Avis Budget Group, Inc. (

NASDAQ: CAR) announced

financial results for first quarter 2024 today.

We ended the quarter with revenues of $2.6

billion, driven by strong travel demand. Net loss was $113 million

and our Adjusted EBITDA1 was $12 million.

Our liquidity position at the end of the quarter

was approximately $0.7 billion, with an additional $3.8 billion of

fleet funding capacity. We have well-laddered corporate debt, and

after giving effect to our euro note repayment in April 2024, will

have no meaningful maturities until 2027.

“The strong travel demand from last year

continued into the first quarter with record volume in the Americas

as well as improved pricing trends as the quarter progressed,” said

Joe Ferraro, Avis Budget Group Chief Executive Officer. “We took

the necessary actions to get our fleet size in-line by disposing a

record number of vehicles in the quarter allowing us to exit March

with utilization in-line with prior year. The steps we have taken

in the first quarter set us up well to take advantage of the peak

spring and summer travel seasons.”

Q1 HIGHLIGHTS

- Revenues were $2.6

billion with rental days up 5% compared to first quarter 2023.

- Adjusted EBITDA in

the Americas was $44 million, driven by strong demand.

- Adjusted EBITDA

loss in International was $15 million.

- In February 2024,

we issued €600 million Senior Notes due February 2029 primarily to

redeem our outstanding €350 million Senior Notes due January

2026.

INVESTOR CONFERENCE CALL

We will host a conference call to discuss our

first quarter results on May 2, 2024, at 8:30 a.m. (ET).

Investors may access the call on our investor relations website at

ir.avisbudgetgroup.com or by dialing (877) 407-2991. A replay of

the call will be available on our website and at (877) 660-6853

using conference code 13743680.

ABOUT AVIS BUDGET GROUP

We are a leading global provider of mobility

solutions, both through our Avis and Budget brands, which have

approximately 10,250 rental locations in approximately 180

countries around the world, and through our Zipcar brand, which is

the world's leading car sharing network. We operate most of our car

rental locations in North America, Europe and Australasia directly,

and operate primarily through licensees in other parts of the

world. We are headquartered in Parsippany, N.J. More information is

available at avisbudgetgroup.com.

NON-GAAP FINANCIAL MEASURES AND KEY

METRICS

This release includes financial measures such as

Adjusted EBITDA and Adjusted Free Cash Flow, as well as other

financial measures, that are not considered generally accepted

accounting principle (“GAAP”) measures as defined under SEC rules.

Important information regarding such non-GAAP measures is contained

in the tables within this release and in Appendix I, including the

definitions of these measures and reconciliations to the most

comparable GAAP measures.

We measure performance principally using the

following key metrics: (i) rental days, (ii) revenue per day, (iii)

vehicle utilization, and (iv) per-unit fleet costs. Our rental

days, revenue per day and vehicle utilization metrics are all

calculated based on the actual rental of the vehicle during a

24-hour period. We believe that this methodology provides

management with the most relevant metrics in order to effectively

manage the performance of our business. Our calculations may not be

comparable to the calculations of similarly-titled metrics by other

companies. We present currency exchange rate effects on our key

metrics to provide a method of assessing how our business performed

excluding the effects of foreign currency rate fluctuations.

Currency exchange rate effects are calculated by translating the

current-period's results at the prior-period average exchange rates

plus any related gains and losses on currency hedges.

FORWARD-LOOKING STATEMENTS

Certain statements in this press release

constitute “forward-looking statements” as that term is defined in

the Private Securities Litigation Reform Act of 1995. The

forward-looking statements contained herein are subject to known

and unknown risks, uncertainties, assumptions and other factors

that may cause our actual results, performance or achievements to

be materially different from those expressed or implied by any such

forward-looking statements. Forward-looking statements include

information concerning our future financial performance, business

strategy, projected plans and objectives. These statements may be

identified by the fact that they do not relate to historical or

current facts and may use words such as “believes,” “expects,”

“anticipates,” “will,” “should,” “could,” “may,” “would,”

“intends,” “projects,” “estimates,” “plans,” “forecasts,”

