter and

Nine Months of 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| in

millions €, except per share data |

|

|

Third Quarter 2024 |

|

|

Third Quarter 2023 |

|

|

Nine Months 2024 |

|

|

Nine Months 2023 |

|

Revenues |

|

|

1,244.8 |

|

|

895.3 |

|

|

1,561.1 |

|

|

2,340.0 |

| Net

profit / (loss) |

|

|

198.1 |

|

|

160.6 |

|

|

(924.8) |

|

|

472.4 |

| Diluted

earnings / (loss) per share |

|

|

0.81 |

|

|

0.66 |

|

|

(3.83) |

|

|

1.94 |

Revenues reported were €1,244.8

million for the three months ended September 30, 2024,

compared to €895.3 million for the comparative prior year period.

For the nine months ended September 30, 2024, revenues were

€1,561.1 million, compared to €2,340.0 million for the

comparative prior year period. The higher revenues in the third

quarter of 2024 as compared to the comparative prior year period

can be largely attributed to the earlier approvals received for its

variant-adapted COVID-19 vaccines as compared to last year.

Cost of sales were

€178.9 million for the three months ended September 30,

2024, compared to €161.8 million for the comparative prior

year period. For the nine months ended September 30, 2024,

cost of sales were €297.8 million, compared to

€420.7 million for the comparative prior year period.

Research and development

(“R&D”) expenses were €550.3 million for the three months

ended September 30, 2024, compared to €497.9 million for

the comparative prior year period. For the nine months ended

September 30, 2024, R&D expenses were

€1,642.4 million, compared to €1,205.3 million for the

comparative prior year period. R&D expenses were mainly

influenced by progressing clinical studies for the Company’s

late-stage oncology pipeline candidates.

Sales, general and

administrative (“SG&A”) expenses2, in total, amounted

to €150.5 million for the three months ended

September 30, 2024, compared to €153.5 million for the

comparative prior year period. For the nine months ended

September 30, 2024, SG&A expenses were

€466.9 million, compared to €415.4 million for the

comparative prior year period. SG&A expenses were mainly

influenced by personnel expenses.

Other operating result amounted

to negative €354.6 million during the three months ended

September 30, 2024, compared to negative €9.0 million for the

comparative prior year period. For the nine months ended

September 30, 2024, other operating result amounted to

negative €616.9 million compared to negative €134.4 million for the

prior year period. Other operating result was primarily influenced

by provisions for contractual disputes.

Income taxes were realized with

an amount of €39.4 million in tax income for the three months

ended September 30, 2024, compared to €66.8 million in accrued

tax expenses for the comparative prior year period. For the nine

months ended September 30, 2024, income taxes were realized

with an amount of €54.1 million in tax income for the nine months

ended September 30, 2024, compared to €50.5 million of accrued

tax expenses for the comparative prior year period.

Net profit was €198.1 million

for the three months ended September 30, 2024, compared to

€160.6 million net profit for the comparative prior year period.

For the nine months ended September 30, 2024, net loss was

€924.8 million, compared to a net profit of €472.4 million for

the comparative prior year period.

Cash and cash equivalents plus security

investments as of September 30, 2024, reached

€17,839.8 million, comprising €9,624.6 million in cash

and cash equivalents, €7,078.0 million in current security

investments and €1,137.2 million in non-current security

investments.

Diluted earnings per share was

€0.81 for the three months ended September 30, 2024, compared

to €0.66 for the comparative prior year period. For the nine months

ended September 30, 2024, loss per share was €3.83, compared

to diluted earnings per share of €1.94 for the comparative prior

year period.

Shares outstanding as of

September 30, 2024, were 239,739,752, excluding 8,812,448

shares held in treasury.

“We successfully launched our variant-adapted

COVID-19 vaccines upon receipt of earlier approvals as compared to

last year. This drove our strong revenues in the third quarter,”

said Jens Holstein, CFO of BioNTech. “Our cost

discipline in combination with our financial position allow us to

continue to focus on those assets that we believe offer a fast path

to market and the highest potential to generate value for patients

and shareholders.”

2024 Financial Year

Guidance3

The Company expects its revenues for the full

2024 financial year to be at the low end of the guidance range

provided in its outlook:

|

Total revenues for the 2024 financial year |

|

low end of €2.5 billion -

€3.1 billion |

The range reflects certain assumptions and

expectations, including, but not limited to: COVID-19 vaccine

uptake and price levels, including seasonal variations; inventory

write-downs and other charges by BioNTech’s collaboration partner

Pfizer Inc. (“Pfizer”) that negatively influence BioNTech’s

revenues; anticipated revenues from a pandemic preparedness

contract with the German government; and revenues from the

BioNTech Group service businesses, namely InstaDeep Ltd

(“InstaDeep”), JPT Peptide Technologies GmbH, and BioNTech

Innovative Manufacturing Services GmbH. Generally, the Company

continues to remain largely dependent on revenues generated in its

collaboration partner’s territories in 2024.

