0001173514false00011735142024-08-062024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_______________________________________________________________________________________________________________________________________________________________________________________________________

FORM 8-K | | |

| CURRENT REPORT |

| Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934 |

|

| | | | | | | | |

| Date of Report (Date of earliest event reported): | August 6, 2024 |

| | |

| HYSTER-YALE, INC. |

| (Exact name of registrant as specified in its charter) |

| | |

| Delaware | 000-54799 | 31-1637659 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

| 5875 Landerbrook Drive, Suite 300 | | |

| Cleveland | (440) | |

| OH | 449-9600 | 44124-4069 |

| (Address of principal executive offices) | (Registrant's telephone number, including area code) | (Zip code) |

| N/A | |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, $0.01 par value per share | HY | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 6, 2024, Hyster-Yale, Inc. (the “Company”) issued a press release announcing the unaudited financial results for the three and six months ended June 30, 2024, a copy of which is attached as Exhibit 99 to this Current Report on Form 8-K.

The information set forth in Item 2.02 of this Current Report on Form 8-K and the information attached hereto are being furnished by the Company pursuant to Item 2.02 of Form 8-K, insofar as they disclose historical information regarding the Company's results of operations.

The information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99, shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

As described in Item 2.02 of this Current Report on Form 8-K, the following Exhibit is furnished as part of this Current Report on Form 8-K.

| | | | | | | | |

| (d) Exhibits | | |

| | |

| 99 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| Date: | August 6, 2024 | | HYSTER-YALE, INC. |

| | | |

| | By: | /s/ Dena R. McKee |

| | | Dena R. McKee |

| | | Title: Vice President, Controller and Chief Accounting Officer |

| | | |

| | | | | | | | |

NEWS RELEASE | | 5875 Landerbrook Drive, Suite 300 • Cleveland, Ohio 44124-4069 |

| Tel. (440) 449-9600 • Fax (440) 449-9577 |

| | |

| FOR FURTHER INFORMATION, CONTACT: | | |

| Christina Kmetko | | For Immediate Release |

| (440) 449-9589 | | Tuesday, August 6, 2024 |

| | |

HYSTER-YALE

ANNOUNCES SECOND QUARTER 2024 RESULTS

Q2 2024 Consolidated Highlights:

•Continued consolidated revenue growth of more than 7% over Q2 2023

•Operating profit of $95.6 million, up 63% from Q2 2023, and ahead of expectations

•Operating profit margin of 8.2%, up from 5.4% in Q2 2023

•Net income of $63.3 million, up 65%, from Q2 2023

Cleveland, Ohio, August 6, 2024: Hyster-Yale, Inc. (NYSE: HY) reported the following consolidated results for the three months ended June 30, 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| ($ in millions except per share amounts) | 6/30/24 | | 6/30/23 | | % Change | | 3/31/24 | | % Change |

| Revenues | $1,168.1 | | $1,090.6 | | 7% | | $1,056.5 | | 11% |

Operating Profit | $95.6 | | $58.8 | | 63% | | $83.8 | | 14% |

Net Income | $63.3 | | $38.3 | | 65% | | $51.5 | | 23% |

Diluted Earnings per Share | $3.58 | | $2.21 | | 62% | | $2.93 | | 22% |

Effective May 31, 2024, the Company changed its name to Hyster-Yale, Inc. and changed the name of its Lift Truck business to Hyster-Yale Materials Handling, Inc.

Lift Truck Business Results

Revenues by geographic segment were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions) | Q2 2024 | | Q2 2023 | | % Change | | Q1 2024 | | % Change | |

| Revenues | $1,118.0 | | $1,038.7 | | 8% | | $1,006.8 | | 11% | |

Americas(1) | $881.5 | | $788.5 | | 12% | | $769.7 | | 15% | |

EMEA(1) | $187.8 | | $200.6 | | (6)% | | $199.4 | | (6)% | |

JAPIC(1) | $48.7 | | $49.6 | | (2)% | | $37.7 | | 29% | |

(1) The Americas segment includes the North America, Latin America and Brazil markets, EMEA includes operations in the Europe, Middle East and Africa markets, and JAPIC includes operations in the Asia and Pacific markets, including China.

