Apollo shines in major in-vehicle driving test

with NVIDIA

Plan to establish Apollo manufacturing line

with LITEON in 2024

AEye, Inc. (Nasdaq: LIDR), a global leader in adaptive, high

performance lidar solutions, today announced its results for the

third quarter ended September 30, 2024.

Quarterly Business

Highlights

- Apollo met the NVIDIA DRIVE Hyperion specifications, paving way

for platform integration

- Apollo samples shipped to OEMs; sets new long-distance

performance standard of 1 kilometer

- Apollo manufacturing line planned with LITEON in 2024, quoting

multiple OEMs

- New financial instruments extend cash runway; pave way to

automotive mass production

Management Commentary

Matt Fisch, AEye CEO, said, “AEye’s made significant strides in

the third quarter in meeting product and partner milestones and

putting the financial tools in place that move us closer to our

production goals. On the product front, we announced that Apollo

set a new bar in terms of performance, with high-resolution object

detection at a distance of one kilometer. We believe this

accomplishment is the first among our peers. Apollo demonstrations

have led to a spike in customer interest across the board, and we

have now delivered samples of Apollo to our partners.

“During the quarter, we demonstrated that Apollo met the NVIDIA

Hyperion specifications, which demand a challenging combination of

high-resolution detection at very long distances. This major

in-vehicle driving test is a significant achievement that further

validates the strength of our technology and paves the way for

deeper integration with the NVIDIA platform.

“We made significant progress with our partners over the

quarter. ATI, our partner in China, is demonstrating Apollo to

potential customers. We are also engaged in multiple global OEM

quoting activities with our Tier 1 partner, LITEON, and plan to

begin development of an Apollo manufacturing line in the fourth

quarter of 2024.

“Our ability to attract new investors to AEye has enabled us to

build the financial tools and liquidity to support the multi-year

runway required by the automotive production pipeline. We believe

we have the most efficient business model in the industry and our

capital-light approach positions us well to navigate the evolving

lidar landscape.”

Third Quarter 2024 Financial

Highlights

- Quarterly revenue of $104 thousand, primarily from sales of

inventory to non-automotive customers, meeting consensus

estimates

- Cash burn of $5.6 million, beating guidance of $5.9

million

- GAAP net loss was $(8.7) million, or $(1.01) per share, based

on 8.6 million weighted average common shares outstanding

- Non-GAAP net loss was $(6.0) million, or $(0.70) per share,

based on 8.6 million weighted average common shares outstanding,

beating consensus estimates

- Cash, cash equivalents, and marketable securities were $22.4

million as of September 30, 2024

“We believe our unique capital-light model is a key

differentiator in the lidar market. Not only does it allow us to

maintain a balance sheet with very little debt compared to some of

our peers, it also gives us what we believe is the lowest cost

structure in the industry. We expect this will lead to greater

efficiencies as we can do more with less. We believe this is a

powerful selling point to OEMs, as it enables us to offer a

superior product at a competitive price point.

“We ended the quarter with $22.4 million of cash, cash

equivalents, and marketable securities. Our total potential

liquidity, which includes the ELOC and the ATM facility, we

believe, extends our cash runway, gives us the ability to execute

with our OEM partners, and ultimately prepares us for the

commercialization of Apollo,” said Conor Tierney, AEye CFO.

In December 2023, the company effected a 1-for-30 reverse stock

split, and all the financial information disclosed has been

adjusted to account for the revised share count numbers.

Conference Call and Webcast

Details

AEye management will hold a conference call today, November 12,

2024, at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time) to discuss

these results. AEye CEO Matt Fisch and CFO Conor Tierney will host

the call, followed by a question-and-answer session.

The webcast and accompanying slides will be accessible via the

company’s website at https://investors.aeye.ai/.

Access is also available

via:

Conference call: https://aeye.pub/48pgxWe

Webcast: https://aeye.pub/4e8yny0

About AEye

AEye’s unique software-defined lidar solution enables advanced

driver-assistance, vehicle autonomy, smart infrastructure, and

logistics applications that save lives and propel the future of

transportation and mobility. AEye’s 4Sight™ Intelligent Sensing

Platform, with its adaptive sensor-based operating system, focuses

on what matters most: delivering faster, more accurate, and

reliable information. AEye’s 4Sight™ products, built on this

platform, are ideal for dynamic applications which require precise

measurement imaging to ensure safety and performance.

Non-GAAP Financial

Measures

The non-GAAP measures provided in this press release should not

be considered a substitute for, or superior to, measures of

financial performance prepared in accordance with generally

accepted accounting principles (GAAP) in the United States. A

reconciliation between GAAP and non-GAAP financial data is included

in the supplemental financial data attached to this press release.

