false

0001760903

0001760903

2024-03-07

2024-03-07

0001760903

us-gaap:CommonStockMember

2024-03-07

2024-03-07

0001760903

SHOT:WarrantsEachExercisableForOneShareOfCommonStockAt8.50PerShareMember

2024-03-07

2024-03-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C., 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 7, 2024

SAFETY

SHOT, INC.

(Exact

name of registrant as specified in charter)

| Delaware |

|

001-39569 |

|

83-2455880 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

1061

E. Indiantown Rd., Ste. 110, Jupiter, FL 33477

(Address

of principal executive offices) (Zip Code)

(561)

244-7100

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

SHOT |

|

The

Nasdaq Stock Market LLC

(The

Nasdaq Capital Market) |

| |

|

|

|

|

| Warrants,

each exercisable for one share of Common Stock at $8.50 per share |

|

SHOTW |

|

The

Nasdaq Stock Market LLC

(The

Nasdaq Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mart if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01. Entry into a Material Definitive Agreement

The

information set forth in Item 5.02 above is incorporated by reference into this Item 1.01.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers

On

March 13, 2024, the board of directors (the “Board”) of Safety Shot, Inc. (the “Company”) appointed Jordan

Schur as a member to the Board, and as the President of the Company. Since 2006, Mr. Schur has been the Chief Executive Officer and Chairman of Suretone Entertainment Group, as well

as the Chief Executive Officer of Mimram Shur Pictures which he founded in 2007.

In

connection with his employment as the director on March 7, 2024, the Company entered into an director’s agreement with Mr. Schur

(the “Jordon Agreement”). Pursuant to the Jordon Agreement, Mr. Schur is entitled to:

| |

● |

Compensation:

$25,000 per-annum, payable bi-monthly. |

| |

● |

Stock

Options: option to purchase 50,000 shares of common stock for each year he serves as a member of the Board, with an exercise price

of the current market price of the Company’s common stock at time of issuance. The options shall expire 3 years after the date

of issuance and shall be subject to the terms and conditions of the stock award agreement to be entered into by and between the Company

and Jordon. |

In

connection with his employment as the President on March 7, 2024, the Company entered into an employment agreement with Mr. Schur (the

“President Agreement”). Pursuant to the President Agreement, Mr. Schur is entitled to:

| |

● |

Compensation:

$300,000 per annum payable bi-monthly. With an increment up to $400,000 if the Company earns a revenue of above $10 million, and

an increment up to $500,000 if the Company earns a revenue of above $15 million. Following the increment, the base salary

shall remain $500,000 unless the Chief Executive Officer, in conjunction with the compensation committee, decides otherwise. |

| |

● |

Stock

Options: options to purchase 1,000,000 shares of common stock, with an exercise price of $1.96, the closing price as of March 7,

2024, and vesting quarterly. Mr. Schur shall receive additional options to purchase 100,000 shares of common stock for each fiscal

year with the Company revenue more than $10 million, with a maximum limit of options to purchase 2,000,000 shares of common stock. |

On

March 8, 2024, the Board the Company appointed David Long as a member of the Board. Mr. Long has over 20 years of experience in leading

and increasing growth for companies in the fitness and wellness industries. Since January 2010 Mr. Long has served as the CEO and the

Co-Founder of Orangetheory Fitness Corporate. From June 2008 to June 2007 Mr. Long served as the Developer and Owner of European Wax

Center. Mr. Long has a Bachelor’s degree in Health Science, Physical Therapy, and International Business from University of Florida

and an MBA from University of Florida.

In

connection with his employment as the director on March 11, 2024, the Company entered into an independent director’s agreement

with Mr. Long (the “David Agreement,” together with Jordan Agreement as the “Agreements”). Pursuant to the David

Agreement, Mr. Long is entitled to:

| |

● |

Compensation:

$25,000 per-annum. |

| |

● |

Stock

Options: option to purchase 50,000 shares of common stock for each year he serves as a member of the Board, with an exercise price

of the current market price of the Company’s common stock at time of issuance. The options shall expire 3 years after the date

of issuance and shall be subject to the terms and conditions of the stock award agreement to be entered into by and between the Company

and David. |

The

foregoing description of each of the Agreements do not purport to be complete and is qualified in its entirety by the text of the Agreement

which are filed as Exhibit 10.1 and Exhibit 10.2, and 10.3 are incorporated herein by reference.

There

are no arrangements or understandings between the Company and the newly appointed executive officer or director and any other person

or persons pursuant to which each executive officer or director was appointed and there is no family relationship between or among any

director or executive officer of the Company or any person nominated or chosen by the Company to become a director or executive officer.

There

are no transactions between the Company and any newly appointed executive officer or director that are reportable pursuant to Item 404(a)

of Regulation SK. The Company did not enter into or materially amend any material plan, contract or arrangement with any newly appointed

executive officer or director in connection with his or her appointment as a director or executive officer.

Item

7.01 Regulation FD Disclosure

On

March 13, 2024, the Company issued a press release. A copy of the press release is furnished hereto as Exhibit 99.1 and incorporated

herein by reference.

