false000159158712/3100015915872024-09-052024-09-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 5, 2024

AssetMark Financial Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-38980 | 30-0774039 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | |

1655 Grant Street, 10th Floor Concord, California | 94520 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (925) 521-2200

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.001 par value | | AMK | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Introductory Note.

As previously disclosed in the Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on April 25, 2024, AssetMark Financial Holdings, Inc., a Delaware corporation (the “Company”), entered into an Agreement and Plan of Merger, dated as of April 25, 2024 (the “Merger Agreement”) with GTCR Everest Borrower, LLC, a Delaware limited liability company (“Parent”), and GTCR Everest Merger Sub, Inc., a Delaware corporation and a direct, wholly owned subsidiary of Parent (“Merger Sub”). On September 5, 2024 (the “Closing Date”), upon the terms and subject to the conditions set forth in the Merger Agreement and in accordance with the applicable provisions of the Delaware General Corporation Law, Merger Sub merged with and into the Company (the “Merger”), with the Company continuing as the surviving corporation. As a result of the Merger, the Company is now a wholly owned subsidiary of Parent. Parent and Merger Sub are affiliates of GTCR Everest Holdings, LLC (“GTCR”).

Item 1.02 Termination of a Material Definitive Agreement.

In connection with the consummation of the Merger, on September 5, 2024, the Company terminated all commitments and repaid all outstanding indebtedness under the Amended and Restated Credit Agreement, dated as of January 12, 2022, by and among the Company, the Guarantors party thereto, the Lenders party thereto and Bank of Montreal, as the Administrative Agent and Sustainability Coordinator.

Item 2.01 Completion of Acquisition or Disposition of Assets.

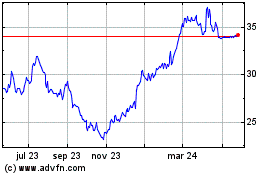

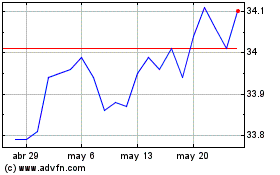

At the effective time of the Merger (the “Effective Time”), on the terms and subject to the conditions set forth in the Merger Agreement, each share of common stock, par value $0.001 per share, of the Company (the “Company Common Stock”) issued and outstanding immediately prior to the Effective Time (other than shares of Company Common Stock (a) held by the Company as treasury stock or owned by Parent or Merger Sub immediately prior to the Effective Time or (b) held by any subsidiary of either the Company or Parent (other than Merger Sub) immediately prior to the Effective Time (in each case, other than shares of Company Common Stock held by any such person in a trustee, custodian or nominee capacity for the account of clients or customers of such persons)) issued and outstanding immediately prior to the Effective Time (other than shares held by any holder who is entitled to appraisal rights and has properly exercised such rights under Delaware law) was converted into the right to receive $35.25 in cash, without interest thereon and less applicable withholding taxes (the “Merger Consideration”).

Pursuant to the Merger Agreement, at the Effective Time: (i) each (1) option to purchase shares of Company Common Stock and (2) stock appreciation right with respect to shares of Company Common Stock (including each stock appreciation right which will settle in cash), in each case, that was outstanding as of immediately prior to the Effective Time (each such option, a “Company Stock Option” and each such stock appreciation right, a “Company SAR”) became fully vested and was canceled in exchange for the right to receive a cash payment equal to the product of (x) the excess (if any) of the per share Merger Consideration over the applicable exercise price of such Company Stock Option or Company SAR and (y) the number of shares of Company Common Stock underlying such Company Stock Option or Company SAR; (ii) each (1) restricted stock unit (including restricted stock units which settle in cash) and (2) restricted stock award, in each case, with respect to shares of Company Common Stock that was outstanding as of immediately prior to the Effective Time, whether or not vested, became fully vested and was canceled in exchange for the right to receive the Merger Consideration; and (iii) each long-term cash incentive award that was outstanding as of immediately prior to the Effective Time, excluding any cash retention awards, whether or not vested, became fully vested and payable as of immediately prior to the Effective Time. Any Company Stock Option or Company SAR (whether vested or unvested) that had an exercise price per Company Stock Option or Company SAR equal to or greater than the Merger Consideration was cancelled for no consideration.

The foregoing description of the Merger Agreement and the transactions contemplated thereby is not complete and is subject to and qualified in its entirety by reference to the full text of the Merger Agreement, a copy of which was filed as Exhibit 2.1 to the Company’s Current Report on Form 8-K filed with the SEC on April 25, 2024, the terms of which are incorporated herein by reference.

The information in the Introductory Note and in Item 3.03, Item 5.01, Item 5.02 and Item 5.03 of this Current Report on Form 8-K is incorporated by reference into this Item 2.01.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

In connection with the closing of the Merger, the Company notified the New York Stock Exchange (the “NYSE”) on September 5, 2024 of the anticipated closing of the Merger on the Closing Date and that trading of the Company Common

Stock should be suspended prior to the opening of business on the Closing Date. The Company subsequently confirmed to the NYSE that the Merger was completed prior to the opening of business on the Closing Date and trading of the Company Common Stock on the NYSE was suspended prior to the opening of business on the Closing Date. The Company also requested that the NYSE file a notification of removal from listing and deregistration on Form 25 with the SEC to delist and deregister the Company Common Stock pursuant to Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). After the Form 25 becomes effective, the Company intends to file with the SEC a Form 15 under the Exchange Act, requesting the deregistration of the Company Common Stock under Section 12(g) of the Exchange Act and the suspension of the Company’s reporting obligations under Sections 13 and 15(d) of the Exchange Act. Trading of the Company Common Stock on the NYSE was suspended on September 5, 2024 prior to the NYSE opening.

The information in the Introductory Note and in Item 2.01 and Item 3.03 of this Current Report on Form 8-K is incorporated by reference into this Item 3.01.

Item 3.03 Material Modification to Rights of Security Holders.

Pursuant to the Merger Agreement and in connection with the consummation of the Merger, each outstanding share of Company Common Stock (except as described in Item 2.01 of this Current Report on Form 8-K) was canceled and automatically converted into the right to receive the Merger Consideration.

The information in the Introductory Note and in Item 2.01, Item 3.01, Item 5.01 and Item 5.03 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03. The description of the Merger Agreement and the transactions contemplated thereby is not complete and is subject to and qualified in its entirety by reference to the full text of the Merger Agreement.

Item 5.01 Changes in Control of Registrant.

As a result of the consummation of the Merger, a change in control of the Company occurred, and the Company became a wholly owned subsidiary of Parent.