2024 Financial Year Expenses and

Capex

The Company has reduced its previous guidance

for expected SG&A expenses and capital expenditures for

operating activities for the 2024 financial year:

|

|

|

|

Guidance March 2024 |

Guidance November 2024 |

|

|

R&D expenses4 |

|

|

€2,400 million - €2,600 million |

€2,400 million - €2,600 million |

|

|

SG&A expenses |

|

|

€700 million - €800 million |

€600 million - €700 million |

|

|

Capital expenditures for operating activities |

|

|

€400 million - €500 million |

€300 million - €400 million |

|

The full interim unaudited condensed

consolidated financial statements can be found in BioNTech’s Report

on Form 6-K for the period ended September 30, 2024, filed

today with the United States Securities and Exchange Commission

(“SEC”) and available at https://www.sec.gov/.

Endnotes1Calculated applying

the average foreign exchange rate for the nine months ended

September 30, 2024, as published by the German Central Bank

(Deutsche Bundesbank).

2 SG&A expenses include sales and marketing

expenses as well as general and administrative expenses.

3Guidance excludes external risks that are not

yet known and/or quantifiable. It does not include potential

payments resulting from the outcomes of ongoing and/or future legal

disputes or related activity, such as judgements or settlements, or

other extraordinary items, all of which may have a material effect

on the Company’s results of operations and/or cash flows. BioNTech

continues to expect to report a loss for the 2024 financial

year.

4 Guidance for R&D expenses reflects the

expected impact of collaborations and potential M&A

transactions, in each case to the extent disclosed, and which are

subject to change based on future developments. Guidance does not

otherwise reflect M&A, collaboration or licensing transactions

that the Company may enter into in the future.

Operational Review of the Third Quarter

2024, Key Post Period-End Events and Outlook

Variant-adapted COVID-19

Vaccines

In the third quarter of 2024, BioNTech and Pfizer executed the

commercial launch of their variant-adapted COVID-19 vaccines for

the 2024/2025 vaccination season.

- On July 3, 2024, BioNTech and Pfizer’s Omicron JN.1-adapted

COVID-19 vaccine was approved by the European Commission (“EC”).

Shortly following approval, the updated vaccines were made

available to European Union (“EU”) member states. The EC approved

the co-administration of the companies’ COVID-19 vaccine with

approved seasonal influenza vaccines in individuals 12 years of age

and older and also authorized glass pre-filled syringes, a new

presentation of the vaccine that allows for refrigerated storage

conditions. On September 24, 2024, the EC approved BioNTech and

Pfizer’s Omicron KP.2-adapted COVID-19 vaccine. The companies began

shipments of their KP.2-adapted COVID-19 vaccine to EU member

states that ordered this formulation.

- On August 22, 2024, the U.S. Food and Drug Administration

(“FDA”) approved the companies’ KP.2-adapted COVID-19 vaccine. The

vaccines were shipped immediately following approval and made

available in pharmacies, hospitals, and clinics across the

U.S.

- On July 24, 2024, the United Kingdom’s Medicines and Healthcare

Products Regulatory Agency (“MHRA”) approved the companies’

JN.1-adapted vaccine and post period, on October 10, 2024, approved

the companies’ KP.2-adapted COVID-19 vaccine.

- BioNTech and Pfizer will continue to monitor the evolving

epidemiology of COVID-19 and remain prepared to develop modified

vaccine formulas as the data support and as regulatory agencies

recommend.

COVID-19 – Influenza Combination Vaccine

Program

An mRNA-based combination vaccine candidate

(BNT162b2 + BNT161) against COVID-19 and influenza

is in development in collaboration with Pfizer.

- In August 2024, BioNTech and Pfizer provided topline results

from the Phase 3 trial (NCT06178991) evaluating the

companies’ mRNA combination vaccine candidate in healthy

individuals 18-64 years of age. The vaccine candidate was compared

to the co-administration of a licensed influenza vaccine with the

companies’ licensed COVID-19 vaccine. The primary immunogenicity

objectives were non-inferiority of the antibody responses to

influenza (hemagglutination inhibition) and to SARS-CoV-2

(neutralizing titer) elicited by the combination vaccine candidate

as compared to standard of care. The trial showed higher influenza

A responses and comparable COVID-19 responses versus the comparator

vaccines but did not meet one of its primary immunogenicity

objectives of non-inferiority against the influenza B strain. No

safety signals with the combination vaccine candidate have been

identified in an ongoing safety data review. BioNTech and Pfizer

are evaluating adjustments to the candidate and will discuss next

steps with health authorities.

Select Oncology Pipeline

Updates

Next-Generation Immune Checkpoint

Immunomodulator Programs

BNT327/PM8002 is a bispecific

antibody candidate combining Programmed Cell Death Ligand-1

(“PD-L1”) checkpoint inhibition with Vascular Endothelial Growth

Factor A (“VEGF-A”) neutralization and is being developed in

collaboration with Biotheus Inc. (“Biotheus”).

- In October 2024, the first patient was dosed in a multi-site,

open-label Phase 2 clinical trial (NCT06449222) to evaluate the

safety, efficacy, and pharmacokinetics of BNT327/PM8002 at two dose

levels in combination with chemotherapy in the first- and

second-line treatment of patients with locally advanced/metastatic

triple negative breast cancer (“TNBC”). These data will inform a

Phase 3 clinical trial in first-line TNBC that is expected to start

in 2025.

- In September 2024, the first patient was dosed in a multi-site,

open-label Phase 2 clinical trial (NCT06449209) to evaluate

BNT327/PM8002 in combination with chemotherapy in patients with

untreated extensive-stage small-cell lung cancer (“ES-SCLC”), and

in patients with SCLC that progressed after first- or second-line

treatment. These data will inform a Phase 3 clinical trial in

first-line SCLC that is expected to start in 2024.

