Invitation Homes Inc. (NYSE: INVH) (“Invitation Homes” or the

“Company”), the nation’s premier single-family home leasing and

management company, today announced its Q3 2024 financial and

operating results.

Third Quarter 2024 Highlights

- Year over year, total revenues increased 6.9% to $660 million,

property operating and maintenance costs increased 5.6% to $242

million, net income available to common stockholders decreased

27.8% to $95 million, and net income per diluted common share

decreased 27.8% to $0.15.

- Year over year, Core FFO per share increased 6.8% to $0.47 and

AFFO per share increased 7.2% to $0.38.

- Same Store NOI increased 3.9% year over year on 3.6% Same Store

Core Revenues growth and 3.1% Same Store Core Operating Expenses

growth.

- Same Store Average Occupancy was 97.0%, generally consistent

with the prior year result.

- Same Store renewal rent growth of 4.2% and Same Store new lease

rent growth of 1.7% drove Same Store blended rent growth of

3.6%.

- Acquisitions by the Company and the Company’s joint ventures

totaled 926 homes for approximately $331 million while dispositions

totaled 331 homes for approximately $128 million.

- The Company continued to improve the strength of its

investment-grade balance sheet. Specifically:

- As previously announced on September 23, 2024, Fitch Ratings

upgraded the Company’s issuer and issue-level credit ratings to

‘BBB+’ from ‘BBB’ with a stable outlook.

- As previously announced on September 9, 2024, the Company

replaced its existing credit facility and lowered the cost of its

debt with a new $3.5 billion senior unsecured credit facility,

consisting of a $1.75 billion revolving line of credit and a $1.75

billion term loan, with each carrying two six-month extension

options such that the final maturity date is September 2029,

subject to certain conditions.

- As previously announced on September 23, 2024, the Company

closed a public offering of $500 million aggregate principal amount

of 4.875% Senior Notes due 2035.

- In addition, during September 2024, the Company amended certain

interest rate swaps and entered into $1.4 billion of new interest

rate swaps. As of September 30, 2024, the Company’s currently

active swaps have a weighted average strike rate of 2.86% and are

scheduled to terminate between November 30, 2024 and July 31, 2025,

while its forward starting swaps, which will become active between

December 31, 2024 and July 9, 2025 and mature between May 31, 2028

and May 31, 2029, have a weighted average strike rate of

2.95%.

- The Company experienced mostly limited damages to its homes in

several markets from Hurricanes Beryl, Debby, and Helene, which it

estimates at approximately $14.0 million of expenses, net of

estimated insurance recoveries; subsequent to quarter end, the

Company incurred losses and damages to homes in its Florida markets

as a result of Hurricane Milton, with initial expense estimates

totaling approximately $37.5 million, net of estimated insurance

recoveries.

Comments from Chief Executive Officer Dallas Tanner

“We’re pleased to report another strong quarter, driven by year

over year growth in total revenues of 6.9% and AFFO per share of

7.2%. We continue to believe our growth prospects, coupled with the

attractive value proposition of single-family rentals compared to

homeownership, create a constructive backdrop for the foreseeable

future. Based on our solid year to date results and expectations

for the remainder of the year, we have raised our full year 2024

Core FFO and AFFO per share guidance by a penny at the midpoint to

$1.88 and $1.59 per share, respectively.”

Glossary & Reconciliations of Non-GAAP Financial and

Other Operating Measures

Financial and operating measures found in the Earnings Release

and Supplemental Information include certain measures used by

Invitation Homes management that are measures not defined under

accounting principles generally accepted in the United States

(“GAAP”). These measures are defined herein and, as applicable,

reconciled to the most comparable GAAP measures.

Financial Results

Net Income,

FFO, Core FFO, and AFFO Per Share — Diluted

Q3 2024

Q3 2023

YTD 2024

YTD 2023

Net income

$

0.15

$

0.21

$

0.51

$

0.64

FFO

0.37

0.40

1.14

1.23

Core FFO

0.47

0.44

1.41

1.32

AFFO

0.38

0.36

1.19

1.12

Net Income

Net income per common share — diluted for Q3 2024 was $0.15,

compared to net income per common share — diluted of $0.21 for Q3

2023. Total revenues and total property operating and maintenance

expenses for Q3 2024 were $660 million and $242 million,

respectively, compared to $618 million and $229 million,

respectively, for Q3 2023.

Net income per common share — diluted for YTD 2024 was $0.51,

compared to net income per share — diluted of $0.64 for YTD 2023.

Total revenues and total property operating and maintenance

expenses for YTD 2024 were $1,960 million and $707 million,

respectively, compared to $1,808 million and $652 million,

respectively, for YTD 2023.

Core FFO

Year over year, Core FFO per share for Q3 2024 increased 6.8% to

$0.47, while Core FFO per share for YTD 2024 increased 6.6% to

$1.41, primarily due to NOI growth.

AFFO

Year over year, AFFO per share for Q3 2024 increased 7.2% to

$0.38, while AFFO per share for YTD 2024 increased 6.0% to $1.19,

primarily due to the increase in Core FFO per share described

above.

