Cable One, Inc. (NYSE: CABO) (the “Company” or “Cable One”)

today reported financial and operating results for the quarter

ended June 30, 2024.

Three Months Ended June

30,

(dollars in

thousands)

2024

2023

$ Change

% Change

Revenues

$

394,461

$

424,024

$

(29,563

)

(7.0

)%

Net income

$

47,649

$

55,246

$

(7,597

)

(13.8

)%

Net profit margin

12.1

%

13.0

%

Cash flows from operating activities

$

155,548

$

169,564

$

(14,016

)

(8.3

)%

Adjusted EBITDA(1)

$

212,372

$

231,294

$

(18,922

)

(8.2

)%

Adjusted EBITDA margin(1)

53.8

%

54.5

%

Capital expenditures

$

71,592

$

81,507

$

(9,915

)

(12.2

)%

Adjusted EBITDA less capital

expenditures(1)

$

140,780

$

149,787

$

(9,007

)

(6.0

)%

"We believe our strategic initiatives intended to drive

penetration deeper across all market segments are setting the stage

for sustainable long-term growth," said Julie Laulis, Cable One

President and CEO. "Despite challenges such as the discontinuation

of the Affordable Connectivity Program ("ACP") and typical seasonal

headwinds, the underlying fundamentals of both residential and

business data additions and retention levels maintained positive

momentum during the second quarter, with both connects and

disconnects improving year-over-year for the second consecutive

quarter."

Second Quarter 2024 Summary:

- Residential data primary service units ("PSUs") decreased by

approximately 4,200 sequentially, of which approximately 4,000

related to the expiration of the ACP during the second quarter.

Business data PSUs increased by 500 sequentially.

- Net income was $47.6 million in the second quarter of 2024

compared to $55.2 million in the second quarter of 2023. Adjusted

EBITDA was $212.4 million in the second quarter of 2024 compared to

$231.3 million in the second quarter of 2023. Net profit margin was

12.1% and Adjusted EBITDA margin was 53.8%.

- Net cash provided by operating activities was $155.5 million in

the second quarter of 2024 compared to $169.6 million in the second

quarter of 2023. Adjusted EBITDA less capital expenditures was

$140.8 million in the second quarter of 2024 compared to $149.8

million in the second quarter of 2023.

- Total revenues were $394.5 million in the second quarter of

2024 compared to $424.0 million in the second quarter of 2023.

- The Company paid $17.1 million in dividends during the second

quarter of 2024.

- The Company repaid $50.0 million under its revolving credit

facility (the "Revolver") during the second quarter of 2024.

____________________

(1)

Adjusted EBITDA, Adjusted EBITDA margin

and Adjusted EBITDA less capital expenditures are defined in the

section of this press release entitled “Use of Non-GAAP Financial

Measures.” Adjusted EBITDA and Adjusted EBITDA less capital

expenditures are reconciled to net income, Adjusted EBITDA margin

is reconciled to net profit margin and Adjusted EBITDA less capital

expenditures is also reconciled to net cash provided by operating

activities. Refer to the “Reconciliations of Non-GAAP Measures”

tables within this press release.

Second Quarter 2024 Financial Results Compared to Second

Quarter 2023

Revenues were $394.5 million in the second quarter of 2024

compared to $424.0 million in the second quarter of 2023.

Residential data revenues decreased $16.4 million, or 6.7%,

year-over-year due primarily to a 6.9% decrease in average revenue

per unit. Residential video revenues decreased $9.0 million, or

13.5%, year-over-year due primarily to a decrease in residential

video subscribers, partially offset by a rate adjustment enacted

earlier in the year. Business data revenues increased $0.9 million,

or 1.6%, year-over-year, due primarily to an increase in business

data subscribers.

Net income was $47.6 million in the second quarter of 2024

compared to $55.2 million in the prior year quarter. The

year-over-year decrease was due primarily to lower revenues,

partially offset by an $8.5 million reduction in programming costs

resulting from video customer losses, a $5.5 million severance

charge resulting from organizational changes implemented during the

quarter and a $7.7 million gain related to C-band spectrum

relocation funding received from the federal government. Net profit

margin was 12.1% in the second quarter of 2024 compared to 13.0% in

the prior year quarter.

Adjusted EBITDA was $212.4 million and $231.3 million for the

second quarter of 2024 and 2023, respectively. Adjusted EBITDA

margin was 53.8% in the second quarter of 2024 compared to 54.5% in

the prior year quarter.