Lift Truck revenues were 8% higher than Q2 2023 due to higher average sales prices and the favorable impact of reduced dealer incentive programs. Improved Americas and EMEA sales mix partly offset lower unit and parts volumes principally in EMEA.

•Average lift truck sales prices increased 23% year-over-year largely due to carryover pricing from previously implemented price increases.

•Sales mix improved compared to prior year mainly due to increased sales of high-value options on Class 5 internal combustion engine trucks in the Americas.

•EMEA unit volume declined year-over-year primarily due to lower production rates as a result of reduced market demand compared to the prior year and lower backlog levels.

Gross profit and operating profit (loss) by geographic segment were as follows: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions) | Q2 2024 | | Q2 2023 | | % Change | | Q1 2024 | | % Change |

| Gross Profit | $239.4 | | $177.0 | | 35% | | $215.6 | | 11% |

| Americas | $202.1 | | $143.4 | | 41% | | $178.1 | | 13% |

| EMEA | $32.5 | | $27.1 | | 20% | | $33.9 | | (4)% |

| JAPIC | $4.8 | | $6.5 | | (26)% | | $3.6 | | 33% |

| Operating Profit (Loss) | $103.1 | | $62.5 | | 65% | | $89.3 | | 15% |

| Americas | $104.0 | | $65.2 | | 60% | | $89.6 | | 16% |

| EMEA | $4.8 | | $1.1 | | 336% | | $5.2 | | (8)% |

| JAPIC | $(5.7) | | $(3.8) | | (50)% | | $(5.5) | | 4% |

Q2 2024 operating profit increased 65% year-over-year, with operating profit margin moving higher by 320 basis points to 9.2%. This improvement was primarily due to higher unit margins. Increased operating expenses, including employee-related costs, partly offset this benefit.

•Globally, in Q2 2024 more units were sold at the latest and highest price increase levels than those sold in Q2 2023.

•Significant increase in product margins was led by a strong Americas price-to-cost ratio.

•Higher EMEA margins were primarily due to a mix shift to higher-priced/higher-margin Class 5 internal combustion engine trucks, including Big Trucks.

•Lower year-over-year JAPIC operating profit was primarily due to a mix shift to lower-margin trucks, reduced unit volumes and increased freight expense.

Bolzoni Results | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions) | Q2 2024 | | Q2 2023 | | % Change | | Q1 2024 | | % Change |

| Revenues | $102.4 | | $96.6 | | 6% | | $96.2 | | 6% |

| Gross Profit | $22.4 | | $22.6 | | (1)% | | $21.8 | | 3% |

| Operating Profit | $4.0 | | $5.4 | | (26)% | | $3.3 | | 21% |

Bolzoni's revenues increased 6% over both the prior year and Q1 2024 primarily due to higher sales volumes. The increased sales volumes allowed Bolzoni's manufacturing plants to run more efficiently, thus lowering costs. Gross profit was similar to the prior year as increased material and freight costs offset the favorable effect of the higher volumes and lower manufacturing costs. Operating profit declined compared to the prior year mainly due to higher warranty and employee-related costs. Both profit measures improved sequentially as a result of an increase in sales of higher-margin attachments.

Nuvera Results | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions) | Q2 2024 | | Q2 2023 | | % Change | | Q1 2024 | | % Change |

| Revenues | $0.2 | | $1.0 | | (80)% | | $0.5 | | (60)% |

| Gross Profit (Loss) | $(2.5) | | $(1.8) | | (39)% | | $(2.3) | | (9)% |

| Operating Loss | $(11.5) | | $(9.2) | | (25)% | | $(9.4) | | (22)% |

Nuvera remains focused on increasing its sales pipeline for 45kW and 60kW engines. The hydrogen fuel cell industry is facing slow customer adoption due to ongoing hydrogen supply constraints, and to delayed heavy-duty electric vehicle fuel cell product development programs. Despite a strong demonstration channel, these industry constraints have delayed Nuvera's bookings and reduced its overall engine shipments. As a result, Nuvera's Q2 2024 revenues decreased to $0.2 million from $1.0 million in Q2 2023. The operating loss was above 2023's largely due to increased product development and lease costs.

