Helix Announces Redemption of Its 6.75% Convertible Senior Notes Due 2026

16 Enero 2024 - 7:00AM

Business Wire

Helix Energy Solutions Group, Inc. (NYSE: HLX) announced today

that it has delivered a notice to the trustee for its 6.75%

Convertible Senior Notes due 2026 (the “Notes”) under which it has

called all of the outstanding Notes for redemption on March 20,

2024 (the “Redemption Date”). The redemption price for the Notes is

equal to 100% of the principal amount of the Notes to be redeemed,

plus accrued and unpaid interest, if any, to, but excluding, the

Redemption Date, plus the applicable make-whole premium. As of

January 16, 2024, the aggregate principal amount of the Notes

outstanding is $39,983,000.

The Notes may be converted at any time before the close of

business on March 18, 2024, the second business day immediately

preceding the Redemption Date, unless the Company fails to pay the

redemption price. The Notes would be convertible into shares of

Helix’s common stock at a rate of 143.3795 shares per $1,000

principal amount of the Notes. However, Helix has elected to

deliver cash to satisfy its entire conversion obligation upon any

conversion of the Notes. Holders who wish to convert their Notes

must comply with the requirements set forth in the Notes and

related indenture.

The address of The Bank of New York Mellon Trust Company, N.A.,

which is acting as the paying agent and the conversion agent, is as

follows:

By First Class / Registered /

Certified Mail

By Express / Overnight

Delivery

By Hand or In Person

The Bank of New York Mellon Trust

Company N.A.

c/o BNY Mellon Corp Trust

2001 Bryan Street 10th Floor

Dallas, Texas 75201

Attention:

Transfers/Redemptions

The Bank of New York Mellon Trust

Company N.A.

c/o BNY Mellon Corp Trust

2001 Bryan Street 10th Floor

Dallas, Texas 75201

Attention:

Transfers/Redemptions

The Bank of New York Mellon Trust

Company N.A.

c/o BNY Mellon Corp Trust

2001 Bryan Street 10th Floor

Dallas, Texas 75201

Attention:

Transfers/Redemptions

The Company also intends to enter into unwind agreements with

financial institutions to terminate the remaining portions of the

capped call transactions entered into in connection with the

issuance of the Notes. Under such unwind agreements, the Company

currently expects such financial institution would deliver to the

Company cash in respect of the remaining portions of the

transactions being early terminated.

This press release shall not constitute a notice of redemption

with respect to or an offer to purchase or sell (or the

solicitation of an offer to purchase or sell) any securities, nor

shall there be any sale of any securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About Helix

Helix Energy Solutions Group, Inc., headquartered in Houston,

Texas, is an international offshore energy services company that

provides specialty services to the offshore energy industry, with a

focus on well intervention, robotics and full field decommissioning

operations. Its services are centered on a three-legged business

model well positioned for a global energy transition by maximizing

production of existing oil and gas reserves, decommissioning

end-of-life oil and gas fields and supporting renewable energy

developments.

Forward-Looking Statements

This press release contains forward-looking statements that

involve risks, uncertainties and assumptions that could cause our

results to differ materially from those expressed or implied by

such forward-looking statements. All statements, other than

statements of historical fact, are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995, including, without limitation, any statements regarding

the redemption, the conversion consideration, the capped call

unwind agreements and any impact on our financial and operating

results and estimates; any statements regarding our strategy; any

statements regarding our business model or the global energy

transition; and any statements of assumptions underlying any of the

foregoing. The forward-looking statements are subject to a number

of known and unknown risks, uncertainties and other factors that

could cause results to differ materially from those in the

forward-looking statements, including but not limited to the terms

of the redemption; actions by governments, customers, suppliers and

partners with respect thereto; market conditions; results from

acquired properties; demand for our services; the performance of

contracts by suppliers, customers and partners; actions by

governmental and regulatory authorities; operating hazards and

delays, which includes delays in delivery, chartering or customer

acceptance of assets or terms of their acceptance; our ultimate

ability to realize current backlog; employee management issues;

complexities of global political and economic developments;

geologic risks; volatility of oil and gas prices and other risks

described from time to time in our reports filed with the

Securities and Exchange Commission (the “SEC”), including Helix’s

most recently filed Annual Report on Form 10-K and in Helix’s other

filings with the SEC, which are available free of charge on the

SEC’s website at www.sec.gov. We assume no obligation and do not

intend to update these forward-looking statements, which speak only

as of their respective dates, except as required by the securities

laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240116748151/en/

Erik Staffeldt Executive Vice President and CFO email:

estaffeldt@helixesg.com Ph: 281-618-0465

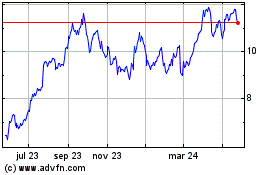

Helix Energy Solutions (NYSE:HLX)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

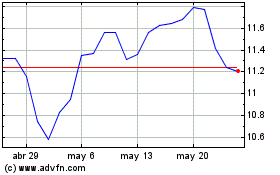

Helix Energy Solutions (NYSE:HLX)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024