UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2024

Commission File Number: 001-39006

AMTD IDEA GROUP

(Translation of registrant’s name into English)

66 rue Jean-Jacques Rousseau

75001 Paris

France

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

AMTD

IDEA Reports Half Year Performance

PARIS &

NEW YORK & SINGAPORE, December 30, 2024

AMTD IDEA Group

(“AMTD IDEA” or the “Company”, NYSE: AMTD; SGX: HKB), a NYSE and SGX-ST dual listed company and also an investment

holding platform for (i) digital solutions, (ii) media, entertainment and cultural connectors, and (iii) global premium assets, hospitality

and VIP services today announced its unaudited financial results for the six months ended June 30, 2024.

Highlights

of Half Year Financial Results

| |

● |

During

the six months ended June 30, 2024, the Company’s business mix underwent significant changes following its restructuring and

divestment of certain non-core operations. We are adapting to the evolving global market landscape and entering refocused growth

stage. Our total revenue for the first half of 2024 is US$35.9 million and we have maintained a trajectory of growth in our refocused

businesses including media and entertainment and hotel operations. This demonstrates our resilience and strategic development as

we position ourselves for future opportunities. |

| ● | Our

fashion, arts and luxury media advertising and marketing services income increased by more

than 40% compared to the previous year, reaching US$10.4 million for the six months ended

June 30, 2024. The growth continues to benefit from the successful operations and expansions

of L’Officiel and The Art Newspaper since our acquisition of these businesses in 2022

and 2023 respectively. |

| |

● |

Our

hotel operations, hospitality and VIP services income rose from US$4.3 million in the comparable

period of 2023 to US$7.9 million for the six months ended June 30, 2024, representing an

85.2% growth compared to the same period in 2023. |

| |

● |

We recorded

a total of US$15.9 million of dividends and fair value gain on financial assets measured at fair value through profit or loss for

the six months ended June 30, 2024. |

| |

● |

We recorded

other gains of US$24.7 million from the disposal of certain subsidiaries as a part of the restructuring during the six months ended

June 30, 2024. |

Statement

from the Board Members and Senior Management:

Dr. Feridun

Hamdullahpur, Chairman of the board and audit committee of AMTD IDEA, “AMTD IDEA is confidently continuing to execute key operational

plans and pursue expansion initiatives as determined in its long-term strategy. I am pleased to see steady growth trends and developments

in the new areas that the Company has reengineered its focus and set forth as the new directions. I am confident that these results signal

strong, healthy, and sustainable growth in future years”.

Dr. Timothy

Tong, independent director of the Company and Chairman of the board of AMTD Digital, “AMTD IDEA is becoming a diversified company with businesses in multi jurisdictions and diversified areas, which allow the company to navigate

in a sustainable and competitive manner. The restructuring is to position the company for the next phase of growth and developments. We

are confident that the company is ready for a new era of development through the media and entertainment segment of business opportunities

and expansions”.

Mr. Xavier

Zee, CFO of AMTD IDEA, “After the acquisition of L’Officiel and The Art Newspaper in the prior two years, the Group has successfully

repositioned the focus in media and entertainment business through these wholly owned subsidiaries. The recent blockbuster movie “The

Last Dance” released in November 2024 and co-produced by us exemplifies our success of investment and development in this industry

sector”.

Financial

Results for the Six Months Ended June 30, 2024

Revenue

Our

revenue for the six months ended June 30, 2024 amounted to US$35.9 million, a change from US$109.1 million recorded for the same period

in 2023. The decline was primarily attributable to (i) one-off divestment gains from the disposal of certain financial assets at fair

value through profit or loss in the first half of 2023, (ii) a change in revenue mix following the disposal of specific business operations,

and (iii) a decline in net fair value movement of investments.

| |

● |

Digital

solutions and other services income was US$1.7 million for six months ended June 30, 2024, compared to US$11.6 million for the same

period last year. The decrease primarily resulted from the disposal of the relevant business operations in 2023. |

| ● | Fashion,

arts and luxury media advertising and marketing services income was US$10.4 million, representing

more than 40% growth versus the comparative figure for the same period of last year. The

increase was mainly attributable to the successful operations and expansions of L’Officiel

and the acquisition of The Art Newspaper in late 2023. |

| |

● |

Hotel

operations, hospitality and VIP services income rose from US$4.3 million in the comparable period to US$7.9 million for the six months

ended June 30, 2024, representing an 85.2% growth compared to the same period in 2023. |

| |

● |

Dividends

and disposal gains of investments was US$8.7 million for the six months ended June 2024, compared to US$93.5 million for the same

period last year. The difference was mainly attributable to the one-off divestment gains of US$83.6 million recorded in 2023. |

Other

Income And Gains

Other income

and gains remain relatively steady compared to the same period in 2023 at US$37.5 million, primarily consisting of (i) gain on disposal

of subsidiaries resulting from restructuring, (ii) bank and other interest income, and (iii) interest income from our immediate holding

company, which is interest bearing.

