0001031203false00010312032024-10-012024-10-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 1, 2024

Group 1 Automotive, Inc.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-13461 | | 76-0506313 |

(State or other jurisdiction of

incorporation or organization) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

800 Gessner, Suite 500

Houston, Texas 77024

(Address of principal executive offices, including zip code)

Registrant's telephone number, including area code (713) 647-5700

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 40.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Ticker symbol(s) | | Name of exchange on which registered |

| Common stock, par value $0.01 per share | | GPI | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.¨

Item 8.01 Other Events.

On October 1, 2024, Group 1 Automotive, Inc. (“the Company”), announced the appointment of Mark Raban as Chief Executive Officer of Group 1 Automotive U.K.

A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

On October 1, 2024, the Company also announced the expansion of its U.K. operations with the acquisition of one BMW/MINI dealership located north of London in the county of Lincolnshire.

A copy of the press release is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | | | | | | | |

| Exhibit No. | | Description |

| | Press release of Group 1 Automotive, Inc., dated as of October 1, 2024. |

| | Press release of Group 1 Automotive, Inc., dated as of October 1, 2024. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | |

| Group 1 Automotive, Inc. |

| | | | | |

| Date: | | October 1, 2024 | | By: | | /s/ Gillian A. Hobson |

| | | | | | | Name: Gillian A. Hobson |

| | | | | | | Title: Senior Vice President |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Group 1 Automotive Appoints Mark Raban as CEO of U.K. Operations

Houston, TX, USA and London, England, U.K. - October 1, 2024 - Group 1 Automotive, Inc. (NYSE: GPI) (“Group 1” or the “Company”), a Fortune 250 automotive retailer with 260 dealerships located in the U.S. and U.K., announced the appointment of Mark Raban as Chief Executive Officer (“CEO”) of Group 1 Automotive U.K.

Raban brings more than 20 years of executive experience in automotive retail operations and finance to Group 1. In this new role, he will oversee the integration of the recently acquired Inchcape dealerships to drive strategic growth in the U.K. Leveraging the Company's expanded brand portfolio and presence, Raban will also focus on enhancing customer experience and reinforcing Group 1’s strong OEM partnerships.

“Mark is a proven leader with a history of success in the U.K. motor trade,” said Daryl Kenningham, Group 1’s President and CEO. “Following the transformative growth of our U.K. business, he will be instrumental in creating a high-performing culture among our team members and engaging customers across our expanded dealership network.”

Prior to joining Group 1, Raban progressed from Chief Financial Officer (“CFO”) to CEO at Lookers Motor Group, a dealership group in the U.K. and Ireland. Prior to joining Lookers, he served as CFO of Marshall Motor Holdings and held senior finance roles at companies such as Inchcape Retail, Selfridges, and Borders.

"I am excited to join the accomplished team at Group 1 during a pivotal moment for the organization and look forward to empowering our teams throughout the country,” said Raban. “By harnessing our combined strengths, we can drive operational excellence and customer-centric innovation. We have an opportunity to set the highest standard for automotive retailing in the U.K.”

Group 1 has operated in the U.K. since 2007. Today, the Company has 114 dealerships across the market and an extensive brand portfolio including Audi, BMW/MINI, Jaguar Land Rover, Lexus, Mercedes-Benz/smart, Porsche, Toyota, Volkswagen and Volkswagen Commercial Vehicles.

ABOUT GROUP 1 AUTOMOTIVE, INC.

Group 1 owns and operates 260 automotive dealerships, 338 franchises, and 44 collision centers in the United States and the United Kingdom that offer 35 brands of automobiles. Through its dealerships and omni-channel platform, the Company sells new and used cars and light trucks; arranges related vehicle financing; sells service and insurance contracts; provides automotive maintenance and repair services; and sells vehicle parts.

Group 1 discloses additional information about the Company, its business, and its results of operations at www.group1corp.com, www.group1auto.com, www.group1collision.com, www.acceleride.com, and www.facebook.com/group1auto.

SOURCE: Group 1 Automotive, Inc.

Investor contacts:

Terry Bratton

Manager, Investor Relations

Group 1 Automotive, Inc.

ir@group1auto.com

Media contacts:

Pete DeLongchamps

Senior Vice President, Manufacturer Relations, Financial Services and Public Affairs

Group 1 Automotive, Inc.

pdelongchamps@group1auto.com

or

Clint Woods

Pierpont Communications, Inc.

