UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 18)1

AGCO CORPORATION

(Name

of Issuer)

Common Stock

(Title of Class of Securities)

001084102

(CUSIP Number)

Andrew M. Freedman

Olshan Frome Wolosky LLP

1325 Avenue of the Americas

New York, New York 10019

(212) 451-2300

Dennis Hranitzky

Quinn Emanuel Urquhart & Sullivan LLP

51 Madison Avenue, 22nd Floor

New York, New York 10010

(212) 849-7000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications)

August 6, 2024

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box ¨.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Tractors and Farm Equipment Limited |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Republic of India |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

0 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

12,150,152 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

0 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

12,150,152 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

12,150,152 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☒ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

16.3% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

TAFE Motors and Tractors Limited |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Republic of India |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

0 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

3,262,321 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

0 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

3,262,321 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

3,262,321 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☒ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

4.4% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Mallika Srinivasan |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☒ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Republic of India |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

23,713 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

12,150,152 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

23,713 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

12,150,152 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

12,173,865 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

16.3% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

The Schedule 13D originally

filed with the Securities and Exchange Commission (the “SEC”) with respect to the Issuer on April 9, 2013, as amended by Amendment

Nos. 1 through 17 (the “Schedule 13D”), is hereby further amended and supplemented to include the information set forth herein.

This amended Statement on Schedule 13D/A constitutes Amendment No. 18 to the Schedule 13D. Capitalized terms used but not defined herein

have the meanings given to such terms in the Schedule 13D.

Item 1. Security

and Issuer

This Schedule 13D relates

to shares of the common stock (the “Common Stock”) of AGCO Corporation (“AGCO” or the “Issuer”), the

principal executive offices of which are located at 4205 River Green Parkway, Duluth, Georgia 30096.

Item 3. Source and

Amount of Funds or Other Consideration

Except for the 23,713 shares

that Ms. Srinivasan (together with the Companies (as defined below), the “Reporting Persons”) holds directly and that were

awarded to her under the AGCO Corporation 2006 Long-Term Incentive Plan for her services as a director of the Issuer, the source of the

funds used by the Reporting Persons to purchase the reported shares, pursuant to the Purchase Plans, was the working capital of Tractors

and Farm Equipment Limited (“TAFE”) or of TAFE Motors and Tractors Limited (“TAFE Motors and Tractors” and, together

with TAFE, the “Companies”). The Reporting Persons paid a total of $585,803,125.51 (exclusive of brokers’ commissions

and other administrative costs) to purchase the reported shares. Ms. Srinivasan did not pay for the shares that were awarded to her under

the AGCO Corporation 2006 Long-Term Incentive Plan.

Item 4. Purpose of

Transaction.

Item 4 of the Schedule 13D

is hereby further amended and supplemented by adding the following:

The Reporting Persons are

the largest shareholders of the Issuer, holding approximately 16.3% of the Issuer’s outstanding Common Stock in the aggregate. The

Reporting Persons have been long-term strategic investors in the Issuer with more than six decades of partnership that has included a

variety of commercial agreements that have been mutually beneficial to both AGCO and TAFE. The Reporting Persons have serious concerns

regarding recent actions taken by the Issuer. This includes, but is not limited to, calculated and protectionist actions that certain

members of the Issuer’s Board of Directors (the “Board”) – namely Chairman and CEO Eric Hansotia, Lead Director

and Chair of the Governance Committee Michael C. Arnold, and Chair of the Audit Committee Sondra Barbour – have taken that the Reporting

Persons believe have the potential to further negatively impact AGCO’s operational performance, shareholder returns, and corporate

governance.

Rather than address issues

plaguing AGCO that the Reporting Persons have repeatedly called attention to, including flaws with AGCO’s corporate governance,

wholly inadequate engagement with shareholders, and financial and operational performance in key areas, these directors have sought to

distort agreements, trust, and cooperative frameworks that existed between AGCO and TAFE to suppress and restrain the Reporting Persons

from fulfilling responsibilities both in the interest of the Issuer and of enhanced value creation for all shareholders.

