Forestar Group Inc. (“Forestar”) (NYSE: FOR), a leading national

residential lot developer, today reported financial results for its

first fiscal quarter ended December 31, 2023.

Fiscal 2024 First Quarter Highlights All comparisons are

year-over-year

- Net income increased 84% to $38.2 million or $0.76 per diluted

share

- Pre-tax income increased 84% to $51.2 million

- Pre-tax profit margin improved 380 basis points to 16.7%

- Consolidated revenues increased 41% to $305.9 million

- Residential lots sold increased 39% to 3,150 lots

- Owned and controlled 82,400 lots

- Return on equity of 14.1% for the trailing twelve months ended

December 31, 2023

- Book value per share increased 15% to $28.21

- Net debt to total capital ratio improved to 14.9%

Financial Results Net income for the first quarter of

fiscal 2024 increased 84% to $38.2 million, or $0.76 per diluted

share, compared to $20.8 million, or $0.42 per diluted share, in

the same quarter of fiscal 2023. Pre-tax income for the quarter

increased 84% to $51.2 million from $27.9 million in the same

quarter of fiscal 2023. Revenues for the quarter increased 41% to

$305.9 million from $216.7 million in the same quarter of fiscal

2023.

The Company’s return on equity was 14.1% for the trailing twelve

months ended December 31, 2023. Return on equity is calculated as

net income for the trailing twelve months divided by average

stockholders’ equity, where average stockholders’ equity is the sum

of ending stockholders’ equity balances of the trailing five

quarters divided by five.

Operational Results Lots sold during the first quarter

increased 39% to 3,150 lots compared to 2,263 lots in the same

quarter of fiscal 2023. During the first quarter of fiscal 2024,

Forestar sold 316 lots to customers other than D.R. Horton, Inc.

(“D.R. Horton”), compared to 169 lots in the prior year quarter. In

the first quarter of fiscal 2024, lots sold to customers other than

D.R. Horton included 124 lots that were sold to a lot banker who

expects to sell those lots to D.R. Horton at a future date.

The Company’s lot position at December 31, 2023 was 82,400 lots,

of which 55,400 were owned and 27,000 were controlled through land

and lot purchase contracts. Lots owned at December 31, 2023

included 7,300 that were fully developed. Of the Company’s owned

lot position at December 31, 2023, 16,700 lots, or 30%, were under

contract to be sold, representing approximately $1.6 billion of

future revenue. Another 17,500 lots, or 32%, of the Company’s owned

lots were subject to a right of first offer to D.R. Horton based on

executed purchase and sale agreements at December 31, 2023.

Capital Structure, Leverage and Liquidity Forestar ended

the quarter with $458.9 million of unrestricted cash and $385.7

million of available borrowing capacity on its senior unsecured

revolving credit facility for total liquidity of $844.6 million.

Debt at December 31, 2023 totaled $705.3 million, with no senior

note maturities until fiscal 2026. The Company’s net debt to total

capital ratio at the end of the quarter was 14.9%. Net debt to

total capital consists of debt net of unrestricted cash divided by

stockholders’ equity plus debt net of unrestricted cash.

Outlook Donald J. Tomnitz, Chairman of the Board, said,

“The Forestar team delivered solid results in the first quarter of

fiscal 2024, including an 84% increase in pre-tax income to $51.2

million, a 41% increase in revenues to $305.9 million and a 39%

increase in lots sold to 3,150 lots. Forestar delivered attractive

double-digit returns and strong profitability, with a pre-tax

profit margin of 16.7%.

“The supply of vacant developed lots, particularly at affordable

price points, continues to be constrained across most of the

country, and Forestar is uniquely positioned to take advantage of

the shortage of finished lots in the homebuilding industry. In

fiscal 2024, we still expect to deliver between 14,500 and 15,500

lots, generating $1.4 billion to $1.5 billion in revenue.