Non-GAAP financial measures do not have any standardized meaning

and are therefore unlikely to be comparable to similarly titled

measures presented by other companies. AEye considers these

non-GAAP financial measures to be important because they provide

additional insight into the Company’s on-going performance. The

Company provides this information to help investors evaluate the

results of the Company’s on-going operations and to enable more

meaningful and consistent period-to-period comparisons. Non-GAAP

financial measures are presented only as supplemental information

to understand the Company’s operating results. The non-GAAP

financial measures should not be considered a substitute for

financial information presented in accordance with GAAP.

This press release includes non-GAAP financial measures,

including:

- Non-GAAP net loss which is defined as GAAP net loss plus

stock-based compensation, plus expenses related to registration

statements and common stock purchase agreements, less change in

fair value of convertible note and warrant liabilities, plus

realized loss on instrument-specific credit risk, plus one-time

termination benefits and other restructuring costs, plus

non-routine write-down of inventory, plus impairment of

right-of-use assets, less gain on termination of operating lease,

net; and

- Adjusted EBITDA, defined as non-GAAP net loss plus depreciation

and amortization expense, less interest income and other, less

interest expense and other, plus provision for income tax

expense.

Forward-Looking

Statements

Certain statements included in this press release that are not

historical facts are forward-looking statements within the meaning

of the federal securities laws, including the safe harbor

provisions under the United States Private Securities Litigation

Reform Act of 1995. Forward-looking statements are sometimes

accompanied by words such as “believe,” “continue,” “project,”

“expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,”

“opportunity,” “predict,” “plan,” “may,” “should,” “will,” “would,”

“potential,” “seem,” “seek,” “outlook,” and similar expressions

that predict or indicate future events or trends, or that are not

statements of historical matters. Forward-looking statements are

predictions, projections, and other statements about future events

that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties. Forward looking

statements included in this press release include statements about

deeper integration of Apollo with the NVIDIA DRIVE Hyperion

platform, the success of global OEM quoting activities, LITEON’s

anticipated establishment of a manufacturing line in 2024, the

potential liquidity available to AEye from new financial

instruments, expected efficiencies deriving from our capital-light

model, and the competitiveness of our pricing as compared to our

competitors, among others. These statements are based on various

assumptions, whether or not identified in this press release. These

forward-looking statements are provided for illustrative purposes

only and are not intended to serve as and must not be relied on by

an investor as a guarantee, an assurance, a prediction, or a

definitive statement of fact or probability. Actual events and

circumstances are very difficult or impossible to predict and will

differ from the assumptions. Many actual events and circumstances

are beyond the control of AEye. Many factors could cause actual

future events to differ from the forward-looking statements in this

press release, including but not limited to: (i) the risks that

Apollo, despite meeting the NVIDIA DRIVE Hyperion specifications,

may not be integrated into the NVIDIA DRIVE platform in the time

frame anticipated, or at all; (ii) the risks that LITEON may not

establish a manufacturing line for Apollo in 2024, or at all; (iii)

the risks that AEye may be unable to meet the requirements to draw

on one or more of the new financial instruments such that the

extension of the cash runway will not extend as far as anticipated,

nor allow AEye to execute with its OEM partners or adequately

prepare AEye for the commercialization of Apollo to the extent

anticipated, or at all; (iv) the risks that the high-resolution

object detection at a distance of up to one kilometer has been or

may be met or exceeded by AEye’s competitors; (v) the risks that

AEye’s capital-light business model may not position AEye to

navigate the evolving lidar landscape to the extent anticipated;

(vi) the risks that AEye’s capital-light business model may not be

a key differentiator in the lidar market to the extent anticipated,

or at all; (vii) the risks that AEye may not be in a position to

maintain a balance sheet with very little debt compared to some of

its peers to the extent anticipated, or at all; (viii) the risks

that AEye may be unable to maintain the lowest cost structure in

the industry; (ix) the risks that AEye may not realize the greater

efficiencies expected to the extent anticipated, or at all; (x) the

risks that AEye may not be able to offer OEMs a superior product at

a competitive price point to the extent anticipated, or at all;

(xi) the risks that market conditions may create delays in the

demand for commercial lidar products beyond AEye’s expectations;

