0000712515false00007125152024-01-262024-01-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported) January 26, 2024

ELECTRONIC ARTS INC.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 0-17948 | | 94-2838567 | |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) | |

| | | | | | | | | | | | | | | | | |

| 209 Redwood Shores Parkway, | Redwood City, | California | 94065-1175 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

| | | | | | | | | | | | | | | | | |

| | (650) | 628-1500 | | |

| (Registrant’s Telephone Number, Including Area Code) |

| | | | | | | | | | | | | | | | | | | | |

| (Former Name or Former Address, if Changed Since Last Report) |

| | | | | | |

| | | | | | | | | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, $0.01 par value | | EA | | NASDAQ Global Select Market |

| | | | | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933(17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). |

| Emerging growth company | ☐ |

| |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02 Result of Operations and Financial Condition.

On January 30, 2024, Electronic Arts Inc. ("Electronic Arts" or “EA”) issued a press release announcing its financial results for the third fiscal quarter ended December 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1.

Neither the information in this Form 8-K nor the information in the press release attached hereto as Exhibit 99.1 shall be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01 Other Events.

On January 26, 2024, the Audit Committee of EA, on behalf of EA’s full Board of Directors declared a cash dividend of $0.19 per share of EA's common stock. The dividend is payable on March 20, 2024 to stockholders of record as of the close of business on February 28, 2024.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | Press release dated January 30, 2024, relating to Electronic Arts Inc.’s financial results for its third fiscal quarter ended December 31, 2023. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

INDEX TO EXHIBITS

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | ELECTRONIC ARTS INC. |

| | | | |

| Dated: | January 30, 2024 | By: | /s/ Stuart Canfield |

| | | Stuart Canfield | |

| | | Chief Financial Officer |

Exhibit 99.1

| | | | | | | | | | | | | | | | | | | | | | | |

Electronic Arts Reports Strong Q3 FY24 Results

| |

|

|

|

|

EA SPORTS FCTM Momentum Continues, Driving Record Live Services Net Bookings

REDWOOD CITY, CA – January 30, 2024 – Electronic Arts Inc. (NASDAQ: EA) today announced preliminary financial results for its third quarter ended December 31, 2023.

“Our incredible teams delivered a strong Q3, entertaining hundreds of millions of people across our portfolio, driving deep engagement and record live services,” said Andrew Wilson, CEO of EA. “We remain focused on growing our biggest franchises and delivering new, innovative games and experiences for our global communities.”

“EA SPORTS FC outperformed expectations again this quarter, delivering 7% year-over-year net bookings growth, as momentum continued through the FC brand transition,” said Stuart Canfield, CFO of EA. “We will continue to build upon the strength within our portfolio, while prioritizing investments in our largest opportunities for multi-year growth.”

Selected Operating Highlights and Metrics1

•Net bookings2 for Q3 was $2.366 billion, up 1% year-over-year (up 2% in constant currency).

•Live services and other net bookings for Q3 achieved a record $1.712 billion, up 3% year-over-year (up 5% in constant currency). On a trailing twelve-month basis, live services were 73% of our business.

•The EA SPORTS FCTM franchise outperformed Q3 expectations, delivering 7% net bookings growth against a prior year that included the World Cup.

•EA SPORTSTM Madden NFL delivered net bookings growth of 5% year-over-year.

Selected Financial Highlights and Metrics

•Net revenue was $1.945 billion for the quarter.

•Net cash provided by operating activities for the quarter was $1.264 billion, up 13% year-over-year. For the trailing twelve months, net cash provided by operating activities was a record $2.352 billion.

•EA repurchased 2.5 million shares for $325 million during the quarter, bringing the total for the trailing twelve months to 10.4 million shares for $1.300 billion.

Dividend

EA has declared a quarterly cash dividend of $0.19 per share of the Company’s common stock. The dividend is payable on March 20, 2024 to shareholders of record as of the close of business on February 28, 2024.

Quarterly Financial Highlights

| | | | | | | | | | | |

| Three Months Ended |

| December 31, |

| (in $ millions, except per share amounts) | 2023 | | 2022 |

| Full game | 618 | | | 622 | |

| Live services and other | 1,327 | | | 1,259 | |

| Total net revenue | 1,945 | | | 1,881 | |

| | | |

| Net income | 290 | | | 204 |

| Diluted earnings per share | 1.07 | | | 0.73 |

| | | |

| Operating cash flow | 1,264 | | | 1,123 | |

| | | |

| Value of shares repurchased | 325 | | | 325 | |

| Number of shares repurchased | 2.5 | | | 2.6 | |

| | | |

| Cash dividend paid | 51 | | | 52 | |

| | | |

The following GAAP-based financial data3 and tax rate of 19% was used internally by company management to adjust its GAAP results in order to assess EA’s operating results:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 |

