Abaxx Technologies Inc. (NEO:ABXX)(OTCQX:ABXXF)

(“Abaxx” or the “Company”), a financial software and market

infrastructure company, majority shareholder of the

Abaxx

Commodity Exchange and Clearinghouse (“Abaxx Singapore”),

and producer of the

SmarterMarkets™ Podcast,

summarizes development activities over the past quarter and the

general progress of the Company’s business plans.

Highlights:

- Achieved an

important corporate milestone by recognizing first revenues on the

Company’s 2.5% gross revenue royalty on Base Carbon sales, the

first group revenue from an organic development project within

Abaxx.

- Advanced

commercial development of the Abaxx Exchange ahead of launch as

commercial participants reached out to their respective Futures

Commission Merchants (FCMs), signaling their intention to trade

Abaxx commodity futures product when available; to date, 7 global

energy companies, 14 global merchant traders, 7 global financial

institution commodity trading groups, 3 global mining companies, 2

OEMs and battery manufacturing companies, 6 utility companies, and

4 financial participants have reached out to trade Abaxx

products.

- Abaxx Exchange

held its first nickel sulphate industry working group to advance

final contract-specification development before submitting the

proposed nickel futures products for regulatory review; 11 metals

merchant trading companies, 2 global mining companies, 4 global

auto and battery manufacturers, and 4 market makers and financial

participants have participated in the working group and proposed

product specification review.

- Abaxx Exchange

and Clearing progressed security and operational readiness testing,

completing the final round of user acceptance testing (“UAT”) and

advanced technology work required to secure licenses and regulatory

approvals; completion of this stage of testing and submission of

the related regulatory documentation for the Exchange’s Technology

Risk Assessment marked the completion of major operational

development milestones, leaving essentially regulatory reserve

financing the remaining critical path ahead of final license

application submittals.

- Progressed the

strategic-partner financing process for an equity financing in the

Company’s subsidiary Abaxx Singapore Pte. Ltd., with multiple

institutions reviewing a reserve capital financing with the goals

of incentivizing exchange ecosystem participation with minority

ownership, and to meet regulatory licensing capital requirements

prior to the launch of the exchange.

- Received

conditional approval from the Cboe US Equity Exchange (the “Cboe US

Exchange”) to list the Company’s common shares on Tier 1 of the

Cboe US Equities Exchange, an innovative US securities exchange

within the Cboe Global Listings Network, as announced on June 2nd,

2023.

Dear Shareholders,

Over the course of the second quarter, the

Company maintained focused velocity toward a 2023 launch of the

Abaxx Exchange and Clearinghouse in Singapore while recognizing

first revenues on the Company’s 2.5% gross revenue royalty on Base

Carbon sales of carbon credits. Member engagement accelerated as

commercial participants reached out to their respective Futures

Commission Merchants (FCMs), signaling their intention to trade

Abaxx commodity futures products when available. To date, 43

trading firms, companies and financial participants have reached

out to their FCMs with the intention to trade Abaxx products.

Collaborative market consultation continued as the Company hosted

its first nickel sulphate industry working group to advance final

contract-specification development before submitting the proposed

nickel futures products for regulatory review.

The Company remains on track to complete RMO and

ACH final licensing applications over the coming weeks, subject to

all regulatory approvals and successfully completing the Abaxx

Singapore strategic financing for required reserve capital and

regulatory approval.

Abaxx Exchange and Clearing

Developments

Risk and Regulatory: In Q2, the Company advanced

the finalization of its risk management policies, including various

assessments against regulatory requirements, and is wrapping up the

regulatory review for all critical path elements of enterprise risk

management, financial risk management, and technology risk

management. The Company’s risk and regulatory frameworks and

policies were presented to its board of directors and received

approval in May of 2023. The Company maintains active engagement

with the Monetary Authority of Singapore (“MAS”) to obtain Approved

Clearing House (ACH), Approved Holding Company (AHC), and

Recognized Market Operator (RMO) licenses once all remaining

licensing conditions are met. Estimated timelines to complete the

remaining processes have been shared with MAS.

