Filed Pursuant to Rule 424(b)(4)

Registration No. 333-264229

PROSPECTUS

Stabilis Solutions, Inc.

13,444,944 Shares

Common Stock, par value $0.001 per share

This prospectus relates to the offering for resale from time to time by the selling stockholders identified herein in "Selling Stockholders" (which term, as used in this prospectus, includes pledgees, donees, transferees or other successors-in-interest) of up to an aggregate of 13,444,944 shares of our common stock, par value $0.001 per share. The selling stockholders acquired the shares registered hereunder in private placements between us and the selling stockholders. We are not selling any shares of common stock under this prospectus and will not receive any proceeds from the sale of any shares of common stock by the selling stockholders. We have agreed to bear all of the expenses incurred in connection with the registration of these shares. The selling stockholders will pay or assume discounts, commissions, fees of underwriters, selling brokers or dealer managers and similar expenses, if any, incurred for the sale of shares of our common stock.

The selling stockholders identified in this prospectus may offer the shares from time to time through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. See “Plan of Distribution” on page 37 of this prospectus for a more complete description of the ways in which the shares may be sold.

Because all of the shares of common stock offered under this prospectus are being offered by the selling stockholders, we cannot currently determine the price or prices at which our shares may be sold under this prospectus.

You should carefully read this prospectus and any applicable prospectus supplement before you invest in any of our securities. You should also read the documents we have referred you to in the “Incorporation of Certain Information by Reference” section of this prospectus for information about us and our financial statements.

Our common stock is traded on The Nasdaq Stock Market LLC under the symbol “SLNG.” On April 25, 2022, the closing price of our common stock on the Nasdaq was $4.79 per share.

________________________

Our business and investment in our common stock involves risks. The risks are described in the section titled “Risk Factors” beginning on page 7 of this prospectus. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

________________________

The date of this prospectus is April 26, 2022

TABLE OF CONTENTS

| | | | | |

| Page |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | |

| |

| |

| |

| |

| |

| |

| INCORPORATION OF CERTAIN INFORMATION BY REFERENCE | |

| |

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we have filed with the Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”). This prospectus provides you with a general description of us and the common stock offered under this prospectus. Before you invest in our securities, you should carefully read this prospectus and any prospectus supplement and the additional information described under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference” and any additional information that you may need to make your investment decision including any of the documents we incorporated by reference.

We have not authorized any dealer, salesman or other person to provide you with information other than the information contained in or incorporated by reference into this prospectus. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, the common stock offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of the prospectus or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus and the documents incorporated by reference into this prospectus contain forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. See “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.”

Certain amounts and percentages included in this prospectus have been rounded. Accordingly, in certain instances, the sum of the numbers in a column of a table may not exactly equal the total figure for that column.

The market data and certain other statistical information used throughout this prospectus or incorporated by reference into this prospectus are based on independent industry publications, government publications and other published independent sources. Although we believe these third-party sources are reliable as of their respective dates, we have not independently verified the accuracy or completeness of this information. Some data is also based on our good faith estimates. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled "Risk Factors." These and other factors could cause results to differ materially from those expressed in these publications.

Unless the context requires otherwise or unless stated otherwise, references to the “Company,” “Stabilis,” “we,” “our”

and “us” refer to Stabilis Solutions, Inc. and its subsidiaries on a consolidated basis.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein include statements that constitute "forward-looking statements" within the meaning of the federal securities laws. These forward-looking statements may relate to, but are not limited to, information or assumptions about us, our capital and other expenditures, dividends, financing plans, capital structure, cash flow, pending legal and regulatory proceedings and claims, including environmental matters, future economic performance, operating income, cost savings, and management’s plans, strategies, goals and objectives for future operations and growth. These forward-looking statements generally are accompanied by words such as “intend,” “anticipate,” “believe,” “estimate,” “expect,” “should,” “seek,” “project,” “plan” or similar expressions. Any statement that is not a historical fact is a forward-looking statement. It should be understood that these forward-looking statements are necessarily estimates reflecting the best judgment of senior management, not guarantees of future performance. They are subject to a number of assumptions, risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements described under the heading “Risk Factors” included in this prospectus and the documents incorporated by reference herein as described under the heading “Incorporation of Certain Information by Reference.”

Forward-looking statements represent intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In addition to the risk factors and other cautionary statements described under the heading “Risk Factors” included in this prospectus and the documents incorporated by reference herein, important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, those summarized below.

SUMMARY RISK FACTORS

Risks Relating to Our Business and Industry

•We may not be able to implement our business strategy;

•Our business may require additional funding from various sources, which may be on unfavorable terms;

•We may not be profitable for an indeterminate period of time;

•The loss of a significant customer could adversely affect our operating results;

•We could be materially and adversely affected if any customer fails to perform its contractual obligations;

•Any failure to perform by our counterparties under agreements may adversely affect our operating results, liquidity and access to financing;

•Our customer contracts are subject to termination under certain circumstances;

•Cyclical or other changes in the demand for and price of LNG and natural gas may adversely affect us;

•Failure to maintain sufficient working capital could limit our growth and harm our business;

•Operation of our LNG infrastructure, plants and other assets involves particular, significant risks;

•Climate change may increase the frequency and severity of weather events and other natural disasters that could result in an interruption of our operations, a delay in the completion of future facilities, or delays in payments from our customers;

•Our insurance may be insufficient to cover losses that may occur to our property or result from our operations;

•Our energy-related infrastructure is subject to operational, regulatory, environmental, political, legal and economic risks;

•We are relying on third party contractors to operate our business and execute our strategy;

•We may not be able to purchase or receive physical delivery of natural gas in sufficient quantities and/or at economically attractive prices to satisfy our delivery obligations;

•Changes in legislation and regulations could have a material adverse impact on our business, results of operations, financial condition, liquidity and prospects;

•We face competition in the LNG industry which is intense, and some of our competitors have greater financial, technological and other resources than we currently possess;

•Failure of LNG to be a competitive source of energy in the markets in which we operate, and seek to operate, could adversely affect our expansion strategy;

•Our lack of diversification could have an adverse effect on our business, operating results, liquidity and prospects;

•Our risk management strategies cannot eliminate all LNG price and supply risks; any non-compliance with our risk management strategies could result in significant financial losses;

•We may experience increased labor costs, and the unavailability of skilled workers or failure to attract and retain qualified personnel could adversely affect us;

•We may incur impairments to goodwill or long-lived assets;

•A major health and safety incident involving LNG or within the energy industry may lead to more stringent regulation of LNG operations or the energy business generally, resulting in difficulties in obtaining permits, on favorable terms, and may otherwise lead to significant liabilities and reputational damage;

•Failure to obtain and maintain permits, approvals and authorizations from governmental and regulatory agencies could impede operations and could have a material adverse effect on us;

•Existing and future environmental, health and safety laws and regulations could result in increased compliance costs or additional operating costs or construction costs and restrictions;

•Environmental, social, and governance (“ESG”) goals, programs, and reporting may impact our access to capital;

•Our Chinese Joint Venture, BOMAY, has a limited life and is subject to risk that it may not be renewed;

•We have operations and investment in foreign countries and we could experience losses from foreign economies as well as unexpected operating, financial, political or cultural factors; and

•Our ability to maintain our liquidity may be materially and adversely affected if we are unable to access the capital markets or if any significant customer fails to perform its contractual obligations for any reason.

