UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE

14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed by the Registrant ☒ |

| Filed by a Party other than the Registrant ☐ |

| |

| Check the appropriate box: |

| |

| ☐

Preliminary Proxy Statement |

| ☐ Confidential, For Use of the Commission Only

(as permitted by Rule 14a-6(e)(2) |

| ☒

Definitive Proxy Statement |

| ☐ Definitive Additional Materials |

| ☐ Soliciting Material Pursuant to §240.14a-12 |

TruGolf

Holdings, Inc.

(Name

of Registrant as Specified in its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment

of Filing Fee (Check the appropriate box): |

| |

| |

☒

No fee required. |

| |

☐

Fee paid previously with preliminary materials. |

| |

☐

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

TRUGOLF

HOLDINGS, INC.

60

North 1400

West

Centerville, Utah 84014

February

26, 2024

Dear

Fellow Stockholder:

On

behalf of the Board of Directors (the “Board”) and management of TruGolf Holdings, Inc. (the “Company”), you

are cordially invited to attend the Special Meeting of Stockholders of the Company to be held online at https://www.cleartrustonline.com/trugolf,

on March 11, 2024, at 10:00 a.m., Eastern Time (the “Special Meeting”).

The

attached Notice of the Special Meeting (the “Notice”) and proxy statement (“Proxy Statement”) describe in greater

detail all of the formal business that will be transacted at the Special Meeting. There will not be a physical location for the Special

Meeting. You will be able to attend the Special Meeting online, vote your shares electronically, and submit your questions during the

meeting by visiting https://www.cleartrustonline.com/trugolf. Directors and officers of the Company will be available at the Special

Meeting to respond to any questions that you may have regarding the business to be transacted.

The

Company’s Board has determined that each of the proposals that will be presented to the stockholders for their consideration at

the Special Meeting are in the best interests of the Company and its stockholders, and unanimously recommends and urges you to vote “FOR”

the proposals set forth in this Proxy Statement. If any other business is properly presented at the Special Meeting, the proxies

will be voted in accordance with the recommendations of the Company’s Board.

We

encourage you to attend the Special Meeting online, but if you are unable to attend, it is important that you vote in advance via the

Internet, by telephone, or sign, date and return the enclosed proxy card in the enclosed postage-paid envelope. Your cooperation is appreciated

since a majority of the common stock entitled to vote must be represented, either in person or by proxy, to constitute a quorum for the

transaction of business at the Special Meeting.

On

behalf of the Board and all of the employees of the Company, we thank you for your continued support.

| Sincerely, |

|

| |

|

| /s/ Christopher Jones |

|

| Christopher Jones |

|

| Chief Executive Officer |

|

TRUGOLF

HOLDINGS, INC.

60

North 1400

West

Centerville, Utah 84014

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS TO BE HELD MARCH 11, 2024

NOTICE

IS HEREBY GIVEN that a Special Meeting of Stockholders (the “Special Meeting”) of TruGolf Holdings, Inc. (the “Company”)

will be held online at https://www.cleartrustonline.com/trugolf, on March 11, 2024, at 10:00 a.m., Eastern Time, for the following

purposes:

Proposal

1. To approve, for purposes of complying with Nasdaq Listing Rule 5635(d), our issuance of all of the shares of our Class A common

stock upon conversion of the PIPE Convertible Notes (defined herein) and upon exercise of the PIPE Warrants (defined herein), without

regard to any limitations on conversion or exercise set forth in the PIPE Convertible Notes or PIPE Warrants, respectively, and assuming

all Additional Notes (defined herein) have been issued and all adjustments with respect to such issuances shall have been made to the

PIPE Convertible Notes and PIPE Warrants, as applicable (collectively, the “Nasdaq Proposal”).

Proposal

2. To approve an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes

in favor of the Nasdaq Proposal (the “Adjournment Proposal”).

Please

refer to the proxy statement for the Special Meeting (the “Proxy Statement”) for detailed information on the Nasdaq Proposal

and Adjournment Proposal.

The

Board of Directors (the “Board”) is not aware of any other business that will be presented for consideration at the Special

Meeting. If any other matters should be properly presented at the Special Meeting or any adjournments or postponements of the Special

Meeting for action by stockholders, the persons named in the form of proxy will vote the proxy in accordance with their best judgment

on that matter.

The

Board recommends that you vote “FOR” the Nasdaq Proposal and “FOR” the Adjournment Proposal.

Only

stockholders of record as of the close of business on February 15, 2024 are entitled to receive notice of, to attend and to vote at the

Special Meeting. If you are a beneficial owner as of that date, you will receive communications from your broker, bank or other nominee

about the Special Meeting and how to direct the vote of your shares, and you are welcome to attend the Special Meeting online, all as

described in more detail in the attached Proxy Statement.

Important

Notice Regarding the Availability of Proxy Materials for the Special Meeting to Be Held on March 11, 2024. The Proxy Statement and

form of Proxy are available on the Internet at https://www.cleartrustonline.com/trugolf and on our corporate website at www.trugolf.com

under “Investor Relations—SEC Filings.”

By

Order of the Board of Directors,

| /s/ Christopher Jones |

|

| Christopher Jones |

|

| Chief Executive Officer |

|

| February 26, 2024 |

|

TABLE

OF CONTENTS

TRUGOLF

HOLDINGS, INC.

60

North 1400

West

Centerville, Utah 84014

PROXY

STATEMENT

GENERAL

INFORMATION

For

the Special Meeting of Stockholders

To

Be Held on March 11, 2024

Our

Board of Directors is soliciting proxies to be voted at the Special Meeting of Stockholders (the “Special Meeting”) to be

held virtually on March 11, 2024, at 10:00 a.m., Eastern Time, for the purposes set forth in the attached Notice of Special Meeting

of Stockholders (the “Notice”) and in this Proxy Statement. This Proxy Statement and the proxies solicited hereby are being

first sent or delivered to stockholders of the Company on or about February 26, 2024.