“guidance,” and similar words, expressions or phrases. The

following important factors and assumptions could affect our future

results and could cause actual results to differ materially from

those expressed in such forward-looking statements. These factors

include, but are not limited to:

- the high level of competition in

the mobility industry, including from new companies or technology,

and the impact such competition may have on pricing and rental

volume;

- a change in our fleet costs,

including as a result of a change in the cost of new vehicles,

resulting from inflation or otherwise, manufacturer recalls,

disruption in the supply of new vehicles, including due to labor

actions or otherwise, shortages in semiconductors used in new

vehicle production, and/or a change in the price at which we

dispose of used vehicles either in the used vehicle market or under

repurchase or guaranteed depreciation programs;

- the results of operations or

financial condition of the manufacturers of our vehicles, which

could impact their ability to perform their payment obligations

under our agreements with them, including repurchase and/or

guaranteed depreciation arrangements, and/or their willingness or

ability to make vehicles available to us or the mobility industry

as a whole on commercially reasonable terms or at all;

- levels of and volatility in travel

demand, including future volatility in airline passenger

traffic;

- a deterioration in economic

conditions, resulting in a recession or otherwise, particularly

during our peak season or in key market segments;

- an occurrence or threat of

terrorism, pandemic diseases such as COVID-19, natural disasters,

military conflicts, including the ongoing military conflicts in the

Middle East and Eastern Europe, or civil unrest in the locations in

which we operate, and the potential effects of sanctions on the

world economy and markets and/or international trade;

- any substantial changes in the cost

or supply of fuel, vehicle parts, energy, labor or other resources

on which we depend to operate our business, including as a result

of a global pandemic such as COVID-19, inflation, the ongoing

military conflicts in the Middle East and Eastern Europe, and any

embargoes on oil sales imposed on or by the Russian

government;

- our ability to successfully

implement or achieve our business plans and strategies, achieve and

maintain cost savings and adapt our business to changes in

mobility;

- political, economic or commercial

instability in the countries in which we operate, and our ability

to conform to multiple and conflicting laws or regulations in those

countries;

- the performance of the used vehicle

market from time to time, including our ability to dispose of

vehicles in the used vehicle market on attractive terms;

- our dependence on third-party

distribution channels, third-party suppliers of other services and

co-marketing arrangements with third parties;

- risks related to completed or

future acquisitions or investments that we may pursue, including

the incurrence of incremental indebtedness to help fund such

transactions and our ability to promptly and effectively integrate

any acquired businesses or capitalize on joint ventures,

partnerships and other investments;

- our ability to utilize derivative

instruments, and the impact of derivative instruments we utilize,

which can be affected by fluctuations in interest rates, fuel

prices and exchange rates, changes in government regulations and

other factors;

- our exposure to uninsured or unpaid

claims in excess of historical levels and our ability to obtain

insurance at desired levels and the cost of that insurance;

- risks associated with litigation or

governmental or regulatory inquiries, or any failure or inability

to comply with laws, regulations or contractual obligations or any

changes in laws, regulations or contractual obligations, including

with respect to personally identifiable information and consumer

privacy, labor and employment, and tax;

- risks related to protecting the

integrity of, and preventing unauthorized access to, our

information technology systems or those of our third-party vendors,

licensees, dealers, independent operators and independent

contractors, and protecting the confidential information of our

employees and customers against security breaches, including

physical or cybersecurity breaches, attacks, or other disruptions,

compliance with privacy and data protection regulation, and the

effects of any potential increase in cyberattacks on the world

economy and markets and/or international trade;

- any impact on us from the actions

of our third-party vendors, licensees, dealers, independent

operators and independent contractors and/or disputes that may

arise out of our agreements with such parties;

- any major disruptions in our

communication networks or information systems;

- risks related to tax obligations

and the effect of future changes in tax laws and accounting

standards;

- risks related to our indebtedness,

including our substantial outstanding debt obligations, recent and

future interest rate increases, which increase our financing costs,

downgrades by rating agencies and our ability to incur

substantially more debt;

- our ability to obtain financing for

our global operations, including the funding of our vehicle fleet

through the issuance of asset-backed securities and use of the

global lending markets;

- our ability to meet the financial

and other covenants contained in the agreements governing our

indebtedness, or to obtain a waiver or amendment of such covenants

should we be unable to meet such covenants;

- significant changes in the

assumptions and estimates that are used in our impairment testing

for goodwill or intangible assets, which could result in a

significant impairment of our goodwill or intangible assets;

and

- other business, economic,

competitive, governmental, regulatory, political or technological

factors affecting our operations, pricing or services.

