Buffett's Kraft Heinz Bet Dragged Down Berkshire Hathaway in 2018--Update

23 Febrero 2019 - 8:35AM

Noticias Dow Jones

By Nicole Friedman

The world's most famous investor had one of his worst years ever

in 2018.

Warren Buffett's Berkshire Hathaway Inc. said Saturday it swung

to a $25.4 billion loss in the fourth quarter due to an unexpected

write-down at Kraft Heinz Co. and unrealized investment losses.

Berkshire posted operating earnings of $5.7 billion, up from

$3.3 billion a year earlier, due to increased earnings from

Berkshire's railroads, energy business and other segments. For the

year, Berkshire posted $24.8 billion in operating earnings. That

was a record high, Mr Buffett said in his annual letter to

shareholders that was also released Saturday.

Mr. Buffett in his letter offered no hints about who will

eventually succeed him as CEO. But he did offer praise for deputies

Ajit Jain and Greg Abel, saying that decisions to elevate the two

men last year into more prominent roles "were overdue."

Messrs. Jain and Abel were promoted in early 2018 to vice

chairmen and now oversee many of Berkshire's day-to-day operations.

One of the two men is expected to succeed Mr. Buffett as chief

executive.

"Berkshire is now far better managed than when I alone was

supervising operations," Mr. Buffett wrote.

Berkshire reported net earnings of $4 billion in 2018, down from

$44.94 billion in 2017. Berkshire's 2017 earnings soared in the

fourth quarter of 2017 due to changes in the U.S. tax law that

lowered Berkshire's deferred tax obligations for stock investments

that it currently holds.

Berkshire's earnings are unusually volatile because it holds

large equity stakes in companies including Wells Fargo & Co.

and Apple Inc. An accounting rule that went into effect last year

requires Berkshire to include unrealized investment gains or losses

in its net income.

Kraft Heinz contributed a $2.7 billion loss to Berkshire in

2018, compared to adding $2.9 billion to its earnings in 2017.

Kraft Heinz on Thursday wrote down the value of some of its biggest

brands, disclosed an investigation by federal securities regulators

and slashed its dividend.

The company's book value per share rose 0.4% in 2018, the

company said, compared with a -4.4% total return in the S&P

500, including dividends.

Mr. Buffett has traditionally encouraged shareholders to pay

attention to Berkshire's book value over its market value, but he

said in the letter that market value is now the more relevant

metric.

Berkshire hasn't notably outperformed the S&P 500 in recent

years. Berkshire hasn't done a major deal in three years, and Mr.

Buffett has struggled to find reasonably priced large companies to

buy. As Berkshire continues to grow and accumulate cash, Mr.

Buffett is under pressure to make ever-larger deals to move the

needle on its earnings. Berkshire's largest acquisition in 2018 was

the $2.5 billion purchase of a New York medical malpractice

insurer.

Berkshire's cash pile, which is mostly invested in Treasury

bills, grew to almost $112 billion at year-end, marking the sixth

straight quarter above $100 billion.

Mr. Buffett offered no specific guidance on how he may use his

growing pile of cash. He expects to move "much of our excess

liquidity into businesses that Berkshire will permanently own" but

prices are still too high, he wrote. "We continue, nevertheless, to

hope for an elephant-sized acquisition."

Berkshire repurchased a bit over $400 million of its stock in

the fourth quarter, down from $928 million in buybacks in the third

quarter. Investors were hoping Berkshire would spend a significant

chunk of its cash buying back shares.

Some of Berkshire's 60-odd subsidiaries completed acquisitions,

but those deals tend to be small. Berkshire spent $1 billion on

bolt-on acquisitions in 2018, the company said, down from $2.7

billion the prior year.

Write to Nicole Friedman at nicole.friedman@wsj.com

(END) Dow Jones Newswires

February 23, 2019 09:20 ET (14:20 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

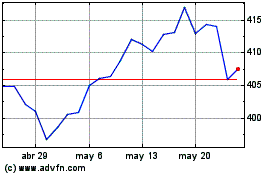

Berkshire Hathaway (NYSE:BRK.B)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

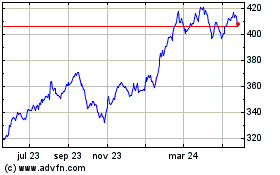

Berkshire Hathaway (NYSE:BRK.B)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024