ALLETE, Inc. (NYSE: ALE) today reported first quarter 2024

earnings of 88 cents per share on net income of $50.7 million. Last

year’s first quarter results were $1.02 per share on net income of

$58.2 million. Net income in 2024 includes interim rate refund

reserves of 7 cents per share due to Minnesota Power’s rate case

settlement, a 6 cent per share negative impact due to warmer winter

weather, and 2 cents per share of transaction expenses related to

the recently announced merger.

“I am proud of our entire ALLETE team, working diligently on

many fronts to execute our Sustainability in Action strategy. We

are pleased that Minnesota Power worked collaboratively to reach a

balanced resolution to settle the current rate case with all

intervening parties, which is subject to approval by the Minnesota

Public Utilities Commission,” said ALLETE Chair, President, and

Chief Executive Officer Bethany Owen. “In addition, Minnesota

Power’s requests for proposals for new solar and wind projects are

progressing as planned, ALLETE Clean Energy has begun taking

advantage of the Inflation Reduction Act with the sale of

production tax credits in the second quarter, and New Energy Equity

is executing on its strategy and robust pipeline of projects.”

ALLETE’s Regulated Operations segment, which includes Minnesota

Power, Superior Water, Light and Power and the Company’s investment

in the American Transmission Company, recorded first quarter 2024

net income of $44.2 million, compared to $40.6 million in the first

quarter a year ago. Net income at Minnesota Power was higher

primarily due to the implementation of interim rates, net of

reserves. Interim rates went into effect on January 1, 2024, and as

a result of the rate case settlement, Minnesota Power recorded a

reserve of $3.9 million after-tax for the interim rate refund.

ALLETE Clean Energy recorded first quarter 2024 net income of

$3.8 million compared to $8.5 million in 2023. Earnings in 2024

reflect impacts from a forced network outage near its Caddo wind

energy facility as well as a transformer outage at its Diamond

Springs wind energy facility. These decreases were partially offset

by lower operating and maintenance expense.

Corporate and Other businesses, which include New Energy, BNI

Energy, ALLETE Properties and our investments in renewable energy

facilities, recorded net income of $2.7 million in the first

quarter of 2024, compared to net income of $9.1 million in 2023.

Net income in 2024 reflects lower earnings from Minnesota solar

projects as investment tax credits were recognized in 2023, as well

as higher income tax and interest expense as compared to 2023. Net

income in 2024 also included transaction expenses of $1.2 million

after-tax, or 2 cents per share, related to the merger entered into

on May 5, 2024, with Canada Pension Plan Investment Board and

Global Infrastructure Partners.

“Results for the first quarter of 2024 reflect several items not

in our original 2024 guidance, including warmer weather negatively

impacting sales to residential and commercial customers and the

implementation of interim rate reserves as a result of the rate

case settlement," said ALLETE Senior Vice President and Chief

Financial Officer Steve Morris. “Excluding these items, results for

our Regulated Operations segment were well ahead of our internal

expectations. New Energy's financial results were as expected in

the first quarter of 2024. ALLETE Clean Energy’s results were lower

than our expectations due to lower wind resources and availability,

as well as an extended third-party network outage and a transformer

outage at ALLETE Clean Energy’s wind energy facilities in

Oklahoma.”

Cancellation of Q1 Earnings Conference Call

In light of the announced merger agreement with Canada Pension

Plan Investment Board and Global Infrastructure Partners, ALLETE

has cancelled its earnings conference call previously scheduled for

May 9, 2024, at 10 a.m. Eastern time.

ALLETE is an energy company headquartered in Duluth, Minn. In

addition to its electric utilities, Minnesota Power and Superior

Water, Light and Power of Wisconsin, ALLETE owns ALLETE Clean

Energy, based in Duluth, BNI Energy in Bismarck, N.D., New Energy

Equity in Annapolis, MD, and has an eight percent equity interest

in the American Transmission Co. More information about ALLETE is

available at www.allete.com. ALE-CORP

The statements contained in this release and statements that

ALLETE may make orally in connection with this release that are not

historical facts, are forward-looking statements. Actual results

may differ materially from those projected in the forward-looking

statements. These forward-looking statements involve risks and

uncertainties and investors are directed to the risks discussed in

documents filed by ALLETE with the Securities and Exchange

Commission.

ALLETE's press releases and other communications may include

certain non-Generally Accepted Accounting Principles (GAAP)

financial measures. A "non-GAAP financial measure" is defined as a

numerical measure of a company's financial performance, financial

position or cash flows that excludes (or includes) amounts that are

included in (or excluded from) the most directly comparable measure

calculated and presented in accordance with GAAP in the company's

financial statements.

