false

0001857086

DE

0001857086

2024-02-23

2024-02-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February

23, 2024 (February 19, 2024)

TruGolf

Holdings, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40970 |

|

85-3269086 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

| 60

North 1400 West Centerville, Utah |

|

84014 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (801)

298-1997

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class

A Common Stock, $0.0001 par value per share |

|

TRUG |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

EXPLANATORY

NOTE

On

January 31, 2024 Deep Medicine Acquisition Corp., a Delaware corporation and our predecessor company (“DMAQ”), completed

the previously announced business combination (the “Business Combination”) pursuant to the terms of the Business Combination

Agreement, dated as of July 21, 2023 (as amended, the “Business Combination Agreement”), by and among DMAQ, DMAC Merger Sub

Inc., a Nevada corporation and wholly-owned subsidiary of DMAQ (“Merger Sub”), Bright Vision Sponsor LLC, a Delaware limited

liability company, in the capacity as the representative for the stockholders of DMAQ, Christopher Jones, an individual, in the capacity

as the representative for the TruGolf stockholders and TruGolf, Inc., a Nevada corporation (“TruGolf Nevada”), which provided

for, among other things, the merger of Merger Sub with and into TruGolf Nevada (the “Merger”), with TruGolf Nevada being

the surviving corporation of the Merger and having become a direct, wholly owned subsidiary of DMAQ as a consequence of the Merger (together

with the other transactions contemplated by the Business Combination Agreement, the “Business Combination”) In connection

with the Business Combination, DMAQ changed its name to “TruGolf Holdings, Inc.”

Item

4.01 Changes in Registrant’s Certifying Accountant.

Change

of the Company’s Independent Registered Public Accounting Firm

Part (a)

On

February 19, 2024, the Audit Committee of the Board of Directors of TruGolf Holdings, Inc. (“Company”) approved the engagement

of Haynie & Company (“Haynie”) as independent registered public accounting firm to audit the Company’s consolidated

financial statements for the year ending December 31, 2023. Accordingly, MaloneBailey, LLP (“MaloneBailey”), the Company’s

independent registered public accounting firm prior to the Business Combination (completed on January 31, 2024) was dismissed on February

19, 2024.

MaloneBailey’s

reports on the Company’s balance sheets as of March 31, 2023 and March 31, 2022 and the related consolidated statements

of operations, changes in stockholders’ deficit, and cash flows for the years then ended did not contain any adverse opinion or

disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles, except that such report

contained an explanatory paragraph which noted that there was substantial doubt as to the Company’s ability to continue as a going

concern because of the Company’s liquidity condition and date for mandatory liquidation.

During

the Company’s fiscal years ended March 31, 2023 and March 31, 2022, through the date of MaloneBailey’s dismissal, there were

no: (i) disagreements with MaloneBailey on any matter of accounting principles or practices, financial statement disclosures or audited

scope or procedures, which disagreements if not resolved to MaloneBailey’s satisfaction would have caused MaloneBailey to make

reference to the subject matter of the disagreement in connection with its reports on the Company’s consolidated financial statements

for such years or any period through the date of dismissal or (ii) “reportable events” as defined in Item 304(a)(1)(v) of

Regulation S-K.

During

the Company’s fiscal years ended March 31, 2023 and March 31, 2022, and through the date of Haynie’s engagement, the Company

did not consult Haynie with respect to either: (i) the application of accounting principles to a specified transaction, either completed

or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements, and no written report or

oral advice was provided to the Company by Haynie that Haynie concluded was an important factor considered by the Company in reaching

a decision as to the accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a “disagreement,”

as that term is described in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K, or a reportable

event, as that term is defined in Item 304(a)(1)(v) of Regulation S-K.

The

Company has provided MaloneBailey with a copy of the disclosures made by the Company in response to this Item 4.01 and has requested

that MaloneBailey furnish the Company with a letter addressed to the SEC stating whether it agrees with the statements made by the registrant

in response to this Item 4.01 and, if not, stating the respects in which it does not agree. A letter from MaloneBailey is attached as

Exhibit 16.1 to this Current Report on Form 8-K.

TruGolf

Nevada has been determined to be the accounting acquirer for purposes of the Business Combination. The following information relates

to the changes in TruGolf Nevada’s independent registered public accounting firm.

Part (b)

CohnReznick

LLP (“CohnReznick”) served as the TruGolf Inc.’s independent

registered public accounting firm for the fiscal year ended December 31, 2022. On February 2, 2024, CohnReznick was dismissed.

CohnReznick’s

report of independent registered public accounting firm, dated July 31, 2023, on TruGolf Inc.’s

balance

sheet as of December 31, 2022 and the related statements of operations, changes in stockholders’ deficit, and cash flows for the

years then ended did not contain any adverse opinion or disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit

scope or accounting principles.