Risks Inherent in an Investment in Us

•Investment in us is speculative, and our common stock is thinly traded with a limited market and volatile;

•We may continue to incur losses and may never achieve profitability;

•Our Company may need substantial additional funding or we may be compelled to delay, reduce or eliminate portions of our existing business operations and development efforts;

•Raising additional capital may cause dilution to our stockholders or restrict our operations;

•Casey Crenshaw has voting control over our Company, and we may have conflicts of interest arising out of transactions with parties related to Casey Crenshaw;

•Provisions in our corporate charter documents and under Florida law could make an acquisition of the Company, which may be beneficial to its stockholders, more difficult and prevent attempts by our stockholders to replace or remove our current management;

•We do not anticipate that we will pay any cash dividends in the foreseeable future;

•Our present and future success depends on key members of our management team and certain employees and our ability to retain such key members, the loss of any of whom could disrupt our business operations; and

•Our success will depend on pre-existing relationships with third parties; any adverse changes in these relationships could adversely affect our business, financial condition or results of operations.

Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in the forward-looking statements contained herein or the documents incorporated by reference herein. Any forward-looking statements made by us in this prospectus or documents incorporated by reference herein speak only as of the date on which they are made. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. All forward-looking statements included in this prospectus or the documents incorporated by reference herein are

expressly qualified in their entirety by the cautionary statements contained or referred to in this section. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue.

We are under no obligation to, and expressly disclaim any obligation to, update or alter our forward-looking statements, whether as a result of new information, subsequent events or otherwise.

In this prospectus or the documents incorporated by reference herein, we may rely on and refer to information from market research reports, analyst reports and other publicly available information. Although we believe that this information is reliable, we cannot guarantee the accuracy and completeness of this information, and we have not independently verified it.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus and the documents that we incorporate by reference. It is not complete and does not contain all of the information that you should consider before making an investment decision. For a more complete understanding of our business and this offering and before making any investment decision, you should read the entire prospectus and the documents incorporated by reference, including the section entitled “Risk Factors” commencing on page 7 of this prospectus and the “Risk Factors” section contained in our Annual Report on Form 10-K for the year ended December 31, 2021 (our “Annual Report”) and any subsequently filed Quarterly Reports on Form 10-Q.

Stabilis Solutions, Inc.

Stabilis Solutions, Inc. and its subsidiaries (the “Company”, “Stabilis”, “our”, “us” or “we”) is an energy transition company that provides turnkey clean energy production, storage, transportation and fueling solutions primarily using liquefied natural gas (“LNG”) to multiple end markets across North America. We have safely delivered over 360 million gallons of LNG through more than 36,000 truck deliveries during our 17-year operating history, which we believe makes us one of the largest and most experienced small-scale LNG providers in North America. We define “small-scale” LNG production to include liquefiers that produce less than 1,000,000 LNG gallons per day and “small-scale” LNG distribution to include distribution by trailer or tank container up to 15,000 LNG gallons or marine vessels that carry less than 8,000,000 LNG gallons. We provide LNG solutions to customers in diverse end markets, including aerospace, agriculture, industrial, utility, pipeline, mining, energy, remote clean power, and high horsepower transportation markets. Our customers use LNG as a partner fuel for renewable energy, and as an alternative to traditional fuel sources, such as distillate fuel oil and propane, to reduce harmful environmental emissions and lower fuel costs. Our customers also use LNG as a “virtual pipeline” solution when natural gas pipelines are not available or are curtailed. We also have the capability, knowledge and expertise to deliver other clean energy fuels still in commercial development such as hydrogen, renewable natural gas and synthetic natural gas.

We also provide electrical switch-gear, generator and instrumentation construction, installation and service to the marine, power generation, oil and gas, and broad industrial market segments in Brazil. Our products are used to safely distribute and control the flow of electricity from a power generation source to mechanical devices utilizing the power. We also offer a range of electrical and instrumentation turnarounds, maintenance and renovation projects.

Additionally, we have a 40% interest in our Chinese joint venture, BOMAY Electric Industries, Inc (“BOMAY”) which builds power and control systems for the energy industry in China.

Our Industry

LNG can be used to deliver natural gas to locations where pipeline service is not available, has been interrupted, or needs to be supplemented. LNG can also be used to replace a variety of alternative fuels, including distillate fuel oil (including diesel fuel and other fuel oils) and propane, among others to provide both environmental and economic benefits. We believe that these alternative fuel markets are large and provide significant opportunities for LNG substitution.

In addition, other clean energy solutions such as hydrogen will play an increasingly important role in the energy transition as clean energy initiatives increase globally.

We believe that LNG as well as other clean energy solutions will provide an important balance between environmental sustainability, security and accessibility, and economic viability and will play a key role in the energy transition.

Our Competitive Strengths

Stabilis believes that we are well positioned to execute our business strategies based on the following competitive strengths:

LNG is an economically and environmentally attractive product. Stabilis believes that many of our customers use LNG because it can significantly reduce harmful carbon dioxide, nitrogen oxide, sulfur, particulate matter, and other emissions as compared to other hydrocarbon-based fuels. LNG is also an important partner fuel for renewables such as solar and wind power and will be a key component of the energy transition to more sustainable sources of energy. We also believe that the combination of cost and environmental benefits makes LNG a compelling fuel source for many energy consumers. We believe that LNG can be delivered to customers at prices that are lower and more stable than what they would pay for distillate fuels or propane. In addition, several of our customers have reported that LNG as a fuel decreases their operating costs by reducing equipment maintenance requirements and providing more consistent burn characteristics.

Demonstrated ability to execute LNG projects safely and cost effectively. Stabilis has produced and delivered over 360 million gallons of LNG to our customers throughout our 17-year operating history. Our experience includes building and operating LNG production facilities, delivering LNG from third-party sources to our customers, and designing and executing a wide-variety of turnkey LNG fueling solutions for our customers using our cryogenic equipment fleet supported by our field service team. We have experience serving customers in multiple end markets including aerospace, industrial, utilities and pipelines, mining, energy, remote clean power, and transportation. We also have experience exporting LNG to Mexico and Canada. Finally, we believe our team is among the most experienced in the small-scale LNG industry. We believe that we can leverage this proven LNG execution experience to grow our business in existing markets and expand our business into new markets including the nascent hydrogen market. The production and distribution of hydrogen shares many attributes with LNG and we believe hydrogen will be a safe fuel and increasingly cost effective as acceptance grows.

Comprehensive provider of “virtual natural gas pipeline” solutions throughout North America. Stabilis offers our customers a comprehensive off-pipeline natural gas solution by providing the supply infrastructure, transportation and logistics, and field service support necessary to deliver LNG to them in a program that is tailored to their consumption needs. We believe we own one of the largest fleets of cryogenic transportation, storage, and vaporization equipment in North America. We can provide our customers LNG and related services for a wide variety of applications almost anywhere in the United States, Canada and Mexico. We believe that our ability to be a “one stop shop” for all of our customers’ off-pipeline natural gas requirements throughout North America is unique among LNG providers. We believe our LNG experience allows us to expand our comprehensive offerings using hydrogen.

Ability to leverage existing LNG production and delivery capabilities into new markets. Stabilis believes that our experience producing and distributing LNG can be leveraged to grow into new geographic and service end markets. Since our founding we have expanded our service area across the United States, northern Mexico, and western Canada. We have also expanded our industry coverage to include multiple new end markets and customers. We accomplished this expansion into new markets by leveraging our LNG production and distribution expertise, in combination with our cryogenic engineering and project development capabilities, to meet new customer needs.

