0001299709false00012997092023-10-262023-10-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 26, 2023

Axos Financial, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

|

| | |

| Delaware | 001-37709 | 33-0867444 |

(State or other jurisdiction of

incorporation) | (Commission File Number) | (IRS Employer Identification

Number) |

9205 West Russell Road, Ste 400

Las Vegas, NV 89148

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (858) 649-2218

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.01 par value | AX | New York Stock Exchange |

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On October 26, 2023, Axos Financial, Inc. (the “Registrant” or the “Company”) issued a press release announcing its fiscal first quarter results of operations for the period ended September 30, 2023. The press release is furnished as Exhibit 99.1. In addition, the Registrant is furnishing the related quarterly earnings supplement in two different formats as Exhibits 99.2 and 99.3.

Pursuant to General Instruction B.2. of Form 8-K, the information in this Item 2.02 of Form 8-K, including Exhibit 99.1, 99.2 and 99.3 is being furnished pursuant to Item 2.02 and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise be subject to the liabilities of that section, nor is it incorporated by reference into any filing of the Registrant under the Securities Act of 1933 or the Securities Exchange Act of 1934, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit | | Description |

| 99.1 | | |

| 99.2 | | |

| 99.3 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

|

| | | | |

| | | Axos Financial, Inc. |

| | |

| | | |

| Date: | October 26, 2023 | By: | /s/ Derrick K. Walsh | |

| | | | Derrick K. Walsh |

| | | | EVP and Chief Financial Officer |

Axos Financial, Inc. Reports First Quarter Fiscal 2024 Results

LAS VEGAS, NV – (BUSINESS WIRE) – October 26, 2023 – Axos Financial, Inc. (NYSE: AX) (“Axos” or the “Company”) today announced unaudited financial results for the first fiscal quarter ended September 30, 2023. Net income was $82.6 million, an increase of 41.5% from $58.4 million for the quarter ended September 30, 2022. Diluted earnings per share was $1.38, an increase of $0.41, or 42.3%, as compared to diluted earnings per share of $0.97 for the quarter ended September 30, 2022.

Adjusted earnings and adjusted earnings per diluted common share (“Adjusted EPS”), non-GAAP measures, which exclude non-cash amortization expenses, non-recurring costs related to mergers and acquisitions, and other non-recurring costs increased 18.1% to $84.6 million and 19.5% to $1.41, respectively, for the quarter ended September 30, 2023, compared to $71.6 million and $1.18, respectively, for the quarter ended September 30, 2022.

First Quarter Fiscal 2024 Financial Summary

| | | | | | | | | | | | | | | | | |

| | | | | |

| Three Months Ended

September 30, | | |

| (Dollars in thousands, except per share data) | 2023 | | 2022 | | % Change |

| Net interest income | $ | 211,155 | | | $ | 180,475 | | | 17.0% |

| Non-interest income | $ | 34,507 | | | $ | 27,208 | | | 26.8% |

| Net income | $ | 82,645 | | | $ | 58,407 | | | 41.5% |

Adjusted earnings (Non-GAAP)1 | $ | 84,596 | | | $ | 71,615 | | | 18.1% |

| | | | | |

| Diluted EPS | $ | 1.38 | | | $ | 0.97 | | | 42.3% |

Adjusted EPS (Non-GAAP)1 | $ | 1.41 | | | $ | 1.18 | | | 19.5% |

1 See “Use of Non-GAAP Financial Measures” | | | | | |

“We generated strong net interest income growth year-over-year and linked quarter as a result of balanced loan growth and rising net interest margins,” stated Greg Garrabrants, President and Chief Executive Officer of Axos. “Our net interest margin increased 17 basis points linked quarter and 10 basis points year-over-year, as we continue to offset rising deposit costs with higher loan yields. Our nearly 17% return on equity and strong capital position allowed us to make another accretive, strategic acquisition of the LaVictoire Finance marine finance business and opportunistically purchase our common stock at an attractive valuation.”