Net cash provided by operating activities was $155.5 million in

the second quarter of 2024 compared to $169.6 million in the second

quarter of 2023. Capital expenditures for the second quarter of

2024 totaled $71.6 million compared to $81.5 million for the second

quarter of 2023. Adjusted EBITDA less capital expenditures for the

second quarter of 2024 was $140.8 million compared to $149.8

million in the prior year quarter.

Liquidity and Capital Resources

At June 30, 2024, the Company had $201.5 million of cash and

cash equivalents on hand compared to $190.3 million at December 31,

2023. The Company’s debt balance was $3.57 billion and $3.68

billion at June 30, 2024 and December 31, 2023, respectively. The

Company had $238.0 million of borrowings and $762.0 million

available for borrowing under the Revolver as of June 30, 2024.

The Company paid $17.1 million in dividends to stockholders

during the second quarter of 2024.

The Company repaid $50.0 million under the Revolver during the

second quarter of 2024 and repaid an additional $50.0 million in

July 2024.

The Company's capital expenditures by category for the three

months ended June 30, 2024 and 2023 were as follows (in

thousands):

Three Months Ended June

30,

2024

2023

Customer premise equipment(1)

$

15,411

$

13,061

Commercial(2)

2,955

11,725

Scalable infrastructure(3)

9,472

7,086

Line extensions(4)

18,372

10,758

Upgrade/rebuild(5)

7,288

13,818

Support capital(6)

18,094

25,059

Total

$

71,592

$

81,507

____________________

(1)

Customer premise equipment includes costs

incurred at customer locations, including installation costs and

customer premise equipment (e.g., modems and set-top boxes).

(2)

Commercial includes costs related to

securing business services customers and PSUs, including small and

medium-sized businesses and enterprise customers.

(3)

Scalable infrastructure includes costs not

related to customer premise equipment to secure growth of new

customers and PSUs or provide service enhancements (e.g., headend

equipment).

(4)

Line extensions include network costs

associated with entering new service areas (e.g., fiber/coaxial

cable, amplifiers, electronic equipment, make-ready and design

engineering).

(5)

Upgrade/rebuild includes costs to modify

or replace existing fiber/coaxial cable networks, including

betterments.

(6)

Support capital includes costs associated

with the replacement or enhancement of non-network assets due to

technological and physical obsolescence (e.g., non-network

equipment, land, buildings and vehicles) and capitalized internal

labor costs not associated with customer installation

activities.

Conference Call

Cable One will host a conference call with the financial

community to discuss results for the second quarter of 2024 on

Thursday, August 1, 2024, at 5 p.m. Eastern Time (ET).

The conference call will be available via an audio webcast on

the Cable One Investor Relations website at ir.cableone.net or by

dialing 1-888-800-3155 (International: 1-646-307-1696) and using

the access code 1202376. Participants should register for the

webcast or dial in for the conference call shortly before 5 p.m.

ET.

A replay of the call will be available from August 1, 2024 until

August 15, 2024 at ir.cableone.net.

Additional Information Available on Website

The information in this press release should be read in

conjunction with the condensed consolidated financial statements

and notes thereto contained in the Company’s Quarterly Report on

Form 10-Q for the period ended June 30, 2024, which will be posted

on the “SEC Filings” section of the Cable One Investor Relations

website at ir.cableone.net when it is filed with the Securities and

Exchange Commission (the “SEC”). Investors and others interested in

more information about Cable One should consult the Company’s

website, which is regularly updated with financial and other

important information about the Company.

Use of Non-GAAP Financial Measures

The Company uses certain measures that are not defined by

generally accepted accounting principles in the United States

(“GAAP”) to evaluate various aspects of its business. Adjusted

EBITDA, Adjusted EBITDA margin, Adjusted EBITDA less capital

expenditures and capital expenditures as a percentage of Adjusted

EBITDA are non-GAAP financial measures and should be considered in

addition to, not as superior to, or as a substitute for, net

income, net profit margin, net cash provided by operating

activities or capital expenditures as a percentage of net income

reported in accordance with GAAP. Adjusted EBITDA and Adjusted

EBITDA less capital expenditures are reconciled to net income,

Adjusted EBITDA margin is reconciled to net profit margin and

capital expenditures as a percentage of Adjusted EBITDA is

reconciled to capital expenditures as a percentage of net income.

