UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): November 14, 2024

WISA TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38608 |

|

30-1135279 |

(State or other jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

|

15268 NW Greenbrier Pkwy

Beaverton, OR |

|

97006 |

| (Address of registrant’s principal executive office) |

|

(Zip code) |

(408) 627-4716

(Registrant’s telephone

number, including area code)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| x |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.0001 per share |

|

WISA |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange

Act of 1934.

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 |

Entry into a Material Definitive Agreement. |

Amendment to Asset

Purchase Agreement

As previously disclosed,

on September 4, 2024, WiSA Technologies, Inc. (the “Company”) entered into an asset purchase agreement (the “Asset Purchase

Agreement”) with Data Vault Holdings Inc., a Delaware corporation (the “Data Vault”), pursuant to which the Company

has agreed to purchase, assume and accept from Data Vault all of the rights, title and interests in, to and under the assets and interests

used in the acquired business, and products and services solely to the extent they utilize the transferred assets, including certain patents,

trademarks, and software source code.

On November 14, 2024,

the Company and Data Vault entered into amendment to the Asset Purchase Agreement (the “Asset Purchase Agreement Amendment”).

Pursuant to the Asset Purchase Agreement Amendment, the parties agreed to amend the definition of Acquired Business to Acquired Assets,

to better describe the transferred asset. The parties also updated the schedules describing the transferred assets.

Pursuant to the Asset Purchase Agreement Amendment, the parties also agreed to amend the definition of Key Employees to only include Nathaniel

Bradley and Brett Moyer, and revise the initial terms of the Promissory Note (as defined in the Asset Purchase Agreement) by adding a

floor price of $1.116, and clarifying that all the payments made by the Company to Data Vault will be reduced by the amount owned by Data

Vault to the Company under certain senior secured promissory notes.

Except as stated above,

the Asset Purchase Agreement Amendment does not make any other substantive changes to the Asset Purchase Agreement.

A copy of the Asset Purchase

Agreement Amendment is filed with this Current Report on Form 8-K (“Form 8-K”) as Exhibit 2.1 and is incorporated herein by

reference, and the foregoing description of the Asset Purchase Agreement Amendment is qualified in its entirety by reference thereto.

| Item 2.02 | Results of Operations and Financial Condition. |

On November 15, 2024,

the Company issued a press release announcing its financial and business highlights for the quarter ended September 30, 2024. The press

release is attached as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference.

Additionally, on November

15, 2024, the Company will host a conference call to deliver to the Company’s stockholders a presentation of the Company’s

third quarter results. The Company released presentation materials that incorporate, among other items, the Company’s third quarter

2024 update, recent business highlights and update regarding the asset purchase with Data Vault. The presentation materials for the conference

call are attached as Exhibit 99.2 to this Form 8-K and are incorporated herein by reference.

The information contained

in Item 2.02 of this Form 8-K, including Exhibit 99.1 and Exhibit 99.2, is being furnished and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference

in any filing under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, except as shall be

expressly set forth by specific reference in such a filing.

| Item 7.01 | Regulation FD Disclosure |

On November

15, 2024, the Company issued a press release announcing the filing of its preliminary proxy statement with the U.S. Securities and Exchange

Commission in connection with the Company’s 2024 annual meeting of stockholders (the “Annual Meeting”). At the Annual

Meeting, the Company’s stockholders will be entitled to vote on a number of proposals, including, among others, a proposal to approve

the transactions contemplated by the Asset Purchase Agreement, as amended. The press release is attached as Exhibit 99.3 to this Form

8-K and is incorporated herein by reference.

The information contained

in Item 7.01 of this Form 8-K, including Exhibit 99.3, is being furnished and shall not be deemed “filed” for purposes of

Section 18 of the Exchange Act, or incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall

be expressly set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d)

Exhibits

* Schedules and exhibits omitted pursuant

to Item 601(b)(2) of Regulation S-K. The Company agrees to furnish supplementally a copy of any omitted schedule to the SEC upon request.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 15, 2024 |

WISA TECHNOLOGIES, INC. |

| |

|

|

| |

By: |

/s/ Brett Moyer |

| |

|

Name: |

Brett Moyer |

| |

|

Title: |

Chief Executive Officer |

Exhibit 2.1

AMENDMENT TO

ASSET PURCHASE AGREEMENT

This Amendment to Asset Purchase

Agreement (this “Amendment”) is made and entered into as of November 14, 2023, by and between WiSA Technologies, Inc.,

a Delaware corporation (together with its successors, “Purchaser”), and Data Vault Holdings Inc., a Delaware corporation

(“Seller”). Capitalized terms used herein without definition shall have the same definition ascribed thereto in the

Purchase Agreement (as defined below).

RECITALS

WHEREAS,

the Asset Purchase Agreement was made and entered into as of September 4, 2024, by and among Purchaser and Seller (the “Purchase

Agreement”), pursuant to which pursuant to which the Company has agreed to purchase, assume and accept from Seller all of the

rights, title and interests in, to and under the assets and interests used in the Acquired Business, and products and services solely

to the extent they utilize the Transferred Assets, including Seller’s information technology assets, certain patents, trademarks,

and software source code;

WHEREAS,

Section 11.8 of the Purchase Agreement provides that the Purchase Agreement may be amended, supplemented or otherwise modified by a written

instrument executed by both Seller and Purchaser; and

WHEREAS,

Purchaser and Seller desire to amend the Purchase Agreement as set forth below and intend for the amendments made in this Amendment to

be retroactively effective as of September 4, 2024, the date on which Purchaser and Seller originally entered into the Purchase Agreement.

AGREEMENT

NOW,

THEREFORE, in consideration of the mutual promises contained in this Amendment and for other good and valuable consideration,

the receipt and sufficiency of which is hereby acknowledged, the parties hereby agree as follows:

1.