Operating Results

Same Store

Operating Results Snapshot

Number of homes in Same Store

Portfolio:

77,186

Q3 2024

Q3 2023

YTD 2024

YTD 2023

Core Revenues growth (year over year)

3.6

%

4.8

%

Core Operating Expenses growth (year over

year)

3.1

%

5.6

%

NOI growth (year over year)

3.9

%

4.5

%

Average Occupancy

97.0

%

97.1

%

97.5

%

97.5

%

Bad Debt % of gross rental revenue

1.0

%

1.1

%

0.9

%

1.4

%

Turnover Rate

6.2

%

6.8

%

17.5

%

18.8

%

Rental Rate Growth (lease-over-lease):

Renewals

4.2

%

6.5

%

5.2

%

7.0

%

New Leases

1.7

%

4.6

%

2.1

%

5.5

%

Blended

3.6

%

5.9

%

4.3

%

6.5

%

Same Store NOI

For the Same Store Portfolio of 77,186 homes, Same Store NOI for

Q3 2024 increased 3.9% year over year on Same Store Core Revenues

growth of 3.6% and Same Store Core Operating Expenses growth of

3.1%. YTD 2024 Same Store NOI increased 4.5% year over year on Same

Store Core Revenues growth of 4.8% and Same Store Core Operating

Expenses growth of 5.6%.

Same Store Core Revenues

Same Store Core Revenues growth for Q3 2024 of 3.6% year over

year was primarily driven by a 3.7% increase in Average Monthly

Rent, a 10 basis point year over year improvement in Bad Debt as a

percentage of gross rental revenue, and a 2.4% increase in other

income, net of resident recoveries, partially offset by a 10 basis

point year over year decline in Average Occupancy.

YTD 2024 Same Store Core Revenues growth of 4.8% year over year

was primarily driven by a 4.2% increase in Average Monthly Rent, a

50 basis point year over year improvement in Bad Debt as a

percentage of gross rental revenue, and a 9.1% increase in other

income, net of resident recoveries.

Same Store Core Operating Expenses

Same Store Core Operating Expenses for Q3 2024 increased 3.1%

year over year, primarily attributable to a 5.3% increase in fixed

expenses, partially offset by a 0.5% decrease in controllable

expenses.

YTD 2024 Same Store Core Operating Expenses increased 5.6% year

over year, primarily driven by a 8.4% increase in fixed expenses

and a 0.8% increase in controllable expenses.

Investment and Property Management Activity

Acquisitions for Q3 2024 included 891 wholly owned homes for

approximately $319 million and 35 homes for approximately $12

million in the Company’s joint ventures. Dispositions for Q3 2024

included 310 wholly owned homes for gross proceeds of approximately

$119 million and 21 homes for gross proceeds of approximately $9

million in the Company’s joint ventures.

Year to date through Q3 2024, the Company acquired 1,591 wholly

owned homes for $557 million and 108 homes for $37 million in the

Company’s joint ventures. The company also sold 937 wholly owned

homes for $378 million and 57 homes for $25 million in the

Company’s joint ventures.

A summary of the Company’s owned and/or managed homes is

included in the following table:

Summary of

Homes Owned and/or Managed As Of 9/30/2024

Number of Homes Owned and/or

Managed as of 6/30/2024

Acquired or Added In Q3

2024

Disposed or Subtracted In Q3

2024

Number of Homes Owned and/or

Managed as of 9/30/2024

Wholly owned homes

84,640

891

(310

)

85,221

Joint venture owned homes

7,605

35

(21

)

7,619

Managed-only homes

17,261

696

(41

)

17,916

Total homes owned and/or

managed

109,506

1,622

(372

)

110,756

Balance Sheet and Capital Markets Activity

As of September 30, 2024, the Company had $2,027 million in

available liquidity through a combination of unrestricted cash and

undrawn capacity on its revolving credit facility. The Company’s

total indebtedness as of September 30, 2024 was $9,098 million,

consisting of $7,075 million of unsecured debt and $2,023 million

of secured debt. Net debt / TTM adjusted EBITDAre was 5.4x at

September 30, 2024, a slight decrease from 5.5x as of December 31,

2023. As of September 30, 2024, 99.6% of the Company’s total debt

was fixed rate or swapped to fixed rate and 83.8% of its wholly

owned homes were unencumbered.

During Q3 2024, the Company continued to improve the strength of

its investment-grade balance sheet. Specifically:

- As previously announced, on September 23, 2024, Fitch Ratings

upgraded the Company’s issuer and issue-level credit ratings to

‘BBB+’ from ‘BBB’ with a stable outlook.

- As previously announced, on September 9, 2024, the Company

replaced its existing credit facility and lowered the cost of its

debt with a new $3.5 billion senior unsecured credit facility,

consisting of a $1.75 billion revolving line of credit and a $1.75

billion term loan, both maturing on September 9, 2028, with two

six-month extension options, subject to certain conditions.

- As previously announced, on September 23, 2024, the Company

closed a public offering of $500 million aggregate principal amount

of 4.875% Senior Notes due 2035.

- In addition, during September 2024, the Company amended certain

interest rate swaps and entered into $1.4 billion of new interest

rate swaps. As of September 30, 2024, the Company’s currently

active swaps have a weighted average strike rate of 2.86% and are

scheduled to terminate between November 30, 2024 and July 31, 2025,

while its forward starting swaps, which will become active between

December 31, 2024 and July 9, 2025 and mature between May 31, 2028

and May 31, 2029, have a weighted average strike rate of

2.95%.