The information in the Introductory Note and in Item 2.01, Item 3.03 and Item 5.03 of this Current Report on Form 8-K is incorporated by reference into this Item 5.01.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

At the Effective Time, the following persons became directors of the Company: Louis Maiuri, Gary Zyla and Michael Lomio. Additionally, Michael Kim, who was a director of the Company immediately prior to the Merger, continued to be a director of the Company. In connection with the Merger, effective as of the Effective Time, Rohit Bhagat, Patricia Guinn, Bryan Lin, Xiaoning Jiao, Ying Sun, Joseph Velli, Yi Zhou and Lei Wang ceased to be directors of the Company.

At the Effective Time, the following persons became officers of the Company: Louis Maiuri. Additionally, Michael Kim, Gary Zyla and Carrie Hansen will continue as officers of the Company following the Merger until their successors are duly appointed, if applicable.

The information in the Introductory Note and in Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 5.02.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Pursuant to the terms of the Merger Agreement, at the Effective Time, the certificate of incorporation of the Company, as in effect immediately prior to the Effective Time, was amended and restated in its entirety to be in the form of the certificate of incorporation attached as Exhibit 3.1, which is incorporated herein by reference and the bylaws of the Company were amended and restated to be in the form of the bylaws attached as Exhibit 3.2, which is incorporated herein by reference.

Item 8.01 Other Events.

On September 5, 2024, the Company and Parent issued a joint press release announcing the completion of the Merger. A copy of the joint press release is attached as Exhibit 99.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) – Exhibits

| | | | | | | | |

Exhibit

Number | | Description of Exhibit |

| | |

| 2.1* | | |

| 3.1 | | |

| 3.2 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

* Schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule and or exhibit will be furnished supplementally to the SEC upon request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| AssetMark Financial Holdings, Inc. |

| |

| Date: September 5, 2024 | /s/ Gary Zyla |

| Gary Zyla |

| Chief Financial Officer |

SECOND AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

ASSETMARK FINANCIAL HOLDINGS, INC.

ARTICLE ONE

The name of the Corporation is AssetMark Financial Holdings, Inc.

ARTICLE TWO

The address of the Corporation’s registered office in the State of Delaware is 131 Continental Drive, Suite 305, in the City of Newark, County of New Castle 19713. The name of its registered agent at such address is Legalinc Corporate Services Inc.

ARTICLE THREE

The nature of the business or purposes to be conducted or promoted is to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of the State of Delaware.

ARTICLE FOUR

The total number of shares of stock which the Corporation has authority to issue is one thousand (1,000) shares of Common Stock, par value one cent ($0.01) per share.

ARTICLE FIVE

The Corporation is to have perpetual existence.

ARTICLE SIX

In furtherance and not in limitation of the powers conferred by statute, the board of directors of the Corporation (the “Board of Directors”) is expressly authorized to make, alter or repeal the by-laws of the Corporation.

ARTICLE SEVEN

Meetings of stockholders may be held within or without the State of Delaware, as the by-laws of the Corporation may provide. The books of the Corporation may be kept outside the State of Delaware at such place or places as may be designated from time to time by the board of directors or in the by-laws of the Corporation. Election of directors need not be by written ballot unless the by-laws of the Corporation so provide.

ARTICLE EIGHT

To the fullest extent permitted by law, no director or officer of the Corporation shall be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director or officer. Without limiting the effect of the preceding sentence, if the General Corporation Law of the State of Delaware is hereafter amended to authorize the further elimination or limitation of the liability of a director or officer, then the liability of a director or officer of the Corporation shall be limited to the fullest extent permitted by the General Corporation Law of the State of Delaware, as so amended. Any amendment, repeal or elimination of this paragraph, or the adoption of any provision of this Second Amended Certificate inconsistent with this paragraph, shall not affect its application with respect to an act or omission by a director or officer occurring before such amendment, adoption, repeal or elimination. Solely for purposes of this ARTICLE EIGHT, “officer” shall have the meaning provided in Section 102(b)(7) of the General Corporation Law of the State of Delaware as amended from time to time.

ARTICLE NINE

The Corporation shall indemnify and hold harmless, to the fullest extent permitted by applicable law as it presently exists or may hereafter be amended, any individual (and the heirs, executors or administrators of such individual) (a “Covered Person”) who was or is made or is threatened to be made a party or is otherwise involved in any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (a “Proceeding”), by reason of the fact that he or she, or an individual for whom he or she is the legal representative, is or was a director or officer of the Corporation, or, while a director or officer of the Corporation, is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation or of a limited liability company, partnership, joint venture, trust or other enterprise, and such indemnification shall continue as to an individual who has ceased to be a director or officer and shall inure to the benefit of his or her heirs, executors and administrators. Notwithstanding the preceding sentence, the Corporation shall be required to indemnify a Covered Person in connection with a Proceeding (or part thereof) commenced by such Covered Person only if the commencement of such Proceeding (or part thereof) by the Covered Person was authorized in the specific case by the Board of Directors. The Corporation may, by the action of the Board of Directors, provide indemnification to employees and agents of the Corporation with the same scope and effect as the foregoing indemnification of directors and officers as the Board of Directors shall determine to be appropriate and authorized by applicable law.

ARTICLE TEN

The Corporation shall to the fullest extent permitted by applicable law pay the expenses (including attorneys’ fees and expenses) incurred by a Covered Person in defending any proceeding in advance of its final disposition, provided, however, that such payment of expenses in advance of the final disposition of the proceeding shall be made only upon receipt of an undertaking by the Covered Person to repay all amounts advanced if it should be ultimately determined that the Covered Person is not entitled to be indemnified under ARTICLE NINE or

otherwise. The rights contained in this ARTICLE TEN shall inure to the benefit of a Covered Person’s heirs, executors and administrators. By action of the Board of Directors, the Corporation may advance expenses to employees and agents of the Corporation with the same scope and effect as the foregoing rights to advancement of expenses of directors and officers as the Board of Directors shall determine to be appropriate and authorized by applicable law.

ARTICLE ELEVEN

The Corporation expressly elects not to be governed by §203 of the General Corporation Law of the State of Delaware.

ARTICLE TWELVE

The Corporation reserves the right to amend, alter, change or repeal any provision contained in this certificate of incorporation in the manner now or hereafter prescribed herein and by the laws of the State of Delaware, and all rights conferred upon stockholders herein are granted subject to this reservation.

ARTICLE THIRTEEN

To the maximum extent permitted from time to time under the law of the State of Delaware, the Corporation renounces any interest or expectancy of the Corporation in, or in being offered an opportunity to participate in, business opportunities that are from time to time presented to its officers, directors or stockholders, other than those officers, directors or stockholders who are employees of the Corporation. No amendment or repeal of this ARTICLE THIRTEEN shall apply to or have any effect on the liability or alleged liability of any officer, director or stockholder of the Corporation for or with respect to any opportunities of which such officer, director, or stockholder becomes aware prior to such amendment or repeal.