Amendment to “Acquired Business” Definition. The definition of “Acquired Business” shall be amended

in its entirety to read as follows, and all the references to the Acquired Business shall be changed to Acquired Assets:

“Acquired

Asset” shall mean solely the Transferred Assets.

2.

Amendment to “Assumed Payables” Definition. The definition of “Assumed Payables” shall be deleted

in its entirety.

3.

Amendment to “Closing Indebtedness” Definition. The definition of “Closing Indebtedness” shall be

amended in its entirety to read as follows:

“Closing

Indebtedness” shall mean the Indebtedness of Seller immediately before the Closing relating solely to the Transferred Assets,

which shall be set forth on Section 4.7 of the Disclosure Schedules.

4.

Amendment to “Key Employees” Definition. The definition of “Key Employees” shall be amended in its

entirety to read as follows:

“Key

Employees” shall mean Nathaniel Bradley and Brett Moyer.

5.

Amendment to “ordinary course of business” Definition. The definition of “ordinary course of business”

shall be amended in its entirety to read as follows:

“ordinary

course of business” shall mean in the ordinary course of the operation of the Company, consistent with past practices of the

Company.

6.

Amendment to “Promissory Note” Definition. The definition of “Promissory Note” shall be amended

in its entirety to read as follows:

“Promissory

Note” shall mean an unsecured promissory note, in a form to be mutually agreed between the Parties, having the following terms:

(i) the maturity date will be on the third anniversary of the Closing Date (the “Maturity Date”), (ii) the outstanding

principal plus accrued and unpaid interest shall be paid on the Maturity Date, (iii) for so long as the Promissory Note remains outstanding,

in the event that Purchaser receives proceeds from any one or more subsequent financings (the “Subsequent Financing”),

then, at Seller’s option it may demand that ten percent (10%) of such proceeds shall be used to repay the outstanding balance of

the Promissory Note, (iv) if the aggregate gross proceeds of the Subsequent Financings reach or exceed $50,000,000, then Purchaser shall

repay the Promissory Note in full, (v) if the outstanding balance of the Promissory Note is not fully repaid on the Maturity Date, Seller

is entitled to convert the outstanding amount into shares of Common Stock using seventy-five percent (75%) of the average of the VWAPs

for the ten (10) consecutive Trading Days ending on (and including) the Maturity Date, (vi) all the payments made by Purchaser to Seller

will be reduced by the amount owned by Seller to Purchaser under those certain senior secured promissory notes, dated June 13, 2024, August

7, 2024, and September 23, 2024, and (vii) the Promissory Note will have a floor price of $1.116.

7.

Amendment to Section 7.2(g). Section 7.2(g) of the Purchase Agreement shall be amended in its entirety to read as follows:

(g) Key

Employees. The Employment Agreement, entered into between Purchaser and Nathaniel Bradley in connection with this Agreement will be

in full force and effect and he will not have terminated, rescinded or repudiated his Employment Agreement;

8.

Amendment to Section 10.1(b). Section 10.1(b) of the Purchase Agreement shall be amended in its entirety to read as follows:

(b) after

March 31, 2025 (the “Outside Date”), by any Party by delivery of a written notice to the other Party in accordance

with Section 11.1 if the Closing shall not have been consummated on or prior to 5:00 pm Eastern Time on the Outside Date; provided,

however, that the right to terminate this Agreement under this Section 10.1(b) shall not be available to any Party whose failure or whose

Affiliate’s failure to perform any of its representations, warranties, covenants or other obligations under this Agreement has been

the primary cause of, or otherwise primarily resulted in, the failure of the Closing to occur on or prior to such date;

9.

Amendment to Exhibit B. Exhibit B of the Purchase Agreement shall be amended in its entirety to read as set out in the Exhibit

A of this Amendment.

10.

Amendment to Annex I of Exhibit B. Annex I of Exhibit B of the Purchase Agreement shall be amended in its entirety to read

as set out in the Exhibit B of this Amendment.

11.

Amendment to Exhibit C. Exhibit C of the Purchase Agreement shall be amended in its entirety to read as set out in the

Exhibit C of this Amendment.

12.

Amendment to Exhibit A. Exhibit A of the Purchase Agreement shall be amended in its entirety to read as set out in the Exhibit

D of this Amendment.

13.

Amendment to Disclosure Schedules. Disclosure Schedules of the Purchase Agreement shall be amended in its entirety to read

as set out in the Exhibit E of this Amendment.

14.

Retroactive Effectiveness. This Amendment shall be retroactively effective as of September 4, 2024 and at all times thereafter,

with the same force and effect as if this Amendment had been executed on that date.

15.

Recitals. Purchaser and Seller acknowledge and agree that the recitals set forth above are true and correct in all material

respects and are hereby incorporated herein by reference and made a part of this Amendment.

16.

No Other Modification. Except as specifically amended by the terms of this Amendment, all terms and conditions set forth

in the Purchase Agreement shall remain in full force and effect, as applicable.

17.

Governing Law. This Amendment shall be governed by, and construed in accordance with, the laws of the State of Delaware,

without regard to any rule or principle that might refer the governance or construction of this Amendment to the Laws of another jurisdiction.

18.

Entire Agreement. This Amendment contains the entire agreement and understanding of the parties hereto with respect to the

subject matter contained therein and may not be contradicted by evidence of any alleged oral agreement.

19.

Further Assurances. Each party to this Amendment agrees to perform any further acts and execute and deliver any documents

that may be reasonably necessary to carry out the provisions of this Amendment.

20.