Other Highlights

•Net interest margin was 4.36% compared to 4.26% for the quarter ended September 30, 2022

•Net loans for investment totaled $17.0 billion at September 30, 2023, an increase of $0.5 billion, or 12.1% annualized, from $16.5 billion at June 30, 2023

•Total deposits were $17.5 billion at September 30, 2023, an increase of $0.4 billion, or 10.3% annualized, from $17.1 billion at June 30, 2023

•Approximately 90% of total deposits were FDIC-insured or collateralized at September 30, 2023

•After-tax net unrealized losses of $5.8 million on the available-for-sale securities portfolio less than 0.5% of stockholders’ equity at September 30, 2023

•Pretax income for the Securities Business was $12.6 million for the three months ended September 30, 2023, up 40.9% from the three months ended September 30, 2022

•Non-performing loans to total loans was 0.62%, down from 0.78% at September 30, 2022

•Total capital to risk-weighted assets was 14.06% for Axos Financial, Inc. at September 30, 2023, up from 13.82% at June 30, 2023

•Book value increased to $33.78 per share, from $28.35 at September 30, 2022, an increase of 19.2%

•Repurchased $24.5 million of common stock during the quarter ended September 30, 2023

•Repurchased $35.2 million of common stock between October 1, 2023 through October 20, 2023

First Quarter Fiscal 2024 Income Statement Summary

Net income was $82.6 million and earnings per diluted common share was $1.38 for the three months ended September 30, 2023, compared to net income of $58.4 million and earnings per diluted common share of $0.97 for the three months ended September 30, 2022. Net interest income increased $30.7 million or 17.0% for the three months ended September 30, 2023 compared to the three months ended September 30, 2022, primarily due to an increase in interest income from loans and from deposits in other financial institutions, both attributable to higher rates earned and higher average balances, partially offset by higher rates paid and higher average interest-bearing deposit balances.

The provision for credit losses was $7.0 million for the three months ended September 30, 2023, compared to $8.8 million for the three months ended September 30, 2022. The decrease in the provision for credit losses for the three months ended September 30, 2023, was primarily due to net loan growth of $498 million in the current quarter compared to net loan growth of $1.1 billion in the three months ended September 30, 2022.

Non-interest income increased to $34.5 million for the three months ended September 30, 2023, compared to $27.2 million for the three months ended September 30, 2022. The increase was primarily due to higher broker-dealer fee income, banking and services fees and advisory fee income.

Non-interest expense, comprised of various operating expenses, increased $4.4 million to $120.5 million for the three months ended September 30, 2023 from $116.1 million for the three months ended September 30, 2022. The increase was primarily due to increased salaries and related costs, advertising and promotional expenses, data and operational processing expense and professional services, partially offset by the absence of a $16.0 million accrual in the prior-year quarter for an adverse legal judgment that has not been finalized.

Balance Sheet Summary

Axos’ total assets increased by $0.5 billion, or 2.3%, to $20.8 billion, at September 30, 2023, from $20.3 billion at June 30, 2023, primarily due to an increase of $0.5 billion in loans held for investment. Total liabilities increased by $0.4 billion, or 2.3%, to $18.8 billion at September 30, 2023, from $18.4 billion at June 30, 2023, primarily due to an increase of $0.4 billion in deposits. Stockholders’ equity increased by approximately $59.0 million, or 3.1%, to $2.0 billion at September 30, 2023 from $1.9 billion at June 30, 2023. The increase was primarily the result of net income of $82.6 million, partially offset by purchases of common stock of $24.5 million under the share repurchase program.

Conference Call

A conference call and webcast will be held on Thursday, October 26, 2023 at 5:00 PM Eastern / 2:00 PM Pacific. Analysts and investors may dial in and participate in the question/answer session. To access the call, please dial: 877-407-8293. The conference call will be webcast live, and both the webcast and the earnings supplement may be accessed at Axos’ website, investors.axosfinancial.com. For those unable to listen to the live broadcast, a replay will be available until November 26, 2023, at Axos’ website and telephonically by dialing toll-free number 877-660-6853, passcode 13741557.

