0001332551false0001332551us-gaap:CommonStockMember2023-07-212023-07-2100013325512023-07-212023-07-210001332551us-gaap:SeriesCPreferredStockMember2023-07-212023-07-210001332551us-gaap:SeriesDPreferredStockMember2023-07-212023-07-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): July 21, 2023 |

ACRES Commercial Realty Corp.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Maryland |

1-32733 |

20-2287134 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

390 RXR Plaza |

|

Uniondale, New York |

|

11556 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 516-535-0015 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 par value per share |

|

ACR |

|

New York Stock Exchange |

8.625% Fixed-to-Floating Series C Cumulative Redeemable Preferred Stock |

|

ACRPrC |

|

New York Stock Exchange |

7.875% Series D Cumulative Redeemable Preferred Stock |

|

ACRPrD |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

On July 21, 2023, ACRES Commercial Realty Corp. (the “Company”), entered into Amendment No. 5 to Guarantee Agreement (the “JPM Guarantee Amendment”) with JPMorgan Chase Bank, National Association (“JPM”), which made certain amendments and modifications to the Guarantee Agreement dated October 26, 2018 between the Company and JPM, as amended (the “JPM Guarantee”), including but not limited to amending the (i) EBITDA to Interest Expense ratio (as defined in the JPM Guarantee), (ii) maximum ratio of Total Indebtedness to its Total Equity (as defined in the JPM Guarantee) and (iii) minimum unencumbered Liquidity requirement (as defined in the JPM Guarantee), each through December 2024.

On July 21, 2023, RCC Real Estate SPE 8, LLC ("SPE 8"), an indirect, wholly owned subsidiary of the Company, entered into Amendment No. 4 to Master Repurchase Agreement (the “JPM Master Repurchase Amendment”) with JPM, which made certain amendments and modifications to the Master Repurchase Agreement dated October 26, 2018 between the Company and JPM, as amended, including but not limited to amending the maturity date from October 26, 2024 to July 21, 2026.

The foregoing descriptions of the JPM Guarantee Amendment and JPM Master Repurchase Amendment do not purport to be complete and are qualified in their entirety by reference to the full text of the amendments, which have been filed with this Current Report on Form 8-K as Exhibits 99.1 and 99.2, respectively.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

ACRES COMMERCIAL REALTY CORP. |

|

|

|

|

Date: |

July 25, 2023 |

By: |

/s/ David J. Bryant |

|

|

|

David J. Bryant

Chief Financial Officer |

EXHIBIT 99.1

AMENDMENT NO. 5 TO GUARANTEE AGREEMENT

AMENDMENT NO. 5 TO GUARANTEE AGREEMENT, dated as of July 21, 2023 (this “Amendment”), between ACRES COMMERCIAL REALTY CORP, f/k/a Exantas Capital Corp., a Maryland corporation (“Guarantor”), and JPMORGAN CHASE BANK, NATIONAL ASSOCIATION, a national banking association (“Buyer”). Capitalized terms used but not otherwise defined herein shall have the meanings given to them in the Repurchase Agreement (as defined below).

RECITALS

WHEREAS, RCC REAL ESTATE SPE 8, LLC (“Seller”) and Buyer are parties to that certain Uncommitted Master Repurchase Agreement, dated as of October 26, 2018 (as amended by that certain First Amendment to Uncommitted Master Repurchase Agreement, dated as of August 14, 2020, as further amended by that certain Amendment No. 2 to Master Repurchase Agreement, dated as of September 1, 2021, as further amended by that certain Amendment No. 3 to Master Repurchase Agreement and Guarantee Agreement, dated as of October 26, 2021, as further amended by that certain Term SOFR Conforming Changes Amendment, dated as of December 31, 2021, as further amended by that certain Amendment No. 4 to Master Repurchase Agreement, dated as of July 21, 2023, as amended hereby, and as may be further amended, restated, supplemented or otherwise modified and in effect from time to time, the “Repurchase Agreement”);

WHEREAS, in connection with the Repurchase Agreement, Guarantor entered into that certain Guarantee Agreement, dated as of October 26, 2018 (as amended by that certain Amendment No. 1 to Guarantee Agreement, dated as of May 6, 2020, as further amended by that certain Amendment No. 2 to Guarantee Agreement, dated as October 2, 2020, as further amended by that certain Amendment No. 3 to Master Repurchase Agreement and Guarantee Agreement, dated as of October 26, 2021, as further amended by that certain Amendment No. 4 to Guarantee Agreement, dated as of November 17, 2022, as amended hereby, and as may be further amended, restated, supplemented or otherwise modified and in effect from time to time, the “Guarantee Agreement”); and

WHEREAS, Guarantor and Buyer have agreed to amend certain provisions of the Guarantee Agreement in the manner set forth herein.

