false

--03-31

0001857086

0001857086

2024-02-06

2024-02-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 6, 2024 (January 31, 2024)

TruGolf

Holdings, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40970 |

|

85-3269086 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

| 60

North 1400 West Centerville, Utah |

|

84014 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (917) 289-2776

Deep

Medicine Acquisition Corp.

595

Madison Avenue, 12th Floor

New

York, NY 10017

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value per share |

|

TRUG |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

INTRODUCTORY

NOTE

Unless

otherwise stated or unless the context otherwise requires, the terms “we,” “us,” “our,” “New

TruGolf,” and the “Company” refer to TruGolf Holdings Inc., a Nevada corporation (f/k/a Deep Medicine Acquisition Corp.,

a Delaware corporation), after giving effect to the Business Combination (as defined below), and where appropriate, its wholly-owned

subsidiaries following the Closing. Any references to “TruGolf” mean TruGolf prior to the consummation of the Merger and

means New TruGolf after the consummation of the Merger. Furthermore, unless otherwise stated or unless the context otherwise requires,

references to “DMAQ” or “Deep Medicine” refer to Deep Medicine Acquisition Corp., a Delaware corporation, prior

to the Closing. All references herein to the “Board” refer to the board of directors of the Company.

Terms

used in this Current Report on Form 8-K (this “Current Report”) but not defined herein, or for which definitions are not

otherwise incorporated by reference herein, shall have the meaning given to such terms in the joint proxy statement/prospectus of DMAQ

dated December 29, 2023 and filed with the U.S. Securities and Exchange Commission (the “SEC”) on January 1, 2024 (the “Proxy

Statement/Prospectus”), and such definitions are incorporated herein by reference.

This

Current Report incorporates by reference certain information from reports and other documents that were previously filed with the SEC,

including certain information from the Proxy Statement/Prospectus. To the extent there is a conflict between the information contained

in this Current Report and the information contained in such prior reports and documents and incorporated by reference herein, the information

in this Current Report controls.

As

previously disclosed, on January 26, 2024, DMAQ held the Special Meeting, at which the DMAQ stockholders considered and adopted, among

other matters, a proposal to approve the Business Combination. On January 31, 2024 (the “Closing Date”) the parties completed

the Business Combination. In connection with the Business Combination, DMAQ changed its name from Deep Medicine Acquisition Corp. to

TruGolf Holdings, Inc.

In

connection with DMAQ’s initial public offering on October 29, 2021 (the “IPO”), 12,650,000 units, with each unit

consisting of one Deep Medicine Class A Share and one right to receive one-tenth of one share of Deep Medicine Class A Common Stock

upon the consummation of Deep Medicine’s initial business combination were issued. As disclosed in the Current Report on Form

8-K filed on January 25, 2024, at the stockholders’ meeting held on January 19, 2024, in connection with the approval of the

Business Combination, holders of 378,744 Class A Shares properly exercised their right to have such shares redeemed for a full pro

rata portion of the trust account holding the proceeds from the IPO, calculated as of two business days prior to the completion of

the Business Combination, which was approximately $11.50 per share resulting in the removal of $4,355,556 from the trust account. As

disclosed in the Company’s Current Report on Form 8-K filed on February 1, 2024, in connection with the January 26, 2024,

meeting to amend certain provisions of its corporate documents allowing the Company to extend its existence, an additional 943

shares were redeemed resulting in the removal of an additional $10,845 from the trust account.

As

a result of the Business Combination, Deep Medicine no longer has any units traded on Nasdaq following the consummation of the Business

Combination and such units automatically separated into their component securities without any action needed to be taken on the part

of the holders. Deep Medicine’s stockholders who did not elect to have their Deep Medicine Class A Shares redeemed delivered their

Deep Medicine Class A Shares to Deep Medicine or to Deep Medicine’s transfer agent and they will remain outstanding.

At

the Effective Time (as defined in the Merger Agreement), (i) each share of TruGolf Class A Common Stock outstanding as of immediately

prior to the Effective Time will be converted into a right to receive a number of Deep Medicine Class A Shares and (ii) each share of

TruGolf Class B Common Stock outstanding as of immediately prior to the Effective Time will be converted into a right to receive a number

of Deep Medicine Class B Shares, equal to such shares respective pro rata share of the Merger Consideration, determined on the basis

of a conversion ratio (the “Conversion Ratio”) derived from an implied equity value for TruGolf equal to $80,000,000, subject

to adjustments for TruGolf’s closing debt, net of cash and unpaid transaction expenses (the “Merger Consideration”),

and (iii) each outstanding option to acquire shares of TruGolf common stock (whether vested or unvested) will be assumed by Deep Medicine

and automatically converted into an option to acquire shares of Deep Medicine common stock, with its price and number of shares equitably

adjusted based on the Conversion Ratio. The aggregate number of Deep Medicine Common Stock issued to the TruGolf Stockholders is equal

to the Merger Consideration divided by the Purchaser Share Price of $10 per share. The Merger Consideration to be paid to TruGolf Stockholders

will be paid solely by the delivery of new shares of Deep Medicine Common Stock, with each valued at the price per share at which each

share of Deep Medicine Common Stock is redeemed or converted pursuant to the Redemption. The Merger Consideration will be subject to

a post-Closing true-up 90 days after the Closing. The Merger Consideration will be allocated among TruGolf Stockholders, pro rata amongst

them based on the number of shares of TruGolf common stock owned by such stockholder. Such consideration otherwise payable to TruGolf

stockholders is subject to reduction for purchase price adjustments. As of the date of the Proxy Statement/Prospectus, the Conversion

Ratio was approximately 0.001548 based on TruGolf’s 12,381 shares issued and outstanding and 8,000,000 shares of New TruGolf Common

Stock that TruGolf stockholders receive at the Closing of the Business Combination. Upon the Closing, each Deep Medicine Right will convert

into one-tenth (1/10) of one Deep Medicine Class A Share. No fractional shares will be issued upon conversion of the Deep Medicine Rights.

As a result, if a holder does not hold Deep Medicine Rights in multiples of ten, such holder must sell or purchase Deep Medicine Rights

in order to obtain full value from the fractional interest.

On

the Closing Date, (i) the total number of Deep Medicine Class A Shares issued as Merger Consideration in connection with

the Business Combination was 5,750,274, and these Deep Medicine Class A Shares represent approximately 44.0%, of the issued

and outstanding Deep Medicine Common Stock immediately following the closing of the Business Combination, (ii) the total number of Deep

Medicine Class B Shares issued in connection with the Business Combination was 1,716,860 Deep Medicine Class B Shares, and these Deep

Medicine Class B Shares represent approximately 13.1%, of the issued and outstanding Deep Medicine Common Stock immediately following

the closing of the Business Combination.

| Item

1.01 |

Entry

into Material Definitive Agreement. |

Merger

Agreement

As

previously disclosed, on January 26, 2024, DMAQ held the Special Meeting, at which the Deep Medicine stockholders considered and adopted,

among other matters, a proposal to approve the Business Combination. On the Closing Date, the parties completed the Business Combination

pursuant to the terms of that certain Agreement and Plan of Merger, dated July 21, 2023, as amended, including by the First Amendment

to the Amended and Restated Agreement and Plan of Merger, dated December 7, 2023, and as it may be further amended and/or restated from

time to time, and as it may be further amended and/or restated from time to time, (the “Merger Agreement”), by and among

DMAQ, DMAC Merger Sub Inc., a Nevada corporation and wholly-owned subsidiary of DMAQ (“Merger Sub”), Bright Vision Sponsor

LLC, a Delaware limited liability company, in the capacity as the representative from and after the Effective Time (as defined in the

Merger Agreement) for the stockholders of Deep Medicine (the “Purchaser Representative”), Christopher Jones, an individual,

in the capacity as the representative for the TruGolf Stockholders (the “Seller Representative”), and TruGolf.