Specifically, Messrs. Arnold

and Hansotia and Ms. Barbour sought to have TAFE extend the duration of its Amended and Restated Letter Agreement (the “Agreement”)

with the Issuer for one year effective April 24, 2024 – only to deliver notice just two days after the extension’s effective

date that the Issuer was unilaterally terminating its commercial relationships with TAFE. TAFE had agreed to extend the duration of the

Agreement despite no necessity to do so in good faith to provide adequate time to discuss and resolve “strategic and risk”-related

issues that it had highlighted while objecting to the curtailment of its shareholder rights sought by the Issuer. It is worth noting that

the Agreement has been in place for 10 years in the spirit of long-term strategic investment and partnership. Particularly troubling is

the fact that the Board made no mention of any perceived issues affecting the commercial relationship between TAFE or the impending termination

during the full Board meeting on April 25, 2024, which AGCO Board Member and TAFE Representative Mallika Srinivasan attended. The Reporting

Persons question whether the full Board participated in the deliberations to terminate the commercial relationship with TAFE. The extension

of the term of the Agreement, which expires on April 24, 2025, and the timing of events is suggestive of a calculated maneuver by the

Board, led by Messrs. Hansotia and Arnold and Ms. Barbour, to disenfranchise TAFE and stifle its ability to seek changes while protecting

management and the Board.

As AGCO’s largest shareholder,

with a history of successfully driving strategic initiatives and value creation at AGCO, it is particularly concerning that the Issuer’s

actions come at a time when its competitive position has deteriorated due to what the Reporting Persons believe to be a short-sighted

operational strategy that does not address structural readiness for the down cycle nor the timely execution of portfolio corrections.

The impact is seen in weak financial performance in core segments versus peers, continuing high costs, and unsuccessful key investments,

which further necessitate a comprehensive re-evaluation and transformation of the Issuer’s strategic direction. AGCO’s failure

to effectively integrate and derive value from costly acquisitions has led to significant write-offs, including the Issuer’s recently

announced sale of the majority of its Grain & Protein business, which has incurred a total loss of $670.6 million after being acquired

by AGCO for nearly $1.5 billion. Moreover, the Issuer’s acquisition-focused mindset has shifted valuable time and attention away

from internal innovation and growth, with several key investments failing to deliver returns and critical projects falling short. AGCO’s

second quarter 2024 earnings results, which fell short of expectations, and its lower guidance for the year, demonstrate the Issuer’s

inability to adapt in the face of reduced demand. This insufficient strategy further highlights the significant gaps in management’s

capabilities and the Board’s oversight, as well as the urgency for stronger governance and a strategic reset at AGCO.

The Reporting Persons believe

it is high time that the Issuer take measures to improve its operational performance, shareholder returns, and corporate governance, including

by separating the roles of Chairman and CEO (as urged by the Reporting Persons in 2020), adopting additional shareholder-friendly governance

structures, and undertaking a meaningful Board refresh to restore a level of oversight and accountability to ensure that the Board is

truly independent from management and is acting in the best interest of shareholders. Additionally, considering the Board’s poor

shareholder engagement and governance, as well as its recent ill-advised actions, the Reporting Persons caution the Board against taking

any “defensive” measures that may further harm shareholders and erode the market’s confidence in the Issuer.

Following the Issuer’s

sudden and ill-advised announcement of the cancellation of the commercial relationships between the Issuer and TAFE, TAFE was compelled

to commence legal proceedings in India for the protection of its contractual, commercial, and legal rights, and TAFE reserves its right

to take such further steps as it may deem advisable or necessary to protect its rights.

In light of these developments,

TAFE and the other Reporting Persons are actively exploring all of their options, including a consent solicitation to remove and replace

certain members of the Board and/or litigation, to protect not only their rights and investment as the Issuer’s largest shareholder,

but the rights and investments of all of the Issuer’s shareholders, and also to ensure that the Board and its leadership are held

accountable.

