UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported): September 14, 2023

Frequency Electronics, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | | 1-8061 | | 11-1986657 |

| (State or Other Jurisdiction of

Incorporation) | | (Commission File Number) | | (IRS Employer Identification

Number) |

55 Charles Lindbergh Blvd.,

Mitchel Field, New York 11553

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (516) 794-4500

(Former name or former address, if changed since last report): Not Applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock (par value $1.00 per share) | FEIM | NASDAQ Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02.

|

Results of Operations and Financial Condition.

|

On September 14, 2023, Frequency Electronics, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended July 31, 2023. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1 hereto, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing or document.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: September 14, 2023

|

|

| |

FREQUENCY ELECTRONICS, INC.

By: /s/ Steven L. Bernstein

Name: Steven L. Bernstein

Title: Chief Financial Officer, Secretary and Treasurer

|

false

0000039020

0000039020

2023-09-14

2023-09-14

Exhibit 99.1

PRESS RELEASE

Frequency Electronics, Inc. Announces First Quarter Fiscal Year 2024 Financial Results

Mitchel Field, NY, September 14, 2023 – Frequency Electronics, Inc. (“FEI” or the “Company”) (NASDAQ-FEIM) is reporting revenues for the first quarter ended July 31, 2023, of approximately $12.4 million, compared to revenues of $8.2 million, for the first quarter of fiscal year 2023, ended July 31, 2022. Operating income for the first quarter of fiscal year 2024 was $2.1 million compared to an operating loss of $3.1 million for the same period of fiscal year 2023. Net Income from operations was $2.0 million or $0.22 per diluted share compared to a net loss from operations of $3.1 million or ($0.33) per diluted share for the first quarter of fiscal year 2023

FEI President and CEO, Tom McClelland commented, “In the first quarter of fiscal year 2024 we continued to see the results of the cost cutting efforts and management reorganization which has taken place over the last year. Revenue and gross margin have increased substantially compared to the first quarter of fiscal year 2023, and the Company is reporting an operating profit of $2.0M compared to an operating loss of $3.1M in the same quarter of last year. Although the operating profit for the quarter is affected by several one time items, even without these items the Company would have reported an operating profit of slightly over $1M. The backlog of $51.8M at the end of Q1 is close to the historic high at the end of FY2023, and is up dramatically compared to $39.7M at the end of Q1 last year. More importantly, bookings are expected to increase the backlog significantly over the next two quarters.

I believe our efforts have put us on a sustainable positive trajectory. The Company remains committed to achieving sustained profitability and cash generation going forward.”

Fiscal Year 2024 Selected Financial Metrics and Other Items

| |

-

|

For the three months ended July 31, 2023, revenues from satellite payloads were approximately $4.9 million, or 39%, of consolidated revenues compared to $3.5 million, or 42%, for the same period of the prior year.

|

| |

-

|

For the three months ended July 31, 2023, revenues for non-space U.S. Government/DOD customers were $6.9 million, or 55%, of consolidated revenues compared to $4.1 million, or 50%, for the same period of the prior year.

|

| |

-

|

For the three months ended July 31, 2023, revenues from other commercial and industrial sales accounted for approximately $672,000, or 5%, of consolidated revenues compared to approximately $664,000, or 8%, for the same period of the prior year.

|

| |

-

|

Net cash used in operations was $2.8 million in the first quarter of fiscal year 2024, compared to net cash used in operations of $3.6 million for the same period of fiscal year 2023.

|

| |

-

|

Backlog at July 31, 2023 was approximately $52 million compared to $57 million at April 30, 2023.

|

Investor Conference Call

As previously announced, the Company will hold a conference call to discuss these results on Thursday, September 14, 2023, at 4:30 PM Eastern Time. Investors and analysts may access the call by dialing 1-888-506-0062. International callers may dial 1-973-528-0011. Callers should provide participant access code: 782267 or ask for the Frequency Electronics conference call.

The archived call may be accessed by calling 1-877-481-4010 (domestic), or 1-919-882-2331 (international), for one week following the call (replay passcode: 48702). Subsequent to that, the call can be accessed via a link available on the Company’s website through October 12, 2023.

About Frequency Electronics

Frequency Electronics, Inc. is a world leader in the design, development and manufacture of high precision timing, frequency generation and RF control products for space and terrestrial applications. Frequency’s products are used in satellite payloads and in other commercial, government and military systems including C4ISR and electronic warfare, missiles, UAVs, aircraft, GPS, secure communications, energy exploration and wireline and wireless networks. Frequency has received over 100 awards of excellence for achievements in providing high performance electronic assemblies for over 150 space and DOD programs. The Company invests significant resources in research and development to expand its capabilities and markets.

Frequency’s Mission Statement: “Our mission is to provide precision time and low phase noise frequency generation systems from 1 Hz to 50 GHz, for space and other challenging environments.”