Pursuant

to the Merger Agreement, subject to the terms and conditions set forth therein, at the closing of the transactions contemplated by the

Merger Agreement (the “Closing”), Merger Sub will merge with and into TruGolf, with TruGolf surviving the merger as a wholly-owned

subsidiary of Deep Medicine (the “Merger”). In connection with the Merger, Deep Medicine will change its corporate name to

“TruGolf, Inc.” (which we sometimes refer to as “New TruGolf”).

Employment

Agreements

The

information set forth under Item 5.02 of this Current Report relating to the Executive Employment Agreements is hereby incorporated herein

by reference.

| Item

2.01 |

Completion

of Acquisition or Disposition of Assets. |

To

the extent required by this Item 2.01, the disclosure set forth in the “Introductory Note” section and Item 1.01 above is

hereby incorporated into this Item 2.01 by reference.

FORM

10 INFORMATION

Item

2.01(f) of Form 8-K states that if the predecessor registrant was a “shell company,” (as such term is defined in Rule 12b-2

under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)), as the Company was immediately before the Business

Combination, then the registrant must disclose the information that would be required if the registrant were filing a general form for

registration of securities on Form 10. As a result of the completion of the Business Combination, and as discussed below in Item 5.06

of this Current Report, the Company has ceased to be a shell company. Accordingly, the Company is providing below the information that

would be included in a Form 10 if it were to file a Form 10. Please note that the information provided below relates to the Company after

the completion of the Business Combination, unless otherwise specifically indicated or the context otherwise requires.

Forward-Looking

Statements

This

Current Report and the information incorporated herein by reference contains forward-looking statements within the meaning of the “safe

harbor” provisions of the Private Securities Litigation Reform Act of 1995, including with respect to the effects of the Business

Combination. These statements are based on the current expectations and beliefs of management of the Company and are subject to a number

of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements.

These forward-looking statements include statements about future financial and operating results of the Company; statements of the plans,

strategies, and objectives of management for future operations of the Company; statements regarding future economic conditions or performance;

and other statements regarding the future business of the Company. Forward-looking statements may contain words such as “will be,”

“will,” “expect,” “anticipate,” “continue,” “project,” “believe,”

“plan,” “could,” “estimate,” “forecast,” “guidance,” “intend,”

“may,” “plan,” “possible,” “potential,” “predict,” “pursue,”

“should,” “target,” or similar expressions, and include the assumptions that underlie such statements. These

statements include, but are not limited to the following:

| |

● |

the

outcome of any known and unknown litigation and regulatory proceedings, including the occurrence of any event, change or other circumstances,

including the outcome of any legal proceedings that may be instituted against the Company; |

| |

|

|

| |

● |

the

ability to maintain the listing of Company common stock on The Nasdaq Stock Market; |

| |

|

|

| |

● |

the

inability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition

and the ability to grow, manage growth profitably, and retain key employees; |

| |

|

|

| |

● |

changes

adversely affecting the business in which the Company is engaged; |

| |

|

|

| |

● |

the

Company’s projected financial information, growth rate, strategies, and market opportunities; |

| |

|

|

| |

● |

the

ability of the Company to meet its future capital requirements to fund its operations, which may involve debt and/or equity financing,

and to obtain such debt and/or equity financing on favorable terms, and its sources and uses of cash; |

| |

|

|

| |

● |

the

Company’s ability, assessment of, and strategies to compete with, its competitors; |

| |

|

|

| |

● |

the

Company’s reliance on third-party service providers; |

| |

|

|

| |

● |

the

Company’s estimates regarding expenses, future revenue, capital requirements, and needs for additional financing; |

| |

|

|

| |

● |

the

Company’s ability to maintain and protect its intellectual property; |

| |

|

|

| |

● |

changes

in applicable laws or regulations affecting the Company and/or its business; |

| |

|

|

| |

● |

the

risk of disruption to the Company’s current plans and operations, including, but not limited to, as a result of any business

disruption due to political or economic instability, pandemics or armed hostilities or a business disruption resulting from a cybersecurity

attack; and |

| |

|

|

| |

● |

other

factors disclosed under the section entitled “Risk Factors” in the Proxy Statement/Prospectus, which is hereby incorporated

herein by reference. |

The

foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties

described in the “Risk Factors” section of the other documents filed by the Company from time to time with the SEC. There

can be no assurance that future developments affecting the Company will be those that the Company has anticipated. The Company undertakes

no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise,

except as may be required under applicable securities laws.

Business

Reference

is made to the disclosure contained in the Proxy Statement/Prospectus in the section entitled “Information about TruGolf, Inc.,”

which is hereby incorporated herein by reference.

Risk

Factors

Reference

is made to the disclosure contained in the Proxy Statement/Prospectus in the section entitled “Risk Factors,” which is hereby

incorporated herein by reference.

Financial

Information

Management’s

Discussion and Analysis of Financial Condition and Results of Operations

Reference

is made to the disclosure contained in the Proxy Statement/Prospectus in the section entitled “Management’s Discussion and

Analysis of Financial Condition and Results of Operations of TruGolf,” which is hereby incorporated herein by reference.

Quantitative

and Qualitative Disclosures about Market Risk

Reference

is made to the disclosure contained in the Proxy Statement/Prospectus in the section entitled “Management’s Discussion and

Analysis of Financial Condition and Results of Operations of TruGolf — Quantitative and Qualitative Disclosures about Market

Risk,” which is hereby incorporated herein by reference.

Other

Financial Information

Reference

is made to the disclosure set forth in Item 9.01 of this Current Report concerning the consolidated financial information of TruGolf.

and the unaudited pro forma condensed combined financial information of the Company.

The

selected historical financial information of TruGolf as of and for the years ended December 31, 2022 and 2021, and for the nine months

ended September 30, 2023 and September 30, 2022 is described in the Proxy Statement/Prospectus in the section of the financial statements

entitled “Financial Statements — TruGolf Financial Statements,” which is hereby incorporated herein by reference.

Properties

Reference

is made to the disclosure contained in the Proxy Statement/Prospectus in the section entitled “Information About TruGolf, Inc.

— Facilities,” which is hereby incorporated herein by reference.

Security

Ownership of Certain Beneficial Owners and Management

The

following table sets forth beneficial ownership of Company common stock immediately following the completion of the Business Combination

by:

| |

● |

each

person known to be the beneficial owner of more than 5% of the outstanding Company common stock; |

| |

|

|

| |

● |

each

of the Company’s executive officers and directors; and |

| |

|

|

| |

● |

all

of the Company’s current executive officers and directors as a group. |

Beneficial

ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security

if he, she, or it possesses sole or shared voting or investment power over that security. Under those rules, beneficial ownership includes

securities that the individual or entity has the right to acquire, such as through the exercise of warrants or stock options or the vesting

of restricted stock units, within 60 days of the closing of the Business Combination for purposes of the calculations set forth below.