- A Phase 2/3 clinical trial in first-line non-small cell lung

cancer (“NSCLC”) is expected to start in 2024.

- In June 2024, evaluation of BNT327/PM8002 in combination with

BNT325/DB-1305, a Trophoblast Cell-Surface Antigen 2

(“TROP2”)-targeted antibody-drug conjugate (“ADC”) candidate, was

initiated as part of an ongoing Phase 1/2 clinical trial

(NCT05438329). The clinical trial evaluates the safety and

tolerability of BNT325/DB-1305 alone and in combination with

BNT327/PM8002 in various solid tumor indications. Additional trials

of novel BNT327/PM8002 combinations with proprietary ADCs are

planned to start in 2024.

- In September 2024, data were presented from three clinical

trials evaluating BNT327/PM8002 in patients with advanced TNBC,

Epidermal Growth Factor Receptor (“EGFR”)-mutated NSCLC and renal

cell carcinoma (“RCC”) at the 2024 Congress of the European Society

for Medical Oncology (“ESMO”):

- Data from an ongoing open-label, single-arm Phase 1/2 clinical

trial (NCT05918133) evaluating BNT327/PM8002 in combination with

chemotherapy as first-line treatment in patients with advanced or

metastatic TNBC showed clinically meaningful anti-tumor activity

regardless of PD-L1 status and a manageable safety profile

with no new safety signals observed beyond those typically

described for anti-PD-(L)1 therapies, anti-VEGF therapies, and

chemotherapy.

- Data from a Phase 2 clinical trial (NCT05756972) evaluating

BNT327/PM8002 in combination with chemotherapy in patients with

advanced EGFR-mutated NSCLC who progressed after EGFR-tyrosine

kinase inhibitor treatment showed encouraging anti-tumor activity

regardless of PD-L1 status and a generally manageable safety

profile.

- Data from an open-label multi-cohort Phase 1/2 clinical trial

(NCT05918445) evaluating BNT327/PM8002 monotherapy showed

encouraging anti-tumor activity and a manageable safety profile in

patients with previously untreated advanced non clear cell RCC or

treated advanced clear cell RCC.

- Data in first-line TNBC are planned to be presented at the San

Antonio Breast Cancer Symposium, taking place from December 10 to

December 13 in San Antonio, Texas, U.S. Additional data are

expected to be presented in 2025.

BNT316/ONC-392 (gotistobart) is an

anti-cytotoxic T-lymphocyte Associated Protein 4 (“CTLA-4”)

monoclonal antibody candidate being developed in collaboration with

OncoC4, Inc. (“OncoC4”).

- In October 2024, the FDA placed a partial clinical hold on the

Phase 3 trial (PRESERVE-003; NCT05671510) due to varying results

between patient populations. The trial assesses the efficacy and

safety of BNT316/ONC-392 as monotherapy in patients with metastatic

NSCLC that progressed under previous PD-(L)1-inhibitor treatment.

Enrollment of new patients has been paused while patients already

enrolled in the trial will continue to receive treatment. Trials

evaluating BNT316/ONC-392 in other indications remain

unaffected.

- In September 2024, preliminary data from the Phase 2

(PRESERVE-004; NCT05446298) clinical trial evaluating

BNT316/ONC-392 in combination with pembrolizumab in patients with

platinum-resistant ovarian cancer were presented at ESMO. The data

suggest encouraging preliminary clinical activity and a manageable

tolerability profile with no new safety signals detected for the

combination.

mRNA Cancer Vaccine Programs

BNT111, BNT113 and autogene cevumeran

(BNT122/RO7198457) are investigational vaccines for the treatment

of cancer based on BioNTech’s systemically administered uridine

mRNA-lipoplex technology.

BNT111 is based on BioNTech’s

wholly owned, off-the-shelf FixVac platform, and encodes shared

melanoma associated antigens.

- A randomized Phase 2 clinical trial (BNT111-01; NCT04526899) is

being conducted in collaboration with Regeneron Pharmaceuticals

Inc. (“Regeneron”) to evaluate BNT111 in combination with

cemiplimab in patients with anti-PD-(L)1 refractory/relapsed,

unresectable stage III or IV melanoma.

- In July 2024, BioNTech announced that the trial met its primary

efficacy outcome measure, demonstrating a statistically significant

improvement in overall response rate (“ORR”) in patients treated

with BNT111 in combination with cemiplimab, as compared to an

historical control in this indication and treatment setting. The

ORR in the cemiplimab monotherapy arm was in line with the

historical control of anti-PD-(L)1 or anti-CTLA-4 treatments in

this patient group. The treatment was generally well tolerated and

the safety profile of BNT111 in combination with cemiplimab in this

trial was consistent with previous clinical trials assessing BNT111

in combination with anti-PD-(L)1-containing treatments. The Phase 2

trial will continue as planned to further assess the secondary

endpoints which were not mature at the time of the primary

analysis.

- BioNTech plans to present data from this trial at an upcoming

medical conference in 2025.

BNT113 is based on BioNTech’s

FixVac platform encoding Human Papilloma Virus 16 (“HPV16”)

antigens.