As

used in this Proxy Statement, the terms “Company,” “we,” “us,” “our” and “TruGolf”

refer to TruGolf Holdings, Inc., and the terms “Board of Directors” and “Board” refers to the Board of Directors

of the Company.

QUESTIONS

AND ANSWERS ABOUT THE SPECIAL MEETING

What

information is contained in this Proxy Statement?

This

information relates to the proposals to be voted on at the Special Meeting, the voting process, and certain other required information.

Can

I access the Company’s proxy materials electronically?

Yes.

The Proxy Statement and form of Proxy are available at https://www.cleartrustonline.com/trugolf. To view this material, you must have

available the control number located on the proxy card or, if shares are held in the name of a broker, bank or other nominee, the voting

instruction form.

What

does it mean if I receive more than one set of proxy materials?

It

means your shares are registered differently or are in more than one account. Please provide voting instructions for each account for

which you have received a set of proxy materials.

Who

is soliciting my vote pursuant to this Proxy Statement?

Our

directors and employees may solicit proxies in person, by telephone, fax, electronic transmission or other means of communication. We

will not pay these directors and employees any additional compensation for these services. We will ask banks, brokerage firms, and other

institutions, nominees, and fiduciaries to forward these proxy materials to their principal, and to obtain authority to execute proxies,

and will reimburse them for their expenses.

Who

is entitled to vote?

Only

stockholders of record at the close of business on the Record Date will be entitled to vote at the Special Meeting.

How

many shares are eligible to be voted?

As

of the Record Date, we had 13,255,112 shares of common stock outstanding, of which 11,538,252 shares are Class A common stock and 1,716,860

shares are Class B common stock. Each outstanding share of our Class A common stock will entitle its holder to one vote on each of the

matters to be voted on at the Special Meeting, and each outstanding share of our Class B common stock will entitle its holder to 25 votes

on each proposal at the Special Meeting.

What

am I voting on?

You

are voting on the following matters:

1. Nasdaq

Proposal. To approve, for purposes of complying with Nasdaq Listing Rule 5635(d), our issuance of all of the shares of our Class

A common stock upon conversion of the PIPE Convertible Notes (defined herein) and upon exercise of the PIPE Warrants (defined herein),

without regard to any limitations on conversion or exercise set forth in the PIPE Convertible Notes or PIPE Warrants, respectively, and

assuming all Additional Notes (defined herein) have been issued and all adjustments with respect to such issuances shall have been made

to the PIPE Convertible Notes and PIPE Warrants, as applicable (collectively, the “Nasdaq Proposal”).

2. Adjournment

Proposal. To approve an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient

votes in favor of the Nasdaq Proposal (the “Adjournment Proposal”).

How

does the Board recommend that I vote?

The

Board unanimously recommends that you vote your shares as follows:

| |

☐ |

“FOR”

the Nasdaq Proposal; and |

| |

☐ |

“FOR”

the Adjournment Proposal |

None

of our directors have informed us in writing that he or she intends to oppose any action intended to be taken by us at the Special Meeting.

How

many votes are required to hold the Special Meeting and what are the voting procedures?

Quorum

Requirement: As of the Record Date, 13,255,112 shares of the Company’s common stock were issued and outstanding, of

which 11,538,252 shares are Class A common stock and 1,716,860 shares are Class B common stock. The shares of Class B common stock are

entitled to 25 votes per share. The holders of a majority in voting power of the issued and outstanding shares entitled to vote at the

Special Meeting, present or represented by proxy, constitutes a quorum for the purpose of adopting proposals at the Special Meeting.

If you submit a properly executed proxy, then you will be considered part of the quorum.

Required

Votes: Each outstanding share of our Class A common stock is entitled to one vote on each proposal at the Special Meeting,

and each outstanding share of our Class B common stock is entitled to 25 votes on each proposal at the Special Meeting. If there is a

quorum at the Special Meeting, the matters to be voted upon by the stockholders require the following votes for such matter to be approved:

| |

☐ |

Approval

of the Nasdaq Proposal: The affirmative vote of the holders of at least the majority of the voting power of the votes cast

(in person or by proxy) at the Special Meeting is necessary to approve the Nasdaq Proposal. Abstentions and broker non-votes will

have no effect on the outcome of this proposal. |

| |

☐ |

Approval

of the Adjournment Proposal: The affirmative vote of the holders of at least the majority of the voting power of the votes

cast (in person or by proxy) at the Special Meeting is necessary to approve the Adjournment Proposal. Abstentions and broker non-votes

will have no effect on the outcome of this proposal. |

If

a broker indicates on its proxy that it submits to the Company that it does not have authority to vote certain shares held in “street

name,” the shares not voted are referred to as “broker non-votes.” Broker non-votes occur when brokers do not have

discretionary voting authority to vote certain shares held in “street name” on particular proposals under the rules of the

New York Stock Exchange, and the “beneficial owner” of those shares has not instructed the broker how to vote on those proposals.

If you are a beneficial owner and you do not provide instructions to your broker, bank or other nominee, your broker, bank or other nominee

is permitted to vote your shares for or against “routine” matters. Brokers are not permitted to exercise discretionary voting

authority to vote your shares for or against “non-routine” matters.

How

can I vote my shares in person and participate at the Special Meeting?

The

Special Meeting will be held entirely online. Stockholders may participate in the Special Meeting by visiting the following website:

https://www.cleartrustonline.com/trugolf. To participate in the Special Meeting, you will need the control number included on your proxy

card or on the instructions that accompanied your proxy materials. Shares held in your name as the stockholder of record may be voted

electronically during the Special Meeting. Shares for which you are the beneficial owner but not the stockholder of record also may be

voted electronically during the Special Meeting in accordance with the instructions from your broker, bank or other nominee. However,

even if you plan to attend the Special Meeting online, the Company recommends that you vote your shares in advance, so that your vote

will be counted if you later decide not to attend the Special Meeting.

How

can I vote my shares without attending the Special Meeting?