NOW THEREFORE, in consideration of the premises and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Guarantor and Buyer agree as follows:

Section 1.Amendments to Guarantee Agreement.

(a)Section 9(a)(i) of the Guarantee Agreement is hereby amended by amending and restating that section in its entirety to read as follows:

“(i) At all times, Guarantor shall maintain unpledged, unencumbered Liquidity of (1) from the Closing Date through October 25, 2021, not less than the greater of (A) $10,000,000 and (B) ten percent (10%) of the aggregate outstanding Repurchase Price of all Purchased Assets as of such time; (2) from October 26, 2021 through September 30, 2022, not less than the greater of (A) $10,000,000 and (B) five percent (5%) of the aggregate outstanding Repurchase Price of all Purchased Assets as of such time; (3) from October 1, 2022 through December 31, 2024, not less than the greater of (A) $15,000,000 and (B) seven and a half percent (7.5%) of the aggregate outstanding Repurchase Price of all Purchased Assets as of such time; and (4) from and after January 1, 2025, not less than the greater of (A) $10,000,000 and (B) five percent (5%) of the aggregate outstanding Repurchase Price of all Purchased Assets as of such time.”

(b)Section 9(a)(iii) of the Guarantee Agreement is hereby amended by amending and restating that section in its entirety to read as follows:

“(iii) Guarantor shall not permit, for any Test Period, the ratio of its Total Indebtedness to its Total Equity to be (1) from the Closing Date through the calendar quarter ending September 30, 2022, greater than 6.00 to 1.00; (2) from calendar quarter ending December 31, 2022 through the calendar quarter ending December 31, 2024, greater than 5.50 to 1.00; and (3) at all times after the calendar quarter ending December 31, 2024, greater than 6.00 to 1.00. For the avoidance of doubt, any calculation of Total Indebtedness will include any and all recourse and non-recourse debt of any Consolidated Subsidiary of Guarantor.”

(c)Section 9(a)(v) of the Guarantee Agreement is hereby amended by amending and restating that section in its entirety to read as follows:

“(v) Guarantor shall not permit, for any Test Period, the ratio of (i) the sum of the trailing four (4) fiscal quarters EBITDA for Guarantor and its Consolidated Subsidiaries for such Test Period to (ii) the trailing four (4) fiscal quarters Interest Expense for Guarantor and its Consolidated Subsidiaries for such Test Period to be (1) from the Closing Date through the calendar quarter ending September 30, 2022, less than 1.50 to 1.00; (2) from the calendar quarter ending December 31, 2022 through the calendar quarter ending December 31, 2024, less than 1.25 to 1.00; and at all times after the calendar quarter ending December 31, 2024, less than 1.50 to 1.00.”

Section 2.Conditions Precedent; Effective Date. This Amendment shall become effective on the date on which this Amendment is executed and delivered by a duly authorized officer of each of Buyer and Guarantor (the “Amendment Effective Date”).

Section 3.Guarantor’s Representations and Warranties. On and as of the Amendment Effective Date, and after giving effect to the matters contained in this Amendment, Guarantor hereby represents and warrants to Buyer that (a) it is in compliance with all the terms and provisions set forth in the Guarantee Agreement on its part to be observed or performed, (b) with respect to Guarantor’s covenants in Section 9(a)(i), 9(a)(iii) and 9(a)(v) of the Guarantee,

-2-

after giving effect to this Amendment and, with respect to all other requirements of the Transaction Documents, both prior to and after giving effect to this Amendment, no Default or Event of Default under the Repurchase Agreement has occurred and is continuing, and (c) it has no, and hereby waives all, defenses, rights of setoff, claims, counterclaims or causes of action of any kind or description against Buyer arising under or in respect of the Guarantee Agreement or any other Transaction Document (other than a defense of payment or performance). Guarantor hereby confirms and reaffirms the representations and warranties contained in the Guarantee Agreement and all of the other Transaction Documents.