Adjusted EBITDA less capital expenditures is also reconciled to net

cash provided by operating activities. These reconciliations are

included in the “Reconciliations of Non-GAAP Measures” tables

within this press release.

“Adjusted EBITDA” is defined as net income plus net interest

expense, income tax provision, depreciation and amortization,

equity-based compensation, severance and contract termination

costs, acquisition-related costs, net (gain) loss on asset sales

and disposals, system conversion costs, rebranding costs, net

equity method investment (income) loss, net other (income) expense

and any special items, as provided in the “Reconciliations of

Non-GAAP Measures” tables within this press release. As such, it

eliminates the significant non-cash depreciation and amortization

expense that results from the capital-intensive nature of the

Company’s business as well as other non-cash or special items and

is unaffected by the Company’s capital structure or investment

activities. This measure is limited in that it does not reflect the

periodic costs of certain capitalized tangible and intangible

assets used in generating revenues and the Company’s cash cost of

debt financing. These costs are evaluated through other financial

measures.

“Adjusted EBITDA margin” is defined as Adjusted EBITDA divided

by total revenues.

“Adjusted EBITDA less capital expenditures,” when used as a

liquidity measure, is calculated as net cash provided by operating

activities excluding the impact of capital expenditures, net

interest expense, amortization of debt discount and issuance costs,

income tax provision, changes in operating assets and liabilities,

change in deferred income taxes and certain other items, as

provided in the “Reconciliations of Non-GAAP Measures” tables

within this press release.

“Capital expenditures as a percentage of Adjusted EBITDA” is

defined as capital expenditures divided by Adjusted EBITDA.

The Company uses Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted EBITDA less capital expenditures and capital expenditures

as a percentage of Adjusted EBITDA to assess its performance, and

it also uses Adjusted EBITDA less capital expenditures as an

indicator of its ability to fund operations and make additional

investments with internally generated funds. In addition, Adjusted

EBITDA generally correlates to the measure used in the leverage

ratio calculations under the Company’s credit agreement and the

indenture governing the Company’s non-convertible senior unsecured

notes to determine compliance with the covenants contained in the

credit agreement and the ability to take certain actions under the

indenture governing the non-convertible senior unsecured notes.

Adjusted EBITDA less capital expenditures is also a significant

performance measure that has been used by the Company in its

incentive compensation programs. Adjusted EBITDA does not take into

account cash used for mandatory debt service requirements or other

non-discretionary expenditures, and thus does not represent

residual funds available for discretionary uses.

The Company believes that Adjusted EBITDA, Adjusted EBITDA

margin and capital expenditures as a percentage of Adjusted EBITDA

are useful to investors in evaluating the operating performance of

the Company. The Company believes that Adjusted EBITDA less capital

expenditures is useful to investors as it shows the Company’s

performance while taking into account cash outflows for capital

expenditures and is one of several indicators of the Company’s

ability to service debt, make investments and/or return capital to

its stockholders.

Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EBITDA less

capital expenditures, capital expenditures as a percentage of

Adjusted EBITDA and similar measures with similar titles are common

measures used by investors, analysts and peers to compare

performance in the Company’s industry, although the Company’s

measures of Adjusted EBITDA, Adjusted EBITDA margin, Adjusted

EBITDA less capital expenditures and capital expenditures as a

percentage of Adjusted EBITDA may not be directly comparable to

similarly titled measures reported by other companies.

About Cable One

Cable One, Inc. (NYSE:CABO) is a leading broadband

communications provider committed to connecting customers and

communities to what matters most. Through Sparklight® and the

associated Cable One family of brands, the Company served more than

one million residential and business customers in 24 states as of

June 30, 2024. Powered by a fiber-rich network, the Cable One

family of brands provide residential customers with a wide array of

connectivity and entertainment services, including Gigabit speeds,

advanced Wi-Fi and video. For businesses ranging from small and

mid-market up to enterprise, wholesale and carrier, the Company

offers scalable, cost-effective solutions that enable businesses of

all sizes to grow, compete and succeed.

