0000102752false00001027522024-11-042024-11-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 4, 2024

VSE CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | | 000-03676 | | 54-0649263 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification Number) |

| | | | | | | | | | | | | | | | | |

3361 Enterprise Way | | | | |

Miramar, | Florida | | | | 33025 |

(Address of Principal Executive Offices) | | | | (Zip Code) |

(954) 430-6600

(Registrant's Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, par value $.05 per share | | VSEC | | The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

Item 2.02 | Results of Operations and Financial Condition. |

On November 6, 2024, VSE Corporation (the "Company") issued a press release reporting its financial results for the third quarter ended September 30, 2024. Additionally, the Company made available related materials to be discussed during the Company’s webcast and conference call referred to in such press release. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K and is hereby incorporated by reference.

The information in the preceding paragraph, as well as Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. It may only be incorporated by reference into another filing under the Exchange Act or the Securities Act of 1933, as amended if such subsequent filing specifically references this Current Report on Form 8-K.

| | | | | |

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

As disclosed on March 6, 2024, Chad M. Wheeler, Group President for the Company's Fleet Segment, notified the Company on February 29, 2024, of his decision to resign from his position as VSE’s Group President for the Fleet Segment, with an effective date to be set later in 2024. Mr. Wheeler’s last day in his role was November 5, 2024. On November 6, 2024, the Company entered into a Consulting Agreement (the “Consulting Agreement”) with Mr. Wheeler whereby Mr. Wheeler has agreed to provide consulting and advisory services for up to a one-year period. Pursuant to the Consulting Agreement, Mr. Wheeler will receive compensation of $300 per hour for up to a maximum of 35 hours per month in consideration for providing these services. The Company will also pay Mr. Wheeler a lump sum cash bonus of $500,000 (the “Consulting Bonus”) if he continuously provides the consulting services until the earlier of (a) November 6, 2025, and (b) the date on which the Company completes its strategic alternative review process involving the Fleet Segment, as determined by the Company. Payment of the Consulting Bonus will be subject to Mr. Wheeler’s execution of a release of claims in favor of the Company.

Mr. Wheeler’s departure is not related to the operations, policies, or practices of the Company. This disclosure is qualified in its entirety by the Consulting Agreement, a copy of which is filed herewith as Exhibit 10.1 and incorporated herein by reference.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | | | | |

| Exhibit | | |

| Number | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File |

VSE CORPORATION AND SUBSIDIARIES

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | VSE CORPORATION |

| | | (Registrant) |

| | | |

Date: | November 6, 2024 | By: | /s/ Adam R. Cohn |

| | | Adam R. Cohn |

| | | Chief Financial Officer |

| | | (Principal Financial Officer) |

CONSULTING AGREEMENT

This Consulting Agreement (“Agreement”) is made and entered into as of November 6, 2024, by and between VSE Corporation, a Delaware corporation (“VSE”), and Chad Wheeler (the “Consultant”).

WHEREAS, the Consultant is currently employed by VSE and serves as the Group President of Wheeler Fleet Solutions, Inc., a Pennsylvania Corporation (the “Company”), a wholly-owned subsidiary of VSE, and has notified VSE and the Company that he will resign from all positions he holds with VSE and the Company (collectively, the “VSE Companies”) effective November 5, 2024;

WHEREAS, VSE desires to engage the Consultant following his resignation to provide consulting services to transition his responsibilities, upon the terms and subject to the conditions hereinafter set forth; and

WHEREAS, the Consultant has agreed to provide such consulting services, upon the terms and subject to the conditions hereinafter set forth.

NOW, THEREFORE, in consideration of the mutual covenants contained herein, the parties hereto agree as follows:

1.Status of Employment. The Consultant will cease serving as President of the Company, and as an employee of VSE and the Company, effective November 5, 2024 (the “Resignation Date”). As of the Resignation Date, the Consultant will terminate from any positions the Consultant holds as an officer or director of any VSE Companies.

2.Term. The term of this Agreement shall commence on November 6, 2024 and shall terminate on November 6, 2025 (the “Term”).

3.Duties. During the Term, the Consultant will provide consulting and advisory services, including, but not limited to, assistance with any strategic review, transaction related matters, historical knowledge, finance related matters or advisory services as requested by management of VSE or the Company (“Consulting Services”) including the President and Chief Executive Officer of VSE, John Cuomo, or the Company’s Chief Information Officer, Chris Wheeler.

4.Compensation. As compensation for the Consulting Services, the Company shall pay the Consultant an hourly rate of $300 per hour for up to a maximum of thirty-five (35) hours per month as determined by VSE or the Company. The Consultant shall submit an invoice for each month during the Term on the last day of the month. The Company shall pay the Consultant the fees for such month within 15 business days after receipt of the invoice.

5.Bonus. The Company will pay the Consultant a lump sum in cash in an amount equal to $500,000 (the “Consulting Bonus”) if the Consultant continuously provides the Consulting Services until the earlier of (a) November 6, 2025, and (b) the date on which VSE completes its strategic alternative review process involving the Company, as determined by VSE (such applicable date, the “Trigger Date”). If the Company terminates this Agreement without cause prior to the Trigger Date, the Company will pay the Consultant the Consulting Bonus. If the Consultant terminates this Agreement prior to the Trigger Date, then the Company will not have the obligation to pay the Consulting Bonus. The Company will pay the Consulting Bonus within 60 days following the Trigger Date. Any amounts paid to the Consultant pursuant to this Agreement may be paid by any VSE Company, and such payment will satisfy VSE’s obligations hereunder. Notwithstanding the foregoing, neither the Company nor any other VSE Company will be obligated to pay the Consulting Bonus to the Consultant unless, prior to the 30th day following the Trigger Date, the Consultant executes a release of all current or future claims, known or unknown, arising on or before the date of the release against the VSE Companies and the directors, officers, employees and affiliates of any of them, in a form approved by VSE and the Company, and any applicable revocation period has expired without the Consultant revoking such release.

