Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

26 Julio 2022 - 4:21PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the month of July 2022

Commission

File Number 001-34738

Luokung

Technology Corp.

(Translation

of registrant’s name into English)

B9-8,

Block B, SOHO Phase II, No. 9, Guanghua Road, Chaoyang District,

Beijing

People’s Republic of China 100020

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

This report on Form 6-K is hereby incorporated

by reference into the Registration Statements on Form F-3 (File Nos. 333-258976 and 333-233108) of Luokung Technology Corp. (the “Company”),

and related prospectuses, as such registration statement and prospectuses may be amended from time to time, and to be a part thereof from

the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

Entry

into Material Definitive Agreements in Connection with a Registered Direct Offering.

On July 26, 2022, the

Company entered into a Securities Purchase Agreement (the “Purchase Agreement”) with certain institutional investors (the

“Buyers”) pursuant to which the Company agreed to sell to the Buyers, in a registered direct offering (the “Offering”),

an aggregate of 26,666,667 ordinary shares, par value $0.01 per share, of the Company (“Ordinary Shares” and such Ordinary

Shares as are included in the Offering, the “Shares”), for a price of $0.30 per Share. As part of the Offering, the Company

will also issue to the Buyers warrants (“Warrants”) for the purchase of up to 26,666,667 Ordinary Shares. The Offering’s

aggregate gross proceeds to the Company are approximately $8 million, before deducting fees to the placement agent and other estimated

offering expenses payable by the Company. At the closing, the Company shall issue to the Buyers under the Purchase Agreement an aggregate

of 26,666,667 Ordinary Shares and Warrants exercisable into an aggregate of up to 26,666,667 Ordinary Shares.

The Warrants have a term of five years and are exercisable by the holders at any time after the date of issuance at an exercise price

of $0.41 per share. The exercise price and the number of shares issuable upon exercise of the Warrants are subject to an adjustment upon

the occurrence of certain events, including, but not limited to, stock splits or dividends, business combinations, sale of assets, similar

recapitalization transactions, or other similar transactions. The exercise price of the Warrants is subject to adjustment in the event

that the Company issues or is deemed to issue Ordinary Shares for less than the applicable exercise price of the Warrants. With respect

to any warrants to purchase Ordinary Shares held by a Buyer as of the date of the Purchase Agreement (each, a “Prior Warrant”),

the Company has agreed that the exercise price of such Prior Warrant will be reduced to a price being the lower of $0.30 and the lowest

daily volume weighted average price of the Ordinary Shares on the Nasdaq stock exchange on any trading day during the five (5) trading

day period immediately following the date of the Purchase Agreement and future similar anti-dilution protection during the term of such

Prior Warrant. The exercisability of the Warrants may be limited if, upon exercise, the holder or any of its affiliates would beneficially

own more than 4.99% or 9.99% of our issued and outstanding Ordinary Shares, which percentage will be elected by the holder on or prior

to the issuance date. The Company has the right to request the mandatory exercise of the Warrants if the closing bid price of the Ordinary

Shares equals or exceeds $1.02 per share for 10 consecutive days, subject to certain other conditions being satisfied as set forth in

the Warrants.

Pursuant to the terms

of the Purchase Agreement, the Company agreed that subject to certain exceptions, the Company will not, within sixty (60) calendar days

following the closing of the Offering, (i) enter into any agreement to issue or announce the issuance or disposition or proposed issuance

or disposition of any securities or (ii) file any registration statement or amendment or supplement thereto, other than (a) the prospectus

supplement for the Offering, (b) after August 15, 2022, a shelf registration statement on Form F-3 to convert the Company’s automatic

shelf registration statement into a non-automatic shelf registration statement and/or to carry over any remaining amount from the registration

statement that was effective August 16, 2019, to a new shelf registration statement or (c) filing a registration statement on Form S-8

in connection with any employee benefit plan. In addition, the Company granted the investors participation rights in future offering of

securities during the year after the closing of the Offering in an amount of up to 35% of the securities being sold in such future offerings.

FT Global Capital, Inc.

(“FT Global Capital”) acted as the exclusive placement agent in connection with the Offering pursuant to the terms of a placement

agency agreement, dated July 26, 2022, between the Company and FT Global Capital (the “Placement Agency Agreement”). Pursuant

to the Placement Agency Agreement, the Company agreed to pay FT Global Capital a cash fee equal to 6.5% of the aggregate proceeds received

by the Company from the sale of securities in the Offering. FT Global Capital is also entitled to additional tail compensation for any

financings consummated through April 8, 2023 to the extent that such financing is provided to the Company by investors that FT Global

Capital had introduced to the Company or “wall-crossed” in connection with this Offering during the term of this Agreement.

In addition to the cash fees, the Company agreed to issue to FT Global Capital and/or its designees five-year warrants to purchase an

aggregate of 3.0% of the aggregate number of Ordinary Shares sold in the Offering (the “Placement Agent Warrants”).

The Shares, the Warrants,

the Placement Agent Warrants and our Ordinary Shares issuable upon exercise of the Warrants and the Placement Agent Warrants are being

offered by the Company pursuant to an effective shelf registration statement on Form F-3, which was filed with the Securities and Exchange

Commission on August 8, 2019 and was declared effective on August 16, 2019 (File No. 333-233108).

The foregoing descriptions

of the Placement Agency Agreement, the form of Purchase Agreement, the form of Warrant, and the form of the Placement Agent Warrants do

not purport to be complete and are qualified in their entirety by reference to the full text of such agreements, copies of which are attached

hereto as Exhibits 10.1, 10.2, 10.3, and 10.4, respectively, and are incorporated herein by reference. Readers should review such agreements

for a complete understanding of the terms and conditions associated with these transactions.

On July 26, 2022, the

Company issued a press release announcing the offering. A copy of the press release is attached hereto as Exhibit 99.1.

Financial

Statements and Exhibits

Exhibits.

| * | To

be filed by amendment. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Date:

July 26, 2022

| |

LUOKUNG

TECHNOLOGY CORP. |

| |

|

| |

By: |

/s/

Xuesong Song |

| |

|

Name:

|

Xuesong

Song |

| |

|

Title: |

Chief

Executive Officer |

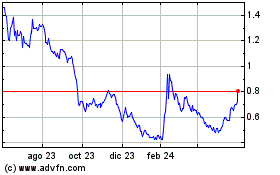

Luokung Technology (NASDAQ:LKCO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

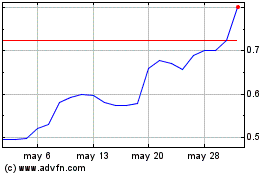

Luokung Technology (NASDAQ:LKCO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025