Growth Strategy

Stabilis’ primary business objective is to provide superior returns to our shareholders by becoming the leading vertically integrated small-scale LNG solution provider in North America. We intend to accomplish this objective by implementing the following growth strategies:

Expand our LNG production business throughout North America. Stabilis believes that the customers and markets we serve could benefit from localized LNG supply sourcing. To this end, we believe that expanding our LNG liquefaction footprint throughout North America will enhance our competitive position by lowering our delivered cost and by creating a comprehensive and reliable supply network for our customers. We intend to leverage our liquefier development, construction, and operations experience to develop new liquefiers in markets that require LNG supply. We may build new liquefiers or acquire existing liquefiers based on whichever offers the best service to our customers and returns to our investors.

Expand our LNG distribution business throughout North America. Stabilis believes that expanding our LNG distribution capabilities throughout North America will enhance our competitive position by creating a comprehensive and reliable supply network for our customers, lowering our delivered LNG costs, and expanding our ability to service new industries and geographies. We currently provide LNG distribution and field service support throughout the United States and parts of Mexico. We plan to expand our distribution capabilities by adding equipment to our fleet. In addition, we plan to explore opportunities that expand our geographic reach and industry expertise, including expansion into aerospace and marine bunkering.

Consistent with our strategy to expand our LNG production business, Stabilis will focus the expansion of our LNG distribution business in the United States and Mexico. We believe that supporting our liquefiers with our distribution capabilities optimizes our asset base and our ability to service our customers. We also plan to expand our third-party LNG supply network in these markets so we can provide our customers with comprehensive and reliable service.

Expand our ability to deliver other clean energy fuels to our customers. Stabilis has the ability, knowledge and expertise to deliver other clean energy fuels still in commercial development such as hydrogen and renewable natural gas. We believe these clean energy solutions will play an increasingly important role as clean energy initiatives increase globally.

Maintain financial strength and flexibility. Stabilis will seek to maintain a conservative balance sheet which we believe will allow us to better react to market opportunities. We believe that maintaining adequate balance sheet flexibility, along with positive cash flows from operations, will provide us with sufficient liquidity to execute on our business strategies.

Share Exchange Transaction

On July 26, 2019 (the “Effective Date”), the Company completed a share exchange (the “Share Exchange”) with American Electric Technologies, Inc. (“American Electric”) and its subsidiaries. In the Share Exchange, American Electric acquired directly 100% of the outstanding limited liability company membership interests of Stabilis Energy, LLC (“Stabilis LLC”) from LNG Investment Company, LLC, and 20% of the outstanding limited liability membership interests of PEG Partners, LLC (“PEG”) from AEGIS NG LLC (“AEGIS”). AEGIS owned a 20% non-controlling interest of PEG. The remaining 80% of the outstanding limited liability company interests of PEG were owned directly by Stabilis LLC. As a result, Stabilis LLC became a direct 100% owned subsidiary of American Electric and PEG became an indirectly-owned 100% subsidiary of American Electric.

Immediately following the Effective Date, the Company declared a reverse stock split of its outstanding common stock at a ratio of one-for-eight, American Electric changed its name to Stabilis Energy, Inc., and our common stock began trading under the ticker symbol “SLNG”. In connection with the Share Exchange, the Company issued 13,178,750 post-split shares of common stock to acquire Stabilis LLC, which represented approximately 90% of our total amount of common stock issued and outstanding as of the Effective Date. The proposed transaction was approved by the shareholders of the Company at a Special Meeting of Stockholders. The Share Exchange resulted in a change of control of the Company to control by Casey Crenshaw by virtue of his beneficial ownership of 88.4% of our common stock outstanding as of the Effective Date.

The securities being registered for resale herein include 12,580,808 shares of common stock owned by LNG Investment Company, LLC and 364,136 owned by JCH Crenshaw Holdings, LLC, both beneficially owned by Casey Crenshaw, that were issued in connection with the Share Exchange. The shares are subject to a registration rights agreement, dated the Effective Date, by and between the Company, LNG Investment Company, LLC, and AEGIS, filed as Exhibit 4.2 to the registration statement of which this prospectus forms a part.

Risk Factors

Investing in our common stock involves risks. You should carefully read and consider the “Summary Risk Factors” in this prospectus, and the section titled "Risk Factors”" in our Annual Report on Form 10-K, any subsequently filed Quarterly Reports on Form 10-Q, and all other information in this prospectus and the documents incorporated by reference herein before investing in our common stock.

Principal Executive Offices

Our principal executive offices is located at 11750 Katy Freeway, Suite 900, Houston, Texas 77079. Our telephone number is 832-456-6500 and our website address is www.stabilis-solutions.com. Information contained in, or that can be accessed through, our website does not constitute a part of this prospectus, and inclusion of our website address in this prospectus and the information incorporated by reference is intended to be an inactive textual reference only.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in the Securities Exchange Act of 1934, as amended, and accordingly may provide less public disclosure than larger public companies, including the inclusion or incorporation by reference of only two years of audited financial statements and only two years of management’s discussion and analysis of financial condition and results of operations disclosure. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

The Offering

| | | | | |

| Common Stock Offered by the Selling Stockholders: | 13,444,944 shares of our common stock, par value $0.001 per share. |

| | | | | |

| Common Stock Outstanding: | 18,192,602 shares of common stock outstanding as of April 8, 2022 |

| | | | | |

| Use of Proceeds: | We will not receive any proceeds from the sale of shares in this offering. See the section titled "Selling Stockholders" for additional information. |

| | | | | |

| Risk Factors: | See “Risk Factors” and the other information included in this prospectus and incorporated by reference for a discussion of factors you should consider carefully before deciding to invest in our common stock. |

| | | | | |

| Listing and Trading Symbol: | Our common stock is traded on The Nasdaq Stock Market, LLC under the symbol “SLNG.” |

Except as otherwise indicated, all information in this prospectus regarding the number of shares of common stock that will be outstanding immediately after this offering is based on 18,192,602 shares of common stock outstanding as of April 8, 2022 and does not include:

•465,781 shares of common stock underlying restricted stock units that were outstanding as of April 8, 2022;

•1,300,000 shares of common stock underlying options related to Mr. Ballard granted in 2021 with a strike price of $10.00 per share;

•774,505 shares of common stock underlying options related to Mr. Ballard, Mr. Puhala, Mr. Knight and other certain key members of management, granted in 2022, with a strike price of $6.00 per share;

•511,083 shares of common stock available for future issuance under the Company’s Amended and Restated 2019 Long Term Incentive Plan; and

•62,500 shares of common stock underlying warrants issued with a weighted average price of $18.08 per share which expire November 13, 2022.

SUMMARY FINANCIAL INFORMATION

The following tables summarize our financial data for our business for the years ended December 31, 2021 and 2020. The summary financial data for the years ended December 31, 2021 and 2020 are derived from Stabilis Solutions, Inc.’s audited consolidated financial statements included in our Annual Report, incorporated by reference in this prospectus. Our financial statements are prepared and presented in accordance with accounting principles generally accepted in the United States of America, or U.S. GAAP. The historical results are not necessarily indicative of the operating results to be expected in the future.