Counterparts. This Amendment may be executed in multiple counterparts, each of which shall be deemed an original and all

of which, together, shall constitute one and the same instrument. Facsimile, .pdf and other electronic execution and delivery of this

consent is legal, valid and binding for all purposes.

21.

Headings. The descriptive headings of the various provisions of this Amendment are inserted for convenience of reference

only and shall not be deemed to affect the meaning or construction of any of the provisions hereof.

[Remainder

of Page Intentionally Left Blank]

IN WITNESS WHEREOF, the parties

hereto have duly executed this Amendment as of the date first above written.

| |

WISA

TECHNOLOGIES, INC. |

| |

|

| |

By: |

/s/ Brett Moyer |

| |

|

Name: Brett Moyer |

| |

|

Title: Chief Executive Officer |

| |

|

| |

DATA

VAULT HOLDINS INC. |

| |

|

| |

By: |

/s/ Nathaniel Bradley |

| |

|

Name: Nathaniel Bradley |

| |

|

Title: Chief Executive Officer |

[Signature Page to Amendment to Asset Purchase Agreement]

Exhibit

99.1

WiSA Technologies,

Inc. Reports Q3 2024 Results

- Increases revenue

240% in Q3 2024 from Q2 2024 -

BEAVERTON,

OR — (November 15, 2024) — WiSA Technologies, Inc. (NASDAQ: WISA), which is in a definitive agreement to acquire AI,

blockchain and Data Web 3.0 IP assets of Data Vault Holdings, Inc.® (“Data Vault”) to form a data technology

& licensing company leveraging IP & proprietary HPC software, reported third quarter 2024 financial results in its Form 10-Q,

which was filed on November 14, 2024. In its conference call and presentation today at 8:00 am PT / 11:00 am ET, WiSA CEO Brett Moyer

will discuss the Company’s results and provide a general business update.

“In

Q3 2024, we delivered 240% sequential revenue growth, driven by both WiSA HT and our new WiSA E IP being in production with a multi-national

licensee,” said Brett Moyer, CEO of WiSA Technologies. “With WiSA E TX intellectual property now shipping in media boxes

with android OS and expected to be in stores for Christmas, we expect to further this momentum with additional design wins and production

advancements in 2025. Further leveraging our WiSA E technology, we are expanding the addressable market by adapting this software for

Linux implementations in 2025.”

WiSA

Technologies Q3 2024 and Recent Operating Hightlights

| · | Hired

Stanley Mbugua as Vice President of Finance, who will also assume the role of Chief Accounting

Officer, effective November 30, 2024. |

| | | |

| · | Achieved

WiSA E wireless milestone with immersive audio software embedded onto an Amlogic reference

design, which became available for customer implementation and showcased the IBC show in

Amsterdam. |

| | | |

| · | Executed

licensing agreements with leading HDTV brands, covering 43% of the HDTV market that uses

the Android operating system. |

Q3

2024 and Subsequent Financial Hightlights

| · | Q3

2024 revenue was $1.2 million, up 52% from $0.8 million in Q3 2023. The increase in revenue

was a result of an increase in Components sales of $0.7 million, partially offset by a decrease

in Consumer Audio Product sales of $0.3 million. |

| | | |

| · | Q3

2024 gross margin as a percentage of sales was 19%, compared to negative 217% in Q3 2023.

The improvement in gross margin compared to the prior period is mainly attributable to an

increase of $0.4 million increase in revenue between comparison periods and due to the fact

that Q3 2023 included a $1.4 million increase in inventory reserves whereas Q3 2024 had only

a nominal increase in inventory reserves. |

| | | |

| · | Held

$3.9 million cash at September 30, 2024. |

WiSA Technologies Investor Conference

Call

Management will host its third quarter

2024 results conference call at 8:00 am PT / 11:00 am ET, on Friday, November 15, 2024.

The conference call will be available

through a live webcast found here:

Webcast | Third Quarter 2024 Results

Those without internet access or

who wish to dial in may call: 1-833-366-1124 (domestic), or 1-412-317-0702 (international). All callers should dial in

approximately 10 minutes prior to the scheduled start time and ask to be joined into the WiSA Technologies call.

A webcast replay of the call will be

available approximately one hour after the end of the call and will be available for 90 days, at the above webcast link. A telephonic

replay of the call will be available through November 22, 2024, and may be accessed by calling 1- 877-344-7529 (domestic) or 1- 412-317-0088

(international) or Canada (toll free) 855-669-9658 and using access code 4877124.

A presentation of the Q3 2024 results

will be accessible on Friday, November 15, 2024, under the “Investors” section of WiSA Technologies’ website.

About

WiSA Technologies, Inc.

WiSA is a leading provider of immersive, wireless sound technology for intelligent devices and next-generation

home entertainment systems. Working with leading CE brands and manufacturers such as Harman International, a division of Samsung; LG;

Hisense; TCL; Bang & Olufsen; Platin Audio; and others, the company delivers immersive wireless sound experiences for high-definition

content, including movies and video, music, sports, gaming/esports, and more. WiSA Technologies, Inc. is a founding member of WiSA™

(the Wireless Speaker and Audio Association) whose mission is to define wireless audio interoperability standards as well as work with

leading consumer electronics companies, technology providers, retailers, and ecosystem partners to evangelize and market spatial audio

technologies driven by WiSA Technologies, Inc. The company is headquartered in Beaverton, OR with sales teams in Taiwan, China, Japan,

Korea, and California.

About Data

Vault Holdings, Inc.

Data

Vault Holdings Inc. is a technology holding company that provides a proprietary, cloud-based platform for the delivery of blockchain

objects. Data Vault Holdings Inc. provides businesses with the tools to monetize data assets securely over its Information Data Exchange®

(IDE). The company is in the process of finalizing the consolidation of its affiliates Data Donate Technologies, Inc., ADIO LLC,

and Datavault Inc. as wholly owned subsidiaries under one corporate structure. Learn more about Data Vault Holdings Inc. here.