(xii) the risks that lidar adoption occurs slower than anticipated

or fails to occur at all; (xiii) the risks that AEye’s products may

not meet the diverse range of performance and functional

requirements of target markets and customers; (xiv) the risks that

AEye’s products may not function as anticipated by AEye, or by

target markets and customers; (xv) the risks that AEye may not be

in a position to adequately or timely address either the near or

long-term opportunities that may or may not exist in the evolving

autonomous transportation industry;(xvi) the risks that laws and

regulations are adopted impacting the use of lidar that AEye is

unable to comply with, in whole or in part; (xvii) the risks

associated with changes in competitive and regulated industries in

which AEye operates, variations in operating performance across

competitors, and changes in laws and regulations affecting AEye’s

business; (xviii) the risks that AEye is unable to adequately

implement its business plans, forecasts, and other expectations,

and identify and realize additional opportunities; and (xix) the

risks of economic downturns and a changing regulatory landscape in

the highly competitive and evolving industry in which AEye

operates. These risks and uncertainties may be amplified by current

or future global conflicts and the lingering effects of the

COVID-19 pandemic, both of which continue to cause economic

uncertainty. The foregoing list of factors is not exhaustive. You

should carefully consider the foregoing factors and the other risks

and uncertainties described in the “Risk Factors” section of the

periodic report that AEye has most recently filed with the U.S.

Securities and Exchange Commission, or the SEC, and other documents

filed by us or that will be filed by us from time to time with the

SEC. These filings identify and address other important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are

made.

Readers are cautioned not to put undue reliance on

forward-looking statements; AEye assumes no obligation and does not

intend to update or revise these forward-looking statements,

whether as a result of new information, future events, or

otherwise. AEye gives no assurance that AEye will achieve any of

its expectations.

AEYE, INC.Consolidated Balance Sheets(In

thousands)(Unaudited)

September 30, 2024

December 31, 2023

ASSETS Current Assets: Cash and cash equivalents

$

5,851

$

16,932

Marketable securities

16,584

19,591

Accounts receivable, net

76

131

Inventories, net

258

583

Prepaid and other current assets

1,482

2,517

Total current assets

24,251

39,754

Right-of-use assets

703

11,226

Property and equipment, net

630

281

Restricted cash

—

2,150

Other noncurrent assets

784

906

Total assets

$

26,368

$

54,317

LIABILITIES AND STOCKHOLDERS’ EQUITY Current

Liabilities: Accounts payable

$

3,717

$

3,442

Accrued expenses and other current liabilities

6,960

6,585

Contract liabilities

35

—

Total current liabilities

10,712

10,027

Operating lease liabilities, noncurrent

537

14,858

Convertible note

146

—

Other noncurrent liabilities

67

409

Total liabilities

11,462

25,294

Stockholders’ Equity: Preferred stock

—

—

Common stock

1

1

Additional paid-in capital

379,425

366,647

Accumulated other comprehensive income

27

10

Accumulated deficit

(364,547

)

(337,635

)

Total stockholders’ equity

14,906

29,023

Total liabilities and stockholders’ equity

$

26,368

$

54,317

AEYE, INC.Consolidated Statements of Operations(In

thousands, except share amounts and per share data)(Unaudited)

Three months ended September 30, Nine months ended

September 30,

2024

2023

2024

2023

Revenue: Prototype sales

$

65

$

56

$

91

$

426

Development contracts

39

132

65

969

Total revenue

104

188

156

1,395

Cost of revenue

306

4,479

729

8,651

Gross loss

(202

)

(4,291

)

(573

)

(7,256

)

Operating expenses: Research and development

3,767

5,654

12,137

20,993

Sales and marketing

74

1,910

482

10,782

General and administrative

3,803

5,380

13,641

20,279

Total operating expenses

7,644

12,944

26,260

52,054

Loss from operations

(7,846

)

(17,235

)

(26,833

)

(59,310

)

Other income (expense): Change in fair value of convertible note

and warrant liabilities

9

12

(4

)

(914

)

Interest income and other

233

354

656

932

Interest expense and other

(1,102

)

(174

)

(729

)

(9

)

Total other income (expense), net

(860

)

192

(77

)

9

Loss before income tax expense

(8,706

)

(17,043

)

(26,910

)

(59,301

)

Provision for income tax expense

—

5

2

43

Net loss

$

(8,706

)

$

(17,048

)

$

(26,912

)

$

(59,344

)

Per Share Data Net loss per common share (basic and diluted)

$

(1.01

)

$

(2.78

)

$

(3.90

)

$

(10.34

)

Weighted average common shares outstanding (basic and

diluted)

8,629,683

6,137,251

6,892,910

5,739,425

AEYE, INC.Consolidated Statements of Cash Flows(In

thousands)(Unaudited) Nine months endedSeptember 30,

2024

2023

Cash flows from operating activities: Net loss

$

(26,912

)

$

(59,344

)

Adjustments to reconcile net loss to net cash used in operating

activities: Depreciation and amortization

80

998

Loss (gain) on sale of property and equipment, net

(12

)

53

Noncash lease expense relating to operating lease right-of-use

assets

905

1,058

Gain on termination of operating lease, net

(680

)