We operate in a continuously changing business

environment and new risk factors emerge from time to time. New risk

factors, factors beyond our control, or changes in the impact of

identified risk factors may cause actual results to differ

materially from those set forth in any forward-looking statements.

Accordingly, forward-looking statements should not be relied upon

as a prediction of actual results. Moreover, we do not assume

responsibility if future results are materially different from

those forecasted or anticipated. Other factors and assumptions not

identified above, including those discussed in “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations,” set forth in Part II, Item 7, in "Risk Factors," set

forth in Part I, Item 1A, and in other portions of our 2023 Annual

Report on Form 10-K filed with the Securities and Exchange

Commission (the “SEC”) on February 16, 2024 (the “2023 Form 10-K”),

as well as in similarly titled sections set forth in Part I, Item 2

and Part II, Item 1A of our subsequently filed quarterly reports,

may cause actual results to differ materially from those projected

in any forward-looking statements.

Although we believe that our assumptions are

reasonable, any or all of our forward-looking statements may prove

to be inaccurate and we can make no guarantees about our future

performance. Should unknown risks or uncertainties materialize or

underlying assumptions prove inaccurate, actual results could

differ materially from past results and/or those anticipated,

estimated or projected. We undertake no obligation to release any

revisions to any forward-looking statements, to report events or to

report the occurrence of unanticipated events. For any

forward-looking statements contained in any document, we claim the

protection of the safe harbor for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995.

For additional information concerning forward-looking statements

and other important factors, refer to our 2023 Form 10-K, Quarterly

Reports on Form 10-Q and other filings with the SEC.