6.Confidentiality.

a.The Consultant will strictly maintain the confidentiality of any information of whatever kind and in whatever form that he obtains from any VSE Company or from any other source relating to a VSE Company, whether identified as Confidential Information or not, including but not limited to information regarding the organization, operations, strategies, financial condition, financial statements, operating plans, financial forecasts, competitive information, customer, employees and any other confidential information relating to any transactions in which any VSE Company may be involved (collectively “Confidential Information”). The Consultant will not disclose any Confidential Information to any third party without the prior written consent of the applicable VSE Company, and will not use any Confidential Information except as required to perform his obligations under this Agreement. Upon the termination of this Agreement, or as requested by VSE or the Company, the Consultant shall destroy all Confidential Information in his possession and shall certify the destruction to VSE and the Company within five (5) business days after the request. The obligations under this Section shall remain in effect during the Term of this Agreement and for a period of three (3) months thereafter.

b.Nothing in this Agreement prevents the Consultant from providing, without prior notice to VSE or the Company, information to governmental authorities regarding possible legal violations or otherwise testifying or participating in any investigation or proceeding by any governmental authorities regarding possible legal violations. Furthermore, no VSE Company policy or individual agreement between any VSE Company and the Consultant shall prevent the Consultant from providing information to government authorities regarding possible legal violations, participating in investigations, testifying in proceedings regarding VSE Companies’ past or future conduct, engaging in any future activities protected under the whistleblower statutes administered by any government agency (e.g., EEOC, NLRB, SEC, etc.) or receiving a monetary award from a government-administered whistleblower award program for providing information directly to a government agency. The VSE Companies nonetheless assert and do not waive their attorney-client privilege over any information appropriately protected by privilege.

7.Acknowledgements. The Consultant acknowledges and reaffirms his obligations under all confidentiality, noncompete, non-solicitation and other restrictive covenants contained in agreements with VSE, including but not limited to the Executive Employment Agreement, dated as of December 7, 2021, between VSE and the Consultant (the “Employment Agreement”). The Consultant further acknowledges that he is not entitled to any severance compensation or benefits in connection with his resignation under the Employment Agreement or otherwise.

8.Return of Property. The Consultant will, within a reasonable time after the end of the Term, return to the Company all Company property and equipment.

9.Stock Trading. The Consultant acknowledges that VSE is a publicly traded company and that U.S. federal and state securities laws prohibit any person who has material, non-public information about a VSE Company from purchasing or selling securities of VSE or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell VSE securities. The Consultant shall be subject to VSE’s insider trading policy and restrictions and shall not trade (i.e. buy or sell) any VSE stock or derivative security, or recommend to anyone else to trade VSE stock during the Term to the extent that the Consultant is in possession of material non-public information about VSE or the Company.

10.Independent Contractor. It is understood by the parties that during the Term, the Consultant will at all times be and remain an independent contractor of the Company, and not an employee nor agent of the Company. The Consultant acknowledges and agrees that, during the Term, the Consultant will not be treated as an employee of the Company or any of its affiliates for purposes of any income tax withholding, nor unless otherwise specifically provided by law, for purposes of the Federal Insurance Contributions Act, the Social Security Act, the Federal Unemployment Tax Act or any Worker’s Compensation law of any state or country and for purposes of benefits provided to employees of the Company under any employee benefit plan. The Consultant acknowledges and agrees that as an independent contractor, the Consultant will be required, during the Term, to pay any applicable taxes on the fees paid to the Consultant. In addition, the Consultant shall not be authorized to bind the Company to any contracts or agreements of any nature.

11.Termination. This Agreement may be terminated by either party with fifteen (15) days written notice to the other party.

12.Survival. Notwithstanding any expiration or termination of this Agreement, the provisions of Sections 6 through 9 hereof will survive and remain in full force and effect, as will any other provision hereof that, by its terms or reasonable interpretation thereof, sets forth obligations that extend beyond the termination of this Agreement.

13.Governing Law. This Agreement shall be governed by the laws of the Commonwealth of Pennsylvania.

14.Assignment. The Consultant shall not assign any of his rights under this Agreement or delegate the performance of any of his duties hereunder, without the prior written consent of VSE.

15.Amendment. Any amendment to this Agreement shall be in writing signed by the parties hereto.

16.Counterparts. This Agreement may be executed in separate counterparts, each of which shall be deemed to be an original and both of which taken together shall constitute one and the same agreement.

IN WITNESS WHEREOF the undersigned have executed this Agreement as of the day and year first written above.

VSE Corporation Consultant

By: _/s/John Cuomo_______________________ By: _/s/ Chad Wheeler

Name: John Cuomo Name: Chad Wheeler

Title: President and Chief Executive Officer

VSE Corporation Announces Third Quarter 2024 Results

Record Revenue and Record Profitability for Aviation Segment

Raising Full Year 2024 Aviation Revenue Guidance

ALEXANDRIA, Va, November 6, 2024 - VSE Corporation (NASDAQ: VSEC, "VSE", or the "Company"), a leading provider of aftermarket distribution and repair services, announced today results for the third quarter 2024.

THIRD QUARTER 2024 RESULTS(1)

(As compared to the Third Quarter 2023)

▪Total Revenues of $273.6 million increased 18.3%

▪GAAP Net Income of $11.7 million decreased 3.8%

▪GAAP EPS (Diluted) of $0.63 decreased 21.3%

▪Adjusted EBITDA(2) of $33.2 million increased 2.6%

▪Adjusted Net Income(2) of $13.1 million decreased 5.3%

▪Adjusted EPS (Diluted)(2) of $0.71 decreased 22.8%

1 From continuing operations

2 Non-GAAP measure. See additional information at the end of this release regarding non-GAAP financial measures

MANAGEMENT COMMENTARY

"We are very pleased to announce our third quarter 2024 results, marked by the strongest quarterly performance in our Aviation segment's history, achieving a revenue milestone of over $200 million," stated John Cuomo, President and CEO of VSE Corporation. "The 34% year-over-year revenue growth, combined with record profitability, reflects balanced contributions across our Aviation business units. The key drivers to our growth include the successful execution of new distribution awards, the expansion of our maintenance, repair, and overhaul ("MRO") capabilities, the launch of our new OEM-licensed manufacturing program, and contributions from our recent acquisition of Turbine Controls ("TCI")."