—

Common stock purchase agreement costs

1,136

—

Impairment of right-of-use assets

—

47

Inventory write-downs, net of scrapped inventory

167

3,666

Change in fair value of convertible note and warrant liabilities

4

914

Realized loss on instrument-specific credit risk

—

46

Stock-based compensation

7,002

14,707

Amortization of premiums and accretion of discounts on marketable

securities, net of change in accrued interest

(491

)

33

Expected credit losses, net of write-offs

35

—

Changes in operating assets and liabilities: Accounts receivable,

net

20

379

Inventories, current and noncurrent, net

157

(2,681

)

Prepaid and other current assets

1,035

1,672

Other noncurrent assets

123

133

Accounts payable

275

1,494

Accrued expenses and other current liabilities

(3,411

)

(2,571

)

Operating lease liabilities

(936

)

(1,143

)

Contract liabilities

35

(969

)

Other noncurrent liabilities

(346

)

—

Net cash used in operating activities

(21,814

)

(41,508

)

Cash flows from investing activities: Purchases of property

and equipment

(420

)

(1,421

)

Proceeds from sale of property and equipment

45

243

Purchases of marketable securities

(24,241

)

(8,736

)

Proceeds from redemptions and maturities of marketable securities

27,756

76,350

Net cash provided by investing activities

3,140

66,436

Cash flows from financing activities: Proceeds from exercise

of stock options

134

450

Proceeds from the issuance of convertible note

146

—

Payments for convertible note redemptions

—

(6,235

)

Taxes paid related to the net share settlement of equity awards

(113

)

(1,312

)

Proceeds from issuance of common stock under the Common Stock

Purchase Agreements

5,863

136

Stock issuance costs related to Common Stock Purchase Agreements

(613

)

—

Proceeds from issuance of common stock through the Employee Stock

Purchase Plan

26

118

Net cash provided by (used in) financing activities

5,443

(6,843

)

Net (decrease) increase in cash, cash equivalents and restricted

cash

(13,231

)

18,085

Cash, cash equivalents and restricted cash at beginning of period

19,082

21,214

Cash, cash equivalents and restricted cash at end of period

$

5,851

$

39,299

AEYE, INC.Reconciliation of GAAP to Non-GAAP Financial

Measures(In thousands, except share amounts and per share

data)(Unaudited) Three months ended September 30,

Nine months ended September 30

2024

2023

2024

2023

GAAP net loss

$

(8,706

)

$

(17,048

)

$

(26,912

)

$

(59,344

)

Non-GAAP adjustments: Stock-based compensation

2,248

4,084

7,002

14,707

Expenses related to registration statements and common stock

purchase agreements

1,136

233

1,136

233

Change in fair value of convertible note and warrant liabilities

(9

)

(12

)

4

914

Realized loss on instrument-specific credit risk

—

46

—

46

One-time termination benefits and other restructuring costs

—

172

—

1,470

Non-routine write-down of inventory

—

3,007

—

3,007

Impairment of right-of-use assets

—

—

—

47

Gain on termination of operating lease, net

(680

)

—

(680

)

—

Non-GAAP net loss

$

(6,011

)

$

(9,518

)

$

(19,450

)

$

(38,920

)

Depreciation and amortization expense

24

332

80

998

Interest income and other

(233

)

(354

)

(656

)

(932

)

Interest expense and other

(34

)

128

(407

)

(84

)

Provision for income tax expense

—

5

2

43

Adjusted EBITDA

$

(6,254

)

$

(9,407

)

$

(20,431

)

$

(38,895

)

GAAP net loss per share attributable to common

stockholders: Basic and diluted

$

(1.01

)

$

(2.78

)

$

(3.90

)

$

(10.34

)

Non-GAAP net loss per share attributable to common

stockholders: Basic and diluted

$

(0.70

)

$

(1.55

)

$

(2.82

)

$

(6.78

)

Shares used in computing GAAP net loss per share attributable to

common stockholders: Basic and diluted

8,629,683

6,137,251

6,892,910

5,739,425

Shares used in computing Non-GAAP net loss per share

attributable to common stockholders: Basic and diluted

8,629,683

6,137,251

6,892,910

5,739,425

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112782801/en/

Investor Relations

Contacts:

Agency Contact Evan Niu, CFA Financial Profiles, Inc.

eniu@finprofiles.com 310-622-8243

Company Contact AEye, Inc. Investor Relations

info@aeye.ai 925-400-4366

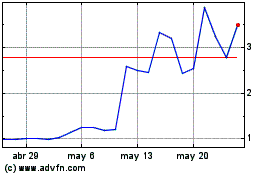

AEye (NASDAQ:LIDR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

AEye (NASDAQ:LIDR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024