Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

29 Julio 2024 - 4:06PM

Edgar (US Regulatory)

|

|

|

| Supplementing the Preliminary Prospectus |

|

Filed Pursuant to Rule 433 |

| Supplement dated July 29, 2024 |

|

Registration Statement No. 333-260091 |

| (To Prospectus dated October 6, 2021) |

|

and 333-260091-03 |

$1,300,000,000

Chubb INA Holdings LLC

$700,000,000 4.650% Senior Notes due 2029

$600,000,000 5.000% Senior Notes due 2034

Each Fully and Unconditionally Guaranteed by

Chubb Limited

Pricing

Term Sheet

July 29, 2024

|

|

|

| Issuer: |

|

Chubb INA Holdings LLC |

|

|

| Guarantor: |

|

Chubb Limited |

|

|

| Ratings (Moody’s / S&P / Fitch)(1): |

|

A3 (Positive) / A (Stable) / A (Stable) |

|

|

| Offering Format: |

|

SEC Registered |

|

|

| Security Type: |

|

Senior Unsecured Notes |

|

|

| Description of Securities: |

|

4.650% Senior Notes due 2029 (the “2029 Notes) and 5.000% Senior Notes due 2034 (the “2034 Notes” and, together with the 2029 Notes, the “Notes”). The 2034 Notes will constitute a further issuance, and will

be consolidated and form a single series with, of the 5.000% Senior Notes due 2034, of which $1,000,000,000 aggregate principal amount was issued by the Issuer on March 7, 2024 (the “Existing 2034 Notes”). The terms of the 2034 Notes,

other than their issue date and issue price, will be identical to the terms of the Existing 2034 Notes. Upon settlement, the 2034 Notes will have the same CUSIP number as, and will trade interchangeably with, the Existing 2034 Notes. Immediately

after giving effect to the issuance of the 2034 Notes offered hereby, the Issuer will have $1,600,000,000 aggregate principal amount of 5.000% Senior Notes due 2034 outstanding. |

|

|

| Pricing Date: |

|

July 29, 2024 |

|

|

| Settlement Date(2): |

|

July 31, 2024 (T+2) |

|

|

| Maturity Date: |

|

2029 Notes: August 15, 2029 2034 Notes:

March 15, 2034 |

|

|

| Aggregate Principal Amount: |

|

2029 Notes: $700,000,000 2034 Notes:

$600,000,000. Immediately after giving effect to the issuance of the 2034 Notes offered hereby, the Issuer will have $1,600,000,000 aggregate principal amount of 5.000% Senior Notes due 2034

outstanding. |

|

|

|

|

|

|

|

| Public Offering Price: |

|

2029 Notes: 99.904% of the principal amount, plus accrued interest from, and including, July 31, 2024, if settlement occurs

after that date 2034 Notes: 100.281% of the principal amount, plus accrued interest on the 2034 Notes from, and including, March 7, 2024 |

|

|

| Accrued Interest on the 2034 Notes Payable to the Issuer: |

|

$12,000,000 accrued interest from, and including, March 7, 2024, to, but excluding, the issue date of the 2034 Notes (which is expected to be July 31, 2024) |

|

|

| Coupon (Interest Rate): |

|

2029 Notes: 4.650% 2034 Notes:

5.000% |

|

|

| Interest Payment Dates: |

|

2029 Notes: Semi-annually on February 15 and August 15, commencing February 15, 2025 (long first interest

period) 2034 Notes: Semi-annually on March 15 and September 15, commencing September 15, 2024 |

|

|

| Benchmark Treasury: |

|

2029 Notes: UST 4.000% due July 31, 2029

2034 Notes: UST 4.375% due May 15, 2034 |

|

|

| Benchmark Treasury Price / Yield: |

|

2029 Notes: 99-213⁄4 / 4.071% 2034 Notes: 101-17 / 4.182% |

|

|

| Spread to Benchmark Treasury: |

|

2029 Notes: +60 basis points 2034

Notes: +78 basis points |

|

|

| Yield to Maturity: |

|

2029 Notes: 4.671% 2034 Notes:

4.962% |

|

|

| Optional Redemption: |

|

In each case, as described in the Preliminary Prospectus Supplement |

|

|

|

|

|

|

2029 Notes |

|

• |

|

Make-Whole Call prior to July 15, 2029 (T

+ 15 basis points) |

|

|

|

|

• |

|

Par Call on or after July 15, 2029 |

|

|

|

|

|

|

2034 Notes |

|

• |

|

Make-Whole Call prior to December 15, 2033

(T + 15 basis points) |

|

|

|

|

• |

|

Par Call on or after December 15, 2033 |

|

|

| CUSIP/ISIN: |

|

2029 Notes: 171239AL0 / US171239AL07

2034 Notes: 171239AK2 / US171239AK24 |

|

|

| Joint Book-Running Managers: |

|

Wells Fargo Securities, LLC

Barclays Capital Inc. Citigroup Global Markets Inc.