Income Tax Expense

Q2 2024's $90 million of income before taxes increased 77% compared to the prior year, while net income increased 65%. The effective income tax rate of 29% in Q2 2024 was higher than the 24% in Q2 2023. This increase is primarily due to the continued capitalization of research and development expenditures for U.S. tax purposes combined with the Company's inability to record deferred tax assets on its balance sheet due to its U.S. valuation allowance position.

Balance Sheet and Liquidity

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions) | June 30, 2024 | | June 30, 2023 | | % Change | | March 31, 2024 | | % Change |

| Debt | $501.9 | | $542.3 | | 7% | | $474.8 | | (6)% |

| Cash | 66.5 | | 65.7 | | 1% | | 62.2 | | 7% |

| Net Debt | $435.4 | | $476.6 | | 9% | | $412.6 | | (6)% |

Debt-to-total Capital | 51% | | 64% | | — | | 53% | | — |

The Company's financial leverage continued to improve in Q2 2024.

•Debt-to-total capital ratio of 51% improved 200 basis points from the March 31, 2024 level primarily as a result of higher earnings.

•Net debt improved by 9% compared to June 30, 2023, but increased compared to March 31, 2024, as a result of higher debt levels required for working capital.

•Unused borrowing capacity of $217 million declined compared to $269 million as of March 31, 2024, primarily due to the higher debt level and lower available borrowing capacity due to the expiration of a temporary increase to the Company’s asset-based lending facility initially secured in mid-2023.

The Company continues to focus on decreasing working capital, especially through inventory reductions.

•Inventory decreased 6% and 4% from Q1 2024 and Q2 2023 levels, respectively.

•Finished goods and raw materials inventories each decreased compared to Q1 2024.

•Working capital at June 30, 2024 represented 18.3% of sales, improving from 18.5% at Q2 2023 and 18.7% at Q1 2024.

Outlook

Lift Truck Business

The Company is focused on delivering optimal solutions to its broad customer base, including lift trucks and advanced on-truck technologies, such as its innovative Operator Assist Systems (OAS). Together, these solutions provide customers with the right capabilities and functionality for their specific applications, while also increasing the unit sales value substantially. As a result of both Hyster-Yale's product line breadth and increasingly value-add technology solutions, per unit truck sales values can differ materially. Thus, aggregate unit data has become less meaningful. In this context, the Company will focus on total dollar values as its measure for bookings and backlog.

The Company estimates that the Q2 2024 global lift truck market was lower than prior year levels, with a significant decrease in the Americas market and a more moderate reduction in the EMEA market. The Industrial Truck Association (ITA) provides current North America market data for factory bookings, generally defined as orders placed directly with the manufacturer, which showed a 56% year-over-year decrease in Q2 2024. The reduced North America factory booking rates were expected after the highly elevated levels experienced during the pandemic and subsequent period of supply chain shortages. However, the decrease was steeper and earlier than anticipated. In effect, these recent, low factory bookings are quickly moving total average factory bookings back toward a normalized growth trend line. The Company currently expects below-trend North America factory bookings to continue into early 2025. During this period, it is expected that the below-trend booking levels will balance out the prior above-trend rates, returning the market to a normalized level.

Dollar-value Lift Truck bookings and backlog were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(In millions) | Q2 2024 | | Q2 2023 | | % Change | | Q1 2024 | | % Change |

| Unit Bookings $ Value | $380 | | $680 | | (44)% | | $520 | | (27)% |

| Unit Backlog $ Value | $2,560 | | $3,610 | | (29)% | | $3,060 | | (16)% |

| | | | | | | | | |

Consistent with these market factors, the Company's dollar-value factory bookings continued to decline quarter-over-quarter to $380 million in Q2 2024 from $680 million in Q2 2023 and $520 million in Q1 2024.

The Americas segment decline was most significant with Q2 2024 factory bookings of $230 million down 56% from prior year and 36% sequentially. While the Company increased its Americas market share in the first six months of 2024, this did not offset the steep market decline. To put 2024's North America factory bookings in context, the Company believes that recent factory booking declines are due to:

•Order cancellations by customers who no longer need previously placed orders due to lower than expected activity,

•Reduced lead times,

•Customer and dealer requests to delay shipments of current backlog orders to a time that better suits their needs, or

•Current retail bookings, orders placed through dealers with specific end-customer purchase orders, being fulfilled from existing, unshipped factory bookings or from current dealer stock levels.