If

you are the stockholder of record, you may vote by one of the following four methods:

| |

☐ |

Online

at the Special Meeting; |

| |

|

|

| |

☐ |

Via

the Internet; |

| |

|

|

| |

☐ |

By

telephone; or |

| |

|

|

| |

☐ |

By

mail. |

If

you elect to vote by mail and you requested and received a printed set of proxy materials, you may mark, sign, date and mail the proxy

card you received from us in the return envelope. If you did not receive a printed proxy card and wish to vote by mail, you may do so

by requesting a paper copy of the proxy materials (as described below), which will include a proxy card.

Whichever

method of voting you use, the proxies identified on the proxy card will vote the shares of which you are the stockholder of record in

accordance with your instructions. If you submit a proxy card properly voted and returned through available channels without giving specific

voting instructions, the proxies will vote the shares as recommended by our Board.

If

you own your shares in “street name,” that is, through a brokerage account or in another nominee form, you must provide instructions

to the broker or nominee as to how your shares should be voted. Your broker or nominee will usually provide you with the appropriate

instruction forms at the time you receive the proxy materials. If you own your shares in this manner, you cannot vote in person at the

Special Meeting unless you receive a proxy to do so from the broker or the nominee.

How

may I cast my vote over the Internet or by Telephone?

Voting

over the Internet: If you are a stockholder of record, you may use the Internet to transmit your vote up until 11:59 P.M., Eastern

Time, March 10, 2024 (the day before the Special Meeting). Visit https://www.cleartrustonline.com/trugolf and have your proxy card in

hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form.

Voting

by Telephone: If you are a stockholder of record, you may call 1-813-235-4490, toll-free in the United States, U.S. territories

and Canada, and use any touch-tone telephone to transmit your vote up until 11:59 P.M., Eastern Time, March 10, 2024 (the day before

the Special Meeting). Have your proxy card in hand when you call and then follow the instructions.

If

you hold your shares in “street name,” that is through a broker, bank or other nominee, that institution will instruct you

as to how your shares may be voted by proxy, including whether telephone or Internet voting options are available.

How

may a stockholder bring any other business before the Special Meeting?

The

Company’s bylaws (the “Bylaws”) provide that the only matters that may be brought before a special meeting are the

matters specified in the notice of meeting, and, as such, stockholders shall not be permitted to propose business at the Special Meeting.

How

may I revoke or change my vote?

If

you are the record owner of your shares, and you completed and submitted a proxy card, you may revoke your proxy at any time before it

is voted at the Special Meeting by:

| |

☐ |

submitting

a new proxy card with a later date; |

| |

☐ |

delivering

written notice to our Corporate Secretary on or before 10:00 a.m. Eastern Time on, March 11, 2024 (the Special Meeting date

and time), stating that you are revoking your proxy; |

| |

☐ |

attending

the Special Meeting and voting your shares online; or |

| |

☐ |

if

you are a record owner of your shares and you submitted your proxy by telephone or via the Internet, you may change your vote or

revoke your proxy with a later telephone or Internet proxy, as the case may be. |

Please

note that attendance at the Special Meeting will not, in itself, constitute revocation of your proxy.

If

you own your shares in “street name,” you may later revoke your voting instructions by informing the bank, broker or other

holder of record in accordance with that entity’s procedures.

Who

is paying for the costs of this proxy solicitation?

The

Company will bear the cost of preparing, printing, and mailing the materials in connection with this solicitation of proxies. In addition

to mailing these materials, officers and regular employees of the Company may, without being additionally compensated, solicit proxies

personally and by mail, telephone, facsimile or electronic communication.

Are

there any rights of appraisal?

The

Board of Directors is not proposing any action for which the laws of the State of Delaware, our Third Amended and Restated Certificate

of Incorporation or our Bylaws provide a right of a stockholder to obtain appraisal of or payment for such stockholder’s shares.

Who

will count the votes?

The

inspector of election appointed for the Special Meeting will receive and tabulate the ballots and voting instruction forms. The Board

has appointed ClearTrust, LLC, or its designee, to serve as the inspector of election.

Where

do I find the voting results of the Special Meeting?

The

voting results will be disclosed in a Current Report on Form 8-K that we will file with the SEC within four (4) business days after the

Special Meeting.

How

can I obtain the Company’s corporate governance information?

Our

corporate governance information is available on our website at www.trugolf.com under “Investor Relations—Corporate Governance.”

Our stockholders may also obtain written copies at no cost by writing to us at TruGolf Holdings, Inc., 60 North 1400 West Centerville,

Utah 84014, Attention: Corporate Secretary, or by calling (917) 289-2776.

How

do I request electronic or printed copies of this and future proxy materials?

You

may request and consent to delivery of electronic or printed copies of this and future proxy statements, annual reports and other stockholder

communications by visiting www.cleartrustonline.com/trugolf:

When

requesting copies of proxy materials and other stockholder communications, you should have available the control number located on the

proxy card or, if shares are held in the name of a broker, bank or other nominee, the voting instruction form.

BENEFICIAL

OWNERSHIP OF COMMON STOCK

The

following table sets forth information regarding the beneficial ownership of our common stock as of February 14, 2024:

| |

☐ |

each

person or group known by us to own beneficially more than five percent (5%) of the outstanding shares of common stock; |

| |

☐ |

each

of our executive officers and directors; and |

| |

☐ |

all

of our directors and executive officers as a group. |

We

have determined beneficial ownership in accordance with the rules of the SEC. These rules generally provide that a person is the beneficial

owner of securities if such person has or shares the power to vote or direct the voting of securities, or to dispose or direct the disposition

of securities, or has the right to acquire such powers within 60 days through (i) the exercise of any option or warrant, (ii) the conversion

of a security, (iii) the power to revoke a trust, discretionary account or similar arrangement or (iv) the automatic termination of a

trust, discretionary account or similar arrangement.