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING STATEMENTS

This communication may contain “forward-looking statements” that

involve risks and uncertainties. These statements can be identified

by the fact that they do not relate strictly to historical or

current facts, but rather are based on current expectations,

estimates, assumptions and projections about the Company’s

industry, business, strategy, acquisitions and strategic

investments, market expansion plans, announced organizational

changes, dividend policy, capital allocation, financing strategy,

ability to fund the purchase price payable if the put option

associated with the remaining equity interests in Mega Broadband

Investments Holdings LLC ("MBI") is exercised, financial results

and financial condition. Forward-looking statements often include

words such as “will,” “should,” “anticipates,” “estimates,”

“expects,” “projects,” “intends,” “plans,” “believes” and words and

terms of similar substance in connection with discussions of future

operating or financial performance. As with any projection or

forecast, forward-looking statements are inherently susceptible to

uncertainty and changes in circumstances. The Company’s actual

results may vary materially from those expressed or implied in its

forward-looking statements. Accordingly, undue reliance should not

be placed on any forward-looking statement made by the Company or

on its behalf. Important factors that could cause the Company’s

actual results to differ materially from those in its

forward-looking statements include government regulation, economic,

strategic, political and social conditions and the following

factors, which are discussed in the Company’s latest Annual Report

on Form 10-K as filed with the SEC:

- rising levels of competition from historical and new entrants

in the Company’s markets;

- recent and future changes in technology, and the Company's

ability to develop, deploy and operate new technologies, service

offerings and customer service platforms;

- the Company’s ability to continue to grow its residential data

and business data revenues and customer base;

- increases in programming costs and retransmission fees;

- the Company’s ability to obtain hardware, software and

operational support from vendors;

- risks that the Company may fail to realize the benefits

anticipated as a result of the Company's purchase of the remaining

interests in Hargray Acquisition Holdings, LLC that the Company did

not already own;

- risks relating to existing or future acquisitions and strategic

investments by the Company, including risks associated with the

potential exercise of the put option associated with the remaining

equity interests in MBI;

- risks that the implementation of the Company’s new enterprise

resource planning and billing systems disrupt business

operations;

- the integrity and security of the Company’s network and

information systems;

- the impact of possible security breaches and other disruptions,

including cyber-attacks;

- the Company’s failure to obtain necessary intellectual and

proprietary rights to operate its business and the risk of

intellectual property claims and litigation against the

Company;

- legislative or regulatory efforts to impose network neutrality

and other new requirements on the Company’s data services;

- additional regulation of the Company’s video and voice

services;

- the Company’s ability to renew cable system franchises;

- increases in pole attachment costs;

- changes in local governmental franchising authority and

broadcast carriage regulations;

- changes in government subsidy programs;

- the potential adverse effect of the Company’s level of

indebtedness on its business, financial condition or results of

operations and cash flows;

- the restrictions the terms of the Company’s indebtedness place

on its business and corporate actions;

- the possibility that interest rates will continue to rise,

causing the Company’s obligations to service its variable rate

indebtedness to increase significantly;

- risks associated with the Company’s convertible

indebtedness;

- the Company’s ability to continue to pay dividends;

- provisions in the Company’s charter, by-laws and Delaware law

that could discourage takeovers and limit the judicial forum for

certain disputes;

- adverse economic conditions, labor shortages, supply chain

disruptions, changes in rates of inflation and the level of move

activity in the housing sector;

- pandemics, epidemics or disease outbreaks, such as the COVID-19

pandemic, have, and may in the future, disrupt the Company's

business and operations, which could materially affect the

Company's business, financial condition, results of operations and

cash flows;

- lower demand for the Company's residential data and business

data products;

- fluctuations in the Company’s stock price;

- dilution from equity awards, convertible indebtedness and

potential future convertible debt and stock issuances;

- damage to the Company’s reputation or brand image;

- the Company’s ability to retain key employees (whom the Company

refers to as associates);

- the Company’s ability to incur future indebtedness;

- provisions in the Company’s charter that could limit the

liabilities for directors; and

- the other risks and uncertainties detailed from time to time in

the Company’s filings with the SEC, including but not limited to

those described under "Risk Factors" in its latest Annual Report on

Form 10-K and in its subsequent filings with the SEC.

Any forward-looking statements made by the Company in this

communication speak only as of the date on which they are made. The

Company is under no obligation, and expressly disclaims any

obligation, except as required by law, to update or alter its

forward-looking statements, whether as a result of new information,

subsequent events or otherwise.