* * * * *

SECOND AMENDED AND RESTATED

BYLAWS

OF

ASSETMARK FINANCIAL HOLDINGS, INC.

A Delaware corporation

(Adopted as of September 5, 2024)

ARTICLE I

OFFICES

Section 1.Registered Office. The registered office of the corporation in the State of Delaware shall be located at 131 Continental Dr Suite 305, in the City of Newark, New Castle County, Delaware 19713. The name of the corporation's registered agent at such address shall be Legalinc Corporate Services Inc. The registered office and/or registered agent of the corporation may be changed from time to time by action of the board of directors.

Section 2.Other Offices. The corporation may also have offices at such other places, both within and without the State of Delaware, as the board of directors may from time to time determine or the business of the corporation may require.

ARTICLE II

MEETINGS OF STOCKHOLDERS

Section 1.Place and Time of Annual Meeting. An annual meeting of the stockholders shall be held each year for the purpose of electing directors and conducting such other proper business as may come before the meeting. The date, time and place of the annual meeting shall be determined by the president of the corporation; provided, that if the president does not act, the board of directors shall determine the date, time and place of such meeting.

Section 2.Special Meetings. Special meetings of stockholders may be called for any purpose and may be held at such time and place, within or without the State of Delaware, as shall be stated in a notice of meeting or in a duly executed waiver of notice thereof. Such meetings may be called at any time by the board of directors or the president and shall be called by the president upon the written request of holders of shares entitled to cast not less than a majority of the votes at the meeting, such written request shall state the purpose or purposes of the meeting and shall be delivered to the president.

Section 3.Place of Meetings. The board of directors may designate any place, either within or without the State of Delaware, as the place of meeting for any annual meeting or for any special meeting called by the board of directors. If no designation is made, or if a special meeting be otherwise called, the place of meeting shall be the principal executive office of the corporation.

Section 4.Notice. Whenever stockholders are required or permitted to take action at a meeting, written or printed notice stating the place, date, time, and, in the case of special meetings, the purpose or purposes, of such meeting, shall be given to each stockholder entitled to vote at such meeting not less than ten (10) nor more than sixty (60) days before the date of the meeting. All such notices shall be delivered, either personally or by mail, or electronic mail, by or at the direction of the board of directors, the president or the secretary, and if mailed, such notice shall be deemed to be delivered when deposited in the United States mail, postage prepaid, addressed to the stockholder at his, her or its address as the same appears on the records of the corporation. Attendance of a person at a meeting shall constitute a waiver of notice of such meeting, except when the person attends for the express purpose of objecting at the beginning of the meeting to the transaction of any business because the meeting is not lawfully called or convened.

Section 5.Stockholders List. The officer having charge of the stock ledger of the corporation shall make, at least ten (10) days before every meeting of the stockholders, a complete list of the stockholders entitled to vote at such meeting arranged in alphabetical order, showing the address of each stockholder and the number of shares registered in the name of each stockholder. Such list shall be open to the examination of any stockholder, for any purpose germane to the meeting, during ordinary business hours, for a period of at least ten (10) days prior to the meeting, either at a place within the city where the meeting is to be held, which place shall be specified in the notice of the meeting or, if not so specified, at the place where the meeting is to be held. The list shall also be produced and kept at the time and place of the meeting during the whole time thereof, and may be inspected by any stockholder who is present.

Section 6.Quorum. The holders of a majority of the outstanding shares of capital stock, present in person or represented by proxy, shall constitute a quorum at all meetings of the stockholders, except as otherwise provided by statute or by the certificate of incorporation of the corporation (as amended and in effect from time to time, the "Certificate of Incorporation"). If a quorum is not present, the holders of a majority of the shares present in person or represented by proxy at the meeting, and entitled to vote at the meeting, may adjourn the meeting to another time and/or place.

Section 7.Adjourned Meetings. When a meeting is adjourned to another time and place, notice need not be given of the adjourned meeting if the time and place thereof are announced at the meeting at which the adjournment is taken. At the adjourned meeting the corporation may transact any business which might have been transacted at the original meeting. If the adjournment is for more than thirty (30) days, or if after the adjournment a new record date is fixed for the adjourned meeting, a notice of the adjourned meeting shall be given to each stockholder of record entitled to vote at the meeting.

Section 8.Vote Required. When a quorum is present, the affirmative vote of the majority of shares present in person or represented by proxy at the meeting and entitled to vote on the subject matter shall be the act of the stockholders, unless the question is one upon which by express provisions of an applicable law or of the Certificate of Incorporation a different vote

is required, in which case such express provision shall govern and control the decision of such question.

Section 9.Voting Rights. Except as otherwise provided by the General Corporation Law of the State of Delaware or by the Certificate of Incorporation every stockholder shall at every meeting of the stockholders be entitled to one (1) vote in person or by proxy for each share of common stock held by such stockholder.

Section 10.Proxies. Each stockholder entitled to vote at a meeting of stockholders or to express consent or dissent to corporate action in writing without a meeting may authorize another person or persons to act for him or her by proxy, but no such proxy shall be voted or acted upon after three (3) years from its date, unless the proxy provides for a longer period. A duly executed proxy shall be irrevocable if it states that it is irrevocable and if, and only as long as, it is coupled with an interest sufficient in law to support an irrevocable power. A proxy may be made irrevocable regardless of whether the interest with which it is coupled is an interest in the stock itself or an interest in the corporation generally. Any proxy is suspended when the person executing the proxy is present at a meeting of stockholders and elects to vote, except that when such proxy is coupled with an interest and the fact of the interest appears on the face of the proxy, the agent named in the proxy shall have all voting and other rights referred to in the proxy, notwithstanding the presence of the person executing the proxy. At each meeting of the stockholders, and before any voting commences, all proxies filed at or before the meeting shall be submitted to and examined by the secretary or a person designated by the secretary, and no shares may be represented or voted under a proxy that has been found to be invalid or irregular.

Section 11.Action by Written Consent. Unless otherwise provided in the Certificate of Incorporation, any action required to be taken at any annual or special meeting of stockholders of the corporation, or any action which may be taken at any annual or special meeting of such stockholders, may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken and bearing the dates of signature of the stockholders who signed the consent or consents, shall be signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted and shall be delivered to the corporation by delivery to its registered office in the state of Delaware, or the corporation's principal place of business, or an officer or agent of the corporation having custody of the book or books in which proceedings of meetings of the stockholders are recorded. Delivery made to the corporation's registered office shall be by hand or by certified or registered mail, return receipt requested provided, however, that no consent or consents delivered by certified or registered mail shall be deemed delivered until such consent or consents are actually received at the registered office. All consents properly delivered in accordance with this section shall be deemed to be recorded when so delivered. No written consent shall be effective to take the corporate action referred to therein unless, within sixty (60) days of the earliest dated consent delivered to the corporation as required by this section, written consents signed by the holders of a sufficient number of shares to take such corporate action are so recorded. Prompt notice of the taking of the corporate action without a meeting by less than unanimous written consent shall be given to those stockholders who have not consented in

writing. Any action taken pursuant to such written consent or consents of the stockholders shall have the same force and effect as if taken by the stockholders at a meeting thereof.