Section 4.Acknowledgments of Guarantor. Guarantor hereby acknowledges and agrees that (a) it continues to be bound by the Guarantee Agreement to the extent of the Obligations (as defined therein), and (b) as of the date hereof, Buyer is in compliance with its undertakings and obligations under the Repurchase Agreement, the Guarantee Agreement and each of the other Transaction Documents.

Section 5.Limited Effect. The Guarantee Agreement (except as the foregoing is expressly amended and modified by this Amendment), and each of the other Transaction Documents remain, in full force and effect in accordance with their respective terms; provided, however, that on the Amendment Effective Date, (a) all references in the Repurchase Agreement to the “Transaction Documents” shall be deemed to include, in any event, this Amendment, and (b) each reference to the “Guarantee” or “Guarantee Agreement” in any of the Transaction Documents shall be deemed to be a reference to the Guarantee Agreement, as amended hereby.

Section 6.Counterparts. This Amendment may be executed in counterparts, each of which when so executed shall be deemed to be an original and all of which when taken together shall constitute one and the same instrument, and the words “executed,” signed,” “signature,” and words of like import as used above and elsewhere in this Amendment or in any other certificate, agreement or document related to this transaction shall include, in addition to manually executed signatures, images of manually executed signatures transmitted by facsimile or other electronic format (including, without limitation, “pdf”, “tif” or “jpg”) and other electronic signatures (including, without limitation, any electronic sound, symbol, or process, attached to or logically associated with a contract or other record and executed or adopted by a person with the intent to sign the record). The use of electronic signatures and electronic records (including, without limitation, any contract or other record created, generated, sent, communicated, received, or stored by electronic means) shall be of the same legal effect, validity and enforceability as a manually executed signature or use of a paper-based record-keeping system to the fullest extent permitted by applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act and any other applicable law, including, without limitation, any state law based on the Uniform Electronic Transactions Act or the Uniform Commercial Code.

Section 7.Costs and Expenses. Guarantor shall pay Buyer’s reasonable actual out of pocket costs and expenses, including reasonable fees and expenses of attorneys, incurred in connection with the preparation, negotiation, execution and consummation of this Amendment.

Section 8.No Novation, Effect of Agreement. Guarantor and Buyer have entered into this Amendment solely to amend the terms of the Guarantee Agreement and do not

-3-

intend this Amendment or the transactions contemplated hereby to be, and this Amendment and the transactions contemplated hereby shall not be construed to be, a novation of any of the obligations of Guarantor under or in connection with the Guarantee Agreement.

Section 9.Submission to Jurisdiction. Each party hereto irrevocably and unconditionally (i) submits to the exclusive jurisdiction of any United States Federal or New York State court sitting in Manhattan, and any appellate court from any such court, solely for the purpose of any suit, action or proceeding brought to enforce its obligations under this Amendment or relating in any way to this Amendment and (ii) waives, to the fullest extent it may effectively do so, any defense of an inconvenient forum to the maintenance of such action or proceeding in any such court and any right of jurisdiction on account of its place of residence or domicile.

The parties hereto hereby irrevocably consent to the service of any summons and complaint and any other process by the mailing of copies of such process to them at their respective address specified in the Guarantee Agreement. The parties hereto hereby agree that a final judgment in any such action or proceeding shall be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by law. Nothing in this Section 9 shall affect the right of Buyer to serve legal process in any other manner permitted by law or affect the right of Buyer to bring any action or proceeding against Guarantor or its property in the courts of other jurisdictions.

Section 10.WAIVER OF JURY TRIAL. EACH OF THE PARTIES HERETO HEREBY IRREVOCABLY WAIVES ALL RIGHT TO A TRIAL BY JURY IN ANY ACTION, PROCEEDING OR COUNTERCLAIM ARISING OUT OF OR RELATING TO THIS AMENDMENT.