Mr. Cuomo continued, "Additionally, during the quarter, we completed the integration of Desser Aerospace's U.S. distribution business, launched a new Aviation e-commerce platform, made substantial progress in establishing our OEM-licensed manufacturing capabilities, and began distributing new products through our European Distribution Center of Excellence in Hamburg, Germany. The Aviation segment continues to perform successfully during a year of repositioning and focused execution.

"In our Fleet segment, we continue to advance our customer diversification strategy, with our commercial customers representing 64% of segment revenue as of the third quarter. Following a temporary reduction in activity with the United States Postal Service ("USPS") due to their system integration, activity levels have stabilized at the quarter's end, positioning us for improved revenue and profitability in the fourth quarter as compared to the third quarter," Mr. Cuomo concluded.

"Our third quarter 2024 results reflect our commitment to financial discipline," stated Adam Cohn, Chief Financial Officer of VSE Corporation. "During the quarter, we generated positive free cash flow, reduced our debt, and maintained an adjusted net leverage ratio within our target range of 3.0 to 3.5 times. Following our successful October 2024 equity offering, the Company has ample financial liquidity and flexibility to complete the acquisition of Kellstrom Aerospace in the fourth quarter and capitalize on the significant growth opportunities that lie ahead. As we look out to the fourth quarter, we expect to drive stronger free cash flow supported by ongoing operational execution on the strategic inventory investments made earlier this year. As I step into my role as CFO, I am excited to join such a dynamic team and look forward to building on VSE's impressive track record. In the months ahead, I am committed to enhancing shareholder value as we continue to execute on our strategic priorities."

STRATEGIC UPDATE

KELLSTROM AEROSPACE ACQUISITION:

•On October 15, 2024, VSE announced it signed a definitive agreement to acquire Kellstrom Aerospace Group, Inc. ("Kellstrom Aerospace"), a leading full-service aftermarket solutions provider of value-added distribution and technical services for the commercial aerospace aftermarket. Kellstrom's portfolio of engine-focused products and MRO services, coupled with its technical advisory capabilities, expands VSE Aviation's portfolio of product and service solutions in the high-growth commercial aftermarket.

•Kellstrom generated approximately $175 million of revenue for the trailing-twelve-month period ended September 2024. The Company expects to generate run-rate synergies of approximately $4 million within 18 months of close. The total consideration for the acquisition is approximately $200 million, comprised of approximately $185 million in cash and approximately $15 million of common shares of the Company, subject to working capital adjustments. The acquisition is expected to close in the fourth quarter of 2024, pending customary closing conditions, including regulatory review.

AVIATION NEW PROGRAM EXECUTION AND INTEGRATION UPDATE:

•The Aviation segment continues to scale the new European distribution Center of Excellence in Hamburg, Germany, supporting the Pratt & Whitney Canada Europe, Middle East and Africa ("EMEA") aftermarket product support program. The program is expected to be at a full year run-rate by the end of the fourth quarter of 2024.

•The OEM-licensed manufacturing fuel control program continues to outpace expectations and contribute to the segment's profitability. The Kansas facility expansion supporting the fuel control program is expected to be operational in the first quarter of 2025.

•The integration of Desser Aerospace's U.S. distribution business was completed in the third quarter of 2024. Desser Aerospace's tire, tube, brake and battery product lines are now being sold under the VSE Aviation name, and tires are now being sold in Europe through the Company's new distribution facility in Hamburg, Germany.

•VSE Aviation's new e-commerce site was successfully launched in the third quarter of 2024, focused on initial offerings including legacy Desser Aerospace products.

FLEET UPDATE:

•The USPS transition to a new Fleet Management Information System ("FMIS") platform was completed in the third quarter of 2024. Post-implementation, the Company expects an increase in repair activity, and subsequently, an increase in the usage of parts.

•The e-commerce fulfillment distribution center continues to scale and support above-market growth and additional market share opportunities.

•The Fleet segment strategic review remains in process, and the Company expects to provide an update in the coming months.

CORPORATE UPDATE:

•In October 2024, VSE completed a follow-on equity offering of 1,982,757 shares of common stock at $87.00 per share, resulting in net cash proceeds of approximately $163.8 million.

•The net proceeds from the offering will be used to finance a portion of the Kellstrom Aerospace acquisition.

THIRD QUARTER SEGMENT RESULTS

Aviation segment revenue increased 34% year-over-year to a record $203.6 million in the third quarter of 2024. The year-over-year revenue improvement was attributable to strong program execution of new and existing distribution awards, an expanded portfolio of MRO capabilities, and contributions from the TCI acquisition. Aviation distribution and MRO revenue increased 12% and 86%, respectively, in the third quarter of 2024, versus the prior-year period. The Aviation segment reported operating income of $25.4 million in the third quarter, compared to $21.0 million in the same period of 2023. Segment Adjusted EBITDA increased by 29% in the third quarter to $32.6 million, versus $25.3 million in the prior-year period. Adjusted EBITDA margin was 16.0%, a decline of approximately 60 basis points versus the prior-year period, driven by lower margin contributions from the TCI acquisition.