LEGAL

DISCLAIMER

Forward-Looking

Statements

This

press release of WiSA Technologies, Inc. (NASDAQ: WISA) (the “Company”, “us”, “our” or “WiSA”)

contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities

Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements, include, among others,

the Company’s and Data Vault Holdings, Inc.’s (“Datavault”) expectations with respect to the proposed asset purchase

(the “Asset Purchase) between them, including statements regarding the benefits of the Asset Purchase, the anticipated timing of

the Asset Purchase, the implied valuation of Datavault, the products offered by Datavault and the markets in which it operates, and the

Company’s and Datavault’s projected future results and market opportunities, as well as information with respect to WiSA’s

future operating results and business strategy. Readers are cautioned not to place undue reliance on these forward-looking statements.

Actual results may differ materially from those indicated by these forward-looking statements as a result of a variety of factors, including,

but are not limited to: (i) risks and uncertainties impacting WiSA’s business including, risks related to its current liquidity

position and the need to obtain additional financing to support ongoing operations, WiSA’s ability to continue as a going concern,

WiSA’s ability to maintain the listing of its common stock on Nasdaq, WiSA’s ability to predict the timing of design wins

entering production and the potential future revenue associated with design wins, WiSA’s ability to predict its rate of growth,

WiSA’s ability to predict customer demand for existing and future products and to secure adequate manufacturing capacity, consumer

demand conditions affecting WiSA’s customers’ end markets, WiSA’s ability to hire, retain and motivate employees, the

effects of competition on WiSA’s business, including price competition, technological, regulatory and legal developments, developments

in the economy and financial markets, and potential harm caused by software defects, computer viruses and development delays, (ii) risks

related to the Asset Purchase, including WiSA’s ability to close the Asset Purchase in a timely manner or at all, or on the terms

anticipated, whether due to WiSA’s ability to satisfy the applicable closing conditions and secure stockholder approval from WiSA

stockholders or otherwise, as well as risks related to WiSA’s ability to realize some or all of the anticipated benefits from the

Asset Purchase, (iii) any risks that may adversely affect the business, financial condition and results of operations of Datavault, including

but not limited to cybersecurity risks, the potential for AI design and usage errors, risks related to regulatory compliance and costs,

potential harm caused by data privacy breaches, digital business interruption and geopolitical risks, and (iv) other risks as set forth

from time to time in WiSA’s filings with the U.S. Securities and Exchange Commission (the “SEC”). The information in

this press release is as of the date hereof and neither the Company nor Datavault undertakes any obligation to update such information

unless required to do so by law. The reader is cautioned not to place under reliance on forward looking statements. Neither the Company

nor Datavault gives any assurance that either the Company or Datavault will achieve its expectations.

This

press release shall not constitute an offer to sell, or the solicitation of an offer to buy, nor will there be any sale of these securities

in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification

under the securities laws of such state or jurisdiction. No offering of securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the Securities Act, or an exemption therefrom.

Additional

Information and Where to Find It

In

connection with the proposed Asset Purchase, WiSA intends to file with the SEC a definitive proxy statement. The definitive proxy statement

for WiSA (if and when available) will be mailed to stockholders of WiSA. WISA STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND

OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED ASSET PURCHASE.

WiSA

stockholders will be able to obtain free copies of these documents (if and when available) and other documents containing important information

about WiSA and Data Vault, once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov.

Copies of the documents filed with the SEC will also be made available free of charge by contacting WiSA using the contact information

below.

Participants

in the Solicitation

WISA

and its directors, executive officers and other members of its management and employees may be deemed to be participants in the solicitation

of proxies from WiSA’s stockholders in connection with the Asset Purchase. Stockholders are urged to carefully read the proxy

statement regarding the Asset Purchase when it becomes available, because it will contain important information. Information regarding

the persons who may, under the rules of the SEC, be deemed participants in the solicitation of WiSA’s stockholders in connection

with the Asset Purchase will be set forth in the proxy statement when it is filed with the SEC. Information about WiSA’s

executive officers and directors will be set forth in the proxy statement relating to the Asset Purchase when it becomes available. You

can obtain free copies of these and other documents containing relevant information at the SEC’s web site at www.sec.gov or by

directing a request to the address or phone number set forth below.

For

further information, please contact:

WiSA

Technologies, Inc.

15268 NW Greenbrier Pkwy

Beaverton, OR 97006

(408) 627-4716

Investors

Contact for WiSA Technologies and Data Vault Holdings:

David Barnard, Alliance Advisors Investor Relations, 415-433-3777, wisa@lhai.com

Exhibit 99.2

| Third Quarter 2024 and

Transaction Update

November 15, 2024 |

| Forward Looking Statements

2

This presentation of WiSA Technologies, Inc. (NASDAQ: WISA) (the “Company”, “us”, “our” or “WiSA”) contains forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking

statements, include, among others, the Company’s and Data Vault Holdings, Inc.’s (“Datavault”) expectations with respect to the proposed asset purchase (the “Asset

Purchase) between them, including statements regarding the benefits of the Asset Purchase, the anticipated timing of the Asset Purchase, the implied valuation of