ARTICLE III

DIRECTORS

General Powers. The business and affairs of the corporation shall be managed by or under the direction of the board of directors.

Section 1.Number, Election and Term of Office. The number of directors which shall constitute the board shall be (4) four. Thereafter, the number of directors shall be established from time to time by resolution of the board of directors. The directors shall be elected by a plurality of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote in the election of directors. The directors shall be elected in this manner at the annual meeting of the stockholders, except as provided in Section 4 of this Article III. Each director elected shall hold office until a successor is duly elected and qualified or until his or her earlier death, resignation or removal as hereinafter provided.

Section 2.Removal and Resignation. Except as otherwise provided by the Certificate of Incorporation or in any agreement to which the corporation is party or by which it is bound, any director or the entire board of directors may be removed at any time, with or without cause, by the holders of a majority of the shares then entitled to vote at an election of directors. Whenever the holders of any class or series are entitled to elect one or more directors by the provisions of the corporation's Certificate of Incorporation, the provisions of this section shall apply, in respect to the removal without cause of a director or directors so elected, to the vote of the holders of the outstanding shares of that class or series and not to the vote of the outstanding shares as a whole. Any director may resign at any time upon written notice to the corporation.

Section 3.Vacancies. Vacancies and newly created directorships resulting from any increase in the authorized number of directors may be filled by a majority of the directors then in office, though less than a quorum, or by a sole remaining director. Each director so chosen shall hold office until a successor is duly elected and qualified or until his or her earlier death, resignation or removal as herein provided.

Section 4.Annual Meetings. The annual meeting of each newly elected board of directors shall be held without other notice than this by-law immediately after, and at the same place as, the annual meeting of stockholders.

Section 5.Other Meetings and Notice. Regular meetings, other than the annual meeting, of the board of directors may be held without notice at such time and at such place as shall from time to time be determined by resolution of the board of directors. Special meetings of the board of directors may be called by or at the request of the president or any two (2) directors (provided, however, that if the number of directors then in office is one (1), such sole director may call a special meeting) on at least twenty-four (24) hours notice to each director, either personally, by telephone, by mail, by electronic mail or by facsimile.

Section 6.Quorum, Required Vote and Adjournment. A majority of the total number of directors shall constitute a quorum for the transaction of business. The vote of a majority of directors present at a meeting at which a quorum is present shall be the act of the board of directors. If a quorum shall not be present at any meeting of the board of directors, the directors present thereat may adjourn the meeting from time to time, without notice other than announcement at the meeting, until a quorum shall be present.

Section 7.Committees. The board of directors may, by resolution passed by a majority of the whole board of directors, designate one or more committees, each committee to consist of one or more of the directors of the corporation, which to the extent provided in such resolution or these bylaws shall have and may exercise the powers of the board of directors in the management and affairs of the corporation except as otherwise limited by law. The board of directors may designate one or more directors as alternate members of any committee, who may replace any absent or disqualified member at any meeting of the committee. Such committee or committees shall have such name or names as may be determined from time to time by resolution adopted by the board of directors. Each committee shall keep regular minutes of its meetings and report the same to the board of directors when required.

Section 8.Committee Rules. Each committee of the board of directors may fix its own rules of procedure and shall hold its meetings as provided by such rules, except as may otherwise be provided by a resolution of the board of directors designating such committee. Unless otherwise provided in such a resolution, the presence of at least a majority of the members of the committee shall be necessary to constitute a quorum. In the event that a member and that member's alternate, if alternates are designated by the board of directors as provided in Section 8 of this Article III, of such committee is or are absent or disqualified, the member or members thereof present at any meeting and not disqualified from voting, whether or not such member or members constitute a quorum, may unanimously appoint another member of the board of directors to act at the meeting in place of any such absent or disqualified member.

Section 9.Communications Equipment. Members of the board of directors or any committee thereof may participate in and act at any meeting of such board of directors or committee through the use of a conference telephone or other communications equipment by means of which all persons participating in the meeting can hear each other, and participation in the meeting pursuant to this section shall constitute presence in person at the meeting.

Section 10.Waiver of Notice and Presumption of Assent. Any member of the board of directors or any committee thereof who is present at a meeting shall be conclusively presumed to have waived notice of such meeting except when such member attends for the express purpose of objecting at the beginning of the meeting to the transaction of any business because the meeting is not lawfully called or convened. Such member shall be conclusively presumed to have assented to any action taken unless his or her dissent shall be entered in the minutes of the meeting or unless his or her written dissent to such action shall be filed with the person acting as the secretary of the meeting before the adjournment thereof or shall be forwarded by registered mail to the secretary of the corporation immediately after the adjournment of the meeting. Such right to dissent shall not apply to any member who voted in favor of such action.

Section 11.Action by Written Consent. Unless otherwise restricted by the Certificate of Incorporation, any action required or permitted to be taken at any meeting of the board of directors, or of any committee thereof, may be taken without a meeting if all members of the board of directors or committee, as the case may be, consent thereto in writing, and the writing or writings are filed with the minutes of proceedings of the board of directors or committee.

ARTICLE IV

OFFICERS

Section 1.Number. The officers of the corporation shall be elected by the board of directors and may consist of a president, one or more vice-presidents, a secretary, a treasurer, and such other officers and assistant officers as may be deemed necessary or desirable by the board of directors. Any number of offices may be held by the same person. In its discretion, the board of directors may choose not to fill any office for any period as it may deem advisable, except that the offices of president and secretary shall be filled as expeditiously as possible.

Section 2.Election and Term of Office. The officers of the corporation shall be elected annually by the board of directors at its first meeting held after each annual meeting of stockholders or as soon thereafter as conveniently may be. The president shall be elected annually by the board of directors at the first meeting of the board of directors held after each annual meeting of stockholders or as soon thereafter as conveniently may be. The president shall appoint other officers to serve for such terms as he or she deems desirable. Vacancies may be filled or new offices created and filled at any meeting of the board of directors. Each officer shall hold office until a successor is duly elected and qualified or until his or her earlier death, resignation or removal as hereinafter provided.

Section 3.Removal. Any officer or agent elected by the board of directors may be removed by the board of directors whenever in its judgment the best interests of the corporation would be served thereby, but such removal shall be without prejudice to the contract rights, if any, of the person so removed.