Fleet segment revenue decreased 11% year-over-year to $70.0 million in the third quarter of 2024. Revenue from the USPS declined approximately 40% on a year-over-year basis. This revenue decline was primarily driven by USPS' transition to a new Fleet Management Information System ("FMIS") platform, which has resulted in a temporary reduction in maintenance related activities and reduced part requirements. The FMIS conversion was completed in the third quarter of 2024, supporting a modest recovery beginning in the fourth quarter of 2024. Revenue from commercial customers increased 20% on a year-over-year basis, driven by growth in e-commerce fulfillment and commercial fleet sales. Commercial, or non-USPS, revenue represented 64% of total Fleet segment revenue in the period. The Fleet segment reported operating income of $2.5 million in the third quarter, compared to $8.5 million in the same period of 2023. Segment Adjusted EBITDA decreased 59% year-over-year to $3.8 million, and Adjusted EBITDA margin declined approximately 620 basis points to 5.4%, primarily driven by the decline in USPS revenue.

FINANCIAL RESOURCES AND LIQUIDITY

As of September 30, 2024, the Company had $189 million in cash and unused commitment availability under its $350 million revolving credit facility maturing in 2026. The Company generated approximately $4 million of free cash flow in the third quarter of 2024. As of September 30, 2024, VSE had a total net debt outstanding of $442 million. Adjusted net leverage was approximately 3.3 times trailing-twelve-month Adjusted EBITDA as of the end of the third quarter.

GUIDANCE

VSE is increasing its full-year 2024 revenue growth and maintaining Adjusted EBITDA margin percentage guidance for its Aviation segment. The guidance is as follows:

•Aviation segment full-year 2024 revenue guidance is increasing from 34% to 38% growth to 39% to 41%, as compared to the prior year revenue. Revenue contributions from the Kellstrom acquisition, which is expected to close in the in the fourth quarter of 2024, are not included in our updated guidance.

•Aviation segment maintains full-year 2024 Adjusted EBITDA margin guidance of 15.5% to 16.5%.

VSE is revising its full-year 2024 revenue and maintaining Adjusted EBITDA margin guidance for its Fleet segment. The guidance is as follows:

•Fleet segment full-year 2024 revenue guidance is decreasing from 0% to 5% to (5)% to (10)%, as compared to the prior year revenue.

•Fleet segment maintains full-year 2024 Adjusted EBITDA margin guidance of 6% to 8%.

THIRD QUARTER RESULTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| (in thousands, except per share data) | | 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| Revenues | | $ | 273,613 | | | $ | 231,353 | | | 18.3 | % | | $ | 781,111 | | | $ | 625,163 | | | 24.9 | % |

| Operating income | | $ | 23,698 | | | $ | 25,264 | | | (6.2) | % | | $ | 54,004 | | | $ | 62,677 | | | (13.8) | % |

| Net income from continuing operations | | $ | 11,650 | | | $ | 12,111 | | | (3.8) | % | | $ | 20,973 | | | $ | 30,318 | | | (30.8) | % |

| EPS (Diluted) | | $ | 0.63 | | | $ | 0.80 | | | (21.3) | % | | $ | 1.22 | | | $ | 2.22 | | | (45.0) | % |

THIRD QUARTER SEGMENT RESULTS

The following is a summary of revenues and operating income for the three and nine months ended September 30, 2024 and September 30, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| (in thousands) | | 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| Revenues: | | | | | | | | | | | | |

| Aviation | | $ | 203,642 | | | $ | 152,355 | | | 33.7 | % | | $ | 558,853 | | | $ | 390,319 | | | 43.2 | % |

| Fleet | | 69,971 | | | 78,998 | | | (11.4) | % | | 222,258 | | | 234,844 | | | (5.4) | % |

| Total revenues | | $ | 273,613 | | | $ | 231,353 | | | 18.3 | % | | $ | 781,111 | | | $ | 625,163 | | | 24.9 | % |

| | | | | | | | | | | | |

| Operating income: | | | | | | | | | | | | |

| Aviation | | $ | 25,435 | | | $ | 20,951 | | | 21.4 | % | | $ | 72,214 | | | $ | 52,397 | | | 37.8 | % |

| Fleet | | 2,471 | | | 8,531 | | | (71.0) | % | | 11,299 | | | 22,284 | | | (49.3) | % |

| Corporate/unallocated expenses | | (4,208) | | | (4,218) | | | (0.2) | % | | (29,509) | | | (12,004) | | | 145.8 | % |

| Operating income | | $ | 23,698 | | | $ | 25,264 | | | (6.2) | % | | $ | 54,004 | | | $ | 62,677 | | | (13.8) | % |

| | | | | | | | | | | | |

The Company reported $5.8 million and $17.4 million of total capital expenditures for three and nine months ended September 30, 2024, respectively.

NON-GAAP MEASURES

In addition to the financial measures prepared in accordance with generally accepted accounting principles ("GAAP"), this earnings release also contains Non-GAAP financial measures. These measures provide useful information to investors, and a reconciliation of these measures to the most directly comparable GAAP measures and other information relating to these Non-GAAP measures is included in the supplemental schedules attached.

NON-GAAP FINANCIAL INFORMATION

Adjusted Net Income from Continuing Operations and Adjusted EPS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| (in thousands) | 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| Net income from continuing operations | $ | 11,650 | | | $ | 12,111 | | | (3.8) | % | | $ | 20,973 | | | $ | 30,318 | | | (30.8) | % |

| Adjustments to income from continuing operations: | | | | | | | | | | | |

| Non-recurring professional fees | — | | | 300 | | | (100.0) | % | | — | | | 300 | | | (100.0) | % |

| Debt issuance costs | — | | | 266 | | | (100.0) | % | | — | | | 266 | | | (100.0) | % |

| Acquisition, integration and restructuring costs | 1,973 | | | 1,700 | | | 16.1 | % | | 6,010 | | | 3,800 | | | 58.2 | % |

| Severance costs | 372 | | | — | | | — | % | | 372 | | | — | | | — | % |

| Lease abandonment and termination (benefits) costs (1) | (612) | | | — | | | — | % | | 12,245 | | | — | | | — | % |

| Divestiture-related restructuring costs | 178 | | | — | | | — | % | | 4,039 | | | — | | | — | % |

| | | | | | | | | | | | |

| 13,561 | | | 14,377 | | | (5.7) | % | | 43,639 | | | 34,684 | | | 25.8 | % |

| Tax impact of adjusted items | (477) | | | (566) | | | (15.7) | % | | (5,655) | | | (1,090) | | | 418.8 | % |