Datavault, the products offered by Datavault and the markets in which it operates, and the Company’s and Datavault’s projected future results and market opportunities,

as well as information with respect to WiSA’s future operating results and business strategy. Readers are cautioned not to place undue reliance on these forward-looking

statements. Actual results may differ materially from those indicated by these forward-looking statements as a result of a variety of factors, including, but are not limited

to: (i) risks and uncertainties impacting WiSA’s business including, risks related to its current liquidity position and the need to obtain additional financing to support

ongoing operations, WiSA’s ability to continue as a going concern, WiSA’s ability to maintain the listing of its common stock on Nasdaq, WiSA’s ability to predict the timing

of design wins entering production and the potential future revenue associated with design wins, WiSA’s ability to predict its rate of growth, WiSA’s ability to predict

customer demand for existing and future products and to secure adequate manufacturing capacity, consumer demand conditions affecting WiSA’s customers’ end markets,

WiSA’s ability to hire, retain and motivate employees, the effects of competition on WiSA’s business, including price competition, technological, regulatory and legal

developments, developments in the economy and financial markets, and potential harm caused by software defects, computer viruses and development delays, (ii) risks

related to the Asset Purchase, including WiSA’s ability to close the Asset Purchase in a timely manner or at all, or on the terms anticipated, whether due to WiSA’s ability to

satisfy the applicable closing conditions and secure stockholder approval from WiSA stockholders or otherwise, as well as risks related to WiSA’s ability to realize some or all

of the anticipated benefits from the Asset Purchase, (iii) any risks that may adversely affect the business, financial condition and results of operations of Datavault,

including but not limited to cybersecurity risks, the potential for AI design and usage errors, risks related to regulatory compliance and costs, potential harm caused by

data privacy breaches, digital business interruption and geopolitical risks, and (iv) other risks as set forth from time to time in WiSA’s filings with the U.S. Securities and

Exchange Commission (the “SEC”). The information in this presentation is as of the date hereof and neither the Company nor Datavault undertakes any obligation to

update such information unless required to do so by law. The reader is cautioned not to place under reliance on forward looking statements. Neither the Company nor

Datavault gives any assurance that either the Company or Datavault will achieve its expectations.

This presentation shall not constitute an offer to sell, or the solicitation of an offer to buy, nor will there be any sale of these securities in any state or other jurisdiction in

which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction. No offering of

securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or an exemption therefrom. |

| Additional Information

3

Additional Information and Where to Find It

In connection with the proposed Asset Purchase, WiSA intends to file with the SEC a definitive proxy statement. The definitive proxy statement for WiSA (if and when

available) will be mailed to stockholders of WiSA. WISA STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS THAT MAY BE FILED

WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE

PROPOSED ASSET PURCHASE.

WiSA stockholders will be able to obtain free copies of these documents (if and when available) and other documents containing important information about WiSA and

Data Vault, once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC

will also be made available free of charge by contacting WiSA using the contact information below.

Participants in the Solicitation

WISA and its directors, executive officers and other members of its management and employees may be deemed to be participants in the solicitation of proxies from

WiSA’s stockholders in connection with the Asset Purchase. Stockholders are urged to carefully read the proxy statement regarding the Asset Purchase when it becomes

available, because it will contain important information. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation

of WiSA’s stockholders in connection with the Asset Purchase will be set forth in the proxy statement when it is filed with the SEC. Information about WiSA’s executive

officers and directors will be set forth in the proxy statement relating to the Asset Purchase when it becomes available. You can obtain free copies of these and other

documents containing relevant information at the SEC’s web site at www.sec.gov or by directing a request to the address or phone number set forth below.

For further information, please contact:

WiSA Technologies, Inc.

15268 NW Greenbrier Pkwy

Beaverton, OR 97006

(408) 627-4716 |

| WiSA E Drives Growth in Third Quarter 2024

WiSA E IP now in production with a multi-national licensee

4

• Improving financials Q3 ’24 vs. Q2 ‘24

• 240% revenue increase to $1.2M

• 19.3% gross margin up from 3.2%

• 17% inventory reduction to $1.9M

• $3.9M cash at September 30, 2024

• Shipping WiSA E TX IP in media boxes, with

android OS to be in stores for Christmas

• Adapting WiSA E for Linux implementations

in 2025

• 5 WiSA E license agreements in place,

more in the pipeline

Multiple Sources Multiple Audio Devices

Well-positioned to penetrate multiple end

markets through licensing |

| Transaction Update

Asset Purchase Agreement

• $210M paid to Data Vault Holdings Inc. in exchange for Datavault® and ADIO® IP assets

o $200M in the form of shares of restricted common stock of WiSA Technologies

to be issued at $5.00/share

o $10M in an unsecured promissory Note due 3 years from closing, with 10% of the proceeds

of any financings used to pay down or pay off the Note in the interim

• 3% royalty on future revenues from Datavault and ADIO® product lines to be paid to Master Vault, LLC over the life of the patents

Closing Expectations

• WiSA expects to mail a Definitive Proxy Statement for its Annual Meeting, to be held in December 2024, at which stockholder will have

an opportunity to vote to approve the Asset Purchase. If approved by stockholders, WiSA expects that the Asset Purchase will close

shortly after the Annual Meeting, subject to satisfaction of customary closing conditions.

Post Closing Highlights

• Change name to Datavault®

• Name Nate Bradley as CEO & Brett Moyer as CFO

5 |

| 1998 2010 2020 2022 2024

12 patents,

NASDAQ:UPLD $1.6B

market cap on 02/2021.

“patents acquired “

by UPLAND

SOFTWARE.

120 patents,

NASDAQ: MARA,

market cap $3.2B

on 4/21.

16 patents,

NASDAQ: AEYE,

market cap

$258.8M on 12/20.