Considering the Company's strong global backlog, including in the Americas, shipments are expected to continue at sound levels for the remainder of 2024. The Americas' few remaining open 2024 production slots are expected to be filled between August and December. This segment is working to extend its backlog by filling open 2025 production slots, largely in the second half of the year. The Company expects to continue increasing Americas' market share over the remainder of 2024 and into 2025. These expected gains are the result of the recently introduced 1 to 3.5-ton modular, scalable products reaching their full market potential, as well as additional modular, scalable products expected to be launched in the second half of 2024 and first half of 2025.

The market situation in the EMEA and JAPIC segments is similar to the Americas but much less pronounced. During the pandemic and supply chain disruption periods, factory orders in these regions increased more slowly than in the Americas. EMEA and JAPIC factory orders were $150 million in Q2 2024 compared to $160 million in both Q2 2023 and Q1 2024. EMEA and JAPIC market shares are expected to strengthen as production rates for the new 1 to 3.5-ton modular, scalable products ramps up. Share is expected to improve further as the new products begin to achieve their full potential, along with the launch of additional products later in 2024 and in 2025. Production slots in these regions are also largely filled for the balance of 2024, with some lines already in a strong backlog position for 2025.

The Company's current backlog should keep its global shipments generally in line with 2024 production expectations. However, certain lines, particularly in the JAPIC and EMEA lower value warehouse products, are expected to have lower shipments in the second half of 2024 compared to the first half. Global production levels may moderate in 2025 without market or share improvements above current expectations.

Over the past 18 months, the Company has benefited from strong pricing tailwinds and a significant order backlog, which led to product margins above the Company's targeted levels. Looking ahead, the Company is focused on maintaining competitively priced products at or above targeted margin levels. The Company expects to achieve its targeted booking margins through a combination of new model introductions, cost decreases and ongoing pricing discipline.

The combination of rising market share and new bookings, along with the seasonally lower Q3 production

levels and the Company’s $2.6 billion backlog, which is equal to 6 to 7 months of revenue at the current quarterly run rate, should help to support the business until market levels improve.

In this context, the Company expects continued year-over-year revenue growth and strong product margins in the second half of 2024 as higher-priced, higher-margin backlog units are shipped. Material and freight cost inflation is expected to somewhat temper the favorable second-half price-to-cost ratio. The combination of these factors and higher operating expenses are expected to reduce second-half operating profit modestly compared with the prior year. The Company is closely monitoring the effects of freight and material cost inflation and a weaker U.S. market and will quickly take any additional cost containment actions needed to help offset the negative impacts. Specifically, in Q3 2024, revenues are expected to increase compared to the prior year, while operating profit is expected to be comparable. Sequentially, third-quarter revenues and operating profit are expected to decrease from the strong second-quarter results due to normal business seasonality and modest impacts from freight cost inflation.

Bolzoni

Bolzoni expects second-half 2024 gross profit to increase compared to second-half 2023. Product margins are expected to improve, despite an expected revenue decline, as Bolzoni increases production of higher-margin attachments and phases out lower-margin legacy component sales to the Lift Truck business. Second-half 2024 operating profit is expected to increase year-over-year, with increased gross profits partly offset by higher operating expenses.

Nuvera

Nuvera remains focused on increasing customer product demonstrations and customer orders in second-half 2024. Shipments are expected to increase in the second half of the year, specifically Q4 2024, compared to second-half 2023, due to current customer orders and anticipated orders for Nuvera's new portable generator, which was introduced in May 2024. The combination of the higher sales and anticipated lower operating expenses is expected to lead to a lower second-half operating loss year-over-year.

Consolidated

Full-year 2024 results are expected to improve compared to the Company's prior outlook due to better-than-expected second quarter results and anticipated further financial improvements in the second half of the year. Second-half revenues should increase while operating profit is likely to moderate slightly compared to the same 2023 period. The Company expects lower interest and tax expense in the second half, year-over-year. As a result, second-half 2024 net income is anticipated to be generally comparable to strong prior year levels, with a modest third-quarter decline expected to be offset by a fourth-quarter improvement. The Company's effective tax rate is anticipated to be modestly higher than 2023, largely due to the capitalization of research and development expenses, but lower than previously anticipated due to a higher U.S. earnings base.