Subsidiaries and Affiliates: FEI-Zyfer provides GPS and secure timing ("SAASM") capabilities for critical military and commercial applications; FEI-Elcom Tech provides Electronic Warfare (“EW”) sub-systems and state-of-the-art RF microwave products. Additional information is available on the Company’s website: www.frequencyelectronics.com

Forward-Looking Statements

The statements in this press release regarding future earnings and operations and other statements relating to the future constitute “forward-looking” statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements inherently involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. Factors that would cause or contribute to such differences include, but are not limited to, the risks associated with health epidemics and pandemics, including the COVID-19 pandemic and similar outbreaks, such as their impact on our financial condition and results of operations and on our ability to continue manufacturing and distributing our products, and the impact of health epidemics and pandemics on general economic conditions, including any resulting recession, our inability to integrate operations and personnel, actions by significant customers or competitors, general domestic and international economic conditions, reliance on key customers, continued acceptance of the Company’s products in the marketplace, competitive factors, new products and technological changes, product prices and raw material costs, dependence upon third-party vendors, other supply chain related issues, increasing costs for materials, operating related expenses, competitive developments, changes in manufacturing and transportation costs, the availability of capital, the outcome of any litigation and arbitration proceedings, and failure to maintain an effective system of internal controls over financial reporting. The factors listed above are not exhaustive and should be read in conjunction with the other cautionary statements that are included in this release and in our filings with the Securities and Exchange Commission. The Company’s Annual Report on Form 10-K fiscal year ended April 30, 2023, filed on July 27, 2023 respectively, with the Securities and Exchange Commission includes additional factors that could materially and adversely impact the Company’s business, financial condition and results of operations, as such factors are updated from time to time in our periodic filings with the Securities and Exchange Commission, which are accessible on the Securities and Exchange Commission’s website at www.sec.gov. Moreover, the Company operates in a very competitive and rapidly changing environment. New factors emerge from time to time and it is not possible for management to predict the impact of all these factors on the Company’s business, financial condition or results of operations or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not rely on forward-looking statements as a prediction of actual results. Any or all of the forward-looking statements contained in this press release and any other public statement made by the Company or its management may turn out to be incorrect. The Company expressly disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Contact information: Dr. Thomas McClelland, President and Chief Executive Officer;

Steven Bernstein, Chief Financial Officer;

TELEPHONE: (516) 794-4500 ext.5000 WEBSITE: www.freqelec.com

Frequency Electronics, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

(in thousands except per share data)

| |

|

Three Months Ended

|

|

| |

|

July 31,

|

|

| |

|

(unaudited)

|

|

| |

|

2023

|

|

|

2022

|

|

|

Revenues

|

|

$ |

12,408 |

|

|

$ |

8,204 |

|

|

Cost of Revenues

|

|

|

7,540 |

|

|

|

8,209 |

|

|

Gross Margin

|

|

|

4,868 |

|

|

|

(5 |

) |

|

Selling and Administrative

|

|

|

2,302 |

|

|

|

1,992 |

|

|

Research and Development

|

|

|

506 |

|

|

|

1,110 |

|

|

Operating income (loss)

|

|

|

2,060 |

|

|

|

(3,107 |

) |

|

Interest and Other, Net

|

|

|

(11 |

) |

|

|

(9 |

) |

|

Income (loss) before Income Taxes

|

|

|

2,049 |

|

|

|

(3,116 |

) |

|

Provision for Income Taxes

|

|

|

7 |

|

|

|

1 |

|

|

Net income (loss)

|

|

$ |

2,042 |

|

|

$ |

(3,117 |

) |

| |

|

|

|

|

|

|

|

|

|

Net income (loss) per share:

|

|

|

|

|

|

|

|

|

|

Basic and diluted income (loss) per share

|

|

$ |

0.22 |

|

|

$ |

(0.33 |

) |

| |

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding

|

|

|

|

|

|

|

|

|

|

Basic and Diluted

|

|

|

9,384 |

|

|

|

9,308 |

|

Frequency Electronics, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(in thousands)

| |

|

July 31, 2023

|

|

|

April 30, 2023

|

|

| |

|

(unaudited)

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

9,061 |

|

|

$ |

12,049 |

|

|

Accounts Receivable, net

|

|

|

6,385 |

|

|

|

4,622 |

|

|

Contract Assets

|

|

|

11,028 |

|

|

|

10,009 |

|

|

Inventories, net

|

|

|

22,604 |

|

|

|

20,526 |

|

|

Other Current Assets

|

|

|

1,185 |

|

|

|

1,101 |

|

|

Property, plant, and equipment, net

|

|

|

6,778 |

|

|

|

7,093 |

|

|

Other Assets

|

|

|

11,868 |

|

|

|

11,714 |

|

|

Right-of-Use Assets – Operating Leases

|

|

|

7,062 |

|

|

|

7,382 |

|

| |

|

$ |

75,971 |

|

|

$ |

74,496 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Lease Liability - current

|

|

$ |

1,766 |

|

|

$ |

1,753 |

|

|

Contract Liabilities

|

|

|

18,356 |

|

|

|

18,586 |

|

|

Other Current Liabilities

|

|

|

6,758 |

|

|

|

6,942 |

|

|

Other Long-term Obligations

|

|

|

8,404 |

|

|

|

8,446 |

|

|

Operating Lease Liability – non-current

|

|

|

5,518 |

|

|

|

5,883 |

|

|

Stockholders’ Equity

|

|

|

35,169 |

|

|

|

32,886 |

|

| |

|

$ |

75,971 |

|

|

$ |

74,496 |

|

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

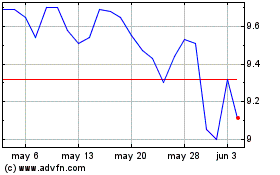

Frequency Electronics (NASDAQ:FEIM)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Frequency Electronics (NASDAQ:FEIM)

Gráfica de Acción Histórica

De May 2023 a May 2024