Adjusted net income from continuing operations | $ | 13,084 | | | $ | 13,811 | | | (5.3) | % | | $ | 37,984 | | | $ | 33,594 | | | 13.1 | % |

| Weighted average dilutive shares | 18,479 | | | 15,050 | | | 22.8 | % | | 17,212 | | | 13,639 | | | 26.2 | % |

| Adjusted EPS (Diluted) | $ | 0.71 | | | $ | 0.92 | | | (22.8) | % | | $ | 2.21 | | | $ | 2.46 | | | (10.2) | % |

| (1) Includes consulting costs incurred in conjunction with lease termination. |

EBITDA and Adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| (in thousands) | 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| Net income from continuing operations | $ | 11,650 | | | $ | 12,111 | | | (3.8) | % | | $ | 20,973 | | | $ | 30,318 | | | (30.8) | % |

| Interest expense | 8,983 | | | 8,459 | | | 6.2 | % | | 27,996 | | | 21,805 | | | 28.4 | % |

| Income taxes | 3,065 | | | 4,694 | | | (34.7) | % | | 5,035 | | | 10,554 | | | (52.3) | % |

| Amortization of intangible assets | 4,809 | | | 3,203 | | | 50.1 | % | | 12,550 | | | 10,743 | | | 16.8 | % |

| Depreciation and other amortization | 2,734 | | | 1,836 | | | 48.9 | % | | 7,561 | | | 4,869 | | | 55.3 | % |

| EBITDA | 31,241 | | | 30,303 | | | 3.1 | % | | 74,115 | | | 78,289 | | | (5.3) | % |

| Non-recurring professional fees | — | | | 300 | | | (100.0) | % | | — | | | 300 | | | (100.0) | % |

| Acquisition, integration and restructuring costs | 1,973 | | | 1,700 | | | 16.1 | % | | 6,010 | | | 3,800 | | | 58.2 | % |

| Severance costs | 372 | | | — | | | — | % | | 372 | | | — | | | — | % |

| Lease abandonment and termination (benefits) costs | (612) | | | — | | | — | % | | 12,245 | | | — | | | — | % |

| Divestiture-related restructuring costs | 178 | | | — | | | — | % | | 4,039 | | | — | | | — | % |

| | | | | | | | | | | | |

| Adjusted EBITDA | $ | 33,152 | | | $ | 32,303 | | | 2.6 | % | | $ | 96,781 | | | $ | 82,389 | | | 17.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted EBITDA Summary | | | | | | | | | | | | |

| (in thousands) | Three months ended September 30, | | Nine months ended September 30, | |

| | 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change | |

| Aviation | $ | 32,594 | | | $ | 25,320 | | | 28.7 | % | | $ | 91,250 | | | $ | 63,453 | | | 43.8 | % | |

| Fleet | 3,786 | | | 9,193 | | | (58.8) | % | | 14,596 | | | 26,894 | | | (45.7) | % | |

| Adjusted Corporate expenses (1) | (3,228) | | | (2,210) | | | 46.1 | % | | (9,065) | | | (7,958) | | | 13.9 | % | |

| Adjusted EBITDA | $ | 33,152 | | | $ | 32,303 | | | 2.6 | % | | $ | 96,781 | | | $ | 82,389 | | | 17.5 | % | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

(1) Includes certain adjustments not directly attributable to any of our segments. | |

Segment EBITDA and Adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended September 30, | | Nine months ended September 30, |

| (in thousands) | | 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| Aviation | | | | | | | | | | | | |

| Operating income | | $ | 25,435 | | | $ | 20,951 | | | 21.4 | % | | $ | 72,214 | | | $ | 52,397 | | | 37.8 | % |

| Depreciation and amortization | | 6,951 | | | 4,329 | | | 60.6 | % | | 17,919 | | | 11,016 | | | 62.7 | % |

| EBITDA | | 32,386 | | | 25,280 | | | 28.1 | % | | 90,133 | | | 63,413 | | | 42.1 | % |

| Acquisition, integration and restructuring costs | | 150 | | | 40 | | | 275.0 | % | | 1,059 | | | 40 | | | 2,547.5 | % |

| Severance costs | | 58 | | | — | | | — | % | | 58 | | | — | | | — | % |

| | | | | | | | | | | | | |

| Adjusted EBITDA | | $ | 32,594 | | | $ | 25,320 | | | 28.7 | % | | $ | 91,250 | | | $ | 63,453 | | | 43.8 | % |

| | | | | | | | | | | | | |

| Fleet | | | | | | | | | | | | |

| Operating income | | $ | 2,471 | | | $ | 8,531 | | | (71.0) | % | | $ | 11,299 | | | $ | 22,284 | | | (49.3) | % |

| Depreciation and amortization | | 710 | | | 662 | | | 7.3 | % | | 2,188 | | | 4,452 | | | (50.9) | % |

| EBITDA | | 3,181 | | | 9,193 | | | (65.4) | % | | 13,487 | | | 26,736 | | | (49.6) | % |

| Acquisition, integration and restructuring costs | | 291 | | | — | | | — | % | | 795 | | | 158 | | | 403.2 | % |

| Severance costs | | 314 | | | — | | | — | % | | 314 | | | — | | | — | % |

| Adjusted EBITDA | | $ | 3,786 | | | $ | 9,193 | | | (58.8) | % | | $ | 14,596 | | | $ | 26,894 | | | (45.7) | % |