Voice America

7 patents,

100 Employees.

Phoenix, Arizona

Pioneer in Internet Talk

Radio

Featured in Forbes,

Fortune and Entrepreneur

As seen in:

Nathaniel T Bradley

Datavault Co-Founder &

Chief Executive Officer

6

Total: 67 Patents*

26 patents*

41 patents*

Proven Leadership Monetizing IP

*Includes patents filed, pending and issued |

| Blockchain Data Artificial Intelligence Web 3.0

Rapidly Growing, Multi-Billion Dollar Markets

68% CAGR $1076 B 40% CAGR $298 B $795 B

’24 ‘27 ’23 ’27

$123B

Source: Statista Market Insights, market.us, Blockchain Technology Market Published March 2024, Global Blockchain Technology Market 2022 7 |

| • Data over sound and invisible mobile QR code

• Ultrasonic anchor

• Data tone transmission

• Mobile response receiver platform allows for

complete management of ultrasonic tones

Further Monetizing Acoustic Science

Patented data over sound, spatial control of it and the industry standard

in multi-channel wireless transmission quality only from Datavault®

8

Drives two-way dialog

with broadcasting

Anchors real world to mobile

marketing

Ties to data for comprehensive

analysis and gamification

Benefits |

| Events Market

Goals

• Increase engagement

by gamifying

experience

• Boost Resorts World

revenue

• Direct traffic to

bars & night club

• Offer additional events

14% Visitor Engagement*

$120 Average

Visitor Spend

7% of Engaged Visitors

Bought Additional

RW Events

Results

9

Concert Event Resorts

World, Las Vegas

Dec. 2023: 5,000 Participants

* 21 years and older

Sponsored by Levis & Las Vegas Convention Center to increase

wayfinding and brand loyalty

statistic game features and commemorative tokens

Fostering fan engagement

through an innovative game experience

• Mobile and

Location-Based

Marketing

• Experiential and

Events

• E-commerce and

Retail Platforms

• Content

Streaming |

| • Partnership with HYPERVSN, which is

backed by prominent venture

investors, including Sir Richard

Branson and Mark Cuban

• HYPERVSN’s holographic solutions are

combined with ADIO®, which

leverages data packets embedded

within audio signals to deliver precise,

targeted content

Benefits1 :

• 40% longer viewing and

engagement time vs. 2D digital

• 2X higher chance of holographic

images being seen

• Up to 40% increase in sales of

promoted products

HYPERVSN and ADIO® Designed to Drive Results

10

1 HYPERVSN - 3D Holographic Displays for Advertising, Events

Shopping Malls

Drive traffic to retailers and increase

conversion.

Sports Arenas and Stadiums

Increase fan experience and drive engagement

during games or events.

Product Suite

Events and Conventions

Enhance attendee engagement create

memorable brand experience.

Hotels and Resorts

Connect with travelers and enhance their stay

with convenient, personalized experiences.

University Campuses

introduce students to wayfinding materials, new

products or services. |

| Education Real-World Applications

11

• Generates immutable metadata that indexes,

scores and prices data of all types in Web 3.0

• Creates value through scarcity, utility and encrypted data protection

• Ensures identity of credentialed graduates is verifiable over patented sonic data

verification

VerifyU TM - Monetizing Credentials, Degrees and Memorabilia

Benefits of Our Platform

Protect Credentials

Create, mint & issue credentials that are tokenized and

encrypted with identity & credential information.

Web 3.0 Systems Integration

Connect to existing infrastructure to add Web 3.0 blockchain

functionality. Manage cohorts and alumni connections through

secure and scalable infrastructure.

Generate Revenue

Develop new revenue through creation of data objects of value

and market them on our patented Information Data Exchange.

Other Extended Benefits

Monetizing Name, Image, Likeness (NIL)

NIL market set to grow from $1B in 2024

to $1.7B in 2025*

Licensing Supercomputer time for

AI course work and research

Worldwide shortage of supercomputer

infrastructure effecting .edu AI degreed programs

*Opendorse. "NIL AT 3: The Annual Opendorse Report." Opendorse, 2024, https://biz.opendorse.com/nil-3-annual-report/ |

| Supercomputing – Digital Twins Symposium

12

The collaboration with a US national labs for High Performance Computing (HPC),

focusing on securing 200+ projects across energy, life sciences, agriculture, and

healthcare, starting with a custom Phytointel platform, powered by Datavault and HPC.

Biodiesel Market Potential: The global biodiesel market is valued between $30B – 40B annually,

with about $1.75B attributable to canola oil, assuming a 50% vegetable oil share and a 10% canola oil

share within it. This market is growing at an estimated 7%-10% compound annual growth rate.

Emerging Demand for Biofuels: Driven by government initiatives like the Renewable Fuel

Standard, the biofuel market is projected to surpass $190B by 2027, highlighting opportunities for

crops like canola as key biofuel feedstocks.

Datavault’s PhytoIntel’s Role in Plant Biotechnology: The PhytoIntel platform, powered by

Datavault’s underlying Data Management and Visualization technologies, applies HPC and AI to create

predictive models for gene modification, aiming to develop a “Digital Twin” of plant species. This

technology supports advancements in plant traits such as yield and stress resistance.

Data-Driven Biotechnology for Precision: Unlike traditional approaches, PhytoIntel integrates multi-omics data (genomics, transcriptomics, metabolomics) with AI for a comprehensive, predictive model—

promising precision improvements in gene-editing outcomes for plant biotechnology.

Canola as a Strategic Biofuel Feedstock: Enhancing canola’s yield and oil quality through biotech

solutions positions it well to meet the rising demand for sustainable energy sources, further

strengthening its role in the biofuels sector.

