false

--06-30

0001451448

MT

0001451448

2024-01-03

2024-01-03

0001451448

us-gaap:CommonStockMember

2024-01-03

2024-01-03

0001451448

GMBL:CommonStockPurchaseWarrantsMember

2024-01-03

2024-01-03

0001451448

GMBL:Sec10.0SeriesCumulativeRedeemableConvertiblePreferredStockMember

2024-01-03

2024-01-03

0001451448

GMBL:CommonStockPurchaseWarrantsOneMember

2024-01-03

2024-01-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): January 3, 2024

ESPORTS

ENTERTAINMENT GROUP, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-39262 |

|

26-3062752 |

(State

or other jurisdiction

of

incorporation or organization) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

BLOCK

6,

TRIQ

PACEVILLE,

ST.

JULIANS STJ 3109

MALTA

(Address

of principal executive offices)

356

2713 1276

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

GMBL |

|

The

Nasdaq Stock Market LLC |

| Common

Stock Purchase Warrants |

|

GMBLW |

|

The

Nasdaq Stock Market LLC |

| 10.0%

Series A Cumulative Redeemable Convertible Preferred Stock |

|

GMBLP |

|

The

Nasdaq Stock Market LLC |

| Common

Stock Purchase Warrants |

|

GMBLZ |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

Series

E Preferred Stock

On

January 5, 2024, Esports Entertainment Group, Inc. (the “Company”), entered into a Subscription and Investment Representation

Agreement with the Chief Financial Officer of the Company, who is an accredited investor (the “Purchaser”), pursuant to which

the Company agreed to issue and sell one hundred (100) shares of the Company’s new Series E Preferred Stock, par value $0.001

per share (the “Series E Preferred Stock”), to the Purchaser for $10.00 per share in cash, or $1,000 in the aggregate. The

sale closed on January 5, 2024.

On

January 5, 2024, the Company filed a certificate of designations (the “Certificate of Designations”) with the Secretary of

State of Nevada, effective as of the time of filing, designating the rights, preferences, privileges and restrictions of the shares of

Series E Preferred Stock. The Certificate of Designations provides that one hundred (100) shares of Series E Preferred Stock will have

6,000,000 votes each and will vote together with the outstanding shares of the Common Stock as a single class exclusively with respect

to any proposal of an amendment to the Company’s articles of incorporation to increase the authorized shares of Common Stock (the

“Authorized Share Increase Proposal”) or any proposal to adjourn the annual or special meeting related to the Authorized

Share Increase Proposal, if applicable. The Series E Preferred Stock will be voted, without action by the holder, on any such proposals

in the same proportion as shares of Common Stock are voted. The Series E Preferred Stock otherwise has no voting rights except as

otherwise required by the Nevada Revised Statutes.

The

Series E Preferred Stock is not convertible into, or exchangeable for, shares of any other class or series of stock or other securities

of the Company. The Series E Preferred Stock has no rights with respect to any distribution of assets of the Company, including upon

a liquidation, bankruptcy, reorganization, merger, acquisition, sale, dissolution or winding up of the Company, whether voluntarily or

involuntarily. The holder of the Series E Preferred Stock will not be entitled to receive dividends of any kind.

The

outstanding shares of Series E Preferred Stock shall be redeemed in whole, but not in part, at any time (i) if such redemption is ordered

by the Board of Directors in its sole discretion or (ii) automatically upon the effectiveness of the Authorized Share Increase Proposal.

Upon such redemption, the holder of the Series E Preferred Stock will receive consideration of $10 per share in cash, or $1,000 in

the aggregate.

The

foregoing description of the Subscription and Investment Representation Agreement and the Certificate of Designations do not purport

to be complete and are qualified in their entirety by reference to the full text of the Subscription and Investment Representation Agreement

and Certificate of Designations, which are filed as Exhibits 10.1 and 3.1, respectively, to this Current Report on Form 8-K and incorporated

herein by reference.

Item

3.02 Unregistered Sales of Equity Securities

The

disclosure required by this Item is included in Item 1.01 of this Current Report on Form 8-K and is incorporated herein by reference.

Based in part upon the representations of the Purchaser in the Subscription Agreement, the offering and sale of the Series E Preferred

Stock was exempt from registration under Section 4(a)(2) of the Securities Act of 1933, as amended.