Item

9.01 Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

March 13, 2024

| |

SAFETY

SHOT, INC. |

| |

|

| |

By: |

/s/

Jarrett Boon |

| |

|

Jarrett

Boon |

| |

|

Chief

Executive Officer |

Exhibit 10.1

Exhibit 10.2

Exhibit 10.3

Exhibit

99.1

Safety

Shot Taps Music and Film Industry Veteran Jordan Schur as New President and Company Board Member

With

tremendous success throughout a storied career in the music and film industries, Schur aims to significantly boost brand awareness for

Safety Shot.

JUPITER,

FL – March 13, 2024 – Safety Shot, Inc. (Nasdaq: SHOT) (the “Company” or “Safety Shot”),

a pioneer in innovative well-being solutions, is excited to announce that American entrepreneur, record executive, and film producer

Jordan Schur has been appointed as President of the Company. Schur will also join the Company’s Board of Directors.

“I

am honored to join the Safety Shot team and to accelerate the next stage of growth for Safety Shot. I

am excited to help lead the Company towards global recognition,” stated Schur.

“Given

the sheer talent that has been under Schur’s guidance, we are very excited to have this renowned pioneer join the Safety Shot team.

His legacy in film and music as well as his diligence, innovation, and intuition will be a driving force in navigating Safety Shot to

become a leading household brand in the wellness beverage arena,” commented Safety Shot Chairman

of the Board John Gulyas.

For

over two decades Schur has been a prominent figure in the film and music industries. With a unique blend of creativity and business savvy,

he has played a pivotal role at several studios and record companies that have hosted some of the most influential figures in music and

Hollywood.

In

2006 Schur founded Los Angeles-based Suretone Entertainment, an independent full-service entertainment company that has consistently

impacted culture in music, film, and television. Suretone Entertainment encompasses Suretone Records, Suretone Pictures, and Suretone

Management. Schur additionally co-founded film production company Mimran Schur Pictures in 2007.

In

1999, prior to the formation of these companies, Schur joined Universal Music Group’s Geffen Records as President and re-launched

the label to new heights. Several years into his Geffen term, Schur was asked to also take on the duties of President of MCA Records.

The newly enlarged Geffen artist roster included some of the world’s most legendary artists amongst them Snoop Dogg, Nirvana,

Guns and Roses, Beck, Blink 182, Mary J. Blige, Hole, Enrique Iglesias, Counting Crows, Weezer, Nelly Furtado, Peter Gabriel, Rob Zombie,

Sigur Ros, Sonic Youth, The Roots, along with many others. Under Schur’s oversight, Geffen Records achieved over $1 billion in

revenue while becoming a consistent global market share leader for Universal Music Group.

In

1999, prior to the formation of these companies, Schur joined Universal Music Group’s Geffen Records as President and re-launched

the label to new heights. Several years into his Geffen term, Schur was asked to also take on the duties of President of MCA Records.

The newly enlarged Geffen artist roster included some of the world’s most legendary artists amongst them Snoop Dogg, Nirvana,

Guns and Roses, Beck, Blink 182, Mary J. Blige, Hole, Enrique Iglesias, Counting Crows, Weezer, Nelly Furtado, Peter Gabriel, Rob Zombie,

Sigur Ros, Sonic Youth, The Roots, along with many others. Under Schur’s oversight, Geffen Records achieved over $1 billion in

revenue while becoming a consistent global market share leader for Universal Music Group.

Prior

to his Geffen/MCA tenure, Schur founded the legendary Flip Records which rose to the top ranks of the music industry with 100M in album

sales for ground-breaking artists such as Limp Bizkit and Staind, youth driven groups that changed the landscape of music globally. Flip

Records pioneered a new business model as it selectively entered into equal joint venture relationships with respect to its artists with

a number of prominent music groups such as Interscope/UMG, Elektra/WMG, A&M/Polygram, and Epic/Sony Music Group.

In

partnership with Lionsgate Films, Mimran Schur Pictures produced the awe-inspiring Warrior [Tom Hardy, Joel Edgerton, Nick Nolte]

which was directed by the acclaimed Gavin O’Connor, leading to an Academy® Award nomination for Nolte; MSP also produced the

highly respected Stone [Robert De Niro, Edward Norton, Milla Jovovich], as well as the comedy gem Henry’s Crime [Keanu

Reeves, Vera Farmiga, James Caan]. In addition, in partnership with Lionsgate Films, MSP produced the cult classic Rapturepalooza

[Anna Kendrick, Craig Robinson], and in partnership with Sony Pictures, MSP produced Holmes & Watson [Will Ferrell, John

C. Reilly].

Schur

founded Suretone Pictures in 2011, where his notable film productions include The Kid [Ethan Hawke, Chris Pratt, Dane Dehaan,

Jake Schur] (2019), Pawnshop Chronicles [Paul Walker, Brendan Fraser, Elijah Wood, Matt Dillon, Norman Reedus] (2013). Suretone

Pictures recently completed DO NOT ENTER, financed in an equal joint-venture partnership with Lionsgate and based on the best-selling

book Creepers by David Morrell (author of the various Rambo books on which the film franchise is based), starring Jake

Manley, Adeline Rudolph, Francesca Reale, Nicholas Hamilton, and Laurence O’Faurian, and directed by Marc Klasfeld. Suretone Pictures

diverse upcoming slate includes the romantic comedy Revenge Wedding in conjunction with Lionsgate Films, and the action/thriller

Five Against A Bullet in conjunction with Mimran Schur Pictures.