| GAAP-Based Financial Data |

| (in $ millions) | Statement of Operations | | Acquisition-related expenses | | Change in deferred net revenue (online-enabled games) | | Restructuring and related charges | | Stock-based compensation |

| Total net revenue | 1,945 | | | — | | | 421 | | | — | | | — | |

| Cost of revenue | 529 | | | (16) | | | — | | | — | | | (2) | |

| Gross profit | 1,416 | | | 16 | | | 421 | | | — | | | 2 | |

| Total operating expenses | 1,051 | | | (21) | | | — | | | — | | | (149) | |

| Operating income | 365 | | | 37 | | | 421 | | | — | | | 151 | |

| Interest and other income (expense), net | 17 | | | — | | | — | | | — | | | — | |

| Income before provision for income taxes | 382 | | | 37 | | | 421 | | | — | | | 151 | |

| Number of shares used in computation: | | | | | | | | | |

| Diluted | 271 | | | | | | | | | |

Trailing Twelve Months Financial Highlights

| | | | | | | | | | | |

| Twelve Months Ended |

| December 31, |

| (in $ millions) | 2023 | | 2022 |

| Full game | 2,054 | | | 2,003 | |

| Live services and other | 5,603 | | | 5,374 | |

| Total net revenue | 7,657 | | | 7,377 | |

| | | |

| Net income | 1,079 | | | 1,039 | |

| | | |

| Operating cash flow | 2,352 | | | 1,377 | |

| | | |

| Value of shares repurchased | 1,300 | | | 1,295 | |

| Number of shares repurchased | 10.4 | | | 10.2 | |

The following GAAP-based financial data3 and a tax rate of 19% was used internally by company management to adjust its GAAP results in order to assess EA’s operating results.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Twelve Months Ended December 31, 2023 |

| GAAP-Based Financial Data |

| (in $ millions) | Statement of Operations | | Acquisition-related expenses | | Change in deferred net revenue (online-enabled games) | | Restructuring and related charges | | Stock-based compensation |

| Total net revenue | 7,657 | | | — | | 53 | | | — | | — |

| Cost of revenue | 1,801 | | | (72) | | | — | | — | | (8) | |

| Gross profit | 5,856 | | | 72 | | | 53 | | | — | | 8 | |

| Total operating expenses | 4,397 | | | (96) | | | — | | (158) | | | (570) | |

| Operating income | 1,459 | | | 168 | | | 53 | | | 158 | | | 578 | |

| Interest and other income (expense), net | 51 | | | — | | — | | — | | — |

| Income before provision for income taxes | 1,510 | | | 168 | | | 53 | | | 158 | | | 578 | |

Operating Metric

The following is a calculation of our total net bookings2 for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| (in $ millions) | 2023 | | 2022 | | 2023 | | 2022 |

| Total net revenue | 1,945 | | | 1,881 | | | 7,657 | | | 7,377 | |

| Change in deferred net revenue (online-enabled games) | 421 | | | 461 | | | 53 | | | (231) | |

| Total net bookings | 2,366 | | | 2,342 | | | 7,710 | | | 7,146 | |

Business Outlook as of January 30, 2024

Fourth Quarter Fiscal Year 2024 Expectations – Ending March 31, 2024

Financial outlook metrics:

•Net revenue is expected to be approximately $1.625 billion to $1.925 billion.

◦No change in deferred net revenue (online-enabled games) is expected.

•Net income is expected to be approximately $54 million to $183 million.

•Diluted earnings per share is expected to be approximately $0.20 to $0.68.

•The Company estimates a share count of 271 million for purposes of calculating diluted earnings per share.

Operational outlook metric:

•Net bookings2 is expected to be approximately $1.625 billion to $1.925 billion.

In addition, the following outlook for GAAP-based financial data3 and long-term tax rate of 19% are used internally by EA to adjust GAAP expectations to assess EA’s operating results and plan for future periods:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 |

| GAAP-Based Financial Data* |

| (in $ millions) | GAAP Guidance Range | | Acquisition-related expenses** | | Change in deferred net revenue (online-enabled games) | | Restructuring and related charges | | Stock-based compensation |

| Total net revenue | 1,625 to 1,925 | | — | | | — | | | — | | | — | |

| Cost of revenue | 360 to 410 | | (30) | | | — | | | — | | | (5) | |

| Operating expense | 1,125 to 1,205 | | (75) | | | — | | | — | | | (150) | |

| Income before provision for income taxes | 158 to 325 | | 105 | | | — | | | — | | | 155 | |

| Net income | 54 to 183 | | | | | | | | |

| Number of shares used in computation: | | | | | | | | | |

| Diluted shares | 271 | | | | | | | | | |

*The mid-point of the range has been used for purposes of presenting the reconciling items.