Item 5. Interest in Securities

of the Issuer

(a) The aggregate percentage

of shares reported owned on this Schedule 13D is based on 74,619,501 shares of Common Stock outstanding as of April 30, 2024, which is

the total number of shares of Common Stock outstanding as reported in the Issuer’s Quarterly Report on Form 10-Q filed with the

SEC on May 3, 2024. As of the date hereof (i) TAFE beneficially owned 12,150,152 shares of Common Stock, which constituted approximately

16.3% of the Common Stock outstanding; (ii) TAFE Motors and Tractors beneficially owned 3,263,321 shares of Common Stock, which constituted

approximately 4.4% of the Common Stock outstanding; and (iii) Ms. Srinivasan beneficially owned 12,173,865 shares of Common Stock,

which constituted approximately 16.3% of the Common Stock outstanding, including the 23,713 shares she holds in her individual capacity.

Ms. Srinivasan disclaims beneficial ownership of the Common Stock beneficially owned by each of the Companies, and this report shall not

be deemed an admission that Ms. Srinivasan is a beneficial owner of such shares for the purposes of Section 13(d) or 13(g) of the Securities

Exchange Act of 1934 or for any other purpose. Each of the Companies disclaims beneficial ownership of the 23,713 shares of Common Stock

owned directly by Ms. Srinivasan in her individual capacity, and this report shall not be deemed an admission that either of the Companies

is a beneficial owner of such shares for the purposes of Section 13(d) or 13(g) of the Securities Exchange Act of 1934 or for any other

purpose. TAFE Motors and Tractors disclaims beneficial ownership of the 8,886,831 shares of Common Stock purchased on behalf of TAFE under

the Purchase Plans, and this report shall not be deemed an admission that TAFE Motors and Tractors is a beneficial owner of such shares

for the purposes of Section 13(d) or 13(g) of the Securities Exchange Act of 1934 or for any other purpose.

(b) For each person listed,

the following table indicates the number of shares of Common Stock as to which there is sole power to vote or to direct the vote, shared

power to vote or to direct the vote, sole power to dispose or to direct the disposition and shared power to dispose or to direct the disposition:

| Reporting Person |

Sole Voting Power |

Shared Voting Power |

Sole Dispositive Power |

Shared Dispositive Power |

| TAFE |

0 |

12,150,152 |

0 |

12,150,152 |

| TAFE Motors and Tractors |

0 |

3,263,321 |

0 |

3,263,321 |

| Mallika Srinivasan |

23,713 |

12,173,865 |

23,713 |

12,173,865 |

(c) See Annex A hereto.

(d) Not applicable.

(e) Not applicable.

Item 7. Material to Be

Filed as Exhibits

| Exhibit A* | Persons

through whom Amalgamations Private Limited (“Amalgamations”) may be deemed to control the Companies |

| Exhibit B* | Directors

and Executive Officers of the Companies |

| Exhibit C* | Directors

and Executive Officers of Amalgamations |

| Exhibit D** | Amended

and Restated Letter Agreement, dated April 24, 2019, between Tractors and Farm Equipment Limited and AGCO Corporation |

| Exhibit E† | Limited

Power of Attorney, dated as of July 24, 2024 |

| Exhibit F*** | Joint

Filing Agreement, dated as of April 3, 2013 |

| Exhibit G**** | Amendment

No. 1 to the Amended and Restated Letter Agreement, effective April 24, 2024, between Tractors and Farm Equipment Limited and AGCO Corporation |

| * | Included by reference to Amendment No. 17 to this Schedule 13D, filed with the SEC on April 27, 2024. |

| ** | Included by reference to Amendment No. 10 to this Schedule 13D, filed with the SEC on April 26, 2019. |

| *** | Included by reference to the initial filing of this Schedule 13D, filed with the SEC on April 9, 2013. |

| **** | Included by reference to Exhibit 10.1 to Issuer’s Form 8-K, filed with the SEC on April 16, 2024.

|

SIGNATURE

After reasonable inquiry

and to the best of his or its knowledge and belief, the undersigned certifies that the information set forth in this statement is true,

complete and correct.