Source: Biodiesel Market Size & Share, Growth Opportunity 2024-2032 (gminsights.com) North America Biodiesel Market Share, 2032 Statistics Report (gminsights.com) |

| Data Technology & Licensing Company

6th IP Company CEO, a proven leader, leveraging his experience commercializing and

successfully monetizing an IP portfolio for 5 licensing companies

67 Patents IP and patents targeting AI applications, decentralized blockchain, redefined

data ownership, crypto anchors and acoustic science

Large, Growing AI &

Blockchain Markets

Blockchain data + AI Web 3.0 growing TAM expected to reach ~$2B by 2027

for solutions enabling customers to monetize their digital assets

High-margin Licensing

Model

HPC software licensing for sports & entertainment, events & venues, biotech,

education, fintech, real estate, healthcare, energy and more

Traction with

Global Customers

Solutions providing Digital Twins, tokenization, data ownership and more with

AI, ML & marketing automation, customization, security, privacy and third-party & Web 3.0 systems integration

13 |

| Thank You

November 15, 2024

WiSA & Datavault®

Proposed Business Combination

Thank You

Investor Contact

David Barnard, CFA

Alliance Advisors Investor Relations

wisa@allianceadvisors.com

1-415-433-3777 |

Exhibit

99.3

WiSA Technologies,

Inc. Files Preliminary Proxy, Advancing Data Vault Asset Purchase

- Data Vault’s

CEO to join today’s Q3 2024 conference call to discuss its commercialization strategy –

BEAVERTON,

OR — (November 15, 2024) — WiSA Technologies, Inc. (NASDAQ: WISA), which is in a definitive agreement to acquire AI,

blockchain and Data Web 3.0 IP assets of Data Vault Holdings, Inc.® (“Data Vault”) to form a data technology

& licensing company leveraging IP & proprietary HPC software, today filed a Preliminary Proxy Statement for its Annual Meeting,

which included information regarding its planned acquisition of Data Vault’s ADIO® and Data Vault assets (the “Asset

Purchase”). In its Q3 2024 conference call and presentation today at 8:00 am PT / 11:00 am ET, Data Vault’s CEO Nate Bradley

will also be joining to discuss recent news and the commercialization strategy.

The

Asset Purchase Agreement

On

September 4, 2024, as amended on November 14, 2024, WiSA Technologies executed a $210 million Definitive Agreement to purchase assets,

including High-Performance Computing (HPC) software and acoustic technologies IP, from Data Vault, to create a licensing and technology

company with an extensive patent portfolio serving multiple industry and government entities in bioengineering, energy, education, finance

& fintech, healthcare, sports entertainment, consumer, restaurants, automotive, and more. The $210 million purchase price consists

of 40 million shares of WiSA common stock to be issued at $5 per share plus a $10 million 3-year Note, along with a 3% royalty on applicable

product revenues.

Nathaniel

T. Bradley, CEO and co-founder of Data Vault, said, “Data Vault continues to execute on our strategic initiatives to monetize our

technologies with partners, licensees, and direct customers in large addressable markets. We’ve made strong inroads into the entertainment

and events market, where we’ve demonstrated capabilities across multiple venues, including concerts, MMA, boxing, golf and sports

entertainment arenas, which we expect to substantially monetize in 2025. We look forward to building a well-capitalized public company

in combination with WiSA Technologies and unlocking shareholder value for all our investors.”

“The

Data Vault transaction continues to move forward, and on November 15, 2024, we filed the preliminary proxy for WiSA stockholders to vote

on the planned asset acquisition, which will create a larger, more dynamic entity with broad reach in multiple, rapidly growing markets,”

said Brett Moyer, CEO of WiSA. “Data Vault’s substantial IP portfolio significantly amplifies our spatial audio technology

and adds powerful HPC assets.”

Data

Vault’s Recent Operating Highlights

| · | Received

three new patents and one new allowance from the United States Patent Office and related

International publication of its now patented innovations. |

| · | Launched

DVHolo, its hologram product suite, powered by ADIO and developed in partnership with HYPERVSN,

renowned for its innovative holographic solutions that provide an immersive, real-time 3D

experience that is both visually compelling and commercially potent. |

| | | |

| · | Partnered

with CLEAR, the security identity platform, to power CLEAR’s Know Your Customer (KYC)

solution. |

| | | |

| · | Launched

VerifyU in collaboration with Arizona State University and its Luminosity Lab. The VerifyU

platform provides secure, real-time blockchain-based academic credential verification, a

key solution for students, educational institutions, and employers who rely on trustworthy

and efficient methods to confirm qualifications. |

| | | |

| · | Presented

at the New York Scientific Data Summit 2024. Hosted by Brookhaven National Laboratory on

September 16-17, 2024, Datavault addressed key advancements in Digital Twin technologies

impacting various sectors, and in particular bioenergy. |

Stockholders’

Meeting

The

Company has filed a Preliminary Proxy on November 15, 2024 for its Annual Meeting of Stockholders (the “Annual Meeting”)

to be held in December 2024. Stockholders will have an opportunity to vote at the Annual Meeting to approve the Asset Purchase of Datavault

and Adio assets. If approved by stockholders, WiSA expects that the Asset Purchase will close shortly after the Annual Meeting, subject

to satisfaction of customary closing conditions.

WiSA Technologies Investor Conference

Call

Management will host its third quarter

2024 results conference call at 8:00 am PT / 11:00 am ET, on Friday, November 15, 2024.

The conference call will be available

through a live webcast found here:

Webcast | Third Quarter 2024 Results

Those without internet access or

who wish to dial in may call: 1-833-366-1124 (domestic), or 1-412-317-0702 (international). All callers should dial in approximately

10 minutes prior to the scheduled start time and ask to be joined into the WiSA Technologies call.

A webcast replay of the call will be

available approximately one hour after the end of the call and will be available for 90 days, at the above webcast link. A telephonic

replay of the call will be available through November 22, 2024, and may be accessed by calling 1- 877-344-7529 (domestic) or 1- 412-317-0088

(international) or Canada (toll free) 855-669-9658 and using access code 4877124.