FY 2024 Guidance Details

The Company has revised its full year 2024 guidance

expectations, as outlined in the following table:

FY 2024

Guidance

FY 2024 Current Guidance

Range

FY 2024 Midpoint

Current

Prior (As of July

2024)

Change

Core FFO per share — diluted

$1.86 to $1.90

$

1.88

$

1.87

$

0.01

AFFO per share — diluted

$1.57 to $1.61

$

1.59

$

1.58

$

0.01

Same Store Core Revenues growth (1)

4.0% to 4.5%

4.25

%

4.875

%

-62.5 bps

Same Store Core Operating Expenses growth

(2)

3.25% to 4.25%

3.75

%

5.75

%

-200.0 bps

Same Store NOI growth

4.0% to 5.0%

4.50

%

4.5

%

0.0 bps

Wholly owned acquisitions

$600 million to $1,000

million

$800 million

$800 million

$

—

JV acquisitions

$100 million to $300 million

$200 million

$200 million

$

—

Wholly owned dispositions

$400 million to $600 million

$500 million

$500 million

$

—

(1) Guidance assumes FY 2024 Average

Occupancy is similar to FY 2023 Average Occupancy. Guidance assumes

average Bad Debt for FY 2024 in a range of 65 to 95 basis

points.

(2) Guidance assumes (i) FY 2024 property

taxes expense growth in a range of 5.0% to 6.5% year over year,

reflecting an improvement in expectations from the prior guidance

range of 8.0% to 9.5%, primarily due to favorable information

received to date from Florida and Georgia; and (ii) FY 2024

insurance expense growth of approximately 7.5% year over year.

The Company does not provide guidance for the most comparable

GAAP financial measures of net income (loss), total revenues, and

property operating and maintenance expense. Additionally, a

reconciliation of the forward-looking non-GAAP financial measures

of Core FFO per share, AFFO per share, Same Store Core Revenues

growth, Same Store Core Operating Expenses growth, and Same Store

NOI growth to the comparable GAAP financial measures cannot be

provided without unreasonable effort because the Company is unable

to reasonably predict certain items contained in the GAAP measures,

including non-recurring and infrequent items that are not

indicative of the Company’s ongoing operations. Such items include,

but are not limited to, impairment on depreciated real estate

assets, net (gain)/loss on sale of previously depreciated real

estate assets, share-based compensation, casualty loss, non-Same

Store revenues, and non-Same Store operating expenses. These items

are uncertain, depend on various factors, and could have a material

impact on the Company’s GAAP results for the guidance period.

Earnings Conference Call Information

Invitation Homes has scheduled a conference call at 2:00 p.m.

Eastern Time on October 31, 2024, to review third quarter of 2024

results, discuss recent events, and conduct a question-and-answer

session. The domestic dial-in number is 1-888-330-2384, and the

international dial-in number is 1-240-789-2701. The conference ID

is 7714113.

Listen-only participants are encouraged to join the conference

call via a live audio webcast, which is available online from the

Company’s investor relations website at www.invh.com. Following the

conclusion of the earnings call, the Company will post a replay of

the webcast to its website for one year.

Supplemental Information

The full text of the Earnings Release and Supplemental

Information referenced in this release are available on Invitation

Homes’ Investor Relations website at www.invh.com.

About Invitation Homes

Invitation Homes, an S&P 500 company, is the nation’s

premier single-family home leasing and management company, meeting

changing lifestyle demands by providing access to high-quality,

updated homes with valued features such as close proximity to jobs

and access to good schools. The Company’s mission, “Together with

you, we make a house a home,” reflects its commitment to providing

homes where individuals and families can thrive and high-touch

service that continuously enhances residents’ living

experiences.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), which include, but are not limited

to, statements related to the Company’s expectations regarding the

performance of the Company’s business, its financial results, its

liquidity and capital resources, and other non-historical

statements. In some cases, you can identify these forward-looking

statements by the use of words such as “outlook,” “guidance,”

“believes,” “expects,” “potential,” “continues,” “may,” “will,”

“should,” “could,” “seeks,” “projects,” “predicts,” “intends,”

“plans,” “estimates,” “anticipates,” or the negative version of

these words or other comparable words. Such forward-looking

statements are subject to various risks and uncertainties,

including, among others, risks inherent to the single-family rental

industry and the Company’s business model, macroeconomic factors

beyond the Company’s control, competition in identifying and

acquiring properties, competition in the leasing market for quality

residents, increasing property taxes, homeowners’ association and

insurance costs, poor resident selection and defaults and

non-renewals by the Company’s residents, the Company’s dependence

on third parties for key services, risks related to the evaluation

of properties, performance of the Company’s information technology

systems, development and use of artificial intelligence, risks

related to the Company’s indebtedness, and risks related to the

potential negative impact of unfavorable global and United States

economic conditions (including inflation), uncertainty in financial

markets (including as a result of events affecting financial

institutions), geopolitical tensions, natural disasters, climate

change, and public health crises, on the Company’s financial

condition, results of operations, cash flows, business, associates,

and residents. Accordingly, there are or will be important factors

that could cause actual outcomes or results to differ materially

from those indicated in these statements. The Company believes

these factors include, but are not limited to, those described

under Part I. Item 1A. “Risk Factors” of its Annual Report on Form

10-K for the year ended December 31, 2023 (the “Annual Report”), as

such factors may be updated from time to time in the Company’s

periodic filings with the Securities and Exchange Commission (the

“SEC”), which are accessible on the SEC’s website at www.sec.gov.

These factors should not be construed as exhaustive and should be

read in conjunction with the other cautionary statements that are

included in this release, in the Annual Report, and in the

Company’s other periodic filings. The forward-looking statements

speak only as of the date of this press release, and the Company

expressly disclaims any obligation or undertaking to publicly

update or review any forward-looking statement, whether as a result

of new information, future developments or otherwise, except to the

extent otherwise required by law.