|

Investor Relations Contact: |

Media Relations Contact: |

|

David Calabria, IR@avisbudget.com |

James Tomlinson, ABGPress@edelman.com |

| |

|

|

*** Tables 1 - 6 and Appendix I attached *** |

Table 1

|

Avis Budget Group, Inc.SUMMARY DATA SHEET

(Unaudited)(In millions, except per share

data) |

|

|

| |

Three Months Ended March 31, |

| |

|

2024 |

|

|

|

2023 |

|

|

% Change |

| Income Statement and

Other Items |

|

|

|

|

|

|

Revenues |

$ |

2,551 |

|

|

$ |

2,557 |

|

|

— |

% |

|

Income (loss) before income taxes |

|

(142 |

) |

|

|

397 |

|

|

(136) |

% |

| Net income (loss) |

|

(113 |

) |

|

|

312 |

|

|

(136) |

% |

|

Earnings (loss) per share - diluted |

|

(3.21 |

) |

|

|

7.72 |

|

|

(142) |

% |

| |

|

|

|

|

|

|

Adjusted EBITDA(a) |

|

12 |

|

|

|

535 |

|

|

(98) |

% |

| |

|

|

|

|

|

| |

As of |

|

|

| |

March 31, 2024 |

|

December 31, 2023 |

|

|

|

Balance Sheet Items |

|

|

|

|

|

|

Cash and Cash Equivalents |

$ |

522 |

|

|

$ |

555 |

|

|

|

|

Program cash and restricted cash |

|

77 |

|

|

|

89 |

|

|

|

|

Vehicles, net |

|

22,020 |

|

|

|

21,240 |

|

|

|

|

Debt under vehicle programs |

|

19,190 |

|

|

|

18,937 |

|

|

|

|

Corporate debt |

|

5,437 |

|

|

|

4,823 |

|

|

|

| Stockholders' equity

attributable to Avis Budget Group, Inc. |

|

(515 |

) |

|

|

(349 |

) |

|

|

| |

Three Months Ended March 31, |

| |

|

2024 |

|

|

|

2023 |

|

|

% Change |

|

Segment Results |

|

|

|

|

|

| |

|

|

|

|

|

|

Revenues |

|

|

|

|

|

|

Americas |

$ |

1,993 |

|

|

$ |

2,016 |

|

|

(1) |

% |

|

International |

|

558 |

|

|

|

541 |

|

|

3 |

% |

|

Corporate and Other |

|

— |

|

|

|

— |

|

|

n/m |

|

Total Company |

$ |

2,551 |

|

|

$ |

2,557 |

|

|

— |

% |

| |

|

|

|

|

|

|

Adjusted

EBITDA(a) |

|

|

|

|

|

|

Americas |

$ |

44 |

|

|

$ |

516 |

|

|

(91) |

% |

|

International |

|

(15 |

) |

|

|

50 |

|

|

(130) |

% |

|

Corporate and Other |

|

(17 |

) |

|

|

(31 |

) |

|

45 |

% |

|

Total Company |

$ |

12 |

|

|

$ |

535 |

|

|

(98) |

% |

|

_______ |

|

n/m |

Not meaningful. |

|

(a) |

Refer to Table 5 for the reconciliation of net income to Adjusted

EBITDA and Appendix I for the related definition of the non-GAAP

financial measure. |

Table 2

|

Avis Budget Group, Inc.CONSOLIDATED STATEMENTS OF

OPERATIONS (Unaudited)(In millions, except per share

data) |

|

|

| |

Three Months EndedMarch 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenues |

$ |

2,551 |

|

|

$ |

2,557 |

|

| |

|

|

|

|

Expenses |

|

|

|

|

Operating |

|

1,344 |

|

|

|

1,307 |

|

|

Vehicle depreciation and lease charges, net |

|

636 |

|

|

|

265 |

|

|

Selling, general and administrative |

|

325 |

|

|

|

324 |

|

|

Vehicle interest, net |

|

239 |

|

|

|

133 |

|

|

Non-vehicle related depreciation and amortization |

|

61 |

|

|

|

56 |

|

|

Interest expense related to corporate debt, net |

|

83 |

|

|

|

73 |

|

|

Restructuring and other related charges |

|

3 |

|

|

|

4 |

|

|

Transaction-related costs, net |

|

1 |

|

|

|

— |

|

|

Other (income) expense, net |

|

1 |

|

|

|

(2 |

) |

|

Total expenses |

|

2,693 |

|

|

|

2,160 |

|

| |

|

|

|

|

Income (loss) before income taxes |

|

(142 |

) |

|

|

397 |

|

|

Provision for (benefit from) income taxes |

|

(29 |

) |

|

|

85 |

|

|

Net income (loss) |

|

(113 |

) |

|

|

312 |

|

|

Less: net income attributable to non-controlling interests |

|

1 |

|

|

|

— |

|

| Net income (loss)

attributable to Avis Budget Group, Inc. |

$ |

(114 |

) |

|

$ |

312 |

|

| |

|

|

|

|

Earnings (loss) per share |

|

|

|

|

Basic |

$ |

(3.21 |

) |

|

$ |

7.88 |

|

|

Diluted |

$ |

(3.21 |

) |

|

$ |

7.72 |

|

| |

|

|

|

|

Weighted average shares outstanding |

|

|

|

|

Basic |

|

35.6 |

|

|

|

39.6 |

|

|

Diluted |

|

35.6 |

|

|

|

40.4 |

|

Table 3

| |

Avis Budget Group, Inc.KEY METRICS SUMMARY

(Unaudited) |

| |

|

| |

|

Three Months EndedMarch 31, |

| |

|

|

2024 |

|

|

|

2023 |

|

|

% Change |

|

Americas |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Rental Days (000’s) |

