Amended partnership agreement provides

enhanced timing flexibility for path to full ownership of

MBI

Cable One, Inc. (NYSE: CABO) (“Cable One”) announced today that

it has amended the terms of its strategic investment in Mega

Broadband Investments Holdings LLC (“MBI”) to provide enhanced

timing flexibility for Cable One’s potential acquisition of full

ownership of MBI. Cable One currently owns a 45% stake in MBI, and

affiliates of GTCR LLC (“GTCR”) and MBI management own the balance

of MBI. The amendments provide Cable One with enhanced ability to

control the timing for acquiring the 55% interest it does not

currently own pursuant to the put right held by GTCR, with any such

acquisition to occur no earlier than October 1, 2026 unless Cable

One elects to close the transaction at an earlier date.

“Our strategic investment in MBI reflects our commitment to

provide rural America with reliable high-speed internet service,”

said Julie Laulis, President and CEO of Cable One. “We continue to

value MBI for all the reasons that first drew us to them: their

commitment to providing leading broadband services in rural

markets, their track record of strong growth and impressive

potential for future growth, as well as their exceptional

team.”

Todd Koetje, CFO of Cable One, said, “We are pleased with the

terms provided by the partnership agreement amendments, which we

believe will further enhance Cable One’s overall capital structure

flexibility, as our net leverage ratio is now expected to peak in

the fourth quarter of 2024 following this transaction.”

MBI is a leading provider of broadband services across the

Southeast, Northwest and Mid-South United States and offers an

extensive range of broadband, fiber connectivity, cable television

and voice services for commercial and residential customers under

the Vyve Broadband brand. MBI's total revenues for the 12 months

ended September 30, 2024 were approximately $320 million, with

approximately 226,000 residential and business data customers

across a network footprint with approximately 674,000 passings as

of September 30, 2024.

Transaction Details

As part of the amended partnership agreement, Cable One paid

$250 million to the other MBI equity holders, and those same other

equity holders also received the proceeds from $100 million of new

MBI debt. The combined $350 million of payments will reduce the

purchase price payable by Cable One on a dollar-for-dollar basis

for the 55% interest in MBI it does not currently own as described

in more detail below. Concurrently, new arrangements were put in

place to provide timing flexibility for Cable One’s potential

acquisition of full ownership of MBI:

- Cable One has a new option to call the 55% of MBI it does not

already own, exercisable starting in the third quarter of

2025;

- GTCR’s existing option to put to Cable One the 55% of MBI it

does not already own has been adjusted to defer the closing of any

put exercise to no earlier than October 1, 2026 (unless Cable One

elects to cause the closing to occur earlier);

- If the closing of a put option exercise or call option exercise

occurs prior to October 1, 2026, the purchase price payable by

Cable One will be discounted at a rate of 12% for the period from

October 1, 2026 to the closing date.

The purchase price payable by Cable One at the closing of a call

option exercise or put option exercise will be calculated under a

formula based on (i) a multiple of MBI’s adjusted earnings before

interest, taxes, depreciation and amortization for the 12-month

period ended June 30, 2025 and (ii) MBI’s total net indebtedness

(disregarding the impact of the $100 million of new MBI debt

described above), less a dollar-for-dollar reduction for both the

upfront payment and the proceeds from the new MBI debt received by

the other MBI equity holders as part of the amendment.

Based on currently available information, if the closing of a

call option exercise or put option exercise occurs on October 1,

2026, Cable One estimates that (i) the purchase price payable by

Cable One will range between approximately $410 million and $550

million and (ii) MBI’s total net indebtedness that will be

outstanding at the time it becomes wholly-owned by Cable One will

be approximately $845 million to $895 million. These estimates are

based on MBI’s past performance and current forecasts and are

subject to numerous assumptions and risks including, without

limitation, factors that could impact MBI’s performance, such as

competition, economic conditions, operating performance and other

factors referenced below under “Cautionary Statement Regarding

Forward-Looking Statements”. If any of those underlying assumptions

prove incorrect, or if any of those risks materialize, the actual

purchase price payable by Cable One upon a call option exercise or

put option exercise and the amount of MBI’s indebtedness

outstanding at that time may differ from the estimated amounts

described above.

Cravath, Swaine & Moore LLP acted as legal advisor, and

Centerview Partners LLC acted as financial advisor to Cable One on

the amended partnership transaction.

About Cable One

Cable One, Inc. (NYSE:CABO) is a leading broadband

communications provider delivering exceptional service and enabling

more than 1 million residential and business customers across 24

states to thrive and stay connected to what matters most. Through

Sparklight® and the associated Cable One family of brands, we're

not just shaping the future of connectivity–we're transforming it

with a commitment to innovation, reliability and customer

experience at our core.

Our robust infrastructure and cutting-edge technology don’t just

keep our customers connected; they help drive progress in

education, business and everyday life. We’re dedicated to bridging

the digital divide, empowering our communities and fostering a more

connected world. When our customers choose Cable One, they are

choosing a team that is always working for them–one that believes

in the relentless pursuit of reliability, because being a trusted

neighbor isn’t just what we do–it’s who we are.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Actual results may differ materially from those expressed or

implied by these statements. You can generally identify

forward-looking statements by the words “anticipate,” “believe,”

“can,” “continue,” “could,” “estimate,” “expect,” “forecast,”

“goal,” “intend,” “may,” “might,” “objective,” “outlook,” “plan,”

“potential,” “predict,” “projection,” “seek,” “should,” “target,”

“trend,” “will,” “would” or the negative version of these words or

other comparable words. Any statements regarding expectations and

opportunities related to MBI, Cable One’s future net leverage

ratio, the related put right and call right, the amounts payable

upon the exercise of those rights and any other statements that are

not historical facts are forward-looking statements. Such

forward-looking statements are subject to various risks,

uncertainties, assumptions, or changes in circumstances that are

difficult to predict or quantify. Accordingly, there are or will be

important factors that could cause actual outcomes or results to

differ materially from those indicated in these statements. These

factors include, but are not limited to, the factors described

under “Risk Factors” in Cable One’s Amendment No.1 to its Annual

Report on Form 10-K/A for the period ended December 31, 2023 and

its other filings with the Securities and Exchange Commission, and

uncertainties, assumptions and changes in circumstances that may

cause Cable One’s and/or MBI’s actual results, performance or

achievements to differ materially from those expressed or implied

in any forward-looking statement. Each forward-looking statement

contained herein speaks only as of the date of this press release,

and Cable One undertakes no obligation to update or revise any

forward-looking statements whether as a result of new information,

future developments or otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241219790728/en/

Trish Niemann Vice President, Communications Strategy

patricia.niemann@cableone.biz Todd Koetje CFO

investor_relations@cableone.biz

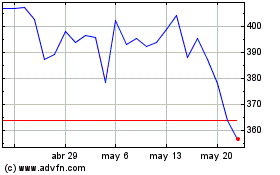

Cable One (NYSE:CABO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Cable One (NYSE:CABO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024