AVITA Medical, Inc. (NASDAQ: RCEL, ASX: AVH), a commercial-stage

regenerative medicine company focused on first-in-class devices for

wound care management and skin restoration, today reported

financial results for the first quarter ended March 31, 2024.

Financial Results and Recent Business

Updates

- Commercial revenue increased approximately 5.8% to $11.1

million compared to the same period in 2023

- Gross profit margin of 86.4%

- Launched PermeaDerm, a co-branded biosynthetic wound matrix, in

the U.S. on March 23, 2024

“We believe we have taken the necessary measures to invigorate

our burns business and improve our commercial sales process to

return to sustained growth," said Jim Corbett, AVITA Medical Chief

Executive Officer. “We remain dedicated to establishing RECELL as

the standard of care for burn and full-thickness skin defects.

Simultaneously, we are actively transforming AVITA Medical into a

broad wound care business by expanding our portfolio to address the

full spectrum of clinical needs. We are confident that our

strategic initiatives to transform our business will enhance

accessibility and reach more patients."

Future Milestones

- RECELL GO, a device which provides consistent disaggregation of

skin to produce RECELL Spray-On Skin Cells, is currently undergoing

a 180-day interactive review by the U.S. Food and Drug

Administration under the Breakthrough Devices Program; the 180-day

period will end on May 30, 2024

- Plan to submit a PMA supplement for RECELL GO mini, which is

designed to address smaller wounds. This submission will fall under

the Breakthrough Device designation, which has been granted to

RECELL for burns, RECELL for full-thickness skin defects, RECELL

for repigmentation of stable depigmented vitiligo lesions, and

RECELL GO

- Expect to submit both our post-market study (TONE) treating

patients with stable vitiligo, and separate health economics study

for publication by year-end

Financial Guidance

- Commercial revenue for the second quarter 2024 is expected to

be in the range of $14.3 to $15.3 million

- Commercial revenue for the full-year 2024 is expected to be in

the lower end of our previously provided guidance range of $78.5 to

$84.5 million, reflecting growth of approximately 57% at the lower

end of the range over the full-year 2023

- Expect to achieve previously given guidance of cashflow break

even and GAAP profitability no later than the third quarter of

2025

"We acknowledge the significant cash utilization this quarter,

however we remain confident in our financial stability and our

ability to reach cashflow break even as guided," said David

O'Toole, Chief Financial Officer of AVITA Medical. "It's important

to note that the cash use was driven by several non-recurring

items, including expenses incurred related to our distribution

agreement with Stedical, totaling approximately $4.0 million for

inventory purchases and other costs. Of this amount, approximately

$3.1 million represents inventory that we will recover through

future product sales, with gross sales in the range of $6

million."

First Quarter 2024 Financial Results

Our commercial revenue, which excludes Biomedical Advanced

Research and Development Authority (BARDA) revenue, increased by

approximately 5.8% to $11.1 million in the three-months ended March

31, 2024, compared to $10.5 million in the same period in 2023.

Gross profit margin was 86.4% compared to 84.2% in the

corresponding period in the prior year.

Total operating expenses for the quarter were $26.8 million,

compared to $19.4 million in the same period in 2023. The increase

in operating expenses is primarily attributable to an increase of

$6.1 million in sales and marketing expenses due to

employee-related costs, including salaries and benefits,

commissions, professional fees, and travel expenses, collectively,

as a result of the expansion of our commercial organization to

support our growing commercial operations in the second quarter of

2023. G&A expenses increased by $0.7 million as a result of

higher salaries and benefits, partially offset by lower stock-based

compensation. In addition, the increase in operating expenses

included an increase of $0.6 million in R&D costs, which was

primarily due to employee compensation costs of the team of Medical

Science Liaisons.

Other income/expense, net increased by $0.8 million of expense,

compared to the same period in 2023, as we recognized $0.4 million

and $0.9 million in expense for non-cash charges due to the change

in fair value of the debt and the warrant liability, respectively.

These expenses were offset by an increase of approximately $0.5

million in income related to our investment activities and other

income.

Net loss was $18.7 million, or a loss of $0.73 per basic and

diluted share, compared to a net loss of $9.2 million, or a loss of

$0.37 per basic and diluted share, in the same period in 2023.

BARDA income consisted of funding from the Biomedical Advanced

Research and Development Authority, under the Assistant Secretary

for Preparedness and Response, within the U.S. Department of Health

and Human Services, under ongoing USG Contract No.

HHSO100201500028C.