Consolidated

Balance Sheets

($ in thousands, except shares and per

share data)

September 30, 2024

December 31, 2023

(unaudited)

Assets:

Investments in single-family residential

properties, net

$

17,284,631

$

17,289,214

Cash and cash equivalents

1,027,199

700,618

Restricted cash

218,273

196,866

Goodwill

258,207

258,207

Investments in unconsolidated joint

ventures

244,647

247,166

Other assets, net

599,891

528,896

Total assets

$

19,632,848

$

19,220,967

Liabilities:

Mortgage loans, net

$

1,614,220

$

1,627,256

Secured term loan, net

401,595

401,515

Unsecured notes, net

3,799,034

3,305,467

Term loan facilities, net

2,444,054

3,211,814

Revolving facility

750,000

—

Accounts payable and accrued expenses

398,894

200,590

Resident security deposits

180,484

180,455

Other liabilities

92,905

103,435

Total liabilities

9,681,186

9,030,532

Equity:

Stockholders’ equity

Preferred stock, $0.01 par value per

share, 900,000,000 shares authorized, none outstanding as of

September 30, 2024 and December 31, 2023

—

—

Common stock, $0.01 par value per share,

9,000,000,000 shares authorized, 612,605,478 and 611,958,239

outstanding as of September 30, 2024 and December 31, 2023,

respectively

6,126

6,120

Additional paid-in capital

11,164,240

11,156,736

Accumulated deficit

(1,275,601

)

(1,070,586

)

Accumulated other comprehensive income

21,310

63,701

Total stockholders’ equity

9,916,075

10,155,971

Non-controlling interests

35,587

34,464

Total equity

9,951,662

10,190,435

Total liabilities and equity

$

19,632,848

$

19,220,967

Consolidated

Statements of Operations

($ in thousands, except shares and per

share amounts) (unaudited)

Q3 2024

Q3 2023

YTD 2024

YTD 2023

Revenues:

Rental revenues

$

575,462

$

555,270

$

1,723,757

$

1,633,672

Other property income

65,880

59,021

187,157

164,058

Management fee revenues

18,980

3,404

48,898

10,227

Total revenues

660,322

617,695

1,959,812

1,807,957

Expenses:

Property operating and maintenance

242,228

229,488

706,809

651,793

Property management expense

34,382

23,399

98,252

70,563

General and administrative

21,727

22,714

66,673

59,957

Interest expense

91,060

86,736

270,912

243,408

Depreciation and amortization

180,479

170,696

532,414

501,128

Casualty losses, impairment, and other

20,872

2,496

35,362

5,527

Total expenses

590,748

535,529

1,710,422

1,532,376

Gains (losses) on investments in equity

and other securities, net

(257

)

(499

)

1,038

113

Other, net

(9,345

)

(2,533

)

(57,384

)

(7,968

)

Gain on sale of property, net of tax

47,766

57,989

141,531

134,448

Losses from investments in unconsolidated

joint ventures

(12,160

)

(4,902

)

(22,780

)

(11,087

)

Net income

95,578

132,221

311,795

391,087

Net income attributable to non-controlling

interests

(309

)

(403

)

(988

)

(1,163

)

Net income attributable to common

stockholders

95,269

131,818

310,807

389,924

Net income available to participating

securities

(185

)

(181

)

(584

)

(518

)

Net income available to common

stockholders — basic and diluted

$

95,084

$

131,637

$

310,223

$

389,406

Weighted average common shares

outstanding — basic

612,674,802

612,000,811

612,508,300

611,849,302

Weighted average common shares

outstanding — diluted

613,645,188

613,580,042

613,759,171

613,155,041

Net income per common share —

basic

$

0.16

$

0.22

$

0.51

$

0.64

Net income per common share —

diluted

$

0.15

$

0.21

$

0.51

$

0.64

Dividends declared per common

share

$

0.28

$

0.26

$

0.84

$

0.78

Glossary and Reconciliations

Average Monthly Rent

Average monthly rent represents average monthly rental income

per home for occupied properties in an identified population of

homes over the measurement period, and reflects the impact of

non-service rental concessions and contractual rent increases

amortized over the life of the lease.

Average Occupancy

Average occupancy for an identified population of homes

represents (i) the total number of days that the homes in such

population were occupied during the measurement period, divided by

(ii) the total number of days that the homes in such population

were owned during the measurement period.

Bad Debt

Bad debt represents the Company’s reserves for residents’

accounts receivables balances that are aged greater than 30 days,

under the rationale that a resident’s security deposit should cover

approximately the first 30 days of receivables. For all resident

receivables balances aged greater than 30 days, the amount reserved

as bad debt is 100% of outstanding receivables from the resident,

less the amount of the resident’s security deposit on hand. For the

purpose of determining age of receivables, charges are considered

to be due based on the terms of the original lease, not based on a

payment plan if one is in place. All rental revenues and other

property income, in both Total Portfolio and Same Store Portfolio

presentations, are reflected net of bad debt.

Core Operating Expenses

Core operating expenses for an identified population of homes

reflect property operating and maintenance expenses, excluding any

expenses recovered from residents.

Core Revenues

Core revenues for an identified population of homes reflects

total revenues, net of any resident recoveries.

EBITDA, EBITDAre, and Adjusted EBITDAre

EBITDA, EBITDAre, and Adjusted EBITDAre are supplemental,

non-GAAP measures often utilized to evaluate the performance of

real estate companies. The Company defines EBITDA as net income or

loss computed in accordance with accounting principles generally

accepted in the United States (“GAAP”) before the following items:

interest expense; income tax expense; depreciation and

amortization; and adjustments for unconsolidated joint ventures.

