SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D AMENDMENT

Under the Securities Exchange Act of 1934

(Amendment No.4)

------------------------------------------

Perma-Pipe International Holdings Inc.

COMMON STOCK

-------------------------------------------

(Title of class of securities

714167103

---------------------------------------

CUSIP Number)

STRATEGIC VALUE PARTNERS

CARL W. DINGER III.

732 13TH STREET

BERTHOUD, CO 80513

(973)-819-9923

----------------------------------------

Name, address and telephone number of persons authorized to receive notices and communications.

AUGUST 19, 2024

------------------------------------------

(Date of event which requires filing of this statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of 240.13d-1(e),240.13d-1(f) or 240.13d-1(g), check the following box: / /.

Note: Schedules filed in paper format shall include a signed original and five copies of Schedule, including all exhibits. See 240.13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934("Act") or otherwise subject to the liabilities of that

section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 714167103

| |

1.

|

NAMES OF REPORTING PERSONS. I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY):

|

| Carl W. Dinger III* |

XXX-XX-XXXX |

| Carousel World L.P. |

XX-XXXXXXX |

| Ashley E. Dinger |

XXX-XX-XXXX |

| Caleigh N. Dinger |

XXX-XX-XXXX |

| Shelby C. Dinger |

XXX-XX-XXXX |

(*individually and as general partner for Carousel World LP).

2. CHECK THE APPROPRIATE BOX IF MEMBER OF A GROUP (a) / X /(b) / /

3. SEC USE ONLY

4. SOURCE OF FUNDS (SEE INSTRUCTIONS)

PF, OO of each reporting person of the group.

5. CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) //.

6. CITIZENSHIP OR PLACE OF ORGANIZATION

Carl W. Dinger III - USA

Ashley E. Dinger - USA

Caleigh N. Dinger - USA

Shelby C. Dinger – USA

Carousel World LP - A Colorado Limited Partnership

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING

PERSON:

7. SOLE VOTING POWER

8. SHARED VOTING POWER

384,966

9. SOLE DISPOSITIVE POWER

10. SHARED DISPOSITIVE POWER

384,966

11. AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

| Carl W. Dinger III - |

150,742 |

| Carousel World LP - |

130,400 |

| Ashley E. Dinger - |

33,902 |

| Caleigh N. Dinger - |

38,100 |

| Shelby C. Dinger - |

31,762 |

12. CHECK IF THE AGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARE //.

13. PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.80%

14. TYPE OF REPORTING PERSON

IN, CO (all related)

SPECIAL INSTRUCTIONS FOR COMPLYING WITH SCHEDULE 13D.

The following constitutes the Schedule 13D filed by the Undersigned:

ITEM 1. SECURITY AND ISSUER

This statement relates to the Common Stock, $0.01 par value per share ("the shares"), of Perma-Pipe International Holdings Inc., (the "Issuer"). The principal offices of the issuer are at:

24900 Pitkin Road, Suite 309

Spring, TX 77386

ITEM 2. IDENTITY AND BACKROUND

a.) This statement has been filed jointly by Carl W. Dinger III, Carl W. Dinger III’s children, (Ashley, Caleigh and Shelby), and by Carousel World L.P., a Colorado limited partnership.

b.) The principal address of each person or entity in the group is as follows:

Carl W. Dinger III, (and children):

732 13th Street

Berthoud, CO 80513

Carousel World L.P.

732 13th Street

Berthoud, CO 80513

c.) Present Principal occupation or employment and the name, principal business and address of any corporation or other organization in which such employment is conducted;

Carl W. Dinger III – General Partner of Carousel World LP, (address same as in (b.)

Ashley E. Dinger – Owner of The Dog Ranch

Caleigh N. Dinger – Student

Shelby C. Dinger – Veterinarian

d.) No reporting person in the group has, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

e.) None of the reporting persons in this group has, during the last five years, been party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or State securities laws or finding any violation with respect to such laws.

f.) Mr. Carl W. Dinger III, his children, and are all US citizens and Carousel World LP is a Colorado limited partnership.

ITEM 3. SOURCE AND AMOUNT OF FUNDS

The source of funds of each of the reporting persons in the group are the personal funds of each individual.

ITEM 4. PURPOSE OF THE TRANSACTION

The group owns a 4.80% stake in the issuer. See the addendum below regarding the purpose of the transaction.

ITEM 5. INTEREST IN THE SECURITIES OF THE ISSUER

As reported in the Issuer's 10Q for the quarter ending 4/30/2024, the issuer had 8,017,981 common shares outstanding. The reporting persons own an aggregate of 384, 966 common shares representing 4.80% of the Issuer's shares outstanding. Each member of the reporting group owns shares individually as follows:

<see above Item 11.>

c.) Transactions over the past sixty days are as follows):

Carousel World LP:

7/03/24 Sale 600 at $9.70

7/24?24 Sale 500 at $8.30

d.) No person other than the Reporting Persons is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, such shares of the Common Stock.

e.) Not applicable.

ITEM 6. CONTRACTS, AGREEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER.

Other than described herein, there are no contracts, arrangements or understandings among the Reporting Persons, (other than the termination of this group (Strategic Value Partners) on August 16, 2024.

