Meiwu Technology Co., Limited (NASDAQ: WNW) (“Meiwu” or the

“Company”), an online and mobile commerce company providing organic

and green food products to customers on its online platform and in

its restaurant in China. The Company today announced its unaudited

financial results for the six months ended June 30, 2022.

First Half Fiscal Year of 2022 Operating

Highlights

| |

● |

Registered users of the Company’s online planform

were 711,534 as of June 30, 2022, compared to 672,398 as of June

30, 2021. |

| |

|

|

| |

● |

Average daily active users (“DAUs”) of the

Company’s online platform decreased to approximately 197.3 from

894.98 in the same period of 2021. |

| |

|

|

| |

● |

Number of merchants carried in the Company’s

online platform were 504 as of June 30, 2022, compared to 417 as of

June 30, 2021. |

| |

|

|

| |

● |

Type of goods carried in the Company’s online

platform were 3,225 as of June 30, 2022, compared to 3,607 as of

June 30, 2021. |

First Half Fiscal Year of 2022 Financial

Highlights

| |

● |

Total revenues in the first half fiscal year of

2022 decreased by 84.45% to US$1.17 million compared to US$7.50

million in the same period of 2021. |

| |

|

|

| |

● |

Net loss in the first half fiscal year of 2022

increased by 354.30% to US$5.53 million from US$1.22 million in the

same period of 2021. |

First Half Fiscal Year of 2022 Key

Operating Metrics

The Company monitors the following key metrics

to evaluate the growth of its business, measure the effectiveness

of its marketing efforts, identify trends affecting its business,

and make strategic decisions.

Registered users of the Company’s online

platform. The Company defines this metric as the total

number of the registered users of the Company’s online platform as

of the end of the period. As an online and mobile e-commerce

business, the Company believes that this is a key operating metric

for understanding the growth of its business. The Company views the

number of registered users at the end of a given period as a key

indicator of the attractiveness and usability of its online

platform traffic. As of June 30, 2022, the registered users of

Meiwu’s online platform exceeded 711,534, as compared to 672,398 as

of June 30, 2021. The Company believes that this increase in

registered users demonstrates the successful conversion of the

Company’s offline customers to its online users.

Daily Active Users (DAUs). The

Company defines daily active users, or DAUs, as users who have

logged in or accessed its online platform, whether on a mobile

phone or tablet. The Company calculates DAUs using internal company

data based on the activity of the user account and as adjusted to

remove “duplicate” accounts. The DAU number is a metric that

Meiwu’s management uses to manage their operations. In particular,

its management sets daily targets of DAUs and monitors the DAUs to

see whether the Company needs to make adjustments as to the

promotional activities and advertising campaigns. For the six

months ended June 30, 2022 and 2021, the average DAUs were 197.3

and 894.98 respectively.

Number of merchants. The

company defines this metric as the total number of the merchants

which sell goods on Meiwu’s online platform as of the end of the

period. Merchants sell goods on Meiwu’s online platform after

passing the Company’s inspection and evaluation. The number of

merchants were 504 as of June 30, 2022, compared to 417 as of June

30, 2021.

Impacts of the COVID-19

Pandemic. During the first half fiscal year of 2022, there

had been outbreaks of the Omicron and other variants of the

COVID-19 and the local governments in China placed lockdown and

mass testing policies in several cities, including Shenzhen, Xi’an

and Shanghai, where our customers and suppliers operate. The travel

restrictions, mandatory COVID-19 tests, quarantine requirements

and/or temporary closure of office buildings and facilities have

been imposed by local governments. The temporary closure of office

buildings and facilities severely impacted the operation OF the

offline stores and the fulfillment of the online orders. The

business of Meiwu has been adversely impacted by the COVID-19

pandemic, and the sales has been significantly decreased. With the

Company’s efforts in the marketing, the Company expects its sales

performance to recover and grow in the second half fiscal year of

2022.

First Half Fiscal Year of 2022 Financial

Results

Revenues in the first half

fiscal year of 2022 decreased by 84.45% to US$1.17 million compared

to US$7.50 million in the same period of 2021, which was mainly due

to the decrease in online retail revenues and offline revenue.