Except

as otherwise indicated, we believe that the beneficial owners of common stock listed below, based on the information each of them has

given to us, have sole investment and voting power with respect to their shares, except where community property laws may apply. Except

as otherwise noted below, the address for each person or entity listed in the table is c/o TruGolf Holdings, Inc., 60 North 1400 West

Centerville, Utah 84014.

| Name of Beneficial Owner | |

Class A Common Stock | | |

Percent of

Class A

Common Stock (%) | | |

Class B Common Stock | | |

Percent of

Class B

Common Stock (%) | | |

Total Voting Power (%) | |

| Directors and Executive Officers | |

| | | |

| | | |

| | | |

| | | |

| | |

| Christopher Jones (4) | |

| 2,352,113 | | |

| 20.4 | % | |

| 860,082 | | |

| 50.1 | % | |

| 43.0 | % |

| Lindsay Jones | |

| 15,000 | | |

| * | | |

| | | |

| | | |

| * | |

| Brenner Adams | |

| 141,832 | | |

| 1.2 | % | |

| - | | |

| - | | |

| * | |

| Nathan E. Larson | |

| 206,832 | | |

| 1.8 | % | |

| - | | |

| - | | |

| * | |

| B. Shaun Limbers | |

| 293,443 | | |

| 2.5 | % | |

| - | | |

| - | | |

| * | |

| Steven R. Johnson | |

| 1,353,134 | | |

| 11.7 | % | |

| - | | |

| - | | |

| 2.5 | % |

| Humphrey P. Polanen | |

| 125,000 | | |

| 1.1 | % | |

| - | | |

| - | | |

| * | |

| Riley Russell | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| AJ Redmer | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| All directors and executive officers as a group (9 individuals) | |

| 4,487,354 | | |

| 38.9 | % | |

| 439,952 | | |

| 25.6 | % | |

| 28.4 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| 5% Beneficial Owners | |

| | | |

| | | |

| | | |

| | | |

| | |

| David Ashby (2) | |

| 988,253 | | |

| 8.6 | % | |

| 439,952 | | |

| 25.6 | % | |

| 22.0 | % |

| Steven R. Johnson (3) | |

| 936,308 | | |

| 8.1 | % | |

| 416,826 | | |

| 24.3 | % | |

| 20.9 | % |

| Christopher Jones (4) | |

| 1,931,983 | | |

| 16.7 | % | |

| 860,082 | | |

| 50.1 | % | |

| 43.0 | % |

| Bright Vision Sponsor LLC (1) | |

| 2,492,566 | | |

| 21.6 | % | |

| - | | |

| - | | |

| 4.6 | % |

| * |

Less

than 1%. |

| |

|

| (1) |

Mr.

Li served as the managing member of the sponsor. Mr. Li disclaims beneficial ownership of these securities. |

| |

|

| (2) |

Includes

439,952 shares of Class B Common Stock, which are entitled to 25 votes per share and are convertible into shares of Class A Common

Stock on a one-for-one basis. |

| (3) |

Includes

416,826 shares of Class B Common Stock, which are entitled to 25 votes per share and are

convertible into shares of Class A Common Stock on a one-for-one basis.

|

| (4) |

Includes

860,082 shares of Class B Common Stock, which are entitled to 25 votes per share and are convertible into shares of Class A Common

Stock on a one-for-one basis. |

PROPOSAL

1: THE NASDAQ PROPOSAL

Background

and Overview

On

February 2, 2024, the Company executed a securities purchase agreement (the “Purchase Agreement”) with certain investors

(the “PIPE Investors”) pursuant to which the PIPE Investors agreed to purchase from the Company (i) senior convertible notes

in the aggregate principal amount of up to $15,500,000 (the “PIPE Convertible Notes”), (ii) Series A warrants to initially

purchase 1,409,091 shares of the Company’s Class A common stock (the “Series A Warrants”); and (iii) Series B warrants

to initially purchase 1,550,000 shares of the Company’s Class A common stock (the “Series B Warrants,” and collectively

with the Series A Warrants, the “PIPE Warrants”) (the “PIPE Financing”).

The

Purchase Agreement contemplates funding of the investment (the “Investment”) across multiple tranches. At the first closing

(the “Initial Closing”), which occurred on February 6, 2024, an aggregate principal amount of $4,650,000 of PIPE Convertible

Notes were issued in exchange for aggregate gross proceeds of $4,185,000, representing an original issue discount of 10%. On such date

(the “Initial Closing Date”), the Company also issued the PIPE Investors the Series A Warrants and the Series B Warrants.

Subject

to satisfying certain conditions, the Company has the right under the Purchase Agreement, but not the obligation, to require that the

PIPE Investors purchase additional PIPE Convertible Notes at up to two additional closings. Upon notice at any time after the 2nd trading

day following the Initial Closing Date, the Company may require that the PIPE Investors purchase an additional aggregate principal amount

of $4,650,000 of PIPE Convertible Notes, in exchange for aggregate gross proceeds of $4,185,000, if (i) the registration statement (the

“Registration Statement”) required to be filed pursuant to registration rights agreement (the “Registration Rights

Agreement”) between the parties has been filed (which filing occurred on February 14, 2024); and (ii) certain customary closing

conditions are satisfied (the “First Mandatory Additional Closing”). Upon notice at any time after the 2nd trading day following

the date that the First Mandatory Additional Closing is consummated, the Company may require that the PIPE Investors purchase an additional

aggregate principal amount of $6,200,000 of PIPE Convertible Notes, in exchange for aggregate gross proceeds of $5,580,000, if (i) the

Company’s shareholders approve this Proposal 1 at the Special Meeting; (ii) the Registration Statement has been declared effective

by the SEC; and (iii) certain customary closing conditions are satisfied (the “Second Mandatory Additional Closing”).

In

addition, pursuant to the Purchase Agreement, each PIPE Investor has the right, but not the obligation, to require that, upon notice,

the Company sell to such PIPE Investor at one or more additional closings such PIPE Investor’s pro rata share of up to a maximum

aggregate principal amount of $10,850,000 in additional PIPE Convertible Notes (each such additional closing, an “Additional Optional

Closing”); provided that, the principal amount of the additional PIPE Convertible Notes issued at each Additional Optional Closing

must equal at least $250,000. If a PIPE Investor has not elected to effect an Additional Optional Closing on or prior to August 2, 2024,

such PIPE Investor shall have no further right to effect an Additional Optional Closing under the Purchase Agreement. We refer to the

PIPE Convertible Notes that may be issued pursuant to a First Mandatory Additional Closing,

Second Mandatory Additional Closing or Additional Optional Closing as the “Additional Notes.”