713-627-2223

cwoods@piercom.com

Exhibit 99.2

FOR IMMEDIATE RELEASE

Group 1 Automotive Announces the Acquisition of Soper of Lincoln BMW/MINI in the U.K.

•2024 YTD Acquired Revenues total $3.9 Billion

HOUSTON, TX, October 1, 2024 - Group 1 Automotive, Inc. (NYSE: GPI) (“Group 1” or the “Company”), a Fortune 250 automotive retailer with 260 dealerships located in the U.S. and U.K., today announced the expansion of its U.K. operations with the acquisition of Soper of Lincoln BMW/MINI located north of London in the county of Lincolnshire. This acquisition is expected to generate approximately $125 million in annual revenues.

Group 1’s Chief Executive Officer Daryl Kenningham stated, “We want to welcome our new teammates from Soper of Lincoln to the Group 1 family and are delighted to expand our operations with these great brands. Our strong relationship with the manufacturer and our experience in this market area make this a terrific addition to our U.K. operations.”

Group 1 has now acquired an estimated $3.9 billion of annual revenues in 2024, which follows $1.1 billion of acquired revenues in 2023.

ABOUT GROUP 1 AUTOMOTIVE, INC.

Group 1 owns and operates 260 automotive dealerships, 338 franchises, and 44 collision centers in the United States and the United Kingdom that offer 35 brands of automobiles. Through its dealerships and omni-channel platform, the Company sells new and used cars and light trucks; arranges related vehicle financing; sells service and insurance contracts; provides automotive maintenance and repair services; and sells vehicle parts.

Group 1 discloses additional information about the Company, its business, and its results of operations at www.group1corp.com, www.group1auto.com, www.group1collision.com, www.acceleride.com, and www.facebook.com/group1auto.

FORWARD-LOOKING STATEMENTS

This press release contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, which are statements related to future, not past, events and are based on our current expectations and assumptions regarding our business, the economy and other future conditions. In this context, the forward-looking statements often include statements regarding, our ability to realize the anticipated benefits of the acquisition and our future financial position following such acquisition, as well as guidance regarding the annualized revenues of recently completed acquisitions. These forward-looking statements often contain words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "should," "foresee," "may" or "will" and similar expressions. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. Any such forward-looking statements are not assurances of future performance and involve risks and uncertainties that may cause actual results to differ materially from those set forth in the statements. These risks and uncertainties include, among other things (a) general economic and business conditions, (b) the level of manufacturer incentives, (c) the future regulatory environment, (d) our ability to obtain an inventory of desirable new and used vehicles, (e) our relationship with our automobile manufacturers and the willingness of manufacturers to approve future acquisitions, (f) our cost of financing and the availability of credit for consumers, (g) our ability to complete acquisitions and dispositions, on a timely basis, if at all and the risks associated therewith, (h) our ability to realize the benefits expected from proposed acquisitions, including any anticipated cost reductions,(i) foreign exchange controls and currency fluctuations, (j) the armed conflicts in Ukraine and the Middle East, (k) the impacts of continued inflation and any potential global recession, (l) our ability to maintain sufficient liquidity to operate, (m) our ability to successfully integrate recent and future acquisitions, and (n) a material failure in or breach of our vendors' information technology systems and other cybersecurity incidents. For additional information regarding known material factors that could cause our actual results to differ from our projected results, please see our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise.

SOURCE: Group 1 Automotive, Inc.

Investor contacts:

Terry Bratton

Manager, Investor Relations

Group 1 Automotive, Inc.

ir@group1auto.com

Media contacts:

Pete DeLongchamps

Senior Vice President, Manufacturer Relations, Financial Services and Public Affairs

Group 1 Automotive, Inc.

pdelongchamps@group1auto.com

or

Clint Woods

Pierpont Communications, Inc.

713-627-2223

cwoods@piercom.com

v3.24.3

Cover

|

Oct. 01, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 01, 2024

|

| Entity Registrant Name |

Group 1 Automotive, Inc

|

| Entity Central Index Key |

0001031203

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-13461

|

| Entity Tax Identification Number |

76-0506313

|

| Entity Address, Address Line One |

800 Gessner

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77024

|

| City Area Code |

713

|

| Local Phone Number |

647-5700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

GPI

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

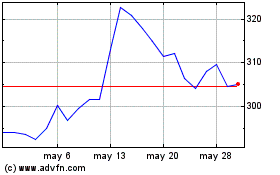

Group 1 Automotive (NYSE:GPI)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Group 1 Automotive (NYSE:GPI)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024