For the twelve-month period ended June 30, 2024, the Company achieved its 7% operating profit margin goal for the combined Lift Truck and Bolzoni businesses, and it achieved its consolidated goal for a greater than 20% return on total capital employed. These favorable results were due to the substantial post-pandemic backlog in the Lift Truck business and lower-than-anticipated cost inflation. The latter followed a sustained period of high inflation that resulted in multiple lift truck price increases. With markets returning to more normalized levels over time, results are likely to moderate in the 2024 second half from the robust first-half levels. As a result, the Company expects its return measures to moderate, but remain above pre-pandemic levels. However, over time, the Company expects its return measures to return to target levels and be sustainable as a result of its maturing strategic initiatives.

The Company continues to focus on reducing its financial leverage and improving its cash flows and expects further inventory reductions to decrease working capital. Capital expenditures are expected to be

$60 million in 2024, down from a Q1 2024 projection of $84 million. While substantial investments are anticipated, maintaining liquidity remains a priority. Overall, the Company expects 2024 cash flow from operations to increase significantly compared with 2023.

Long-Term Objectives

Hyster-Yale's vision is to transform the way the world moves materials from Port to Home. It strives to do this through two customer promises: providing optimized product solutions and exceptional customer care. Ongoing execution of established strategic initiatives and key projects are expected to help the Company fulfill these promises and achieve long-term revenue and operating profit growth rates above the material handling market's expected growth rates. The Company believes these actions will contribute to an increased and sustainable lift truck and attachment competitive advantage over time. In addition, the Company believes that Nuvera's revenues will increase significantly over future years, bringing additional value to Hyster-Yale's shareholders.

Further information regarding the Company's strategic initiatives can be found in the Company's Q2 2024 Investor Deck. This presentation, currently available on the Hyster-Yale website, elaborates on the strategies that are critical for Hyster-Yale's long-term prospects. The Company encourages investors to review this material to ensure a clear understanding of Hyster-Yale's future direction.

*****

Conference Call

The management of Hyster-Yale, Inc. will conduct a conference call with investors and analysts on Wednesday, August 7, 2024, at 11:00 a.m. Eastern Time to discuss the financial results. The conference call will be broadcast and can be accessed through Hyster-Yale's website at https://www.hyster-yale.com/investor-overview. Please allow 15 minutes to register, download and install any necessary audio software required to listen to the webcast. An archive of the webcast will be available on the Company's website two hours after the live call ends.

Non-GAAP and Other Measures

This release contains non-GAAP financial measures. Included in this release are reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated in accordance with U.S. generally accepted accounting principles (“GAAP”).

EBITDA in this release is provided solely as supplemental non-GAAP disclosures of operating results. EBITDA does not represent operating profit (loss) or net income (loss), as defined by GAAP, and should not be considered as a substitute for operating profit (loss) or net income (loss). Hyster-Yale defines EBITDA as income (loss) before income taxes and noncontrolling interests plus net interest expense and depreciation and amortization expense. EBITDA is not a measurement under GAAP and is not necessarily comparable with similarly titled measures of other companies. Management believes that EBITDA assists investors in understanding the results of operations of the Company. In addition, management evaluates results using EBITDA.

For purposes of this release, discussions about net income (loss) refer to net income (loss) attributable to stockholders.

Forward-looking Statements Disclaimer

The statements contained in this news release that are not historical facts are “forward-looking statements.” These forward-looking statements are made subject to certain risks and uncertainties, which could cause actual results to differ materially from those presented. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof. Among the factors that could cause plans, actions and results to differ materially from current expectations are, without limitation: (1) delays in delivery and other