Item

3.03 Material Modifications to Rights of Security Holders

The

disclosure required by this Item and included in Item 1.01 of this Current Report is incorporated herein by reference.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

(b)

Director not Standing for Reelection

On

January 3, 2024, Chul Woong Lim, a director of the Company, notified the Company that he would be resigning as a director

of the Company and would therefore not be standing for reelection to the Company’s Board of Directors (the “Board”)

at the 2023 Annual Meeting of the Stockholders (the “2023 Annual Meeting”). Mr. Lim’s resignation from the

Board and the Audit Committee and the Compensation, Nominating and Corporate Governance Committee will be effective on the day of the

2023 Annual Meeting. Mr. Lim’s decision to resign was not the result of any disagreement between Mr. Lim and

the Company.

Item

5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

The

disclosure required by this Item and included in Item 1.01 of this Current Report is incorporated herein by reference.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| Date:

January 9, 2024 |

|

|

| |

|

|

| |

ESPORTS

ENTERTAINMENT GROUP, INC. |

| |

|

|

| |

By: |

/s/

Michael Villani |

| |

Name:

|

Michael

Villani |

| |

Title: |

Chief

Financial Officer |

Exhibit

3.1

ESPORTS

ENTERTAINMENT GROUP, INC.

CERTIFICATE

OF DESIGNATIONS, POWERS, PREFERENCES AND OTHER RIGHTS OF PREFERRED STOCK AND QUALIFICATIONS, LIMITATIONS AND RESTRICTIONS THEREOF

OF

SERIES

E PREFERRED STOCK

(Pursuant

to Section 78.1955 of the

Nevada Revised Statutes)

ESPORTS

ENTERTAINMENT GROUP, INC., a Nevada

corporation (the “Corporation”), pursuant to the provisions of Section 78.1955 of the Nevada Revised Statutes, does

hereby make this Certificate of Designations, Powers, Preferences and Other Rights of Preferred Stock and Qualifications, Limitations

and Restrictions (the “Certificate of Designations”) and does hereby state and certify that pursuant to the authority

expressly vested in the Board of Directors of the Corporation (the “Board”) by the Articles of Incorporation of the

Corporation (as amended, the “Articles”), which authorizes the issuance of 10,000,000 shares of blank check preferred

stock, $0.001 par value per share, in one or more series, the Board has duly adopted the following resolutions, which resolutions remain

in full force and effect as of the date hereof:

RESOLVED,

that, pursuant to Article VI(B) of the Articles, the Board hereby authorizes the issuance of, and fixes the designation and preferences

and relative, participating, optional and other special rights, and qualifications, limitations and restrictions, of a series of preferred

stock of the Corporation subject to the following terms and provisions:

1.

Designation, Amount and Par Value. The series of Preferred Stock created hereby shall be designated as the Series E Preferred

Stock (the “Series E Preferred Stock”), and the number of shares so designated shall be one hundred (100). The shares

of Series E Preferred Stock shall have a par value of $0.001 per share and will be uncertificated and represented in book-entry form

2.

Dividends. The holder of Series E Preferred Stock, as such, shall not be entitled to receive dividends or distributions of

any kind.

3.

Voting Rights

3.1.

Except as otherwise provided by the Articles or required by law, the holder of Series E Preferred Stock shall have no voting rights,

except that the holder of Series E Preferred Stock shall have the right to vote on any resolution or proposal presented to the stockholders

of the Corporation to approve an increase in the number of the Corporation’s authorized shares of Common Stock (as defined below)

or an amendment to the Corporation’s Articles for the purpose of effecting an increase in the number of the Corporation’s

authorized shares of Common Stock (the “Authorized Share Increase Proposal”), or any adjournment in the event that

the number of shares of Common Stock and Series E Preferred Stock present or represented by proxy at an annual or special meeting and

voting “FOR” the adoption of a proposal to increase the number of the Corporation’s authorized shares of Common Stock

are insufficient (the “Adjournment Proposal”).

3.2.

Except as otherwise provided herein, the outstanding shares of Series E Preferred Stock shall have 6,000,000 votes per share. The

outstanding shares of Series E Preferred Stock shall be considered issued and outstanding shares and entitled to vote for purposes of

a quorum and shall vote together with the outstanding shares of common stock, par value $0.001 per share (the “Common Stock”),

of the Corporation as a single class exclusively with respect to the Authorized Share Increase Proposal and Adjournment Proposal and

shall not be entitled to vote on any other matter except to the extent required under the Nevada Revised Statutes.

