Identiv Announces Security Business Asset Sale Transaction Receives CFIUS Clearance

19 Agosto 2024 - 6:00AM

Business Wire

$145 Million Transaction Receives Final

Remaining Regulatory Approval

Transaction Expected to Close Within 30

Days

Identiv, Inc. (NASDAQ: INVE), a global digital

security and identification leader in the Internet of Things (IoT),

today announced that the Committee on Foreign Investment in the

United States ("CFIUS") has approved the Company’s transaction to

sell its physical security, access card, and identity reader

operations and assets (the “Physical Security Business”) to

Vitaprotech, a security solutions provider.

Identiv submitted notice of the proposed transaction to the U.S.

government on May 9, 2024. Pursuant to Section 721 of the Defense

Production Act of 1950, as amended, CFIUS reviewed the transaction.

On August 15, 2024, Identiv received notification of approval from

the Department of Treasury, on behalf of the Committee on Foreign

Investment in the United States. CFIUS determined that there were

no unresolved national security concerns; therefore, action under

Section 721 with respect to the transaction was concluded.

Having met all regulatory requirements and received shareholder

approval of the transaction, all regulatory and statutory

conditions for closing have been satisfied. Both parties are now

proceeding to close the transaction promptly. Based on the

anticipated time needed to complete the actions required to close,

Identiv and Vitaprotech expect to close the transaction within 30

days following CFIUS approval.

Upon closing of the transaction, Identiv will receive a cash

payment of $145 million, subject to customary adjustments. The

proceeds from the sale will significantly strengthen Identiv’s

financial position, providing capital to pursue growth

opportunities for its specialty IoT solutions business.

About Identiv

Identiv, Inc. is a global leader in digitally securing the

physical world. Identiv's platform encompasses RFID and NFC,

cybersecurity, and the full spectrum of physical access, video, and

audio security. For more information, visit identiv.com.

Note Regarding Forward-Looking Information

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements are those involving future events

and future results that are based on current expectations as well

as the current beliefs and assumptions of management of Identiv and

can be identified by words such as “anticipate,” “believe,”

“continue,” “plan,” “will,” “intend,” “expect,” “outlook,” and

similar references to the future. Any statement that is not a

historical fact is a forward-looking statement, including

statements regarding: Identiv’s strategy, opportunities, focus and

goals; the expected timing of the closing of the transaction;

expected amount of proceeds from the transaction; the terms and

conditions related to the transaction, including regulatory

approvals; Identiv’s expectations with respect to the use of

proceeds from the proposed transaction and the potential benefits

thereof; Identiv’s beliefs regarding access to future capital; and

Identiv’s expectations relating to the growth of its IoT business.

Forward-looking statements are only predictions and are subject to

a number of risks and uncertainties, many of which are outside

Identiv’s control, which could cause actual results to differ

materially and adversely from those expressed in any

forward-looking statements. Factors that could cause actual results

to differ materially from those in the forward-looking statements

include, but are not limited to: the risk that the other conditions

to the closing of the transaction are not satisfied; the occurrence

of any event, change or other circumstances that could give rise to

the termination of the asset purchase agreement; the failure of the

proposed transaction to close for any reason; potential litigation

relating to the transaction and the effects of any outcome related

thereto; any purchase price adjustments to the amount of proceeds

from the transaction; the timing of closing of the proposed

transaction; risks that the proposed transaction disrupts current

business, plans and operations of Identiv or its business

prospects; diversion of management’s attention from Identiv’s

ongoing business; the ability of Identiv to retain and hire key

personnel; the effect of the change in management following the

completion of the proposed transaction; competitive responses to

the proposed transaction; potential adverse reactions or changes to

business relationships resulting from the announcement or

completion of the proposed transaction; Identiv’s ability to

continue the momentum in its business; Identiv’s ability to

successfully execute its business strategy; Identiv’s ability to

capitalize on trends in its business; Identiv’s ability to satisfy

customer demand and expectations; the level and timing of customer

orders and changes/cancellations; the loss of customers, suppliers

or partners; the success of Identiv’s products and strategic

partnerships; industry trends and seasonality; the impact of

macroeconomic conditions and customer demand, inflation and

increases in prices; and the other factors discussed in its

periodic reports, including its Annual Report on Form 10-K for the

year ended December 31, 2023, Quarterly Report on Form 10-Q for the

quarter ended June 30, 2024 and subsequent reports filed with the

Securities and Exchange Commission. All forward-looking statements

are based on information available to Identiv on the date hereof,

and Identiv assumes no obligation to update such statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240819905104/en/

Investor Relations Contact: IR@identiv.com

Media Contact: press@identiv.com

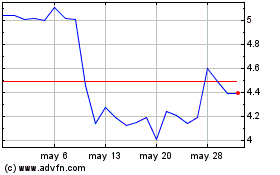

Identiv (NASDAQ:INVE)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Identiv (NASDAQ:INVE)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024