About Axos Financial, Inc. and Subsidiaries

Axos Financial, Inc., with approximately $20.8 billion in consolidated assets as of September 30, 2023, is the holding company for Axos Bank, Axos Clearing LLC and Axos Invest, Inc. Axos Bank provides consumer and business banking products nationwide through its low-cost distribution channels and affinity partners. Axos Clearing LLC (including its business division Axos Advisor Services), with approximately $33.9 billion of assets under custody and/or administration as of September 30, 2023, and Axos Invest, Inc., provide comprehensive securities clearing services to introducing broker-dealers and registered investment advisor correspondents, and digital investment advisory services to retail investors, respectively. Axos Financial, Inc.’s common stock is listed on the NYSE under the symbol “AX” and is a component of the Russell 2000® Index, the S&P SmallCap 600® Index, the KBW Nasdaq Financial Technology Index, and the Travillian Tech-Forward Bank Index. For more information on Axos Financial, Inc., please visit http://investors.axosfinancial.com.

Segment Reporting

The Company operates through two segments: Banking Business and Securities Business. In order to reconcile the two segments to the consolidated totals, the Company includes parent-only activities and intercompany eliminations. Inter-segment transactions are eliminated in consolidation and primarily include non-interest income earned by the Securities Business segment and non-interest expense incurred by the Banking Business segment for cash sorting fees related to deposits sourced from Securities Business segment customers, as well as interest expense paid by the Banking Business segment to each of the wholly-owned subsidiaries of the Company and to the Company itself for their operating cash held on deposit with the Business Banking segment.

The following tables present the operating results of the segments and reconciliations:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 |

| (Dollars in thousands) | Banking Business | | Securities Business | | Corporate/Eliminations | | Axos Consolidated |

| Net interest income | $ | 209,219 | | | $ | 5,542 | | | $ | (3,606) | | | $ | 211,155 | |

| Provision for credit losses | 7,000 | | | — | | | — | | | 7,000 | |

| Non-interest income | 12,557 | | | 34,555 | | | (12,605) | | | 34,507 | |

| Non-interest expense | 100,786 | | | 27,523 | | | (7,803) | | | 120,506 | |

| Income before taxes | $ | 113,990 | | | $ | 12,574 | | | $ | (8,408) | | | $ | 118,156 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2022 |

| (Dollars in thousands) | Banking Business | | Securities Business | | Corporate/Eliminations | | Axos Consolidated |

| Net interest income | $ | 179,730 | | | $ | 4,275 | | | $ | (3,530) | | | $ | 180,475 | |

| Provision for credit losses | 8,750 | | | — | | | — | | | 8,750 | |

| Non-interest income | 10,712 | | | 29,165 | | | (12,669) | | | 27,208 | |

| Non-interest expense | 100,796 | | | 24,515 | | | (9,224) | | | 116,087 | |

| Income before taxes | $ | 80,896 | | | $ | 8,925 | | | $ | (6,975) | | | $ | 82,846 | |

Use of Non-GAAP Financial Measures

In addition to the results presented in accordance with accounting principles generally accepted in the United States of America

(“GAAP”), this release includes non-GAAP financial measures such as adjusted earnings, adjusted earnings per diluted common share, and tangible book value per common share. Non-GAAP financial measures have inherent limitations, may not be comparable to similarly titled measures used by other companies and are not audited. Readers should be aware of these limitations and should be cautious as to their reliance on such measures. Although we believe the non-GAAP financial measures disclosed in this release enhance investors’ understanding of our business and performance, these non-GAAP measures should not be considered in isolation, or as a substitute for GAAP basis financial measures.