National Association of Real Estate Investment Trusts (“Nareit”)

recommends as a best practice that REITs that report an EBITDA

performance measure also report EBITDAre. The Company defines

EBITDAre, consistent with the Nareit definition, as EBITDA, further

adjusted for gain on sale of property, net of tax, impairment on

depreciated real estate investments, and adjustments for

unconsolidated joint ventures. Adjusted EBITDAre is defined as

EBITDAre before the following items: share-based compensation

expense; severance; casualty losses, net; (gains) losses on

investments in equity securities, net; and other income and

expenses. EBITDA, EBITDAre, and Adjusted EBITDAre are used as

supplemental financial performance measures by management and by

external users of the Company’s financial statements, such as

investors and commercial banks. Set forth below is additional

detail on how management uses EBITDA, EBITDAre, and Adjusted

EBITDAre as measures of performance.

The GAAP measure most directly comparable to EBITDA, EBITDAre,

and Adjusted EBITDAre is net income or loss. EBITDA, EBITDAre, and

Adjusted EBITDAre are not used as measures of the Company’s

liquidity and should not be considered alternatives to net income

or loss or any other measure of financial performance presented in

accordance with GAAP. The Company’s EBITDA, EBITDAre, and Adjusted

EBITDAre may not be comparable to the EBITDA, EBITDAre, and

Adjusted EBITDAre of other companies due to the fact that not all

companies use the same definitions of EBITDA, EBITDAre, and

Adjusted EBITDAre. Accordingly, there can be no assurance that the

Company’s basis for computing these non-GAAP measures is comparable

with that of other companies. See below for a reconciliation of

GAAP net income to EBITDA, EBITDAre, and Adjusted EBITDAre.

Funds from Operations (FFO), Core Funds from Operations (Core

FFO), and Adjusted Funds from Operations (AFFO)

FFO, Core FFO, and Adjusted FFO are supplemental, non-GAAP

measures often utilized to evaluate the performance of real estate

companies. FFO is defined by Nareit as net income or loss (computed

in accordance with GAAP) excluding gains or losses from sales of

previously depreciated real estate assets, plus depreciation,

amortization and impairment of real estate assets, and adjustments

for unconsolidated joint ventures. The Company defines Core FFO as

FFO adjusted for the following: non-cash interest expense related

to amortization of deferred financing costs, loan discounts, and

non-cash interest expense from derivatives; share-based

compensation expense; legal settlements; severance expense;

casualty (gains) losses, net; and (gains) losses on investments in

equity and other securities, net, as applicable. The Company

defines Adjusted FFO as Core FFO less recurring capital

expenditures that are necessary to help preserve the value, and

maintain the functionality, of its homes. Where appropriate, FFO,

Core FFO, and Adjusted FFO are adjusted for the Company’s share of

investments in unconsolidated joint ventures.

The Company believes that FFO is a meaningful supplemental

measure of the operating performance of its business because

historical cost accounting for real estate assets in accordance

with GAAP assumes that the value of real estate assets diminishes

predictably over time, as reflected through depreciation and

amortization. Because real estate values have historically risen or

fallen with market conditions, management considers FFO an

appropriate supplemental performance measure as it excludes

historical cost depreciation and amortization, impairment on

depreciated real estate investments, gains or losses related to

sales of previously depreciated homes, as well non-controlling

interests, from GAAP net income or loss. The Company believes that

Core FFO and Adjusted FFO are also meaningful supplemental measures

of its operating performance for the same reasons as FFO and are

further helpful to investors as they provide a more consistent

measurement of the Company’s performance across reporting periods

by removing the impact of certain items that are not comparable

from period to period.

The GAAP measure most directly comparable to Core FFO and

Adjusted FFO is net income or loss. FFO, Core FFO, and Adjusted FFO

are not used as measures of the Company’s liquidity and should not

be considered alternatives to net income or loss or any other

measure of financial performance presented in accordance with GAAP.

The Company’s FFO, Core FFO, and Adjusted FFO may not be comparable

to the FFO, Core FFO, and Adjusted FFO of other companies due to

the fact that not all companies use the same definition of FFO,

Core FFO, and Adjusted FFO. Accordingly, there can be no assurance

that the Company’s basis for computing these non-GAAP measures is

comparable with that of other companies. See “Reconciliation of

FFO, Core FFO, and Adjusted FFO” for a reconciliation of GAAP net

income to FFO, Core FFO, and Adjusted FFO.

Net Operating Income (NOI)

NOI is a non-GAAP measure often used to evaluate the performance

of real estate companies. The Company defines NOI for an identified

population of homes as rental revenues and other property income

less property operating and maintenance expense (which consists

primarily of property taxes, insurance, HOA fees (when applicable),

market-level personnel expenses, repairs and maintenance, leasing

costs, and marketing expense). NOI excludes: interest expense;

depreciation and amortization; property management expense; general

and administrative expense; impairment and other; gain on sale of

property, net of tax; (gains) losses on investments in equity

securities, net; other income and expenses; management fee

revenues; and income from investments in unconsolidated joint

ventures.

The GAAP measure most directly comparable to NOI is net income

or loss. NOI is not used as a measure of liquidity and should not

be considered as an alternative to net income or loss or any other

measure of financial performance presented in accordance with GAAP.

The Company’s NOI may not be comparable to the NOI of other

companies due to the fact that not all companies use the same

definition of NOI. Accordingly, there can be no assurance that the

Company’s basis for computing this non-GAAP measure is comparable

with that of other companies.

