UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO-C

(Rule 14d-100)

TENDER OFFER STATEMENT UNDER SECTION 14(D)(1)

OR (13)(E)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

MILLICOM INTERNATIONAL CELLULAR S.A.

(Name of Subject Company (Issuer))

Atlas Luxco S.à r.l.

a wholly owned subsidiary of

Atlas Investissement

(Names of Filing Persons (Offerors))

Common Shares, par value $1.50 per share

(Title of Class of Securities)

L6388F110

(CUSIP Number of Class of Securities)

Anthony Maarek

Directeur Général

Atlas Investissement

16 rue de la Ville l’Evêque 75008 Paris, France

Telephone: +33.1.42.66.99.19

(Name, Address, and Telephone Numbers of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

Copies to:

Denis Klimentchenko

Skadden, Arps, Slate, Meagher & Flom (UK) LLP

22 Bishopsgate

London, EC2N 4BQ

Telephone: +44(0)20 7519 7289

CALCULATION OF FILING FEE

| Transaction Valuation |

Amount of Filing Fee* |

| Not applicable |

Not applicable |

| * | Pursuant to General Instruction D to Schedule TO, a filing fee is not required in connection with this

filing because it relates solely to preliminary communications made before the commencement of a tender offer. |

| ¨ | Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing

with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule

and the date of its filing. |

| Amount Previously Paid: N/A |

Filing Party: N/A |

| Form of Registration No.: N/A |

Date Filed: N/A |

| x | Check the box if the filing relates solely to preliminary communications made before the commencement

of a tender offer. |

Check the appropriate

boxes below to designate any transactions to which the statement relates:

| x | Third-party tender offer subject to Rule 14d-1. |

| ¨ | Issuer tender offer subject to Rule 13e-4. |

| x | Going-private transaction subject to Rule 13e-3. |

| ¨ | Amendment to Schedule 13D under Rule 13d-2. |

Check the following

box if the filing is a final amendment reporting the results of the tender offer: ☐

If applicable,

check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| ¨ | Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ¨ | Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

This Tender Offer Statement on Schedule TO-C relates solely to preliminary

communications made before the commencement of a potential tender offer by Atlas Luxco S.à r.l., a Luxembourg limited liability

company (société à responsibilité limitée) (“Purchaser”), a wholly owned subsidiary

of Atlas Investissement, a French société par actions simplifiée (“Parent”), to purchase all of

the outstanding common shares, nominal value $1.50 per share (each, a “Common Share,” and collectively, the “Common

Shares”), including Swedish Depositary Receipts representing Common Shares (each Swedish Depositary Receipt represents one Common

Share) (each, an “SDR,” and collectively, the “SDRs,” and together with the Common Shares, the “Shares”)

of Millicom International Cellular SA, a public limited liability company (société anonyme) organized and established

under the laws of the Grand Duchy of Luxembourg (“Millicom” or the “Company”) payable, as applicable, net to the

seller in cash, without interest, less any withholding taxes that may be applicable.

Additional Information and Where to Find It

The potential tender offer described herein has not yet

commenced. This document is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to

sell any Shares of Millicom or any other securities. On the commencement date of the potential tender offer, if such potential

offer proceeds, a tender offer statement on Schedule TO, including an offer to purchase, a letter of transmittal and related

documents, will be filed with the U.S. Securities and Exchange Commission (the “SEC”) by Parent and one or more of its

subsidiaries and a solicitation/recommendation statement on Schedule 14D-9 will be filed with the SEC by Millicom. The potential

offer to purchase all of the issued and outstanding Shares of the Company will only be made pursuant to the offer to purchase, the

letter of transmittal and related documents filed as a part of the tender offer statement on Schedule TO. THE TENDER OFFER MATERIALS

(INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE

SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 WILL CONTAIN IMPORTANT INFORMATION. INVESTORS AND SHAREHOLDERS OF MILLICOM

ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT SUCH

HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES IN THE POTENTIAL TENDER OFFER. Investors and security holders may obtain a

free copy of these statements (when available) and other documents filed with the SEC at the website maintained by the SEC at

www.sec.gov, or by directing such requests to the Information Agent for the tender offer that will be named in the tender offer

statement on Schedule TO.

Forward-Looking Statements

This document and the materials attached hereto contain

forward-looking statements related to the potential transaction between Parent and Company. Words such as “anticipate,”

“believe,” “estimate,” “expect,” “forecast,” “intend,”

“may,” “plan,” “project,” “predict,” “should,” “would” and

“will” and variations of such words and similar expressions are intended to identify such forward-looking statements.

Such statements are based on Parent’s expectations as of the date they were first made and involve risks and uncertainties

that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Such

risks and uncertainties include, among others, the possibility that the potential tender offer will not occur as planned or at the

expected offer price, for instance if the expected financing is not available for any reason, or if one or more of the various

conditions to the potential tender offer is not satisfied or waived, and other risks and uncertainties regarding the

potential tender offer that will be discussed in the Schedule TO and Schedule 13E-3 to be filed with the SEC. A number of factors

could cause actual results to differ materially from those contained in any forward-looking statement. All information provided in

this document is as of the date of this document, and Parent does not undertake any obligation to update any forward-looking

statement, except as required under applicable law. SEC filings for Parent are also available on Parent’s Investor Relations

website at w https://www.atlas-investissement.com/en, and SEC filings for the Company are available in the Investor Relations

section of its website at https://www.millicom.com/investors/.