CABLE ONE, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(Unaudited)

Three Months Ended June

30,

(dollars in

thousands, except per share data)

2024

2023(1)

Change

% Change

Revenues:

Residential data

$

230,404

$

246,840

$

(16,436

)

(6.7

)%

Residential video

57,178

66,137

(8,959

)

(13.5

)%

Residential voice

8,203

9,507

(1,304

)

(13.7

)%

Business data

56,687

55,792

895

1.6

%

Business other

18,663

21,020

(2,357

)

(11.2

)%

Other

23,326

24,728

(1,402

)

(5.7

)%

Total Revenues

394,461

424,024

(29,563

)

(7.0

)%

Costs and Expenses:

Operating (excluding depreciation and

amortization)

105,845

112,804

(6,959

)

(6.2

)%

Selling, general and administrative

90,770

86,173

4,597

5.3

%

Depreciation and amortization

85,314

87,240

(1,926

)

(2.2

)%

(Gain) loss on asset sales and disposals,

net

2,395

2,767

(372

)

(13.4

)%

Total Costs and Expenses

284,324

288,984

(4,660

)

(1.6

)%

Income from operations

110,137

135,040

(24,903

)

(18.4

)%

Interest expense, net

(34,964

)

(38,737

)

3,773

(9.7

)%

Other income (expense), net

(641

)

(6,593

)

5,952

(90.3

)%

Income before income taxes and equity

method investment income (loss), net

74,532

89,710

(15,178

)

(16.9

)%

Income tax provision

17,774

20,949

(3,175

)

(15.2

)%

Income before equity method investment

income (loss), net

56,758

68,761

(12,003

)

(17.5

)%

Equity method investment income (loss),

net

(9,109

)

(13,515

)

4,406

(32.6

)%

Net income

$

47,649

$

55,246

$

(7,597

)

(13.8

)%

Net Income per Common Share:

Basic

$

8.48

$

9.76

$

(1.28

)

(13.1

)%

Diluted

$

8.16

$

9.36

$

(1.20

)

(12.8

)%

Weighted Average Common Shares

Outstanding:

Basic

5,620,592

5,660,751

(40,159

)

(0.7

)%

Diluted

6,029,382

6,070,996

(41,614

)

(0.7

)%

Unrealized gain (loss) on cash flow hedges

and other, net of tax

$

(693

)

$

21,711

$

(22,404

)

(103.2

)%

Comprehensive income

$

46,956

$

76,957

$

(30,001

)

(39.0

)%

____________________

(1)

Interest and investment income for the

three months ended June 30, 2023 has been reclassified from Other

income (expense), net, to Interest expense, net, to conform to the

current year presentation.

CABLE ONE, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(dollars in

thousands, except par values)

June 30, 2024

December 31, 2023

Assets

Current Assets:

Cash and cash equivalents

$

201,518

$

190,289

Accounts receivable, net

66,051

93,973

Prepaid and other current assets

71,177

58,116

Total Current Assets

338,746

342,378

Equity investments

1,128,363

1,125,447

Property, plant and equipment, net

1,785,765

1,791,120

Intangible assets, net

2,563,427

2,595,892

Goodwill

928,947

928,947

Other noncurrent assets

82,393

63,149

Total Assets

$

6,827,641

$

6,846,933

Liabilities and Stockholders'

Equity

Current Liabilities:

Accounts payable and accrued

liabilities

$

142,297

$

156,645

Deferred revenue

26,270

27,169

Current portion of long-term debt

18,898

19,023

Total Current Liabilities

187,465

202,837

Long-term debt

3,521,450

3,626,928

Deferred income taxes

972,144

974,467

Other noncurrent liabilities

182,958

169,556

Total Liabilities

4,864,017

4,973,788

Stockholders' Equity:

Preferred stock ($0.01 par value;

4,000,000 shares authorized; none issued or outstanding)

—

—

Common stock ($0.01 par value; 40,000,000

shares authorized; 6,175,399 shares issued; and 5,619,200 and

5,616,987 shares outstanding as of June 30, 2024 and December 31,

2023, respectively)

62

62

Additional paid-in capital

622,150

607,574

Retained earnings

1,886,596

1,825,542

Accumulated other comprehensive income

(loss)

54,326

36,745

Treasury stock, at cost (556,199 and

558,412 shares held as of June 30, 2024 and December 31, 2023,

respectively)

(599,510

)

(596,778

)

Total Stockholders' Equity

1,963,624

1,873,145

Total Liabilities and Stockholders'

Equity

$

6,827,641

$

6,846,933

CABLE ONE, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

Three Months Ended June

30,

(in

thousands)