- A global, randomized Phase 2 clinical trial (AHEAD-MERIT;

NCT04534205) is being conducted to evaluate BNT113 in combination

with pembrolizumab versus pembrolizumab monotherapy as a first-line

treatment in patients with unresectable, recurrent or metastatic,

PD-L1+, HPV16+ head and neck squamous cell carcinoma.

- In September 2024, an exploratory analysis of antitumor

activity (15 patients) and immunogenicity (3 patients) from the

safety run-in of AHEAD-MERIT was presented at ESMO. The data

support the tolerability of BNT113 and clinical activity in

combination with pembrolizumab was observed. In addition, BNT113

was found to induce de novo T-cell responses against HPV16

antigens.

- Also at ESMO, results were presented from an

investigator-sponsored Phase 1/2 dose escalation clinical trial

(HARE-40; NCT03418480) evaluating BNT113 alone in the post-adjuvant

and metastatic settings in patients with HPV16+ head and neck and

other cancers. BNT113 was shown to induce immune responses in

patients in the adjuvant and end-stage clinical settings and to be

overall well tolerated with a manageable safety profile.

Autogene cevumeran

(BNT122/RO7198457) is an mRNA cancer vaccine candidate for

individualized neoantigen-specific immunotherapy (“iNeST”) being

developed in collaboration with Genentech, Inc. (“Genentech”), a

member of the Roche Group (“Roche”).

- A randomized, double-blind, multi-site Phase 2 clinical trial

(IMCODE-004; NCT06534983) evaluating autogene cevumeran as an

adjuvant treatment with nivolumab in patients with high-risk

muscle-invasive urothelial cancer (“MIUC”) is enrolling patients.

The trial aims to evaluate the efficacy of autogene cevumeran in

combination with nivolumab compared to nivolumab alone in

approximately 360 patients. The primary endpoint for the study is

investigator-assessed disease-free survival (“DFS”). Secondary

objectives include overall survival (“OS”) and safety.

- Autogene cevumeran is also being evaluated in ongoing Phase 2

trials in adjuvant resected pancreatic ductal adenocarcinoma

(“PDAC”) (NCT05968326), adjuvant colorectal cancer (“CRC”)

(NCT04486378) and first-line advanced melanoma (NCT03815058).

- BioNTech plans to disclose interim data from the Phase 2

clinical trial (NCT04486378) in stage II (high-risk) and III

circulating tumor DNA+ (“ctDNA”) adjuvant CRC, which is projected

for late 2025 or 2026.

ADC Programs

BNT323/DB-1303

(trastuzumab pamirtecan) is an ADC candidate

targeting Human Epidermal Growth Factor 2 (“HER2”) that is being

developed in collaboration with Duality Biologics (Suzhou) Co. Ltd.

(“DualityBio”).

- BNT323/DB-1303 is being evaluated in a Phase 1/2 clinical trial

(NCT05150691) in patients with advanced/unresectable, recurrent or

metastatic HER2-expressing solid tumors. A potentially

registrational cohort of patients with HER2-expressing (IHC3+, 2+,

1+ or ISH-positive) advanced/recurrent endometrial carcinoma has

completed enrollment. Data from this cohort are expected in

2025.

- A confirmatory Phase 3 trial (NCT06340568) in patients with

advanced endometrial cancer is in planning.

- A pivotal Phase 3 trial (DYNASTY-Breast02; NCT06018337) is

being conducted in patients with Hormone Receptor-positive (“HR+”)

and HER2-low metastatic breast cancer that progressed on hormone

therapy and/or Cyclin-Dependent Kinase 4/6 (“CDK4/6”) inhibition.

In September 2024, a Trial-in-Progress poster was presented at

ESMO.

- Topline data from the ongoing Phase 3 trial in HR+ and HER2-low

metastatic breast cancer that have progressed on hormone therapy

and/or CDK4/6 inhibition are expected in 2026.

BNT324/DB-1311 is an ADC

candidate targeting B7H3 that is being developed in collaboration

with DualityBio.

- A first-in-human, open-label Phase 1/2 clinical trial

(NCT05914116) in patients with advanced solid tumors is

ongoing.

- In July 2024, the FDA granted Orphan Drug designation to

BNT324/DB-1311 for the treatment of advanced or metastatic

esophageal squamous cell carcinoma.

- The first preliminary data update from this trial is expected

to be presented at the ESMO Asia Congress (December 6-8, 2024 in

Singapore).

BNT326/YL202 is an ADC

candidate targeting Human Epidermal Growth Factor 3 (“HER3”) that

is being developed in collaboration with MediLink Therapeutics

(Suzhou) Co., Ltd. (“MediLink”).

- A multi-site, international, open-label, first-in-human Phase 1

clinical trial (NCT05653752) sponsored by MediLink evaluating

BNT326/YL202 as a later-line treatment in patients with locally

advanced or metastatic EGFR-mutated NSCLC or HR+/HER2-negative

breast cancer is ongoing. On August 15, 2024, the FDA lifted the

partial clinical hold that was placed on this trial, initially

announced on June 17, 2024. Trial recruitment has been reinitiated

with a focus on dose levels no higher than 3 mg/kg, where the

safety profile was manageable and encouraging clinical activity was

observed.

Cell Therapy Programs

BNT211 consists of a chimeric antigen receptor

(“CAR”)-T cell product candidate targeting Claudin-6

(“CLDN6”)-positive solid tumors in combination with a CAR-T

cell-amplifying RNA vaccine (“CARVac”) encoding CLDN6.

