Current Report Filing (8-k)

04 Abril 2023 - 3:31PM

Edgar (US Regulatory)

0001836176false0001836176us-gaap:CommonClassAMember2023-03-292023-03-2900018361762023-03-292023-03-290001836176fath:ClassACommonUnitsMember2023-03-292023-03-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 29, 2023

FATHOM DIGITAL MANUFACTURING CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware |

|

001-39994 |

|

98-1571400 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1050 Walnut Ridge Drive

Hartland, WI 53029

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (262) 367-8254

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

Class A common stock, par value $0.0001 per share |

|

FATH |

|

NYSE |

Warrants to purchase Class A common stock |

|

FATH.WS |

|

NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

er next two years Expanded mid-volume production of existing program $1.7 million in 2021; expect $4-$8 million in 2022 orders Prototype with mid-volume production follow-on $4.5 million over three-month period New cross-sell of sheet metal low-volume production $450k in 2021; expect over $1.5 million in 2022 orders Prototype & low-volume production Global healthcare company Global semiconductor company Disruptive electric vehicle manufacturer Global leader in mobile robotics 1 2 3 4 5 6 Global leader in gas measurement instruments and technologies Leading subsea technology company $550K production order Expansion to higher volume production of existing program New Strategic Accounts Existing Strategic Accounts

Statement (preliminary unaudited) Repor

|

|

Item 3.01. |

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Tranfer of Listing. |

On March 29, 2023, Fathom Digital Manufacturing Corporation (the “Company”) was notified by the New York Stock Exchange (the “NYSE”) that the average closing price of the Company’s Class A common stock, par value $0.0001 per share (the “Common Stock”), over the prior 30 consecutive trading day period was below $1.00 per share, which is the minimum average closing price per share required to maintain listing on the NYSE under Section 802.01C of the NYSE Listed Company Manual (“Section 802.01C”).

Under Section 802.01C, the Company has a period of six months following the receipt of the notice to regain compliance with the minimum share price requirement, or until the Company’s next annual meeting of stockholders if stockholder approval is required to cure the share price non-compliance, as would be the case to effectuate a reverse stock split. The Company can regain compliance at any time during the six-month cure period if on the last trading day of any calendar month during the cure period, the Common Stock has (i) a closing price of at least $1.00 per share and (ii) an average closing price of at least $1.00 per share over the 30-trading day period ending on the last trading day of such month.

As required by the NYSE, the Company intends to timely respond to the NYSE with respect to its intent to cure the deficiency to regain compliance with the price criteria.

The notice has no immediate impact on the listing of the Common Stock, which will continue to be listed and traded on the NYSE during this period, subject to the Company’s compliance with the other continued listing requirements of the NYSE. Failure to satisfy the conditions of the cure period or to maintain other listing requirements could lead to a delisting.

|

|

Item 7.01. |

Regulation FD Disclosure |

As required by Section 802.01C of the NYSE Listed Company Manual, the Company issued a press release on April 4, 2023, announcing that it had received the notice of noncompliance with the NYSE’s continued listing standard. A copy of the press release is furnished herewith as Exhibit 99.1.

In accordance with General Instruction B.2 of Form 8-K, the information contained in Item 2.02 of this Current Report and in Exhibit 99.1 is being furnished and shall not be deemed “filed” with the Securities and Exchange Commission (the “SEC”) for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section and will not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing.

Cautionary Statement Regarding Forward-looking Statements

Certain statements in this Current Report on Form 8-K constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results to be materially different from any future results expressed or implied by such forward-looking statements. Any statements that refer to or implicate future events are forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. Risks and uncertainties include the Company’s ability to regain compliance with the continued listing criteria of the NYSE within the applicable cure period and continue to comply with applicable listing standards of the NYSE; and other factors set forth under “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 as well as Fathom's other filings with the SEC. You are cautioned not to place undue reliance on these forward-looking statements. The Company does not undertake any obligation to publicly update or revise any forward-looking statements because of new information, future events or otherwise.

|

|

Item 9.01. |

Financial Statement and Exhibits |

(d) Exhibits.

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

FATHOM DIGITAL MANUFACTURING CORPORATION |

|

|

By: |

|

/s/ Mark Frost |

Name: |

|

Mark Frost |

Title: |

|

Chief Financial Officer |

Date: April 4, 2023

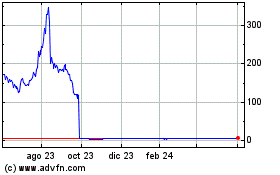

Fathom Digital Manufactu... (NYSE:FATH)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

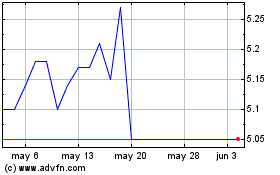

Fathom Digital Manufactu... (NYSE:FATH)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024