Free Cash Flow

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| (in thousands) | | 2024 | | 2023 | | 2024 | | 2023 | | |

| Net cash provided by (used in) operating activities | | $ | 10,176 | | | $ | 15,320 | | | $ | (86,412) | | | $ | (49,771) | | | |

| Capital expenditures | | (5,765) | | | (4,658) | | | (17,439) | | | (10,795) | | | |

| Free cash flow | | $ | 4,411 | | | $ | 10,662 | | | $ | (103,851) | | | $ | (60,566) | | | |

Net Debt

| | | | | | | | | | | |

| (in thousands) | September 30, 2024 | | December 31, 2023 |

| Principal amount of debt | $ | 453,000 | | | $ | 433,000 | |

| Debt issuance costs | (2,659) | | | (3,656) | |

| Cash and cash equivalents | (7,907) | | | (7,768) | |

| Net Debt | $ | 442,434 | | | $ | 421,576 | |

Net Leverage Ratio

| | | | | | | | | | | |

| ($ in thousands) | September 30, 2024 | | December 31, 2023 |

| Net Debt | $ | 442,434 | | | $ | 421,576 | |

TTM Adjusted EBITDA (1) | $ | 128,225 | | | $ | 113,833 | |

| Net Leverage Ratio | 3.5 | x | | 3.7 | x |

| | | |

TTM Acquisition Adjusted EBITDA (2) | $ | 134,970 | | | $ | 124,304 | |

| Adjusted Net Leverage Ratio | 3.3 | x | | 3.4 | x |

(1) TTM Adjusted EBITDA is defined as Adjusted EBITDA for the most recent twelve (12) month period.

(2) TTM Acquisition Adjusted EBITDA includes Turbine Controls EBITDA for the trailing twelve months that are not included in historical results. |

The non-GAAP Financial Information set forth in this document is not calculated in accordance with GAAP under SEC Regulation G. We consider Adjusted Net Income, Adjusted EPS (Diluted), EBITDA, Adjusted EBITDA, Acquisition Adjusted EBITDA, net debt, adjusted net leverage ratio and free cash flow as non-GAAP financial measures and important indicators of performance and useful metrics for management and investors to evaluate our business' ongoing operating performance on a consistent basis across reporting periods. These non-GAAP financial measures, however, should not be considered in isolation or as a substitute for performance measures prepared in accordance with GAAP. Adjusted Net Income represents Net Income adjusted for acquisition-related costs, other discrete items, and related tax impact. Adjusted EPS (Diluted) is computed by dividing net income, adjusted for the discrete items as identified above and the related tax impacts, by the diluted weighted average number of common shares outstanding. EBITDA represents net income before interest expense, income taxes, amortization of intangible assets and depreciation and other amortization. Adjusted EBITDA represents EBITDA (as defined above) adjusted for discrete items as identified above. Acquisition Adjusted EBITDA represents Adjusted EBITDA plus the pre-acquisition portion of EBITDA for the trailing twelve months. Net debt is defined as principal amount of debt less debt issuance costs and less cash and cash equivalents. Free cash flow represents operating cash flow less capital expenditures. Adjusted net leverage ratio is calculated as net debt divided by trailing twelve month Acquisition Adjusted EBITDA.

The Company has presented forward-looking statements regarding Adjusted EBITDA margin. This non-GAAP financial measure is derived by excluding certain amounts, expenses or income, from the corresponding financial measure determined in accordance with GAAP. The determination of the amounts that are excluded from this non-GAAP financial measure is a matter of management judgment and depends upon, among other factors, the nature of the underlying expense or income amounts recognized in a given period in reliance on the exception provided by item 10(e)(1)(i)(B) of Regulation S-K. We are unable to present a quantitative reconciliation of forward-looking Adjusted EBITDA margin to its most directly comparable forward-looking GAAP financial measure because such information is not available, and management cannot reliably predict all of the necessary components of such GAAP measure without unreasonable effort or expense. In addition, we believe such reconciliation would imply a degree of precision that would be confusing or misleading to investors. The unavailable information could have a significant impact on the company's future financial results. This non-GAAP financial measure is a preliminary estimate and is subject to risks and uncertainties, including, among others, changes in connection with quarter-end and year-end adjustments. Any variation between the company's actual results and preliminary financial data set forth above may be material.

CONFERENCE CALL

A conference call will be held Wednesday, November 6, 2024 at 8:30 A.M. ET to review the Company’s financial results, discuss recent events and conduct a question-and-answer session.

A webcast of the conference call and accompanying presentation materials will be available in the Investor Relations section of VSE’s website at https://ir.vsecorp.com. To listen to the live broadcast, go to the site at least 15 minutes prior to the scheduled start time in order to register, download and install any necessary audio software.

To participate in the live teleconference:

| | | | | |

| Domestic Live: | (844) 826-3035 |

| International Live: | (412) 317-5195 |

| Audio Webcast: | https://viavid.webcasts.com/starthere.jsp?ei=1690580&tp_key=8747ae1c41

|

To listen to a replay of the teleconference through November 20, 2024:

| | | | | |

| Domestic Replay: | (844) 512-2921 |

| International Replay: | (412) 317-6671 |

| Replay PIN Number: | 10189934 |

ABOUT VSE CORPORATION

VSE is a leading provider of aftermarket distribution and repair services. Operating through its two key segments, VSE significantly enhances the productivity and longevity of its customers' high-value, business-critical assets. The Aviation segment is a leading provider of aftermarket parts distribution and maintenance, repair, and overhaul ("MRO") services for components and engine accessories to commercial, business, and general aviation operators. The Fleet segment specializes in part distribution, engineering solutions, and supply chain management services catered to the medium and heavy-duty fleet market. For more detailed information, please visit VSE's website at www.vsecorp.com.