2024

2023

Cash flows from operating

activities:

Net income

$

47,649

$

55,246

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

85,314

87,240

Amortization of debt discount and issuance

costs

2,189

2,274

Equity-based compensation

7,111

5,999

Change in deferred income taxes

(5,628

)

1,354

(Gain) loss on asset sales and disposals,

net

2,396

2,766

Equity method investment (income) loss,

net

9,109

13,515

Fair value adjustments

8,360

6,508

Changes in operating assets and

liabilities:

Accounts receivable, net

(5,521

)

(28,462

)

Prepaid and other current assets

4,081

8,852

Accounts payable and accrued

liabilities

3,560

4,378

Deferred revenue

(809

)

3,859

Other

(2,263

)

6,035

Net cash provided by operating

activities

155,548

169,564

Cash flows from investing

activities:

Cash paid for debt and equity

investments

(20,000

)

(14,704

)

Capital expenditures

(71,592

)

(81,507

)

Change in accrued expenses related to

capital expenditures

(1,749

)

(3,170

)

Proceeds from sales of property, plant and

equipment

575

565

Net cash used in investing activities

(92,766

)

(98,816

)

Cash flows from financing

activities:

Payment of debt issuance costs

—

(198

)

Payments on long-term debt

(54,813

)

(54,719

)

Repurchases of common stock

—

(41,368

)

Payment of withholding tax for equity

awards

(77

)

(122

)

Dividends paid to stockholders

(17,107

)

(16,339

)

Net cash used in financing activities

(71,997

)

(112,746

)

Change in cash and cash equivalents

(9,215

)

(41,998

)

Cash and cash equivalents, beginning of

period

210,733

202,732

Cash and cash equivalents, end of

period

$

201,518

$

160,734

Supplemental cash flow

disclosures:

Cash paid for interest, net of capitalized

interest

$

43,605

$

46,179

Cash paid for income taxes, net of refunds

received

$

26,349

$

17,882

CABLE ONE, INC.

RECONCILIATIONS OF NON-GAAP

MEASURES

(Unaudited)

Three Months Ended June

30,

(dollars in

thousands)

2024

2023

$ Change

% Change

Net income

$

47,649

$

55,246

$

(7,597

)

(13.8

)%

Net profit margin

12.1

%

13.0

%

Plus: Interest expense, net

34,964

38,737

(3,773

)

(9.7

)%

Income tax provision

17,774

20,949

(3,175

)

(15.2

)%

Depreciation and amortization

85,314

87,240

(1,926

)

(2.2

)%

Equity-based compensation

7,111

5,999

1,112

18.5

%

Severance and contract termination

costs

5,544

—

5,544

NM

Acquisition-related costs

209

248

(39

)

(15.7

)%

(Gain) loss on asset sales and disposals,

net

2,395

2,767

(372

)

(13.4

)%

System conversion costs

1,230

—

1,230

NM

Rebranding costs

432

—

432

NM

Equity method investment (income) loss,

net

9,109

13,515

(4,406

)

(32.6

)%

Other (income) expense, net

641

6,593

(5,952

)

(90.3

)%

Adjusted EBITDA

$

212,372

$

231,294

$

(18,922

)

(8.2

)%

Adjusted EBITDA margin

53.8

%

54.5

%

Less: Capital expenditures

$

71,592

$

81,507

$

(9,915

)

(12.2

)%

Capital expenditures as a percentage of

net income

150.2

%

147.5

%

Capital expenditures as a percentage of

Adjusted EBITDA

33.7

%

35.2

%

Adjusted EBITDA less capital

expenditures

$

140,780

$

149,787

$

(9,007

)

(6.0

)%

____________________

NM = Not meaningful.

Three Months Ended June

30,

(dollars in

thousands)

2024

2023

$ Change

% Change

Net cash provided by operating

activities

$

155,548

$

169,564

$

(14,016

)

(8.3

)%

Capital expenditures

(71,592

)

(81,507

)

9,915

(12.2

)%

Interest expense, net

34,964

38,737

(3,773

)

(9.7

)%

Amortization of debt discount and issuance

costs

(2,189

)

(2,274

)

85

(3.7

)%

Income tax provision

17,774

20,949

(3,175

)

(15.2

)%

Changes in operating assets and

liabilities

951

5,338

(4,387

)

(82.2

)%

Change in deferred income taxes

5,628

(1,354

)

6,982

NM

Acquisition-related costs

209

248

(39

)

(15.8

)%

Severance and contract termination

costs

5,544

—

5,544

NM

System conversion costs

1,230

—

1,230

NM

Rebranding costs

432

—

432

NM

Fair value adjustments

(8,360

)

(6,508

)

(1,852

)

28.5

%

Other (income) expense, net

641

6,593

(5,952

)

(90.3

)%

Adjusted EBITDA less capital

expenditures

$

140,780

$

149,787

$

(9,007

)

(6.0

)%

____________________

NM = Not meaningful.