We define “adjusted earnings”, a non-GAAP financial measure, as net income without the after-tax impact of non-recurring acquisition-related costs (including amortization of intangible assets related to acquisitions) and other costs (unusual or non-recurring charges). Adjusted EPS, a non-GAAP financial measure, is calculated by dividing non-GAAP adjusted earnings by the average number of diluted common shares outstanding during the period. We believe the non-GAAP measures of adjusted earnings and Adjusted EPS provide useful information about Axos’ operating performance. We believe excluding the non-recurring acquisition-related costs, and other costs provides investors with an alternative understanding of Axos’ core business.

Below is a reconciliation of net income, the nearest compatible GAAP measure, to adjusted earnings and adjusted EPS (Non-GAAP) for the periods shown:

| | | | | | | | | | | | | | | |

| Three Months Ended | | |

| September 30, | | |

| (Dollars in thousands, except per share amounts) | 2023 | | 2022 | | | | |

| Net income | $ | 82,645 | | | 58,407 | | | | | |

| Acquisition-related costs | 2,790 | | | 2,734 | | | | | |

Other costs1 | — | | | 16,000 | | | | | |

| Income tax effect | (839) | | | (5,526) | | | | | |

| Adjusted earnings (Non-GAAP) | $ | 84,596 | | | $ | 71,615 | | | | | |

| | | | | | | |

| Average dilutive common shares outstanding | $ | 59,808,322 | | | $ | 60,486,394 | | | | | |

| | | | | | | |

| Diluted EPS | $ | 1.38 | | | $ | 0.97 | | | | | |

| Acquisition-related costs | 0.05 | | | 0.04 | | | | | |

Other costs1 | — | | | 0.26 | | | | | |

| Income tax effect | (0.02) | | | (0.09) | | | | | |

| Adjusted EPS (Non-GAAP) | $ | 1.41 | | | $ | 1.18 | | | | | |

1 Other costs for the three months ended September 30, 2022 reflect an accrual in the first quarter of fiscal year 2023 as a result of an adverse legal judgement that has not been finalized. |

We define “tangible book value”, a non-GAAP financial measure, as book value adjusted for goodwill and other intangible assets. Tangible book value is calculated using common stockholders’ equity minus servicing rights, goodwill and other intangible assets. Tangible book value per common share, a non-GAAP financial measure, is calculated by dividing tangible book value by the common shares outstanding at the end of the period. We believe tangible book value per common share is useful in evaluating the Company’s capital strength, financial condition, and ability to manage potential losses.

Below is a reconciliation of total stockholders’ equity, the nearest compatible GAAP measure, to tangible book value per common share (non-GAAP) as of the dates indicated:

| | | | | | | | | | | |

| September 30, |

| (Dollars in thousands, except per share amounts) | 2023 | | 2022 |

| Common stockholders’ equity | $ | 1,976,208 | | | $ | 1,700,972 | |

| Less: servicing rights, carried at fair value | 29,338 | | | 26,373 | |

| Less: goodwill and intangible assets | 149,572 | | | 160,429 | |

| Tangible common stockholders’ equity (Non-GAAP) | $ | 1,797,298 | | | $ | 1,514,170 | |

| | | |

| Common shares outstanding at end of period | 58,503,976 | | | 59,998,673 | |

| | | |

| Book Value per common share | 33.78 | | | 28.35 | |

| Less: servicing rights, carried at fair value per common share | 0.50 | | | 0.44 | |

| Less: goodwill and other intangible assets per common share | 2.56 | | | 2.67 | |

| Tangible book value per common share (Non-GAAP) | $ | 30.72 | | | $ | 25.24 | |