Other

Operating Expenses

Other operating

expenses for the six months ended June 30, 2024 increased by 51.9% as compared to the same period in 2023 to US$16.9 million, primarily

attributable to (i) additional hotel depreciation charges, and (ii) increase in operation expenses of L’Officiel’s

and The Art Newspaper businesses.

Staff

Costs

Staff costs

for the six months ended June 30, 2024 decreased by 38.0% as compared to the same period in 2023 to US$6.4 million. This was due to the

disposal of operations, netting of the incremental costs of new operations in The Art Newspaper and hotel operations.

Finance

Costs

Finance costs

for the six months ended June 30, 2024 increased by 74.0% compared to the same period in 2023 to US$6.3 million, primarily due to higher

market interest rates and bank borrowings.

Income

Tax Expense

Income tax

expense for the six months ended June 30, 2024 decreased by 71.1% compared to the same period in 2023 to US$1.9 million, primarily due

to a decrease in tax assessable income.

Profit

For The Period

Profit for

the six months ended June 30, 2024 decreased by 63.2% as compared to the same period in 2023 to US$42.0 million.

AMTD

IDEA GROUP

UNAUDITED

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF PROFIT OR LOSS

FOR

THE SIX MONTHS ENDED JUNE 30, 2023 AND 2024

| | |

Six

months ended June 30, | |

| | |

2023 | | |

2024 | |

| | |

US$’000 | | |

US$’000 | |

| REVENUE | |

| | |

| |

| Digital

solutions and other services income | |

| 11,592 | | |

| 1,722 | |

| Fashion,

arts and luxury media advertising and marketing services income | |

| 7,245 | | |

| 10,446 | |

| Hotel

operations, hospitality and VIP services income | |

| 4,268 | | |

| 7,905 | |

| Dividends

and gains from disposed financial assets at fair value through profit or loss | |

| 93,493 | | |

| 8,660 | |

| Net

fair value changes on financial assets at fair value through profit or loss (except derivative financial assets and gains from disposed