Section 4.Vacancies. Any vacancy occurring in any office because of death, resignation, removal, disqualification or otherwise, may be filled by the board of directors for the unexpired portion of the term by the board of directors then in office.

Section 5.Compensation. Compensation of all officers shall be fixed by the board of directors, and no officer shall be prevented from receiving such compensation by virtue of his or her also being a director of the corporation.

Section 6.The President. The president shall be the chief executive officer of the corporation, and shall have the powers and perform the duties incident to that position. Subject to the powers of the board of directors, the president shall be in the general and active charge of the entire business and affairs of the corporation, and shall be its chief policy making officer. The president shall preside at all meetings of the board of directors and at all meetings of the stockholders and shall have such other powers and perform such other duties as may be prescribed by the board of directors or provided in these bylaws. The president shall execute

bonds, mortgages and other contracts except where the signing and execution thereof shall be expressly delegated by the board of directors to some other officer or agent of the corporation. Whenever the president is unable to serve, by reason of sickness, absence or otherwise, the chief operating officer shall perform all the duties and responsibilities and exercise all the powers of the president.

Section 7.Vice-presidents. The vice-president, or if there shall be more than one, the vice-presidents in the order determined by the board of directors or by the president, shall, in the absence or disability of the chief operating officer, act with all of the powers and be subject to all the restrictions of the president. The vice-presidents shall also perform such other duties and have such other powers as the board of directors, president or these bylaws may, from time to time, prescribe.

Section 8.The Secretary and Assistant Secretaries. The secretary shall attend all meetings of the board of directors, all meetings of the committees thereof and all meetings of the stockholders and record all the proceedings of the meetings in a book or books to be kept for that purpose. Under the president's supervision, the secretary shall give, or cause to be given, all notices required to be given by these bylaws or by law; shall have such powers and perform such duties as the board of directors, the president or these bylaws may, from time to time, prescribe. The assistant secretary, or if there be more than one, the assistant secretaries in the order determined by the board of directors, shall, in the absence or disability of the secretary, perform the duties and exercise the powers of the secretary and shall perform such other duties and have such other powers as the board of directors, the president, or secretary may, from time to time, prescribe.

Section 9.The Treasurer and Assistant Treasurer. The treasurer shall have the custody of the corporate funds and securities; shall keep full and accurate accounts of receipts and disbursements in books belonging to the corporation; shall deposit all monies and other valuable effects in the name and to the credit of the corporation as may be ordered by the board of directors; shall cause the funds of the corporation to be disbursed when such disbursements have been duly authorized, taking proper vouchers for such disbursements; and shall render to the president and the board of directors, at its regular meeting or when the board of directors so requires, an account of the corporation; shall have such powers and perform such duties as the board of directors, the president or these bylaws may, from time to time, prescribe. If required by the board of directors, the treasurer shall give the corporation a bond (which shall be rendered every six (6) years) in such sums and with such surety or sureties as shall be satisfactory to the board of directors for the faithful performance of the duties of the office of treasurer and for the restoration to the corporation, in case of death, resignation, retirement, or removal from office, of all books, papers, vouchers, money, and other property of whatever kind in the possession or under the control of the treasurer belonging to the corporation. The assistant treasurer, or if there shall be more than one, the assistant treasurers in the order determined by the board of directors, shall in the absence or disability of the treasurer, perform the duties and exercise the powers of the treasurer. The assistant treasurers shall perform such other duties and have such other powers as the board of directors, the president or treasurer may, from time to time, prescribe.

Section 10.Other Officers, Assistant Officers and Agents. Officers, assistant officers and agents, if any, other than those whose duties are provided for in these bylaws, shall have such authority and perform such duties as may from time to time be prescribed by resolution of the board of directors.

Section 11.Absence or Disability of Officers. In the case of the absence or disability of any officer of the corporation and of any person hereby authorized to act in such officer's place during such officer's absence or disability, the board of directors may by resolution delegate the powers and duties of such officer to any other officer or to any director, or to any other person whom it may select.

ARTICLE V

INDEMNIFICATION OF OFFICERS, DIRECTORS AND OTHERS

Section 1.Nature of Indemnity. Each person who was or is made a party or is threatened to be made a party to or is involved in any action, suit or proceeding, whether brought by or in the right of the corporation or any of its subsidiaries and whether civil, criminal, administrative or investigative (hereinafter a "proceeding"), or any appeal of such proceeding, by reason of or arising out of the fact that such person, or any other person for whom such person is the legal representative, is or was a director or officer of the corporation or is or was serving at the request of the corporation as a director, officer, manager, general partner, employee, fiduciary, or agent of another corporation or of a partnership, limited liability company, joint venture, trust or other enterprise, shall be indemnified and held harmless by the corporation to the fullest extent which it is empowered to do so unless prohibited from doing so by the General Corporation Law of the State of Delaware, as the same exists or may hereafter be amended (but, in the case of any such amendment, only to the extent that such amendment permits the corporation to provide broader indemnification rights than said law permitted the corporation to provide prior to such amendment) against all expense, liability and loss (including attorneys' fees actually and reasonably incurred by such person in connection with such proceeding), and such indemnification shall inure to the benefit of his or her heirs, executors and administrators; provided, however, that, except as provided in Section 2 hereof, the corporation shall indemnify any such person seeking indemnification in connection with a proceeding initiated by such person only if such proceeding was authorized by the board of directors of the corporation. The right to indemnification conferred in this Article V shall be a contract right and, subject to Sections 2 and 5 hereof, shall include the right to be paid by the corporation the expenses incurred in defending any such proceeding in advance of its final disposition. The corporation may, by action of its board of directors, provide indemnification to employees and agents of the corporation with the same scope and effect as the foregoing indemnification of directors and officers.

Section 2.Procedure for Indemnification of Directors and Officers. Any indemnification of a director or officer of the corporation provided for under Section 1 of this Article V or advance of expenses provided for under Section 5 of this Article V shall be made promptly, and in any event within thirty (30) days, upon the written request of the director or officer. If a determination by the corporation that the director or officer is entitled to

indemnification pursuant to this Article V is required, and the corporation fails to respond within sixty (60) days to a written request for indemnity, the corporation shall be deemed to have approved the request. If the corporation wrongfully denies a written request for indemnification or advancing of expenses, in whole or in part, or if payment in full pursuant to such request is not properly made within thirty (30) days, the right to indemnification or advances as granted by this Article V shall be enforceable by the director or officer in any court of competent jurisdiction. Such person's costs and expenses incurred in connection with successfully establishing his or her right to indemnification, in whole or in part, in any such action shall also be indemnified by the corporation. It shall be a defense to any such action (other than an action brought to enforce a claim for expenses incurred in defending any proceeding in advance of its final disposition where the required undertaking, if any, has been tendered to the corporation) that the claimant has not met the standards of conduct which make it permissible under the General Corporation Law of the State of Delaware for the corporation to indemnify the claimant for the amount claimed, but the burden of such defense shall be on the corporation. Neither the failure of the corporation (including its board of directors, independent legal counsel, or its stockholders) to have made a determination prior to the commencement of such action that indemnification of the claimant is proper in the circumstances because he or she has met the applicable standard of conduct set forth in the General Corporation Law of the State of Delaware, nor an actual determination by the corporation (including its board of directors, independent legal counsel, or its stockholders) that the claimant has not met such applicable standard of conduct, shall be a defense to the action or create a presumption that the claimant has not met the applicable standard of conduct.