|

29,692 |

|

|

|

28,274 |

|

|

5 |

% |

| |

Revenue per Day |

$ |

67.12 |

|

|

$ |

71.30 |

|

|

(6) |

% |

| |

Revenue per Day, excluding exchange rate effects |

$ |

67.11 |

|

|

$ |

71.30 |

|

|

(6) |

% |

| |

Average Rental Fleet |

|

497,313 |

|

|

|

452,535 |

|

|

10 |

% |

| |

Vehicle Utilization |

|

65.6 |

% |

|

|

69.4 |

% |

|

(3.8) pps |

| |

Per-Unit Fleet Costs per Month |

$ |

326 |

|

|

$ |

128 |

|

|

155 |

% |

| |

Per-Unit Fleet Costs per Month, excluding exchange rate

effects |

$ |

326 |

|

|

$ |

128 |

|

|

155 |

% |

| |

|

|

|

|

|

|

|

International |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

Rental Days (000’s) |

|

10,360 |

|

|

|

9,962 |

|

|

4 |

% |

| |

Revenue per Day |

$ |

53.86 |

|

|

$ |

54.28 |

|

|

(1) |

% |

| |

Revenue per Day, excluding exchange rate effects |

$ |

53.88 |

|

|

$ |

54.28 |

|

|

(1) |

% |

| |

Average Rental Fleet |

|

170,071 |

|

|

|

168,298 |

|

|

1 |

% |

| |

Vehicle Utilization |

|

66.9 |

% |

|

|

65.8 |

% |

|

1.1 pps |

| |

Per-Unit Fleet Costs per Month |

$ |

292 |

|

|

$ |

179 |

|

|

63 |

% |

| |

Per-Unit Fleet Costs per Month, excluding exchange rate

effects |

$ |

289 |

|

|

$ |

179 |

|

|

61 |

% |

| |

|

|

|

|

|

|

|

Total |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

Rental Days (000’s) |

|

40,052 |

|

|

|

38,236 |

|

|

5 |

% |

| |

Revenue per Day |

$ |

63.69 |

|

|

$ |

66.87 |

|

|

(5) |

% |

| |

Revenue per Day, excluding exchange rate effects |

$ |

63.69 |

|

|

$ |

66.87 |

|

|

(5) |

% |

| |

Average Rental Fleet |

|

667,384 |

|

|

|

620,833 |

|

|

7 |

% |

| |

Vehicle Utilization |

|

65.9 |

% |

|

|

68.4 |

% |

|

(2.5) pps |

| |

Per-Unit Fleet Costs per Month |

$ |

318 |

|

|

$ |

142 |

|

|

124 |

% |

| |

Per-Unit Fleet Costs per Month, excluding exchange rate

effects |

$ |

317 |

|

|

$ |

142 |

|

|

123 |

% |

| _______ |

|

|

|

|

|

|

Refer to Table 6 for key metrics calculations and Appendix I for

key metrics definitions. |

Table 4

|

Avis Budget Group, Inc.CONSOLIDATED

CONDENSED SCHEDULE OF CASH FLOW AND ADJUSTED FREE CASH FLOW

(Unaudited)(In millions) |

|

|

|

CONSOLIDATED CONDENSED SCHEDULE OF CASH FLOW |

Three Months Ended March 31, 2024 |

|

Operating Activities |

|

|

Net cash provided by operating activities |

$ |

589 |

|

|

Investing Activities |

|

|

Net cash used in investing activities exclusive of vehicle

programs |

|

(53 |

) |

|

Net cash used in investing activities of vehicle programs |

|

(1,465 |

) |

|

Net cash used in investing activities |

|

(1,518 |

) |

|

Financing Activities |

|

|

Net cash provided by financing activities exclusive of vehicle

programs |

|

615 |

|

|

Net cash provided by financing activities of vehicle programs |

|

282 |

|

|

Net cash provided by financing activities |

|

897 |

|

|

Effect of changes in exchange rates on cash and cash equivalents,

program and restricted cash |

|

(13 |

) |

|

Net change in cash and cash equivalents, program and restricted

cash |

|

(45 |

) |

|

Cash and cash equivalents, program and restricted cash,

beginning of period |

|

644 |

|

|

Cash and cash equivalents, program and restricted cash, end

of period |

$ |

599 |

|

|

ADJUSTED FREE CASH

FLOW(a) |

|

Adjusted

EBITDA(b) |

$ |

12 |

|

|

Interest expense related to corporate debt, net (excluding early

extinguishment of debt) |

|

(83 |

) |

|

Working capital and other |

|

(3 |

) |

|

Capital expenditures(c) |

|

(56 |

) |

|