3.3.

The shares of Series E Preferred Stock shall be voted, without action by the holder, on the Authorized Share Increase Proposal and

Adjournment Proposal in the same proportion as shares of Common Stock are voted (excluding any shares of Common Stock that are not voted,

or otherwise, or which are counted as abstentions or broker non-votes) on the Authorized Share Increase Proposal and Adjournment Proposal

(and, for purposes of clarity, such voting rights shall not apply on any other resolution presented to the stockholders of the Corporation).

4.

Rank; Liquidation and Other. The Series E Preferred Stock shall have no rights as to any distribution of assets of the Corporation

for any reason, including upon a liquidation, bankruptcy, reorganization, merger, acquisition, sale, dissolution or winding up of the

Corporation, whether voluntarily or involuntarily, and shall not affect the liquidation or distribution rights of holders of any other

outstanding series of preferred stock of the Corporation, if any.

5.

Transfer. The Series E Preferred Stock may not be Transferred at any time prior to stockholder approval of the Authorized

Share Increase Proposal without the prior written consent of the Board of Directors. “Transferred” means, directly

or indirectly, whether by merger, consolidation, share exchange, division, or otherwise, the sale, transfer, gift, pledge, encumbrance,

assignment or other disposition of the shares of Series E Preferred Stock (or any right, title or interest thereto or therein) or any

agreement, arrangement or understanding (whether or not in writing) to take any of the foregoing actions.

6.

Redemption.

6.1.

The outstanding shares of Series E Preferred Stock shall be redeemed in whole, but not in part, at any time (i) if such redemption

is ordered by the Board of Directors in its sole discretion, automatically and effective on such time and date specified by the Board

of Directors in its sole discretion, or (ii) automatically upon the stockholder approval of the Authorized Share Increase Proposal (any

such redemption pursuant to this Section 6.1, the “Redemption”). As used herein, the “Redemption Time”

shall mean the effective time of the Redemption.

6.2.

Each share of Series E Preferred Stock redeemed in the Redemption pursuant to this Section 6 shall be redeemed in consideration for

the right to receive an amount equal to $10 in cash (the “Redemption Price”) for each share of Series E Preferred

Stock that is owned of record as of immediately prior to the applicable Redemption Time and redeemed pursuant to the Redemption, payable

upon the applicable Redemption Time.

6.3.

From and after the time at which the shares of Series E Preferred Stock are called for Redemption (whether automatically or otherwise)

in accordance with Section 6.1, such shares of Series E Preferred Stock shall cease to be outstanding, and the only right of the former

holder of such shares of Series E Preferred Stock, as such, will be to receive the applicable Redemption Price. The shares of Series

E Preferred Stock redeemed by the Corporation pursuant to this Certificate of Designations shall be automatically retired and restored

to the status of authorized but unissued shares of Preferred Stock, upon such Redemption. Notice of a meeting of the Corporation’s

stockholders for the submission to such stockholders of any proposal to approve the Authorized Share Increase Proposal or of any adjournment

thereof shall constitute notice of the Redemption of shares of Series E Preferred Stock and result in the automatic Redemption of the

shares of Series E Preferred Stock at the Redemption Time pursuant to Section 6.1 hereof. In connection with the filing of this Certificate

of Designations, the Corporation has set apart funds for payment for the Redemption of the shares of Series E Preferred Stock and shall

continue to keep such funds apart for such payment through the payment of the purchase price for the Redemption of such shares.

7.

Severability. Whenever possible, each provision hereof shall be interpreted in a manner as to be effective and valid under

applicable law, but if any provision hereof is held to be prohibited by or invalid under applicable law, then such provision shall be

ineffective only to the extent of such prohibition or invalidity, without invalidating or otherwise adversely affecting the remaining

provisions hereof.

[Remainder

of Page Intentionally Left Blank]

IN

WITNESS WHEREOF, Esports Entertainment Group, Inc. has caused this Certificate of Designations of Series E Preferred Stock to be

duly executed by the undersigned duly authorized officer as of this 5th day of January, 2024.

| |

ESPORTS

ENTERTAINMENT GROUP, INC. |

| |

|

|

| |

By: |

/s/

Michael Villani |

| |

Name: |

Michael

Villani |

| |

Title: |

Chief

Financial Officer |

[Signature

Page to the Certificate of Designations]

Exhibit

10.1

ESPORTS

ENTERTAINMENT GROUP, INC.