Section 11. GOVERNING LAW. THIS AMENDMENT AND ANY CLAIM, CONTROVERSY OR DISPUTE ARISING UNDER OR RELATED TO THIS AMENDMENT, THE RELATIONSHIP OF THE PARTIES TO THIS AMENDMENT, AND/OR THE INTERPRETATION AND ENFORCEMENT OF THE RIGHTS AND DUTIES OF THE PARTIES TO THIS AMENDMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE INTERNAL LAWS AND DECISIONS OF THE STATE OF NEW YORK, WITHOUT REGARD TO THE CHOICE OF LAW RULES THEREOF. THE PARTIES HERETO INTEND THAT THE PROVISIONS OF SECTION 5-1401 OF THE NEW YORK GENERAL OBLIGATIONS LAW SHALL APPLY TO THIS AMENDMENT.

[SIGNATURE PAGES FOLLOW]

-4-

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed and delivered as of the day and year first above written and effective as of the Amendment Effective Date.

ACRES COMMERCIAL REALTY CORP, f/k/a Exantas Capital Corp., a Maryland corporation

|

|

By: |

/s/ Michael Pierro |

|

Name: Michael Pierro |

|

Title: Senior Vice President |

JPMORGAN CHASE BANK, NATIONAL ASSOCIATION, a national banking association

|

|

By: |

/s/ Thomas N. Cassino |

|

Name: Thomas N. Cassino |

|

Title: Managing Director |

Exhibit 99.2

AMENDMENT NO. 4 TO MASTER REPURCHASE AGREEMENT

AMENDMENT NO. 4 TO MASTER REPURCHASE AGREEMENT, dated as of July 21, 2023 (this “Amendment”), between RCC REAL ESTATE SPE 8, LLC (“Seller”), a Delaware limited liability company and JPMORGAN CHASE BANK, NATIONAL ASSOCIATION, a national banking association (the “Buyer”). Capitalized terms used but not otherwise defined herein shall have the meanings given to them in the Repurchase Agreement (as defined below).

RECITALS

WHEREAS Seller and Buyer are parties to that certain Uncommitted Master Repurchase Agreement, dated as of October 26, 2018 (as amended by that certain First Amendment to Uncommitted Master Repurchase Agreement, dated as of August 14, 2020, as further amended by that certain Amendment No. 2 to Master Repurchase Agreement, dated as of September 1, 2021, as further amended by that certain Amendment No. 3 to Master Repurchase Agreement and Guarantee Agreement, dated as of October 26, 2021, as further amended by that certain Term SOFR Conforming Changes Amendment, dated as of December 31, 2021, and as further amended hereby, and as may be further amended, restated, supplemented or otherwise modified and in effect from time to time, the “Repurchase Agreement”); and

WHEREAS, Seller and Buyer have agreed, subject to the terms and conditions hereof, that the Repurchase Agreement shall be amended as set forth in this Amendment and ACRES COMMERCIAL REALTY CORP, f/k/a Exantas Capital Corp., a Maryland corporation (“Guarantor”) has agreed to make the acknowledgements set forth herein.

NOW THEREFORE, in consideration of the premises and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Seller and Buyer each agree as follows:

Section 1.Amendments to Repurchase Agreement.

(i) The first line of the defined term “Maturity Date”, as set forth in Article 2 of the Repurchase Agreement, is hereby amended to change the date “October 26, 2024” to “July 21, 2026”.

(ii) The last line of the defined term “Maturity Date”, as set forth in Article 2 of the Repurchase Agreement, is hereby amended to change the words “five (5) years from the Closing Date” to “July 21, 2028”.

(b)Article 2 of the Repurchase Agreement is hereby amended by adding the following definitions thereto in the correct alphabetical order:

“Fourth Amendment Effective Date” shall mean July 21, 2023.

(c)Article 3(n)(i) of the Repurchase Agreement is hereby amended and restated in its entirety to read as follows:

“(n)(i) Notwithstanding the definition of Maturity Date herein, upon written request of Seller prior to the then current Maturity Date, provided that Buyer has determined that all of the extension conditions listed in clause (ii) below (collectively, the “Maturity Date Extension Conditions”) shall have been satisfied, Buyer may, in its sole discretion, agree to extend the Maturity Date for a period of up to three hundred sixty-four (364) additional days (the “Extension Period”) by giving notice to Seller of such extension; provided, that any failure by Buyer to deliver such notice of extension to Seller within thirty (30)) days from the date first received by Buyer shall be deemed a denial of Seller’s request to extend such Maturity Date. Notwithstanding anything to the contrary in this Article 3(n)(i) hereof, in no event shall the Maturity Date be extended for more than two (2) Extension Periods and in no event shall the Final Maturity Date be after July 21, 2028.”