** Subsequent to December 31, 2023, we impaired certain acquisition-related intangible assets totaling approximately $70 million that will be recorded in the fourth quarter of fiscal year 2024.

Fiscal Year 2024 Expectations – Ending March 31, 2024

Financial outlook metrics:

•Net revenue is expected to be approximately $7.408 billion to $7.708 billion.

◦Change in deferred net revenue (online-enabled games) is expected to be approximately ($19) million.

•Net income is expected to be approximately $1.145 billion to $1.274 billion.

•Diluted earnings per share is expected to be approximately $4.21 to $4.68.

•Operating cash flow is expected to be approximately $1.950 billion to $2.100 billion.

•The Company estimates a share count of 272 million for purposes of calculating diluted earnings per share.

Operational outlook metric:

•Net bookings2 is expected to be approximately $7.389 billion to $7.689 billion.

In addition, the following outlook for GAAP-based financial data3 and long-term tax rate of 19% are used internally by EA to adjust GAAP expectations to assess EA’s operating results and plan for future periods:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Twelve Months Ended March 31, 2024 |

| GAAP-Based Financial Data* |

| (in $ millions) | GAAP Guidance Range | | Acquisition-related expenses** | | Change in deferred net revenue (online-enabled games) | | Restructuring and related charges | | Stock-based compensation |

| Total net revenue | 7,408 to 7,708 | | — | | | (19) | | | — | | | — | |

| Cost of revenue | 1,713 to 1,763 | | (77) | | | — | | | — | | | (11) | |

| Operating expense | 4,271 to 4,351 | | (145) | | | — | | | (3) | | | (580) | |

| Income before provision for income taxes | 1,487 to 1,654 | | 222 | | | (19) | | | 3 | | | 591 | |

| Net income | 1,145 to 1,274 | | | | | | | | |

| Number of shares used in computation: | | | | | | | | | |

| Diluted shares | 272 | | | | | | | | | |

*The mid-point of the range has been used for purposes of presenting the reconciling items.

** Includes Q4 impairment of acquisition-related intangible assets as per previous table.

Conference Call and Supporting Documents

Electronic Arts will host a conference call on January 30, 2024 at 2:00 pm PT (5:00 pm ET) to review its results for the third quarter ended December 31, 2023 and its outlook for the future. During the course of the call, Electronic Arts may disclose material developments affecting its business and/or financial performance. Listeners may access the conference call live through the following dial-in number (888) 330-2446 (domestic) or (240) 789-2732 (international), using the conference code 5939891 or via webcast at EA’s IR Website at http://ir.ea.com.

EA has posted a slide presentation with a financial model of EA’s historical results and guidance on EA’s IR Website. EA will also post the prepared remarks and a transcript from the conference call on EA’s IR Website.

A dial-in replay of the conference call will be available until February 14, 2024 at (800) 770-2030 (domestic) or (647) 362-9199 (international) using conference code 5939891. An audio webcast replay of the conference call will be available for one year on EA’s IR Website.

Forward-Looking Statements

Some statements set forth in this release, including the information relating to EA’s expectations under the heading “Business Outlook as of January 30, 2024” and other information regarding EA's expectations contain forward-looking statements that are subject to change. Statements including words such as “anticipate,” “believe,” “expect,” “intend,” “estimate,” “plan,” “predict,” “seek,” “goal,” “will,” “may,” “likely,” “should,” “could” (and the negative of any of these terms), “future” and similar expressions also identify forward-looking statements. These forward-looking statements are not guarantees of future performance and reflect management’s current expectations. Our actual results could differ materially from those discussed in the forward-looking statements.

Some of the factors which could cause the Company’s results to differ materially from its expectations include the following: sales of the Company’s products and services; the Company’s ability to develop and support digital products and services, including managing online security and privacy; outages of our products, services and technological infrastructure; the Company’s ability to manage expenses; the competition in the interactive entertainment industry; governmental regulations; the effectiveness of the Company’s sales and marketing programs; timely development and release of the Company’s products and services; the Company’s ability to realize the anticipated benefits of, and integrate, acquisitions; the consumer demand for, and the availability of an adequate supply of console hardware units; the Company’s ability to predict consumer preferences among competing platforms; the Company’s ability to develop and implement new technology; foreign currency exchange rate fluctuations; economic and geopolitical conditions; changes in our tax rates or tax laws; and other factors described in Part II, Item 1A of Electronic Arts’ latest Quarterly Report on Form 10-Q under the heading “Risk Factors”, as well as in other documents we have filed with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the fiscal year ended March 31, 2023.