Series

E Preferred Stock

SUBSCRIPTION

AND INVESTMENT REPRESENTATION AGREEMENT

THIS

AGREEMENT, dated as of January 5, 2024, is by and between Esports Entertainment Group, Inc., a Nevada corporation (the “Company”),

and the undersigned subscriber (the “Subscriber”). In consideration of the mutual promises contained herein, and other

good, valuable and adequate consideration, the parties hereto agree as follows:

1.

Agreement of Sale; Closing. The Company agrees to sell to Subscriber, and Subscriber agrees to purchase from the Company, one

hundred (100) shares of the Company’s Series E Preferred Stock, par value $0.001 per share (the “Securities”),

which Securities shall have the rights, preferences, privileges and restrictions set forth in the Certificate of Designations attached

hereto as Exhibit A (the “Certificate of Designations”). Subscriber hereby acknowledges and agrees to the entire

terms of the Certificate of Designations, including, without limitation, the voting rights in Section 3, the restrictions on transfer

of the Securities in Section 5 and the redemption of the Securities pursuant to Section 6 of the Certificate of Designations. The purchase

price will be paid by the Subscriber to the Company in cash at the price of $10.00 per share or $1,000.00 in the aggregate.

2.

Representations and Warranties of Subscriber. In consideration of the Company’s offer to sell the Securities, and in addition

to the purchase price to be paid, Subscriber hereby covenants, represents and warrants to the Company as follows:

a.

Information About the Company.

i.

Subscriber is aware that the Company has limited revenue, is not profitable, has incurred significant liabilities, is currently subject

to a plan of compliance for the continued listing of its securities on the Nasdaq Stock Exchange, and that its financial projections

and future are purely speculative.

ii.

Subscriber has had an opportunity to ask questions of, and receive answers from, the Company concerning the business, management, and

financial and compliance affairs of the Company and the terms and conditions of the purchase of the Securities contemplated hereby. Subscriber

has had an opportunity to obtain, and has received, any additional information deemed necessary by the Subscriber to verify such information

in order to form a decision concerning an investment in the Company.

iii.

Subscriber has been advised to seek legal counsel and financial and tax advice concerning Subscriber’s investment in the Company

hereunder.

b.

Information on Subscriber. Subscriber is an employee, officer, director, and shareholder of the Company.

c.

Restrictions on Transfer. Subscriber covenants, represents and warrants that the Securities are being purchased for Subscriber’s

own personal account and for Subscriber’s individual investment and without the intention of reselling or redistributing the same,

that Subscriber has made no agreement with others regarding any of such Securities, and that Subscriber’s financial condition is

such that it is not likely that it will be necessary to dispose of any of the Securities in the foreseeable future. Moreover, Subscriber

acknowledges that any of the aforementioned actions may require the prior written consent of the Company’s board of directors pursuant

to the Certificate of Designations. Subscriber is aware that, in the view of the Securities and Exchange Commission, a purchase of the

Securities with an intent to resell by reason of any foreseeable specific contingency or anticipated change in market values, or any

change in the condition of the Company, or in connection with a contemplated liquidation or settlement of any loan obtained by Subscriber

for the acquisition of the Securities and for which the Securities were pledged as security, would represent an intent inconsistent with

the covenants, warranties and representations set forth above. Subscriber understands that the Securities have not been registered under

the Securities Act of 1933, as amended (the “Securities Act”), or any state or foreign securities laws in reliance

on exemptions from registration under these laws, and that, accordingly, the Securities may not be resold by the undersigned (i) unless

they are registered under both the Securities Act and applicable state or foreign securities laws or are sold in transactions which are

exempt from such registration, and (ii) except in compliance with Section 5 of the Certificate of Designations, which may require the

prior written consent of the Company’s board of directors. Subscriber therefore agrees not to sell, assign, transfer or otherwise

dispose of the Securities (i) unless a registration statement relating thereto has been duly filed and becomes effective under the Securities

Act and applicable state or foreign securities laws, or unless in the opinion of counsel satisfactory to the Company no such registration

is required under the circumstances, and (ii) except in compliance with Section 5 of the Certificate of Designations. There is not currently,

and it is unlikely that in the future there will exist, a public market for the Securities; and accordingly, for the above and other

reasons, Subscriber may not be able to liquidate an investment in the Securities for an indefinite period.

d.