Forward-Looking Safe Harbor Statement

This press release contains forward-looking statements that involve risks and uncertainties, including without limitation statements relating to Axos’ financial prospects and other projections of its performance and asset quality, Axos’ deposit balances and capital ratios, Axos’ ability to continue to grow profitably and increase its business, Axos’ ability to continue to diversify its lending and deposit franchises, the anticipated timing and financial performance of other offerings, initiatives, and acquisitions, expectations of the environment in which Axos operates and projections of future performance. These forward-looking statements are made on the basis of the views and assumptions of management regarding future events and performance as of the date of this press release. Actual results and the timing of events could differ materially from those expressed or implied in such forward-looking statements as a result of risks and uncertainties, including without limitation Axos’ ability to successfully integrate acquisitions and realize the anticipated benefits of the transactions, changes in the interest rate environment, monetary policy, inflation, government regulation, general economic conditions, changes in the competitive marketplace, conditions in the real estate markets in which we operate, risks associated with credit quality, our ability to attract and retain deposits and access other sources of liquidity, and the outcome and effects of litigation and other factors beyond our control. These and other risks and uncertainties detailed in Axos’ periodic reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended June 30, 2023, could cause actual results to differ materially from those expressed or implied in any forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Axos undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. All written and oral forward-looking statements made in connection with this press release, which are attributable to us or persons acting on Axos’ behalf are expressly qualified in their entirety by the foregoing information.

Investor Relations Contact:

Johnny Lai, CFA

SVP, Corporate Development & Investor Relations

858-649-2218

jlai@axosfinancial.com

The following tables set forth certain selected financial data concerning the periods indicated:

AXOS FINANCIAL, INC.

SELECTED CONSOLIDATED FINANCIAL INFORMATION

(Unaudited – dollars in thousands)

| | | | | | | | | | | | | | | | | |

| September 30,

2023 | | June 30,

2023 | | September 30,

2022 |

| Selected Balance Sheet Data: | | | | | |

| Total assets | $ | 20,825,206 | | | $ | 20,348,469 | | | $ | 18,407,078 | |

| Loans—net of allowance for credit losses | 16,955,041 | | | 16,456,728 | | | 15,211,573 | |

| Loans held for sale, carried at fair value | 8,014 | | | 23,203 | | | 9,463 | |

| Loans held for sale, lower of cost or fair value | — | | | 776 | | | 10,476 | |

Allowance for credit losses | 170,870 | | | 166,680 | | | 155,472 | |

| Securities—trading | 640 | | | 758 | | | 75 | |

| Securities—available-for-sale | 236,726 | | | 232,350 | | | 257,634 | |

| | | | | |

| Securities borrowed | 96,424 | | | 134,339 | | | 87,622 | |

| Customer, broker-dealer and clearing receivables | 285,423 | | | 374,074 | | | 410,842 | |

| Total deposits | 17,565,741 | | | 17,123,108 | | | 15,176,631 | |

| | | | | |

| Advances from the FHLB | 90,000 | | | 90,000 | | | 112,500 | |

| Borrowings, subordinated notes and debentures | 447,733 | | | 361,779 | | | 425,818 | |

| Securities loaned | 116,446 | | | 159,832 | | | 206,889 | |

| Customer, broker-dealer and clearing payables | 341,915 | | | 445,477 | | | 500,584 | |

| Total stockholders’ equity | 1,976,208 | | | 1,917,159 | | | 1,700,972 | |

| | | | | |

| Capital Ratios: | | | | | |

| Equity to assets at end of period | 9.49 | % | | 9.42 | % | | 9.24 | % |

| Axos Financial, Inc.: | | | | | |

| Tier 1 leverage (to adjusted average assets) | 9.27 | % | | 8.96 | % | | 8.98 | % |

| Common equity tier 1 capital (to risk-weighted assets) | 11.11 | % | | 10.94 | % | | 9.97 | % |

| Tier 1 capital (to risk-weighted assets) | 11.11 | % | | 10.94 | % | | 9.97 | % |

| Total capital (to risk-weighted assets) | 14.06 | % | | 13.82 | % | | 12.90 | % |

| Axos Bank: | | | | | |

| Tier 1 leverage (to adjusted average assets) | 9.99 | % | | 9.68 | % | | 10.30 | % |