Section 2.Effective Date.

(a) Conditions Precedent. This Amendment shall become effective on the Fourth Amendment Effective Date provided that on or prior to such date all of the following have occurred: (a) a counterpart of this Amendment being duly executed and delivered by a duly authorized officer of each of the Seller, Guarantor and Buyer and (b) payment to Buyer of a fee in the amount of $458,904.11, which constitutes the first installment of the Structuring Fee minus a credit in an amount equal to the unamortized portion of the structuring fee previously paid by Seller to Buyer.

(b) Conditions Subsequent. Seller shall deliver to Buyer within ten (10) Business Days of the date hereof, a bring down of the bankruptcy safe harbor opinion previously delivered in form and substance acceptable to Buyer in its sole discretion. Failure to so deliver such opinion in the time specified, or such later time as may be acceptable to Buyer, shall be an Event of Default under the Repurchase Agreement.

Section 3.Seller’s Representations and Warranties. On and as of the date first above written, Seller hereby represents and warrants to Buyer that (a) Seller has taken all necessary action to authorize the execution, delivery and performance of this Amendment and (b) this Amendment has been duly executed and delivered by or on behalf of Seller and constitutes the legal, valid and binding obligation of Seller enforceable against Seller in accordance with its terms subject to applicable bankruptcy, insolvency, and other limitations on creditors’ rights generally and to equitable principles.

Section 4.Acknowledgments of Guarantor. Guarantor hereby acknowledges the execution and delivery of this Amendment by Seller and agrees that Guarantor continues to be bound by the Guarantee Agreement to the extent of the Obligations (as defined therein), notwithstanding the impact of the changes set forth herein.

-2-

Section 5.Limited Effect. Except as expressly amended and modified by this Amendment, the Repurchase Agreement and each of the other Transaction Documents shall continue to be, and shall remain, in full force and effect in accordance with their respective terms; provided, however, that upon the effective date hereof, all references in the Repurchase Agreement to the “Transaction Documents” shall be deemed to include, in any event, this Amendment. Each reference to Repurchase Agreement in any of the Transaction Documents shall be deemed to be a reference to the Repurchase Agreement, as amended hereby.

Section 6.Counterparts. This Amendment may be executed in counterparts, each of which when so executed shall be deemed to be an original and all of which when taken together shall constitute one and the same instrument, and the words “executed,” “signed,” “signature,” and words of like import as used above and elsewhere in this Amendment or in any other certificate, agreement or document related to this transaction shall include, in addition to manually executed signatures, images of manually executed signatures transmitted by facsimile or other electronic format (including, without limitation, “pdf”, “tif” or “jpg”) and other electronic signatures (including, without limitation, any electronic sound, symbol, or process, attached to or logically associated with a contract or other record and executed or adopted by a person with the intent to sign the record). The use of electronic signatures and electronic records (including, without limitation, any contract or other record created, generated, sent, communicated, received, or stored by electronic means) shall be of the same legal effect, validity and enforceability as a manually executed signature or use of a paper-based record-keeping system to the fullest extent permitted by applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act and any other applicable law, including, without limitation, any state law based on the Uniform Electronic Transactions Act or the Uniform Commercial Code.

Section 7.No Novation, Effect of Agreement. Guarantor, Seller and Buyer have entered into this Amendment solely to amend the terms of the Repurchase Agreement and do not intend this Amendment or the transactions contemplated hereby to be, and this Amendment and the transactions contemplated hereby shall not be construed to be, a novation of any of the obligations owing by Seller or Guarantor (the “Repurchase Parties”) under or in connection with the Repurchase Agreement or any of the other document executed in connection therewith to which any Repurchase Party is a party (the “Transaction Documents”). It is the intention of each of the parties hereto that (i) the perfection and priority of all security interests securing the payment of the obligations of the Repurchase Parties under the Repurchase Agreement and the other Transaction Documents are preserved, (ii) the liens and security interests granted under the Repurchase Agreement continue in full force and effect, and (iii) any reference to the Repurchase Agreement in any such Transaction Document shall be deemed to also reference this Amendment.