Shares subject to warrants or options that are currently exercisable or exercisable within 60 days of the closing of the Business Combination

or subject to restricted stock units that vest within 60 days of the closing of the Business Combination are considered outstanding and

beneficially owned by the person holding such warrants, options, or restricted stock units for the purpose of computing the percentage

ownership of that person but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

As of the closing of the Business Combination, there are 20,000 issued and outstanding options and no restricted stock units.

Except

as noted by footnote, and subject to community property laws where applicable, based on the information provided to the Company, the

persons and entities named in the table below have sole voting and investment power with respect to all shares shown as beneficially

owned by them. Unless otherwise indicated, the business address of each beneficial owner listed in the table below is c/o TruGolf Holdings,

Inc., 60 North 1400 West Centerville, Utah 84014.

| Name and Address of Beneficial Owner | |

Number of Shares of Company Common Stock Beneficially Owned | | |

Percentage of Shares of Outstanding Company Common Stock | |

| | |

| | |

| |

| Directors and Executive Officers | |

| | | |

| | |

| Christopher Jones (2) | |

| 2,792,065 | | |

| 21.4 | % |

| Lindsay Jones | |

| - | | |

| * | |

| Brenner Adams | |

| 71,832 | | |

| * | |

| Nathan E. Larson | |

| 71,832 | | |

| * | |

| B. Shaun Limbers | |

| 293,443 | | |

| 2.2 | % |

| Steven R. Johnson | |

| 1,353,134 | | |

| 10.4 | % |

| Humphrey P. Polanen | |

| 125,000 | | |

| 1.0 | % |

| Riley Russell | |

| - | | |

| * | |

| AJ Redmer | |

| - | | |

| * | |

| All directors and executive officers as a group (9 individuals) | |

| 4,707,306 | | |

| 36.0 | % |

| | |

| | | |

| | |

| 5% Beneficial Owners | |

| | | |

| | |

| David Ashby (2) | |

| 1,428,205 | | |

| 10.9 | % |

| Steven R. Johnson (2) | |

| 1,353,134 | | |

| 10.4 | % |

| Christopher Jones (2) | |

| 2,792,065 | | |

| 21.4 | % |

| Bright Vision Sponsor LLC (1) | |

| 2,712,566 | | |

| 42.8 | % |

| * |

Less

than 1%. |

| |

|

| (1) |

Mr.

Li served as the managing member of the sponsor. Mr. Li disclaims beneficial ownership of these securities. Accounts for the

transfer of a maximum aggregate of 185,179 Deep Medicine Class A Shares pursuant to the Non-Redemption Agreements. |

| |

|

| (2) |

Includes Class B Common Stock, which is convertible

into shares of Class A Common Stock on a one-for-one basis. |

Directors

and Executive Officers

Other

than as disclosed below in Item 5.02, the Company’s directors and executive officers are described in the Proxy Statement/Prospectus

in the section entitled “Management of New TruGolf Following the Business Combination,” which is hereby incorporated herein

by reference.

Executive

Compensation and Corporate Governance

Executive

Compensation

Certain

matters relating to the Company’s executive officers are described in the Proxy Statement/Prospectus in the sections entitled “Executive

and Director Compensation of TruGolf — Post-Combination Executive Compensation” and “Management of New TruGolf Following

the Business Combination — Agreements with management of New TruGolf following the Business Combination,” which are hereby

incorporated herein by reference. Additionally, the compensation-related disclosure set forth under Item 5.02 of this Current Report

is hereby incorporated herein by reference.

Director

Compensation

Certain

matters relating to the Company’s directors are described in the Proxy Statement/Prospectus in the sections entitled “Executive

and Director Compensation of TruGolf — Post-Combination Executive Compensation” and “Management of New TruGolf Following

the Business Combination — Agreements with management of New TruGolf following the Business Combination,”, which are hereby

incorporated herein by reference.

Committees

of the Board of Directors

The

standing committees of the Board currently include an audit committee, a nominating and corporate governance committee, and a compensation

committee. Each of the committees will report to the Board as they deem appropriate and as the Board may request. The committees of the

Board are described in the Proxy Statement/Prospectus in the section entitled “Management of New TruGolf Following the Business

Combination — Corporate Governance — Committees of the Board,” which is hereby incorporated herein by reference.

Code

of Conduct

The

code of conduct is a “code of ethics,” as defined in Item 406(b) of Regulation S-K. New TruGolf will have a code of ethics

that applies to all of its executive officers, directors and employees, including its principal executive officer, principal financial

officer, principal accounting officer or controller or persons performing similar functions. The code of ethics will be available on

New TruGolf’s website, https://TruGolf.com. In addition, New TruGolf intends to post on its website all disclosures that are required

by law or the listing standards of Nasdaq concerning any amendments to, or waivers from, any provision of the code. The reference to

the New TruGolf website address does not constitute incorporation by reference of the information contained at or available through New

TruGolf’s website, and you should not consider it to be a part of this Current Report.

Compensation

Committee Interlocks and Insider Participation

The

information described in the Proxy Statement/Prospectus in the section entitled “Management of New TruGolf Following the Business

Combination — Compensation Committee Interlocks and Insider Participation” is hereby incorporated herein by reference.

Certain

Relationships and Related Person Transactions, and Director Independence

Certain

relationships and related person transactions are described in the Proxy Statement/Prospectus in the section entitled “Certain

Relationships and Related Person Transactions,” which is hereby incorporated herein by reference.

A

description of the independence of the Company’s directors is described in the Proxy Statement/Prospectus in the section entitled

“Management of New TruGolf Following the Business Combination — Corporate Governance — Director Independence,”

which is hereby incorporated herein by reference.

Legal

Proceedings

Reference

is made to the disclosure regarding legal proceedings in the section of the Proxy Statement/Prospectus entitled “Information About

TruGolf, Inc. — Legal Proceedings,” which is hereby incorporated herein by reference.

Market

Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

Market

Information and Dividends

The

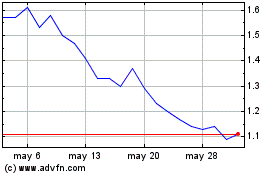

Company’s common stock commenced trading on The Nasdaq Capital Market (“Nasdaq Capital Market”) under the symbol “TRUG”

on February 1, 2024. DMAQ’s units, which were comprised of one Deep Medicine Class A Share and one right to receive one-tenth

of one share of Deep Medicine Class A Common Stock upon the consummation of Deep Medicine’s initial business combination, ceased

trading separately on The Nasdaq Stock Market LLC on January 31, 2024.

The

Company has never declared or paid any cash dividends and does not presently plan to pay cash dividends in the foreseeable future. The

payment of any cash dividends will be within the discretion of the Board. The Company currently expects that it will retain future earnings

to finance operations and grow its business.

Holders

of Record

Effective

upon the Closing, the Company had 11,538,252 shares of Class A common stock and 1,716,860 shares of Class B common stock outstanding,

held of record by approximately 25 holders, and no shares of preferred stock outstanding. Such amounts do not include Depository

Trust Company participants or beneficial owners holding shares through nominee names.

Securities

Authorized for Issuance Under Equity Compensation Plans

Reference

is made to the disclosure described in the Proxy Statement/Prospectus in the section entitled “The Equity Incentive Plan Proposal,”

which is hereby incorporated herein by reference. The TruGolf, Inc. 2024 Stock Incentive Plan (the “2024 Plan”) and the material

terms thereunder were approved by DMAQ’s stockholders at the Special Meeting.