Tax payments, net of refunds |

|

(5 |

) |

|

Vehicle programs and

related(d) |

|

(504 |

) |

|

Adjusted Free Cash

Flow(b) |

$ |

(639 |

) |

|

Borrowings, net of debt repayments |

|

641 |

|

|

Repurchases of common stock |

|

(15 |

) |

|

Change in program and restricted cash |

|

(11 |

) |

|

Other receipts (payments), net |

|

2 |

|

|

Foreign exchange effects, financing costs and other |

|

(23 |

) |

|

Net change in cash and cash equivalents, program and

restricted cash (per above) |

$ |

(45 |

) |

|

_______ |

|

Refer to Appendix I for the definitions of non-GAAP financial

measures Adjusted EBITDA and Adjusted Free Cash Flow. |

|

(a) |

This presentation demonstrates the relationship between Adjusted

EBITDA and Adjusted Free Cash Flow. We believe it is useful to

understand this relationship because it demonstrates how cash

generated by our operations is used. This presentation is not

intended to be reconciliations of these non-GAAP measures, which

are provided on Table 5. |

|

(b) |

Refer to Table 5 for the reconciliations of net income (loss) to

Adjusted EBITDA and net cash provided by operating activities to

Adjusted Free Cash Flow. |

|

(c) |

Includes $3 million of cloud computing implementation costs. |

|

(d) |

Includes vehicle-backed borrowings (repayments) that are

incremental to amounts required to fund vehicle and vehicle-related

assets. |

Table 5

|

Avis Budget Group, Inc.RECONCILIATION OF

NON-GAAP MEASURES (Unaudited)(In

millions) |

| |

|

| |

|

Three Months EndedMarch 31, |

| |

|

2024 |

|

|

|

2023 |

|

|

Reconciliation of Net income (loss) to Adjusted

EBITDA: |

|

|

|

| |

|

|

|

|

|

Net income (loss) |

$ |

(113 |

) |

|

$ |

312 |

|

|

Provision for (benefit from) income taxes |

|

(29 |

) |

|

|

85 |

|

|

Income (loss) before income taxes |

|

(142 |

) |

|

|

397 |

|

|

Non-vehicle related depreciation and amortization |

|

61 |

|

|

|

56 |

|

|

Interest expense related to corporate debt, net |

|

83 |

|

|

|

73 |

|

|

Restructuring and other related charges |

|

3 |

|

|

|

4 |

|

|

Transaction-related costs, net |

|

1 |

|

|

|

— |

|

|

Other (income) expense, net |

|

1 |

|

|

|

(2 |

) |

|

Reported within operating expenses: |

|

|

|

|

|

Cloud computing costs |

|

10 |

|

|

|

7 |

|

| |

Legal matters, net |

|

(5 |

) |

|

|

— |

|

|

Adjusted EBITDA |

$ |

12 |

|

|

$ |

535 |

|

|

Reconciliation of Net cash provided by operating

activities to Adjusted Free Cash

Flow: |

|

|

|

| |

|

|

|

|

Net cash provided by operating activities |

$ |

589 |

|

|

|

|

Net cash used in investing activities of vehicle programs |

|

(1,465 |

) |

|

|

|

Net cash provided by financing activities of vehicle programs |

|

282 |

|

|

|

|

Capital expenditures |

|

(53 |

) |

|

|

|

Proceeds received on sale of assets and nonmarketable equity

securities |

|

1 |

|

|

|

|

Acquisition and disposition-related payments |

|

(2 |

) |

|

|

|

Change in program and restricted cash |

|

11 |

|

|

|

|

Other receipts (payments), net |

|

(2 |

) |

|

|

|

Adjusted Free Cash Flow |

$ |

(639 |

) |

|

|

|

_______ |

|

Refer to Appendix I for the definitions of Adjusted EBITDA and

Adjusted Free Cash Flow, non-GAAP financial measures. For the three

months ended March 31, 2024 and 2023, Adjusted EBITDA includes

stock-based compensation expense and vehicle related deferred

financing fee amortization in the aggregate totaling $15 million,

in each period. |

Table 6

|

Avis Budget Group, Inc.KEY METRICS

CALCULATIONS (Unaudited)($ in millions, except as