Section 3.Article Not Exclusive. The rights to indemnification and the payment of expenses incurred in defending a proceeding in advance of its final disposition conferred in this Article V shall not be exclusive of any other right which any person may have or hereafter acquire under any statute, provision of the Certificate of Incorporation, by-law, agreement, vote of stockholders or disinterested directors or otherwise.

Section 4.Insurance. The corporation may purchase and maintain insurance on its own behalf and on behalf of any person who is or was a director, officer, employee, fiduciary, or agent of the corporation or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against him or her and incurred by him or her in any such capacity, whether or not the corporation would have the power to indemnify such person against such liability under this Article V.

Section 5.Expenses. Expenses incurred by any person described in Section 1 of this Article V in defending a proceeding shall be paid by the corporation in advance of such proceeding's final disposition unless otherwise determined by the board of directors in the specific case upon receipt of an undertaking by or on behalf of the director or officer or other person to repay such amount if it shall ultimately be determined that such person is not entitled to be indemnified by the corporation. Such expenses incurred by other employees and agents may be so paid upon such terms and conditions, if any, as the board of directors deems appropriate.

Section 6.Employees and Agents. Persons who are not covered by the foregoing provisions of this Article V and who are or were employees or agents of the corporation, or who are or were serving at the request of the corporation as employees or agents of another corporation, partnership, joint venture, trust or other enterprise, may be indemnified, and may be advanced expenses, to the extent authorized at any time or from time to time by the board of directors.

Section 7.Contract Rights. The provisions of this Article V shall be deemed to be a vested contract right between the corporation and each director and officer who serves in any such capacity at any time while this Article V and the relevant provisions of the General Corporation Law of the State of Delaware or other applicable law are in effect. Such contract right shall vest for each director and officer at the time such person is elected or appointed to such position, and no repeal or modification of this Article V or any such law shall affect any such vested rights or obligations of any current or former director or officer with respect to any state of facts or proceeding regardless of when occurring.

Section 8.Merger or Consolidation. For purposes of this Article V, references to "the corporation" shall include, in addition to the resulting corporation, any constituent corporation (including any constituent of a constituent) absorbed in a consolidation or merger which, if its separate existence had continued, would have had power and authority to indemnify its directors, officers, and employees or agents, so that any person who is or was a director, officer, employee or agent of such constituent corporation, or is or was serving at the request of such constituent corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, shall stand in the same position under this Article V with respect to the resulting or surviving corporation as he or she would have with respect to such constituent corporation if its separate existence had continued.

ARTICLE VI

CERTIFICATES OF STOCK

Section 1.Form. The board of directors of the corporation may provide by resolution or resolutions that some or all of any or all classes or series of its stock shall be uncertificated shares. If the corporation elects to certificate its shares, every holder of stock in the corporation shall be entitled to have a certificate, signed by, or in the name of the corporation by any two authorized officers of the corporation, certifying the number of shares of a specific class or series owned by such holder in the corporation. If such a certificate is countersigned (1) by a transfer agent or an assistant transfer agent other than the corporation or its employee or (2) by a registrar, other than the corporation or its employee, the signature of any such authorized officer may be facsimiles. In case any officer or officers who have signed, or whose facsimile signature or signatures have been used on, any such certificate or certificates shall cease to be such officer or officers of the corporation whether because of death, resignation or otherwise before such certificate or certificates have been delivered by the corporation, such certificate or certificates may nevertheless be issued and delivered as though the person or persons who signed such certificate or certificates or whose facsimile signature or signatures have been used thereon had not ceased to be such officer or officers of the corporation. All certificates for shares shall

be consecutively numbered or otherwise identified. The name of the person to whom the shares represented thereby are issued, with the number of shares and date of issue, shall be entered on the books of the corporation. Shares of stock of the corporation shall only be transferred on the books of the corporation by the holder of record thereof or by such holder's attorney duly authorized in writing, upon surrender to the corporation of the certificate or certificates for such shares endorsed by the appropriate person or persons, with such evidence of the authenticity of such endorsement, transfer, authorization, and other matters as the corporation may reasonably require, and accompanied by all necessary stock transfer stamps. In that event, it shall be the duty of the corporation to issue a new certificate to the person entitled thereto, cancel the old certificate or certificates, and record the transaction on its books. The board of directors may appoint a bank or trust company organized under the laws of the United States or any state thereof to act as its transfer agent or registrar, or both in connection with the transfer of any class or series of securities of the corporation.

Section 2.Lost Certificates. The board of directors may direct a new certificate or certificates to be issued in place of any certificate or certificates previously issued by the corporation alleged to have been lost, stolen, or destroyed, upon the making of an affidavit of that fact by the person claiming the certificate of stock to be lost, stolen, or destroyed. When authorizing such issue of a new certificate or certificates, the board of directors may, in its discretion and as a condition precedent to the issuance thereof, require the owner of such lost, stolen, or destroyed certificate or certificates, or his or her legal representative, to give the corporation a bond sufficient to indemnify the corporation against any claim that may be made against the corporation on account of the loss, theft or destruction of any such certificate or the issuance of such new certificate.

Section 3.Fixing a Record Date for Stockholder Meetings. In order that the corporation may determine the stockholders entitled to notice of or to vote at any meeting of stockholders or any adjournment thereof, the board of directors may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted by the board of directors, and which record date shall not be more than sixty (60) nor less than ten (10) days before the date of such meeting. If no record date is fixed by the board of directors, the record date for determining stockholders entitled to notice of or to vote at a meeting of stockholders shall be the close of business on the next day preceding the day on which notice is given, or if notice is waived, at the close of business on the day next preceding the day on which the meeting is held. A determination of stockholders of record entitled to notice of or to vote at a meeting of stockholders shall apply to any adjournment of the meeting; provided, however, that the board of directors may fix a new record date for the adjourned meeting.