The following summary consolidated financial and other data should be read in conjunction with the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report and our consolidated financial statements and the related notes incorporated by reference in this prospectus.

| | | | | | | | | | | | | | |

| | Year Ended

December 31, |

| | 2021 | | 2020 |

| Statement of Operations Data | | | | |

| Revenues | | $ | 77,165 | | | $ | 41,550 | |

| Operating expenses: | | | | |

| Costs of revenues | | 59,481 | | | 30,011 | |

| Selling, general and administrative expenses, including gains on asset disposition and asset impairments | | 17,672 | | | 10,481 | |

| Depreciation | | 9,059 | | | 9,041 | |

| Loss from operations before equity income | | (9,047) | | | (7,983) | |

| Net equity income from foreign joint ventures | | 1,783 | | | 2,456 | |

| Loss from operations | | (7,264) | | | (5,527) | |

| Interest expense, net | | (950) | | | (916) | |

| Other income (expense) | | 1,224 | | | (57) | |

| Loss before income tax expense | | (6,990) | | -6990000 | (6,500) | |

| Income tax expense | | 808 | | | 256 | |

| Net loss | | $ | (7,798) | | | $ | (6,756) | |

| | | | | | | | | | | | | | |

| | December 31, 2021 | | December 31, 2020 |

| Balance Sheet Data | | | | |

| Cash and cash equivalents | | $ | 2,060 | | | $ | 1,814 | |

| Property, plant and equipment, net | | 54,687 | | | 52,038 | |

| Total Current Assets | | 15,533 | | | 10,813 | |

| Total Assets | | 87,336 | | | 80,313 | |

| Total Liabilities | | 26,277 | | | 18,283 | |

| Total Stockholders' Equity | | 61,059 | | | 62,030 | |

RISK FACTORS

An investment in our common stock involves a significant degree of risk. Before you invest in our common stock, you should carefully consider the following risk factors together with all of the other information incorporated by reference in this prospectus, including the risks described in our most recent Annual Report on Form 10-K, any subsequently filed Quarterly Reports on Form 10-Q, any subsequently filed Current Reports on Form 8-K and our audited consolidated financial statements and related notes and unaudited interim financial statements and related notes, which are incorporated herein by reference, and those risk factors that may be included in any applicable prospectus supplement, together with all of the other information included in this prospectus, any prospectus supplement and the documents we incorporated by reference, in evaluating an investment in our common stock. Any of these risks and uncertainties could have a material adverse effect on our business, financial condition, cash flows and results of operations. If that occurs, the trading price of our common stock could decline materially and you could lose all or part of your investment. The risks described in the Annual Report are not the only risks we face. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially and adversely affect our business, financial condition and/or operating results. Past financial and operational performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods. Please also read carefully the section above entitled “Cautionary Statement Regarding Forward-Looking Statements.”

USE OF PROCEEDS

All securities sold pursuant to this prospectus will be offered and sold by the selling stockholders. We will not receive any proceeds from the sale of common stock offered by the selling stockholders. We will bear the expenses in connection with the registration of the shares of our common stock offered hereby; all other expenses of issuance and distribution, including brokers’ or underwriters’ discounts and commissions, if any, and all transfer taxes and transfer fees relating to the sale or disposition of the common stock by the selling stockholders will be borne by the selling stockholders.

MARKET PRICE OF OUR COMMON STOCK

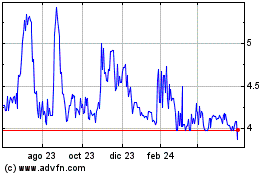

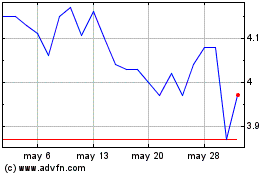

Our common stock traded under the symbol “SLNG” on the OTCQX Best Market from October 3, 2019 to April 28, 2021. On April 29, 2021 the Company’s common shares commenced trading on The Nasdaq Stock Market LLC under the same symbol “SLNG.”

The closing sale price of our common stock on April 25, 2022 was $4.79 per share. As of April 25, 2022 we had 24 holders of record of our common stock, based on information provided by our transfer agent.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Our discussion and analysis of financial condition and results of operations is incorporated by reference from Part II, Item 7 of the Company’s Annual Report on Form 10-K as filed with the SEC on March 10, 2022 (see “Incorporation of Certain Information by Reference”).

BUSINESS

The description of our business is incorporated by reference from Part I, Item 1 of the Company’s Annual Report on Form 10-K as filed with the SEC on March 10, 2022 (see “Incorporation of Certain Information by Reference”).

PROPERTIES

The description of our properties is incorporated by reference from Part I, Item 2 of the Company’s Annual Report on Form 10-K as filed with the SEC on March 10, 2022 (see “Incorporation of Certain Information by Reference”).

MANAGEMENT

Directors and Executive Officers of Stabilis Solutions, Inc.

The following table sets forth the names, ages (as of March 9, 2022) and titles of our current executive officers and directors.

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

| J. Casey Crenshaw | | 47 | | Chairman of the Board of Directors |

| Westervelt T. Ballard, Jr. | | 50 | | President, Chief Executive Officer and Director |

| Andrew L. Puhala | | 52 | | Chief Financial Officer |

| James G. Aivalis | | 63 | | Director |

| Benjamin J. Broussard | | 43 | | Director |

| Stacey B. Crenshaw | | 45 | | Director |

| Edward L. Kuntz | | 77 | | Director |

| Peter C. Mitchell | | 66 | | Director |

| Matthew W. Morris | | 50 | | Director |

J. Casey Crenshaw

Chairman of the Board of Directors

J. Casey Crenshaw, age 47, was appointed Chairman of Stabilis on July 26, 2019. Prior to the completion of the Share Exchange, he served on the Board of Directors of American Electric from 2012 to July 2019 and as the Executive Chairman of the Board of Directors of Stabilis Energy, LLC from November 2018 until July 2019. Mr. Crenshaw previously served as President of Stabilis Energy, LLC from its formation in February 2013 until November 2018. Mr. Crenshaw also serves as President and a member of the Board of Directors of The Modern Group, Ltd, a privately-owned diversified manufacturing, parts and distribution, rental/leasing and finance business headquartered in Beaumont, Texas. Mr. Crenshaw has held various executive positions with The Modern Group since 1997, including over 10 years as CFO. Mr. Crenshaw holds a BA in Finance from Texas A&M University. Mr. Crenshaw is spouse of director Stacey B. Crenshaw.

Westervelt T. Ballard, Jr.

President, Chief Executive Officer and Director

Westervelt T. Ballard, Jr., age 50, was appointed President, Chief Executive Officer and a director on August 23, 2021. Mr. Ballard served as Executive Vice President, Chief Financial Officer and Treasurer of Superior Energy Services, Inc., a highly diversified provider of rental equipment, manufactured products, and engineered and specialized services to the global energy industry from 2018 to 2021. At Superior, Mr. Ballard served in a variety of progressive roles during his 13-year career, including as an operations executive vice president from 2012 to 2018 with full responsibility over strategic and commercial direction, capital allocation, operations, safety, financial and administrative functions for a diversified portfolio of business lines operating in over 30 countries. Additionally, he served as Vice President of Corporate Development where he was responsible for sourcing, evaluating and executing acquisitions and strategic investments globally. Superior entered into Chapter 11 bankruptcy to consummate a prepackaged reorganization in December 2020 and emerged in February 2021. Mr. Ballard served in the United States Marine Corps, earning the rank of captain. He is a graduate of the University of Georgia and is a director of the Marine Corps-Law Enforcement Foundation.

Andrew L. Puhala

Chief Financial Officer

Andrew L. Puhala, age 52, has been Chief Financial Officer of Stabilis since November 2018. From August 2017 until November 2018, Mr. Puhala served as VP of Finance for The Modern Group, Ltd. From September 2015 to June 2017 he served as Chief Financial Officer of ERA Group Inc. (NYSE:ERA), a provider of helicopter transport services primarily to the energy industry. Mr. Puhala served as Chief Financial Officer of American Electric Technologies, Inc. from January 2013 to September 2015 and CFO of AccessESP from 2011- 2012. Mr. Puhala held a variety of senior financial roles at Baker Hughes, Inc. from 1996 - 2011 including VP finance- Middle East Region, Division Controller and Assistant Treasurer. Mr. Puhala is a Certified Public Accountant and received a BBA in Accounting and an MPA from the University of Texas at Austin.