Please refer to the Form 10-Q that will be filed with the Securities and Exchange Commission ("SEC") on or about November 6, 2024 for more details on our third quarter 2024 results. Also, refer to VSE’s Annual Report on Form 10-K for the year ended December 31, 2023 for further information and analysis of VSE’s financial condition and results of operations. VSE encourages investors and others to review the detailed reporting and disclosures contained in VSE’s public filings for additional discussion about the status of customer programs and contract awards, risks, revenue sources and funding, dependence on material customers, and management’s discussion of short- and long-term business challenges and opportunities.

FORWARD LOOKING STATEMENTS

This document contains certain forward-looking statements. These forward-looking statements, which are included in accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, may involve known and unknown risks, uncertainties and other factors that may cause VSE’s actual results and performance in future periods to be materially different from any future results or performance suggested by the forward-looking statements in this document. Although we believe the expectations reflected in such forward-looking statements are based upon reasonable assumptions, we can give no assurance that actual results will not differ materially from these expectations. “Forward-looking” statements, as such term is defined by the SEC in its rules, regulations and releases, represent our expectations or beliefs, including, but not limited to, statements concerning our operations, economic performance, financial condition, growth and acquisition strategies, investments and future operational plans. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “forecast,” “seek,” “plan,” “predict,” “project,” “could,” “estimate,” “might,” “continue,” “seeking” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. These statements, by their nature, involve substantial risks and uncertainties, certain of which are beyond our control, and actual results may differ materially depending on a variety of important factors, including, but not limited to, factors identified in our reports filed or expected to be filed with the SEC including our Annual Report on Form 10-K for the year ended December 31, 2023 and subsequent filings made with the SEC. All forward-looking statements made herein are qualified by these cautionary statements and risk factors and there can be no assurance that the actual results, events or developments referenced herein will occur or be realized. Readers are cautioned not to place undue reliance on these forward looking-statements, which reflect management's analysis only as of the date hereof. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results.

INVESTOR CONTACT

Michael Perlman

VP, Investor Relations & Treasury

T: (954) 547-0480 M: (561) 281-0247

investors@vsecorp.com

VSE Corporation and Subsidiaries

Unaudited Consolidated Balance Sheets

(in thousands except share and per share amounts)

| | | | | | | | | | | | | | |

| | September 30, | | December 31, |

| | 2024 | | 2023 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 7,907 | | | $ | 7,768 | |

Receivables (net of allowance of $6.8 million and $3.4 million, respectively) | | 162,665 | | | 127,958 | |

Contract assets | | 29,549 | | | 8,049 | |

| Inventories | | 533,773 | | | 500,864 | |

| Other current assets | | 41,403 | | | 36,389 | |

| Current assets held-for-sale | | — | | | 93,002 | |

| Total current assets | | 775,297 | | | 774,030 | |

Property and equipment (net of accumulated depreciation of $45.4 million and $37.4 million, respectively) | | 74,631 | | | 58,076 | |

Intangible assets (net of accumulated amortization of $78.8 million and $135.6 million, respectively) | | 160,580 | | | 114,130 | |

| Goodwill | | 390,636 | | | 351,781 | |

| Operating lease right-of-use asset | | 33,549 | | | 28,684 | |

| Other assets | | 29,306 | | | 23,637 | |

| Total assets | | $ | 1,463,999 | | | $ | 1,350,338 | |

| | | | |

| Liabilities and Stockholders' equity | | | | |

| Current liabilities: | | | | |

| Current portion of long-term debt | | $ | 30,000 | | | $ | 22,500 | |

| Accounts payable | | 122,740 | | | 173,036 | |

| Accrued expenses and other current liabilities | | 55,524 | | | 36,383 | |

| Dividends payable | | 1,843 | | | 1,576 | |

| Current liabilities held-for-sale | | — | | | 53,391 | |

| Total current liabilities | | 210,107 | | | 286,886 | |

| Long-term debt, less current portion | | 420,341 | | | 406,844 | |

| Deferred compensation | | 7,683 | | | 7,939 | |

| Long-term operating lease obligations | | 29,061 | | | 24,959 | |

| Deferred tax liabilities | | — | | | 6,985 | |

| Other long-term liabilities | | 9,011 | | | — | |

| Total liabilities | | 676,203 | | | 733,613 | |

| Commitments and contingencies | | | | |

| Stockholders' equity: | | | | |

Common stock, par value $0.05 per share; authorized 23,000,000 shares; issued and outstanding 18,428,955 and 15,756,918, respectively | | 921 | | | 788 | |

| Additional paid-in capital | | 404,983 | | | 229,103 | |

| Retained earnings | | 381,680 | | | 384,702 | |

| Accumulated other comprehensive loss | | 212 | | | 2,132 | |

| Total stockholders' equity | | 787,796 | | | 616,725 | |

| Total liabilities and stockholders' equity | | $ | 1,463,999 | | | $ | 1,350,338 | |

VSE Corporation and Subsidiaries

Unaudited Consolidated Statements of Income

(in thousands except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended September 30, | | Nine months ended September 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | | |

| Products | | $ | 188,334 | | | $ | 184,691 | | | $ | 564,092 | | | $ | 505,135 | |

| Services | | 85,279 | | | 46,662 | | | 217,019 | | | 120,028 | |

| Total revenues | | 273,613 | | | 231,353 | | | 781,111 | | | 625,163 | |

| | | | | | | | |

| Costs and operating expenses: | | | | | | | | |

| Products | | 166,139 | | | 160,326 | | | 495,177 | | | 442,714 | |

| Services | | 77,014 | | | 40,004 | | | 197,454 | | | 102,908 | |

| Selling, general and administrative expenses | | 2,605 | | | 2,556 | | | 9,721 | | | 6,121 | |

