Report of Foreign Issuer (6-k)

21 Mayo 2020 - 3:51PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER

PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES

EXCHANGE ACT OF 1934

For the month of May, 2020

Commission File Number: 001-39042

Akazoo

S.A.

(Translation of registrant’s

name into English)

19 Rue de Bitbourg

1273 Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form

40-F ¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

This

report on Form 6-K shall be deemed to be incorporated by reference into the registration statements on Form F-3 (Registration Nos.

333-237385 and 333-233811) filed by Akazoo S.A. (the “Company”) (including any prospectuses forming a part of such

registration statements) and to be a part thereof from the date on which this report is filed, to the extent not superseded by

documents or reports subsequently filed or furnished.

Special Committee Update; Results of Investigation

On May 21, 2020, the Board of Directors (the “Board”)

of Akazoo S.A. (the Company”) announced the results of the previously announced investigation into the circumstances relating

to the Company’s revenue sources and contractual arrangements with business partners, including the information contained

in a report released by Quintessential Capital Management on April 20, 2020 (the “Investigation”). The Investigation

was conducted by a special committee of independent directors (the “Special Committee”) formed by the Board on April

22, 2020. The Special Committee, with the assistance of outside counsel and advisors, has substantially completed the Investigation

and determined that former members of Akazoo’s management team and associates defrauded Akazoo’s investors, including

the predecessor SPAC acquiring entity Modern Media Acquisition Corp. (“MMAC”), by materially misrepresenting Akazoo’s

business, operations, and financial results as part of a multi-year fraud.

The Board previously announced on May 1, 2020 that, at the recommendation

of the Special Committee, the Board had terminated Apostolos N. Zervos as Chief Executive Officer of the Company for cause, requested

that Mr. Zervos resign as a member of the Board and appointed Michael Knott as interim Chief Executive Officer. At that time, the

Board announced that certain consolidated financial statements of the Company and Akazoo Limited filed or furnished with the U.S.

Securities and Exchange Commission should no longer be relied upon due to the possibility that such financial statements contain

material errors. Subsequently, the Special Committee has determined, among other things, that Akazoo’s historical financial

statements were materially false and misleading, that Akazoo has had only negligible actual revenue and subscribers for years and

that former members of Akazoo management and associates participated in a sophisticated scheme to falsify Akazoo’s books

and records, including due diligence materials provided to MMAC and its legal, financial, and other advisors in connection with

the Akazoo business combination in 2019.

The Company intends to take all available steps to maximize

recovery for defrauded investors, including by seeking to unwind the original business combination between MMAC and Akazoo. The

Special Committee has also directed its advisors to make referrals to, and cooperate with, appropriate regulators.

Notice of Anticipated Delisting

On May 15, 2020, the Company received a letter

for The Nasdaq Stock Market LLC (“Nasdaq”), which states that the Nasdaq Listing Qualifications staff (the “Nasdaq

Staff”) has determined to delist the Company’s securities pursuant to its discretionary authority under Listing Rule

5101. In its determination, the Nasdaq Staff cited the Company’s disclosure regarding circumstances related to the termination

of the Company’s former CEO and the related investigation by the special committee of independent directors, as well the

announcement that the Company’s publicly filed financial statements can no longer be relied upon. The Nasdaq Staff also advised

the Company that its failure to timely file it Form 20-F, as required by listing Rule 5250(c), serves as an additional basis for

delisting.

The Company intends to consent to the Nasdaq

Staff’s decision to delist the Company’s securities. The deadline for the Company to request an appeal is May 22,

2020. The Company does not intend to appeal the decision, and as a

result, the Company’s securities will be suspended from trading on Nasdaq at the opening of business on May 27, 2020.

EXHIBIT INDEX

|

|

Exhibit No.

|

Description of Exhibit

|

|

|

99.1

|

Release, dated May 21, 2020 entitled “Akazoo Special Committee

Determines Former Akazoo Management and Associates Participated in Sophisticated Multi-Year Fraud”

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Akazoo S.A.

|

|

|

|

|

Date: May 21, 2020

|

By:

|

/s/ Lewis W. Dickey, Jr.

|

|

|

Name:

|

Lewis W. Dickey, Jr.

|

|

|

Title:

|

Chairman of the Board of Directors

|

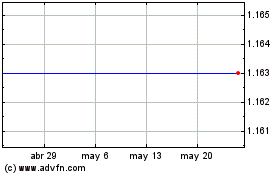

Akazoo (NASDAQ:SONG)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Akazoo (NASDAQ:SONG)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024