James G. Aivalis

Director

James G. Aivalis, age 63, was appointed to the Board of Directors of Stabilis on July 26, 2019. From July 2019 through his retirement in January 2021, he served as Chief Operating Officer of Stabilis. He has served as a consultant to Stabilis since February 2021. Mr. Aivalis was the Chief Executive Officer, President and Director of Prometheus Energy Group from January 2013 until July 2019. He served as Managing Member of AEGIS NG, LLC from April 2016 until September 2019. From May 2006 through June 2012, Mr. Aivalis was the Chief Executive Officer and President of ThruBit, LLC, a Venture Capital funded company focused on drilling and evaluation technologies for horizontal wells and unconventional hydrocarbon reservoirs. From 2002 to 2006, Mr. Aivalis was GM/Managing Director at TenarisConnections, with global responsibilities for high performance OCTG premium connections. Mr. Aivalis served with Schlumberger from 1981 to 2002 with domestic and international roles in Management, Operations, Engineering, Project Management and Sales and Marketing. Mr. Aivalis served from October 2009 to September 2018 as a Non-Executive Director and Business Advisor with XACT Downhole Telemetry, Inc. in Calgary, Canada, and from August 2011 to December 2013 as a Business Advisor to Zinc Air Inc., developing grid scale flow batteries. Since June 2018, Mr. Aivalis has been a member of the Advisory Board at Florida Institute of Technology for the College of Engineering and Sciences. Mr. Aivalis holds a Bachelor of Science degree in Ocean Engineering from Florida Institute of Technology, has authored six patents focused on well construction and optimization technologies, and is a long-standing member of the Society of Petroleum Engineers.

Ben J. Broussard

Director

Ben J. Broussard, age 43, was appointed to the Board of Directors of Stabilis on July 26, 2019. Mr. Broussard has been the Chief Financial Officer for the Modern Group, Ltd since March 2021. Since joining the Modern Group in 2013 until March 2021 he served as the Director of Finance. Mr. Broussard began his career as a commercial banker with Washington Mutual Bank in 2001. After leaving the bank in 2008, he worked at T-Mobile until 2011 and as a consultant to Microsoft’s Global Procurement Group from 2011 to 2013. Mr. Broussard holds a BA from the University of Notre Dame and JD from South Texas College of Law Houston.

Stacey B. Crenshaw

Director

Stacey B. Crenshaw, age 45, was appointed to the Board of Directors of Stabilis on February 4, 2020. She co-founded Stabilis Energy, LLC in 2013. Prior to her role with Stabilis she was a practicing attorney with Germer Gertz, LLP from 2002 to 2004. Mrs. Crenshaw is the owner of ClaraVaille, a designer and retailer of custom jewelry. Mrs. Crenshaw is also actively involved in her local community through leadership roles at the Neches River Festival and the Symphony League of Beaumont. From 2006 to 2011 she was the founder and director of CHAD’s Place, a non-profit that held conferences and provided support groups for the bereaved. Mrs. Crenshaw has also served on several boards including Family Services of Southeast Texas, All Saints Episcopal School, and the advisory board of the Art Museum of Southeast Texas. Mrs. Crenshaw received a Bachelor of Liberal Arts degree in Journalism from Texas A&M University and a Doctor of Jurisprudence degree from the University of Houston Law Center. Mrs. Crenshaw is the spouse of Mr. Crenshaw.

Edward L. Kuntz

Director

Edward L. Kuntz, age 77, was appointed to the Board of Directors of Stabilis on July 26, 2019. He served on the Board of Directors and as Chairman of the Audit Committee of American Electric from September 2013 to July 2019. Mr. Kuntz currently serves as the Chairman of the Board of Directors of U.S Physical Therapy, Inc., a publicly held operator of physical therapy clinics and related businesses. He has been a director since 2014. Mr. Kuntz is the former Chairman and Chief Executive Officer of Kindred Healthcare, the largest diversified provider of post-acute care services in the United States. From 1998 through May 2014 he served as Chairman of the Board of Directors of Kindred and as Chief Executive Officer from 1998 to 2004. From 2000 through 2016, Mr. Kuntz served as a director of Rotech Healthcare, Inc., one of the largest providers of home medical equipment and related products and services in the United States. Mr. Kuntz received B.A., J.D. and L.L.M. degrees from Temple University.

Peter C. Mitchell

Director

Peter C. Mitchell, age 66, was appointed to the Board of Directors of Stabilis on July 26, 2019. He was most recently Senior Vice President and Chief Financial Officer of Coeur Mining, Inc. a leading precious metals producer, which owns and operates mines throughout North America, including the Palmarejo complex in Mexico, one of the world’s largest silver mines. Peter joined Coeur as CFO in 2013, and was responsible for investor relations, financial planning and analysis, financial reporting, information technology, tax and compliance, in addition to serving as a key team member on the company’s acquisition and divestiture activities and leading all capital markets activity in multiple equity and debt financings. Previously, he held executive leadership positions in finance and operations with a variety of U.S. and Canadian companies both public and private equity sponsored, among them Taseko Mines Ltd., Vatterott Education Centers, Von Hoffmann Corporation and Crown Packaging Ltd. Mr. Mitchell is a former member of the Board of Directors and Audit Committee Chair for Northern Dynasty Minerals Ltd and is currently a member of the Board of Directors and Audit Committee Chair of Northcliff Resources Ltd., Taseko Mines Limited and Montage Gold Limited. He earned a BA in Economics from Western University, an MBA from the University of British Columbia, is a Chartered Accountant (CPA-CA).

Matthew W. Morris

Director

Matthew W. Morris, age 50, was appointed to the Board of Directors of Stabilis on November 2, 2021. Mr. Morris has served as a director for Cornerstone Strategic Value Fund, Inc., and Cornerstone Total Return Fund, Inc. since November 2017, and is a member of the Audit Committee and Nominating and Corporate Governance Committee for both companies. Mr. Morris served as CEO of Stewart Information Services Corporation from 2011 to September 9, 2019 and as President from September 9, 2019 to January 2020. Prior to serving as CEO, he served in various executive management positions for Stewart Information Services Corporation, Stewart Title Company and Stewart Title Guaranty Company. Mr. Morris also served as a consultant from January 16, 2020 to June 16, 2020. He previously served as director for a strategic litigation consulting firm, offering trial, and settlement sciences, crisis management and communications strategy. He received a Bachelor of Business Administration in organizational behavior and business policy from Southern Methodist University, and a Master of Business Administration with a concentration in finance from The University of Texas.

Controlled Company Exception

We are a “controlled company” in accordance with the rules of The Nasdaq Stock Market LLC because more than 50% of the voting power for the election of directors of the Company is beneficially held by Casey Crenshaw. As a controlled company, we may elect not to comply with certain corporate governance standards, including that: (i) a majority of our board of directors consists of “independent directors,” as defined under the Nasdaq rules; (ii) a nominating and corporate governance committee is established that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and (iii) a compensation committee is established that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities. Accordingly, to the extent and for so long as we rely on these exemptions, you will not have the same protections afforded to stockholders of companies that are subject to all of these corporate governance requirements. In the event that we cease to be a “controlled company” and our common stock continues to be listed on The Nasdaq Stock Market LLC, we will be required to comply with these provisions within the applicable transition periods.