noted) |

| |

| |

Three Months Ended March 31, 2024 |

|

Three Months Ended March 31, 2023 |

| |

Americas |

|

International |

|

Total |

|

Americas |

|

International |

|

Total |

|

Revenue per Day (RPD) |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

1,993 |

|

|

$ |

558 |

|

|

$ |

2,551 |

|

|

$ |

2,016 |

|

|

$ |

541 |

|

|

$ |

2,557 |

|

|

Currency exchange rate effects |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Revenue excluding exchange rate effects |

$ |

1,993 |

|

|

$ |

558 |

|

|

$ |

2,551 |

|

|

$ |

2,016 |

|

|

$ |

541 |

|

|

$ |

2,557 |

|

|

Rental days (000's) |

|

29,692 |

|

|

|

10,360 |

|

|

|

40,052 |

|

|

|

28,274 |

|

|

|

9,962 |

|

|

|

38,236 |

|

|

RPD excluding exchange rate effects (in $'s) |

$ |

67.11 |

|

|

$ |

53.88 |

|

|

$ |

63.69 |

|

|

$ |

71.30 |

|

|

$ |

54.28 |

|

|

$ |

66.87 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle Utilization |

|

|

|

|

|

|

|

|

|

|

|

|

Rental days (000's) |

|

29,692 |

|

|

|

10,360 |

|

|

|

40,052 |

|

|

|

28,274 |

|

|

|

9,962 |

|

|

|

38,236 |

|

|

Average rental fleet |

|

497,313 |

|

|

|

170,071 |

|

|

|

667,384 |

|

|

|

452,535 |

|

|

|

168,298 |

|

|

|

620,833 |

|

|

Number of days in period |

|

91 |

|

|

|

91 |

|

|

|

91 |

|

|

|

90 |

|

|

|

90 |

|

|

|

90 |

|

|

Available rental days (000's) |

|

45,255 |

|

|

|

15,477 |

|

|

|

60,732 |

|

|

|

40,728 |

|

|

|

15,147 |

|

|

|

55,875 |

|

|

Vehicle utilization |

|

65.6 |

% |

|

|

66.9 |

% |

|

|

65.9 |

% |

|

|

69.4 |

% |

|

|

65.8 |

% |

|

|

68.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Per-Unit Fleet Costs |

|

|

|

|

|

|

|

|

|

|

|

| Vehicle depreciation and lease charges, net |

$ |

487 |

|

|

$ |

149 |

|

|

$ |

636 |

|

|

$ |

174 |

|

|

$ |

90 |

|

|

$ |

264 |

|

|

Currency exchange rate effects |

|

— |

|

|

|

(1 |

) |

|

|

(1 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Vehicle depreciation excluding exchange rate effects |

$ |

487 |

|

|

$ |

148 |

|

|

$ |

635 |

|

|

$ |

174 |

|

|

$ |

90 |

|

|

$ |

264 |

|

|

Average rental fleet |

|

497,313 |

|

|

|

170,071 |

|

|

|

667,384 |

|

|

|

452,535 |

|

|

|

168,298 |

|

|

|

620,833 |

|

|

Per-unit fleet costs (in $'s) |

$ |

979 |

|

|

$ |

868 |

|

|

$ |

951 |

|

|

$ |

385 |

|

|

$ |

537 |

|

|

$ |

426 |

|

|

Number of months in period |

|

3 |

|

|

|

3 |

|

|

|

3 |

|

|

|

3 |

|

|

|

3 |

|

|

|

3 |

|

| Per-unit fleet costs per month excluding exchange rate effects

(in $'s) |

$ |

326 |

|

|

$ |

289 |

|

|

$ |

317 |

|

|

$ |

128 |

|

|

$ |

179 |

|

|

$ |

142 |

|

|

_______ |

|

|

|

|

Our calculation of rental days and revenue per day may not be

comparable to the calculation of similarly-titled metrics by other

companies. Currency exchange rate effects are calculated by

translating the current-period's results at the prior-period

average exchange rates plus any related gains and losses on

currency hedges. |

Appendix I

Avis Budget Group,

Inc.DEFINITIONS OF NON-GAAP MEASURES AND KEY

METRICS

Adjusted EBITDAThe accompanying

press release presents Adjusted EBITDA, which is a non-GAAP measure

most directly comparable to net income (loss). Adjusted EBITDA is

defined as income (loss) from continuing operations before

non-vehicle related depreciation and amortization; any impairment

charges; restructuring and other related charges; early

extinguishment of debt costs; non-vehicle related interest;