These forward-looking statements are current as of January 30, 2024. Electronic Arts assumes no obligation to revise or update any forward-looking statement for any reason, except as required by law. In addition, the preliminary financial results set forth in this release are estimates based on information currently available to Electronic Arts.

While Electronic Arts believes these estimates are meaningful, they could differ from the actual amounts that Electronic Arts ultimately reports in its Quarterly Report on Form 10-Q for the fiscal quarter ended December 31, 2023. Electronic Arts assumes no obligation and does not intend to update these estimates prior to filing its Form 10-Q for the fiscal quarter ended December 31, 2023.

About Electronic Arts

Electronic Arts (NASDAQ: EA) is a global leader in digital interactive entertainment. The Company develops and delivers games, content and online services for Internet-connected consoles, mobile devices and personal computers.

In fiscal year 2023, EA posted GAAP net revenue of approximately $7.4 billion. Headquartered in Redwood City, California, EA is recognized for a portfolio of critically acclaimed, high-quality brands such as EA SPORTS FC™, Battlefield™, Apex Legends™, The Sims™, EA SPORTS Madden NFL, Need for Speed™, Titanfall™, Plants vs. Zombies™ and EA SPORTS F1®. More information about EA is available at www.ea.com/news.

EA, EA SPORTS, EA SPORTS FC, Battlefield, Need for Speed, Apex Legends, The Sims, Titanfall, and Plants vs. Zombies are trademarks of Electronic Arts Inc. John Madden, NFL, FIFA and F1 are the property of their respective owners and used with permission.

For additional information, please contact:

| | | | | |

| |

| Katie Burke | Erin Rheaume |

| Director, Investor Relations | Director, Financial Communications |

| 650-628-7605 | 650-628-7978 |

| katieburke@ea.com | erheaume@ea.com |

1 For more information on constant currency, please refer to the earnings slides available on EA’s IR Website.

2 Net bookings is defined as the net amount of products and services sold digitally or sold-in physically in the period. Net bookings is calculated by adding total net revenue to the change in deferred net revenue for online-enabled games.

3 For more information about the nature of the GAAP-based financial data, please refer to EA’s Form 10-K for the fiscal year ended March 31, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | |

| ELECTRONIC ARTS INC. AND SUBSIDIARIES | |

| Unaudited Condensed Consolidated Statements of Operations | |

| (in $ millions, except per share data) | |

| | | | | | | | |

| Three Months Ended

December 31, | | Nine Months Ended December 31, | |

| | |

| 2023 | | 2022 | | 2023 | | 2022 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net revenue | 1,945 | | | 1,881 | | | 5,783 | | | 5,552 | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Cost of revenue | 529 | | | 568 | | | 1,353 | | | 1,344 | | |

| Gross profit | 1,416 | | | 1,313 | | | 4,430 | | | 4,208 | | |

| Operating expenses: | | | | | | | | |

| Research and development | 584 | | | 556 | | | 1,782 | | | 1,693 | | |

| Marketing and sales | 276 | | | 256 | | | 785 | | | 723 | | |

| General and administrative | 170 | | | 162 | | | 506 | | | 503 | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Amortization and impairment of intangibles | 21 | | | 50 | | | 70 | | | 132 | | |

| Restructuring | — | | | — | | | 3 | | | — | | |

| Total operating expenses | 1,051 | | | 1,024 | | | 3,146 | | | 3,051 | | |

| Operating income | 365 | | | 289 | | | 1,284 | | | 1,157 | | |

| | | | | | | | |

| Interest and other income (expense), net | 17 | | | (7) | | | 45 | | | (12) | | |

| Income before provision for income taxes | 382 | | | 282 | | | 1,329 | | | 1,145 | | |

| Provision for income taxes | 92 | | | 78 | | | 238 | | | 331 | | |

| Net income | 290 | | | 204 | | | 1,091 | | | 814 | | |

| Earnings per share | | | | | | | | |

| Basic | 1.08 | | | 0.74 | | 4.03 | | 2.93 | | |

| Diluted | 1.07 | | | 0.73 | | 4.01 | | | 2.92 | | |

| Number of shares used in computation | | | | | | | | |

| Basic | 269 | | | 276 | | | 271 | | | 278 | | |

| Diluted | 271 | | | 278 | | | 272 | | | 279 | | |

Results (in $ millions, except per share data)