Compared to the first half fiscal year of 2021 caused by the impact

of COVID-19.

Total operating expenses in the

first half fiscal year of 2022 increased by 95.09% to US$5.71

million from US$2.93 million in the same period of 2021.

| |

● |

Cost of revenues in the first half fiscal year of

2022 decreased by 82.49% to US$1.02 million from US$5.80 million in

the same period of 2021, mainly due to the decrease of online

retail business and offline business. The downward trend of cost of

revenues was close to the decrease of the revenues. |

| |

|

|

| |

● |

Sales and marketing expenses in the first half

fiscal year of 2022 decreased by 72.86% to US$0.41 million from

US$1.53 million in the same period of 2021, mainly due to the

decrease in revenue leads to a decrease in commission service

fee. |

| |

|

|

| |

● |

General and administrative expenses in the first

half fiscal year of 2022 increased by 354.76% to US$5.12 million

from US$1.13 million in the same period of 2021, mainly due to the

increase in financing charges of convertible notes and warrants,

employee salary and service fee as compared to the same period of

2021. |

| |

|

|

| |

● |

Research and development expenses in the first

half fiscal year of 2022decreased by 36.59% to US$0.17 million from

US$0.27 million in the same period of 2021, mainly due to the

salary and software service fee decreased in the first half fiscal

year of 2022 compared to the same period of 2021. |

Gross Profit in the first half

fiscal year of 2022 was US$0.15 million, decreasing 91.13% from

US$1.70 million in the same period of 2021. Gross margin in the

first half fiscal year of 2022 was 12.92%, compared to 22.65% for

the same period of 2021.

Net loss in the first half

fiscal year of 2022 increased by 354.30% to US$5.53 million from

US$1.22 million in the same period of 2021. The net loss decreased

mainly due to the increase in general and administrative expenses

in the first half fiscal year of 2022 compared to the same period

of 2021.

Basic and diluted loss per

share in the first half fiscal year of 2022 was US$0.17,

compared to US$0.04 in the same period of 2021.

Net cash used in operating

activities in the first half fiscal year of 2022 was

US$10.07 million, compared to US$6.96 million in the same period of

2021. In this first half year, we spent substantially on the

continued expansion of the business. Further increase spending on

marketing and development of online platform and Meiwu App’s.

As of June 30, 2022, the Company had

cash and cash equivalents of US$24.47 million,

compared to US$26.63 million as of December 31, 2021.

About Meiwu

Technology Company Limited

Meiwu Technology Company Limited is a British

Virgin Islands company incorporated on December 4, 2018, and

conduct our business in China through our subsidiaries and variable

interest entity, Wunong Technology (Shenzhen) Co., Ltd. The group

is an online and mobile commerce company and conduct our business

through our online retail store on the website www.wnw108.com. The

group sell a myriad of food products on the website all the food

products sold on the website are from the suppliers. The group do

not sell genetically modified food and committed to providing our

customers with safe, high-quality, nutritious, tasty and

non-genetically modified food products through our portfolio of

trusted and well-known suppliers. Optimizing the Website and

real-time data, the group able to respond to and match supply with

demand for food products in keeping with consumer trends.

Safe Harbor Statement

Certain statements made in this release are

“forward looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. When used in this press release, the

words “estimates,” “projected,” “expects,” “anticipates,”

“forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,”

“will,” “should,” “future,” “propose” and variations of these words

or similar expressions (or the negative versions of such words or

expressions) are intended to identify forward-looking statements.