transaction-related costs, net; legal matters, which includes

amounts recorded in excess of $5 million related to class

action lawsuits and personal injury matters; non-operational

charges related to shareholder activist activity, which includes

third-party advisory, legal and other professional fees; COVID-19

charges, net; cloud computing costs; other (income) expense, net;

and income taxes.

We believe Adjusted EBITDA is useful to

investors as a supplemental measure in evaluating the performance

of our operating businesses and in comparing our results from

period to period. We also believe that Adjusted EBITDA is useful to

investors because it allows them to assess our results of

operations and financial condition on the same basis that

management uses internally. Adjusted EBITDA is a non-GAAP measure

and should not be considered in isolation or as a substitute for

net income or other income statement data prepared in accordance

with U.S. GAAP. Our presentation of Adjusted EBITDA may not be

comparable to similarly titled measures used by other companies. A

reconciliation of Adjusted EBITDA from net income (loss) recognized

under GAAP is provided on Table 5.

Adjusted Free Cash

FlowRepresents net cash provided by operating activities

adjusted to reflect the cash inflows and outflows relating to

capital expenditures, the investing and financing activities of our

vehicle programs, asset sales, if any, and to exclude debt

extinguishment costs, transaction-related costs, restructuring and

other related charges, charges for legal matters, net, which

includes amounts recorded in excess of $5 million related to class

action lawsuits and personal injury matters, COVID-19 charges,

other (income) expense, and non-operational charges related to

shareholder activist activity. We believe that Adjusted Free Cash

Flow is useful to management and investors in measuring the cash

generated that is available to be used to repay debt obligations,

repurchase stock, pay dividends and invest in future growth through

new business development activities or acquisitions. Adjusted Free

Cash Flow should not be construed as a substitute in measuring

operating results or liquidity, and our presentation of Adjusted

Free Cash Flow may not be comparable to similarly-titled measures

used by other companies. A reconciliation of Adjusted Free Cash

Flow from net cash provided by operating activities recognized

under GAAP is provided on Table 5.

Adjusted EBITDA MarginRepresents

Adjusted EBITDA as a percentage of revenues.

Available Rental DaysDefined as

Average Rental Fleet times the numbers of days in a given

period.

Average Rental FleetRepresents the

average number of vehicles in our fleet during a given period of

time.

Currency Exchange Rate

EffectsRepresents the difference between current-period

results as reported and current-period results translated at the

prior-period average exchange rates plus any related currency

hedges.

Net Corporate DebtRepresents

corporate debt minus cash and cash equivalents.

Net Corporate LeverageRepresents

Net Corporate Debt divided by Adjusted EBITDA for the twelve months

prior to the date of calculation.

Per-Unit Fleet CostsRepresents

vehicle depreciation, lease charges and gain or loss on vehicles

sales, divided by Average Rental Fleet.

Rental DaysRepresents the total

number of days (or portion thereof) a vehicle was rented during a

24-hour period.

Revenue per DayRepresents revenues

divided by Rental Days.

Vehicle UtilizationRepresents

Rental Days divided by Available Rental Days.

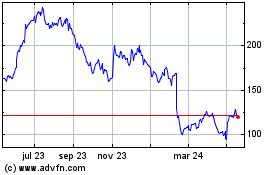

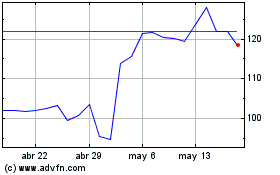

Avis Budget (NASDAQ:CAR)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Avis Budget (NASDAQ:CAR)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024