The following table reports the variance of the actuals versus our guidance provided on November 1, 2023 for the three months ended December 31, 2023 plus a comparison to the actuals for the three months ended December 31, 2022.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, |

| 2023 Guidance (Mid-Point) | | | | 2023 Actuals | | 2022 Actuals |

| | Variance | | |

| Net revenue | | | | | | | |

| Net revenue | 1,925 | | | 20 | | | 1,945 | | | 1,881 | |

| GAAP-based financial data | | | | | | | |

Change in deferred net revenue (online-enabled games)1 | 425 | | | (4) | | | 421 | | | 461 | |

| Cost of revenue | | | | | | | |

| Cost of revenue | 515 | | | 14 | | | 529 | | | 568 | |

| GAAP-based financial data | | | | | | | |

| Acquisition-related expenses | (15) | | | (1) | | | (16) | | | (26) | |

| | | | | | | |

| Stock-based compensation | — | | | (2) | | | (2) | | | (2) | |

| | | | | | | |

| Operating expenses | | | | | | | |

| Operating expenses | 1,080 | | | (29) | | | 1,051 | | | 1,024 | |

| GAAP-based financial data | | | | | | | |

| Acquisition-related expenses | (25) | | | 4 | | | (21) | | | (50) | |

| | | | | | | |

| Stock-based compensation | (155) | | | 6 | | | (149) | | | (139) | |

| | | | | | | |

| Income before tax | | | | | | | |

| Income before tax | 337 | | | 45 | | | 382 | | | 282 | |

| GAAP-based financial data | | | | | | | |

| Acquisition-related expenses | 40 | | | (3) | | | 37 | | | 76 | |

| | | | | | | |

Change in deferred net revenue (online-enabled games)1 | 425 | | | (4) | | | 421 | | | 461 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Stock-based compensation | 155 | | | (4) | | | 151 | | | 141 | |

| Tax rate used for management reporting | 19 | % | | | | 19 | % | | 19 | % |

| Earnings per share | | | | | | | |

| Basic | 0.89 | | | 0.19 | | | 1.08 | | | 0.74 | |

| Diluted | 0.88 | | | 0.19 | | | 1.07 | | | 0.73 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Number of shares used in computation | | | | | | | |

| Basic | 270 | | | (1) | | | 269 | | | 276 | |

| Diluted | 272 | | | (1) | | | 271 | | | 278 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

1The change in deferred net revenue (online-enabled games) in the unaudited condensed consolidated statements of cash flows does not necessarily equal the change in deferred net revenue (online-enabled games) in the unaudited condensed consolidated statements of operations primarily due to the impact of unrecognized gains/losses on cash flow hedges.

| | | | | | | | | | | |

| ELECTRONIC ARTS INC. AND SUBSIDIARIES |

| Unaudited Condensed Consolidated Balance Sheets |

| (in $ millions) |

| | | |

| December 31, 2023 | | March 31, 20232 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | 2,742 | | | 2,424 | |

| Short-term investments | 362 | | | 343 | |

| | | |

| Receivables, net | 867 | | | 684 | |

| | | |

| | | |

| Other current assets | 378 | | | 518 | |

| Total current assets | 4,349 | | | 3,969 | |

| Property and equipment, net | 561 | | | 549 | |

| Goodwill | 5,382 | | | 5,380 | |

| Acquisition-related intangibles, net | 501 | | | 618 | |

| Deferred income taxes, net | 2,375 | | | 2,462 | |

| Other assets | 449 | | | 481 | |

| TOTAL ASSETS | 13,617 | | | 13,459 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | 62 | | | 99 | |

| Accrued and other current liabilities | 1,299 | | | 1,285 | |

| | | |

| Deferred net revenue (online-enabled games) | 1,919 | | | 1,901 | |

| | | |

| Total current liabilities | 3,280 | | | 3,285 | |

| Senior notes, net | 1,881 | | | 1,880 | |

| Income tax obligations | 482 | | | 607 | |

| Deferred income taxes, net | 2 | | | 1 | |

| Other liabilities | 439 | | | 393 | |

| Total liabilities | 6,084 | | | 6,166 | |

| | | |

| Stockholders’ equity: | | | |

| Common stock | 3 | | | 3 | |

| | | |

| Retained earnings | 7,614 | | | 7,357 | |

| Accumulated other comprehensive loss | (84) | | | (67) | |

| Total stockholders’ equity | 7,533 | | | 7,293 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | 13,617 | | | 13,459 | |