CABLE ONE, INC.

OPERATING STATISTICS

(Unaudited)

As of June 30,

(in thousands,

except percentages and ARPU data)

2024

2023

Change

% Change

Homes Passed

2,809.2

2,733.9

75.2

2.8

%

Residential Customers

992.9

998.8

(5.9

)

(0.6

)%

Data PSUs

963.2

960.1

3.1

0.3

%

Video PSUs

118.8

149.2

(30.4

)

(20.4

)%

Voice PSUs

72.7

84.7

(12.0

)

(14.1

)%

Total residential PSUs

1,154.7

1,193.9

(39.3

)

(3.3

)%

Business Customers

102.8

102.2

0.6

0.6

%

Data PSUs

99.6

97.8

1.7

1.8

%

Video PSUs

7.2

9.0

(1.7

)

(19.2

)%

Voice PSUs

38.9

40.3

(1.4

)

(3.6

)%

Total business services PSUs

145.7

147.1

(1.4

)

(1.0

)%

Total Customers

1,095.7

1,101.0

(5.3

)

(0.5

)%

Total non-video

967.3

940.5

26.9

2.9

%

Percent of total

88.3

%

85.4

%

2.9

%

Data PSUs

1,062.8

1,057.9

4.8

0.5

%

Video PSUs

126.0

158.1

(32.1

)

(20.3

)%

Voice PSUs

111.6

125.0

(13.4

)

(10.7

)%

Total PSUs

1,300.4

1,341.1

(40.7

)

(3.0

)%

Penetration

Data

37.8

%

38.7

%

(0.9

)%

Video

4.5

%

5.8

%

(1.3

)%

Voice

4.0

%

4.6

%

(0.6

)%

Share of Second Quarter

Revenues

Residential data

58.4

%

58.2

%

0.2

%

Business services

19.1

%

18.1

%

1.0

%

Total

77.5

%

76.3

%

1.2

%

ARPU - Second Quarter

Residential data(1)

$

79.36

$

85.20

$

(5.84

)

(6.9

)%

Residential video(1)

$

155.95

$

143.53

$

12.42

8.7

%

Residential voice(1)

$

36.75

$

36.71

$

0.04

0.1

%

Business services(2)

$

244.52

$

251.02

$

(6.50

)

(2.6

)%

____________________

Note: All totals, percentages and

year-over-year changes are calculated using exact numbers. Minor

differences may exist due to rounding.

(1)

ARPU values represent the

applicable quarterly residential service revenues (excluding

installation and activation fees) divided by the corresponding

average of the number of PSUs at the beginning and end of each

period, divided by three, except that for any PSUs added or

subtracted as a result of an acquisition or divestiture occurring

during the period, the associated ARPU values represent the

applicable residential service revenues (excluding installation and

activation fees) divided by the pro-rated average number of PSUs

during such period.

(2)

ARPU values represent quarterly

business services revenues divided by the average of the number of

business customer relationships at the beginning and end of each

period, divided by three, except that for any business customer

relationships added or subtracted as a result of an acquisition or

divestiture occurring during the period, the associated ARPU values

represent business services revenues divided by the pro-rated

average number of business customer relationships during such

period.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801512701/en/

Trish Niemann Vice President, Communications Strategy

602-364-6372 patricia.niemann@cableone.biz

Todd Koetje Chief Financial Officer

investor_relations@cableone.biz

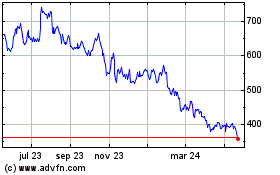

Cable One (NYSE:CABO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

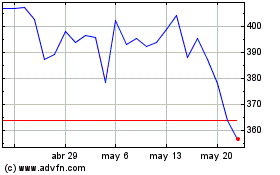

Cable One (NYSE:CABO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024