Section 8.Costs and Expenses. Seller shall pay Buyer’s reasonable actual out of pocket costs and expenses, including reasonable fees and expenses of attorneys, incurred in connection with the preparation, negotiation, execution and consummation of this Amendment.

Section 9.Consent to Jurisdiction; Waiver of Jury Trial.

(a)Each party irrevocably and unconditionally (i) submits to the non‑exclusive jurisdiction of any United States Federal or New York State court sitting in Manhattan, and any

-3-

appellate court from any such court, solely for the purpose of any suit, action or proceeding brought to enforce its obligations under this Amendment or relating in any way to this Amendment or any Transaction under the Repurchase Agreement and (ii) waives, to the fullest extent it may effectively do so, any defense of an inconvenient forum to the maintenance of such action or proceeding and irrevocably consent to the service of any summons and complaint and any other process by the mailing of copies of such process to them at their respective address specified in the Repurchase Agreement. The parties hereby agree that a final judgment in any such action or proceeding shall be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by law. Nothing in this Section 9 shall affect the right of Buyer to serve legal process in any other manner permitted by law or affect the right of Buyer to bring any action or proceeding against the Seller or its property in the courts of other jurisdictions.

(b)EACH OF THE PARTIES HEREBY IRREVOCABLY WAIVES ALL RIGHT TO A TRIAL BY JURY IN ANY ACTION, PROCEEDING OR COUNTERCLAIM ARISING OUT OF OR RELATING TO THIS AMENDMENT, ANY OTHER TRANSACTION DOCUMENT OR ANY INSTRUMENT OR DOCUMENT DELIVERED HEREUNDER OR THEREUNDER.

Section 10.GOVERNING LAW. THIS AMENDMENT AND ANY CLAIM, CONTROVERSY OR DISPUTE ARISING UNDER OR RELATED TO THIS AMENDMENT, THE RELATIONSHIP OF THE PARTIES TO THIS AMENDMENT, AND/OR THE INTERPRETATION AND ENFORCEMENT OF THE RIGHTS AND DUTIES OF THE PARTIES TO THIS AMENDMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE INTERNAL LAWS AND DECISIONS OF THE STATE OF NEW YORK, WITHOUT REGARD TO THE CHOICE OF LAW RULES THEREOF. THE PARTIES HERETO INTEND THAT THE PROVISIONS OF SECTION 5-1401 OF THE NEW YORK GENERAL OBLIGATIONS LAW SHALL APPLY TO THIS AMENDMENT.

[SIGNATURES FOLLOW]

-4-

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed and delivered as of the day and year first above written.

BUYER:

JPMORGAN CHASE BANK, NATIONAL ASSOCIATION,

a national banking association organized under the laws of the United States of America

|

|

By: |

/s/ Thomas N. Cassino |

|

Name: Thomas N. Cassino |

|

Title: Managing Director |

SELLER:

RCC REAL ESTATE SPE 8, LLC, a Delaware limited liability company

|

|

By: |

/s/ Michael Pierro |

|

Name: Michael Pierro |

|

Title: Senior Vice President |

Acknowledged and Agreed:

GUARANTOR:

ACRES COMMERCIAL REALTY CORP, f/k/a Exantas Capital Corp., a Maryland corporation

|

|

By: |

/s/ Michael Pierro |

|

Name: Michael Pierro |

|

Title: Senior Vice President |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesCPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesDPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

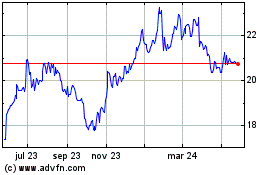

ACRES Commercial Realty (NYSE:ACR-D)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

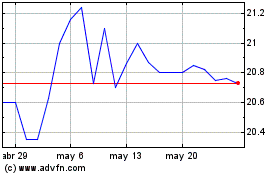

ACRES Commercial Realty (NYSE:ACR-D)

Gráfica de Acción Histórica

De May 2023 a May 2024