- A first-in-human, open-label, multi-site Phase 1 dose

escalation and dose expansion basket trial (NCT04503278) is being

conducted to evaluate BNT211 in patients with CLDN6-positive

relapsed or refractory solid tumors, including ovarian cancers and

testicular germ cell tumors.

- In September 2024, data from the ongoing trial presented at

ESMO showed signs of antitumor activity across indications. CARVac

was shown to improve CAR-T persistence in some patients. The data

also suggested that the safety profile of CLDN6 CAR T cells with

and without CARVac is consistent with the previously published

effects of CAR T therapies and that repeated CARVac administration

does not significantly increase toxicity.

- A pivotal Phase 2 trial in patients with testicular germ cell

tumors is expected to start in 2025 based on encouraging activity

observed in this patient group.

Corporate Update for the Third Quarter

2024 and Key Post Period-End Events

- On October 1, 2024, BioNTech, alongside its artificial

intelligence (“AI”) subsidiary InstaDeep, presented an overview of

its AI approach during an edition of the Company’s Innovation

Series called AI Day. As part of the event, BioNTech showcased the

Company’s approach to AI capability scaling and deployment across

its pipeline. These updates covered the introduction of a new near

exascale supercomputer, the launch of a novel Bayesian Flow Network

(“BFN”) generative model, and multiple updates on the deployment of

AI across BioNTech’s preclinical and clinical operations.

Upcoming Investor and Analyst

Events

- Innovation Series R&D Day: November 14, 2024

- Fourth Quarter and Full Year 2024 Financial Results and

Corporate Update: March 10, 2025

Conference Call and Webcast Information

BioNTech invites investors and the general

public to join a conference call and webcast with investment

analysts today, November 4, 2024, at 8:00 a.m. EST (2:00 p.m.

CET) to report its financial results and provide a corporate update

for the third quarter of 2024.

To access the live conference call via

telephone, please register via this link. Once registered, dial-in

numbers and a PIN number will be provided.

The slide presentation and audio of the webcast

will be available via this link.

Participants may also access the slides and the

webcast of the conference call via the “Events & Presentations”

page of the Investors' section of the Company’s website at

www.BioNTech.com. A replay of the webcast will be available shortly

after the conclusion of the call and archived on the Company’s

website for 30 days following the call.

About BioNTechBiopharmaceutical

New Technologies (BioNTech) is a global next generation

immunotherapy company pioneering novel therapies for cancer and

other serious diseases. BioNTech exploits a wide array of

computational discovery and therapeutic drug platforms for the

rapid development of novel biopharmaceuticals. Its broad portfolio

of oncology product candidates includes individualized and

off-the-shelf mRNA-based therapies, innovative chimeric antigen

receptor (CAR) T cells, several protein-based therapeutics,

including bispecific immune checkpoint modulators, targeted cancer

antibodies and antibody-drug conjugate (ADC) therapeutics, as well

as small molecules. Based on its deep expertise in mRNA vaccine

development and in-house manufacturing capabilities, BioNTech and

its collaborators are developing multiple mRNA vaccine candidates

for a range of infectious diseases alongside its diverse oncology

pipeline. BioNTech has established a broad set of relationships

with multiple global and specialized pharmaceutical collaborators,

including Biotheus, DualityBio, Fosun Pharma, Genentech, a member

of the Roche Group, Genevant, Genmab, MediLink, OncoC4, Pfizer and

Regeneron.

For more information, please visit www.BioNTech.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995, as amended, including, but not limited to,

statements concerning: BioNTech’s expected revenues related to

sales of BioNTech’s COVID-19 vaccine, referred to as

COMIRNATY where approved for use under full or conditional

marketing authorization, in territories controlled by BioNTech’s

collaboration partners, particularly for those figures that are

derived from preliminary estimates provided by BioNTech’s partners;

the rate and degree of market acceptance of BioNTech’s COVID-19

vaccine and, if approved, BioNTech’s investigational medicines;

expectations regarding anticipated changes in COVID-19 vaccine

demand, including changes to the ordering environment and expected

regulatory recommendations to adapt vaccines to address new

variants or sublineages; the initiation, timing, progress, results,

and cost of BioNTech’s research and development programs, including

BioNTech’s current and future preclinical studies and clinical

trials, including statements regarding the expected timing of

initiation, enrollment, and completion of studies or trials and

related preparatory work and the availability of results, and the

timing and outcome of applications for regulatory approvals and

marketing authorizations; BioNTech’s expectations regarding

potential future commercialization in oncology, including goals

regarding timing and indications; the targeted timing and number of

additional potentially registrational trials, and the

registrational potential of any trial BioNTech may initiate;

discussions with regulatory agencies; BioNTech’s expectations with

respect to intellectual property; the impact of BioNTech’s

collaboration and licensing agreements; the development, nature and

feasibility of sustainable vaccine production and supply solutions;

the deployment of AI across BioNTech’s preclinical and clinical

operations; BioNTech’s estimates of revenues, research and

development expenses, selling, general and administrative expenses

and capital expenditures for operating activities; and BioNTech’s

expectations of net profit / (loss). In some cases, forward-looking

statements can be identified by terminology such as “will,” “may,”

“should,” “expects,” “intends,” “plans,” “aims,” “anticipates,”

“believes,” “estimates,” “predicts,” “potential,” “continue,” or

the negative of these terms or other comparable terminology,

although not all forward-looking statements contain these

words.