“We remain focused on growing our platform, turning our

inventory, maximizing returns and consolidating market share in the

highly fragmented lot development industry. Our strong balance

sheet and ample liquidity give us the flexibility to invest in land

opportunities that will drive our future growth. We will maintain

our disciplined approach when investing capital to enhance the

long-term value of Forestar.”

Conference Call and Webcast Details The Company will host

a conference call today (Tuesday, January 23) at 5:00 p.m. Eastern

Time. The dial-in number is 888-506-0062, the entry code is 156201

and the call will also be webcast from the Company’s website at

investor.forestar.com.

About Forestar Group Inc. Forestar Group Inc. is a

residential lot development company with operations in 57 markets

and 23 states. Based in Arlington, Texas, the Company delivered

more than 14,900 residential lots during the twelve-month period

ended December 31, 2023. Forestar is a majority-owned subsidiary of

D.R. Horton, the largest homebuilder by volume in the United States

since 2002.

Forward-Looking Statements Portions of this document may

constitute “forward-looking statements” as defined by the Private

Securities Litigation Reform Act of 1995. Although Forestar

believes any such statements are based on reasonable assumptions,

there is no assurance that actual outcomes will not be materially

different. All forward-looking statements are based upon

information available to Forestar on the date this release was

issued. Forestar does not undertake any obligation to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise.

Forward-looking statements in this release include the supply of

vacant developed lots, particularly at affordable price points,

continues to be constrained across most of the country; Forestar is

uniquely positioned to take advantage of the shortage of finished

lots in the homebuilding industry; and in fiscal 2024, we still

expect to deliver between 14,500 and 15,500 lots, generating $1.4

billion to $1.5 billion in revenue. Forward-looking statements also

include we remain focused on growing our platform, turning our

inventory, maximizing returns and consolidating market share in the

highly fragmented lot development industry; our strong balance

sheet and ample liquidity give us the flexibility to invest in land

opportunities that will drive our future growth; and we will

maintain our disciplined approach when investing capital to enhance

the long-term value of Forestar.

Factors that may cause the actual results to be materially

different from the future results expressed by the forward-looking

statements include, but are not limited to: the effect of D.R.

Horton’s controlling level of ownership on us and the holders of

our securities; our ability to realize the potential benefits of

the strategic relationship with D.R. Horton; the effect of our

strategic relationship with D.R. Horton on our ability to maintain

relationships with our customers; the cyclical nature of the

homebuilding and lot development industries and changes in

economic, real estate and other conditions; the impact of

significant inflation, higher interest rates or deflation; supply

shortages and other risks of acquiring land, construction materials

and skilled labor; the effects of public health issues such as a

major epidemic or pandemic, on the economy and our business; the

impacts of weather conditions and natural disasters; health and

safety incidents relating to our operations; our ability to obtain

or the availability of surety bonds to secure our performance

related to construction and development activities and the pricing

of bonds; the strength of our information technology systems and

the risk of cybersecurity breaches and our ability to satisfy

privacy and data protection laws and regulations; the impact of

governmental policies, laws or regulations and actions or

restrictions of regulatory agencies; our ability to achieve our

strategic initiatives; continuing liabilities related to assets

that have been sold; the cost and availability of property suitable

for residential lot development; general economic, market or

business conditions where our real estate activities are

concentrated; our dependence on relationships with national,

regional and local homebuilders; competitive conditions in our

industry; obtaining reimbursements and other payments from

governmental districts and other agencies and timing of such

payments; our ability to succeed in new markets; the conditions of

the capital markets and our ability to raise capital to fund

expected growth; our ability to manage and service our debt and

comply with our debt covenants, restrictions and limitations; the

volatility of the market price and trading volume of our common

stock; and our ability to hire and retain key personnel. Additional

information about issues that could lead to material changes in

performance is contained in Forestar’s annual report on Form 10-K

and its most recent quarterly report on Form 10-Q, both of which

are or will be filed with the Securities and Exchange

Commission.