Description

of the PIPE Convertible Notes

General.

The PIPE Convertible Notes will mature on the date that is five years from each respective issuance date (the “Maturity Date”),

unless earlier converted (only upon the satisfaction of certain conditions). The Maturity Date may be extended at the sole option of

the holders, under certain circumstances specified therein. The PIPE Convertible Notes will

have an original issue discount of 10%.

Ranking.

The PIPE Convertible Notes

will be our senior unsecured obligations and not the financial obligations of our subsidiaries. Until such date no PIPE Convertible

Notes remain outstanding, all payments due under the PIPE Convertible Notes

will be senior to all of our subordinated indebtedness and subordinated indebtedness of any of our subsidiaries and equal in right of

payment with all of our other indebtedness and other indebtedness of any of our subsidiaries.

Interest.

The PIPE Convertible Notes

bear interest at the rate of 10.0% per annum that (a) shall commence accruing on the date of issuance, (b) shall be computed on the basis

of a 360-day year and twelve 30-day months, and (c) shall be payable in shares of the Company’s Class A common stock so long as

certain conditions are met, provided that the Company may at its option pay such interest in cash or a combination of cash and shares

of the Company’s Class A common stock; provided further that if such interest is being paid in shares of the Company’s Class

A common stock it shall bear interest at the rate of 15.0% per annum. If a holder elects to convert or redeem all or any portion of a

Note prior to the Maturity Date, all accrued and unpaid interest, any make-whole amount, and any late charges on the amount being converted

or redeemed will also be payable.

The

interest rate of the PIPE Convertible Notes

will automatically increase to 15% per annum (the “Default Rate”) upon the occurrence and continuance of an event of default

(See “— Events of Default” below).

Conversion

Rights.

Conversion

at Option of Holder. Each holder of PIPE Convertible Notes may convert all, or any part,

of the outstanding PIPE Convertible Notes, at any time at such holder’s option, into

shares of the Company’s Class A common stock at an initial “Conversion Price”

of $10.00 per share, which is subject to proportional adjustment upon the occurrence of any stock split, stock dividend, stock combination

and/or similar transactions. Upon the voluntary conversion by the holders of the PIPE Convertible Notes, in addition to the issuance

of the Class A common stock issuable upon conversion of the principal amount of PIPE Convertible Notes, the Company shall issue to the

holders in Class A common stock the sum of (A) all accrued interest on the PIPE Convertible Notes to date plus (B) all interest that

would otherwise accrued on such principal amount of the PIPE Convertible Notes if such converted principal would be held to the Maturity

Date at the Conversion Price (the “Make Whole Amount”).

With

limited exceptions, if the Company at any time while a PIPE Convertible Note is outstanding, issues any Class A common stock or securities

entitling any person or entity to acquire shares of Class A common stock (upon conversion, exercise or otherwise), at an effective price

per share less than the Conversion Price then the Conversion Price shall be reduced to the same price as the new investment.

Limitations

on Conversion. A holder shall not have the right to convert any portion of a PIPE Convertible Note to the extent that, after giving

effect to such conversion, the holder (together with certain related parties) would beneficially own in excess of 4.99%, or the “Maximum

Percentage”, of shares of the Company’s Class A common stock outstanding immediately

after giving effect to such conversion. The Maximum Percentage may be raised or lowered to any other percentage not in excess of 9.99%,

at the option of the holder, except that any increase will only be effective upon 61 days’ prior notice to the

Company.

Voluntary

Adjustment Right. Subject to the rules and regulations of the Nasdaq, the Company has the

right, at any time, with the written consent of certain holders of the PIPE Convertible Notes,

to lower the fixed conversion price to any amount and for any period of time deemed appropriate by the

Company’s board of directors. Any voluntary reduction of the conversion price would proportionately increase the number

of shares of Class A common stock that would be issuable upon conversion.

Alternate

Conversion Upon Event of Default. Following the occurrence and during the continuance of an Event of Default (as defined below),

each holder may alternatively elect to convert all or any portion of such holder’s PIPE Convertible Notes at the “Alternate

Conversion Price” equal to the lesser of (i) the Conversion Price, and (ii) 90% of the lowest VWAP of the Class A common stock

during the five consecutive trading days immediately prior to such conversion.

Other

Adjustments. The initial conversion price (the “Conversion Price”) of the PIPE Convertible Notes is $10.00 per share;

provided that the Conversion Price will be automatically reduced to the applicable Adjustment Price (as defined below) if on (i) the

45th calendar day after the initial issuance date, and/or (ii) the date the Registration Statement (as described below) is declared effective

by the SEC (each, an “Adjustment Measuring Date”), the greater of (A) $2.00 with respect to $5.0 million in principal amount

of PIPE Convertible Notes and $2.50 with respect to the remainder of the PIPE Convertible Notes (as adjusted for stock splits, stock

dividends, stock combinations, recapitalizations and similar events), and (B) the lowest volume weighted average price (“VWAP”)

on any trading day during the five trading day period ended, and including, the trading day immediately prior to such applicable Adjustment

Measuring Date (each, an “Adjustment Price”), is less than the Conversion Price then in effect.

Redemption

Rights.

Holder

Event of Default Redemption. Upon an Event of Default, each holder may elect to redeem all or any portion such holder’s PIPE

Convertible Notes in cash at a redemption premium of 25% to the greater of (i) the amount then outstanding under such notes, and (ii)

the equity value of the Company’s Class A common stock underlying the PIPE Convertible

Notes. The equity value of the Company’s Class A common stock underlying the PIPE

Convertible Notes is calculated using the greatest closing sale price of the Company’s Class

A common stock on any trading day immediately preceding such event of default and the date it makes the entire payment required.

Holder

Bankruptcy Event of Default Mandatory Redemption. Upon any bankruptcy Event of Default, the

Company shall immediately redeem in cash all amounts due under the PIPE Convertible Notes at a 25% premium unless the holder waives

such right to receive such payment.