Recent

Sales of Unregistered Securities

The

information set forth under Item 3.02 of this Current Report relating to the issuance of PIPE Convertible Notes and PIPE Warrants in

connection with the PIPE Financing is hereby incorporated herein by reference.

Description

of Registrant’s Securities to be Registered

Reference

is made to the disclosure in the Proxy Statement/Prospectus in the section entitled “Description of New TruGolf’s Securities,”

which is hereby incorporated herein by reference. As described below, the Company’s Third Amended and Restated Certificate of Incorporation

the (“Third A&R Certificate of Incorporation”) was approved by DMAQ’s stockholders at the Special Meeting and became

effective in connection with the Business Combination.

Indemnification

of Directors and Officers

Reference

is made to the disclosure in the Proxy Statement/Prospectus in the sections entitled “Management of New TruGolf Following the Business

Combination — Limitation on Liability and Indemnification of Directors and Officers” and “Description of New TruGolf’s

Securities — Certain Anti-Takeover Provisions of Delaware Law” and “Proposed Third Amended and Restated Certificate

of Incorporation — Limited Liability; Indemnification,” which are hereby incorporated herein by reference.

Financial

Statements and Supplementary Data

Reference

is made to the disclosure set forth under Item 9.01 of this Current Report relating to the financial information of the Company, and

is hereby incorporated herein by reference.

| Item

3.01 |

Notice

of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

The

disclosure set forth in “Introductory Note” above is hereby incorporated into this Item 3.01 by reference.

In

connection with the completion of the Business Combination, on the Closing Date, the Company notified The Nasdaq Stock Market LLC that

the Business Combination had become effective and that DMAQ’s outstanding securities had been converted into Company common stock.

The Company’s common stock commenced trading on the Nasdaq Capital Market under the symbol “TRUG” on February 1, 2024.

The Nasdaq Stock Market LLC delisted DMAQ’s units. Trading of DMAQ’s Class A common stock, and units was suspended at 5 p.m.

on January 31, 2024.

| Item

3.02 |

Unregistered

Sales of Equity Securities. |

The

disclosure set forth in “Introductory Note” above is hereby incorporated into this Item 3.02 by reference.

| Item

3.03 |

Material

Modification to Rights of Security Holders. |

In

connection with the completion of the Business Combination, the Company filed the Third A&R Certificate of Incorporation with the

Secretary of State of the State of Delaware. The material terms of the Third A&R Certificate of Incorporation and the general effect

upon the rights of holders of the Company’s capital stock are discussed in the Proxy Statement/Prospectus in the section entitled

“The Charter Proposal,” which is incorporated herein by reference.

Additionally,

the disclosure set forth in the Introductory Note and Item 5.03 of this Current Report is hereby incorporated herein by reference. A

copy of the Third A&R Certificate of Incorporation is included as Exhibit 3.1 to this Current Report and is incorporated herein by

reference.

| Item

5.01 |

Changes

in Control of the Registrant. |

The

disclosure set forth under the Introductory Note and in Item 2.01 of this Current Report is hereby incorporated herein by reference.

| Item

5.02 |

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Effective

upon the completion of the Business Combination, and in accordance with the terms of the Merger Agreement, (i) each executive officer

of DMAQ, other than Humphrey S. Polanen, ceased serving in such capacities, (ii) all the existing members of DMAQ’s board of directors,

resigned, and (iii) Christopher Jones, Shaun Limbers, Humphrey Polanen, AJ Redmer, and Riley Russell were appointed as directors of the

Company.

Effective

upon the completion of the Business Combination, Mr. Christopher Jones was appointed Chief Executive Officer, President and Chairman

of the Board of the Company. Mr. Lindsay Jones will serve as the Chief Financial Officer of the Company.

Other

than as disclosed in this Item 5.02 of this Current Report, reference is made to the disclosure described in the Proxy Statement/Prospectus

in the section entitled “Management of New TruGolf Following the Business Combination” for biographical information about

each of the directors and officers following the Business Combination and to Item 1.01 of this Current Report, which are hereby incorporated

herein by reference.

Employment

Agreements

Reference

is made to the disclosure of the terms of the Executive Employments Agreements in the Proxy Statement/Prospectus in the section entitled

“Management of New TruGolf Following the Business Combination —Agreements with management of New TruGolf following the Business

Combination,” which is hereby incorporated herein by reference.

Compensatory

Arrangements for Directors

Reference

is made to the disclosure in the Proxy Statement/Prospectus in the section entitled “Management of New TruGolf Following the Business

Combination — Non-Employee Director Compensation,” and “Management of New TruGolf Following the Business Combination

— Cash Compensation,” and “Management of New TruGolf Following the Business Combination — Equity Compensation,”

which is hereby incorporated herein by reference.

Conduit

Pharmaceuticals Inc. 2023 Stock Incentive Plan

Reference

is made to the disclosure in the Proxy Statement/Prospectus in the section entitled “The Equity Incentive Plan Proposal,”

which is hereby incorporated herein by reference, and the full text of the 2024 Plan which is included as Exhibit 10.4 to this Current

Report and is incorporated herein by reference.

Indemnity

Agreements

On

January 31, 2024, each of the Company’s newly appointed directors and officers entered into indemnity agreements with

the Company. Reference is made to the disclosure in the Proxy Statement/Prospectus in the section entitled “Management of New TruGolf

Following the Business Combination — Limitation on Liability and Indemnification of Directors and Officer” which is hereby

incorporated herein by reference, and the full text of the form of the Indemnity Agreement which is included as Exhibit 10.5 to this

Current Report and is incorporated herein by reference.

| Item

5.03 |

Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

In

connection with the completion of the Business Combination, the Company amended and restated its certificate of incorporation, effective

as of the Closing Date, pursuant to the Third A&R Certificate of Incorporation, and the Company adopted amended restated bylaws pursuant

to the Proposed Bylaws (the “A&R Bylaws”).

Copies

of the Third A&R Certificate of Incorporation and the A&R Bylaws are attached as Exhibits 3.1 and 3.2 to this Current Report,

respectively, and are incorporated herein by reference.

The

material terms of the Third A&R Certificate of Incorporation and the A&R Bylaws and the general effect upon the rights of holders

of the Company’s capital stock are described in the Proxy Statement/Prospectus under the sections entitled “The Charter Proposal,”

and “The Governance Proposals,” which are hereby incorporated herein by reference.

Change

in Fiscal Year

Effective

as of the Closing Date, the Company’s fiscal year end automatically changed from March 31 to December 31. This change aligns the

Company’s fiscal year and financial reporting periods with that of TruGolf, Inc.

| Item

5.05 |

Amendments

to the Registrant’s Code of Ethics, or Waiver of a Provision of the Code of Ethics. |

New

TruGolf has adopted a code of ethics that applies to all of its executive officers, directors and employees, including its principal

executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. The

code of ethics is available on New TruGolf’s website, https://TruGolf.com. In addition, New TruGolf intends to post on its website

all disclosures that are required by law or the listing standards of Nasdaq concerning any amendments to, or waivers from, any provision

of the code. The reference to the New TruGolf website address does not constitute incorporation by reference of the information contained

at or available through New TruGolf’s website, and you should not consider it to be a part of this Current Report.

| Item

5.06 |

Change

in Shell Company Status. |

As

a result of the Business Combination, the Company ceased to be a shell company. Reference is made to the disclosure in the Proxy Statement/Prospectus

in the section entitled “The Business Combination Proposal,” which is hereby incorporated herein by reference.

| Item

7.01 |

Regulation

FD Disclosure. |

On

January 31, 2024, the parties issued a joint press release announcing the completion of the Business Combination, a copy of which is

furnished as Exhibit 99.1 to this Current Report.