Section 4.Fixing a Record Date for Action by Written Consent. In order that the corporation may determine the stockholders entitled to consent to corporate action in writing without a meeting, the board of directors may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted by the board of directors, and which date shall not be more than ten (10) days after the date upon which the resolution fixing the record date is adopted by the board of directors. If no record date has been fixed by the board of directors, the record date for determining stockholders entitled to consent to

corporate action in writing without a meeting, when no prior action by the board of directors is required by statute, shall be the first date on which a signed written consent setting forth the action taken or proposed to be taken is delivered to the corporation by delivery to its registered office in the State of Delaware, its principal place of business, or an officer or agent of the corporation having custody of the book in which proceedings of meetings of stockholders are recorded. Delivery made to the corporation's registered office shall be by hand or by certified or registered mail, return receipt requested. If no record date has been fixed by the board of directors and prior action by the board of directors is required by statute, the record date for determining stockholders entitled to consent to corporate action in writing without a meeting shall be at the close of business on the day on which the board of directors adopts the resolution taking such prior action.

Section 5.Fixing a Record Date for Other Purposes. In order that the corporation may determine the stockholders entitled to receive payment of any dividend or other distribution or allotment or any rights or the stockholders entitled to exercise any rights in respect of any change, conversion or exchange of stock, or for the purposes of any other lawful action, the board of directors may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted, and which record date shall be not more than sixty (60) days prior to such action. If no record date is fixed, the record date for determining stockholders for any such purpose shall be at the close of business on the day on which the board of directors adopts the resolution relating thereto.

Section 6.Registered Stockholders. Prior to the surrender to the corporation of the certificate or certificates for a share or shares of stock with a request to record the transfer of such share or shares, the corporation may treat the registered owner as the person entitled to receive dividends, to vote, to receive notifications, and otherwise to exercise all the rights and powers of an owner. The corporation shall not be bound to recognize any equitable or other claim to or interest in such share or shares on the part of any other person, whether or not it shall have express or other notice thereof.

Section 7.Subscriptions for Stock. Unless otherwise provided for in the subscription agreement, subscriptions for shares shall be paid in full at such time, or in such installments and at such times, as shall be determined by the board of directors. Any call made by the board of directors for payment on subscriptions shall be uniform as to all shares of the same class or as to all shares of the same series. In case of default in the payment of any installment or call when such payment is due, the corporation may proceed to collect the amount due in the same manner as any debt due the corporation.

ARTICLE VII

GENERAL PROVISIONS

Section 1.Dividends. Dividends upon the capital stock of the corporation, subject to the provisions of the Certificate of Incorporation, if any, may be declared by the board of directors at any regular or special meeting, pursuant to law. Dividends may be paid in cash, in property, or in shares of the capital stock, subject to the provisions of the Certificate of Incorporation. Before payment of any dividend, there may be set aside out of any funds of the

corporation available for dividends such sum or sums as the directors from time to time, in their absolute discretion, think proper as a reserve or reserves to meet contingencies, or for equalizing dividends, or for repairing or maintaining any property of the corporation, or any other purpose and the board of directors may modify or abolish any such reserve in the manner in which it was created.

Section 2.Checks, Drafts or Orders. All checks, drafts, or other orders for the payment of money by or to the corporation and all notes and other evidences of indebtedness issued in the name of the corporation shall be signed by such officer or officers, agent or agents of the corporation, and in such manner, as shall be determined by resolution of the board of directors or a duly authorized committee thereof.

Section 3.Contracts. The board of directors may authorize any officer or officers, or any agent or agents, of the corporation to enter into any contract or to execute and deliver any instrument in the name of and on behalf of the corporation, and such authority may be general or confined to specific instances.

Section 4.Loans. The corporation may lend money to, or guarantee any obligation of, or otherwise assist any officer or other employee of the corporation or of its subsidiary, including any officer or employee who is a director of the corporation or its subsidiary, whenever, in the judgment of the directors, such loan, guaranty or assistance may reasonably be expected to benefit the corporation. The loan, guaranty or other assistance may be with or without interest, and may be unsecured, or secured in such manner as the board of directors shall approve, including, without limitation, a pledge of shares of stock of the corporation. Nothing in this section contained shall be deemed to deny, limit or restrict the powers of guaranty or warranty of the corporation at common law or under any statute.

Section 5.Fiscal Year. The fiscal year of the corporation shall end on December 31 of each year.

Section 6.Voting Securities Owned By Corporation. Voting securities in any other corporation held by the corporation shall be voted by the president, unless the board of directors specifically confers authority to vote with respect thereto, which authority may be general or confined to specific instances, upon some other person or officer. Any person authorized to vote securities shall have the power to appoint proxies, with general power of substitution.

Section 7.Inspection of Books and Records. Any stockholder of record, in person or by attorney or other agent, shall, upon written demand under oath stating the purpose thereof, have the right during the usual hours for business to inspect for any proper purpose the corporation's stock ledger, a list of its stockholders, and its other books and records, and to make copies or extracts therefrom. A proper purpose shall mean any purpose reasonably related to such person's interest as a stockholder. In every instance where an attorney or other agent shall be the person who seeks the right to inspection, the demand under oath shall be accompanied by a power of attorney or such other writing which authorizes the attorney or other agent to so act on behalf of the stockholder. The demand under oath shall be directed to the corporation at its registered office in the State of Delaware or at its principal place of business.

Section 8.Exclusive Jurisdiction. Unless otherwise waived by resolution of the Board, the Court of Chancery of the State of Delaware shall be the sole and exclusive forum for (i) any derivative action or proceeding brought on behalf of the corporation, (ii) any action asserting a claim of breach of a fiduciary duty owed by any director or officer of the corporation to the corporation or the corporation’s stockholders, (iii) any action asserting a claim against the corporation arising pursuant to any provision of the General Corporation Law of the State of Delaware or the corporation’s certificate of incorporation or by-laws or (iv) any action asserting a claim against the corporation governed by the internal affairs doctrine, except, as to each of (i) through (iv), for any claim for which the Delaware Chancery Court determines there is an indispensable party not subject to its jurisdiction (and such party does not consent to such jurisdiction within ten days of such determination).

Section 9.Section Headings. Section headings in these bylaws are for convenience of reference only and shall not be given any substantive effect in limiting or otherwise construing any provision herein.

Section 10.Inconsistent Provisions. In the event that any provision of these bylaws is or becomes inconsistent with any provision of the Certificate of Incorporation, the General Corporation Law of the State of Delaware or any other applicable law, the provision of these bylaws shall not be given any effect to the extent of such inconsistency but shall otherwise be given full force and effect.

ARTICLE VIII

AMENDMENTS

These bylaws may be amended, altered, or repealed and new bylaws adopted at any meeting of the board of directors by a majority vote. The fact that the power to adopt, amend, alter, or repeal the bylaws has been conferred upon the board of directors shall not divest the stockholders of the same powers.