High Degree of Economic Risk. Subscriber realizes that an investment in the Securities involves a high degree of economic risk

to the Subscriber, including the risks of receiving no return on the investment and/or of losing Subscriber’s entire investment

in the Company. Subscriber is able to bear the economic risk of investment in the Securities, including the total loss of such investment.

The Company can make no assurance regarding its future financial performance or as to the future profitability of the Company.

e.

Suitability. Subscriber has such knowledge and experience in financial, legal and business matters such that Subscriber is capable

of evaluating the merits and risks of an investment in the Securities. Subscriber has obtained, to the extent deemed necessary, Subscriber’s

own personal professional advice with respect to the risks inherent in, and the suitability of, an investment in the Securities in light

of Subscriber’s financial condition and investment needs. Subscriber believes that the investment in the Securities is suitable

for Subscriber based upon Subscriber’s investment objectives and financial needs, and Subscriber has adequate means for providing

for Subscriber’s current financial needs and personal contingencies and has no need for liquidity of investment with respect to

the Securities. Subscriber understands that no federal or state agency has made any finding or determination as to the fairness for investment,

nor any recommendation or endorsement, of the Securities.

f.

Tax Liability. Subscriber has reviewed with Subscriber’s own tax advisors the federal, state, local and foreign tax consequences

of this investment and the transactions contemplated by this Agreement, and has and will rely solely on such advisors and not on any

statements or representations of the Company or any of its agents, representatives, employees or affiliates or subsidiaries. Subscriber

understands that Subscriber (and not the Company) shall be responsible for Subscriber’s own tax liability that may arise as a result

of this investment or the transactions contemplated by this Agreement. Under penalties of perjury, Subscriber certifies that Subscriber

is not subject to back-up withholding either because Subscriber has not been notified that Subscriber is subject to back-up withholding

as a result of a failure to report all interest and dividends, or because the Internal Revenue Service has notified Subscriber that Subscriber

is no longer subject to back-up withholding.

g.

Residence. Subscriber’s present principal residence or business address, and the location where the securities are being

purchased, is located in the State of New York.

h.

Limitation Regarding Representations. Except as set forth in this Agreement, no covenants, representations or warranties have

been made to Subscriber by the Company or any agent, representative, employee, director or affiliate or subsidiary of the Company and

in entering into this transaction, Subscriber is not relying on any information, other than that contained herein and the results of

independent investigation by Subscriber without any influence by Company or those acting on Company’s behalf. Subscriber agrees

it is not relying on any oral or written information not expressly included in this Agreement, including but not limited to the information

which has been provided by the Company, its directors, its officers or any affiliate or subsidiary of any of the foregoing.

i.

Authority. The undersigned is of legal age.

3.

Voting Agreement. Subscriber hereby covenants and agrees to vote the Securities (which shall have an aggregate of 600,000,000

votes) on any Authorized Share Increase Proposal (as defined in the Certificate of Designations) in the same proportion as the shares

of the Company’s common stock, par value $0.001 per share (the “Common Stock”), are voted (excluding any shares

of Common Stock that are not voted, whether due to abstentions, broker non-votes or otherwise) on such proposal.

4.

Legend. Subscriber consents to the notation of the Securities with the following legend reciting restrictions on the transferability

of the Securities:

The

Securities represented hereby have not been registered under the Securities Act of 1933, as amended (the “Securities Act”),

and have not been registered under any state securities laws. These Securities may not be sold, offered for sale or transferred, without

first obtaining (i) an opinion of counsel satisfactory to the Company that such sale or transfer lawfully is exempt from registration

under the UNITED STATES Securities Act OF 1933, and under the applicable state securities laws or (ii) such registration. Moreover, these

Securities may be transferred only in accordance with the terms of the Company’s Certificate of DesignationS of Series E Preferred

Stock, a copy of which is on file with the Secretary of the Company.

5.

Accredited Status. Subscriber covenants, represents and warrants that it does qualify as an “accredited investor”

as that term is defined in Regulation D under the Securities Act.