Dated: August 6, 2024

| |

TRACTORS AND FARM EQUIPMENT LIMITED |

| |

|

| |

By: |

/s/ Andrew M. Freedman |

| |

|

Name: Andrew M. Freedman, |

| |

|

attorney-in-fact* |

| |

TAFE MOTORS AND TRACTORS

LIMITED |

| |

|

| |

By: |

/s/ Andrew M. Freedman |

| |

|

Name: Andrew M. Freedman, |

| |

|

attorney-in-fact* |

| |

/s/ Andrew M. Freedman |

| |

Andrew M. Freedman, attorney-in-fact for Mallika Srinivasan* |

* This Amendment No. 18 to Statement on Schedule 13D

was executed by Andrew M. Freedman as Attorney-In-Fact for Tractors and Farm Equipment Limited, TAFE Motors and Tractors Limited and Mallika

Srinivasan, pursuant to the Limited Power of Attorney granted by them.

ANNEX A

Transactions by TAFE during the last 60

days: None.

Transactions by TAFE Motors and Tractors

during the last 60 days: None.

Transactions by Ms. Srinivasan in her individual

capacity during the last 60 days: None.

EXHIBIT E

POWER OF ATTORNEY

Know all by these presents, that each of the undersigned

parties hereby constitutes and appoints Andrew M. Freedman such party’s true and lawful attorney-in-fact to:

(1) execute

for and on behalf of such party, all documents relating to the reporting of beneficial ownership of securities of AGCO Corporation required

to be filed with the United States Securities and Exchange Commission (the “SEC”) pursuant to Section 13(d) or Section 16(a)

of the Securities Exchange Act of 1934 and the rules thereunder (the “Exchange Act”), including, without limitation, Schedule

13D and Form 3, Form 4 and Form 5 and successive forms thereto;

(2) do

and perform any and all acts for and on behalf of such party that may be necessary or desirable to complete and execute any such documents,

complete and execute any amendment or amendments thereto, and timely file such documents with the SEC and any stock exchange, automated

quotation system or similar authority; and

(3) take

any other action of any type whatsoever in furtherance of the foregoing which, in the opinion of such attorney-in-fact, may be of benefit

to, in the best interest of, or legally required by, such party, it being understood that the documents executed by such attorney-in-fact

on behalf of such party pursuant to this Power of Attorney shall be in such form and shall contain such terms and conditions as such attorney-in-fact

may approve in such attorney-in-fact’s discretion.

Such party hereby grants to each

such attorney-in-fact full power and authority to do and perform any and every act and thing whatsoever requisite, necessary, or proper

to be done in the exercise of any of the rights and powers herein granted, as fully to all intents and purposes as such party might or

could do if personally present, with full power of substitution or revocation, hereby ratifying and confirming all that such attorney-in-fact,

or such attorney-in-fact’s substitute or substitutes, shall lawfully do or cause to be done by virtue of this power of attorney

and the rights and powers herein granted. Each of the undersigned acknowledges that the foregoing attorney-in-fact, in serving in such

capacity at the request of such undersigned, is not assuming, nor is AGCO Corporation assuming, any responsibilities of any of the undersigned

to comply with the Exchange Act.

This Power of Attorney shall remain

in full force and effect until such party is no longer required to file such documents with respect to such party’s holdings of

and transactions in securities issued by AGCO Corporation, unless earlier revoked by such party in a signed writing delivered to the foregoing

attorney-in-fact.

IN WITNESS WHEREOF, each of undersigned

has caused this Power of Attorney to be executed as of this 24th day of July 2024.

| |

TRACTORS AND FARM EQUIPMENT LIMITED |

| |

|

| |

By: |

/s/ S Chandramohan |

| |

|

Name: S Chandramohan |

| |

|

Title: Director |

| |

TAFE MOTORS AND TRACTORS

LIMITED |

| |

|

| |

By: |

/s/ S Chandramohan |

| |

|

Name: S Chandramohan |

| |

|

Title: Director |

| |

/s/ Mallika Srinivasan |

| |

Mallika Srinivasan |

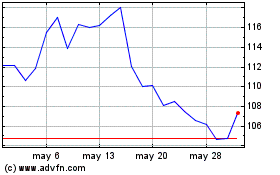

AGCO (NYSE:AGCO)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

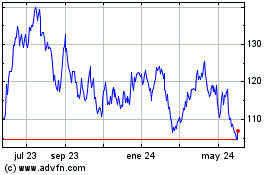

AGCO (NYSE:AGCO)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024