supply chain disruptions, or increases in costs as a result of inflation or otherwise, including materials, critical components and transportation costs and shortages, the imposition of tariffs on raw materials or sourced products, and labor, or changes in or unavailability of quality suppliers or transporters, including the impacts of the foregoing risks on the Company's liquidity, (2) delays in manufacturing and delivery schedules, (3) reduction in demand for lift trucks, attachments and related aftermarket parts and service on a global basis, including any cyclical reduction in demand in the lift truck industry, (4) customer acceptance of pricing, (5) the ability of Hyster-Yale and its dealers, suppliers and end-users to access credit, or obtain financing at reasonable rates, or at all, as a result of interest rate volatility and current economic and market conditions, including inflation, (6) unfavorable effects of geopolitical and legislative developments on global operations, including without limitation the entry into new trade agreements and the imposition of tariffs and/or economic sanctions, including the Uyghur Forced Labor Prevention Act (the “UFLPA”) which could impact Hyster-Yale's imports from China, as well as armed conflicts, including the Russia/Ukraine conflict, the Israel and Gaza conflict and/or the conflict in the Red Sea, and their regional effects, (7) exchange rate fluctuations, interest rate volatility and monetary policies and other changes in the regulatory climate in the countries in which the Company operates and/or sells products, (8) the effectiveness of the cost reduction programs implemented globally, including the successful implementation of procurement and sourcing initiatives, (9) the successful commercialization of Nuvera's technology, (10) political and economic uncertainties in the countries where the Company does business, as well as the effects of any withdrawals from such countries, (11) bankruptcy of or loss of major dealers, retail customers or suppliers, (12) customer acceptance of, changes in the costs of, or delays in the development of new products, (13) introduction of new products by, more favorable product pricing offered by or shorter lead times available through competitors, (14) product liability or other litigation, warranty claims or returns of products, (15) changes mandated by federal, state and other regulation, including tax, health, safety or environmental legislation, (16) the ability to attract, retain, and replace workforce and administrative employees, (17) disruptions resulting from natural disasters, public health crises, political crises or other catastrophic events, and (18) the ability to protect the Company’s information technology infrastructure against service interruptions, data corruption, cyber-based attacks or network breaches.

About Hyster-Yale, Inc.

Hyster-Yale, Inc., headquartered in Cleveland, Ohio, is a globally integrated company offering a full line of lift trucks and solutions, including attachments and hydrogen fuel cell power products aimed at meeting the specific materials handling needs of its customers. Hyster-Yale's vision is to transform the way the world moves materials from Port to Home and deliver on its customer promises of: (1) thoroughly understanding customer applications and offering optimal solutions that will improve productivity at the lowest cost of ownership, and (2) providing exceptional customer care to create increasing value from initial engagement through the product lifecycle.

The Company's wholly owned operating subsidiary, Hyster-Yale Materials Handling, Inc., designs, engineers, manufactures, sells and services a comprehensive line of lift trucks, attachments and aftermarket parts marketed globally primarily under the Hyster® and Yale® brand names. Subsidiaries of Hyster-Yale include Bolzoni S.p.A., a leading worldwide producer of attachments, forks and lift tables marketed under the Bolzoni®, Auramo® and Meyer® brand names and Nuvera Fuel Cells, LLC, an alternative-power technology company focused on fuel cell stacks and engines. Hyster-Yale also has an unconsolidated joint venture in Japan (Sumitomo NACCO). For more information about Hyster-Yale and its subsidiaries, visit the Company's website at www.hyster-yale.com.

*****

| | | | | | | | | | | | | | | | | | | | | | | |

| HYSTER-YALE, INC. |

| FINANCIAL HIGHLIGHTS |

| | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30 | | June 30 |

| 2024 | | 2023 | | 2024 | | 2023 |

| (In millions, except per share data) |

| | | | | | | |

| Revenues | $ | 1,168.1 | | | $ | 1,090.6 | | | $ | 2,224.6 | | | $ | 2,089.9 | |

| Cost of sales | 908.8 | | | 892.7 | | | 1,729.6 | | | 1,717.6 | |

| Gross Profit | 259.3 | | | 197.9 | | | 495.0 | | | 372.3 | |

| Selling, general and administrative expenses | 163.7 | | | 139.1 | | | 315.6 | | | 270.9 | |

| | | | | | | |

Operating Profit | 95.6 | | | 58.8 | | | 179.4 | | | 101.4 | |

| Other (income) expense | | | | | | | |

| Interest expense | 8.8 | | | 8.4 | | | 17.7 | | | 18.6 | |

| Income from unconsolidated affiliates | (2.1) | | | (3.1) | | | (3.1) | | | (4.9) | |

| Other, net | (1.1) | | | 2.7 | | | (2.1) | | | 1.0 | |

Income before Income Taxes | 90.0 | | | 50.8 | | | 166.9 | | | 86.7 | |

Income tax expense | 26.1 | | | 12.0 | | | 51.2 | | | 20.7 | |

| Net income attributable to noncontrolling interests | (0.2) | | | — | | | (0.4) | | | (0.2) | |

| Net income attributable to redeemable noncontrolling interests | (0.1) | | | (0.2) | | | — | | | (0.4) | |

| Accrued dividend to redeemable noncontrolling interests | (0.3) | | | (0.3) | | | (0.5) | | | (0.5) | |