The forward-looking statements in this press

release are based on BioNTech’s current expectations and beliefs of

future events, and are neither promises nor guarantees. You should

not place undue reliance on these forward-looking statements

because they involve known and unknown risks, uncertainties, and

other factors, many of which are beyond BioNTech’s control and

which could cause actual results to differ materially and adversely

from those expressed or implied by these forward-looking

statements. These risks and uncertainties include, but are not

limited to: the uncertainties inherent in research and development,

including the ability to meet anticipated clinical endpoints,

commencement and/or completion dates for clinical trials, projected

data release timelines, regulatory submission dates, regulatory

approval dates and/or launch dates, as well as risks associated

with preclinical and clinical data, including the data discussed in

this release, and including the possibility of unfavorable new

preclinical, clinical or safety data and further analyses of

existing preclinical, clinical or safety data; the nature of the

clinical data, which is subject to ongoing peer review, regulatory

review and market interpretation; BioNTech’s pricing and coverage

negotiations regarding its COVID-19 vaccine with governmental

authorities, private health insurers and other third-party

payors; the future commercial demand and medical need for

initial or booster doses of a COVID-19 vaccine; competition from

other COVID-19 vaccines or related to BioNTech’s other product

candidates, including those with different mechanisms of action and

different manufacturing and distribution constraints, on the basis

of, among other things, efficacy, cost, convenience of storage and

distribution, breadth of approved use, side-effect profile and

durability of immune response; the timing of and BioNTech’s ability

to obtain and maintain regulatory approval for its product

candidates; the ability of BioNTech’s COVID-19 vaccines to prevent

COVID-19 caused by emerging virus variants; BioNTech’s and its

counterparties’ ability to manage and source necessary energy

resources; BioNTech’s ability to identify research opportunities

and discover and develop investigational medicines; the ability and

willingness of BioNTech’s third-party collaborators to continue

research and development activities relating to BioNTech's

development candidates and investigational medicines; the impact of

COVID-19 on BioNTech’s development programs, supply chain,

collaborators and financial performance; unforeseen safety issues

and potential claims that are alleged to arise from the use of

products and product candidates developed or manufactured by

BioNTech; BioNTech’s and its collaborators’ ability to

commercialize and market BioNTech’s COVID-19 vaccine and, if

approved, its product candidates; BioNTech’s ability to manage its

development and related expenses; regulatory developments in the

United States and other countries; BioNTech’s ability to

effectively scale its production capabilities and manufacture its

products and product candidates; risks relating to the global

financial system and markets; and other factors not known to

BioNTech at this time. You should review the risks and

uncertainties described under the heading “Risk Factors” in

BioNTech’s Report on Form 6-K for the period ended

September 30, 2024 and in subsequent filings made by BioNTech

with the SEC, which are available on the SEC’s website

at www.sec.gov. These forward-looking statements speak only as

of the date hereof. Except as required by law, BioNTech disclaims

any intention or responsibility for updating or revising any

forward-looking statements contained in this press release in the

event of new information, future developments or otherwise.

CONTACTS

Investor RelationsMichael

HorowiczInvestors@biontech.de

Media Relations Jasmina Alatovic

Media@biontech.de

Interim Consolidated Statements of Profit

or Loss

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three months ended September

30, |

|

|

Nine months ended September

30, |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

| (in millions €, except per share

data) |

|

|

(unaudited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

Revenues |

|

|

1,244.8 |

|

|

895.3 |

|

|

1,561.1 |

|

|

2,340.0 |

|

Cost of sales |

|

|

(178.9) |

|

|

(161.8) |

|

|

(297.8) |

|

|

(420.7) |

| Research

and development expenses |

|

|

(550.3) |

|

|

(497.9) |

|

|

(1,642.4) |

|

|

(1,205.3) |

| Sales and

marketing expenses |

|

|

(18.1) |

|

|

(14.4) |

|

|

(46.6) |

|

|

(44.7) |

| General

and administrative expenses (1) |

|

|

(132.4) |

|

|

(139.1) |

|

|

(420.3) |

|

|

(370.7) |

| Other

operating expenses (1) |

|

|

(410.9) |

|

|

(36.8) |

|

|

(719.9) |

|

|

(239.6) |

| Other operating income |

|

|

56.3 |

|

|

27.8 |

|

|

103.0 |

|

|

105.2 |

|

Operating profit / (loss) |

|

|

10.5 |

|

|

73.1 |

|

|

(1,462.9) |

|

|

164.2 |

|

Finance income |

|

|

156.2 |

|

|

156.3 |

|

|

498.8 |

|

|

363.2 |

| Finance expenses |

|

|

(8.0) |

|

|

(2.0) |

|

|

(14.8) |

|

|

(4.5) |

|

Profit / (Loss) before tax |

|

|

158.7 |

|

|

227.4 |

|

|

(978.9) |

|

|

522.9 |

|

Income taxes |

|

|

39.4 |

|

|

(66.8) |

|

|

54.1 |

|

|

(50.5) |

| Net profit / (loss) |

|

|

198.1 |

|

|

160.6 |

|

|

(924.8) |

|

|

472.4 |

|

Earnings / (Loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic

earnings / (loss) per share |

|

|

0.82 |

|

|

0.67 |

|

|

(3.83) |

|

|

1.96 |

| Diluted

earnings / (loss) per share |

|

|

0.81 |

|

|

0.66 |

|

|

(3.83) |

|

|

1.94 |

(1) Adjustments to prior-year

figures due to change in functional allocation of general and

administrative expenses and other operating expenses.