The

information in this Item 7.01 and Exhibit 99.1 attached hereto is being furnished and shall not be deemed “filed” for purposes

of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by

reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific

reference in such filing.

| Item

9.01 |

Financial

Statements and Exhibits. |

(a)

Financial Statements of Businesses Acquired.

The

consolidated financial statements of TruGolf as of and for the years ended December 31, 2022 and 2021, and for the nine months ended

September 30, 2023 and September 30, 2022 are set forth in the Proxy Statement/Prospectus in the section of the financial statements

entitled “Financial Statements — TruGolf Financial Statements,” and are incorporated herein by reference.

(b)

Pro Forma Financial Information.

The

unaudited pro forma condensed combined statement of operations for the twelve months ended March 31, 2023 combines the audited statement

of operations of Deep Medicine for the year ended March 31, 2023 and the audited statement of operations of TruGolf for the twelve months

ended December 31, 2022, giving effect to the transactions and other events contemplated by the Merger Agreement as if they have been

consummated on April 1, 2022 (the beginning of the earliest period presented). The unaudited pro forma condensed combined financial information

of DMAQ and TruGolf as of September 30, 2023, is set forth in the Proxy Statement/Prospectus in the section of the financial statements

entitled “Unaudited Pro Forma Condensed Combined Financial Information,” and is incorporated herein by reference.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

February 6, 2024 |

TRUGOLF,

INC. |

| |

|

|

| |

By: |

/s/

Christopher Jones |

| |

Name: |

Christopher

Jones |

| |

Title: |

Chief

Executive Officer |

Exhibit

3.1

THIRD

AMENDED AND RESTATED

CERTIFICATE

OF INCORPORATION

OF

DEEP

MEDICINE ACQUISITION CORP.

January

31, 2024

Deep

Medicine Acquisition Corp., a corporation organized and existing under the laws of the State of Delaware (the “Corporation”),

DOES HEREBY CERTIFY AS FOLLOWS:

1.

The Corporation was originally incorporated under the name Bright Vision Acquisition Corp., upon the filing of its original certificate

of incorporation with the Secretary of State of Delaware on July 8, 2020, which certificate of incorporation was amended by the amended

and restated certificate of incorporation filed with the Secretary State of Delaware on March 26, 2021, and the second amended and restated

certificate of incorporation filed with the Secretary State of Delaware on October 26, 2021, under the name Deep Medicine Acquisition

Corp. (the “Certificate”).

2.

This Third Amended and Restated Certificate of Incorporation (the “Third Amended and Restated Certificate”),

which both restates and amends the provisions of the Certificate, was duly adopted in accordance with Sections 228, 242 and 245 of the

General Corporation Law of the State of Delaware, as amended from time to time (the “DGCL”).

3.

This Third Amended and Restated Certificate shall become effective on the date of filing with Secretary of State of Delaware.

4.

The text of the Certificate is hereby restated and amended in its entirety to read as follows:

ARTICLE

I

NAME

The

name of the corporation is TruGolf Holdings, Inc. (the “Corporation”).

ARTICLE

II

PURPOSE

The

purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the DGCL.

ARTICLE

III

REGISTERED

AGENT

The

address of the Corporation’s registered office in the State of Delaware is 251 Little Falls Drive, in the City of Wilmington, County

of New Castle, State of Delaware, 19808, and the name of the Corporation’s registered agent at such address is Corporation Service

Company.

ARTICLE

IV

CAPITALIZATION

Section

4.1 Authorized Capital Stock. The total number of shares of all classes of capital stock, each with a par value of $0.0001 per

share, which the Corporation is authorized to issue is 110,000,000 shares, consisting of (a) 100,000,000 shares of common stock (the

“Common Stock”), including (i) 90,000,000 shares of Class A Common Stock (the “Class A Common Stock”),

and (ii) 10,000,000 shares of Class B Common Stock (the “Class B Common Stock”), and (b) 10,000,000 shares

of preferred stock (the “Preferred Stock”).

Section

4.2 Common Stock. All shares of Class A Common Stock and Class B Common Stock will be identical and will entitle the holders thereof

to the same rights and privileges, except as otherwise provided herein.

(a)

Voting. The holders of shares of Class A Common Stock and of Class B Common Stock shall have the following voting rights:

(i)

Each share of Class A Common Stock shall entitle the holder thereof to one vote on all matters submitted to a vote of the stockholders

of the Corporation.

(ii)

Each share of Class B Common Stock shall entitle the holder thereof to twenty-five (25) votes on all matters submitted to a vote of the

stockholders of the Corporation.

(iii)

Except as otherwise required by applicable law, the holders of shares of Class A Common Stock and the holders of shares of Class B Common

Stock shall vote together as one class on all matters submitted to a vote of stockholders of the Corporation (or, if any holders of shares

of Preferred Stock are entitled to vote together with the holders of Class A Common Stock and Class B Common Stock, as a single class

with such holders of shares of Preferred Stock).

(b)

Dividends. Subject to applicable law, the rights, if any, of the holders of any outstanding series of the Preferred Stock, the

holders of shares of Common Stock shall be entitled to receive such dividends and other distributions (payable in cash, property or capital

stock of the Corporation) when, as and if declared thereon by the Board from time to time out of any assets or funds of the Corporation

legally available therefor and shall share equally on a per share basis in such dividends and distributions.

(c)

Liquidation, Dissolution or Winding Up of the Corporation. Subject to applicable law, the rights, if any, of the holders of any

outstanding series of the Preferred Stock, in the event of any voluntary or involuntary liquidation, dissolution or winding up of the

Corporation, after payment or provision for payment of the debts and other liabilities of the Corporation, the holders of shares of Common

Stock shall be entitled to receive all the remaining assets of the Corporation available for distribution to its stockholders, ratably

in proportion to the number of shares of Class A Common Stock (on an as converted basis with respect to the Class B Common Stock) held

by them.

(d)

Issuance of Class B Common Stock. From and after the effective time of these Third Amended and Restated Articles (the “Effective

Time”), additional shares of Class B Common Stock may be issued only to, and registered in the name of, (A) Christopher Jones,

Steve Johnson, and David Ashby (each a “Founder” and collectively the “Founders”) and (B) any entities,

directly or indirectly, wholly-owned by (or in the case of a trust solely for the benefit of) the Founders (including all subsequent

successors, assigns and permitted transferees) (collectively, “Permitted Class B Owners”).

(e)

Conversion of Class B Common Stock.