The Company believes that Same Store NOI is also a meaningful

supplemental measure of the Company’s operating performance for the

same reasons as NOI and is further helpful to investors as it

provides a more consistent measurement of the Company’s performance

across reporting periods by reflecting NOI for homes in its Same

Store Portfolio.

See below for a reconciliation of GAAP net income to NOI for the

Company’s total portfolio and NOI for its Same Store Portfolio.

Recurring Capital Expenditures or Recurring CapEx

Recurring Capital Expenditures or Recurring CapEx represents

general replacements and expenditures required to preserve and

maintain the value and functionality of a home and its systems as a

single-family rental.

Rental Rate Growth

Rental rate growth for any home represents the percentage

difference between the monthly rent from an expiring lease and the

monthly rent from the next lease, and, in each case, reflects the

impact of any amortized non-service rent concessions and amortized

contractual rent increases. Leases are either renewal leases, where

the Company’s current resident chooses to stay for a subsequent

lease term, or a new lease, where the Company’s previous resident

moves out and a new resident signs a lease to occupy the same

home.

Same Store / Same Store Portfolio

Same Store or Same Store portfolio includes, for a given

reporting period, wholly owned homes that have been stabilized and

seasoned, excluding homes that have been sold, homes that have been

identified for sale to an owner occupant and have become vacant,

homes that have been deemed inoperable or significantly impaired by

casualty loss events or force majeure, homes acquired in portfolio

transactions that are deemed not to have undergone renovations of

sufficiently similar quality and characteristics as the existing

Invitation Homes Same Store portfolio, and homes in markets that

the Company has announced an intent to exit where the Company no

longer operates a significant number of homes.

Homes are considered stabilized if they have (i) completed an

initial renovation and (ii) entered into at least one post-initial

renovation lease. An acquired portfolio that is both leased and

deemed to be of sufficiently similar quality and characteristics as

the existing Invitation Homes Same Store portfolio may be

considered stabilized at the time of acquisition.

Homes are considered to be seasoned once they have been

stabilized for at least 15 months prior to January 1st of the year

in which the Same Store portfolio was established.

The Company believes presenting information about the portion of

its portfolio that has been fully operational for the entirety of a

given reporting period and its prior year comparison period

provides investors with meaningful information about the

performance of the Company’s comparable homes across periods and

about trends in its organic business.

Total Homes / Total Portfolio

Total homes or total portfolio refers to the total number of

homes owned, whether or not stabilized, and excludes any properties

previously acquired in purchases that have been subsequently

rescinded or vacated. Unless otherwise indicated, total homes or

total portfolio refers to the wholly owned homes and excludes homes

owned in joint ventures.

Turnover Rate

Turnover rate represents the number of instances that homes in

an identified population become unoccupied in a given period,

divided by the number of homes in such population.

Reconciliation of FFO, Core FFO, and

AFFO

($ in thousands, except shares and per

share amounts) (unaudited)

FFO Reconciliation

Q3 2024

Q3 2023

YTD 2024

YTD 2023

Net income available to common

stockholders

$

95,084

$

131,637

$

310,223

$

389,406

Net income available to participating

securities

185

181

584

518

Non-controlling interests

309

403

988

1,163

Depreciation and amortization on real

estate assets

176,174

167,921

521,411

493,027

Impairment on depreciated real estate

investments

270

83

330

342

Net gain on sale of previously depreciated

investments in real estate

(47,766

)

(57,989

)

(141,531

)

(134,448

)

Depreciation and net gain on sale of

investments in unconsolidated joint ventures

4,060

2,111

10,076

6,425

FFO

$

228,316

$

244,347

$

702,081

$

756,433

Core FFO Reconciliation

Q3 2024

Q3 2023

YTD 2024

YTD 2023

FFO

$

228,316

$

244,347

$

702,081

$

756,433

Non-cash interest expense related to

amortization of deferred financing costs, loan discounts, and

non-cash interest expense from derivatives (1)

14,085

9,561

32,207

25,875

Share-based compensation expense

5,417

8,929

20,809

21,493

Legal settlements (2)

17,500

2,000

77,000

2,000

Severance expense

209

392

388

916

Casualty losses, net (1)

20,729

2,429

35,174

5,214

(Gains) losses on investments in equity

and other securities, net

257

499

(1,038

)

(113

)

Core FFO

$

286,513

$

268,157

$

866,621

$

811,818

AFFO Reconciliation

Q3 2024

Q3 2023

YTD 2024

YTD 2023

Core FFO

$

286,513

$

268,157

$

866,621

$

811,818

Recurring capital expenditures (1)

(51,505

)

(49,007

)

(135,262

)

(122,700

)

AFFO

$

235,008

$

219,150

$

731,359

$

689,118

Net income available to common

stockholders

Weighted average common shares outstanding

— diluted

613,645,188

613,580,042

613,759,171

613,155,041

Net income per common share — diluted

$

0.15

$

0.21

$

0.51

$

0.64

FFO, Core FFO, and AFFO

Weighted average common shares and OP

Units outstanding — diluted

615,913,139

615,699,631

615,987,978

615,208,781

FFO per share — diluted

$

0.37

$

0.40

$

1.14

$

1.23

Core FFO per share — diluted

$

0.47

$

0.44

$

1.41

$

1.32

AFFO per share — diluted

$

0.38

$

0.36

$

1.19

$

1.12

(1) Includes the Company’s share from

unconsolidated joint ventures.