Interim Consolidated Statements of

Financial Position

|

|

|

|

|

|

|

|

| |

|

|

September 30, |

|

|

December 31, |

| (in millions €) |

|

|

2024 |

|

|

2023 |

|

Assets |

|

|

(unaudited) |

|

|

|

|

Non-current assets |

|

|

|

|

|

|

|

Goodwill |

|

|

374.0 |

|

|

362.5 |

| Other

intangible assets |

|

|

873.9 |

|

|

804.1 |

| Property,

plant and equipment |

|

|

917.4 |

|

|

757.2 |

|

Right-of-use assets |

|

|

242.0 |

|

|

214.4 |

| Other

financial assets |

|

|

1,332.2 |

|

|

1,176.1 |

| Other non-financial assets |

|

|

84.8 |

|

|

83.4 |

|

Deferred tax assets |

|

|

90.7 |

|

|

81.3 |

|

Total non-current assets |

|

|

3,915.0 |

|

|

3,479.0 |

|

Current assets |

|

|

|

|

|

|

|

Inventories |

|

|

303.1 |

|

|

357.7 |

| Trade and other receivables |

|

|

988.0 |

|

|

2,155.7 |

|

Other financial assets |

|

|

7,084.7 |

|

|

4,885.3 |

| Other

non-financial assets |

|

|

275.8 |

|

|

285.8 |

| Income tax assets |

|

|

210.0 |

|

|

179.1 |

| Cash and

cash equivalents |

|

|

9,624.6 |

|

|

11,663.7 |

|

Total current assets |

|

|

18,486.2 |

|

|

19,527.3 |

|

Total assets |

|

|

22,401.2 |

|

|

23,006.3 |

| |

|

|

|

|

|

|

|

Equity and liabilities |

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

| Share

capital |

|

|

248.6 |

|

|

248.6 |

| Capital

reserve |

|

|

1,373.0 |

|

|

1,229.4 |

| Treasury

shares |

|

|

(8.8) |

|

|

(10.8) |

| Retained

earnings |

|

|

18,838.5 |

|

|

19,763.3 |

| Other reserves |

|

|

(1,336.8) |

|

|

(984.6) |

|

Total equity |

|

|

19,114.5 |

|

|

20,245.9 |

|

Non-current liabilities |

|

|

|

|

|

|

| Lease

liabilities, loans and borrowings |

|

|

206.3 |

|

|

191.0 |

| Other financial liabilities |

|

|

44.3 |

|

|

38.8 |

|

Provisions |

|

|

8.5 |

|

|

8.8 |

| Contract liabilities |

|

|

376.9 |

|

|

398.5 |

|

Other non-financial liabilities |

|

|

90.4 |

|

|

13.1 |

| Deferred

tax liabilities |

|

|

37.8 |

|

|

39.7 |

|

Total non-current liabilities |

|

|

764.2 |

|

|

689.9 |

|

Current liabilities |

|

|

|

|

|

|

| Lease

liabilities, loans and borrowings |

|

|

37.4 |

|

|

28.1 |

| Trade

payables and other payables |

|

|

762.6 |

|

|

354.0 |

| Other financial liabilities |

|

|

241.6 |

|

|

415.2 |

|

Income tax liabilities |

|

|

363.6 |

|

|

525.5 |

|

Provisions |

|

|

731.5 |

|

|

269.3 |

| Contract

liabilities |

|

|

236.0 |

|

|

353.3 |

| Other

non-financial liabilities |

|

|

149.8 |

|

|

125.1 |

|

Total current liabilities |

|

|

2,522.5 |

|

|

2,070.5 |

|

Total liabilities |

|

|

3,286.7 |

|

|

2,760.4 |

|

Total equity and liabilities |

|

|

22,401.2 |

|

|

23,006.3 |

Interim Consolidated Statements of Cash

Flows

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three months ended September

30, |

|

|

Nine months ended September

30, |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

| (in

millions €) |

|

|

(unaudited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

Operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

| Net

profit / (loss) |

|

|

198.1 |

|

|

160.6 |

|

|

(924.8) |

|

|

472.4 |

| Income

taxes |

|

|

(39.4) |

|

|

66.8 |

|

|

(54.1) |

|

|

50.5 |

|

Profit / (Loss) before tax |

|

|

158.7 |

|

|

227.4 |

|

|

(978.9) |

|

|

522.9 |

|

Adjustments to reconcile profit before tax to net cash

flows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization of property, plant, equipment,