Webcast and Conference Call Information

AVITA Medical will host a conference call to discuss its

financial and business results on Monday, May 13, 2024, at 1:30

p.m. Pacific Time (being Tuesday, May 14, 2024, at 6:30 a.m.

Australian Eastern Standard Time). To access the live call via

telephone, please register in advance to receive dial-in details

and a personal PIN using the link here. A simultaneous webcast of

the call will be available via the Company’s website at

https://ir.avitamedical.com/events-and-presentations.

About AVITA Medical, Inc.AVITA Medical® is a

commercial-stage regenerative medicine company transforming the

standard of care in wound care management and skin restoration with

innovative devices. At the forefront of our platform is the RECELL®

System, approved by the Food and Drug Administration for the

treatment of thermal burn wounds and full-thickness skin defects,

and for repigmentation of stable depigmented vitiligo lesions.

RECELL harnesses the regenerative properties of a patient’s own

skin to create Spray-On Skin™ Cells, delivering a transformative

solution at the point-of-care. This breakthrough technology serves

as the catalyst for a new treatment paradigm enabling improved

clinical outcomes. AVITA Medical also holds the exclusive rights to

market, sell, and distribute PermeaDerm®, a biosynthetic wound

matrix, in the United States.

In international markets, the RECELL System is approved to

promote skin healing in a wide range of applications including

burns, full-thickness skin defects, and vitiligo. The RECELL System

is TGA-registered in Australia, has received CE-mark approval in

Europe, and has PMDA approval in Japan.

To learn more, visit www.avitamedical.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

Statements in this press release may contain forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Such forward-looking statements are subject to

significant risks and uncertainties that could cause actual results

to differ materially from those expressed or implied by such

statements. Forward-looking statements generally may be identified

by the use of words such as “anticipate,” “expect,” “intend,”

“could,” “may,” “will,” “believe,” “estimate,” “look forward,”

“forecast,” “goal,” “target,” “project,” “continue,” “outlook,”

“guidance,” “future,” and similar words or expressions, and the use

of future dates. Applicable risks and uncertainties include, among

others, the timing and realization of regulatory approvals of our

products; physician acceptance, endorsement, and use of our

products; failure to achieve the anticipated benefits from approval

of our products; the effect of regulatory actions; product

liability claims; risks associated with international operations

and expansion; and other business effects, including the effects of

industry, economic or political conditions outside of the company’s

control. These statements are made as of the date of this release,

and the Company undertakes no obligation to publicly update or

revise any of these statements, except as required by law. For

additional information and other important factors that may cause

actual results to differ materially from forward-looking

statements, please see the “Risk Factors” section of the Company’s

latest Annual Report on Form 10-K and other publicly available

filings for a discussion of these and other risks and

uncertainties.

Authorized for release by the Chief Financial

Officer of AVITA Medical, Inc.

