false

0001720893

0001720893

2024-09-17

2024-09-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

September 17, 2024

BioXcel

Therapeutics, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-38410 |

|

82-1386754 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

555

Long Wharf Drive

New

Haven, CT

06511

(Address

of principal executive offices, including Zip Code)

(475)

238-6837

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common

Stock, par value $0.001 |

|

BTAI |

|

The Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.05. | Costs Associated with Exit or Disposal Activities. |

On September 17,

2024, the Board of Directors (the “Board”) of BioXcel Therapeutics, Inc. (the “Company”) approved a

plan to reduce its workforce by 15 employees, or approximately 28% of the Company’s headcount (the “Clinical

Prioritization”), in order to extend its cash runway and prioritize investment on the clinical development of its lead

neuroscience asset, BXCL501.

The Company estimates that

it will incur aggregate charges in connection with the Clinical Prioritization of approximately $1.4 million, which relate primarily to

severance payments, notice pay and related continuation of benefits costs, all of which are expected to be paid in cash and anticipated

to result in future cash expenditures, along with the payment of accrued benefits (such as paid-time-off). The Company expects that the

majority of these costs will be incurred, and the Clinical Prioritization is expected to be completed, during the quarter ending December 31,

2024. The estimates of the charges and expenditures that the Company expects to incur in connection with the Clinical Prioritization,

and the timing thereof, are subject to several assumptions and the actual amounts incurred may differ materially from these estimates.

The Company may also incur other cash or non-cash charges or cash expenditures not currently contemplated due to events that may occur

as a result of, or in association with, the Clinical Prioritization.

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers. |

On September 18, 2024,

the Company notified Matt Wiley, the Company’s Chief Commercial Officer, that, in connection with the Clinical Prioritization, his

position was being eliminated. The Company and Mr. Wiley agreed that he would cease his employment in this role effective October 2,

2024 and would serve as a consultant for a period of time thereafter.

Forward-Looking Statements

This Current Report on Form 8-K

(“Form 8-K”) includes “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking

statements contained in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act

of 1934, as amended. All statements contained in this Form 8-K other than statements of historical fact should be considered forward-looking

statements, including, without limitation, statements regarding the expected costs and payments resulting from the Clinical Prioritization

and the timing of management changes. When used herein, words including “anticipate,” “believe,” “can,”

“continue,” “could,” “designed,” “estimate,” “expect,” “forecast,”

“goal,” “intend,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “should,” “target,” “will,” “would” and

similar expressions are intended to identify forward-looking statements, though not all forward-looking statements use these words or

expressions. In addition, any statements or information that refer to expectations, beliefs, plans, projections, objectives, performance

or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking. All forward-looking

statements are based upon the Company’s current expectations and various assumptions. The Company believes there is a reasonable

basis for its expectations and beliefs, but they are inherently uncertain. The Company may not realize its expectations, and its beliefs

may not prove correct. Actual results could differ materially from those described or implied by such forward-looking statements as a

result of various important factors, including, without limitation: its limited operating history; its incurrence of significant losses;

its need for substantial additional funding and ability to raise capital when needed; the impact of the reprioritization; its significant

indebtedness, ability to comply with covenant obligations and potential payment obligations related to such indebtedness and other contractual

obligations; the Company has identified conditions and events that raise substantial doubt about its ability to continue as a going concern;

its limited experience in drug discovery and drug development; its exposure to patent infringement lawsuits; its reliance on third parties;

its ability to comply with the extensive regulations applicable to it; impacts from data breaches or cyber-attacks, if any; risks associated

with the increased scrutiny relating to environmental, social and governance (ESG) matters; risks associated with federal, state or foreign

health care “fraud and abuse” laws; and its ability to commercialize its product candidates, as well as the important factors

discussed under the caption “Risk Factors” in its Annual Report on Form 10-K for the fiscal year ended December 31,

2023, as such factors may be updated from time to time in its other filings with the SEC, including without limitation its Quarterly Report

on Form 10-Q for the quarterly period ended June 30, 2024, which are accessible on the SEC’s website at www.sec.gov. These

and other important factors could cause actual results to differ materially from those indicated by the forward-looking statements made

in this Form 8-K. Any such forward-looking statements represent management’s estimates as of the date of this Form 8-K.

While the Company may elect to update such forward-looking statements at some point in the future, except as required by law, it disclaims

any obligation to do so, even if subsequent events cause our views to change. These forward-looking statements should not be relied upon

as representing the Company’s views as of any date subsequent to the date of this Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: September 19, 2024 |

BIOXCEL THERAPEUTICS, INC. |

| |

|

| |

/s/ Richard Steinhart |

| |

Richard Steinhart |

| |

SVP, Chief Financial Officer |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

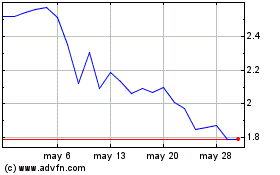

BioXcel Therapeutics (NASDAQ:BTAI)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

BioXcel Therapeutics (NASDAQ:BTAI)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025