Holder

Change of Control Redemption. Upon a change of control of the Company, each holder may require the

Company to redeem in cash all, or any portion, of the PIPE Convertible Notes at a 5% redemption premium to the greater of the

amount then outstanding under the PIPE Convertible Notes to be redeemed, and the equity value of the

Company’s Class A common stock underlying the PIPE Convertible Notes. The equity value of the

Company’s Class A common stock underlying the PIPE Convertible Notes is calculated using the greatest closing sale price

of the Company’s Class A common stock on any trading day immediately preceding the

earlier of (i) the public announcement of such change of control and (ii) the consummation of such change of control, and ending on the

date the Company makes the entire payment required.

Company

Optional Redemption. At any time, the Company shall have the right to redeem in cash all, but not less than all, of the PIPE Convertible

Notes at price equal to the greater of (i) the amount outstanding under such PIPE Convertible Note, and (ii) the equity value of the

Company’s Class A common stock underlying the PIPE Convertible Notes. The equity value of the

Company’s Class A common stock underlying the PIPE Convertible Notes is calculated using the greatest closing sale price

of the Company’s Class A common stock on any trading day immediately preceding the

date that the Company delivers notice of such redemption and the date the

Company makes the entire payment required.

Events

of Default. The PIPE Convertible Notes contain standard and customary events of defaults (each, an “Event of Default”),

including but not limited: (i) the suspension from trading or the failure to list the Company’s

Class A common stock within certain time periods; (ii) failure to pay to the holder any amount of principal, Make-Whole Amount,

interest, late charges or other amounts when due; (iii) the failure to timely file or make effective a registration statement on Form

S-3 pursuant to the Registration Rights Agreement, (iv) the Company’s failure to cure

a conversion failure or failure to deliver shares of its Class A common stock under the PIPE Warrants, or notice of the

Company’s intention not to comply with a request for conversion of any PIPE Convertible Note or a request for exercise of

any PIPE Warrants, and (iv) bankruptcy or insolvency of the Company.

Purchase

Rights. If at any time the Company grants, issues or sells any options, convertible securities, or rights to purchase stock, warrants,

securities or other property pro rata to all or substantially all of the record holders of any class of its common stock (the “Purchase

Rights”), then each holder of PIPE Convertible Notes will be entitled to acquire, upon the terms applicable to such Purchase Rights,

the aggregate Purchase Rights which such holder could have acquired if such holder had held the number of shares of Class A common stock

acquirable upon complete conversion of all the PIPE Convertible Notes held by such holder immediately prior to the date as of which the

record holders of shares of Class A common stock are to be determined for the grant, issue or sale of such Purchase Rights; subject to

certain limitations on beneficial ownership.

Fundamental

Transaction. The PIPE Convertible Notes prohibit the Company from entering specified

fundamental transactions (including, without limitation, mergers, business combinations and similar transactions) unless the

Company (or its successor) assumes in writing all of the Company’s obligations

under the PIPE Convertible Notes and the other transaction documents in the PIPE Financing.

Description

of the Warrants

As

additional consideration for the purchase of the PIPE Convertible Notes, the Company issued to the PIPE Investors, the Series A Warrants

and the Series B warrants.

Series

A Warrants.

Exercise

Period; Number of Shares. The Series A Warrants shall expire five years after issuance and shall initially be exercisable for an

aggregate of 1,409,091 shares of Class A common stock, which number of shares shall be increased each time the holder exercises any Series

B Warrants in an amount equal to 91% of the shares of Class A common stock issued pursuant to such Series B Warrant exercise.

Exercise

Price. The initial exercise price of the Series A Warrants shall be $13.00 per share; provided that if on (A) the 45th

calendar day after issuance, and/or (B) the date the Registration Statement (as described below) is declared effective by the SEC (each,

a “Warrant Adjustment Measuring Date”), the exercise price then in effect is greater than the greater of (i) $4.00 (as adjusted

for stock splits, stock dividends, stock combinations, recapitalizations and similar events), and (ii) the lowest VWAP on any trading

day during the five trading day period ended, and including, the trading day immediately prior to such applicable Warrant Adjustment

Measuring Date, the exercise price shall automatically lower to such price.

Cashless

Exercise. If at the time of exercise of the Series A Warrants, there is no effective registration statement registering the shares

of the Company’s Class A common stock underlying such warrants, such warrants may

be exercised on a cashless basis pursuant to their terms.

Series

B Warrants

Exercise

Period. The Series B Warrants shall expire 30 months after issuance and shall initially be exercisable for an aggregate of 1,550,000

shares of Class A common stock.

Exercise

Price. The initial exercise price of the Series B Warrants shall be $10.00 per share.

Adjustments.

If at any time the sum of (i) the product of (x) the shares underlying the Series B Warrants then remaining and (y) the greater of (A)

$4.00 (as adjusted for stock split, stock dividends, stock combinations, recapitalizations and similar events) and (B) the exercise price

then in effect and (ii) the sum of the amounts in aggregate exercise price received from prior exercises is less than $15.5 million (the

amount of such difference, if any, each a “Deficiency Amount”), the shares underlying the Series B Warrants shall be increased

by the quotient of (I) such applicable Deficiency Amount, divided by (II) the exercise price then in effect; provided that the number

of shares underlying the Series B Warrants shall not be increased an amount greater than 250% of the original number of shares underlying

the Series B Warrants.

Participation

Rights. If the Company issues options, convertible securities, warrants, shares, or

similar securities to holders of the Company’s shares of our Class A common stock,

each Series B Warrant holder has the right to acquire the same as if the holder had exercised its warrant.

Dilutive

Issuances. With limited exceptions, if the Company at any time while the PIPE Warrants are outstanding, issues any Class A common

stock or securities entitling any person or entity to acquire shares of Class A common stock (upon conversion, exercise or otherwise),

at an effective price per share less than the exercise price of the PIPE Warrants (a “Dilutive Issuance”), then the exercise

price of the PIPE Warrants shall be reduced to the same price as the new investment. The adjustment to the PIPE Convertible Notes described

above on the Adjustment Measuring Date shall be deemed a Dilutive Issuance to the extent the date the Registration Statement (as described

below) is declared effective by the SEC after the 45th day after the issuance of the PIPE Warrants.