The

Suretone Records catalog spans music releases by the likes of The Cure, Chris Cornell, Shwayze, New Found Glory, The Black Angels, Collective

Soul, From First To Last, and Angels & Airwaves, the acclaimed group led by Tom DeLonge of Blink 182. Suretone’s current roster

of artists include Limp Bizkit, The Cure, Kiki Kramer, Sayyi and more. Through Suretone’s global distributor WMG’s ADA, the

label also notably released ZZ Top’s Live - Greatest Hits From Around The World, along with Santana’s Africa Speaks, which

landed #3 on The New York Times Best Albums list of 2019.

About

Safety Shot

Safety

Shot, Inc., has developed a first-of-its-kind beverage that makes you feel better faster from the effects of alcohol by reducing blood

alcohol content and increasing mental clarity. Safety Shot leverages scientifically proven ingredients to enhance metabolic pathways

responsible for breaking down blood alcohol levels. The formulation includes a tailored selection of all-natural vitamins, minerals,

and nootropics, promoting faster alcohol breakdown and aiding in recovery and rehydration. Safety Shot has been available for retail

purchase since the first week of December 2023 at www.DrinkSafetyShot.com and www.Amazon.com. In addition, the Company

plans to introduce business-to-business sales to distributors, retailers, restaurants, and bars in 2024.

Forward

Looking Statements

This

communication contains forward-looking statements regarding Safety Shot, including, the anticipated timing of studies and the results

and benefits thereof. You can generally identify forward-looking statements by the use of forward-looking terminology such as “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “explore,”

“evaluate,” “intend,” “may,” “might,” “plan,” “potential,” “predict,”

“project,” “seek,” “should,” or “will,” or the negative thereof or other variations thereon

or comparable terminology. These forward-looking statements are based on each of the Company’s current plans, objectives, estimates,

expectations, and intentions and inherently involve significant risks and uncertainties, many of which are beyond Safety Shot’s

control. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as

a result of these risks and uncertainties and other risks and uncertainties affecting Safety Shot and, including those described from

time to time under the caption “Risk Factors” and elsewhere in Safety Shot’s Securities and Exchange Commission (SEC)

filings and reports, including Safety Shot’s Annual Report on Form 10-K for the year ended December 31, 2023 and future filings

and reports by Safety Shot. Moreover, other risks and uncertainties of which the Company is not currently aware may also affect the Company’s

forward-looking statements and may cause actual results and the timing of events to differ materially from those anticipated. Investors

are cautioned that forward-looking statements are not guarantees of future performance. The forward-looking statements made in this communication

are made only as of the date hereof or as of the dates indicated in the forward-looking statements and reflect the views stated therein

with respect to future events at such dates, even if they are subsequently made available by Safety Shot on its website or otherwise.

Safety Shot undertakes no obligation to update or supplement any forward-looking statements to reflect actual results, new information,

future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements

were made.

Media

Contact:

Phone: 904-477-2306

Email: emily@pantelidespr.com

Investor

Contact:

Phone:

561-244-7100

Email: investors@drinksafetyshot.com

v3.24.0.1

Cover

|

Mar. 07, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 07, 2024

|

| Entity File Number |

001-39569

|

| Entity Registrant Name |

SAFETY

SHOT, INC.

|

| Entity Central Index Key |

0001760903

|

| Entity Tax Identification Number |

83-2455880

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1061

E. Indiantown Rd.

|

| Entity Address, Address Line Two |

Ste. 110

|

| Entity Address, City or Town |

Jupiter

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33477

|

| City Area Code |

(561)

|

| Local Phone Number |

244-7100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Entity Information, Former Legal or Registered Name |

Not

Applicable

|

| Common Stock [Member] |

|

| Title of 12(b) Security |

Common

Stock

|

| Trading Symbol |

SHOT

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each exercisable for one share of Common Stock at $8.50 per share |

|

| Title of 12(b) Security |

Warrants,

each exercisable for one share of Common Stock at $8.50 per share

|

| Trading Symbol |

SHOTW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SHOT_WarrantsEachExercisableForOneShareOfCommonStockAt8.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

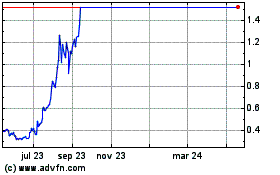

Jupiter Wellness (NASDAQ:JUPW)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Jupiter Wellness (NASDAQ:JUPW)

Gráfica de Acción Histórica

De May 2023 a May 2024