A presentation of the Q3 2024 results

will be accessible on Friday, November 15, 2024, under the “Investors” section of WiSA Technologies’ website.

About Data

Vault Holdings, Inc.

Data

Vault Holdings Inc. is a technology holding company that provides a proprietary, cloud-based platform for the delivery of blockchain

objects. Data Vault Holdings Inc. provides businesses with the tools to monetize data assets securely over its Information Data Exchange®

(IDE). The company is in the process of finalizing the consolidation of its affiliates Data Donate Technologies, Inc., ADIO LLC,

and Datavault Inc. as wholly owned subsidiaries under one corporate structure. Learn more about Data Vault Holdings Inc. here.

LEGAL

DISCLAIMER

Forward-Looking

Statements

This

press release of WiSA Technologies, Inc. (NASDAQ: WISA) (the “Company”, “us”, “our” or “WiSA”)

contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities

Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements, include, among others,

the Company’s and Data Vault Holdings, Inc.’s (“Datavault”) expectations with respect to the proposed asset purchase

(the “Asset Purchase) between them, including statements regarding the benefits of the Asset Purchase, the anticipated timing of

the Asset Purchase, the implied valuation of Datavault, the products offered by Datavault and the markets in which it operates, and the

Company’s and Datavault’s projected future results and market opportunities, as well as information with respect to WiSA’s

future operating results and business strategy. Readers are cautioned not to place undue reliance on these forward-looking statements.

Actual results may differ materially from those indicated by these forward-looking statements as a result of a variety of factors, including,

but are not limited to: (i) risks and uncertainties impacting WiSA’s business including, risks related to its current liquidity

position and the need to obtain additional financing to support ongoing operations, WiSA’s ability to continue as a going concern,

WiSA’s ability to maintain the listing of its common stock on Nasdaq, WiSA’s ability to predict the timing of design wins

entering production and the potential future revenue associated with design wins, WiSA’s ability to predict its rate of growth,

WiSA’s ability to predict customer demand for existing and future products and to secure adequate manufacturing capacity, consumer

demand conditions affecting WiSA’s customers’ end markets, WiSA’s ability to hire, retain and motivate employees, the

effects of competition on WiSA’s business, including price competition, technological, regulatory and legal developments, developments

in the economy and financial markets, and potential harm caused by software defects, computer viruses and development delays, (ii) risks

related to the Asset Purchase, including WiSA’s ability to close the Asset Purchase in a timely manner or at all, or on the terms

anticipated, whether due to WiSA’s ability to satisfy the applicable closing conditions and secure stockholder approval from WiSA

stockholders or otherwise, as well as risks related to WiSA’s ability to realize some or all of the anticipated benefits from the

Asset Purchase, (iii) any risks that may adversely affect the business, financial condition and results of operations of Datavault, including

but not limited to cybersecurity risks, the potential for AI design and usage errors, risks related to regulatory compliance and costs,

potential harm caused by data privacy breaches, digital business interruption and geopolitical risks, and (iv) other risks as set forth

from time to time in WiSA’s filings with the U.S. Securities and Exchange Commission (the “SEC”). The information in

this press release is as of the date hereof and neither the Company nor Datavault undertakes any obligation to update such information

unless required to do so by law. The reader is cautioned not to place under reliance on forward looking statements. Neither the Company

nor Datavault gives any assurance that either the Company or Datavault will achieve its expectations.

This

press release shall not constitute an offer to sell, or the solicitation of an offer to buy, nor will there be any sale of these securities

in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification

under the securities laws of such state or jurisdiction. No offering of securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the Securities Act, or an exemption therefrom.

Additional

Information and Where to Find It

In

connection with the proposed Asset Purchase, WiSA intends to file with the SEC a definitive proxy statement. The definitive proxy statement

for WiSA (if and when available) will be mailed to stockholders of WiSA. WISA STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND

OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED ASSET PURCHASE.

WiSA

stockholders will be able to obtain free copies of these documents (if and when available) and other documents containing important information

about WiSA and Data Vault, once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov.

Copies of the documents filed with the SEC will also be made available free of charge by contacting WiSA using the contact information

below.

Participants

in the Solicitation

WISA

and its directors, executive officers and other members of its management and employees may be deemed to be participants in the solicitation

of proxies from WiSA’s stockholders in connection with the Asset Purchase. Stockholders are urged to carefully read the proxy

statement regarding the Asset Purchase when it becomes available, because it will contain important information. Information regarding

the persons who may, under the rules of the SEC, be deemed participants in the solicitation of WiSA’s stockholders in connection

with the Asset Purchase will be set forth in the proxy statement when it is filed with the SEC. Information about WiSA’s

executive officers and directors will be set forth in the proxy statement relating to the Asset Purchase when it becomes available. You

can obtain free copies of these and other documents containing relevant information at the SEC’s web site at www.sec.gov or by

directing a request to the address or phone number set forth below.

For

further information, please contact:

WiSA

Technologies, Inc.

15268 NW Greenbrier Pkwy

Beaverton, OR 97006

(408) 627-4716

Investors

Contact for WiSA Technologies and Data Vault Holdings:

David Barnard, Alliance Advisors Investor Relations, 415-433-3777, wisa@lhai.com

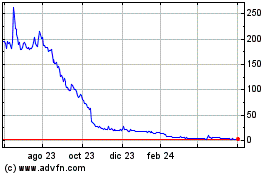

WiSA Technologies (NASDAQ:WISA)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

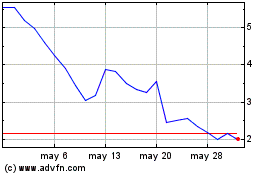

WiSA Technologies (NASDAQ:WISA)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024