intangible assets and right-of-use assets |

|

|

44.4 |

|

|

41.3 |

|

|

132.6 |

|

|

104.6 |

|

Share-based payment expenses |

|

|

40.9 |

|

|

15.5 |

|

|

77.4 |

|

|

37.2 |

|

Net foreign exchange differences |

|

|

(35.5) |

|

|

(20.4) |

|

|

(77.4) |

|

|

(364.3) |

|

(Gain) / Loss on disposal of property, plant and equipment |

|

|

— |

|

|

3.3 |

|

|

(0.2) |

|

|

3.6 |

|

Finance income excluding foreign exchange differences |

|

|

(156.2) |

|

|

(148.5) |

|

|

(498.8) |

|

|

(357.4) |

|

Finance expense excluding foreign exchange differences |

|

|

5.3 |

|

|

2.0 |

|

|

14.8 |

|

|

4.5 |

|

Government grants |

|

|

(14.6) |

|

|

— |

|

|

(26.8) |

|

|

(3.0) |

|

Unrealized (gain) / loss on derivative instruments at fair value

through profit or loss(1) |

|

|

(6.0) |

|

|

(3.5) |

|

|

0.7 |

|

|

196.7 |

|

Working capital adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Decrease / (Increase) in trade and other receivables, contract

assets and other assets(1) |

|

|

(830.2) |

|

|

631.2 |

|

|

1,267.6 |

|

|

5,662.0 |

|

Decrease in inventories |

|

|

37.0 |

|

|

33.2 |

|

|

54.6 |

|

|

23.9 |

|

(Decrease) / Increase in trade payables, other financial

liabilities, other liabilities, contract liabilities, refund

liabilities and provisions |

|

|

117.9 |

|

|

(25.0) |

|

|

590.7 |

|

|

(293.9) |

| Interest

received and realized gains from cash and cash equivalents |

|

|

73.1 |

|

|

70.3 |

|

|

353.3 |

|

|

166.4 |

| Interest

paid and realized losses from cash and cash equivalents |

|

|

(1.6) |

|

|

(1.2) |

|

|

(6.9) |

|

|

(3.7) |

| Income

tax received / (paid), net(1) |

|

|

1.6 |

|

|

(10.2) |

|

|

(190.8) |

|

|

(417.8) |

|

Share-based payments |

|

|

(134.4) |

|

|

(4.2) |

|

|

(143.6) |

|

|

(761.2) |

|

Government grants received |

|

|

60.7 |

|

|

— |

|

|

102.7 |

|

|

— |

| Net cash flows from / (used in)

operating activities |

|

|

(638.9) |

|

|

811.2 |

|

|

671.0 |

|

|

4,520.5 |

|

Investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

| Purchase

of property, plant and equipment |

|

|

(72.8) |

|

|

(53.2) |

|

|

(219.9) |

|

|

(165.6) |

| Proceeds

from sale of property, plant and equipment |

|

|

0.3 |

|

|

(0.8) |

|

|

0.5 |

|

|

(0.8) |

| Purchase

of intangible assets and right-of-use assets |

|

|

(10.2) |

|

|

(97.2) |

|

|

(141.3) |

|

|

(348.9) |

|

Acquisition of subsidiaries and businesses, net of cash

acquired |

|

|

— |

|

|

(336.9) |

|

|

— |

|

|

(336.9) |

|

Investment in other financial assets(1) |

|

|

(2,958.2) |

|

|

(1,047.1) |

|

|

(10,301.5) |

|

|

(3,710.2) |

| Proceeds

from maturity of other financial assets(1) |

|

|

2,898.8 |

|

|

303.0 |

|

|

7,974.3 |

|

|

303.0 |

| Net cash flows used in investing

activities |

|

|

(142.1) |

|

|

(1,232.2) |

|

|

(2,687.9) |

|

|

(4,259.4) |

|

Financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from loans and borrowings |

|

|

— |

|

|

0.1 |

|

|

— |

|

|

0.1 |

| Repayment

of loans and borrowings |

|

|

— |

|

|

(0.1) |

|

|

(2.3) |

|

|

(0.1) |

| Payments

related to lease liabilities |

|

|

(7.9) |

|

|

(9.3) |

|

|

(36.3) |

|

|

(28.0) |

| Share repurchase program |

|

|

— |

|

|

(301.7) |

|

|

— |

|

|

(737.7) |

| Net

cash flows used in financing activities |

|

|

(7.9) |

|

|

(311.0) |

|

|

(38.6) |

|

|

(765.7) |

|

Net decrease in cash and cash equivalents |

|

|

(788.9) |

|

|

(732.0) |

|

|

(2,055.5) |

|

|

(504.6) |

| Change in

cash and cash equivalents resulting from exchange rate

differences |

|

|

(2.3) |

|

|

61.2 |

|

|

1.2 |

|

|

125.3 |

| Change in

cash and cash equivalents resulting from other valuation

effects |

|

|

39.1 |

|

|

— |

|

|

15.2 |

|

|

— |

| Cash and

cash equivalents at the beginning of the period |

|

|

10,376.7 |

|

|

14,166.6 |

|

|

11,663.7 |

|

|

13,875.1 |

|

Cash and cash equivalents as of September 30 |

|

|

9,624.6 |

|

|

13,495.8 |

|

|

9,624.6 |

|

|

13,495.8 |

(1) Adjustments to prior-year figures relate to

reclassifications within the cash flows from operating and

investing activities, respectively.

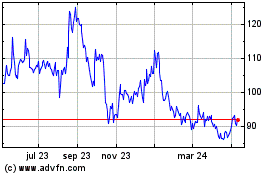

BioNTech (NASDAQ:BNTX)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

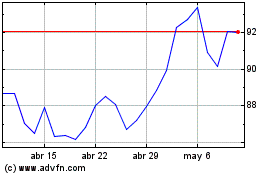

BioNTech (NASDAQ:BNTX)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024