| Common equity tier 1 capital (to risk-weighted assets) | 11.69 | % | | 11.63 | % | | 10.87 | % |

| Tier 1 capital (to risk-weighted assets) | 11.69 | % | | 11.63 | % | | 10.87 | % |

| Total capital (to risk-weighted assets) | 12.65 | % | | 12.50 | % | | 11.71 | % |

| Axos Clearing LLC: | | | | | |

| Net capital | $ | 101,391 | | | $ | 35,221 | | | $ | 49,183 | |

| Excess capital | $ | 96,211 | | | $ | 29,905 | | | $ | 42,324 | |

| Net capital as a percentage of aggregate debit items | 39.14 | % | | 13.25 | % | | 14.34 | % |

| Net capital in excess of 5% aggregate debit items | $ | 88,440 | | | $ | 21,930 | | | $ | 32,035 | |

AXOS FINANCIAL, INC.

SELECTED CONSOLIDATED FINANCIAL INFORMATION

(Unaudited – dollars in thousands, except per share data)

| | | | | | | | | | | |

| At or for the Three Months Ended |

| September 30, |

| 2023 | | 2022 |

| Selected Income Statement Data: | | | |

| Interest and dividend income | $ | 363,952 | | | $ | 223,786 | |

| Interest expense | 152,797 | | | 43,311 | |

| Net interest income | 211,155 | | | 180,475 | |

Provision for credit losses | 7,000 | | | 8,750 | |

| Net interest income after provision for credit losses | 204,155 | | | 171,725 | |

| Non-interest income | 34,507 | | | 27,208 | |

Non-interest expense | 120,506 | | | 116,087 | |

| Income before income tax expense | 118,156 | | | 82,846 | |

| Income tax expense | 35,511 | | | 24,439 | |

| Net income | $ | 82,645 | | | $ | 58,407 | |

| | | |

| | | |

| Per Common Share Data: | | | |

| Net income: | | | |

| Basic | $ | 1.40 | | | $ | 0.98 | |

| Diluted | $ | 1.38 | | | $ | 0.97 | |

Adjusted earnings per common share (Non-GAAP)1 | $ | 1.41 | | | $ | 1.18 | |

| Book value per common share | $ | 33.78 | | | $ | 28.35 | |

Tangible book value per common share (Non-GAAP)1 | $ | 30.72 | | | $ | 25.24 | |

| | | |

| Weighted average number of common shares outstanding: | | | |

| Basic | 58,949,038 | | | 59,854,584 | |

| Diluted | 59,808,322 | | | 60,486,394 | |

| Common shares outstanding at end of period | 58,503,976 | | | 59,998,673 | |

| Common shares issued at end of period | 69,826,263 | | | 69,151,152 | |

| | | |

| Performance Ratios and Other Data: | | | |

| Loan originations for investment | $ | 2,605,332 | | | $ | 2,486,224 | |

| Loan originations for sale | 52,858 | | | 70,073 | |

| | | |

| Return on average assets | 1.64 | % | | 1.32 | % |

| Return on average common stockholders’ equity | 16.91 | % | | 13.91 | % |

Interest rate spread2 | 3.37 | % | | 3.66 | % |

Net interest margin3 | 4.36 | % | | 4.26 | % |

Net interest margin3 – Banking Business Segment | 4.46 | % | | 4.50 | % |

Efficiency ratio4 | 49.05 | % | | 55.90 | % |

Efficiency ratio4 – Banking Business Segment | 45.44 | % | | 52.93 | % |

| | | |

| Asset Quality Ratios: | | | |

| Net annualized charge-offs to average loans | 0.04 | % | | 0.05 | % |

| Non-performing loans and leases to total loans | 0.62 | % | | 0.78 | % |

| Non-performing assets to total assets | 0.56 | % | | 0.68 | % |

| Allowance for credit losses - loans to total loans held for investment | 1.00 | % | | 1.01 | % |

| Allowance for credit losses - loans to non-performing loans | 159.80 | % | | 129.04 | % |

1 See “Use of Non-GAAP Financial Measures” herein.

2 Interest rate spread represents the difference between the annualized weighted average yield on interest-earning assets and the annualized weighted average

rate paid on interest-bearing liabilities.