Board Committees

The Company has appointed certain non-employee Board members to the Audit Committee and the Compensation Committee. Both Committees are governed by charters adopted by the Board. The charters establish the purposes of the Committees as well as membership guidelines. They also define the authority, responsibilities and procedures of each Committee in relation to the Committee’s role in supporting the Board and assisting the Board in discharging its duties in supervising and governing the Company.

Audit Committee

The Audit Committee consist of Messrs. Peter C. Mitchell (Chair), Edward L. Kuntz and Matthew W. Morris. The Board has determined that Mr. Mitchell satisfies the definition of “audit committee financial expert.”

The Audit Committee oversees, reviews, acts on and reports on various auditing and accounting matters to the Board, including the selection of our independent registered public accounting firm, the scope of our annual audits, fees to be paid to the independent registered public accounting firm, the performance of our independent registered public accounting firm and our accounting practices. In addition, the Audit Committee oversees our compliance programs relating to legal and regulatory requirements. The Audit Committee also reviews any potential related party transactions between the Company and its executive officers and directors.

Compensation Committee

The Board of Directors established the Compensation Committee as a standing committee on September 11, 2019. The primary functions of the Compensation Committee are to review and approve the compensation of the Chief Executive Officer and the other executive officers of the Company, to recommend the compensation of the directors, to review and approve the terms of any employment agreements with executive officers and to produce an annual report for inclusion in the Company’s proxy statement. The Compensation Committee also administers and interprets the Company’s equity compensation and employee benefit plans and grants all awards under the employees stock incentive plan. The members of the Compensation Committee are currently J. Casey Crenshaw (Chairman), Peter C. Mitchell, Matthew W. Morris and Edward L. Kuntz. The Board of Directors determined that Messrs. Mitchell, Morris and Kuntz are considered independent as defined in the rules of the Nasdaq. A copy of the Compensation Committee charter is available at http://www.stabilis-solutions.com.

Compensation Committee Interlocks and Insider Participation

During 2021, our Compensation Committee members were J. Casey Crenshaw (Chairman), Peter C. Mitchell, Mushahid Khan (until resigning November 2, 2021), Matthew W. Morris (starting November 2, 2021) and Edward L. Kuntz. The Company has a number of Related Party Transactions with entities affiliated with Casey Crenshaw. Such transactions are described in Note 12 of the Audited Consolidated Financial Statements, which are incorporated by reference in this Prospectus.

Business Ethics and Conduct Policy

We have adopted a Code of Business Ethics and Conduct that is applicable to all employees, officers and members of our Board.

EXECUTIVE COMPENSATION

Overview and Objectives

We believe our success depends on the continued contributions of our named executive officers. We have established our executive compensation program to attract, motivate, and retain our key employees in order to enable us to maximize our profitability and value over the long term. Our policies are also intended to support the achievement of our strategic objectives by aligning the interests of our executive officers with those of our shareholders through operational and financial performance goals and equity-based compensation. We expect that our compensation program will continue to be focused on building long-term shareholder value by attracting, motivating and retaining talented, experienced executives and other key employees. Currently, our Principal Executive Officer oversees the compensation programs for our executive officers.

Named Executive Officers

We are currently considered a smaller reporting company within the meaning of the Securities Act, for purposes of the SEC’s executive compensation disclosure rules. In accordance with such rules, we are required to provide a Summary Compensation Table and an Outstanding Equity Awards at Fiscal Year End Table, as well as limited narrative disclosures regarding executive compensation for our last completed fiscal year. Further, our reporting obligations extend only to our “named executive officers,” who are the individuals who served as our principal executive officer during the last completed fiscal year, our next two other most highly compensated officers at the end of the last completed fiscal year and up to two additional individuals who would have been considered one of our next two most highly compensated officers except that such individuals did not serve as executive officers at the end of the last completed fiscal year.

On August 23, 2021, the Company appointed Westervelt T. Ballard, Jr. as its president and chief executive officer following the resignation of James Reddinger from those positions. Our named executive officers are:

| | | | | |

| Name | Principal Position |

| Westervelt T. Ballard, Jr. | Chief Executive Officer, President |

| Andrew L. Puhala | Chief Financial Officer |

| Koby Knight | SVP Solutions Support |

| James Reddinger | Former Chief Executive Officer, President |

Summary Compensation Table

The following table below shows the total compensation information regarding each of the named executive officers for the fiscal years ended December 31, 2021 and 2020.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | Year | | Salary

($) | | Bonus

($)(1) | | Stock Awards ($)(2) | | Option Awards ($)(3) | | Non-Equity Incentive Plan Compensation ($)(4) | | All other

compensation

($) | | Total

($) |

| Westervelt T. Ballard, Jr., | 2021 | | $ | 175,547 | | | $ | — | | | $ | 3,390,000 | | | $ | 2,879,000 | | | $ | 125,000 | | | $ | — | | | $ | 6,569,547 | |

| Chief Executive Officer (Current) | - | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| James Reddinger, | 2021 | | 333,333 | | | — | | | — | | | — | | | — | | | 666,667 | | (6) | | 1,000,000 | |

Chief Executive Officer (Former) | 2020 | | 420,835 | | | — | | | 875,000 | | | — | | | — | | | — | | | 1,295,835 | |

| Koby Knight, | 2021 | | 325,000 | | | — | | | — | | | — | | | 125,000 | | | 12,000 | | (5) | | 462,000 | |

SVP Solutions Support | 2020 | | 343,334 | | | — | | | 175,000 | | | — | | | — | | | 12,000 | | (5) | | 530,334 | |

| Andrew Puhala, | 2021 | | 315,000 | | | — | | | — | | | — | | | 103,150 | | | — | | | 418,150 | |

| Chief Financial Officer | 2020 | | 262,501 | | | — | | | 35,000 | | | — | | | — | | | — | | | 297,501 | |

(1) No bonus was earned for the fiscal years 2021 and 2020.

(2) The amount represents the full aggregate grant date fair value of restricted stock units granted during the fiscal years 2021 and 2020, computed in accordance with FASB ASC 718. Restricted stock units are valued at market price of the Company's common stock at the closing price at the date of grant. These amounts do not represent the actual value that may be realized by named executive officers.

(3) The Company granted Mr. Ballard 1,300,000 options (see "Employment Arrangements for Mr. Ballard" below). Amount represents the full aggregate grant date fair value in accordance with ASC 718. See Note 14 of the Notes to Consolidated Financial Statements for further discussion of stock options granted to Mr. Ballard.

(4) Pursuant to his Annual Incentive Plan, Mr. Ballard earned the maximum performance award of $125,000 for 2021 performance. Mr. Knight and Mr. Puhala earned performance awards of $125,000 and $103,150, respectively, for 2021 performance. No performance awards were earned for the fiscal 2020 year.

(5) The amount represents an annual auto allowance paid out on a monthly basis.

(6) The amount for James Reddinger represents severance pursuant to the "Separation Agreement" (see below "Separation Arrangements for Mr. Reddinger.")

During the year ended December 31, 2021, the Company granted Mr. Ballard Restricted Stock Units (RSUs) of 500,000. During the year ended December 31, 2020, Mr. Reddinger, Mr. Knight, and Mr. Puhala received RSUs of 500,000, 100,000, and 20,000, respectively. These RSUs are valued at market price of the Company's common stock closing price at the date of grant. Each RSU converts into one share of common stock on vesting.