Non-GAAP financial measures utilized by the Company include

presentations of earnings (loss) per share. ALLETE's management

believes that these non-GAAP financial measures provide useful

information to investors by removing the effect of variances in

GAAP reported results of operations that are not indicative of

changes in the fundamental earnings power of the Company's

operations. Management believes that the presentation of the

non-GAAP financial measures is appropriate and enables investors

and analysts to more accurately compare the company's ongoing

financial performance over the periods presented.

ALLETE, Inc.

Consolidated Statement of

Income

Millions Except Per Share Amounts

- Unaudited

Three Months Ended

March 31,

2024

2023

Operating Revenue

Contracts with Customers – Utility

$338.3

$312.6

Contracts with Customers – Non-utility

63.7

251.0

Other – Non-utility

1.3

1.3

Total Operating Revenue

403.3

564.9

Operating Expenses

Fuel, Purchased Power and Gas –

Utility

133.5

118.6

Transmission Services – Utility

22.7

20.1

Cost of Sales – Non-utility

24.4

210.5

Operating and Maintenance

91.7

85.7

Depreciation and Amortization

65.0

62.3

Taxes Other than Income Taxes

18.7

19.4

Total Operating Expenses

356.0

516.6

Operating Income

47.3

48.3

Other Income (Expense)

Interest Expense

(20.4)

(19.3)

Equity Earnings

5.5

6.0

Other

8.6

4.1

Total Other Expense

(6.3)

(9.2)

Income Before Income Taxes

41.0

39.1

Income Tax Expense

4.0

1.5

Net Income

37.0

37.6

Net Loss Attributable to Non-Controlling

Interest

(13.7)

(20.6)

Net Income Attributable to

ALLETE

$50.7

$58.2

Average Shares of Common Stock

Basic

57.6

57.3

Diluted

57.7

57.3

Basic Earnings Per Share of Common

Stock

$0.88

$1.02

Diluted Earnings Per Share of Common

Stock

$0.88

$1.02

Dividends Per Share of Common

Stock

$0.705

$0.68

Consolidated Balance

Sheet

Millions - Unaudited

Mar. 31,

Dec. 31,

Mar. 31,

Dec. 31,

2024

2023

2024

2023

Assets

Liabilities and Equity

Cash and Cash Equivalents

$32.0

$71.9

Current Liabilities

$260.8

$377.6

Other Current Assets

401.2

396.2

Long-Term Debt

1,772.4

1,679.9

Property, Plant and Equipment – Net

5,009.1

5,013.4

Deferred Income Taxes

195.0

192.7

Regulatory Assets

409.0

425.4

Regulatory Liabilities

564.0

574.0

Equity Investments

333.1

331.2

Defined Benefit Pension and Other

Postretirement Benefit Plans

135.4

160.8

Goodwill and Intangibles – Net

155.4

155.4

Other Non-Current Liabilities

268.0

264.3

Other Non-Current Assets

264.8

262.9

Redeemable Non-Controlling Interest

0.5

0.5

Equity

3,408.5

3,406.6

Total Assets

$6,604.6

$6,656.4

Total Liabilities, Redeemable

Non-Controlling Interest and Equity

$6,604.6

$6,656.4

Three Months Ended

ALLETE, Inc.

March 31,

Income (Loss)

2024

2023

Millions

Regulated Operations

$44.2

$40.6

ALLETE Clean Energy

3.8

8.5

Corporate and Other

2.7

9.1

Net Income Attributable to ALLETE

$50.7

$58.2

Diluted Earnings Per Share

$0.88

$1.02

Statistical Data

Corporate

Common Stock

High

$63.69

$66.64

Low

$55.86

$57.88

Close

$59.64

$64.37

Book Value

$48.95

$47.38

Kilowatt-hours Sold

Millions

Regulated Utility

Retail and Municipal

Residential

306

321

Commercial

338

347

Industrial

1,798

1,658

Municipal

125

128

Total Retail and Municipal

2,567

2,454

Other Power Suppliers

757

696

Total Regulated Utility Kilowatt-hours

Sold

3,324

3,150

Regulated Utility Revenue

Millions

Regulated Utility Revenue

Retail and Municipal Electric Revenue

Residential

$46.7

$42.4

Commercial

47.4

44.0

Industrial

158.5

143.4

Municipal

9.0

8.9

Total Retail and Municipal Electric

Revenue

261.6

238.7

Other Power Suppliers

40.0

35.9

Other (Includes Water and Gas Revenue)

36.7

38.0

Total Regulated Utility Revenue

$338.3

$312.6

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240509123792/en/

Vince Meyer 218-723-3952 vmeyer@allete.com

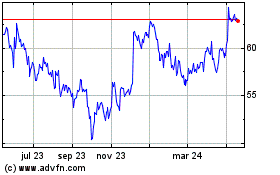

Allete (NYSE:ALE)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

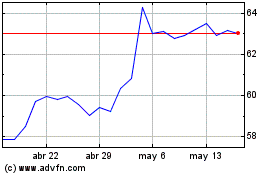

Allete (NYSE:ALE)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024