Fundamental

Transactions. The PIPE Warrants prohibit the Company from entering into specified fundamental

transactions unless the successor entity assumes all of the Company’s obligations

under the PIPE Warrants under a written agreement before the transaction is completed. Upon specified corporate events, a PIPE Warrant

holder will thereafter have the right to receive upon an exercise such shares, securities, cash, assets or any other property whatsoever

which the holder would have been entitled to receive upon the happening of the applicable corporate event had the PIPE Warrant been exercised

immediately prior to the applicable corporate event.

The

above descriptions set forth some but not all of the material terms of the PIPE Convertible Notes

and the PIPE Warrants. The full text of the foregoing securities are attached as exhibits to the Current Report on Form 8-K the

Company filed with the SEC on February 7, 2024.

Shareholder

Approval Requirement

In

compliance with Nasdaq Listing Rule 5635(d), we will not issue any shares of Class A common stock underlying the PIPE Convertible Notes

or the PIPE Warrants if the issuance of such shares of Class A common stock would exceed the aggregate number of shares of Class A common

stock which we may issue upon conversion of the PIPE Convertible Notes or exercise of the PIPE Warrants without breaching our obligations

under the rules or regulations of the Nasdaq Stock Market. Pursuant to the Purchase Agreement, we agreed to hold a special stockholder

meeting on or before April 1, 2024 seeking stockholder approval of the issuance of all of the Class A common stock underlying the PIPE

Convertible Notes or the PIPE Warrants in compliance with the rules and regulations of the Nasdaq Stock Market (without regard to any

limitations on conversion or exercise set forth in the PIPE Convertible Notes or PIPE Warrants, respectively, assuming all notes have

been issued and all adjustments with respect to such issuances shall have been made to the PIPE Warrants, as applicable). We are holding

this Special Meeting to satisfy the foregoing obligations.

Basis

of Shareholder Approval Requirements – Nasdaq Listing Rule 5635(d)

Summary

of Nasdaq Listing Rule 5635(d)

Our

common stock is listed on the NASDAQ Capital Market, and we are subject to the NASDAQ listing standards set forth in its Listing Rules.

Nasdaq Listing Rule 5635(d) requires stockholder approval for the issuance, other than in a public offering, of securities convertible

into Class A common stock at a price less than the greater of book or market value of the Class A common stock if the securities are

convertible into 20% or more of our Class A common stock.

The

Resolutions Subject to Approval at the Special Meeting

For

purposes of complying with Nasdaq Listing Rule 5635(d), pursuant to the Purchase Agreement, we agreed to hold this Special Meeting of

shareholders for approval of resolutions providing for our issuance of all of the shares of our Class A common stock upon conversion

of the PIPE Convertible Notes and upon exercise of the PIPE Warrants, without regard to

any limitations on conversion or exercise set forth in the PIPE Convertible Notes or PIPE Warrants, respectively, and assuming all Additional

Notes have been issued and all adjustments with respect to such issuances shall have been made to the PIPE Convertible Notes and PIPE

Warrants, as applicable.

Dilutive

Effect of Approval of this Proposal

Potential

Dilutive Effect of the PIPE Convertible Notes

Assuming

we issue all Additional Notes, we may issue up to $15.5 million in aggregate principal amount of PIPE

Convertible Notes. Assuming the PIPE Convertible Notes

are held to maturity or if the holders convert such notes into Class A common stock prior to maturity and receive the Make-Whole

Amount, the maximum amount of aggregate principal and interest convertible into Class A common stock will be $27.125 million. Below is

a table summarizing the number of shares of Class A common stock that are potentially issuable upon conversion of the PIPE Convertible

Notes at various assumed conversion prices. As the Alternate Conversion Price described above is

based on the price of our Class A common stock at the time of the event, and since the conversion price may also be adjusted if

we make a Dilutive Issuance as described above or voluntarily reduce such conversion price, the actual conversion price may be less than

the assumed prices set forth in the table.

| Conversion Price | |

$ | 10.00 | | |

$ | 5.00 | | |

$ | 2.50 | | |

$ | 2.00 | | |

$ | 1.00 | |

| Number of shares of Class A common stock issuable upon conversion | |

| 2,7125,000 | | |

| 5,425,000 | | |

| 10,850,000 | | |

| 13,562,500 | | |

| 27,125,000 | |

Potential

Dilutive Effect of the PIPE Warrants

As

described above in “Description of the Warrants – Series B Warrants – Adjustments,” the maximum number of shares

of Class A common stock issuable upon exercise of the

Series B Warrants is 3,875,000 shares. Assuming the full exercise of the Series B Warrants, the maximum

number of shares of Class A common stock issuable upon exercise of the Series A Warrants is 4,935,341 shares.

Consequences

of Not Approving this Proposal

Repayment

of the PIPE Convertible Notes in Cash

If

the Nasdaq Proposal is not approved, the holders of the PIPE Convertible Notes issued as of the

date of this Special Meeting will be unable to convert such notes into our Class A common stock due the limitations set forth

by Nasdaq Listing Rule 5635(d). To the extent any portions of the PIPE Convertible Notes may not

be converted into shares of our Class A common stock due to the limitations in Nasdaq Listing Rule 5635(d), we will be required

to pay interest on the PIPE Convertible Notes in cash and, upon maturity, we will be required to

repay the PIPE Convertible Notes in cash. Repayment of the PIPE Convertible Notes

in cash would divert resources away from funding our business operations, which could negatively impact our prospects, financial

condition and results of operations.

Inability

to Issue PIPE Convertible Notes

Our

ability to require the PIPE Investors to purchase the final tranche of PIPE Convertible Notes pursuant

to the Second Mandatory Additional Closing described above is contingent on our shareholders approving this Nasdaq Proposal. We

would receive $5.58 million upon the closing of the final tranche of PIPE Convertible Notes. Our

inability to draw down on such final tranche would limit the cash available to us to operate our business.