2Derived from audited consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | |

| ELECTRONIC ARTS INC. AND SUBSIDIARIES |

| Unaudited Condensed Consolidated Statements of Cash Flows |

| (in $ millions) |

| | | | | | | |

| Three Months Ended December 31, | | Nine Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| OPERATING ACTIVITIES | | | | | | | |

| Net income | 290 | | | 204 | | | 1,091 | | | 814 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | |

| Depreciation, amortization, accretion and impairment | 82 | | | 122 | | | 255 | | | 363 | |

| | | | | | | |

| | | | | | | |

| Stock-based compensation | 151 | | | 141 | | | 436 | | | 406 | |

| Change in assets and liabilities | | | | | | | |

| Receivables, net | 183 | | | 90 | | | (184) | | | (186) | |

| Other assets | 112 | | | (28) | | | 186 | | | (53) | |

| Accounts payable | (93) | | | (74) | | | (36) | | | (21) | |

| Accrued and other liabilities | 138 | | | 297 | | | (119) | | | 28 | |

| Deferred income taxes, net | (20) | | | (47) | | | 88 | | | (203) | |

| Deferred net revenue (online-enabled games) | 421 | | | 418 | | | 18 | | | (215) | |

| Net cash provided by operating activities | 1,264 | | | 1,123 | | | 1,735 | | | 933 | |

| | | | | | | |

| INVESTING ACTIVITIES | | | | | | | |

| Capital expenditures | (52) | | | (48) | | | (148) | | | (160) | |

| | | | | | | |

| | | | | | | |

| Proceeds from maturities and sales of short-term investments | 148 | | | 77 | | | 450 | | | 243 | |

| Purchase of short-term investments | (147) | | | (90) | | | (460) | | | (263) | |

| | | | | | | |

| | | | | | | |

| Net cash used in investing activities | (51) | | | (61) | | | (158) | | | (180) | |

| | | | | | | |

| FINANCING ACTIVITIES | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Proceeds from issuance of common stock | 3 | | | 3 | | | 43 | | | 47 | |

| Cash dividends paid | (51) | | | (52) | | | (154) | | | (158) | |

| Cash paid to taxing authorities for shares withheld from employees | (58) | | | (44) | | | (178) | | | (161) | |

| Repurchase and retirement of common stock | (325) | | | (325) | | | (975) | | | (970) | |

| | | | | | | |

| | | | | | | |

| Net cash used in financing activities | (431) | | | (418) | | | (1,264) | | | (1,242) | |

| | | | | | | |

| Effect of foreign exchange on cash and cash equivalents | 14 | | | 19 | | | 5 | | | (41) | |

| Change in cash and cash equivalents | 796 | | | 663 | | | 318 | | | (530) | |

| Beginning cash and cash equivalents | 1,946 | | | 1,539 | | | 2,424 | | | 2,732 | |

| Ending cash and cash equivalents | 2,742 | | | 2,202 | | | 2,742 | | | 2,202 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ELECTRONIC ARTS INC. AND SUBSIDIARIES |

| Unaudited Supplemental Financial Information and Business Metrics |

| (in $ millions, except per share data) |

| | | | | | | | | | | |

| Q3 | | Q4 | | Q1 | | Q2 | | Q3 | | YOY % |

| FY23 | | FY23 | | FY24 | | FY24 | | FY24 | | Change |

| Net revenue | | | | | | | | | | | |

| Net revenue | 1,881 | | | 1,874 | | | 1,924 | | | 1,914 | | | 1,945 | | | 3 | % |

| GAAP-based financial data | | | | | | | | | | | |

Change in deferred net revenue (online-enabled games)1 | 461 | | | 72 | | | (346) | | | (94) | | | 421 | | | |

| | | | | | | | | | | |

| Gross profit | | | | | | | | | | | |

| Gross profit | 1,313 | | | 1,426 | | | 1,556 | | | 1,458 | | | 1,416 | | | 8 | % |

| Gross profit (as a % of net revenue) | 70 | % | | 76 | % | | 81 | % | | 76 | % | | 73 | % | | |

| GAAP-based financial data | | | | | | | | | | | |

| Acquisition-related expenses | 26 | | | 25 | | | 16 | | | 15 | | | 16 | | | |

Change in deferred net revenue (online-enabled games)1 | 461 | | | 72 | | | (346) | | | (94) | | | 421 | | | |

| | | | | | | | | | | |

| Stock-based compensation | 2 | | | 2 | | | 2 | | | 2 | | | 2 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Operating income | | | | | | | | | | | |

| Operating income | 289 | | | 175 | | | 542 | | | 377 | | | 365 | | | 26 | % |

| Operating income (as a % of net revenue) | 15 | % | | 9 | % | | 28 | % | | 20 | % | | 19 | % | | |

| GAAP-based financial data | | | | | | | | | | | |

| Acquisition-related expenses | 76 | | | 51 | | | 41 | | | 39 | | | 37 | | | |

Change in deferred net revenue (online-enabled games)1 | 461 | | | 72 | | | (346) | | | (94) | | | 421 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Restructuring and related charges | — | | | 155 | | | 3 | | | — | | | — | | | |