(2) For Q3 2024 and YTD 2024, includes

$17.5 million and $77.0 million, respectively, of settlement costs

related to resolution of an inquiry from the Federal Trade

Commission and the legal dispute entitled City of San Diego et al

v. Invitation Homes, Inc., inclusive of associated costs.

(3) For Q3 2024 and YTD 2024, includes

$14.0 million of estimated losses and damages, net of estimated

insurance recoveries, related to Hurricanes Beryl, Debby, and

Helene.

Reconciliation of Total Revenues to Same Store Core

Revenues, Quarterly

(in thousands) (unaudited)

Q3 2024

Q2 2024

Q1 2024

Q4 2023

Q3 2023

Total revenues (Total

Portfolio)

$

660,322

$

653,451

$

646,039

$

624,321

$

617,695

Management fee revenues

(18,980

)

(15,976

)

(13,942

)

(3,420

)

(3,404

)

Total portfolio resident recoveries

(42,412

)

(37,102

)

(37,795

)

(35,050

)

(36,641

)

Total Core Revenues (Total

Portfolio)

598,930

600,373

594,302

585,851

577,650

Non-Same Store Core Revenues

(43,651

)

(43,980

)

(43,237

)

(42,737

)

(41,773

)

Same Store Core Revenues

$

555,279

$

556,393

$

551,065

$

543,114

$

535,877

Reconciliation of Total Revenues to Same Store Core

Revenues, YTD

(in thousands) (unaudited)

YTD 2024

YTD 2023

Total revenues (Total

Portfolio)

$

1,959,812

$

1,807,957

Management fee revenues

(48,898

)

(10,227

)

Total portfolio resident recoveries

(117,309

)

(101,383

)

Total Core Revenues (Total

Portfolio)

1,793,605

1,696,347

Non-Same Store Core Revenues

(130,868

)

(110,253

)

Same Store Core Revenues

$

1,662,737

$

1,586,094

Reconciliation of Property Operating and Maintenance

Expenses to Same Store Core Operating Expenses,

Quarterly

(in thousands) (unaudited)

Q3 2024

Q2 2024

Q1 2024

Q4 2023

Q3 2023

Property operating and maintenance

expenses (Total Portfolio)

$

242,228

$

234,184

$

230,397

$

228,542

$

229,488

Total Portfolio resident recoveries

(42,412

)

(37,102

)

(37,795

)

(35,050

)

(36,641

)

Core Operating Expenses (Total

Portfolio)

199,816

197,082

192,602

193,492

192,847

Non-Same Store Core Operating Expenses

(18,131

)

(17,612

)

(17,642

)

(17,277

)

(16,589

)

Same Store Core Operating

Expenses

$

181,685

$

179,470

$

174,960

$

176,215

$

176,258

Reconciliation of Property Operating and Maintenance

Expenses to Same Store Core Operating Expenses, YTD

(in thousands) (unaudited)

YTD 2024

YTD 2023

Property operating and maintenance

expenses (Total Portfolio)

$

706,809

$

651,793

Total Portfolio resident recoveries

(117,309

)

(101,383

)

Core Operating Expenses (Total

Portfolio)

589,500

550,410

Non-Same Store Core Operating Expenses

(53,385

)

(42,754

)

Same Store Core Operating

Expenses

$

536,115

$

507,656

Reconciliation of Net Income to Same Store NOI,

Quarterly

(in thousands) (unaudited)

Q3 2024

Q2 2024

Q1 2024

Q4 2023

Q3 2023

Net income available to common

stockholders

$

95,084

$

72,981

$

142,158

$

129,368

$

131,637

Net income available to participating

securities

185

207

192

178

181

Non-controlling interests

309

243

436

395

403

Interest expense

91,060

90,007

89,845

90,049

86,736

Depreciation and amortization

180,479

176,622

175,313

173,159

170,696

Property management expense

34,382

32,633

31,237

25,246

23,399

General and administrative

21,727

21,498

23,448

22,387

22,714

Casualty losses, impairment, and other

(1)

20,872

10,353

4,137

3,069

2,496

Gain on sale of property, net of tax

(47,766

)

(43,267

)

(50,498

)

(49,092

)

(57,989

)

(Gains) losses on investments in equity

securities, net

257

(1,504

)

209

(237

)

499

Other, net (2)

9,345

54,012

(5,973

)

(5,533

)

2,533

Management fee revenues

(18,980

)

(15,976

)

(13,942

)

(3,420

)

(3,404

)

Losses from investments in unconsolidated

joint ventures

12,160

5,482

5,138

6,790

4,902

NOI (Total Portfolio)

399,114

403,291

401,700

392,359

384,803

Non-Same Store NOI

(25,520

)

(26,368

)

(25,595

)

(25,460

)

(25,184

)

Same Store NOI

$

373,594

$

376,923

$

376,105

$

366,899

$

359,619

Reconciliation of Net Income to Same Store NOI,

YTD

(in thousands) (unaudited)

YTD 2024

YTD 2023

Net income available to common

stockholders

$

310,223

$

389,406

Net income available to participating

securities

584

518

Non-controlling interests

988

1,163

Interest expense

270,912

243,408

Depreciation and amortization

532,414

501,128

Property management expense

98,252

70,563

General and administrative

66,673

59,957

Casualty losses, impairment, and other

(1)

35,362

5,527

Gain on sale of property, net of tax

(141,531

)

(134,448

)

(Gains) losses on investments in equity

securities, net

(1,038

)

(113

)

Other, net (2)

57,384

7,968

Management fee revenues

(48,898

)

(10,227

)

Losses from investments in unconsolidated

joint ventures

22,780

11,087

NOI (Total Portfolio)

1,204,105

1,145,937

Non-Same Store NOI

(77,483

)

(67,499

)

Same Store NOI

$

1,126,622

$

1,078,438

(1) For Q3 2024 and YTD 2024, includes

$14.0 million of estimated losses and damages, net of estimated

insurance recoveries, related to Hurricanes Beryl, Debby, and

Helene.