These forward-looking statements are not guarantees of future

performance, conditions or results, and involve a number of known

and unknown risks, uncertainties, assumptions and other important

factors, many of which are outside the Company’s control, that

could cause actual results or outcomes to differ materially from

those discussed in the forward-looking statements. Important

factors, among others, are: the ability to manage growth; ability

to identify and integrate other future acquisitions; ability to

obtain additional financing in the future to fund capital

expenditures; fluctuations in general economic and business

conditions; costs or other factors adversely affecting our

profitability; litigation involving patents, intellectual property,

and other matters; potential changes in the legislative and

regulatory environment; a pandemic or epidemic. The forward-looking

statements contained in this release are also subject to other

risks and uncertainties, including those more fully described in

the Company’s filings with the Securities and Exchange Commission,

including the Company’s Annual Report on Form 20F filed with the

SEC on June 30, 2021, the Current Report on Form 6-K filed with the

SEC on August 31, 2021, which may be amended from time to time, and

in our Quarterly Report on Form 6-K that will be filed following

this earnings release. The Company undertakes no obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by applicable law. Such information speaks only as of the

date of this release.

ContactsMeiwu Technology Company

Limited Xinliang Zhang Email: meiwuBS@usmeiwu.com

MEIWU TECHNOLOGY COMPANY

LIMITEDUNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS(Unaudited)

|

|

|

December 31,2021 |

|

|

June 30,2022 |

|

| |

|

|

|

|

(Unaudited) |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

26,634,332 |

|

|

$ |

24,466,120 |

|

|

Accounts receivable |

|

|

433,002 |

|

|

|

884,647 |

|

|

Inventories, net |

|

|

432,955 |

|

|

|

335,838 |

|

|

Advances to suppliers, net |

|

|

231,230 |

|

|

|

5,621,667 |

|

|

Loan receivable |

|

|

- |

|

|

|

- |

|

|

Other current assets |

|

|

259,170 |

|

|

|

3,534,486 |

|

| Total Current Assets |

|

|

27,990,689 |

|

|

|

34,842,758 |

|

|

Property and equipment, net |

|

|

279,518 |

|

|

|

237,639 |

|

|

Right of use lease assets, net |

|

|

19,833 |

|

|

|

222,874 |

|

|

Goodwill |

|

|

- |

|

|

|

12,232,132 |

|

| TOTAL

ASSETS |

|

$ |

28,290,040 |

|

|

$ |

47,535,403 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,659,501 |

|

|

$ |

2,018,074 |

|

|

Short-term loan |

|

|

47,054 |

|

|

|

268,285 |

|

|

Contract liabilities |

|

|

1,153,717 |

|

|

|

5,133,661 |

|

|

Lease liabilities |

|

|

19,068 |

|

|

|

158,535 |

|

|

Accrued expenses and other current liabilities |

|

|

928,072 |

|

|

|

914,751 |

|

| Total Current

Liabilities |

|

|

3,807,412 |

|

|

|

8,493,306 |

|

|

Due to related parties |

|

|

6,442,729 |

|

|

|

6,433,534 |

|

|

Long-term loan |

|

|

414,072 |

|

|

|

281,530 |

|

|

Convertible notes |

|

|

- |

|

|

|

4,872,030 |

|

|

Derivative financial liabilities |

|

|

- |

|

|

|

2,883,054 |

|

|

Lease liabilities |

|

|

- |

|

|

|

50,761 |

|

| Total Non-current

liabilities |

|

|

6,856,801 |

|

|

|

14,520,909 |

|

| TOTAL

LIABILITIES |

|

$ |

10,664,213 |

|

|

$ |

23,014,215 |

|

| |

|

|

|

|

|

|

|

|

| Commitment and

Contingencies |

|

|

|

|

|

|

|

|

| Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Ordinary Shares, no par value, unlimited shares authorized;

48,945,313 and 32,968,755 shares issued and outstanding as of June

30, 2022 and December 31, 2021, respectively |

|

$ |

- |

|

|

$ |

- |

|

|

Additional paid-in capital |

|

|

23,385,695 |

|

|

|

36,802,261 |

|

|

Accumulated deficit |

|

|

(6,009,313 |

) |

|

|

(11,514,459 |

) |

|

Accumulated other comprehensive (loss) income |

|

|

253,736 |

|

|

|

(737,397 |

) |

|

Equity attributable to owners of the Company |

|

|

17,630,118 |

|

|

|

24,550,405 |

|

|

Non-controlling interests |

|

|

(4,291 |

) |

|

|

(29,217 |

) |

| Total Stockholders’