| Stock-based compensation | 141 | | | 142 | | | 130 | | | 155 | | | 151 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net income (loss) | | | | | | | | | | | |

| Net income (loss) | 204 | | | (12) | | | 402 | | | 399 | | | 290 | | | 42 | % |

| Net income (loss) (as a % of net revenue) | 11 | % | | (1 | %) | | 21 | % | | 21 | % | | 15 | % | | |

| GAAP-based financial data | | | | | | | | | | | |

| Acquisition-related expenses | 76 | | | 51 | | | 41 | | | 39 | | | 37 | | | |

Change in deferred net revenue (online-enabled games)1 | 461 | | | 72 | | | (346) | | | (94) | | | 421 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Restructuring and related charges | — | | | 155 | | | 3 | | | — | | | — | | | |

| Stock-based compensation | 141 | | | 142 | | | 130 | | | 155 | | | 151 | | | |

| Tax rate used for management reporting | 19 | % | | 19 | % | | 19 | % | | 19 | % | | 19 | % | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Diluted earnings (loss) per share | 0.73 | | | (0.04) | | | 1.47 | | | 1.47 | | | 1.07 | | | 47 | % |

| | | | | | | | | | | |

| Number of shares used in computation | | | | | | | | | | | |

| Basic | 276 | | | 274 | | | 272 | | | 271 | | | 269 | | | |

| Diluted | 278 | | | 274 | | | 274 | | | 272 | | | 271 | | | |

Anti-dilutive shares excluded for loss position3 | — | | | 1 | | | — | | | — | | | — | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

1The change in deferred net revenue (online-enabled games) in the unaudited condensed consolidated statements of cash flows does not necessarily equal the change in deferred net revenue (online-enabled games) in the unaudited condensed consolidated statements of operations primarily due to the impact of unrecognized gains/losses on cash flow hedges.

3 Diluted earnings per share reflects the potential dilution from common shares (calculated using the treasury stock method), issuable through stock-based compensation plans. When the company incurs a loss, shares issuable though stock-based compensation plans are excluded from the diluted loss per share calculation as inclusion would be anti-dilutive.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ELECTRONIC ARTS INC. AND SUBSIDIARIES |

| Unaudited Supplemental Financial Information and Business Metrics |

| (in $ millions) |

| | | | | | | | | | | | |

| | Q3 | | Q4 | | Q1 | | Q2 | | Q3 | | YOY % |

| | FY23 | | FY23 | | FY24 | | FY24 | | FY24 | | Change |

| QUARTERLY NET REVENUE PRESENTATIONS | | | | | | | | | | | | |

| Net revenue by composition | | | | | | | | | | | | |

| Full game downloads | | 423 | | | 274 | | | 301 | | | 346 | | | 431 | | | 2 | % |

| Packaged goods | | 199 | | | 98 | | | 142 | | | 275 | | | 187 | | | (6 | %) |

| Full game | | 622 | | | 372 | | | 443 | | | 621 | | | 618 | | | (1 | %) |

| Live services and other | | 1,259 | | | 1,502 | | | 1,481 | | | 1,293 | | | 1,327 | | | 5 | % |

| Total net revenue | | 1,881 | | | 1,874 | | | 1,924 | | | 1,914 | | | 1,945 | | | 3 | % |

| Full game | | 33 | % | | 20 | % | | 23 | % | | 32 | % | | 32 | % | | |

| Live services and other | | 67 | % | | 80 | % | | 77 | % | | 68 | % | | 68 | % | | |

| Total net revenue % | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | |

| GAAP-based financial data | | | | | | |

| Full game downloads | | 45 | | | (24) | | | (21) | | | 24 | | | 32 | | | |

| Packaged goods | | 20 | | | (24) | | | (21) | | | 46 | | | 4 | | | |

| Full game | | 65 | | | (48) | | | (42) | | | 70 | | | 36 | | | |

| Live services and other | | 396 | | | 120 | | | (304) | | | (164) | | | 385 | | | |