|

AVITA MEDICAL, INC.Consolidated Balance

Sheets(In thousands, except share and per share

data) |

|

|

|

|

As of |

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

ASSETS |

(unaudited) |

|

|

(audited) |

|

|

Cash and cash equivalents |

$ |

16,951 |

|

|

$ |

22,118 |

|

|

Marketable securities |

|

51,232 |

|

|

|

66,939 |

|

|

Accounts receivable, net |

|

7,081 |

|

|

|

7,664 |

|

|

BARDA receivables |

|

28 |

|

|

|

30 |

|

|

Prepaids and other current assets |

|

3,523 |

|

|

|

1,659 |

|

|

Inventory |

|

7,171 |

|

|

|

5,596 |

|

| Total

current assets |

|

85,986 |

|

|

|

104,006 |

|

|

Plant and equipment, net |

|

4,297 |

|

|

|

1,877 |

|

|

Operating lease right-of-use assets |

|

3,275 |

|

|

|

2,440 |

|

|

Corporate-owned life insurance ("COLI") asset |

|

2,880 |

|

|

|

2,475 |

|

|

Intangible assets, net |

|

542 |

|

|

|

487 |

|

|

Other long-term assets |

|

401 |

|

|

|

355 |

|

| Total

assets |

$ |

97,381 |

|

|

$ |

111,640 |

|

|

LIABILITIES, NON-QUALIFIED DEFERRED COMPENSATION PLAN SHARE AWARDS

AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

4,477 |

|

|

|

3,793 |

|

|

Accrued wages and fringe benefits |

|

5,803 |

|

|

|

7,972 |

|

|

Current non-qualified deferred compensation ("NQDC") liability |

|

429 |

|

|

|

168 |

|

|

Other current liabilities |

|

1,153 |

|

|

|

1,266 |

|

| Total

current liabilities |

|

11,862 |

|

|

|

13,199 |

|

|

Long-term debt |

|

41,301 |

|

|

|

39,812 |

|

|

Non-qualified deferred compensation liability |

|

3,913 |

|

|

|

3,663 |

|

|

Contract liabilities |

|

349 |

|

|

|

357 |

|

|

Operating lease liabilities, long term |

|

2,532 |

|

|

|

1,702 |

|

|

Warrant liability |

|

4,028 |

|

|

|

3,158 |

|

| Total

liabilities |

|

63,985 |

|

|

|

61,891 |

|

|

Non-qualified deferred compensation plan share awards |

|

827 |

|

|

|

693 |

|

|

Commitments and contingencies (Note 13) |

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

Common stock, $0.0001 par value per share, 200,000,000 shares

authorized, 25,789,051 and 25,682,078, shares issued and

outstanding at March 31, 2024 and December 31, 2023,

respectively |

|

3 |

|

|

|

3 |

|

|

Preferred stock, $0.0001 par value per share, 10,000,000 shares

authorized, no shares issued or outstanding at March 31, 2024 and

December 31, 2023 |

|

- |

|

|

|

- |

|

|

Company common stock held by the non-qualified deferred

compensation plan |

|

(944 |

) |

|

|

(1,130 |

) |

|

Additional paid-in capital |

|

353,205 |

|

|

|

350,039 |

|

|

Accumulated other comprehensive loss |

|

(3,068 |

) |

|

|

(1,887 |

) |

|

Accumulated deficit |

|

(316,627 |

) |

|

|

(297,969 |

) |

| Total

stockholders' equity |

|

32,569 |

|

|

|

49,056 |

|

| Total

liabilities, non-qualified deferred compensation plan share awards

and stockholders' equity |

$ |

97,381 |

|

|

$ |

111,640 |

|

| |

|

|

|

|

|

|

AVITA MEDICAL, INC.Consolidated Statements

of Operations(In thousands, except share and per

share data)(Unaudited) |

|

|

|

|

Three-Months Ended |

|

|

|

March 31, 2024 |

|

|

March 31, 2023 |

|

|

|

|

|

|

|

|

|

Revenues |

$ |

11,104 |

|

|

$ |

10,550 |

|

| Cost of

sales |

|

(1,513 |

) |

|

|

(1,667 |

) |

|

Gross profit |

|

9,591 |

|

|

|

8,883 |

|

| BARDA

income |

|

- |

|

|

|

627 |

|

|

Operating expenses: |

|

|

|

|

|

|

Sales and marketing |

|

(12,640 |

) |

|

|

(6,540 |

) |

|

General and administrative |

|

(8,963 |

) |

|

|

(8,295 |

) |

|

Research and development |

|

(5,194 |

) |

|

|

(4,586 |

) |

| Total

operating expenses |

|

(26,797 |

) |

|

|

(19,421 |

) |

|

Operating loss |

|

(17,206 |

) |

|

|

(9,911 |

) |

| Interest

expense |

|

(1,356 |

) |

|

|

(4 |

) |

| Other

income (expense), net |

|

(66 |

) |

|

|

725 |

|

| Loss

before income taxes |

|

(18,628 |

) |

|

|

(9,190 |

) |

| Income

tax expense |

|

(30 |

) |

|

|

(30 |

) |

| Net

loss |

$ |

(18,658 |

) |

|

$ |

(9,220 |

) |

| Net loss

per common share: |

|

|

|

|

|

|

Basic and Diluted |

$ |

(0.73 |

) |

|

$ |

(0.37 |

) |

|

Weighted-average common shares: |

|

|

|

|

|

|

Basic and Diluted |

|

25,637,783 |

|

|

|

25,202,088 |

|

|

|

|

|

|

|

|

|

|

Investor & Media Contact:

Jessica Ekeberg

Phone +1-661-904-9269

investor@avitamedical.com

media@avitamedical.com

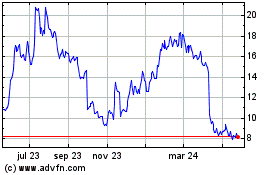

Avita Medical (NASDAQ:RCEL)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

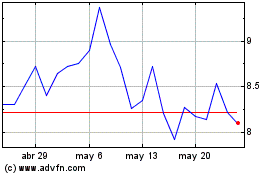

Avita Medical (NASDAQ:RCEL)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024