Equity |

|

|

17,625,827 |

|

|

|

24,521,188 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

$ |

28,290,040 |

|

|

$ |

47,535,403 |

|

MEIWU TECHNOLOGY COMPANY

LIMITEDUNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS(Unaudited)

| |

|

For the Six Months EndedJune

30, |

|

|

|

|

2021 |

|

|

2022 |

|

| NET

REVENUE |

|

$ |

7,499,540 |

|

|

$ |

1,166,425 |

|

| COST OF

REVENUE |

|

|

(5,800,663 |

) |

|

|

(1,015,769 |

) |

| GROSS

PROFIT |

|

|

1,698,877 |

|

|

|

150,656 |

|

| |

|

|

|

|

|

|

|

|

| OPERATING

EXPENSES |

|

|

|

|

|

|

|

|

|

Sales and Marketing Expenses |

|

|

(1,528,278 |

) |

|

|

(414,750 |

) |

|

General and Administrative Expenses |

|

|

(1,126,347 |

) |

|

|

(5,122,188 |

) |

|

Research and Development Expenses |

|

|

(271,925 |

) |

|

|

(172,437 |

) |

|

Total operating expenses |

|

|

(2,926,550 |

) |

|

|

(5,709,375 |

) |

| LOSS FROM

OPERATIONS |

|

|

(1,227,673 |

) |

|

|

(5,558,719 |

) |

| |

|

|

|

|

|

|

|

|

| Other Income, net |

|

|

10,409 |

|

|

|

28,647 |

|

| LOSS BEFORE INCOME

TAX |

|

|

(1,217,264 |

) |

|

|

(5,530,072 |

) |

| Provision for Income

Taxes |

|

|

- |

|

|

|

- |

|

| NET LOSS |

|

|

(1,217,264 |

) |

|

|

(5,530,072 |

) |

| Less: net loss

attributable to non-controlling interest |

|

|

|

|

|

|

(24,926 |

) |

| OTHER COMPREHENSIVE

LOSS |

|

|

|

|

|

|

|

|

| Foreign Currency Translation

Adjustment |

|

|

176,491 |

|

|

|

(991,133 |

) |

| TOTAL COMPREHENSIVE

LOSS |

|

$ |

(1,040,773 |

) |

|

$ |

(6,521,205 |

) |

| |

|

|

|

|

|

|

|

|

| LOSS PER SHARE – BASIC

AND DILUTED |

|

|

(0.04 |

) |

|

|

(0.17 |

) |

| WEIGHTED AVERAGE

SHARES OUTSTANDING – BASIC AND DILUTED |

|

|

25,000,000 |

|

|

|

39,376,394 |

|

MEIWU TECHNOLOGY COMPANY

LIMITEDUNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS(Unaudited)

| |

|

For the Six Months EndedJune

30, |

|

| |

|

2021 |

|

|

2022 |

|

| Net cash used in operating

activities |

|

|

(6,960,387 |

) |

|

|

(10,073,063 |

) |

| Net cash provided by (used in)

investing activities |

|

|

(58,850 |

) |

|

|

(26,915 |

) |

| Net cash provided by financing

activities |

|

|

415,690 |

|

|

|

7,670,698 |

|

| Effect of changes of foreign

exchange rate on cash |

|

|

60,563 |

|

|

|

261,068 |

|

| Net increase in

cash |

|

|

(6,542,984 |

) |

|

|

(2,168,212 |

) |

| Cash, beginning of the

period |

|

|

7,027,964 |

|

|

|

26,634,332 |

|

| Cash, end of the

period |

|

|

484,980 |

|

|

|

24,466,120 |

|

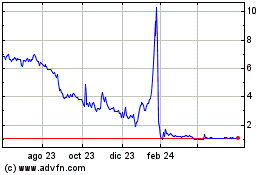

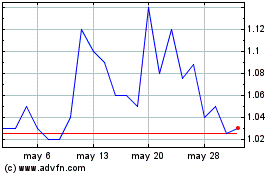

Meiwu Technology (NASDAQ:WNW)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Meiwu Technology (NASDAQ:WNW)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024