Obligation

to Continue to Seek Approval

If

our shareholders do not approve this Nasdaq Proposal, we will be required to seek stockholder approval of this proposal prior to June

1, 2024, and if we are unsuccessful in receiving stockholder approval at that meeting we will be required to seek stockholder approval

of this proposal every three months until we receive approval of this proposal. We are not seeking the approval of our shareholders to

authorize our issuance of the notes and warrants described above, as we have already entered into the Purchase Agreement and issued the

securities (other than the final tranche of PIPE Convertible Notes), which are binding obligations

on us. The failure of our shareholders to approve the Nasdaq Proposal will not negate the existing terms of the documents governing the

securities, and the terms of the Purchase Agreement and the securities will remain binding obligations. Seeking shareholder approval

multiple times would require us to devote cash and management resources to those special meetings, and would leave less resources for

our business.

Vote

Required and Recommendation of the Board of Directors

The

approval of Proposal 1 requires the affirmative vote of a majority of the voting power of the votes cast (in person or by proxy) at the

Special Meeting. Broker non-votes and abstentions will not be taken into account in determining the outcome of the proposal. The

Board recommends that stockholders vote FOR, for purposes of complying with Nasdaq Listing Rule 5635(d), the approval for our issuance

of all of the shares of our Class A common stock upon conversion of the PIPE Convertible Notes and upon exercise of the PIPE Warrants,

without regard to any limitations on conversion or exercise set forth in the PIPE Convertible Notes or PIPE Warrants, respectively, and

assuming all Additional Notes have been issued and all adjustments with respect to such issuances shall have been made to the PIPE Convertible

Notes and PIPE Warrants, as applicable.

PROPOSAL

2: APPROVAL OF AN ADJOURNMENT OF THE SPECIAL

MEETING, IF NECESSARY, TO SOLICIT ADDITIONAL PROXIES IF THERE ARE NOT SUFFICIENT VOTES IN FAVOR OF THE NASDAQ PROPOSAL

Overview

If

the Special Meeting is convened and a quorum is present, but there are not sufficient votes to approve Proposal 1, one or more of our

proxy holders may move to adjourn the Special Meeting at that time in order to enable our Board to solicit additional proxies.

In

this proposal, we are asking our stockholders to authorize one or more of our proxy holders to adjourn the Special Meeting to another

time and place, if necessary, to solicit additional proxies in the event that there are not sufficient votes to approve Proposal 1. If

our stockholders approve this proposal, one or more of our proxy holders can adjourn the Special Meeting and any adjourned session of

the Special Meeting to allow for additional time to solicit additional proxies, including the solicitation of proxies from our stockholders

that have previously voted. Among other things, approval of this proposal could mean that, even if we had received proxies representing

a sufficient number of votes to defeat Proposal 1, we could adjourn the Special Meeting without a vote on such proposals and seek to

convince our stockholders to change their votes in favor of such proposals.

If

it is necessary to adjourn the Special Meeting, no notice of the adjourned meeting is required to be given to our stockholders, other

than an announcement at the Special Meeting of the time and place to which the Special Meeting is adjourned, so long as the meeting is

adjourned for 30 days or less and no new record date is fixed for the adjourned meeting. At the adjourned meeting, we may transact any

business which might have been transacted at the original meeting.

Vote

Required and Recommendation of the Board of Directors

The

approval of Proposal 2 requires the affirmative vote of a majority of the voting power of the votes cast (in person or by proxy) at the

Special Meeting. Broker non-votes and abstentions will not be taken into account in determining the outcome of the proposal. The

Board recommends that stockholders vote FOR the approval to authorize the adjournment of the Special Meeting, if necessary, to solicit

additional proxies if there are not sufficient votes in favor of the Nasdaq Proposal.

Other

Business

As

of the date of this Proxy Statement, management does not know of any other matters that will be brought before the Special Meeting requiring

action of the shareholders. However, if any other matters requiring the vote of the shareholders properly come before the Special Meeting,

it is the intention of the persons named in the enclosed form of proxy to vote the proxies in accordance with the discretion of management.

The persons designated as proxies will also have the right to approve any and all adjournments of the Special Meeting for any reason.

SHAREholders

Sharing the Same Address

The

SEC has adopted rules that permit companies and intermediaries (such as brokers, banks and other nominees) to implement a delivery procedure

called “householding.” Under this procedure, multiple shareholders who reside at the same address may receive a single copy

of the Proxy Statement and other proxy materials, unless the affected shareholder has provided contrary instructions. This procedure

reduces printing costs and postage fees.

Under

applicable law, if you consented or were deemed to have consented, your broker, bank or other intermediary may send only one copy of

the Proxy Statement and other proxy materials to your address for all residents that own shares of the Company’s common stock in

street name. If you wish to revoke your consent to householding, you must contact your broker, bank or other intermediary. If you are

receiving multiple copies of the Proxy Statement and other proxy materials, you may be able to request householding by contacting your

broker, bank or other intermediary. Upon written or oral request, we will promptly deliver a separate set of the Proxy Statement or other

proxy materials to any beneficial owner at a shared address to which a single copy of any of those documents was delivered. If you wish

to request copies free of charge of the Proxy Statement or other proxy materials, please send your request to Investor Relations, TruGolf

Holdings, Inc., 60 North 1400 West Centerville, Utah 84014 or call the Company with your request at (917) 289-2776.

| By Order of the Board of Directors, |

|

| |

|

| /s/ Christopher Jones |

|

| Christopher Jones |

|

| Chief Executive Officer |

|

| |

|

| February 26, 2024 |

|

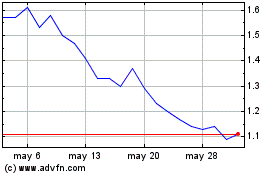

TruGolf (NASDAQ:TRUG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

TruGolf (NASDAQ:TRUG)

Gráfica de Acción Histórica

De May 2023 a May 2024