EXHIBIT INDEX

Exhibit 99.1

Press Release

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION

IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION.

THIS IS NOT A PUBLIC OFFER TO THE HOLDERS OF

SWEDISH DEPOSITORY RECEIPTS OR SHARES IN MILLICOM.

Atlas Investissement statement regarding media

reports

23 May 2024, Paris // In light of media

reports, Atlas Investissement (“Atlas”) announces that it is exploring a potential all cash tender offer for Millicom securities.

In connection with such preliminary efforts, Atlas is exploring financing options to support an offer price of 24.0 USD per common share,

and its SEK equivalent per SDR.

Given the preliminary nature of these efforts,

Atlas cannot guarantee that an offer will materialize.

| Media enquiries |

Atlas Investissement |

| Cornelia Schnepf, FinElk |

contact@atlas-investissement.com |

| Cornelia.Schnepf@finelk.eu |

www.atlas-investissement.com |

+44 7387 108 998

Louise Tingström, FinElk

Louise.tingstrom@finelk.eu

+44 7899 066995

About Atlas Investissement

Atlas Investissement is a wholly-owned subsidiary

of NJJ Holding, an investment vehicle indirectly held by Xavier Niel, a recognised entrepreneur and major long-term investor in the telecoms

sector across several European and African markets. Xavier Niel has investments in the telecoms sector in nine countries in Europe with

nearly 50 million active subscribers combined and more than 10 billion euros of revenues.

Atlas Investissement is independent of iliad

Group and iliad Holding.

Exhibit 99.2

To the Board of Directors of Millicom International Cellular

S.A.

Attention:

Mauricio Ramos

Chairman of the Board of Directors

May 23rd, 2024

STRICTLY PRIVATE & CONFIDENTIAL INSIDE INFORMATION

Dear Mauricio, Dear Directors,

Atlas Investissement or an affiliate

thereof (“Atlas” or “we”) has been working on a potential all-cash acquisition of all the shares

that we do not currently own in Millicom International Cellular S.A. (“Millicom” or the “Company”).

As part of our preparatory work, we have held discussions with financing banks.

In that context, we wanted to clarify

our position vis-à-vis the Company, and we are pleased to submit this letter as a non-binding indication of interest in exploring

such all-cash offer.

We believe that an offer from Atlas

would offer (i) compelling value, (ii) high transaction certainty and (iii) a unique liquidity opportunity to Millicom investors, and

would therefore be in the best interest of the Company and all its investors.

We have begun exploratory discussions

with potential lenders to support a price of 24.0 USD per common share, and the SEK equivalent per SDR (the “Offer Price”).

We are confident that we can progress these conversations to a successful outcome in the coming weeks.

We believe the potential Offer Price

would be highly attractive to the shareholders of the Company, including by reference to the Company’s historical and target share

prices.

| · | Attractive relative

to historical trading prices: The potential Offer Price would represent a 19% premium to Millicom’s volume-weighted average

price for the previous 3 months; a 27% premium over its volume-weighted average price for the previous 6 months, and 38% premium to Millicom’s

volume-weighted average price for the previous 12 months. |

| · | Higher than median

of brokers’ target prices: Time-adjusted target prices from brokers are between $15.6 and $25.9, with a median at $23.9 (11

brokers published since Millicom’s Q1 results) |

Our contemplated offer would provide

all Millicom shareholders with a full cash exit option, in an environment where liquidity has been relatively weak for holders of SDRs

and Common Shares:

| · | Since our entry as

main shareholder, the liquidity has reduced significantly from c.0.5% of the shares outstanding (1-month average daily trading volume)

to c.0.2% today. This potential offer would represent a unique liquidity event for investors |

| · | Many investors have been

shareholders for many years without having had opportunities to monetize their investment at an attractive price |

We anticipate that the Company’s board of

directors would form an independent committee in connection with a potential offer and we look forward to presenting our proposal to the

committee in short order, including the reasons for our conviction that the proposed price would be attractive to all shareholders based

on the performance of the stock price during the relevant periods.

We would also like to share with you the additional

information that we will require from the Company in order to proceed with a potential offer, which remains subject to a number of conditions

at this stage.

For legal reasons, we need to stress that this

letter is not intended to be, nor in any way constitutes, an offer to purchase securities of the Company or any of its affiliates, nor

should it be construed as a binding offer or agreement in any respect. We reserve the right to amend the foregoing in all respects and

terminate any discussions with respect to a potential transaction at any time and for any (or no) reason, in our sole discretion. Atlas,

its affiliates, and their respective directors, officers, employees and advisors shall have no liability whatsoever to Millicom or anyone

else in relation to this letter.

Please also note that we intend for this letter

(including its existence and content) to remain confidential, subject to applicable laws and regulations.

We look forward to hearing from you in the coming

days and to have the opportunity to present our plan and proposal further in person.

Yours sincerely,

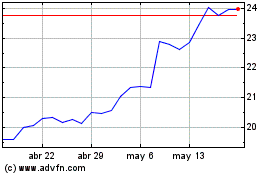

Millicom International C... (NASDAQ:TIGO)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Millicom International C... (NASDAQ:TIGO)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024