ITEM 7. MATERIALS TO BE FILED AS EXHIBITS

Please see Exhibit 1, Termination of Strategic Value Partners partnership union.

Exhibit 2, Letter dated 8/17/24 address to the Perma-Pipe Board of Directors

SIGNATURES

After reasonable inquiry and to the best of our knowledge and belief, we certify that the information set forth in this statement is true, complete and correct.

August 19, 2024

------------------------------

DATE

(Carl W. Dinger III, individually, and as general partner of Carousel World LP).

<Carl W. Dinger III> ------------------------------------------------------- SIGNATURE

(Ashley E. Dinger, individually)

<Ashley E. Dinger> ------------------------------------------------------- SIGNATURE

(Caleigh N. Dinger, individually)

<Caleigh N. Dinger> ------------------------------------------------------- SIGNATURE

(Shelby C. Dinger, individually)

<Shelby C. Dinger> ------------------------------------------------------- SIGNATURE

Addendum as referenced in Item 7:

| |

1.

|

Termination of Strategic Value Partners.

|

On August 16, 2024, Carl Dinger III terminated the partnership agreement of the Strategic Value Partners. Consequently, the filing of this 13D/A has dropped the resultant ownership below the 5% threshold of the Williams Act. As a result, for the time being, the individual ownership will need not be reported under the Act.

| |

2.

|

Pursuant to recent events at the Company in particular the shareholders at large voting against one member of the Board’s candidacy, the following letter was sent to the Board of Directors at large by Carl W. Dinger III. The letter is contained herein:

|

August 17, 2024

Attention: Corporate Secretary

Perma-Pipe International

24900 Pitkin Road, Suite 309

Spring, Texas 77386]

To the Board of Directors at large:

I am a holder of approximately 385,000 shares of Perma-Pipe (personally, for my children and for a family limited partnership). I am well aware of the results of the recent vote at the annual meeting and the rejection of the candidacy of Jerome Walker. My understanding is that the will of the shareholders is being thwarted and this is unacceptable.

The comment made by Jerome Walker on the annual meeting call that the that stock has performed well is a falsehood not supported by the facts. The Company went public at $8 in 1989 and is still at roughly $8 providing long-term shareholders with no return at all while the Board continues to receive substantial benefits, diluting shareholders year after year. I would suggest before such outlandish statements are made that you perform more effective due diligence.

As far as I am concerned, the only single significantly positive decision that has been made by the Board was the hiring of David Mansfield. David undertook significant actions to straighten out what previously was a corporate mess. The turn around has been achieved by David realigning the corporate credo and directional agenda on day one of his hiring. I have met with David many times and he has done exactly what he said he would do and has achieved the improved results that we now are witnessing.

Realizing David is approaching retirement age, the Board needs to incentivize David to stay on past retirement age and manage the improved operating results to their natural conclusion. In an absence of retaining Mr. Mansfield, the momentum risks a serious negative result, the likes of which shareholders at large will not tolerate.

I believe we all agree that Perma-Pipe's recent results and the expected continued improvement is not reflected in the stock price. Selling at a low multiple of earnings, a lack of premium to book value, a low multiple of EBITDA, etc., reflects the “micro-cap” discount that many small companies face. The Board should consider, as the improvement in earnings continues to unfold, that perhaps this Company would recognize improved shareholder value by combining with another like company at some point. The expense of maintaining a duplicative Board of Directors, auditors and other dispensable redundant costs not to mention a useful domestic NOL carry-forward, could provide benefits to a suitor If you fail to retain David, we have a majority of shareholders that will, at a minimum, call a special meeting/proxy contest to replace the entire Board of Directors with a slate of more shareholder-oriented directors. Realizing that David must also agree to stay on, not retaining him would be another failure of the Board and require an immediate proxy contest to replace the Board.

As a Delaware Corporation, your fiduciary duties are to shareholders and not ignoring what will finally drive the positive future of Perma-Pipe. While understanding your decisions currently fall under the business judgement rule, anything less than retaining the successful current management will trigger our seeking to replace the Board, In addition, please take this letter as my demand for a copy of Perma-Pipe’s charter and bylaws as well as a copy of the shareholder list mailed to the address below. You will find proof of ownership attached.

I would be happy to discuss this with a representative of the Board and express our concern that this Board may not do the right thing for shareholders by retaining David Mansfield. He has orchestrated a significant turn-around that is FINALLY bearing fruit.

Sincerely,

Carl W. Dinger III, CFA

732 13th Street

Berthoud, CO 80513

(973)-819-9923

cwdinger3@gmail.com

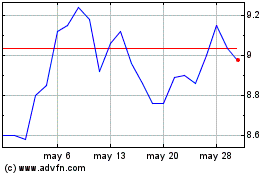

Perma Pipe (NASDAQ:PPIH)

Gráfica de Acción Histórica

De Oct 2024 a Oct 2024

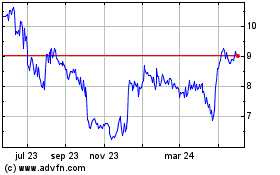

Perma Pipe (NASDAQ:PPIH)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024