3 Net interest margin represents annualized net interest income as a percentage of average interest-earning assets.

4 Efficiency ratio represents non-interest expense as a percentage of the aggregate of net interest income and non-interest income.

Axos Q1 Fiscal 2024 Earnings Supplement October 26, 2023 NYSE: AX

1 Loan Growth by Category for First Quarter Ended September 30, 2023 $ millions Inc (Dec)Q4 FY23Q1 FY24 95$3,924$4,019 45250295 )(1062,2362,130 )(14846832 1425,3465,488 )(173854681 1371,6961,833 )(9116107 ) 4418281,269 )(35476441 )(57065 )(8102 $510$16,652$17,162 Jumbo Mortgage SF Warehouse Lending Multifamily Small Balance Commercial CRE Specialty Lender Finance RE Lender Finance Non-RE Equipment Leasing Asset-Based Lending Auto Unsecured/OD Single Family Mortgage & Warehouse Multifamily & Commercial Mortgage Commercial Real Estate Commercial & Industrial Non-RE Auto & Consumer Other Loans

CRE Specialty* Detail as of September 30, 2023 Non-Performing Loans (mm)Weighted Avg. LTVBalance (mm)Loan Type $1143%$1,804Multifamily 15371,109SFR 0411,061Hotel 039496Industrial 038456Office 043226Retail 041336Other $2641%$5,488Total <=50% > 50% to 60% >60% to 65% > 65% 81% 16% 2% 1% LTV Distribution 2 *Includes CRE Specialty loan portfolio only; see Form 10-Q for the quarterly period ended September 30, 2023 for additional details of other loan categories

Fixed/Hybrid Years to Maturity / Repricing*Mix of Loan Repricing Types Variable 61% Hybrid 32% Fixed 7% 455 944 2,139 3,297 5,516 6,483 6,491 6,543 - 1,000 2,000 3,000 4,000 5,000 6,000 7,000 1/2 1 2 3 5 10 20 >20 Years $M 7% 15% 33% 50% 100%99%99%84% *Excludes SF Warehouse Lending and Equipment Leasing. The years to repricing assumes no loan prepayments and reflects only contractual terms. Interest Rate Components of Loan & Lease Portfolio At September 30, 2023 3 Of the fixed and hybrid rate loan balances in our portfolio at September 30, 2023, 50% will reprice within 3 years and 84% will reprice within 5 years

4 Consumer Direct Distribution Partners Small Business Banking Commercial / Treasury Management Axos Securities Specialty Deposits Fiduciary Services Diversified Deposit Gathering Business Lines $1.1 B $1.1 B $10.1 B $0.6 B $0.3 B $3.4 B $1.0 B Diversified Deposit Gathering Approximately 90% of deposits are FDIC-insured or collateralized *Deposit balances as of 9/30/23 1Excludes approximately $550 million of off-balance sheet deposits 2Excludes approximately $750 million of client deposits held at other banks 1 2 › Full service digital banking, wealth management, and securities trading › White-label banking › Business banking with simple suite of cash management services › Serves approximately 40% of U.S. Chapter 7 bankruptcy trustees in exclusive relationship › Software allows servicing of SEC receivers and non-chapter 7 cases › 1031 exchange firms › Title and escrow companies › HOA and property management › Business management and entertainment › Broker-dealer client cash › Broker-dealer reserve accounts › Full service treasury/cash management › Team enhancements and geographic expansion › Bank and securities cross-sell