6.

Holding Status. Subscriber desires that the Securities be held as set forth on the signature page hereto.

7.

Confidentiality. Subscriber will make no written or other public disclosures regarding the Company and its business, the terms

or existence of the proposed or actual sale of Securities or regarding the parties to the proposed or actual sale of Securities to any

individual or organization without the prior written consent of the Company, except as may be required by law.

8.

Notice. Correspondence regarding the Securities should be directed to Subscriber at the address provided by Subscriber to the

Company in writing.

9.

No Assignment or Revocation; Binding Effect. Neither this Agreement, nor any interest herein, shall be assignable or otherwise

transferable, restricted or limited by Subscriber without prior written consent of the Company. Subscriber hereby acknowledges and agrees

that Subscriber is not entitled to cancel, terminate, modify or revoke this Agreement in any way and that the Agreement shall survive

the death, incapacity or bankruptcy of Subscriber. The provisions of this Agreement shall be binding upon and inure to the benefit of

the parties hereto, and their respective heirs, legal representatives, successors and assigns.

10.

Indemnification. The Company agrees to indemnify and hold harmless the Subscriber and each current and future agent or representative,

if any, of the Subscriber from and against any and all costs, loss, damage or liability associated with this Agreement and the issuance

and voting of the Securities.

11.

Modifications. This Agreement may not be changed, modified, released, discharged, abandoned or otherwise amended, in whole or

in part, except by an instrument in writing, signed by the Subscriber and the Company. No delay or failure of the Company in exercising

any right under this Agreement will be deemed to constitute a waiver of such right or of any other rights.

12.

Entire Agreement. This Agreement and the exhibits hereto are the entire agreement between the parties with respect to the subject

matter hereto and thereto. This Agreement, including the exhibits, supersede any previous oral or written communications, representations,

understandings or agreements with the Company or with any officers, directors, agents or representatives of the Company.

13.

Severability. In the event that any paragraph or provision of this Agreement shall be held to be illegal or unenforceable in any

jurisdiction, such paragraph or provision shall, as to that jurisdiction, be adjusted and reformed, if possible, in order to achieve

the intent of the parties hereunder, and if such paragraph or provision cannot be adjusted and reformed, such paragraph or provision

shall, for the purposes of that jurisdiction, be voided and severed from this Agreement, and the entire Agreement shall not fail on account

thereof but shall otherwise remain in full force and effect.

14.

Governing Law. This Agreement shall be governed by, subject to, and construed in accordance with the laws of the State of Nevada

without regard to conflict of law principles.

15.

Survival of Covenants, Representations and Warranties. Subscriber understands the meaning and legal consequences of the agreements,

covenants, representations and warranties contained herein, and agrees that such agreements, covenants, representations and warranties

shall survive and remain in full force and effect after the execution hereof and payment by Subscriber for the Securities.

For

good, valuable and adequate consideration, the receipt and sufficiency of which is hereby acknowledged, Subscriber hereby agrees that

by signing this Subscription and Investment Representation Agreement, and upon acceptance hereof by the Company, that the

terms, provisions, obligations and agreements of this Agreement shall be binding upon Subscriber, and such terms, provisions, obligations

and agreements shall inure to the benefit of and be binding upon Subscriber and its successors and assigns.

| SUBSCRIBER |

|

| |

|

|

| By: |

/s/

Michael Villani |

|

| Name: |

Michael

Villani |

|

The

Company hereby accepts the subscription evidenced by this Subscription and Investment Representation Agreement:

| ESPORTS

ENTERTAINMENT GROUP, INC. |

|

| |

|

| By: |

/s/

Lydia Roy |

|

| Name: |

Lydia

Roy |

|

| Title: |

Secretary |

|

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=GMBL_CommonStockPurchaseWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=GMBL_Sec10.0SeriesCumulativeRedeemableConvertiblePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=GMBL_CommonStockPurchaseWarrantsOneMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

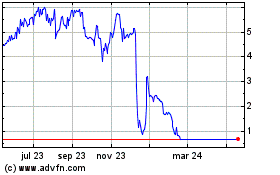

Esports Entertainment (NASDAQ:GMBLP)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Esports Entertainment (NASDAQ:GMBLP)

Gráfica de Acción Histórica

De May 2023 a May 2024