During

the fiscal year ended December 31, 2022, and the subsequent interim period through February 2, 2024, there were:

| |

(i) |

no

disagreements (as described in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) between TruGolf Inc.

and

CohnReznick on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure,

which disagreements, if not resolved to CohnReznick’s satisfaction, would have caused CohnReznick to make reference to the

subject matter of disagreement in connection with its reports on the Company’s financial statements for such year; and |

| |

|

|

| |

(ii) |

no

“reportable events” within the meaning of Item 304(a)(1)(v) of Regulation S-K. |

TruGolf

Inc. provided

CohnReznick with a copy of the disclosures it is making in response to this Item 4.01 and requested that CohnReznick furnish a letter

addressed to the SEC stating whether CohnReznick agrees with the statements made herein. A copy of CohnReznick’s letter dated February

23, 2024,

is filed as Exhibit 16.2 to this Current Report on Form 8-K.

Part (c)

Daszkal

Bolton LLP (“Daszkal”) served as TruGolf Inc.’s independent

registered public accounting firm for the fiscal year ended December 31, 2021. On April 5, 2023, TruGolf Inc.

was

advised by Daszkal that Daszkal completed a combination with CohnReznick. On April 5, 2023, TruGolf Inc.

engaged

CohnReznick to serve as its independent registered public accounting firm for the fiscal year ended December 31, 2022.

Daszkal’s

report of independent registered public accounting firm, dated December 6, 2022, on TruGolf Inc.’s

balance

sheet as of December 31, 2021 and the related statements of operations, changes in stockholders’ deficit, and cash flows for the

year then ended did not contain any adverse opinion or disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit

scope or accounting principles.

During

the fiscal year ended December 31, 2021, and the subsequent interim period, there were:

| |

(i) |

no

disagreements (as described in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) between TruGolf Inc.

and

Daszkal on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which

disagreements, if not resolved to Daszkal’s satisfaction, would have caused Daszkal to make reference to the subject matter

of disagreement in connection with its reports on TruGolf Inc.’s financial

statements for such year; and |

| |

|

|

| |

(ii) |

no

“reportable events” within the meaning of Item 304(a)(1)(v) of Regulation S-K. |

The

Company provided Daszkal with a copy of the disclosures it is making in response to this Item 4.01 and requested that Daszkal furnish

a letter addressed to the SEC stating whether Daszkal agrees with the statements made herein. A copy of Daszkal’s letter dated

February 23, 2024, is filed as Exhibit 16.3 this Current Report on Form 8-K.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

February 23, 2024 |

TRUGOLF HOLDINGS, INC. |

| |

|

|

| |

By: |

/s/

Lindsay Jones |

| |

Name: |

Lindsay

Jones |

| |

Title: |

Chief

Financial Officer |

Exhibit

16.1

February

23, 2024

U.S.

Securities and Exchange Commission

450

Fifth Street N.W.

Washington,

DC 20549

RE:

TruGolf Holdings, Inc. F/K/A Deep Medicine Acquisition Corp.

File

No.: 001-40970

We

have read the statements under item 4.01 of the Form 8-K to be filed with the Securities and Exchange Commission. We agree with statements

pertaining to us.

MaloneBailey,

LLP

www.malonebailey.com

Houston,

Texas

Exhibit

16.2

February

23, 2024

U.S.

Securities and Exchange Commission

100

F Street, NE

Washington,

DC 20549

Re:

TruGolf Inc. Changes in Registrant’s Certifying Accountant

We

have read the statements made by TruGolf Holdings, Inc., which we understand will be filed with the Securities and Exchange Commission,

on Form 8-K of the Company dated February 19, 2024, and agree with such statements contained therein in Part (b) as they pertain

to CohnReznick LLP.

Sincerely,

/s/

CohnReznick LLP

CohnReznick

LLP

Boca

Raton, Florida

Exhibit

16.3

February

23, 2024

U.S.

Securities and Exchange Commission

100

F Street, NE

Washington,

DC 20549

Re:

TruGolf Inc. Changes in Registrant’s Certifying Accountant

We

have read the statements made by TruGolf Holdings, Inc., which we understand will be filed with the Securities and Exchange Commission,

on Form 8-K of the Company dated February 19, 2024, and agree with such statements contained therein in Part (c) as they pertain

to Daszkal Bolton LLP.

Sincerely,

/s/

Daszkal Bolton LLP

Daszkal

Bolton LLP

Boca

Raton, Florida

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

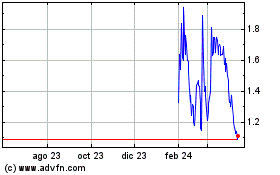

TruGolf (NASDAQ:TRUG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

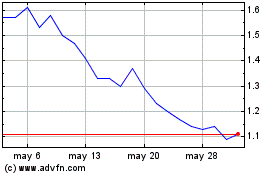

TruGolf (NASDAQ:TRUG)

Gráfica de Acción Histórica

De May 2023 a May 2024