Outstanding Equity Awards

The following table below provides information regarding outstanding stock and option awards held by the named executive officers as of December 31, 2021:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Option Awards | | Stock Awards |

| Name | | | | | | Number of shares or units of stock Underlying Unexercised Options (#) Exercisable | | Number of shares or units of stock Underlying Unexercised Options (#) Unexercisable | | Equity incentive plan awards: Number of securities Underlying Unexercised Unearned Options (#) | | Option Exercise Price ($) | | Option Expiration Date | | Equity incentive plan awards: Number of unearned shares or units of stock that have not vested (#) | | Market value of unearned shares or units of stock that have not vested ($) (1) |

| Westervelt T. Ballard, Jr. | | | | | | 1,300,000 | | | — | | | $ | — | | | $ | 10.00 | | | 8/23/2031 | | 250,000 | | | $ | 1,695,000 | |

| Koby Knight | | | | | | — | | | — | | | — | | | — | | | — | | | 66,667 | | | 116,667 | |

| Andrew Puhala | | | | | | — | | | — | | | — | | | — | | | — | | | 13,333 | | | 23,333 | |

| James Reddinger | | | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

(1) The amount represents the grant date fair value of restricted stock units granted. Restricted stock units are valued at market price of the Company's common stock at the closing price at the date of grant. These amounts do not represent the actual value that may be realized by named executive officers

During the year ended December 31, 2021, the Company granted Mr. Ballard restricted stock units of 500,000 and stock options of 1,300,000 (see below "Employment Arrangements for Mr. Ballard"). In 2020 Mr. Reddinger, Mr. Knight, and Mr. Puhala received restricted stock units of 500,000, 100,000, and 20,000, respectively. Mr. Reddinger's units vested immediately upon his resignation in August 2021 (see below "Separation Arrangements for Mr. Reddinger"). Mr. Knight and Mr. Puhala's units vest in one-third increments each year following the grant date of the award, subject to the terms and conditions of the award agreement. Each RSU converts into one share of common stock on vesting.

Additional Narrative Disclosures

Elements of Compensation

Historically, we have compensated our named executive officers with annual base salaries, annual cash incentive bonuses and employee benefits. Additionally, our named executive officers may be awarded long-term equity incentives in the form of restricted stock awards and stock options. We expect that these elements will continue to constitute the primary elements of our compensation program, although the relative proportions of each element, and the specific plan and award designs, will likely evolve as we become a more established public company.

Employment, Severance or Change in Control Agreements

Arrangements for James Aivalis

James G. Aivalis retired as our Chief Operating Officer on January 31, 2021 at which time his compensation for his executive services terminated and his post-retirement services as an independent consultant commenced pursuant to the terms of his executive employment agreement for the period from February 1, 2021 through January 31, 2022. On October 25, 2021 the Company entered into a consulting agreement (the “Consulting Agreement”) with Mr. Aivalis and Enatek Services, LLC (“Enatek”), an executive services provider, under which Enatek will provide the services of Mr. Aivalis as a consultant and advisor to the Company from February 1, 2022 to January 31, 2023 for the consideration of $12,500 per month plus certain health insurance benefits. Mr. Aivalis’ services to the Company under the Consulting Agreement will include serving as a non-independent member of the Company’s Board of Directors for no additional compensation if he remains on the board.

Prior to his retirement on January 31, 2021, the Company entered into an employment agreement with Mr. Aivalis covering the period from January 1, 2020 through January 31, 2021. Under the terms and conditions of the agreement, Mr. Aivalis received an annualized base salary of $325,000 and an annual bonus for 2019 service equal to $260,000 which was paid in 2020.

Employment Arrangements for Mr. Ballard

The Company has entered into an Employment Agreement with Mr. Ballard effective as of August 23, 2021 (the “Employment Agreement”) pursuant to which it agreed for a term of three years (unless terminated earlier pursuant to the terms of the Employment Agreement), subject to successive one-year extensions, to employ Mr. Ballard as its President and Chief Executive Officer. The Company agreed to cause Mr. Ballard to be elected to the Board and thereafter to cause him to be nominated as a director and recommend his election to stockholders on an annual basis during the term of his employment.

In consideration of his services, the Company has agreed to pay Mr. Ballard an annualized base salary of not less than $500,000. Mr. Ballard will be entitled to participate in the Company’s Annual Bonus Plan, with a target bonus based on performance to be determined by the Compensation Committee of the Board of Directors and to initially range from 50% of Mr. Ballard’s base salary for “threshold” performance, to 100% of his base salary for “target” performance, and 150% of his base salary for “maximum” performance. Notwithstanding the foregoing, Mr. Ballard’s bonus target for calendar year 2021 was prorated in the amount of $125,000. Additionally, the Company granted Mr. Ballard 500,000 restricted stock units (“RSUs”) under the Company’s 2019 Long Term Incentive Plan, subject to Board approval, of which (i) 250,000 RSUs vested on August 23, 2021, (ii) 125,000 RSUs will vest on August 23, 2022, and (iii) 125,000 RSUs will vest on August 23, 2023, conditioned on Mr. Ballard remaining continuously employed through each vesting date. The Company also agreed to grant Mr. Ballard 1,300,000 options to purchase the Company’s common stock under the 2019 Long Term Incentive Plan, subject to Board approval with a strike price equal to $10.00 per share, which will vest (i) 442,000 options on August 23, 2022, (ii) 429,000 options on August 23, 2023, and (iii) 429,000 options on August 23, 2024, conditioned on Mr. Ballard remaining continuously employed through each vesting date. Mr. Ballard shall not be permitted to exercise any of the options while he is employed by the Company on or before the expiration of his term of employment, unless (Y) in connection with a sale of an equal number of more of shares of stock by the Company’s Chairman of the Board, or (Z) the Company’s stock has traded at $20.00 or more per share for at least 120 consecutive days. Mr. Ballard will also be eligible to participate in all of the Company’s discretionary short-term and long-term incentive compensation plans and programs and other employee benefit plans which are generally made available to other similarly situated senior executives of the Company.

Upon a termination of the Employment Agreement by the Company without Cause (as defined in the Employment Agreement) or by Mr. Ballard resigning his employment for Good Reason (as defined in the Employment Agreement), the Company will cause the RSUs and options described above to become fully vested and will pay Mr. Ballard an amount equal to the base salary and target bonus (at “Target” performance) that he would have received during the period between the date the Employment Agreement is terminated and its expiration or renewal date, as applicable, or for 12 months following the date of termination of the Employment Agreement, whichever is greater. Additionally, the Company will pay a pro rata portion of the target bonus that would have been payable to Mr. Ballard for the year of termination, if his employment had not terminated, and will reimburse him for up to 18 months of certain COBRA payments if he timely elects to continue coverage under COBRA. If the Employment Agreement is terminated by the Company for Cause or by Mr. Ballard without Good Reason on or before 24 months from the effective date of the Employment Agreement, Mr. Ballard will forfeit or repay, as applicable, the shares of common stock he received with respect to the 250,000 RSUs that vested on the effective date of the Employment Agreement, with such forfeiture or repayment, as applicable, being net of any withholding obligations.

He will also forfeit any unvested part of the RSUs and options described if the Employment Agreement is terminated by the Company for Cause or by Mr. Ballard without Good Reason.

Upon a Change-in-Control (as defined in the Employment Agreement) of the Company, the RSUs and options described above would become fully vested, subject to Mr. Ballard’s continued employment through the effective date of the Change-in-Control.