FORESTAR GROUP INC.

Consolidated Balance

Sheets

(Unaudited)

December 31, 2023

September 30, 2023

(In millions, except share

data)

ASSETS

Cash and cash equivalents

$

458.9

$

616.0

Real estate

2,009.8

1,790.3

Investment in unconsolidated ventures

0.5

0.5

Property and equipment, net

5.8

5.9

Other assets

58.8

58.0

Total assets

$

2,533.8

$

2,470.7

LIABILITIES

Accounts payable

$

65.3

$

68.4

Accrued development costs

99.9

104.1

Earnest money on sales contracts

140.9

121.4

Deferred tax liability, net

50.2

50.7

Accrued expenses and other liabilities

63.4

61.2

Debt

705.3

695.0

Total liabilities

1,125.0

1,100.8

EQUITY

Common stock, par value $1.00 per share,

200,000,000 authorized shares,

49,909,713 and 49,903,713 shares issued

and outstanding at December 31,

2023 and September 30, 2023,

respectively

49.9

49.9

Additional paid-in capital

644.9

644.2

Retained earnings

713.0

674.8

Stockholders' equity

1,407.8

1,368.9

Noncontrolling interests

1.0

1.0

Total equity

1,408.8

1,369.9

Total liabilities and equity

$

2,533.8

$

2,470.7

FORESTAR GROUP INC.

Consolidated Statements of

Operations

(Unaudited)

Three Months Ended December

31,

2023

2022

(In millions, except per share

amounts)

Revenues

$

305.9

$

216.7

Cost of sales

233.0

169.2

Selling, general and administrative

expense

28.0

22.9

Gain on sale of assets

—

(1.6

)

Interest and other income

(6.3

)

(1.7

)

Income before income taxes

51.2

27.9

Income tax expense

13.0

7.1

Net income

$

38.2

$

20.8

Basic net income per common share

$

0.76

$

0.42

Weighted average number of common

shares

50.1

49.9

Diluted net income per common share

$

0.76

$

0.42

Adjusted weighted average number of common

shares

50.5

49.9

FORESTAR GROUP INC.

Revenues, Residential Lots

Sold and Lot Position

REVENUES

Three Months Ended December

31,

2023

2022

(In millions)

Residential lot sales:

Development projects

$

303.5

$

204.0

Decrease in contract liabilities

0.7

2.7

304.2

206.7

Deferred development projects

1.3

6.7

305.5

213.4

Tract sales and other

0.4

3.3

Total revenues

$

305.9

$

216.7

RESIDENTIAL LOTS SOLD

Three Months Ended December

31,

2023

2022

Development projects

3,150

2,263

Average sales price per lot (1)

$

96,400

$

90,100

LOT POSITION

December 31, 2023

September 30, 2023

Lots owned

55,400

52,400

Lots controlled under land and lot

purchase contracts

27,000

26,800

Total lots owned and controlled

82,400

79,200

Owned lots under contract to sell to D.R.

Horton

16,200

14,400

Owned lots under contract to customers

other than D.R. Horton

500

600

Total owned lots under contract

16,700

15,000

Owned lots subject to right of first offer

with D.R. Horton based on executed

purchase and sale agreements

17,500

17,000

Owned lots fully developed

7,300

6,400

_____________

(1)

Excludes lots sold from deferred

development projects and any impact from change in contract

liabilities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240123587338/en/

Katie Smith, 817-769-1860 Director of Finance & Investor

Relations InvestorRelations@forestar.com

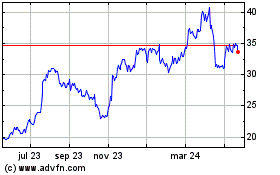

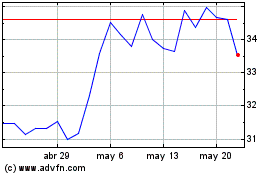

Forestar (NYSE:FOR)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Forestar (NYSE:FOR)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024