(i)

Voluntary Conversion. Each share of Class B Common Stock shall be convertible into one fully paid and nonassessable share of Class

A Common Stock at the option of the holder thereof at any time upon written notice to the Corporation. In order to effectuate a conversion

of shares of Class B Common Stock, a holder shall (a) submit a written election to the Corporation that such holder elects to convert

shares of Class B Common Stock, the number of such shares elected to be converted and (b) (if such shares are certificated), along with

such written election, surrender to the Corporation the certificate or certificates representing the shares being converted, duly assigned

or endorsed for transfer to the Corporation (or accompanied by duly executed stock powers relating thereto) or, in the event the certificate

or certificates are lost, stolen or missing, accompanied by an affidavit of loss executed by the holder. The conversion of such shares

hereunder shall be deemed effective as of the date of surrender of such Class B Common Stock certificate or certificates, delivery of

such affidavit of loss or the written election to convert for uncertificated shares. Upon the receipt by the Corporation of a written

election and, if applicable, the surrender of such certificate(s) and accompanying materials, the Corporation shall as promptly as practicable

(but in any event within 10 days thereafter) either (a) deliver to the relevant holder (i) a certificate in such holder’s name

(or the name of such holder’s designee as stated in the written election) for the number of shares of Class A Common Stock to which

such holder shall be entitled upon conversion of the applicable shares as calculated pursuant to this Section 4.2 and, if applicable

(ii) a certificate in such holder’s (or the name of such holder’s designee as stated in the written election) for the number

of shares of Class B Common Stock (including any fractional share) represented by the certificate or certificates delivered to the Corporation

for conversion but otherwise not elected to be converted pursuant to the written election or (b) note the conversion of the shares on

the stock ledger of the Corporation. All shares of capital stock issued hereunder by the Corporation shall be duly and validly issued,

fully paid and nonassessable, free and clear of all taxes, liens, charges and encumbrances with respect to the issuance thereof. Each

share of Class B Common Stock that is converted pursuant to this Section 4.2(d) shall be retired by the Corporation and shall not be

available for reissuance.

(ii)

Automatic Conversion of Class B Common Stock. Each share of Class B Common Stock will automatically convert into one (1) share

of Class A Common Stock upon any sale, pledge or other transfer (a “Transfer”), whether or not for value, by

the initial registered holder thereof, upon any Transfer, other than in each case any Transfer to a Permitted Class B Owner. Notwithstanding

anything to the contrary set forth herein, any holder of Class B Common Stock may pledge his, her or its shares of Class B Common Stock

to a pledgee pursuant to a bona fide pledge of the shares as collateral security for indebtedness due to the pledgee so long as the shares

are not transferred to or registered in the name of the pledgee. In the event of any pledge meeting these requirements, the pledged shares

will not be converted automatically into shares of Class A Common Stock. If the pledged shares of Class B Common Stock become subject

to any foreclosure, realization or other similar action by the pledgee, they will be converted automatically into shares of Class A Common

Stock upon the occurrence of that action.

(iii)

The Corporation may, from time to time, establish such policies and procedures, not in violation of applicable law or the other provisions

of this Third Amended and Restated Certificate of Incorporation, relating to the conversion of the Class B Common Stock into Class A

Common Stock and the dual class common stock structure contemplated by this Amended and Restated Certificate of Incorporation as it may

deem necessary or advisable.

Section

4.3 Preferred Stock. Shares of Preferred Stock may be issued from time to time in one or more series. The Board of Directors of

the Corporation (the “Board”) is hereby authorized to provide by resolution or resolutions from time to time

for the issuance, out of the unissued shares of Preferred Stock, of one or more series of Preferred Stock, without stockholder approval,

by filing a certificate pursuant to the applicable law of the State of Delaware (the “Preferred Stock Designation”),

setting forth such resolution and, with respect to each such series, establishing the number of shares to be included in such series,

and fixing the voting powers, full or limited, or no voting power of the shares of such series, and the designation, preferences and

relative, participating, optional or other special rights, if any, of the shares of each such series and any qualifications, limitations

or restrictions thereof. The powers, designation, preferences and relative, participating, optional and other special rights of each

series of Preferred Stock, and the qualifications, limitations and restrictions thereof, if any, may differ from those of any and all

other series at any time outstanding. The authority of the Board with respect to each series of Preferred Stock shall include, but not

be limited to, the determination of the following:

(a)

the designation of the series, which may be by distinguishing number, letter or title;

(b)

the number of shares of the series, which number the Board may thereafter (except where otherwise provided in the Preferred Stock Designation)

increase or decrease (but not below the number of shares thereof then outstanding);

(c)

the amounts or rates at which dividends will be payable on, and the preferences, if any, of shares of the series in respect of dividends,

and whether such dividends, if any, shall be cumulative or noncumulative;

(d)

the dates on which dividends, if any, shall be payable;

(e)

the redemption rights and price or prices, if any, for shares of the series;

(f)

the terms and amount of any sinking fund, if any, provided for the purchase or redemption of shares of the series;

(g)

the amounts payable on, and the preferences, if any, of shares of the series in the event of any voluntary or involuntary liquidation,

dissolution or winding up of the affairs of the Corporation;

(h)

whether the shares of the series shall be convertible into or exchangeable for, shares of any other class or series, or any other security,

of the Corporation or any other corporation, and, if so, the specification of such other class or series or such other security, the

conversion or exchange price or prices or rate or rates, any adjustments thereof, the date or dates at which such shares shall be convertible

or exchangeable and all other terms and conditions upon which such conversion or exchange may be made;

(i)

restrictions on the issuance of shares of the same series or any other class or series;

(j)

the voting rights, if any, of the holders of shares of the series generally or upon specified events; and

(k)

any other powers, preferences and relative, participating, optional or other special rights of each series of Preferred Stock, and any

qualifications, limitations or restrictions thereof, all as may be determined from time to time by the Board and stated in the resolution

or resolutions providing for the issuance of such Preferred Stock.

Without

limiting the generality of the foregoing, the resolutions providing for issuance of any series of Preferred Stock may provide that such

series shall be superior or rank equally or be junior to any other series of Preferred Stock to the extent permitted by law.

ARTICLE

V

BOARD

OF DIRECTORS

Section

5.1 Board Powers. The business and affairs of the Corporation shall be managed by, or under the direction of, the Board, except

as otherwise provided by this Third Amended and Restated Certificate or the DGCL.

Section

5.2 Number, Election and Term.

(a)

The number of directors of the Corporation, other than those who may be elected by the holders of one or more series of the Preferred

Stock voting separately by class or series, shall be fixed from time to time exclusively by the Board pursuant to a resolution adopted

by a majority of the Board.

(b)

A director shall hold office until the annual meeting for the year in which his or her term expires and until his or her successor has

been elected and qualified, subject, however, to such director’s earlier death, resignation, retirement, disqualification or removal.

(c)

Unless and except to the extent that the Bylaws of the Corporation (as the same may be amended and/or restated from time to time, the

“Bylaws”) shall so require, the election of directors need not be by written ballot. The holders of shares

of Common Stock and Preferred Stock shall not have cumulative voting rights with regard to election of directors.

Section

5.3 Newly Created Directorships and Vacancies. Subject to the rights of holders of any series of Preferred Stock, any newly created

directorship that results from an increase in the number of directors or any vacancy on the Board that results from the death, disability,

resignation, disqualification or removal of any director or from any other cause shall be filled solely by the affirmative vote of a

majority of the total number of directors then in office, even if less than a quorum, or by a sole remaining director and shall not be

filled by the stockholders. Any director elected in accordance with the preceding sentence shall, in the case of a newly created directorship,

hold office for the full term of the class in which the newly created directorship was created or, in the case of a vacancy, hold office

for the remaining term of his or her predecessor and in each case until his or her successor shall be elected and qualified, subject

to his or her earlier death, disqualification, resignation or removal.