Separation Arrangements for Mr. Reddinger

On August 22, 2021, the Company entered into a Separation and Release Agreement with Mr. Reddinger (the “Separation Agreement”) pursuant to which Mr. Reddinger voluntarily resigned from his employment with the Company and as a member of the Company’s Board of Directors, effective August 22, 2021. Under the Separation Agreement, the Company agreed to pay an amount equal to Mr. Reddinger’s base salary of $500,000 per year that he would have received between the date of his separation of employment and December 31, 2022. Additionally, the Company agreed that Mr. Reddinger’s 500,000 RSUs granted under the 2019 Long Term Incentive Plan fully vested as of the date of his separation of employment; provided that Mr. Reddinger agreed to lock-up restrictions on the sale of the shares of common stock issued upon vesting of the RSUs through December 31, 2022. In accordance with the 2019 Long Term Incentive Plan, the RSUs will be settled upon the earlier of (i) Mr. Reddinger’s death or (ii)

the date that is six months after his separation from service. Under the Separation Agreement, Mr. Reddinger provided a customary general release to the Company and also agreed to certain confidentiality, non-disclosure, non-competition, non-solicitation, non-disparagement, and cooperation covenants in favor of the Company.

Base Salary

Base salary is the fixed annual compensation we pay to each of our named executive officers for carrying out their specific job responsibilities. Base salaries are a major component of the total annual cash compensation paid to our named executive officers. Base salaries are determined after taking into account many factors, including (a) the responsibilities of the officer, the level of experience and expertise required for the position and the strategic impact of the position; (b) the need to recognize each officer’s unique value and demonstrated individual contribution, as well as future contributions; (c) the performance of the company and each officer; and (d) salaries paid for comparable positions in similarly-situated companies.

For the amounts of base salary that our named executive officers received in 2021 and 2020, see “Executive Compensation-Summary Compensation Table.” set forth above.

Our Board reviews the base salaries for each named executive officer periodically as well as at the time of any promotion or significant change in job responsibilities and, in connection with each review, our Board considers individual and company performance over the course of the relevant time period. The Board may make adjustments to base salaries for named executive officers upon consideration of any factors that it deems relevant, including but not limited to: (a) any increase or decrease in the named executive officer’s responsibilities, (b) the named executive officer’s job performance, and (c) the level of compensation paid to senior executives of other companies with whom we compete for executive talent, as estimated based on publicly available information and the experience of our directors.

Annual Cash Bonuses and Annual Non-equity Incentive Plan Compensation

For the year ended December 31, 2021, Mr. Ballard earned non-equity incentive plan compensation of $125,000. Mr. Knight and Mr. Puhala earned non-equity incentive plan compensation of $125,000 and 103,150, respectively. No amounts were earned as non-equity incentive plan compensation for the year ended December 31, 2020.

Other Benefits

We offer participation in broad-based retirement, health and welfare plans to all of our employees.

Pension Benefits

We have not maintained and do not currently maintain a defined benefit pension plan or a supplemental executive retirement plan. Instead, our employees, including our named executive officers, may participate in a retirement plan intended to provide benefits under section 401(k) of the Internal Revenue Code of 1986 (the “401(k) Plan”) pursuant to which employees are allowed to contribute a portion of their base compensation to a tax-qualified retirement account in a defined safe harbor 401(k) Plan, subject to limitations.

Non-Qualified Defined Contribution and Other Non-Qualified Deferred Compensation Plans

We have not had and do not currently have any defined contribution or other plan that provides for the deferral of compensation on a basis that is not tax-qualified.

Description of the Amended and Restated 2019 Long Term Incentive Plan

The following is a description of the material features of the Amended and Restated 2019 Long Term Incentive Plan (as amended to date, the “Plan”).

The Company has a long-term incentive plan which was approved by the Board of Directors on December 9, 2019 (the “2019 Plan”). In July 2021, the Company's Board of Directors approved the Amended and Restated 2019 Long Term Incentive Plan (the “Amended and Restated Plan”), which was subsequently approved by the Company's shareholders on September 14, 2021. Under the Amended and Restated Plan, the maximum number of shares of common stock available for issuance was increased from 1,675,000 shares to 4,000,000 shares.

Eligibility

Awards under the Amended and Restated Plan may be granted to employees, officers and directors of the Company and affiliates and any other person who provides services to the Company and its affiliates. (including independent contractors and consultants of the Company and its subsidiaries).

Shares Subject to the Plan

Prior to the amendment and restatement of the Plan, up to 1,675,000 shares of the Company’s common stock were authorized for issuance under the Plan. After approval at the 2021 Annual Meeting of the stockholders of the Company, on September 14, 2021, an additional 2,325,000 shares were authorized for issuance under the Plan, for a total of 4,000,000 shares, pursuant to awards under the amended and restated Plan. In the event of certain changes in the Company’s common stock such as recapitalization, reclassification, stock split, combination or exchange of shares, stock dividends or the like, appropriate adjustment will be made in the number and kind of shares available for issuance under the Plan and the purchase price, if any, per share.

Administration

The Plan is administered by the Compensation Committee (the “Committee”) of the Board except to the extent that the Board elects to administer the Plan. The Committee has the full and exclusive power to construe, interpret and administer the Plan, including, but not limited to, the authority to designate which eligible participants are to be granted awards and to determine the type of award and the number of shares to be subject thereto and approve forms of award agreements for use under the Plan and the terms and conditions thereof, consistent with the terms of the Plan, including under what circumstances awards may be vested, settled, exercised, cancelled or forfeited. The Committee is also authorized to adopt, amend and revoke rules relating to the administration of the Plan, modify, waive or adjust any term or condition, and determine treatment of awards upon termination of employment or other service relationship and impose a holding period with respect to an award.

Awards Under the Plan

The Plan provides that the Committee may grant or issue stock options, stock appreciation rights, restricted stock, restricted stock units, performance awards, dividend equivalents, substitute awards and other stock-based awards and cash awards and/or any combination of the foregoing, pursuant to a written agreement and may contain such terms as the Committee determines. Subject to the provisions of the Plan, the Committee has the sole and complete authority to determine the eligible recipients of awards under the Plan. All awards shall be subject to such terms, conditions and restrictions determined by the Committee and included in the award agreement. Such terms, conditions and restrictions may include provisions related to vesting of awards, and the effect of a participant’s termination of employment and change of control of the Company on outstanding awards under the Plan. No participant may receive a grant covering more than 2,000,000 shares of our common stock in any year and a non-employee member of the Board may not be granted more than 100,000 shares in any year.

The Plan and all awards granted thereunder are subject to any written clawback policies that the Company may adopt.

Share Counting Rules

When the Committee grants an award under the Plan, the full number of shares subject to the award is charged against the number of shares that remain available for delivery pursuant to awards. After grant, the number of shares subject to any portion of an award that is canceled or that expires without having been settled in shares, or that is settled through the delivery of consideration other than shares, will be available for new awards. If shares are tendered or withheld to pay the exercise price of an award or to satisfy a tax withholding obligation, those tendered or withheld shares will be available for new awards.

Stock Options

Stock options provide for the right to purchase shares of Company common stock at a specified price as determined by the Committee, provided that the exercise price per share of common stock option may not be less than 100% of the fair market value of a share as of the date the option is granted. Stock options granted under the Plan may be incentive stock options (“ISOs”) that are designed to comply with the provisions of Section 422 of the Internal Revenue Code (the “Code”) and will be subject to restrictions contained in the Code or nonqualified stock options (“NQSOs”). The maximum number of shares of Company common stock that may be issued upon the exercise of ISOs may not exceed the total number of shares available for grant under