Total change in deferred net revenue (online-enabled games) by composition1 | | 461 | | | 72 | | | (346) | | | (94) | | | 421 | | | |

| | | | | | | | | | | | |

| Net revenue by platform | | | | | | | | | | | | |

| Console | | 1,152 | | | 1,088 | | | 1,167 | | | 1,187 | | | 1,229 | | | 7 | % |

| PC & Other | | 435 | | | 469 | | | 451 | | | 423 | | | 420 | | | (3 | %) |

| Mobile | | 294 | | | 317 | | | 306 | | | 304 | | | 296 | | | 1 | % |

| Total net revenue | | 1,881 | | | 1,874 | | | 1,924 | | | 1,914 | | | 1,945 | | | 3 | % |

| GAAP-based financial data | | | | | | |

| Console | | 423 | | | 11 | | | (266) | | | (35) | | | 377 | | | |

| PC & Other | | 29 | | | 47 | | | (77) | | | (34) | | | 33 | | | |

| Mobile | | 9 | | | 14 | | | (3) | | | (25) | | | 11 | | | |

Total change in deferred net revenue (online-enabled games) by platform1 | | 461 | | | 72 | | | (346) | | | (94) | | | 421 | | | |

1The change in deferred net revenue (online-enabled games) in the unaudited condensed consolidated statements of cash flows does not necessarily equal the change in deferred net revenue (online-enabled games) in the unaudited condensed consolidated statements of operations primarily due to the impact of unrecognized gains/losses on cash flow hedges.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ELECTRONIC ARTS INC. AND SUBSIDIARIES |

| Unaudited Supplemental Financial Information and Business Metrics |

| (in $ millions) |

| | | | | | | | | | | |

| Q3 | | Q4 | | Q1 | | Q2 | | Q3 | | YOY % |

| FY23 | | FY23 | | FY24 | | FY24 | | FY24 | | Change |

| CASH FLOW DATA | | | | | | | | | | | |

| Operating cash flow | 1,123 | | | 617 | | | 359 | | | 112 | | | 1,264 | | | 13 | % |

| Operating cash flow - TTM | 1,377 | | | 1,550 | | | 1,987 | | | 2,211 | | | 2,352 | | | 71 | % |

| Capital expenditures | 48 | | | 47 | | | 45 | | | 51 | | | 52 | | | 8 | % |

| Capital expenditures - TTM | 213 | | 207 | | 193 | | 191 | | 195 | | (8 | %) |

| Repurchase and retirement of common stock | 325 | | | 325 | | | 325 | | | 325 | | | 325 | | | — | |

| Cash dividends paid | 52 | | 52 | | 52 | | 51 | | 51 | | (2 | %) |

| DEPRECIATION | | | | | | | | | | | |

| Depreciation expense | 46 | | 58 | | 49 | | 49 | | 48 | | 4 | % |

| BALANCE SHEET DATA | | | | | | | | | | | |

| Cash and cash equivalents | 2,202 | | 2,424 | | 2,259 | | 1,946 | | 2,742 | | |

| Short-term investments | 351 | | 343 | | 343 | | 359 | | 362 | | |

| Cash and cash equivalents, and short-term investments | 2,553 | | | 2,767 | | | 2,602 | | | 2,305 | | | 3,104 | | | 22 | % |

| | | | | | | | | | | |

| Receivables, net | 836 | | 684 | | 517 | | 1,047 | | 867 | | 4 | % |

| STOCK-BASED COMPENSATION | | | | | | | | | | | |

| Cost of revenue | 2 | | | 2 | | | 2 | | | 2 | | | 2 | | | |

| Research and development | 95 | | 96 | | 93 | | 113 | | 108 | | |

| Marketing and sales | 15 | | 15 | | 11 | | 13 | | 14 | | |

| General and administrative | 29 | | 29 | | 24 | | 27 | | 27 | | |

| Total stock-based compensation | 141 | | | 142 | | | 130 | | | 155 | | | 151 | | | |

| RESTRUCTURING AND RELATED CHARGES | | | | | | | | | | | |

| Restructuring | — | | | 111 | | | 1 | | | 2 | | | — | | | |

| Office space reductions | — | | | 44 | | | 2 | | | (2) | | | — | | | |

| Total restructuring and related charges | — | | | 155 | | | 3 | | | — | | | — | | | |

v3.24.0.1

Cover Page

|

Jan. 26, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 26, 2024

|

| Entity Registrant Name |

ELECTRONIC ARTS INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

0-17948

|

| Entity Tax Identification Number |

94-2838567

|

| Entity Address, Address Line One |

209 Redwood Shores Parkway,

|

| Entity Address, City or Town |

Redwood City,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94065-1175

|

| City Area Code |

(650)

|

| Local Phone Number |

628-1500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

EA

|

| Security Exchange Name |

NASDAQ

|

| Entity Central Index Key |

0000712515

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

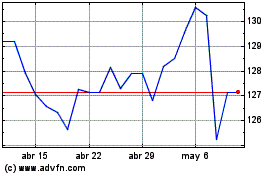

Electronic Arts (NASDAQ:EA)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Electronic Arts (NASDAQ:EA)

Gráfica de Acción Histórica

De May 2023 a May 2024