Axos Advisor Services (AAS) Cash Sorting 5 Ending Balance* *Total ending AAS client deposit balances, both on- and off-balance sheet (895) (383) (188) (51) $(1,000) $(900) $(800) $(700) $(600) $(500) $(400) $(300) $(200) $(100) $- Q2 2023 Q3 2023 Q4 2023 Q1 2024 Pace of AAS Cash Sorting Decline Has Decelerated $1,052$1,103$1,291$1,674 (in millions)

Change in Allowance for Credit Losses (ACL) & Unfunded Loan Commitments Reserve (UCL) ($ in millions) 166.7 2.4 0.8 5.8 170.9 10.5 11.7 130 140 150 160 170 180 190 1.2 June 30, 2023 ACL + UCL Gross Charge-offs Provisions for credit losses Gross Recoveries September 30, 2023 ACL + UCL UCLACL 6

7 Allowance for Credit Losses (ACL) by Loan Category as of September 30, 2023 $ millions Single Family Mortgage & Warehouse Multifamily & Commercial Mortgage Commercial Real Estate Commercial & Industrial Non-RE Auto & Consumer Other Loans ACL %ACL $Loan Balance %0.4174,314 %0.5162,962 %1.2716,169 %1.7553,209 %2.412506 %--2 %1.017117,162

Credit Quality ($ millions) %NPLsLoans O/S9/30/2023 0.85%$36.6$4,313.9Single Family-Mortgage & Warehouse 1.3138.82,962.0Multifamily and Commercial Mortgage 0.4226.16,168.6Commercial Real Estate 0.093.03,209.0Commercial & Industrial - Non-RE 0.472.4506.0Auto & Consumer 0.000.02.4Other 0.62%$106.9$17,161.9Total %NPLsLoans O/S6/30/2023 0.74%$30.7$4,173.8Single Family-Mortgage & Warehouse 1.1435.13,082.2Multifamily and Commercial Mortgage 0.2414.96,199.8Commercial Real Estate 0.113.02,639.7Commercial & Industrial - Non-RE 0.271.5546.3Auto & Consumer 19.612.010.2Other 0.52%$87.2$16,652.0Total %NPLsLoans O/S9/30/2022 1.64%$65.7 $4,009.8Single Family-Mortgage & Warehouse 1.2135.82,965.0Multifamily and Commercial Mortgage 0.2714.95,523.9Commercial Real Estate 0.133.02,244.3Commercial & Industrial - Non-RE 0.161.0631.3Auto & Consumer 1.000.110.0Other 0.78%$120.5$15,384.3Total 8

9

10

11

12 Greg Garrabrants, President and CEO Derrick Walsh, EVP and CFO Andy Micheletti, EVP of Finance investors@axosfinancial.com www.axosfinancial.com Johnny Lai, SVP Corporate Development and Investor Relations Phone: 858.649.2218 Mobile: 858.245.1442 jlai@axosfinancial.com Contact Information

v3.23.3

Cover Page

|

Oct. 26, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 26, 2023

|

| Entity Registrant Name |

Axos Financial, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37709

|

| Entity Tax Identification Number |

33-0867444

|

| Entity Address, Address Line One |

9205 West Russell Road, Ste 400

|

| Entity Address, City or Town |

Las Vegas

|

| Entity Address, State or Province |

NV

|

| Entity Address, Postal Zip Code |

89148

|

| City Area Code |

858

|

| Local Phone Number |

649-2218

|

| Title of 12(b) Security |

Common stock, $0.01 par value

|

| Trading Symbol |

AX

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001299709

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

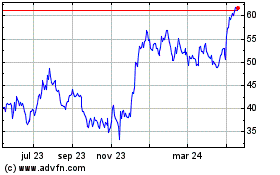

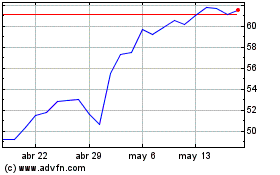

Axos Financial (NYSE:AX)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Axos Financial (NYSE:AX)

Gráfica de Acción Histórica

De May 2023 a May 2024