Commercial: The Abaxx Global Commercial team

held over 50 direct one-on-one meetings during the month of June

alone across Asia, Europe and North America with new and existing

commodity trading firms, major auto manufacturers, battery

manufacturers and new merchant trading firms across the nickel

sulphate and natural gas verticals. These meetings were focused on

moving launch partners through various stages of the onboarding

process and facilitating FCM connectivity. The team continues to

engage with new Exchange participants presenting potential new

futures product ideas that the Company may develop — which will

deepen the relationship with our trading and FCM partners.

Systems and Operations: In Q2, the Company

completed the full and final internal testing of Exchange and

Clearing applications and systems, satisfying operational

requirements for launch.

Infrastructure: In Q2 2023, all network

engineering, failover tests, and security tests required for launch

were completed. Upgrades and improvements identified during testing

were incorporated, including advancements in deployment

automation.

Exchange Product Development: Abaxx Singapore is

pleased to announce significant progress towards completion of

Stage 3 of its Nickel product development — focused on industry,

risk, and regulatory considerations. Engagements, both one-on-one

and group discussion, have progressed on the proposed structure of

the contract with all key sectors of the industry including mining

companies, battery manufacturers, trading companies, financiers,

clearing firms, and brokers. Precious metals solutions currently

under development have also progressed to Stage 3. The effort in

precious metals is broader than futures market development and we

look forward to sharing more details at the appropriate time.

Abaxx Console Apps and ID++ Protocol: In Q2

2023, our product and engineering teams completed porting the

back-end of Verifier to V2 of the ID++ protocol as well as

front-end development of Sign, and began development of a prototype

app for KYC as well as initial development of the ID++ V2 SDK.

Integration and upgrades of Issuer, Drive, and Messenger remain on

target.

Abaxx Corporate Update

Secondary U.S. Listing Application: Abaxx

Technologies has announced its forthcoming intralisting on Cboe

Global Listings. This development signifies a significant

advancement in Abaxx's mission to revolutionize markets and address

critical global challenges such as climate change and the energy

transition.

Through its integration into Cboe's extensive

global exchange network, Abaxx hopes to gain greater access to

expanded capital markets, enhanced liquidity, and a broader

investor base, enabling growth and increased shareholder value.

Abaxx is pleased to strengthen its collaboration with Cboe, a

partner that shares a dedication to technological innovation and

progress, and eagerly anticipates utilizing Cboe's global reach and

services to engage with investors in North America and around the

world.

Additionally, the upcoming launch of the Abaxx

Commodity Futures Exchange and Clearinghouse, subject to regulatory

approval, further solidifies Abaxx's leadership in the transition

towards an electrified, low-carbon emissions economy.

At-the-Market Equity Program: In April, Abaxx

established an ATM Program which allows the Company to issue, at

its discretion, common shares (the “Common Shares”) of the Company

having an aggregate offering price of up to C$30 million to the

public from time to time through the Agent.

The Company intends to use the net proceeds from

the ATM Program for general corporate and working capital

requirements, including to fund ongoing operations and/or working

capital requirements, to repay indebtedness outstanding from time

to time and to complete future acquisitions or for other corporate

purposes. For more information about the ATM Program, please refer

to our April 26th Press Release.

About Abaxx Technologies

Abaxx is a development-stage financial software

and market infrastructure company creating proprietary

technological infrastructure for both global commodity exchanges

and digital marketplaces. The company’s formative technology

increases transaction velocity, data security, and facilitates

improved risk management in the majority-owned Abaxx Commodity

Exchange (Abaxx Singapore Pte. Ltd.) - a commodity futures exchange

seeking final regulatory approvals as a Recognized Market Operator

(“RMO”) and Approved Clearing House (“ACH”) with the Monetary

Authority of Singapore (“MAS”). Abaxx is a founding shareholder in

Base Carbon Inc. and the creator and producer of the

SmarterMarkets™ podcast.