(2) Includes settlement and other costs

related to certain litigation and regulatory matters, interest

income, and other miscellaneous income and expenses.

Reconciliation of Net Income to Adjusted

EBITDAre

(in thousands, unaudited)

Q3 2024

Q3 2023

YTD 2024

YTD 2023

Net income available to common

stockholders

$

95,084

$

131,637

$

310,223

$

389,406

Net income available to participating

securities

185

181

584

518

Non-controlling interests

309

403

988

1,163

Interest expense

91,060

86,736

270,912

243,408

Interest expense in unconsolidated joint

ventures

10,186

5,051

20,970

12,774

Depreciation and amortization

180,479

170,696

532,414

501,128

Depreciation and amortization of

investments in unconsolidated joint ventures

3,590

2,690

9,875

7,686

EBITDA

380,893

397,394

1,145,966

1,156,083

Gain on sale of property, net of tax

(47,766

)

(57,989

)

(141,531

)

(134,448

)

Impairment on depreciated real estate

investments

270

83

330

342

Net (gain) loss on sale of investments in

unconsolidated joint ventures

499

(554

)

285

(1,188

)

EBITDAre

333,896

338,934

1,005,050

1,020,789

Share-based compensation expense

5,417

8,929

20,809

21,493

Severance

209

392

388

916

Casualty losses, net (1)(2)

20,729

2,429

35,174

5,214

(Gains) losses on investments in equity

and other securities, net

257

499

(1,038

)

(113

)

Other, net (3)

9,345

2,533

57,384

7,968

Adjusted EBITDAre

$

369,853

$

353,716

$

1,117,767

$

1,056,267

Trailing Twelve Months (TTM)

Ended

September 30, 2024

December 31, 2023

Net income available to common

stockholders

$

439,591

$

518,774

Net income available to participating

securities

762

696

Non-controlling interests

1,383

1,558

Interest expense

360,961

333,457

Interest expense in unconsolidated joint

ventures

26,451

18,255

Depreciation and amortization

705,573

674,287

Depreciation and amortization of

investments in unconsolidated joint ventures

12,658

10,469

EBITDA

1,547,379

1,557,496

Gain on sale of property, net of tax

(190,623

)

(183,540

)

Impairment on depreciated real estate

investments

415

427

Net gain on sale of investments in

unconsolidated joint ventures

(195

)

(1,668

)

EBITDAre

1,356,976

1,372,715

Share-based compensation expense

28,819

29,503

Severance

449

977

Casualty losses, net (1)(2)

38,160

8,200

(Gains) losses on investments in equity

and other securities, net

(1,275

)

(350

)

Other, net (3)

51,851

2,435

Adjusted EBITDAre

$

1,474,980

$

1,413,480

(1) Includes the Company’s share from

unconsolidated joint ventures.

(2) For Q3 2024 and YTD 2024, includes

$14.0 million of estimated losses and damages, net of estimated

insurance recoveries, related to Hurricanes Beryl, Debby, and

Helene.

(3) Includes settlement and other costs

related to certain litigation and regulatory matters, interest

income, and other miscellaneous income and expenses.

Reconciliation of Net Debt / Trailing Twelve Months

(TTM) Adjusted EBITDAre

(in thousands, except for ratio)

(unaudited)

As of

As of

September 30, 2024

December 31, 2023

Mortgage loans, net

$

1,614,220

$

1,627,256

Secured term loan, net

401,595

401,515

Unsecured notes, net

3,799,034

3,305,467

Term loan facility, net

2,444,054

3,211,814

Revolving facility

750,000

—

Total Debt per Balance Sheet

9,008,903

8,546,052

Retained and repurchased certificates

(87,063

)

(87,703

)

Cash, ex-security deposits and letters of

credit (1)

(1,062,179

)

(713,898

)

Deferred financing costs, net

64,086

45,518

Unamortized discounts on note payable

25,100

21,376

Net Debt (A)

$

7,948,847

$

7,811,345

For the TTM Ended

For the TTM Ended

September 30, 2024

December 31, 2023

Adjusted EBITDAre (B)

$

1,474,980

$

1,413,480

Net Debt / TTM Adjusted EBITDAre (A /

B)

5.4x

5.5x

(1) Represents cash and cash equivalents

and the portion of restricted cash that excludes security deposits

and letters of credit

Note: Refer to “Glossary and Reconciliations” for metric

definitions and reconciliations of non-GAAP financial measures.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030353205/en/

Investor Relations Contact Scott McLaughlin 844.456.INVH

(4684) IR@InvitationHomes.com Media Relations Contact Kristi

DesJarlais 844.456.INVH (4684) Media@InvitationHomes.com

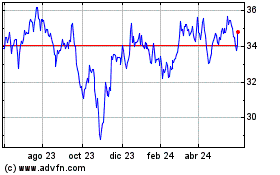

Invitation Homes (NYSE:INVH)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

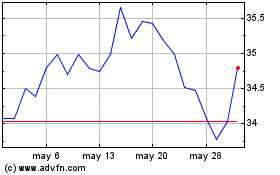

Invitation Homes (NYSE:INVH)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024