Goldman Sachs & Co. LLC HSBC Securities (USA) Inc.

RBC Capital Markets, LLC UBS Securities

LLC |

|

|

|

| Co-Managers: |

|

ANZ Securities, Inc. BNP Paribas Securities

Corp. MUFG Securities Americas Inc. BofA Securities, Inc.

BNY Mellon Capital Markets, LLC Drexel Hamilton, LLC

ING Financial Markets LLC J.P. Morgan Securities LLC

PNC Capital Markets LLC Scotia Capital (USA) Inc.

Standard Chartered Bank |

| (1) |

Note: A security rating is not a recommendation to buy, sell or hold securities and should be evaluated

independently of any other rating. Each rating is subject to revision or withdrawal at any time by the assigning rating organization. |

| (2) |

It is expected that delivery of the notes will be made against payment therefor on or about July 31,

2024, which is the second business day following the date hereof. Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in one

business day unless the parties to that trade expressly agree otherwise. Accordingly, purchasers who wish to trade the notes on any date prior to the first business day before delivery will be required, by virtue of the fact that the notes initially

will settle in T+2, to specify an alternative settlement cycle at the time of any such trade to prevent failed settlement. Purchasers of the notes who wish to trade the notes prior to their date of delivery hereunder should consult their own

advisors. |

The issuer and the guarantor have filed a registration statement (including a prospectus) with the SEC for the

offerings to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer or the guarantor has filed with the SEC for more complete information about the issuer,

the guarantor and these offerings. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in these offerings will arrange to send you the

prospectus if you request it by calling Wells Fargo Securities, LLC at 1-800-645-3751, Barclays Capital Inc. at 1-888-603-5847 and Citigroup Global Markets Inc. at 1-800-831-9146.

This Pricing Term Sheet is not a prospectus for the purposes of Regulation (EU)

2017/1129, including as the same forms part of domestic law in the United Kingdom by virtue of the European Union (Withdrawal) Act 2018, as amended by the European Union (Withdrawal Agreement) Act 2020.

No PRIIPs or UK PRIIPs KID – No PRIIPs or UK PRIIPs key information document (KID) has been prepared as not available to retail in EEA or UK.

In the UK, this Pricing Term Sheet and any other document or materials relating to the issue of the Notes offered hereby is being distributed only to and is

directed only at: (i) persons who are “investment professionals” falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended, the “Order”), (ii) high net worth

companies, unincorporated associations and other bodies within the categories described in Article 49(2)(a) to (d) of the Order and (iii) any other persons to whom an invitation or

inducement to engage in investment activity (within the meaning of Section 21 of the United Kingdom’s Financial Services and Markets Act 2000, as amended (the “FSMA”)) in

connection with the issue or sale of the Notes may otherwise lawfully be communicated or caused to be communicated (all such persons together being referred to as “relevant persons”). Any person who is not a relevant person should not act

or rely on this Pricing Term Sheet or any of its contents. Any investment or investment activity to which this Pricing Term Sheet relates is available only to relevant persons and will be engaged in only with relevant persons.

Any disclaimers or notices that may appear on this Pricing Term Sheet below the text of this legend are not applicable to this Pricing Term Sheet and

should be disregarded. Such disclaimers may have been electronically generated as a result of this Pricing Term Sheet being sent via, or posted on, Bloomberg or another electronic mail system.

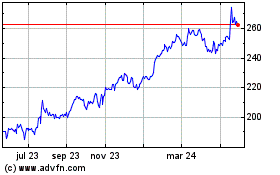

DBA Chubb (NYSE:CB)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

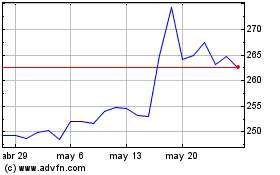

DBA Chubb (NYSE:CB)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024