| Lease abandonment and termination (benefits) costs | | (652) | | | — | | | 12,205 | | | — | |

| Amortization of intangible assets | | 4,809 | | | 3,203 | | | 12,550 | | | 10,743 | |

| Total costs and operating expenses | | 249,915 | | | 206,089 | | | 727,107 | | | 562,486 | |

| Operating income | | 23,698 | | | 25,264 | | | 54,004 | | | 62,677 | |

| | | | | | | | |

| Interest expense, net | | 8,983 | | | 8,459 | | | 27,996 | | | 21,805 | |

| Income from continuing operations before income taxes | | 14,715 | | | 16,805 | | | 26,008 | | | 40,872 | |

| Provision for income taxes | | 3,065 | | | 4,694 | | | 5,035 | | | 10,554 | |

| Net income from continuing operations | | 11,650 | | | 12,111 | | | 20,973 | | | 30,318 | |

| Loss from discontinued operations, net of tax | | — | | | (2,554) | | | (18,711) | | | (2,789) | |

| Net income | | $ | 11,650 | | | $ | 9,557 | | | $ | 2,262 | | | $ | 27,529 | |

| | | | | | | | |

| Earnings per share: | | | | | | | | |

| Basic | | | | | | | | |

| Continuing operations | | $ | 0.63 | | | $ | 0.81 | | | $ | 1.22 | | | $ | 2.23 | |

| Discontinued operations | | — | | | (0.17) | | | (1.09) | | | (0.20) | |

| | $ | 0.63 | | | $ | 0.64 | | | $ | 0.13 | | | $ | 2.03 | |

| | | | | | | | |

| Diluted | | | | | | | | |

| Continuing operations | | $ | 0.63 | | | $ | 0.80 | | | $ | 1.22 | | | $ | 2.22 | |

| Discontinued operations | | — | | | (0.17) | | | (1.09) | | | (0.20) | |

| | $ | 0.63 | | | $ | 0.63 | | | $ | 0.13 | | | $ | 2.02 | |

| | | | | | | | |

| Weighted average shares outstanding: | | | | | | | | |

| Basic | | 18,425,643 | | | 15,001,908 | | | 17,125,502 | | | 13,585,391 | |

| Diluted | | 18,479,123 | | | 15,050,062 | | | 17,211,825 | | | 13,639,064 | |

| | | | | | | | |

| Dividends declared per share | | $ | 0.10 | | | $ | 0.10 | | | $ | 0.30 | | | $ | 0.30 | |

| | | | | | | | |

VSE Corporation and Subsidiaries

Unaudited Consolidated Statements of Cash Flows

(in thousands)

| | | | | | | | | | | | | | |

| | Nine months ended September 30, |

| | | 2024 | | 2023 |

| | (a) | | (a) |

| Cash flows from operating activities: | | | | |

| Net income | | $ | 2,262 | | | $ | 27,529 | |

| Adjustments to reconcile net income to net cash used in operating activities: | | | | |

| Depreciation and amortization | | 20,411 | | | 17,461 | |

| Amortization of debt issuance cost | | 997 | | | 1,028 | |

| Deferred taxes | | (9,840) | | | (1,179) | |

| Stock-based compensation | | 6,497 | | | 5,811 | |

| Provision for inventory | | — | | | 742 | |

| Impairment and loss on sale of business segment | | 16,867 | | | — | |

| Loss on sale of property and equipment | | 421 | | | — | |

| Lease abandonment and termination costs | | 12,205 | | | — | |

| Changes in operating assets and liabilities, net of impact of acquisitions: | | | | |

| Receivables | | (32,720) | | | (25,304) | |

| Contract assets | | 5,267 | | | 5,409 | |

| Inventories | | (26,808) | | | (60,867) | |

| Other current assets and other assets | | (8,232) | | | 2,122 | |

| Operating lease assets and liabilities, net | | (10,442) | | | (262) | |

| Accounts payable and deferred compensation | | (67,860) | | | (16,717) | |

| Accrued expenses and other liabilities | | 4,563 | | | (5,544) | |

| Net cash used in operating activities | | (86,412) | | | (49,771) | |

| Cash flows from investing activities: | | | | |

| Purchases of property and equipment | | (17,439) | | | (10,795) | |

| | | | |

| Proceeds from the sale of business segment | | 42,118 | | | — | |

| Proceeds from the payment on notes receivable | | — | | | 1,557 | |

| Cash paid for acquisitions, net of cash acquired | | (112,206) | | | (218,674) | |

| Net cash used in investing activities | | (87,527) | | | (227,912) | |

| Cash flows from financing activities: | | | | |

Borrowings on bank credit facilities | | 527,165 | | | 610,188 | |

Repayments on bank credit facilities | | (507,165) | | | (435,298) | |

| Proceeds from issuance of common stock | | 161,693 | | | 129,566 | |

| Payment of debt financing costs | | — | | | (1,448) | |

| Payment of taxes for equity transactions | | (2,758) | | | (1,113) | |

| Dividends paid | | (5,019) | | | (3,861) | |

| Net cash provided by financing activities | | 173,916 | | | 298,034 | |

| Net (decrease) increase in cash and cash equivalents | | (23) | | | 20,351 | |

| Cash and cash equivalents, beginning of period | | 7,930 | | | 478 | |

| Cash and cash equivalents, end of period | | $ | 7,907 | | | $ | 20,829 | |

(a) The cash flows related to discontinued operations and held-for-sale assets and liabilities have not been segregated, and remain included in the major classes of assets and liabilities. Accordingly, the Consolidated Statements of Cash Flows include the results of continuing and discontinued operations. |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

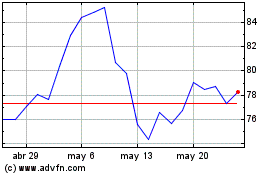

VSE (NASDAQ:VSEC)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

VSE (NASDAQ:VSEC)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025