Section

5.4 Removal. Subject to the rights of the holders of any series of Preferred Stock, any director or the entire Board may be removed

from office at any time, but only for cause.

Section

5.5 Committees. Pursuant to the Bylaws, the Board may establish one or more committees to which may be delegated any or all of

the powers and duties of the Board to the full extent permitted by law.

Section

5.6 Stockholder Nominations and Introduction of Business. Advance notice of stockholder nominations for election of directors

and other business to be brought by stockholders before a meeting of stockholders shall be given in the manner provided by the Bylaws.

Section

5.7 Preferred Stock Directors. During any period when the holders of any series of Preferred Stock have the right to elect additional

directors as provided for or fixed pursuant to the provisions of Article IV hereof or any Preferred Stock Designation, then upon commencement

and for the duration of the period during which such right continues: (i) the then otherwise total number of authorized directors of

the Corporation shall automatically be increased by such specified number of directors, and the holders of such Preferred Stock shall

be entitled to elect the additional directors so provided for or fixed pursuant to said provisions, and (ii) each such additional director

shall serve until such director’s successor shall have been duly elected and qualified, or until such director’s right to

hold such office terminates pursuant to said provisions, whichever occurs earlier, subject to his earlier death, disqualification, resignation

or removal. Except as otherwise provided for or fixed pursuant to the provisions of Article IV hereof or any Preferred Stock Designation,

whenever the holders of any series of Preferred Stock having such right to elect additional directors are divested of such right pursuant

to the provisions of such stock, the terms of office of all such additional directors elected by the holders of such stock, or elected

to fill any vacancies resulting from the death, resignation, disqualification or removal of such additional directors, shall forthwith

terminate and the total authorized number of directors of the Corporation shall be reduced accordingly.

ARTICLE

VI

BYLAWS

In

furtherance and not in limitation of the powers conferred upon it by law, the Board shall have the power and is expressly authorized

to adopt, amend, alter or repeal the Bylaws. The affirmative vote of a majority of the Board shall be required to adopt, amend, alter

or repeal the Bylaws. The Bylaws also may be adopted, amended, altered or repealed by the stockholders; provided, however, that in addition

to any vote of the holders of any class or series of capital stock of the Corporation required by law or by this Third Amended and Restated

Certificate (including any Preferred Stock Designation), the affirmative vote of the holders of at least a majority of the voting power

of all then outstanding shares of capital stock of the Corporation entitled to vote generally in the election of directors, voting together

as a single class, shall be required for the stockholders to adopt, amend, alter or repeal the Bylaws; and provided further, however,

that no Bylaws hereafter adopted by the stockholders shall invalidate any prior act of the Board that would have been valid if such Bylaws

had not been adopted.

ARTICLE

VII

SPECIAL

MEETINGS OF STOCKHOLDERS; ACTION BY WRITTEN CONSENT

Section

7.1 Special Meetings. Subject to the rights, if any, of the holders of any outstanding series of the Preferred Stock, and to the

requirements of applicable law, special meetings of stockholders of the Corporation may be called only by the Chairman of the Board,

the Chief Executive Officer of the Corporation, or the Board pursuant to a resolution adopted by a majority of the Board, and the ability

of the stockholders of the Corporation to call a special meeting is hereby specifically denied. Except as provided in the foregoing sentence,

special meetings of stockholders of the Corporation may not be called by another person or persons.

Section

7.2 Advance Notice. Advance notice of stockholder nominations for the election of directors and of business to be brought by stockholders

before any meeting of the stockholders of the Corporation shall be given in the manner provided in the Bylaws.

Section

7.3 Action by Written Consent. Except as may be otherwise provided for or fixed pursuant to this Third Amended and Restated Certificate

(including any Preferred Stock Designation) relating to the rights of the holders of any outstanding series of Preferred Stock, any action

required or permitted to be taken by the stockholders of the Corporation must be effected by a duly called annual or special meeting

of such stockholders and may not be effected by written consent of the stockholders, other than with respect to any action required or

permitted to be taken by the holders of our Class B Common Stock with respect to which action may be taken by written consent.

ARTICLE

VIII

LIMITED

LIABILITY; INDEMNIFICATION

Section

8.1 Limitation of Liability. To the fullest extent permitted by the DGCL as it presently exists or may hereafter be amended, a

director of the Corporation shall not be personally liable to the Corporation or its stockholders for monetary damages for any breach

of fiduciary duty as a director. Without limiting the effect of the preceding sentence, if the DGCL is hereafter amended to authorize

corporate action further eliminating or limiting the personal liability of directors, then the liability of a director of the Corporation

shall be eliminated or limited to the fullest extent permitted by the DGCL, as so amended.

Section

8.2 Change in Rights. Neither any amendment nor repeal of this Article VIII, nor the adoption of any provision of this Third Amended

and Restated Certificate or the Bylaws of the Corporation inconsistent with this Article VIII, shall eliminate, reduce or otherwise adversely

affect any limitation on the personal liability of a director of the Corporation existing at the time of such amendment, repeal or adoption

of an inconsistent provision.

ARTICLE

IX: CHOICE OF FORUM

Unless

the Corporation consents in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware (or, if

and only if the Court of Chancery of the State of Delaware lacks subject matter jurisdiction, any state court located within the State

of Delaware or, if and only if all such state courts lack subject matter jurisdiction, the federal district court for the District of

Delaware), and any appellate court therefrom shall, to the fullest extent permitted by law, be the sole and exclusive forum for: (a)

any derivative action or proceeding brought on behalf of the Corporation; (b) any action asserting a claim of breach of a fiduciary duty

owed by, or other wrongdoing by, any director, officer, stockholder, employee or agent of the Corporation to the Corporation or the Corporation’s

stockholders; (c) any action asserting a claim against the Corporation or any director, officer, stockholder, employee or agent of the

Corporation arising pursuant to any provision of the DGCL, this Third Amended and Restated Certificate or the Bylaws or as to which the

DGCL confers jurisdiction on the Court of Chancery of the State of Delaware; (d) any action to interpret, apply, enforce or determine

the validity of this Third Amended and Restated Certificate or the Bylaws; or (e) any action asserting a claim against the Corporation

or any director, officer, stockholder, employee or agent of the Corporation governed by the internal affairs doctrine, in all cases to

the fullest extent permitted by law and subject to the court having personal jurisdiction over the indispensable parties named as defendants.

This Article IX shall not apply to claims or causes of action brought to enforce a duty or liability created by the Securities Act of

1933, as amended (the “1933 Act”), or the Securities Exchange Act of 1934, as amended, or any other claim for which the federal

courts have exclusive jurisdiction.

Unless

the Corporation consents in writing to the selection of an alternative forum, to the fullest extent permitted by law, the federal district

courts of the United States of America shall be the exclusive forum for the resolution of any complaint asserting a cause of action arising

under the 1933 Act, including all causes of action asserted against any defendant named in such complaint. For the avoidance of doubt,

this provision is intended to benefit and may be enforced by the Corporation, its officers and directors, the underwriters for any offering

giving rise to such complaint, and any other professional entity whose profession gives authority to a statement made by that person

or entity and who has prepared or certified any part of the documents underlying the offering.