AssetMark Completes Acquisition by GTCR, Launching New Era of Strategic Growth and Expansion

Asset Management and Financial Services Leader Lou Maiuri Named Chairman and Group CEO

CONCORD, Calif., September 05, 2024 (GLOBE NEWSWIRE) - AssetMark Financial Holdings, Inc. (“the Company”), a leading wealth management technology platform for financial advisors, today began a new era of strategic growth and expansion by announcing the closing of its acquisition by GTCR, a leading private equity firm with substantial investment expertise in financial technology, wealth, and asset management.

The closing of the acquisition marks a significant milestone in AssetMark's journey and concludes a successful, multiyear partnership with Huatai Securities. With the completion of the go-private transaction, AssetMark will now operate as an independent, privately owned company.

Concurrent with the closing, AssetMark announced the appointment of Lou Maiuri to the role of Chairman and Group CEO of its parent company, AssetMark Financial Holdings, Inc. Mr. Maiuri brings more than three decades of experience across asset management and financial services, including strong entrepreneurial expertise in building businesses, managing technology development, and leading operational transformations. Michael Kim, President and CEO of AssetMark, will continue in his current role.

Mr. Maiuri and Mr. Kim will partner to collectively run AssetMark, and both will join the Board of Directors of AssetMark Financial Holdings, Inc. Under their leadership, and in partnership with GTCR, AssetMark will focus on expanding its client offerings with new product capabilities and maintain its reputation for delivering exceptional value and providing excellent service to its advisors and their clients.

“Today marks the start of an exciting new chapter for AssetMark,” said Michael Kim, President and CEO of AssetMark. “We’ve been very successful over the past eight years under Huatai’s leadership and look forward to partnering with GTCR to accelerate our growth and industry leadership position. This pivotal moment would not have been possible without the dedication of the entire AssetMark team and support of our advisors, and I am excited to partner with a tremendous leader such as Lou as we embark on this next chapter together.”

“I’m thrilled to be joining the AssetMark team as the Company looks to propel its next phase of growth with GTCR,” said Lou Maiuri, Chairman and Group CEO of AssetMark Financial Holdings, Inc. “The wealth management industry is evolving, and the technology solutions and services that AssetMark provides will play a critical role in shaping outcomes for clients, their businesses, and ultimately, the investors they serve. I look forward to working closely with GTCR, Michael, and the entire AssetMark team to strategically grow the business and unlock the company’s future potential.”

Mr. Maiuri is the former President, COO, and Head of Investment Servicing at State Street Bank. During his tenure, Mr. Maiuri held broad responsibility for operations, technology, and service and led large-scale technology modernization, revenue transformation, and cost-efficiency initiatives. Prior to State Street, he was EVP and Deputy CEO of Bank of New York Mellon (“BNY”) Asset Servicing and Chairman of BNY subsidiary Eagle Investment Systems,

where he also served as CEO from 2006-2009. Prior to its acquisition by BNY, Mr. Maiuri built Eagle Investment Systems from a small start-up to a scaled investment technology platform as part of its founding leadership team from 1996-2004.

“AssetMark's unique combination of high-quality service and innovative technology has solidified its position as a leader in the wealth management industry,” said Collin Roche, Co-CEO and Managing Director at GTCR. “We are excited to partner with Lou, Michael and the AssetMark team to build on this success and drive further growth, both organically and through strategic acquisitions.”

“We look forward to leveraging GTCR’s expertise in asset management and wealth technology alongside AssetMark’s tremendous team and the strong platform they have built, to further transform the business through investment in the Company’s technology, products and people,” said Michael Hollander, Managing Director at GTCR.

The acquisition, valued at approximately $2.7 billion, was executed with the Company’s shareholders receiving $35.25 per share in cash. The transaction was approved unanimously by AssetMark's Board of Directors and was subsequently approved by written consent of shareholders representing a majority of the outstanding voting interests of the Company. GTCR has acquired a 100% interest in AssetMark, and its common stock is no longer publicly traded.

Morgan Stanley & Co. LLC served as exclusive financial advisor to AssetMark, and Davis Polk & Wardwell LLP provided legal counsel. UBS Investment Bank and Barclays served as co-lead financial advisors to GTCR and are providing debt financing support for the transaction. BofA Securities and Jefferies LLC also served as financial advisors. Kirkland & Ellis LLP provided legal counsel and Paul Hastings LLP provided regulatory legal counsel.

About AssetMark

AssetMark operates a wealth management platform whose mission is to help financial advisors and their clients. AssetMark together with its affiliates AssetMark Trust Company, Voyant, and Adhesion Wealth Advisor Solutions, serves advisors at every stage of their journey with flexible, purpose-built solutions that champion client engagement and drive efficiency. Its ecosystem of solutions equips advisors with services and capabilities to help deliver better investor outcomes by enhancing their productivity, profitability, and client satisfaction.

With a history going back to 1996, AssetMark has over 1,000 employees, and its platform serves over 9,200 financial advisors and over 261,000 investor households. As of June 30, 2024, the Company had over $119 billion in platform assets. AssetMark, Inc. is a Registered Investment Adviser with the U.S. Securities and Exchange Commission. For more information, please visit www.assetmark.com. Follow us on LinkedIn.

About GTCR

Founded in 1980, GTCR is a leading private equity firm that invests through The Leaders Strategy™ – finding and partnering with management leaders in core domains to identify, acquire and build market-leading companies through organic growth and strategic acquisitions. GTCR is focused on investing in transformative growth in companies in the Business & Consumer Services, Financial Services & Technology, Healthcare and Technology, Media & Telecommunications sectors. Since its inception, GTCR has invested more than $25 billion in over 280 companies, and the firm currently manages $40 billion in equity capital. GTCR is

based in Chicago with offices in New York and West Palm Beach. For more information, please visit www.gtcr.com. Follow us on LinkedIn.

Media Contacts

Vesselina Davenport

PR & Communications, AssetMark

vesselina.davenport@assetmark.com

Andrew Johnson

Chief Marketing & Communications Officer, GTCR

andrew.johnson@gtcr.com

SOURCE: AssetMark Financial Holdings, Inc.

v3.24.2.u1

Cover

|

Sep. 05, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 05, 2024

|

| Entity Registrant Name |

AssetMark Financial Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38980

|

| Entity Tax Identification Number |

30-0774039

|

| Entity Address, Address Line One |

1655 Grant Street

|

| Entity Address, Address Line Two |

10th Floor

|

| Entity Address, City or Town |

Concord

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94520

|

| City Area Code |

925

|

| Local Phone Number |

521-2200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.001 par value

|

| Trading Symbol |

AMK

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001591587

|

| Current Fiscal Year End Date |

--12-31

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|