Net Income Attributable to Stockholders | $ | 63.3 | | | $ | 38.3 | | | $ | 114.8 | | | $ | 64.9 | |

| | | | | | | |

Basic Earnings per Share | $ | 3.62 | | | $ | 2.23 | | | $ | 6.60 | | | $ | 3.80 | |

| | | | | | | |

Diluted Earnings per Share | $ | 3.58 | | | $ | 2.21 | | | $ | 6.51 | | | $ | 3.76 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic Weighted Average Shares Outstanding | 17.493 | | | 17.164 | | | 17.406 | | | 17.099 | |

| Diluted Weighted Average Shares Outstanding | 17.659 | | | 17.307 | | | 17.631 | | | 17.265 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EBITDA RECONCILIATION |

| Quarter Ended | | |

| 9/30/2023 | | 12/31/2023 | | 3/31/2024 | | 6/30/2024 | | LTM 6/30/2024 |

| (In millions) |

Net Income Attributable to Stockholders | $ | 35.8 | | | $ | 25.2 | | | $ | 51.5 | | | $ | 63.3 | | | $ | 175.8 | |

| | | | | | | | | |

| Noncontrolling interest income and dividends | 0.6 | | | 0.5 | | | 0.3 | | | 0.6 | | | 2.0 | |

| Income tax expense | 16.2 | | | 16.0 | | | 25.1 | | | 26.1 | | | 83.4 | |

| Interest expense | 9.6 | | | 9.1 | | | 8.9 | | | 8.8 | | | 36.4 | |

| Interest income | (0.7) | | | (0.7) | | | (1.1) | | | (0.8) | | | (3.3) | |

| Depreciation and amortization expense | 11.3 | | | 11.3 | | | 11.7 | | | 12.4 | | | 46.7 | |

| EBITDA* | $ | 72.8 | | | $ | 61.4 | | | $ | 96.4 | | | $ | 110.4 | | | $ | 341.0 | |

| | | | | | | | | |

|

| | | | | | | | | |

*EBITDA in this press release is provided solely as a supplemental disclosure. EBITDA does not represent net income (loss), as defined by GAAP, and should not be considered as a substitute for net income or net loss, or as an indicator of operating performance. Hyster-Yale defines EBITDA as income (loss) before income taxes and noncontrolling interest income and dividends plus net interest expense and depreciation and amortization expense. EBITDA is not a measurement under GAAP and is not necessarily comparable with similarly titled measures of other companies. |

| | | | | | | | | | | | | | | | | | | | | | | |

| HYSTER-YALE, INC. |

| FINANCIAL HIGHLIGHTS |

| | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30 | | June 30 |

| 2024 | | 2023 | | 2024 | | 2023 |

| (In millions) |

| Revenues | | | | | | | |

| Americas | $ | 881.5 | | | $ | 788.5 | | | $ | 1,651.2 | | | $ | 1,474.4 | |

| EMEA | 187.8 | | | 200.6 | | | 387.2 | | | 415.5 | |

| JAPIC | 48.7 | | | 49.6 | | | 86.4 | | | 97.5 | |

| Lift Truck Business | $ | 1,118.0 | | | $ | 1,038.7 | | | $ | 2,124.8 | | | $ | 1,987.4 | |

| Bolzoni | 102.4 | | | 96.6 | | | 198.6 | | | 195.2 | |

| Nuvera | 0.2 | | | 1.0 | | | 0.7 | | | 2.6 | |

| Eliminations | (52.5) | | | (45.7) | | | (99.5) | | | (95.3) | |

| Total | $ | 1,168.1 | | | $ | 1,090.6 | | | $ | 2,224.6 | | | $ | 2,089.9 | |

| | | | | | | |

| Gross profit (loss) | | | | | | | |

| Americas | $ | 202.1 | | | $ | 143.4 | | | $ | 380.2 | | | $ | 264.6 | |

| EMEA | 32.5 | | | 27.1 | | | 66.4 | | | 54.0 | |

| JAPIC | 4.8 | | | 6.5 | | | 8.4 | | | 14.0 | |

| Lift Truck Business | $ | 239.4 | | | $ | 177.0 | | | $ | 455.0 | | | $ | 332.6 | |