ARTICLE

X: AMENDMENT OF CERTIFICATE OF INCORPORATION

If

any provision of this Third Amended and Restated Certificate shall be held to be invalid, illegal or unenforceable, then such provision

shall nonetheless be enforced to the maximum extent possible consistent with such holding and the remaining provisions of this Third

Amended and Restated Certificate (including, without limitation, all portions of any section of this Third Amended and Restated Certificate

containing any such provision held to be invalid, illegal or unenforceable, which is not invalid, illegal or unenforceable) shall remain

in full force and effect.

The

Corporation reserves the right to amend, or repeal any provision contained in this Third Amended and Restated Certificate, in the manner

now or hereafter prescribed by the laws of the State of Delaware, and all rights conferred herein are granted subject to this reservation;

provided, however, that, notwithstanding any other provision of this Third Amended and Restated Certificate or applicable

law that might permit a lesser vote or no vote (but subject to the rights of any series of Preferred Stock set forth in any Preferred

Stock Designation) and in addition to any affirmative vote of the holders of any particular class or series of capital stock of the Corporation

required by applicable law or this Third Amended and Restated Certificate, the affirmative vote of the holders of at least a majority

of the voting power of all then-outstanding shares of the capital stock of the Corporation entitled to vote generally in the election

of directors, voting together as a single class, shall be required to amend, repeal, or adopt any provisions inconsistent with this Article

X or Article V, Article VI, Article VII or Article VIII of this Certificate of Incorporation; provided, further,

that if a majority of the Board has approved such amendment or repeal of any provisions of this Third Amended and Restated Certificate,

then only the affirmative vote of the holders of a majority of the voting power of all then-outstanding shares of capital stock of the

Corporation entitled to vote generally in the election of directors, voting together as a single class (in addition to any other vote

of the holders of any class or series of stock of the Corporation required by applicable law or by this Third Amended and Restated Certificate

or any Preferred Stock Designation), shall be required to amend or repeal such provisions of this Third Amended and Restated Certificate.

IN

WITNESS WHEREOF, the Corporation has caused this Third Amended and Restated Certificate to be duly executed and acknowledged in its name

and on its behalf by an authorized officer as of the date first set forth above.

| |

Deep

Medicine Acquisition Corp. |

| |

|

|

| |

By: |

/s/

Humphrey P. Polanen |

| |

Name: |

Humphrey

P. Polanen |

| |

Title: |

Chief

Executive Officer |

Exhibit

10.5

FORM

OF INDEMNIFICATION AGREEMENT

This

Indemnification Agreement (“Agreement”) is made as of January 31, 2024 by and between TruGolf Holdings,

Inc., a Delaware corporation (the “Company”), and [NAME], [a member of the Board of Directors of

the Company]or[OFFICER TITLE] (“Indemnitee”). This Agreement supersedes and replaces any and all previous Agreements

between the Company and Indemnitee covering indemnification and advancement of expenses.

RECITALS

WHEREAS,

the Board of Directors of the Company (the “Board”) believes that highly competent persons have become more

reluctant to serve publicly-held corporations as directors, officers, or in other capacities unless they are provided with adequate protection

through insurance or adequate indemnification and advancement of expenses against inordinate risks of claims and actions against them

arising out of their service to and activities on behalf of the corporation;

WHEREAS,

the Board has determined that, in order to attract and retain qualified individuals, the Company will attempt to maintain on an ongoing

basis, at its sole expense, liability insurance to protect persons serving the Company and its subsidiaries from certain liabilities.

Although the furnishing of such insurance has been a customary and widespread practice among United States-based corporations and other

business enterprises, the Company believes that, given current market conditions and trends, such insurance may be available to it in

the future only at higher premiums and with more exclusions. At the same time, directors, officers, and other persons in service to corporations

or business enterprises are being increasingly subjected to expensive and time-consuming litigation relating to, among other things,

matters that traditionally would have been brought only against the Company or business enterprise itself. The Company’s Bylaws

and Certificate of Incorporation require indemnification of the officers and directors of the Company. Indemnitee may also be entitled

to indemnification pursuant to the General Corporation Law of the State of Delaware (the “DGCL”). The Bylaws,

the Certificate of Incorporation, and the DGCL expressly provide that the rights to indemnification and advancement of expenses are not

exclusive of any other rights acquired under law, an agreement, vote of stockholders or disinterested directors, or otherwise;

WHEREAS,

the uncertainties relating to such insurance, to indemnification, and to advancement of expenses may increase the difficulty of attracting

and retaining such persons;

WHEREAS,

the Board has determined that the increased difficulty in attracting and retaining such persons is detrimental to the best interests

of the Company and its stockholders and that the Company should act to assure such persons that there will be increased certainty of

such protection in the future;

WHEREAS,

it is reasonable, prudent and necessary for the Company contractually to obligate itself to indemnify, and to advance expenses on behalf

of, such persons to the fullest extent permitted by applicable law so that they will serve or continue to serve the Company free from

undue concern that they will not be so indemnified;

WHEREAS,

this Agreement is a supplement to, and in furtherance of, the Bylaws, the Certificate of Incorporation and any resolutions adopted pursuant

thereto, as well as any rights of Indemnitee under any directors’ and officers’ liability insurance policy, and is not a

substitute therefor, and does not diminish or abrogate any rights of Indemnitee thereunder; and

WHEREAS,

Indemnitee does not regard the protection available under the Bylaws, the Certificate of Incorporation, and available insurance as adequate

in the present circumstances, and may not be willing to serve or continue to serve as a directors without adequate additional protection,

and the Company desires Indemnitee to serve or continue to serve in such capacity. Indemnitee is willing to serve, continue to serve

and to take on additional service for or on behalf of the Company on the condition that Indemnitee be so indemnified and be advanced

expenses.

AGREEMENT

NOW,

THEREFORE, in consideration of the premises and the covenants contained herein, the Company and Indemnitee do hereby covenant and agree

as follows:

Section

1. Services to the Company. Indemnitee agrees to serve as a director of the Company. Indemnitee may at any time and for any reason

resign from such position (subject to any other contractual obligation or any obligation imposed by operation of law). This Agreement

does not create any obligation on the Company to continue Indemnitee in such position and is not an employment contract between the Company

(or any of its subsidiaries or any Enterprise) and Indemnitee.

Section

2. Definitions. As used in this Agreement:

(a)

“Agent” means any person who is authorized by the Company or an Enterprise to act for or represent the interests

of the Company or an Enterprise, respectively.

(b)

A “Change in Control” occurs upon the earliest to occur after the date of this Agreement of any of the following

events:

i.

Acquisition of Stock by Third Party. Any Person (as defined below) is or becomes the Beneficial Owner (as defined below), directly or

indirectly, of securities of the Company representing fifteen percent (15%) or more of the combined voting power of the Company’s

then outstanding securities unless the change in relative beneficial ownership of the Company’s securities by any Person results

solely from a reduction in the aggregate number of outstanding shares of securities entitled to vote generally in the election of directors;

ii.

Change in Board of Directors. During any period of two (2) consecutive years (not including any period prior to the execution of this

Agreement), individuals who at the beginning of such period constitute the Board, and any new director (other than a director designated

by a person who has entered into an agreement with the Company to effect a transaction described in Sections 2(b)(i), 2(b)(iii) or 2(b)(iv)

of this Agreement) whose election by the Board or nomination for election by the Company’s stockholders was approved by a vote