financial assets at fair value through profit or loss) | |

| (41,376 | ) | |

| 7,220 | |

| Net

fair value changes on derivative financial assets | |

| 33,868 | | |

| - | |

| | |

| | | |

| | |

| | |

| 109,090 | | |

| 35,953 | |

| | |

| | | |

| | |

| Other

income and gains | |

| 36,647 | | |

| 37,454 | |

| Other

operating expenses | |

| (11,103 | ) | |

| (16,867 | ) |

| Staff

costs | |

| (10,325 | ) | |

| (6,400 | ) |

| Finance

costs | |

| (3,587 | ) | |

| (6,240 | ) |

| | |

| | | |

| | |

| PROFIT

BEFORE TAX | |

| 120,722 | | |

| 43,900 | |

| Income

tax expense | |

| (6,474 | ) | |

| (1,868 | ) |

| | |

| | | |

| | |

| PROFIT

FOR THE PERIOD | |

| 114,248 | | |

| 42,032 | |

| Attributable

to: | |

| | | |

| | |

| Owners

of the company | |

| | | |

| | |

| Ordinary

shareholders | |

| 104,419 | | |

| 40,523 | |

| Holders

of perpetual securities | |

| 6,396 | | |

| 2,141 | |

| Non-controlling

interests | |

| 3,433 | | |

| (632 | ) |

| | |

| 114,248 | | |

| 42,032 | |

| EARNINGS

PER SHARE ATTRIBUTABLE TO ORDINARY EQUITY HOLDERS OF THE COMPANY | |

| | | |

| | |

| Class

A ordinary shares: | |

| | | |

| | |

| Basic

(US$ cents per share) | |

| 35.27 | | |

| 10.22 | |

| Diluted

(US$ cents per share) | |

| 35.27 | | |

| 10.22 | |

| Class

B ordinary shares: | |

| | | |

| | |

| Basic

(US$ cents per share) | |

| 35.27 | | |

| 10.22 | |

| Diluted

(US$ cents per share) | |

| 35.27 | | |

| 10.22 | |

AMTD

IDEA GROUP

UNAUDITED

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

AS

AT DECEMBER 31, 2023 AND JUNE 30, 2024

| | |

December 31,

2023 | | |

June

30,

2024 | |

| | |

US$’000 | | |

US$’000 | |

| ASSETS | |

| | |

| |

| Current

assets | |

| | |

| |

| Accounts

receivable | |

| 5,525 | | |

| 12,819 | |

| Prepayments,

deposits and other receivables | |

| 16,436 | | |

| 18,470 | |

| Due

from immediate holding company | |

| 1,057,007 | | |

| 1,108,996 | |

| Tax

recoverable | |

| 2,327 | | |

| - | |

| Other

assets | |

| 1,020 | | |

| 553 | |

| Restricted

cash | |

| 135 | | |

| - | |

| Cash

and bank balances | |

| 120,234 | | |

| 78,574 | |

| Total

current assets | |

| 1,202,684 | | |

| 1,219,412 | |

| | |

| | | |

| | |

| Non-current

assets | |

| | | |

| | |

| Property,

plant and equipment | |

| 70,054 | | |

| 271,923 | |

| Intangible

assets | |

| 118,423 | | |

| 118,711 | |

| Financial

assets at fair value through profit or loss | |

| 79,607 | | |

| 93,164 | |

| Interests

in joint ventures | |

| 15,822 | | |

| - | |

| Total

non-current assets | |

| 283,906 | | |

| 483,798 | |

| Total

assets | |

| 1,486,590 | | |

| 1,703,210 | |

| | |

| | | |

| | |

| LIABILITIES

AND EQUITY | |

| | | |

| | |

| Current

liabilities | |

| | | |

| | |

| Accounts

payable | |

| 9,382 | | |

| 1,257 | |

| Bank

borrowings | |

| 65,793 | | |

| 30,159 | |

| Other

payables and accruals | |

| 19,260 | | |

| 21,636 | |

| Due

to a non-controlling shareholder | |

| 55,803 | | |

| 76,804 | |

| Provisions | |

| 3,866 | | |

| - | |

| Tax

payable | |

| 2,956 | | |

| 4,601 | |

| Total

current liabilities | |

| 157,060 | | |

| 134,457 | |

| | |

| | | |

| | |

| Non-current

liabilities | |

| | | |

| | |

| Bank

borrowings | |

| 30,373 | | |

| 235,148 | |

| Deferred

tax liabilities | |

| 5,583 | | |

| 5,626 | |

| Provisions | |

| - | | |

| 1,485 | |

| Total

non-current liabilities | |

| 35,956 | | |

| 242,259 | |

| Total

liabilities | |

| 193,016 | | |

| 376,716 | |

AMTD

IDEA GROUP

UNAUDITED

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(CONTINUED)

AS

AT DECEMBER 31, 2023 AND JUNE 30, 2024

| | |

December

31, 2023 | | |

June

30,

2024 | |

| | |

US$’000 | | |

US$’000 | |

| Equity | |

| | |

| |

| Class

A ordinary shares | |

| 22 | | |

| 22 | |

| Class

B ordinary shares | |

| 26 | | |

| 26 | |

| Treasury shares | |

| (734,658 | ) | |

| (734,658 | ) |

| Capital

reserve | |

| 924,348 | | |

| 925,050 | |

| Exchange

reserve | |

| 2,671 | | |

| 4,881 | |

| Retained

profits | |

| 859,849 | | |

| 900,373 | |

| Total

equity attributable to ordinary shareholders of the Company | |

| 1,052,258 | | |

| 1,095,694 | |

| Non-controlling

interests | |

| 7,078 | | |

| (3,444 | ) |

| Perpetual

securities | |

| 234,238 | | |

| 234,244 | |

| Total

equity | |

| 1,293,574 | | |

| 1,326,494 | |

| Total

liabilities and equity | |

| 1,486,590 | | |

| 1,703,210 | |

About AMTD

IDEA Group

AMTD IDEA Group

(NYSE: AMTD; SGX: HKB), a NYSE and SGX-ST dual listed company and a conglomerate housing a diversified business portfolio to include (i) global media business

and cultural projects, (2) motion pictures and other entertainment business; (3) global premium assets, hospitality and VIP services.

AMTD IDEA Group is uniquely positioned as an active super-connector between clients, business partners, investee companies, and investors,

connecting the East and the West.

For more information, please visit www.amtdinc.com or follow us on X (formerly known as “Twitter”) at @AMTDGroup.

Safe Harbor

Statement

This press

release contains statements that may constitute “forward-looking” statements pursuant to the “safe harbor” provisions

of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such

as “will,” “expects,” “anticipates,” “aims,” “future,” “intends,”

“plans,” “believes,” “estimates,” “likely to,” and similar statements. Statements that

are not historical facts, including statements about the beliefs, plans, and expectations of AMTD IDEA Group are forward-looking statements.

Forward-looking statements involve inherent risks and uncertainties. Further information regarding these and other risks is included

in the filings of AMTD IDEA Group with the SEC. All information provided in this press release is as of the date of this press release,

and AMTD IDEA Group does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

AMTD IDEA GROUP |

| |

|

|

| |

By: |

/s/ Feridun Hamdullahpur |

| |

Name: |

Dr. Feridun Hamdullahpur |

| |

Title: |

Director |

Date: December 30, 2024

7

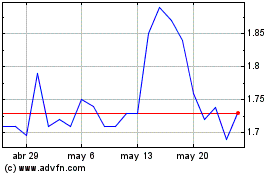

AMTD IDEA (NYSE:AMTD)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

AMTD IDEA (NYSE:AMTD)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025