| Bolzoni | 22.4 | | | 22.6 | | | 44.2 | | | 43.3 | |

| Nuvera | (2.5) | | | (1.8) | | | (4.8) | | | (3.9) | |

| Eliminations | — | | | 0.1 | | | 0.6 | | | 0.3 | |

| Total | $ | 259.3 | | | $ | 197.9 | | | $ | 495.0 | | | $ | 372.3 | |

| | | | | | | |

| Operating profit (loss) | | | | | | | |

| Americas | $ | 104.0 | | | $ | 65.2 | | | $ | 193.6 | | | $ | 112.7 | |

| EMEA | 4.8 | | | 1.1 | | | 10.0 | | | 3.7 | |

| JAPIC | (5.7) | | | (3.8) | | | (11.2) | | | (6.1) | |

| Lift Truck Business | $ | 103.1 | | | $ | 62.5 | | | $ | 192.4 | | | $ | 110.3 | |

| Bolzoni | 4.0 | | | 5.4 | | | 7.3 | | | 9.8 | |

| Nuvera | (11.5) | | | (9.2) | | | (20.9) | | | (19.0) | |

| Eliminations | — | | | 0.1 | | | 0.6 | | | 0.3 | |

| Total | $ | 95.6 | | | $ | 58.8 | | | $ | 179.4 | | | $ | 101.4 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| HYSTER-YALE, INC. |

| FINANCIAL HIGHLIGHTS |

|

|

| CASH FLOW, CAPITAL STRUCTURE AND WORKING CAPITAL |

| | | | | Six Months Ended |

| | | | | June 30 |

| | | | | 2024 | | 2023 |

| | | | | (In millions) |

Net cash provided by operating activities | | | | $ | 19.9 | | | $ | 44.8 | |

| Net cash used for investing activities | | | | | (18.7) | | | (11.9) | |

| Cash Flow Before Financing Activities | | | | | $ | 1.2 | | | $ | 32.9 | |

| | | | | | | |

| | | | | | | |

| June 30, 2024 | | March 31, 2024 | | December 31, 2023 | | September 30, 2023 |

| (In millions) |

| Debt | $ | 501.9 | | | $ | 474.8 | | | $ | 494.0 | | | $ | 510.6 | |

| Cash | 66.5 | | | 62.2 | | | 78.8 | | | 78.2 | |

| Net Debt | $ | 435.4 | | | $ | 412.6 | | | $ | 415.2 | | | $ | 432.4 | |

| | | | | | | |

| | | | | | | |

| June 30, 2024 | | March 31, 2024 | | December 31, 2023 | | September 30, 2023 |

| (In millions) |

| Accounts Receivable | $ | 578.7 | | | $ | 520.5 | | | $ | 497.5 | | | $ | 512.0 | |

| Inventory | 790.7 | | | 841.9 | | | 815.7 | | | 815.4 | |

| Accounts Payable | 513.5 | | | 572.8 | | | 530.2 | | | 549.6 | |

| Working Capital | $ | 855.9 | | | $ | 789.6 | | | $ | 783.0 | | | $ | 777.8 | |

| / | | | | | | |

|

v3.24.2.u1

Cover Page

|

Aug. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 06, 2024

|

| Entity Registrant Name |

HYSTER-YALE, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

000-54799

|

| Entity Tax Identification Number |

31-1637659

|

| Entity Address, Address Line One |

5875 Landerbrook Drive, Suite 300

|

| Entity Address, City or Town |

Cleveland

|

| Entity Address, State or Province |

OH

|

| City Area Code |

(440)

|

| Local Phone Number |

449-9600

|

| Entity Address, Postal Zip Code |

44124-4069

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.01 par value per share

|

| Trading Symbol |

HY

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001173514

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

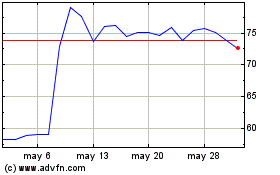

Hyster Yale (NYSE:HY)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Hyster Yale (NYSE:HY)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024