For more information please visit abaxx.tech,

abaxx.exchange and smartermarkets.media.

Media and investor inquiries:

Abaxx Technologies Inc.Investor Relations TeamTel: +1 246 271

0082E-mail: ir@abaxx.tech

Forward-Looking Statements

This News Release includes certain

"forward-looking statements" which do not consist of historical

facts. Forward-looking statements include estimates and statements

that describe Abaxx or the Company’s future plans, objectives, or

goals, including words to the effect that Abaxx expects a stated

condition or result to occur. Forward-looking statements may be

identified by such terms as “seeking”, “believes”, “anticipates”,

“expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”.

Since forward-looking statements are based on assumptions and

address future events and conditions, by their very nature

they involve inherent risks and uncertainties. Although these

statements are based on information currently available to Abaxx,

Abaxx does not provide any assurance that actual results will meet

management’s expectations. Risks, uncertainties, and other factors

involved with forward-looking information could cause actual

events, results, performance, prospects, and opportunities to

differ materially from those expressed or implied by such

forward-looking information. Forward-looking information in this

news release includes but is not limited to, Abaxx’s objectives,

goals or future plans, statements regarding anticipated exchange

listings, receipt of regulatory approvals, timing of the

commencement of operations, financial predictions, and estimates of

market conditions. Such factors include, among others: risks

relating to the global economic climate; dilution; the Company’s

limited operating history; future capital needs and uncertainty of

additional financing; the competitive nature of the industry;

currency exchange risks; the need for Abaxx to manage its planned

growth and expansion; the effects of product development and need

for continued technology change; protection of proprietary rights;

the effect of government regulation and compliance on Abaxx and the

industry; the ability to list the Company’s securities on stock

exchanges in a timely fashion or at all; network security risks;

the ability of Abaxx to maintain properly working systems; reliance

on key personnel; global economic and financial market

deterioration impeding access to capital or increasing the cost of

capital; and volatile securities markets impacting security pricing

unrelated to operating performance. In addition, particular factors

which could impact future results of the business of Abaxx include

but are not limited to: operations in foreign jurisdictions,

protection of intellectual property rights, contractual risk,

third-party risk; clearinghouse risk, malicious actor risks,

third-party software license risk, system failure risk, risk of

technological change; dependence of technical infrastructure, and

an inability to predict and counteract the effects of COVID-19 on

the business of the Company, including but not limited to the

effects of COVID-19 on the price of commodities, capital market

conditions, restriction on labor and international travel and

supply chains. Abaxx has also assumed that no significant events

occur outside of Abaxx’s normal course of business.

Abaxx cautions that the foregoing list of

material factors is not exhaustive. In addition, although Abaxx has

attempted to identify important factors that could cause actual

results to differ materially, there may be other factors that cause

results not to be as anticipated, estimated, or intended. When

relying on Abaxx's forward-looking statements and information to

make decisions, investors and others should carefully consider the

foregoing factors and other uncertainties and potential events.

Abaxx has assumed that the material factors referred to in the

previous paragraph will not cause such forward-looking statements

and information to differ materially from actual results or events.

However, the list of these factors is not exhaustive and is subject

to change and there can be no assurance that such assumptions will

reflect the actual outcome of such items or factors. The

forward-looking information contained in this press release

represents the expectations of Abaxx as of the date of this press

release and, accordingly, is subject to change after such date.

Readers should not place undue importance on forward-looking

information and should not rely upon this information as of any

other date. Abaxx does not undertake to update this information at

any particular time except as required in accordance with

applicable laws. The NEO Exchange does not accept responsibility

for the adequacy or accuracy of this press release

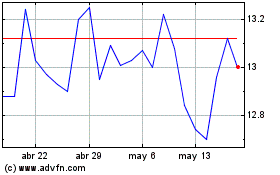

Abaxx Technologies (NEO:ABXX)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Abaxx Technologies (NEO:ABXX)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025